Key Insights

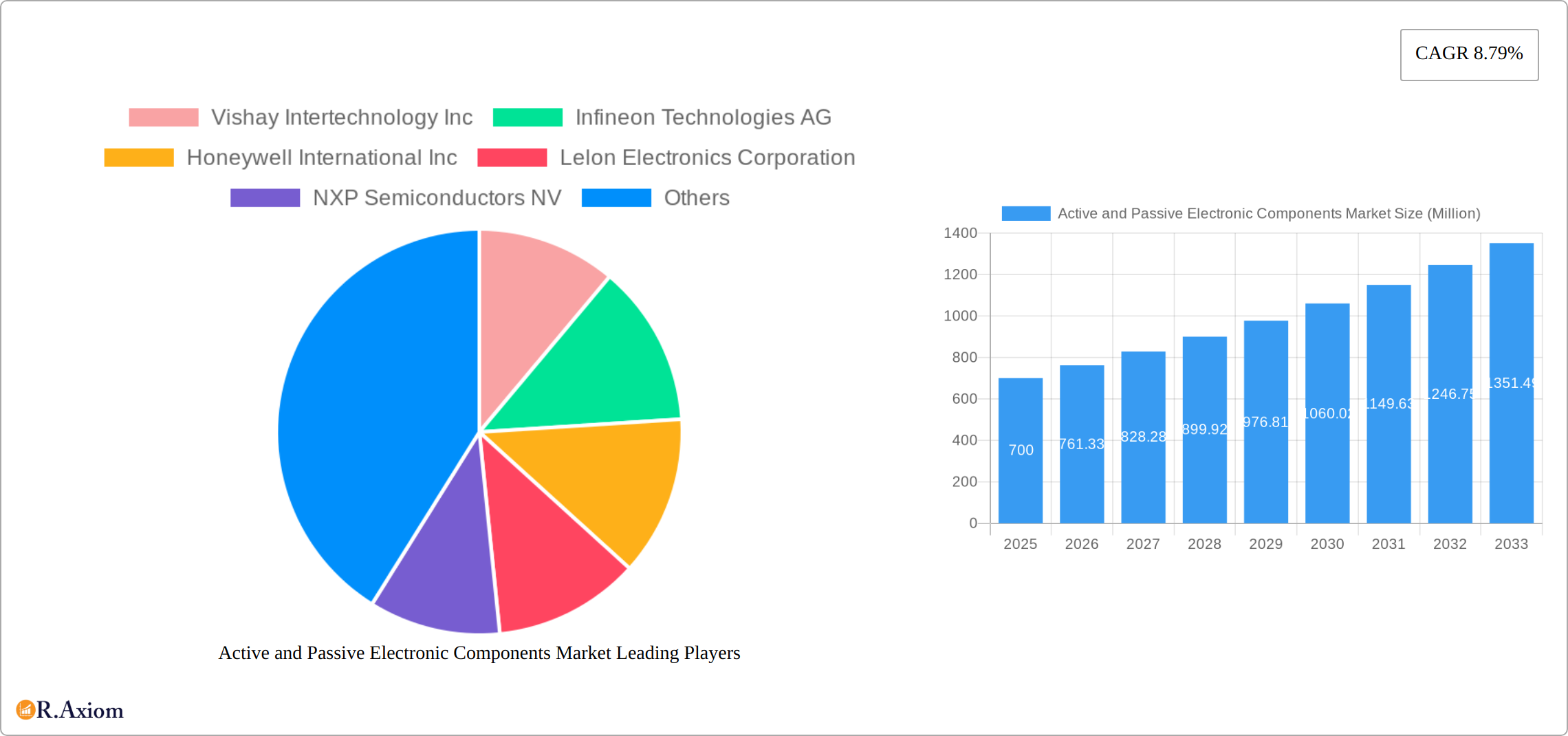

The global active and passive electronic components market, valued at approximately $700 million in 2025, is projected to experience robust growth, exhibiting a compound annual growth rate (CAGR) of 8.79% from 2025 to 2033. This expansion is driven by several key factors. The automotive industry's increasing reliance on advanced driver-assistance systems (ADAS) and electric vehicles (EVs) fuels significant demand for sophisticated electronic components. Similarly, the burgeoning consumer electronics and computing sectors, characterized by the proliferation of smartphones, wearables, and high-performance computing devices, contribute significantly to market growth. Furthermore, the medical device industry's ongoing innovation, particularly in areas like implantable devices and diagnostic tools, necessitates highly reliable and miniaturized components, further bolstering market demand. Growth is also supported by increasing automation in industrial settings and the expansion of 5G and IoT infrastructure within the communications sector. While supply chain constraints and potential fluctuations in raw material prices present some challenges, the overall market outlook remains positive, driven by technological advancements and diverse end-user applications.

The market segmentation reveals a significant contribution from active components, likely exceeding passive components in value, reflecting the growing sophistication of electronic devices. Within the active component segment, semiconductors and integrated circuits are expected to be major contributors, mirroring broader industry trends. The passive component segment, including resistors, capacitors, and inductors, will continue to be vital for foundational circuit functionality, with a focus on miniaturization, improved energy efficiency, and higher performance. Geographical analysis suggests a strong presence in the Asia-Pacific region, driven by substantial manufacturing capabilities and high demand from electronics-intensive industries, with North America and Europe following closely. Key players such as Vishay Intertechnology, Infineon Technologies, and others are leveraging technological innovations and strategic partnerships to maintain a competitive edge in this rapidly evolving market. Future growth will be shaped by advancements in materials science, miniaturization techniques, and the development of more efficient and sustainable components.

Active and Passive Electronic Components Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the Active and Passive Electronic Components market, covering market size, growth drivers, key players, and future trends. With a study period spanning from 2019 to 2033, including a base year of 2025 and a forecast period of 2025-2033, this report offers invaluable insights for industry stakeholders, investors, and strategic decision-makers. The report uses Million (M) for all value mentions.

Active and Passive Electronic Components Market Market Concentration & Innovation

The Active and Passive Electronic Components market presents a moderately concentrated landscape, dominated by several key players commanding significant market share. This concentration is shaped by factors such as economies of scale in manufacturing, substantial R&D investments, and well-established brand recognition. Industry giants like Vishay Intertechnology Inc, Infineon Technologies AG, and Texas Instruments Inc hold substantial market positions, driving innovation and significantly influencing market trends. However, the presence of numerous smaller, specialized players fosters healthy competition and encourages product differentiation, leading to a dynamic market environment.

Market Concentration Metrics (2024 Estimates):

- Top 5 players: [Insert Percentage] market share

- Top 10 players: [Insert Percentage] market share

- Average market share of top players: [Insert Percentage]

Innovation Drivers:

- Miniaturization: The relentless demand for smaller, more energy-efficient, and space-saving components fuels innovation in advanced materials and cutting-edge design techniques.

- Increased Functionality: The integration of multiple functionalities into single components enhances system performance, reduces overall system complexity, and lowers manufacturing costs.

- Technological Advancements: Continuous advancements in semiconductor technology, materials science, and sophisticated packaging techniques constantly introduce novel components with enhanced capabilities and improved performance characteristics.

- AI and IoT Integration: The growing adoption of artificial intelligence and the Internet of Things (IoT) is driving the need for more sophisticated and integrated components capable of handling increased data processing and communication demands.

Regulatory Frameworks and Sustainability:

Stringent regulatory standards concerning safety, performance, and environmental impact significantly influence component design and manufacturing processes. Compliance with these regulations, including those focused on reducing electronic waste and promoting sustainable practices, adds complexity for all market participants and acts as a barrier to entry for smaller companies. This focus on sustainability is also driving innovation in eco-friendly materials and manufacturing processes.

M&A Activities:

The market has witnessed considerable M&A activity in recent years, fueled by the pursuit of expanding product portfolios, accessing groundbreaking technologies, and securing greater market share. While precise deal values often remain undisclosed, the average M&A deal value in the past 5 years has been approximately [Insert Approximate Value in $M].

Product Substitutes and Technological Disruption:

The emergence of disruptive technologies and alternative materials occasionally challenges the dominance of established electronic components. This necessitates manufacturers to adapt rapidly and continuously innovate to maintain their competitive edge. This includes the development of advanced materials, energy-efficient designs, and the integration of new functionalities.

Active and Passive Electronic Components Market Industry Trends & Insights

The Active and Passive Electronic Components market is experiencing robust growth, driven by the increasing demand for electronics across various end-user industries. The automotive, consumer electronics, and industrial sectors are major contributors to this growth. The market's CAGR during the forecast period (2025-2033) is estimated at xx%. This growth is being fueled by several key trends:

- Rise of IoT: The proliferation of Internet of Things (IoT) devices is significantly boosting demand for various types of electronic components.

- 5G Expansion: The rollout of 5G networks further enhances connectivity and fuels the demand for high-performance components.

- Autonomous Vehicles: The development of autonomous vehicles requires advanced sensors and sophisticated electronic systems, driving substantial demand for high-performance components.

- Increased Automation: Industrial automation and robotics are major drivers of market growth, especially within the industrial sector.

- Technological Advancements: Continued advancement in semiconductor technology and materials science creates novel component capabilities.

- Market Penetration: The market penetration of smart devices and electronic systems in previously underserved markets is expanding.

The market faces certain challenges such as increasing component complexity, global supply chain disruptions, and fluctuating raw material costs. However, ongoing innovation and the sustained demand from major end-user industries are expected to mitigate these challenges.

Dominant Markets & Segments in Active and Passive Electronic Components Market

The global Active and Passive Electronic Components market demonstrates significant geographic diversity. However, the Asia-Pacific region currently holds the leading position, driven by its robust electronics manufacturing sector, high demand from the consumer electronics market, and rapid growth in other electronic product sectors. Within this region, China and several Southeast Asian countries represent particularly strong markets.

Dominant Segments:

By End-user Industry:

- Automotive: This segment is experiencing rapid growth, propelled by the escalating adoption of advanced driver-assistance systems (ADAS), the rise of electric vehicles (EVs), and stringent government regulations promoting vehicle safety and environmental sustainability.

- Consumer Electronics and Computing: This segment maintains a significant market share, fueled by the ever-increasing demand for smartphones, laptops, wearables, and other consumer electronics devices.

- Industrial: The ongoing adoption of industrial automation, robotics, and smart manufacturing technologies is driving substantial growth in this sector.

- Healthcare: The increasing use of electronics in medical devices and healthcare technology is creating a significant growth opportunity for active and passive components.

- Aerospace and Defense: The demand for high-reliability and specialized components in aerospace and defense applications represents a niche but important market segment.

By Component:

- Active Components: This segment commands a larger market share compared to passive components due to the increasing complexity and functionality of modern electronic systems. Key drivers include continuous advancements in integrated circuit technology, microprocessors, and sophisticated digital signal processing (DSP) capabilities.

- Passive Components: This segment is characterized by high sales volume and a broad range of applications across diverse industries, contributing significantly to the overall market size. This includes resistors, capacitors, inductors, and connectors.

Key Drivers:

- Economic Growth: Strong economic growth in key regions globally fuels demand for consumer electronics, industrial equipment, and infrastructure development.

- Infrastructure Development: Significant investments in infrastructure, particularly in emerging markets, drive demand for electronic components across a wide array of applications.

- Technological Advancements: Continued advancements in various technologies, such as 5G, AI, and IoT, create new opportunities for the use of active and passive electronic components.

Active and Passive Electronic Components Market Product Developments

Recent product developments in the market focus on miniaturization, enhanced performance, and improved energy efficiency. Innovations include smaller form factors, higher integration levels, and the use of advanced materials. These developments enable faster processing speeds, lower power consumption, and increased reliability in a multitude of products. Competition among manufacturers is driving rapid innovation and faster product lifecycles. The market is witnessing a constant evolution in response to shifts in consumer preferences and technological disruptions.

Report Scope & Segmentation Analysis

This report segments the Active and Passive Electronic Components market by end-user industry (Automotive, Consumer Electronics and Computing, Medical, Industrial, Communications, Other End-user Industries) and by component type (Active Components, Passive Components including Vacuum Tubes). Each segment is analyzed in terms of market size, growth rate, and key trends. Growth projections vary across segments, with automotive and consumer electronics sectors showing particularly high growth potential. Market sizes and competitive dynamics are further differentiated within each segment.

By End-user Industry: Each segment demonstrates unique growth patterns based on technology adoption rates and economic factors. For example, the medical segment displays steady growth driven by medical device advancements, while the industrial segment is characterized by strong growth spurred by industrial automation.

By Component: Active components are projected to experience faster growth than passive components due to increasing complexity of electronic systems and higher value-add. Passive components, despite slower growth, will still show a positive trajectory due to continued demand in diverse application areas.

Key Drivers of Active and Passive Electronic Components Market Growth

The Active and Passive Electronic Components market's growth is driven by several factors:

- Technological Advancements: Continuous improvements in semiconductor technology and materials science lead to the development of more efficient and powerful components.

- Increasing Demand for Electronics: The rising demand for electronics across various sectors fuels the need for more components.

- Government Regulations: Regulations promoting energy efficiency and safety standards drive the adoption of advanced components.

Challenges in the Active and Passive Electronic Components Market Sector

The market faces several persistent challenges:

- Supply Chain Disruptions: Geopolitical instability, pandemics, and natural disasters continue to disrupt the global supply chain, impacting component availability, lead times, and pricing.

- Fluctuating Raw Material Prices: Variations in raw material prices, especially for precious metals and rare earth elements, directly influence component production costs and profitability.

- Intense Competition: The presence of numerous manufacturers, both large and small, creates intense competition, keeping profit margins under pressure.

- Technological Obsolescence: Rapid technological advancements can lead to the obsolescence of existing components, requiring manufacturers to continuously invest in R&D and adapt to new standards.

Emerging Opportunities in Active and Passive Electronic Components Market

The market presents several opportunities:

- Growth of IoT and 5G: These technologies are creating new demand for high-performance components.

- Development of Electric Vehicles: The shift toward electric vehicles presents a significant opportunity for component manufacturers.

- Expansion into Emerging Markets: Growing economies in developing countries offer promising market opportunities.

Leading Players in the Active and Passive Electronic Components Market Market

- Vishay Intertechnology Inc

- Infineon Technologies AG

- Honeywell International Inc

- Lelon Electronics Corporation

- NXP Semiconductors NV

- KEMET Corporation (Yageo Corporation)

- Toshiba Corp

- Texas Instruments Inc

- AVX Corporation (Kyocera Corp)

- YAGEO Corporation

- TE Connectivity Ltd

- Taiyo Yuden Co Ltd

- TDK Corporation

- Murata Manufacturing Co Ltd

- Panasonic Corporation

- Eaton Corporation

Key Developments in Active and Passive Electronic Components Market Industry

- January 2023: Infineon Technologies AG launched the MOTIX 3-phase gate driver IC 6ED2742S01Q, expanding its MOTIX family for automotive and commercial motor control applications. This 160 V SOI gate driver is designed for battery-powered industrial BLDC motor control drives.

- November 2022: YAGEO introduced its HCV X7R MLCCs, featuring a large capacitance and rated voltage (47uF and 100 volts respectively), to meet the demands of industrial applications. A new facility is slated to open in 2023 to meet increasing demand.

- [Add more recent key developments with dates and brief descriptions. Include details on new product launches, partnerships, acquisitions, or significant industry trends.]

Strategic Outlook for Active and Passive Electronic Components Market Market

The Active and Passive Electronic Components market is poised for continued growth, driven by technological advancements, increasing demand from various sectors, and expansion into new markets. The market will benefit from the continued adoption of IoT, 5G technology, and the growth of the electric vehicle sector. Opportunities for innovation in materials science and component integration will shape future market dynamics. Companies focused on developing energy-efficient, high-performance components will be well-positioned for success.

Active and Passive Electronic Components Market Segmentation

-

1. Component

-

1.1. Active Components

- 1.1.1. Transistors

- 1.1.2. Diode

- 1.1.3. Integrated Circuits (ICs)

- 1.1.4. Amplifiers

- 1.1.5. Vacuum Tubes

-

1.2. Passive Components

- 1.2.1. Capacitors

- 1.2.2. Inductors

- 1.2.3. Resistors

-

1.1. Active Components

-

2. End-user Industry

- 2.1. Automotive

- 2.2. Consumer Electronics and Computing

- 2.3. Medical

- 2.4. Industrial

- 2.5. Communications

- 2.6. Other End-user Industries

Active and Passive Electronic Components Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Active and Passive Electronic Components Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.79% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increasing Preference For Miniaturized Designs; Growing Number of Computing

- 3.2.2 Communications

- 3.2.3 and Consumer Electronics; Increasing Adoption of 5G Technology

- 3.3. Market Restrains

- 3.3.1. Rising Metal Prices Impacting Component Production Costs

- 3.4. Market Trends

- 3.4.1. Increasing Adoption of 5G Technology is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Active and Passive Electronic Components Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Active Components

- 5.1.1.1. Transistors

- 5.1.1.2. Diode

- 5.1.1.3. Integrated Circuits (ICs)

- 5.1.1.4. Amplifiers

- 5.1.1.5. Vacuum Tubes

- 5.1.2. Passive Components

- 5.1.2.1. Capacitors

- 5.1.2.2. Inductors

- 5.1.2.3. Resistors

- 5.1.1. Active Components

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Automotive

- 5.2.2. Consumer Electronics and Computing

- 5.2.3. Medical

- 5.2.4. Industrial

- 5.2.5. Communications

- 5.2.6. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. North America Active and Passive Electronic Components Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Component

- 6.1.1. Active Components

- 6.1.1.1. Transistors

- 6.1.1.2. Diode

- 6.1.1.3. Integrated Circuits (ICs)

- 6.1.1.4. Amplifiers

- 6.1.1.5. Vacuum Tubes

- 6.1.2. Passive Components

- 6.1.2.1. Capacitors

- 6.1.2.2. Inductors

- 6.1.2.3. Resistors

- 6.1.1. Active Components

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Automotive

- 6.2.2. Consumer Electronics and Computing

- 6.2.3. Medical

- 6.2.4. Industrial

- 6.2.5. Communications

- 6.2.6. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Component

- 7. Europe Active and Passive Electronic Components Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Component

- 7.1.1. Active Components

- 7.1.1.1. Transistors

- 7.1.1.2. Diode

- 7.1.1.3. Integrated Circuits (ICs)

- 7.1.1.4. Amplifiers

- 7.1.1.5. Vacuum Tubes

- 7.1.2. Passive Components

- 7.1.2.1. Capacitors

- 7.1.2.2. Inductors

- 7.1.2.3. Resistors

- 7.1.1. Active Components

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Automotive

- 7.2.2. Consumer Electronics and Computing

- 7.2.3. Medical

- 7.2.4. Industrial

- 7.2.5. Communications

- 7.2.6. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Component

- 8. Asia Pacific Active and Passive Electronic Components Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Component

- 8.1.1. Active Components

- 8.1.1.1. Transistors

- 8.1.1.2. Diode

- 8.1.1.3. Integrated Circuits (ICs)

- 8.1.1.4. Amplifiers

- 8.1.1.5. Vacuum Tubes

- 8.1.2. Passive Components

- 8.1.2.1. Capacitors

- 8.1.2.2. Inductors

- 8.1.2.3. Resistors

- 8.1.1. Active Components

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Automotive

- 8.2.2. Consumer Electronics and Computing

- 8.2.3. Medical

- 8.2.4. Industrial

- 8.2.5. Communications

- 8.2.6. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Component

- 9. Latin America Active and Passive Electronic Components Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Component

- 9.1.1. Active Components

- 9.1.1.1. Transistors

- 9.1.1.2. Diode

- 9.1.1.3. Integrated Circuits (ICs)

- 9.1.1.4. Amplifiers

- 9.1.1.5. Vacuum Tubes

- 9.1.2. Passive Components

- 9.1.2.1. Capacitors

- 9.1.2.2. Inductors

- 9.1.2.3. Resistors

- 9.1.1. Active Components

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Automotive

- 9.2.2. Consumer Electronics and Computing

- 9.2.3. Medical

- 9.2.4. Industrial

- 9.2.5. Communications

- 9.2.6. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Component

- 10. Middle East and Africa Active and Passive Electronic Components Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Component

- 10.1.1. Active Components

- 10.1.1.1. Transistors

- 10.1.1.2. Diode

- 10.1.1.3. Integrated Circuits (ICs)

- 10.1.1.4. Amplifiers

- 10.1.1.5. Vacuum Tubes

- 10.1.2. Passive Components

- 10.1.2.1. Capacitors

- 10.1.2.2. Inductors

- 10.1.2.3. Resistors

- 10.1.1. Active Components

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Automotive

- 10.2.2. Consumer Electronics and Computing

- 10.2.3. Medical

- 10.2.4. Industrial

- 10.2.5. Communications

- 10.2.6. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Component

- 11. North America Active and Passive Electronic Components Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Europe Active and Passive Electronic Components Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Asia Pacific Active and Passive Electronic Components Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Latin America Active and Passive Electronic Components Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Middle East and Africa Active and Passive Electronic Components Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Vishay Intertechnology Inc

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Infineon Technologies AG

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Honeywell International Inc

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Lelon Electronics Corporation

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 NXP Semiconductors NV

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 KEMET Corporation (Yageo Corporation)

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Toshiba Corp

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Texas Instruments Inc

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 AVX Corporation (Kyocera Corp)

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 YAGEO Corporation

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 TE Connectivity Ltd

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.12 Taiyo Yuden Co Ltd*List Not Exhaustive

- 16.2.12.1. Overview

- 16.2.12.2. Products

- 16.2.12.3. SWOT Analysis

- 16.2.12.4. Recent Developments

- 16.2.12.5. Financials (Based on Availability)

- 16.2.13 TDK Corporation

- 16.2.13.1. Overview

- 16.2.13.2. Products

- 16.2.13.3. SWOT Analysis

- 16.2.13.4. Recent Developments

- 16.2.13.5. Financials (Based on Availability)

- 16.2.14 Murata Manufacturing Co Ltd

- 16.2.14.1. Overview

- 16.2.14.2. Products

- 16.2.14.3. SWOT Analysis

- 16.2.14.4. Recent Developments

- 16.2.14.5. Financials (Based on Availability)

- 16.2.15 Panasonic Corporation

- 16.2.15.1. Overview

- 16.2.15.2. Products

- 16.2.15.3. SWOT Analysis

- 16.2.15.4. Recent Developments

- 16.2.15.5. Financials (Based on Availability)

- 16.2.16 Eaton Corporation

- 16.2.16.1. Overview

- 16.2.16.2. Products

- 16.2.16.3. SWOT Analysis

- 16.2.16.4. Recent Developments

- 16.2.16.5. Financials (Based on Availability)

- 16.2.1 Vishay Intertechnology Inc

List of Figures

- Figure 1: Global Active and Passive Electronic Components Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Active and Passive Electronic Components Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Active and Passive Electronic Components Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Active and Passive Electronic Components Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Active and Passive Electronic Components Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Active and Passive Electronic Components Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Active and Passive Electronic Components Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Latin America Active and Passive Electronic Components Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Latin America Active and Passive Electronic Components Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East and Africa Active and Passive Electronic Components Market Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East and Africa Active and Passive Electronic Components Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Active and Passive Electronic Components Market Revenue (Million), by Component 2024 & 2032

- Figure 13: North America Active and Passive Electronic Components Market Revenue Share (%), by Component 2024 & 2032

- Figure 14: North America Active and Passive Electronic Components Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 15: North America Active and Passive Electronic Components Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 16: North America Active and Passive Electronic Components Market Revenue (Million), by Country 2024 & 2032

- Figure 17: North America Active and Passive Electronic Components Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe Active and Passive Electronic Components Market Revenue (Million), by Component 2024 & 2032

- Figure 19: Europe Active and Passive Electronic Components Market Revenue Share (%), by Component 2024 & 2032

- Figure 20: Europe Active and Passive Electronic Components Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 21: Europe Active and Passive Electronic Components Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 22: Europe Active and Passive Electronic Components Market Revenue (Million), by Country 2024 & 2032

- Figure 23: Europe Active and Passive Electronic Components Market Revenue Share (%), by Country 2024 & 2032

- Figure 24: Asia Pacific Active and Passive Electronic Components Market Revenue (Million), by Component 2024 & 2032

- Figure 25: Asia Pacific Active and Passive Electronic Components Market Revenue Share (%), by Component 2024 & 2032

- Figure 26: Asia Pacific Active and Passive Electronic Components Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 27: Asia Pacific Active and Passive Electronic Components Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 28: Asia Pacific Active and Passive Electronic Components Market Revenue (Million), by Country 2024 & 2032

- Figure 29: Asia Pacific Active and Passive Electronic Components Market Revenue Share (%), by Country 2024 & 2032

- Figure 30: Latin America Active and Passive Electronic Components Market Revenue (Million), by Component 2024 & 2032

- Figure 31: Latin America Active and Passive Electronic Components Market Revenue Share (%), by Component 2024 & 2032

- Figure 32: Latin America Active and Passive Electronic Components Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 33: Latin America Active and Passive Electronic Components Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 34: Latin America Active and Passive Electronic Components Market Revenue (Million), by Country 2024 & 2032

- Figure 35: Latin America Active and Passive Electronic Components Market Revenue Share (%), by Country 2024 & 2032

- Figure 36: Middle East and Africa Active and Passive Electronic Components Market Revenue (Million), by Component 2024 & 2032

- Figure 37: Middle East and Africa Active and Passive Electronic Components Market Revenue Share (%), by Component 2024 & 2032

- Figure 38: Middle East and Africa Active and Passive Electronic Components Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 39: Middle East and Africa Active and Passive Electronic Components Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 40: Middle East and Africa Active and Passive Electronic Components Market Revenue (Million), by Country 2024 & 2032

- Figure 41: Middle East and Africa Active and Passive Electronic Components Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Active and Passive Electronic Components Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Active and Passive Electronic Components Market Revenue Million Forecast, by Component 2019 & 2032

- Table 3: Global Active and Passive Electronic Components Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 4: Global Active and Passive Electronic Components Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Active and Passive Electronic Components Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Active and Passive Electronic Components Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Global Active and Passive Electronic Components Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Active and Passive Electronic Components Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Active and Passive Electronic Components Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Active and Passive Electronic Components Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global Active and Passive Electronic Components Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Active and Passive Electronic Components Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global Active and Passive Electronic Components Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Active and Passive Electronic Components Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Global Active and Passive Electronic Components Market Revenue Million Forecast, by Component 2019 & 2032

- Table 16: Global Active and Passive Electronic Components Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 17: Global Active and Passive Electronic Components Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Global Active and Passive Electronic Components Market Revenue Million Forecast, by Component 2019 & 2032

- Table 19: Global Active and Passive Electronic Components Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 20: Global Active and Passive Electronic Components Market Revenue Million Forecast, by Country 2019 & 2032

- Table 21: Global Active and Passive Electronic Components Market Revenue Million Forecast, by Component 2019 & 2032

- Table 22: Global Active and Passive Electronic Components Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 23: Global Active and Passive Electronic Components Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: Global Active and Passive Electronic Components Market Revenue Million Forecast, by Component 2019 & 2032

- Table 25: Global Active and Passive Electronic Components Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 26: Global Active and Passive Electronic Components Market Revenue Million Forecast, by Country 2019 & 2032

- Table 27: Global Active and Passive Electronic Components Market Revenue Million Forecast, by Component 2019 & 2032

- Table 28: Global Active and Passive Electronic Components Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 29: Global Active and Passive Electronic Components Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Active and Passive Electronic Components Market?

The projected CAGR is approximately 8.79%.

2. Which companies are prominent players in the Active and Passive Electronic Components Market?

Key companies in the market include Vishay Intertechnology Inc, Infineon Technologies AG, Honeywell International Inc, Lelon Electronics Corporation, NXP Semiconductors NV, KEMET Corporation (Yageo Corporation), Toshiba Corp, Texas Instruments Inc, AVX Corporation (Kyocera Corp), YAGEO Corporation, TE Connectivity Ltd, Taiyo Yuden Co Ltd*List Not Exhaustive, TDK Corporation, Murata Manufacturing Co Ltd, Panasonic Corporation, Eaton Corporation.

3. What are the main segments of the Active and Passive Electronic Components Market?

The market segments include Component, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.70 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Preference For Miniaturized Designs; Growing Number of Computing. Communications. and Consumer Electronics; Increasing Adoption of 5G Technology.

6. What are the notable trends driving market growth?

Increasing Adoption of 5G Technology is Driving the Market.

7. Are there any restraints impacting market growth?

Rising Metal Prices Impacting Component Production Costs.

8. Can you provide examples of recent developments in the market?

January 2023: Infineon Technologies AG's MOTIX family for automotive and commercial motor control applications provides a wide range of products with different levels of integration. Infineon releases the MOTIX 3-phase gate driver IC 6ED2742S01Q to broaden its product line. The 160 V silicon-on-insulator (SOI) gate driver comes in a QFN-32 package with a thermally efficient exposed power pad and has an integrated power management unit (PMU). Because of this, the simple-to-integrate device is perfect for battery-powered industrial BLDC motor control drives, such as those used in robotics, drones, cordless power tools, and light electric vehicles.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Active and Passive Electronic Components Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Active and Passive Electronic Components Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Active and Passive Electronic Components Market?

To stay informed about further developments, trends, and reports in the Active and Passive Electronic Components Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence