Key Insights

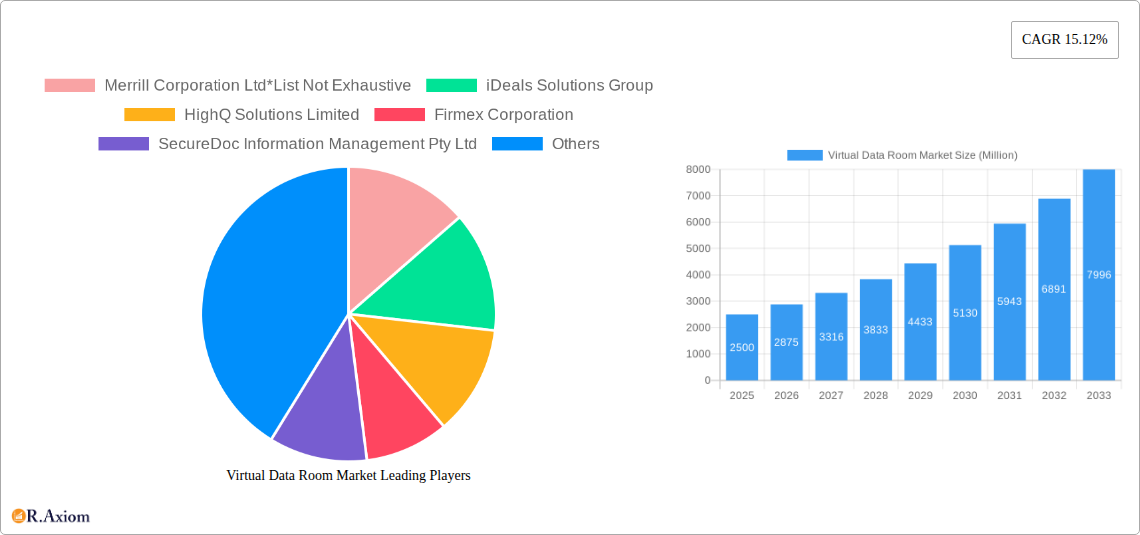

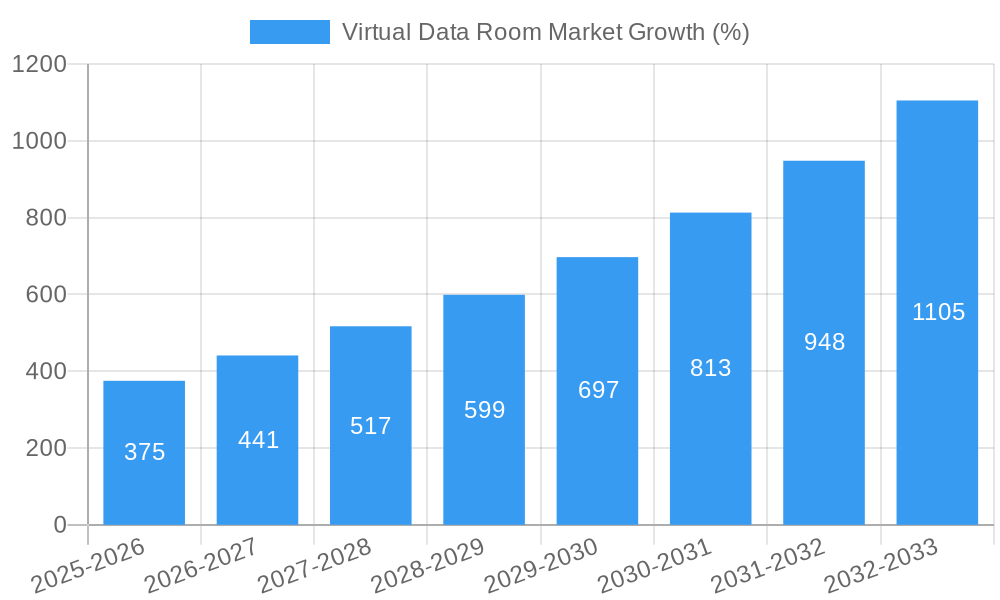

The Virtual Data Room (VDR) market is experiencing robust growth, driven by the increasing need for secure and efficient document sharing and collaboration across various industries. The market, valued at approximately $XX million in 2025, is projected to witness a Compound Annual Growth Rate (CAGR) of 15.12% from 2025 to 2033. This expansion is fueled by several key factors. The rising adoption of cloud-based solutions offers enhanced scalability, accessibility, and cost-effectiveness compared to traditional physical data rooms. Furthermore, stringent regulatory compliance requirements across sectors like BFSI and healthcare necessitate secure platforms for handling sensitive data, significantly boosting VDR adoption. Mergers and acquisitions (M&A) activity, a major driver of VDR usage, is expected to remain strong, further contributing to market growth. The market is segmented by organization size (small and medium-sized enterprises (SMEs) and large organizations), business function (legal, finance, IP management, sales & marketing, etc.), end-user industry (BFSI, IT, healthcare, government, etc.), and VDR type (software and services). Large organizations are currently the leading segment, driven by their extensive need for secure document management across diverse projects and departments. However, increasing digitalization initiatives within SMEs are expected to drive significant growth in this segment over the forecast period.

The competitive landscape is characterized by a mix of established players and emerging providers. Intralinks, iDeals, and other leading vendors are continuously innovating their offerings to meet evolving customer needs, including enhanced security features, improved user experience, and integration with other enterprise applications. Geographic expansion, particularly in emerging markets within the Asia-Pacific region, represents a significant growth opportunity. While the market faces challenges such as security concerns and the initial investment costs associated with implementing VDR solutions, these are being mitigated by robust security protocols offered by providers and the increasing realization of the long-term cost benefits and risk reduction. The overall outlook for the VDR market remains positive, with continued growth projected throughout the forecast period driven by digital transformation, regulatory compliance, and increasing adoption across various sectors.

Virtual Data Room Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Virtual Data Room (VDR) market, encompassing historical data (2019-2024), current estimates (2025), and future projections (2025-2033). It delves into market dynamics, key players, segment performance, and emerging trends, offering actionable insights for stakeholders across the industry. The report covers a wide range of aspects, from market concentration and innovation to emerging opportunities and challenges, providing a 360-degree view of this rapidly evolving landscape.

Virtual Data Room Market Market Concentration & Innovation

The Virtual Data Room market exhibits a moderately concentrated landscape, with several major players vying for market share. While precise market share figures for each company remain confidential and proprietary information, Intralinks Holdings Inc., Merrill Corporation Ltd, and iDeals Solutions Group are widely recognized as significant players. Mergers and Acquisitions (M&A) activity plays a vital role in shaping market concentration, with deal values exceeding xx Million in recent years. Innovation is driven by advancements in security features, user experience enhancements, and integration with other enterprise software solutions. Regulatory frameworks, such as GDPR and CCPA, significantly influence VDR adoption and feature development, mandating robust data protection measures. The rise of cloud computing and the increasing demand for secure data sharing contribute to market growth. The primary substitutes are traditional physical data rooms, email attachments, and file-sharing services; however, the inherent security risks and limitations of these alternatives favor VDR adoption. End-user trends indicate a preference for flexible, scalable, and user-friendly solutions that can be seamlessly integrated into existing workflows.

- Key Players: Intralinks Holdings Inc., Merrill Corporation Ltd, iDeals Solutions Group, HighQ Solutions Limited, Firmex Corporation, SecureDoc Information Management Pty Ltd, Ansarada Pty Limited, ShareVault (Pandesa Corporation), Drooms GmbH, Brainloop AG, Caplinked Inc, Vault Rooms Inc, Ethos Data, BMC Group Inc (SmartRoom), Citrix Systems Inc.

- M&A Activity: xx Million in deal value (estimated).

- Key Innovation Drivers: Enhanced security, improved user experience, cloud integration.

Virtual Data Room Market Industry Trends & Insights

The Virtual Data Room market is experiencing robust growth, driven by the increasing adoption of cloud-based solutions and the growing need for secure data sharing across various industries. The Compound Annual Growth Rate (CAGR) for the period 2025-2033 is projected to be xx%, indicating strong market expansion. Technological disruptions, such as the rise of artificial intelligence (AI) for enhanced security and analytics, are reshaping the market landscape. Consumer preferences are shifting towards user-friendly interfaces and enhanced collaboration features. Competitive dynamics are characterized by intense rivalry among established players and the emergence of new entrants offering niche solutions. Market penetration is steadily increasing, with a significant number of organizations across diverse sectors embracing VDRs for due diligence, mergers & acquisitions, and other critical business processes. The market is segmented by organization size (small and medium-scale organizations, large organizations), business function (legal and compliance, financial management, intellectual property management, sales and marketing, other business functions), end-user industry (BFSI, IT and telecommunication, healthcare, government and legal services, other end-user industries), and type (software, services).

Dominant Markets & Segments in Virtual Data Room Market

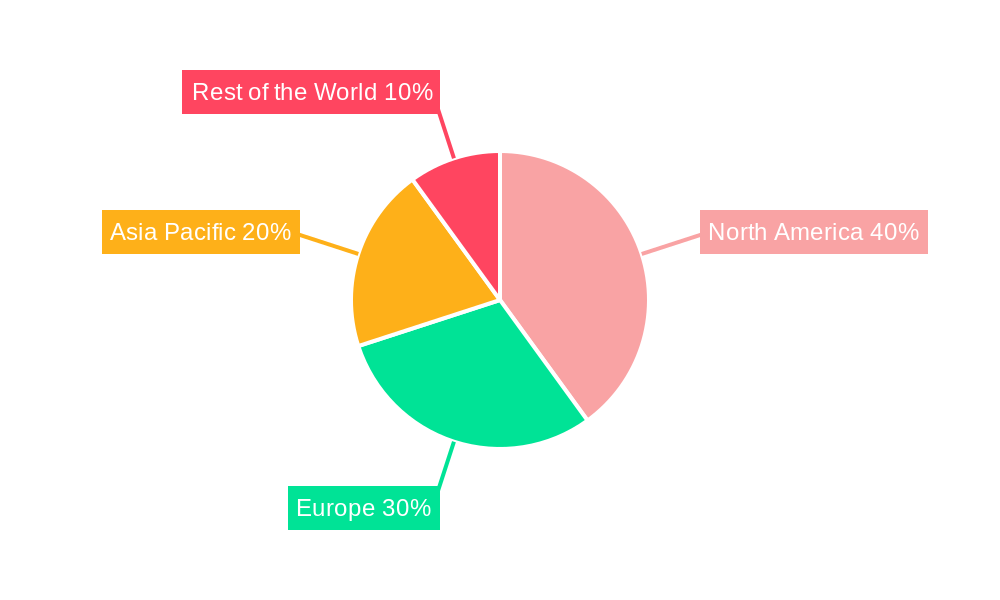

The North American region currently holds a dominant position in the Virtual Data Room market, driven by factors such as high technology adoption rates, robust IT infrastructure, and the presence of major players. However, the Asia-Pacific region is projected to witness significant growth in the coming years, fueled by expanding economies and increasing digitalization.

- By Organization Size: Large organizations are currently the largest segment, driven by their greater need for secure data management and collaboration.

- By Business Function: Legal and Compliance, and Financial Management are the largest segments, reflecting the importance of secure data handling in these areas.

- By End-user Industry: BFSI and IT and Telecommunications are dominant due to their heavy reliance on data security and collaboration.

- By Type: Software and Services are major segments; software solutions are often chosen for their scalability and cost-effectiveness.

Key Drivers for Regional Dominance:

- North America: Strong IT infrastructure, high technology adoption, presence of major players.

- Asia-Pacific: Rapid economic growth, increasing digitalization, expanding government initiatives.

Virtual Data Room Market Product Developments

Recent product innovations in the VDR market center around enhanced security features, improved user interfaces, and integration with other enterprise software systems. These developments aim to cater to increasingly sophisticated user needs and address emerging security threats. The integration of AI and machine learning capabilities is also gaining traction, improving data analysis and streamlining workflows. VDRs are now finding applications beyond traditional use cases, expanding into areas such as intellectual property management, healthcare data exchange, and government collaborations. These innovations offer competitive advantages by providing users with enhanced security, ease of use, and streamlined operations.

Report Scope & Segmentation Analysis

This report provides a comprehensive segmentation of the Virtual Data Room market, analyzing various aspects across different segments.

- By Organization Size: The report segments the market into small- and medium-scale organizations and large organizations, examining growth rates and market size within each category. Competitive dynamics within these segments are also analyzed.

- By Business Function: The report analyzes the market across Legal and Compliance, Financial Management, Intellectual Property Management, Sales and Marketing, and Other Business Functions, analyzing specific drivers and market sizes.

- By End-user Industry: The analysis covers BFSI, IT and Telecommunication, Healthcare, Government and Legal Services, and Other End-user Industries, providing segment-specific growth projections and insights.

- By Type: The report details the Software and Services segments, providing insights into their respective market sizes, growth rates, and competitive landscapes.

Key Drivers of Virtual Data Room Market Growth

Several factors fuel the growth of the Virtual Data Room market. The increasing need for secure data sharing in mergers & acquisitions and due diligence processes is paramount. Technological advancements, like enhanced security features and user-friendly interfaces, further drive adoption. Regulatory compliance mandates, such as GDPR and CCPA, necessitate robust security measures, boosting VDR adoption. Moreover, the rise of cloud-based solutions offers scalability and cost-effectiveness, further propelling market growth.

Challenges in the Virtual Data Room Market Sector

The Virtual Data Room market faces challenges such as stringent regulatory compliance requirements, the need to constantly upgrade security systems to counter evolving cyber threats, and the rising costs associated with maintaining advanced security infrastructure. Intense competition from existing and emerging players creates pricing pressures. Integration with diverse legacy systems can also pose challenges for businesses, impacting seamless data transfer and workflow integration. The xx Million (estimated) spent annually on cybersecurity measures highlights the significance of these challenges.

Emerging Opportunities in Virtual Data Room Market

The Virtual Data Room market offers numerous opportunities. Expanding into new and emerging markets like developing economies presents significant potential. Integrating AI and machine learning for advanced analytics and security enhancement provides a competitive edge. Developing specialized VDR solutions for niche industries, such as healthcare or government, opens new avenues for growth. Finally, enhancing user experience and collaboration features improves adoption rates among organizations.

Leading Players in the Virtual Data Room Market Market

- Merrill Corporation Ltd

- iDeals Solutions Group

- HighQ Solutions Limited

- Firmex Corporation

- SecureDoc Information Management Pty Ltd

- Ansarada Pty Limited

- ShareVault (Pandesa Corporation)

- Drooms GmbH

- Brainloop AG

- Caplinked Inc

- Intralinks Holdings Inc

- Vault Rooms Inc

- Ethos Data

- BMC Group Inc (SmartRoom)

- Citrix Systems Inc

Key Developments in Virtual Data Room Market Industry

- May 2022: Telefonica Tech launched a new Virtual Data Center (VDC) node in Ashburn, Virginia, enhancing cloud computing capabilities for businesses. This development highlights the growing integration of cloud technologies within the VDR market.

- March 2022: Airmeet's launch of 'Airmeet 360 degree Analytics' improved data analysis capabilities for virtual events, demonstrating a shift towards more data-driven decision-making within the broader virtual collaboration space.

Strategic Outlook for Virtual Data Room Market Market

The Virtual Data Room market presents a significant growth opportunity. Continued technological advancements, particularly in AI and security, are expected to drive adoption. Expanding into new geographical markets and developing specialized solutions for niche industries will be key strategic priorities. Focusing on enhanced user experience and seamless integration with other enterprise software will further solidify market leadership. The market’s long-term prospects remain optimistic, driven by the ongoing need for secure and efficient data sharing across various sectors.

Virtual Data Room Market Segmentation

-

1. Type

- 1.1. Software

- 1.2. Services

-

2. Organization Size

- 2.1. Small- and Medium-scale Organizations

- 2.2. Large Organizations

-

3. Business Function

- 3.1. Legal and Compliance

- 3.2. Financial Management

- 3.3. Intellectual Property Management

- 3.4. Sales and Marketing

- 3.5. Other Business Functions

-

4. End-user Industry

- 4.1. BFSI

- 4.2. IT and Telecommunication

- 4.3. Healthcare

- 4.4. Government and Legal Services

- 4.5. Other End-user Industries

Virtual Data Room Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Virtual Data Room Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 15.12% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Cost-effective Data Storage Solutions; Sustained Increase in M&A Activity Driving Demand for Efficient Handling of Complex Data; Stringent Data Privacy Regulations; Increasing Use of Virtual Data Room in IT and Telecom Sector

- 3.3. Market Restrains

- 3.3.1. Security and Data Integration Challenges

- 3.4. Market Trends

- 3.4.1. Increasing Use of Virtual Data Room in IT and Telecom Sector is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Virtual Data Room Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Software

- 5.1.2. Services

- 5.2. Market Analysis, Insights and Forecast - by Organization Size

- 5.2.1. Small- and Medium-scale Organizations

- 5.2.2. Large Organizations

- 5.3. Market Analysis, Insights and Forecast - by Business Function

- 5.3.1. Legal and Compliance

- 5.3.2. Financial Management

- 5.3.3. Intellectual Property Management

- 5.3.4. Sales and Marketing

- 5.3.5. Other Business Functions

- 5.4. Market Analysis, Insights and Forecast - by End-user Industry

- 5.4.1. BFSI

- 5.4.2. IT and Telecommunication

- 5.4.3. Healthcare

- 5.4.4. Government and Legal Services

- 5.4.5. Other End-user Industries

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. Europe

- 5.5.3. Asia Pacific

- 5.5.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Virtual Data Room Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Software

- 6.1.2. Services

- 6.2. Market Analysis, Insights and Forecast - by Organization Size

- 6.2.1. Small- and Medium-scale Organizations

- 6.2.2. Large Organizations

- 6.3. Market Analysis, Insights and Forecast - by Business Function

- 6.3.1. Legal and Compliance

- 6.3.2. Financial Management

- 6.3.3. Intellectual Property Management

- 6.3.4. Sales and Marketing

- 6.3.5. Other Business Functions

- 6.4. Market Analysis, Insights and Forecast - by End-user Industry

- 6.4.1. BFSI

- 6.4.2. IT and Telecommunication

- 6.4.3. Healthcare

- 6.4.4. Government and Legal Services

- 6.4.5. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Virtual Data Room Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Software

- 7.1.2. Services

- 7.2. Market Analysis, Insights and Forecast - by Organization Size

- 7.2.1. Small- and Medium-scale Organizations

- 7.2.2. Large Organizations

- 7.3. Market Analysis, Insights and Forecast - by Business Function

- 7.3.1. Legal and Compliance

- 7.3.2. Financial Management

- 7.3.3. Intellectual Property Management

- 7.3.4. Sales and Marketing

- 7.3.5. Other Business Functions

- 7.4. Market Analysis, Insights and Forecast - by End-user Industry

- 7.4.1. BFSI

- 7.4.2. IT and Telecommunication

- 7.4.3. Healthcare

- 7.4.4. Government and Legal Services

- 7.4.5. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Virtual Data Room Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Software

- 8.1.2. Services

- 8.2. Market Analysis, Insights and Forecast - by Organization Size

- 8.2.1. Small- and Medium-scale Organizations

- 8.2.2. Large Organizations

- 8.3. Market Analysis, Insights and Forecast - by Business Function

- 8.3.1. Legal and Compliance

- 8.3.2. Financial Management

- 8.3.3. Intellectual Property Management

- 8.3.4. Sales and Marketing

- 8.3.5. Other Business Functions

- 8.4. Market Analysis, Insights and Forecast - by End-user Industry

- 8.4.1. BFSI

- 8.4.2. IT and Telecommunication

- 8.4.3. Healthcare

- 8.4.4. Government and Legal Services

- 8.4.5. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of the World Virtual Data Room Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Software

- 9.1.2. Services

- 9.2. Market Analysis, Insights and Forecast - by Organization Size

- 9.2.1. Small- and Medium-scale Organizations

- 9.2.2. Large Organizations

- 9.3. Market Analysis, Insights and Forecast - by Business Function

- 9.3.1. Legal and Compliance

- 9.3.2. Financial Management

- 9.3.3. Intellectual Property Management

- 9.3.4. Sales and Marketing

- 9.3.5. Other Business Functions

- 9.4. Market Analysis, Insights and Forecast - by End-user Industry

- 9.4.1. BFSI

- 9.4.2. IT and Telecommunication

- 9.4.3. Healthcare

- 9.4.4. Government and Legal Services

- 9.4.5. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. North America Virtual Data Room Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1.

- 11. Europe Virtual Data Room Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Asia Pacific Virtual Data Room Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Rest of the World Virtual Data Room Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Competitive Analysis

- 14.1. Global Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 Merrill Corporation Ltd*List Not Exhaustive

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 iDeals Solutions Group

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 HighQ Solutions Limited

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 Firmex Corporation

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 SecureDoc Information Management Pty Ltd

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Ansarada Pty Limited

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 ShareVault (Pandesa Corporation)

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 Drooms GmbH

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 Brainloop AG

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 Caplinked Inc

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.11 Intralinks Holdings Inc

- 14.2.11.1. Overview

- 14.2.11.2. Products

- 14.2.11.3. SWOT Analysis

- 14.2.11.4. Recent Developments

- 14.2.11.5. Financials (Based on Availability)

- 14.2.12 Vault Rooms Inc

- 14.2.12.1. Overview

- 14.2.12.2. Products

- 14.2.12.3. SWOT Analysis

- 14.2.12.4. Recent Developments

- 14.2.12.5. Financials (Based on Availability)

- 14.2.13 Ethos Data

- 14.2.13.1. Overview

- 14.2.13.2. Products

- 14.2.13.3. SWOT Analysis

- 14.2.13.4. Recent Developments

- 14.2.13.5. Financials (Based on Availability)

- 14.2.14 BMC Group Inc (SmartRoom)

- 14.2.14.1. Overview

- 14.2.14.2. Products

- 14.2.14.3. SWOT Analysis

- 14.2.14.4. Recent Developments

- 14.2.14.5. Financials (Based on Availability)

- 14.2.15 Citrix Systems Inc

- 14.2.15.1. Overview

- 14.2.15.2. Products

- 14.2.15.3. SWOT Analysis

- 14.2.15.4. Recent Developments

- 14.2.15.5. Financials (Based on Availability)

- 14.2.1 Merrill Corporation Ltd*List Not Exhaustive

List of Figures

- Figure 1: Global Virtual Data Room Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Virtual Data Room Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Virtual Data Room Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Virtual Data Room Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Virtual Data Room Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Virtual Data Room Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Virtual Data Room Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Rest of the World Virtual Data Room Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Rest of the World Virtual Data Room Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America Virtual Data Room Market Revenue (Million), by Type 2024 & 2032

- Figure 11: North America Virtual Data Room Market Revenue Share (%), by Type 2024 & 2032

- Figure 12: North America Virtual Data Room Market Revenue (Million), by Organization Size 2024 & 2032

- Figure 13: North America Virtual Data Room Market Revenue Share (%), by Organization Size 2024 & 2032

- Figure 14: North America Virtual Data Room Market Revenue (Million), by Business Function 2024 & 2032

- Figure 15: North America Virtual Data Room Market Revenue Share (%), by Business Function 2024 & 2032

- Figure 16: North America Virtual Data Room Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 17: North America Virtual Data Room Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 18: North America Virtual Data Room Market Revenue (Million), by Country 2024 & 2032

- Figure 19: North America Virtual Data Room Market Revenue Share (%), by Country 2024 & 2032

- Figure 20: Europe Virtual Data Room Market Revenue (Million), by Type 2024 & 2032

- Figure 21: Europe Virtual Data Room Market Revenue Share (%), by Type 2024 & 2032

- Figure 22: Europe Virtual Data Room Market Revenue (Million), by Organization Size 2024 & 2032

- Figure 23: Europe Virtual Data Room Market Revenue Share (%), by Organization Size 2024 & 2032

- Figure 24: Europe Virtual Data Room Market Revenue (Million), by Business Function 2024 & 2032

- Figure 25: Europe Virtual Data Room Market Revenue Share (%), by Business Function 2024 & 2032

- Figure 26: Europe Virtual Data Room Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 27: Europe Virtual Data Room Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 28: Europe Virtual Data Room Market Revenue (Million), by Country 2024 & 2032

- Figure 29: Europe Virtual Data Room Market Revenue Share (%), by Country 2024 & 2032

- Figure 30: Asia Pacific Virtual Data Room Market Revenue (Million), by Type 2024 & 2032

- Figure 31: Asia Pacific Virtual Data Room Market Revenue Share (%), by Type 2024 & 2032

- Figure 32: Asia Pacific Virtual Data Room Market Revenue (Million), by Organization Size 2024 & 2032

- Figure 33: Asia Pacific Virtual Data Room Market Revenue Share (%), by Organization Size 2024 & 2032

- Figure 34: Asia Pacific Virtual Data Room Market Revenue (Million), by Business Function 2024 & 2032

- Figure 35: Asia Pacific Virtual Data Room Market Revenue Share (%), by Business Function 2024 & 2032

- Figure 36: Asia Pacific Virtual Data Room Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 37: Asia Pacific Virtual Data Room Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 38: Asia Pacific Virtual Data Room Market Revenue (Million), by Country 2024 & 2032

- Figure 39: Asia Pacific Virtual Data Room Market Revenue Share (%), by Country 2024 & 2032

- Figure 40: Rest of the World Virtual Data Room Market Revenue (Million), by Type 2024 & 2032

- Figure 41: Rest of the World Virtual Data Room Market Revenue Share (%), by Type 2024 & 2032

- Figure 42: Rest of the World Virtual Data Room Market Revenue (Million), by Organization Size 2024 & 2032

- Figure 43: Rest of the World Virtual Data Room Market Revenue Share (%), by Organization Size 2024 & 2032

- Figure 44: Rest of the World Virtual Data Room Market Revenue (Million), by Business Function 2024 & 2032

- Figure 45: Rest of the World Virtual Data Room Market Revenue Share (%), by Business Function 2024 & 2032

- Figure 46: Rest of the World Virtual Data Room Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 47: Rest of the World Virtual Data Room Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 48: Rest of the World Virtual Data Room Market Revenue (Million), by Country 2024 & 2032

- Figure 49: Rest of the World Virtual Data Room Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Virtual Data Room Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Virtual Data Room Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Global Virtual Data Room Market Revenue Million Forecast, by Organization Size 2019 & 2032

- Table 4: Global Virtual Data Room Market Revenue Million Forecast, by Business Function 2019 & 2032

- Table 5: Global Virtual Data Room Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 6: Global Virtual Data Room Market Revenue Million Forecast, by Region 2019 & 2032

- Table 7: Global Virtual Data Room Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Virtual Data Room Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Virtual Data Room Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Virtual Data Room Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global Virtual Data Room Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Virtual Data Room Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global Virtual Data Room Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Virtual Data Room Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Global Virtual Data Room Market Revenue Million Forecast, by Type 2019 & 2032

- Table 16: Global Virtual Data Room Market Revenue Million Forecast, by Organization Size 2019 & 2032

- Table 17: Global Virtual Data Room Market Revenue Million Forecast, by Business Function 2019 & 2032

- Table 18: Global Virtual Data Room Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 19: Global Virtual Data Room Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Global Virtual Data Room Market Revenue Million Forecast, by Type 2019 & 2032

- Table 21: Global Virtual Data Room Market Revenue Million Forecast, by Organization Size 2019 & 2032

- Table 22: Global Virtual Data Room Market Revenue Million Forecast, by Business Function 2019 & 2032

- Table 23: Global Virtual Data Room Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 24: Global Virtual Data Room Market Revenue Million Forecast, by Country 2019 & 2032

- Table 25: Global Virtual Data Room Market Revenue Million Forecast, by Type 2019 & 2032

- Table 26: Global Virtual Data Room Market Revenue Million Forecast, by Organization Size 2019 & 2032

- Table 27: Global Virtual Data Room Market Revenue Million Forecast, by Business Function 2019 & 2032

- Table 28: Global Virtual Data Room Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 29: Global Virtual Data Room Market Revenue Million Forecast, by Country 2019 & 2032

- Table 30: Global Virtual Data Room Market Revenue Million Forecast, by Type 2019 & 2032

- Table 31: Global Virtual Data Room Market Revenue Million Forecast, by Organization Size 2019 & 2032

- Table 32: Global Virtual Data Room Market Revenue Million Forecast, by Business Function 2019 & 2032

- Table 33: Global Virtual Data Room Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 34: Global Virtual Data Room Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Virtual Data Room Market?

The projected CAGR is approximately 15.12%.

2. Which companies are prominent players in the Virtual Data Room Market?

Key companies in the market include Merrill Corporation Ltd*List Not Exhaustive, iDeals Solutions Group, HighQ Solutions Limited, Firmex Corporation, SecureDoc Information Management Pty Ltd, Ansarada Pty Limited, ShareVault (Pandesa Corporation), Drooms GmbH, Brainloop AG, Caplinked Inc, Intralinks Holdings Inc, Vault Rooms Inc, Ethos Data, BMC Group Inc (SmartRoom), Citrix Systems Inc.

3. What are the main segments of the Virtual Data Room Market?

The market segments include Type, Organization Size, Business Function, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Cost-effective Data Storage Solutions; Sustained Increase in M&A Activity Driving Demand for Efficient Handling of Complex Data; Stringent Data Privacy Regulations; Increasing Use of Virtual Data Room in IT and Telecom Sector.

6. What are the notable trends driving market growth?

Increasing Use of Virtual Data Room in IT and Telecom Sector is Driving the Market.

7. Are there any restraints impacting market growth?

Security and Data Integration Challenges.

8. Can you provide examples of recent developments in the market?

May 2022: Telefonica Tech announced the opening of a new Virtual Data Center (VDC) node in Ashburn, Virginia. A private cloud service called VDC is designed to assist businesses in moving workloads to cloud environments. The business said the service will debut with additional features.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Virtual Data Room Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Virtual Data Room Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Virtual Data Room Market?

To stay informed about further developments, trends, and reports in the Virtual Data Room Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence