Key Insights

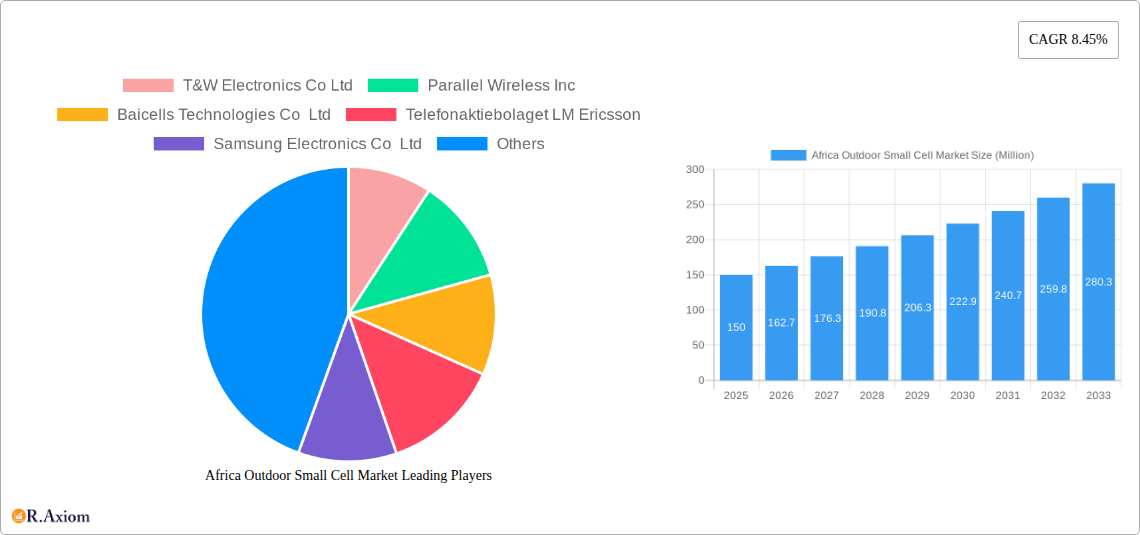

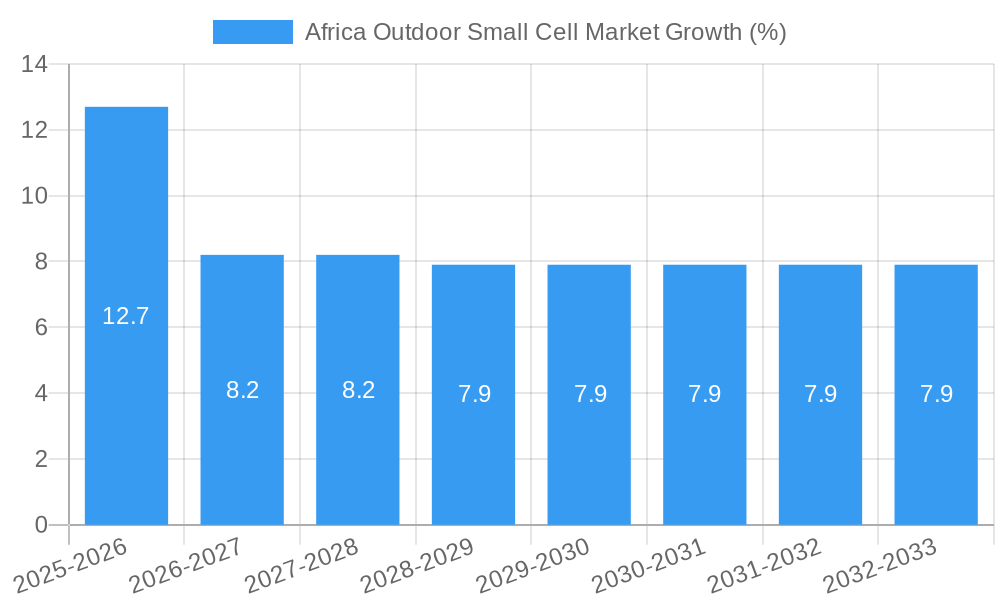

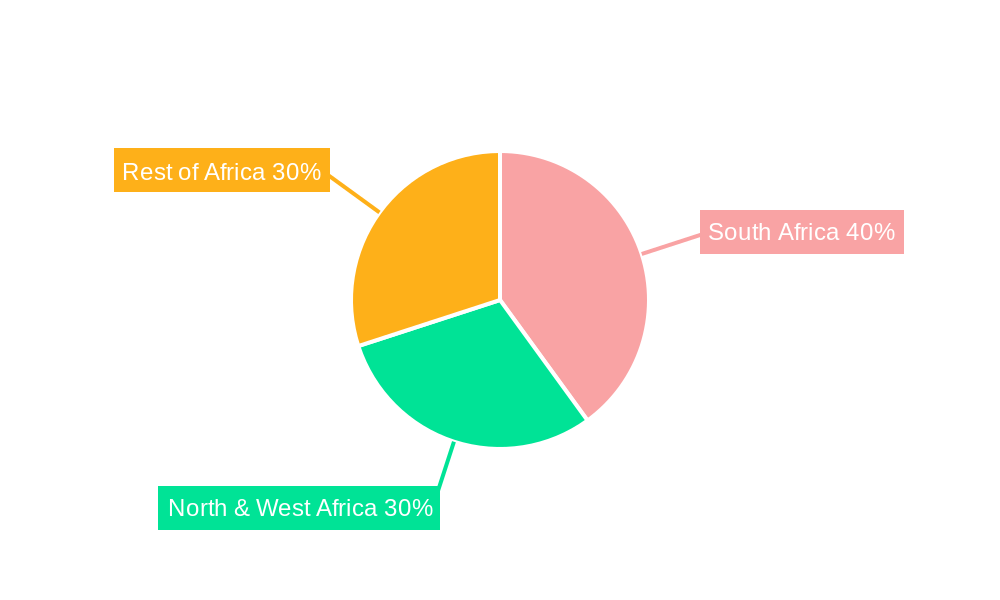

The Africa outdoor small cell market is experiencing robust growth, driven by the increasing demand for enhanced mobile broadband coverage and capacity, particularly in underserved rural areas. A CAGR of 8.45% from 2019-2033 indicates a significant expansion, fueled by factors such as rising smartphone penetration, the proliferation of mobile data consumption, and the expansion of 4G and 5G networks across the continent. The market is segmented by application (outdoor and indoor) and region (North & West Africa, South Africa, and Rest of Africa). South Africa currently holds the largest market share due to its relatively advanced infrastructure and higher mobile penetration rates compared to other African nations. However, significant growth potential exists in other regions like East Africa (Kenya, Tanzania, Uganda) and North Africa, driven by government initiatives to improve digital infrastructure and expand mobile network coverage. The market is competitive, with both global players like Ericsson, Nokia, and Huawei, and regional players like T&W Electronics, vying for market share. The deployment of small cells is crucial for addressing network congestion in densely populated urban areas and expanding coverage in remote locations, thereby driving economic development and bridging the digital divide. Challenges include the high initial investment costs for infrastructure deployment, regulatory hurdles, and the need for robust power solutions in areas with unreliable electricity grids.

Looking ahead, the market's growth trajectory is projected to remain strong through 2033. The increasing adoption of IoT devices, the expansion of 5G networks, and the growing need for reliable connectivity in various sectors, including agriculture, healthcare, and education, will contribute to this growth. The focus will likely shift towards cost-effective, energy-efficient small cell solutions tailored to the unique challenges of the African landscape. Furthermore, partnerships between telecom operators and local vendors are likely to become more prevalent, facilitating faster deployment and wider market penetration. The key to success in this market will be the ability to offer solutions that address the specific needs of different regions and overcome the existing infrastructural challenges.

Africa Outdoor Small Cell Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Africa Outdoor Small Cell Market, offering valuable insights for industry stakeholders, investors, and strategic decision-makers. With a detailed examination of market trends, competitive landscape, and future growth opportunities, this report is an essential resource for navigating the dynamic landscape of Africa's expanding telecommunications sector. The report covers the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033.

Africa Outdoor Small Cell Market Concentration & Innovation

The Africa outdoor small cell market exhibits a moderately concentrated landscape, with key players vying for market share. While precise market share figures for each company are unavailable at this time (xx%), the market is characterized by a mix of established global players and regional vendors. The entry of new players is facilitated by relatively lower barriers to entry compared to macrocell deployments, fostering competition and innovation.

Several factors drive innovation in this market:

- Demand for enhanced network capacity: The surging demand for mobile data and improved network coverage, particularly in underserved rural areas, fuels the adoption of small cells.

- Technological advancements: The ongoing development of 5G and other advanced technologies, such as software-defined networking (SDN) and network function virtualization (NFV), are pushing the boundaries of small cell capabilities.

- Government initiatives: Various government initiatives aimed at bridging the digital divide in Africa are spurring investments in infrastructure, including small cell deployments. Examples include the Universal Communications Service Access Fund (UCSAF) in East Africa.

- Falling hardware costs: Reduced hardware costs make small cell deployments economically viable even in regions with lower average revenue per user (ARPU).

Mergers and acquisitions (M&A) activity is expected to increase as companies seek to expand their footprint and gain access to new technologies. While specific M&A deal values for this market remain confidential (xx Million), the trend is towards consolidation and strategic partnerships. Regulatory frameworks vary across different African countries, influencing market dynamics and investment decisions. This report analyzes the impact of these frameworks on market growth and competitiveness.

Africa Outdoor Small Cell Market Industry Trends & Insights

The Africa outdoor small cell market is experiencing robust growth, driven by a confluence of factors. The Compound Annual Growth Rate (CAGR) during the forecast period (2025-2033) is projected to be xx%. This growth is largely attributable to the increasing mobile penetration rates across the continent, expanding mobile broadband adoption, and the governments' initiative to enhance connectivity. Market penetration is steadily increasing, with small cells playing a crucial role in expanding coverage to previously underserved areas.

Technological disruptions, such as the deployment of 5G networks, are shaping the competitive dynamics. Consumer preferences are shifting towards higher data speeds and improved network reliability, creating significant demand for outdoor small cell solutions. Competitive dynamics are intense, with established players facing competition from new entrants, particularly in the areas of innovative technology offerings and cost-effective solutions.

Dominant Markets & Segments in Africa Outdoor Small Cell Market

By Application: The outdoor segment significantly dominates the market, owing to the higher demand for improved coverage in urban and rural areas compared to indoor deployments. This is primarily driven by the need to increase network capacity to support the surge in mobile data usage. The indoor segment, however, shows promising growth potential, especially in high-density areas like office complexes and shopping malls, indicating a future where both segments complement each other.

By Region: South Africa currently holds the largest market share due to its advanced telecommunications infrastructure and higher mobile penetration rates compared to other regions. However, significant growth opportunities exist in North & West Africa, and the Rest of Africa, particularly in expanding network coverage in rural areas. Key drivers for dominance include the level of economic development, the presence of supportive government policies promoting digital inclusion, and the rate of investments in telecom infrastructure.

Africa Outdoor Small Cell Market Product Developments

Recent product innovations focus on improving network performance, enhancing energy efficiency, and reducing deployment costs. Small cells with integrated functionalities are gaining traction, simplifying deployment and reducing overall system complexity. The focus is on developing robust and cost-effective solutions to cater to the specific needs of the African market, prioritizing factors like weather resilience, ease of installation, and integration with existing infrastructure. Technological trends like virtualization and cloud-based management are driving improved network manageability and flexibility.

Report Scope & Segmentation Analysis

By Application: The report segments the market into outdoor and indoor small cells. The outdoor segment is expected to show a faster growth rate due to the need for wider area coverage. The indoor segment, while smaller, offers growth potential driven by enterprise adoption and the need for improved coverage in dense urban environments.

By Region: The market is geographically segmented into North & West Africa, South Africa, and the Rest of Africa. South Africa is expected to remain the leading region throughout the forecast period, followed by substantial growth in other regions driven by government initiatives and increased investments in telecom infrastructure. The competitive landscape varies across regions, with a mix of international players and local vendors.

Key Drivers of Africa Outdoor Small Cell Market Growth

The primary drivers for the growth of the Africa outdoor small cell market include:

- The rapid expansion of mobile network coverage, especially in rural and underserved areas.

- Increasing mobile data consumption fueled by the rising adoption of smartphones and mobile internet services.

- Government initiatives and investments aimed at enhancing telecommunications infrastructure.

- Decreasing small cell hardware costs, making deployment more financially feasible.

- Technological advancements in small cell technology.

Challenges in the Africa Outdoor Small Cell Market Sector

Several challenges hinder the market's growth, including:

- The lack of consistent regulatory frameworks across different African countries.

- Supply chain constraints and logistical difficulties impacting deployment timelines.

- Competition from existing macrocell networks and other alternative technologies.

- Concerns about energy access and cost in remote areas hindering widespread deployments.

Emerging Opportunities in Africa Outdoor Small Cell Market

Emerging opportunities in the Africa outdoor small cell market include:

- The deployment of 5G networks and private LTE networks in various sectors.

- Growth in demand for small cells in smart city initiatives and IoT applications.

- Government initiatives to reduce the digital divide by improving connectivity in rural areas.

- Adoption of innovative financing models to support the deployment of small cell infrastructure.

Leading Players in the Africa Outdoor Small Cell Market Market

- T&W Electronics Co Ltd

- Parallel Wireless Inc

- Baicells Technologies Co Ltd

- Telefonaktiebolaget LM Ericsson

- Samsung Electronics Co Ltd

- Nokia Corporation

- NEC Corporation

- Huawei Technologies Co Ltd

- ZTE Corporation

- Airspan Networks Inc

Key Developments in Africa Outdoor Small Cell Market Industry

November 2023: Parallel Wireless announced the deployment of 2G and 4G networks for a large national operator in East Africa, focusing on rural and suburban areas under the UCSAF initiative. This significantly expands cellular connectivity in underserved regions.

September 2023: InfiniG introduced a neutral host service using shared spectrum for enhanced in-building mobile coverage. This innovative solution simplifies mobile operator deployments and improves overall network efficiency.

Strategic Outlook for Africa Outdoor Small Cell Market Market

The Africa outdoor small cell market presents substantial growth potential driven by increasing mobile penetration, expanding data consumption, and government initiatives. The ongoing technological advancements, coupled with decreasing hardware costs, will further fuel market expansion. Strategic partnerships, innovative financing models, and a focus on addressing regulatory challenges are crucial for maximizing the opportunities within this dynamic market. The market's future is bright, with significant growth projected over the coming years, making it an attractive investment destination for both established players and new entrants.

Africa Outdoor Small Cell Market Segmentation

-

1. Application

- 1.1. Outdoor

- 1.2. Indoor

Africa Outdoor Small Cell Market Segmentation By Geography

-

1. Africa

- 1.1. Nigeria

- 1.2. South Africa

- 1.3. Egypt

- 1.4. Kenya

- 1.5. Ethiopia

- 1.6. Morocco

- 1.7. Ghana

- 1.8. Algeria

- 1.9. Tanzania

- 1.10. Ivory Coast

Africa Outdoor Small Cell Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.45% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rapid Increase in Mobile Data Traffic in the Region; Growing Emphasis on Operational Efficiency and Reduction of Capital Expenditure through Replacement of Older Networks with Small Cell Towers; Steady Growth in Installations by Market Incumbents

- 3.3. Market Restrains

- 3.3.1. Various Regulations and Policies Coupled with Storage Issues

- 3.4. Market Trends

- 3.4.1. Outdoor to Have Significant Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Africa Outdoor Small Cell Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Outdoor

- 5.1.2. Indoor

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Africa

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. South Africa Africa Outdoor Small Cell Market Analysis, Insights and Forecast, 2019-2031

- 7. Sudan Africa Outdoor Small Cell Market Analysis, Insights and Forecast, 2019-2031

- 8. Uganda Africa Outdoor Small Cell Market Analysis, Insights and Forecast, 2019-2031

- 9. Tanzania Africa Outdoor Small Cell Market Analysis, Insights and Forecast, 2019-2031

- 10. Kenya Africa Outdoor Small Cell Market Analysis, Insights and Forecast, 2019-2031

- 11. Rest of Africa Africa Outdoor Small Cell Market Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 T&W Electronics Co Ltd

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Parallel Wireless Inc

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Baicells Technologies Co Ltd

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Telefonaktiebolaget LM Ericsson

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Samsung Electronics Co Ltd

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Nokia Corporation*List Not Exhaustive

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 NEC Corporation

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Huawei Technologies Co Ltd

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 ZTE Corporation

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Airspan Networks Inc

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 T&W Electronics Co Ltd

List of Figures

- Figure 1: Africa Outdoor Small Cell Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Africa Outdoor Small Cell Market Share (%) by Company 2024

List of Tables

- Table 1: Africa Outdoor Small Cell Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Africa Outdoor Small Cell Market Volume Thousand Forecast, by Region 2019 & 2032

- Table 3: Africa Outdoor Small Cell Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Africa Outdoor Small Cell Market Volume Thousand Forecast, by Application 2019 & 2032

- Table 5: Africa Outdoor Small Cell Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Africa Outdoor Small Cell Market Volume Thousand Forecast, by Region 2019 & 2032

- Table 7: Africa Outdoor Small Cell Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Africa Outdoor Small Cell Market Volume Thousand Forecast, by Country 2019 & 2032

- Table 9: South Africa Africa Outdoor Small Cell Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: South Africa Africa Outdoor Small Cell Market Volume (Thousand) Forecast, by Application 2019 & 2032

- Table 11: Sudan Africa Outdoor Small Cell Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Sudan Africa Outdoor Small Cell Market Volume (Thousand) Forecast, by Application 2019 & 2032

- Table 13: Uganda Africa Outdoor Small Cell Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Uganda Africa Outdoor Small Cell Market Volume (Thousand) Forecast, by Application 2019 & 2032

- Table 15: Tanzania Africa Outdoor Small Cell Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Tanzania Africa Outdoor Small Cell Market Volume (Thousand) Forecast, by Application 2019 & 2032

- Table 17: Kenya Africa Outdoor Small Cell Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Kenya Africa Outdoor Small Cell Market Volume (Thousand) Forecast, by Application 2019 & 2032

- Table 19: Rest of Africa Africa Outdoor Small Cell Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Rest of Africa Africa Outdoor Small Cell Market Volume (Thousand) Forecast, by Application 2019 & 2032

- Table 21: Africa Outdoor Small Cell Market Revenue Million Forecast, by Application 2019 & 2032

- Table 22: Africa Outdoor Small Cell Market Volume Thousand Forecast, by Application 2019 & 2032

- Table 23: Africa Outdoor Small Cell Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: Africa Outdoor Small Cell Market Volume Thousand Forecast, by Country 2019 & 2032

- Table 25: Nigeria Africa Outdoor Small Cell Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Nigeria Africa Outdoor Small Cell Market Volume (Thousand) Forecast, by Application 2019 & 2032

- Table 27: South Africa Africa Outdoor Small Cell Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: South Africa Africa Outdoor Small Cell Market Volume (Thousand) Forecast, by Application 2019 & 2032

- Table 29: Egypt Africa Outdoor Small Cell Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Egypt Africa Outdoor Small Cell Market Volume (Thousand) Forecast, by Application 2019 & 2032

- Table 31: Kenya Africa Outdoor Small Cell Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Kenya Africa Outdoor Small Cell Market Volume (Thousand) Forecast, by Application 2019 & 2032

- Table 33: Ethiopia Africa Outdoor Small Cell Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Ethiopia Africa Outdoor Small Cell Market Volume (Thousand) Forecast, by Application 2019 & 2032

- Table 35: Morocco Africa Outdoor Small Cell Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Morocco Africa Outdoor Small Cell Market Volume (Thousand) Forecast, by Application 2019 & 2032

- Table 37: Ghana Africa Outdoor Small Cell Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Ghana Africa Outdoor Small Cell Market Volume (Thousand) Forecast, by Application 2019 & 2032

- Table 39: Algeria Africa Outdoor Small Cell Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Algeria Africa Outdoor Small Cell Market Volume (Thousand) Forecast, by Application 2019 & 2032

- Table 41: Tanzania Africa Outdoor Small Cell Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Tanzania Africa Outdoor Small Cell Market Volume (Thousand) Forecast, by Application 2019 & 2032

- Table 43: Ivory Coast Africa Outdoor Small Cell Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Ivory Coast Africa Outdoor Small Cell Market Volume (Thousand) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Africa Outdoor Small Cell Market?

The projected CAGR is approximately 8.45%.

2. Which companies are prominent players in the Africa Outdoor Small Cell Market?

Key companies in the market include T&W Electronics Co Ltd, Parallel Wireless Inc, Baicells Technologies Co Ltd, Telefonaktiebolaget LM Ericsson, Samsung Electronics Co Ltd, Nokia Corporation*List Not Exhaustive, NEC Corporation, Huawei Technologies Co Ltd, ZTE Corporation, Airspan Networks Inc.

3. What are the main segments of the Africa Outdoor Small Cell Market?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rapid Increase in Mobile Data Traffic in the Region; Growing Emphasis on Operational Efficiency and Reduction of Capital Expenditure through Replacement of Older Networks with Small Cell Towers; Steady Growth in Installations by Market Incumbents.

6. What are the notable trends driving market growth?

Outdoor to Have Significant Share.

7. Are there any restraints impacting market growth?

Various Regulations and Policies Coupled with Storage Issues.

8. Can you provide examples of recent developments in the market?

November 2023 - Parallel Wireless has announced that it will be deploying 2G and 4G networks for a for a large national operator, Where It will focus on rural and suburban areas, deploying and delivering cellular connectivity under the Universal Communications Service Access Fund (UCSAF) in East Africa which is a government initiative aimed to deliver greater coverage to all residents.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Thousand.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Africa Outdoor Small Cell Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Africa Outdoor Small Cell Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Africa Outdoor Small Cell Market?

To stay informed about further developments, trends, and reports in the Africa Outdoor Small Cell Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence