Key Insights

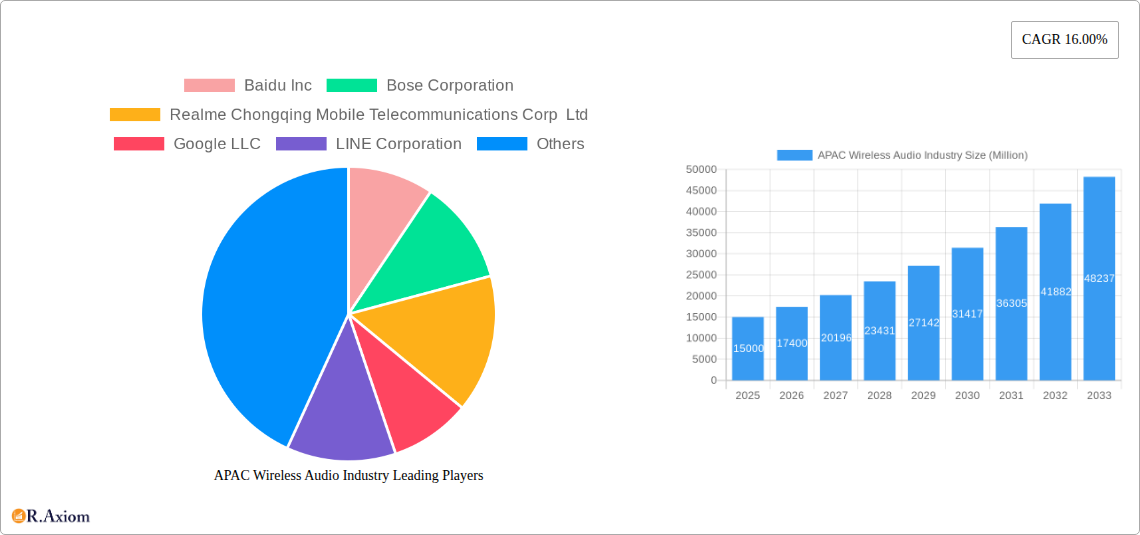

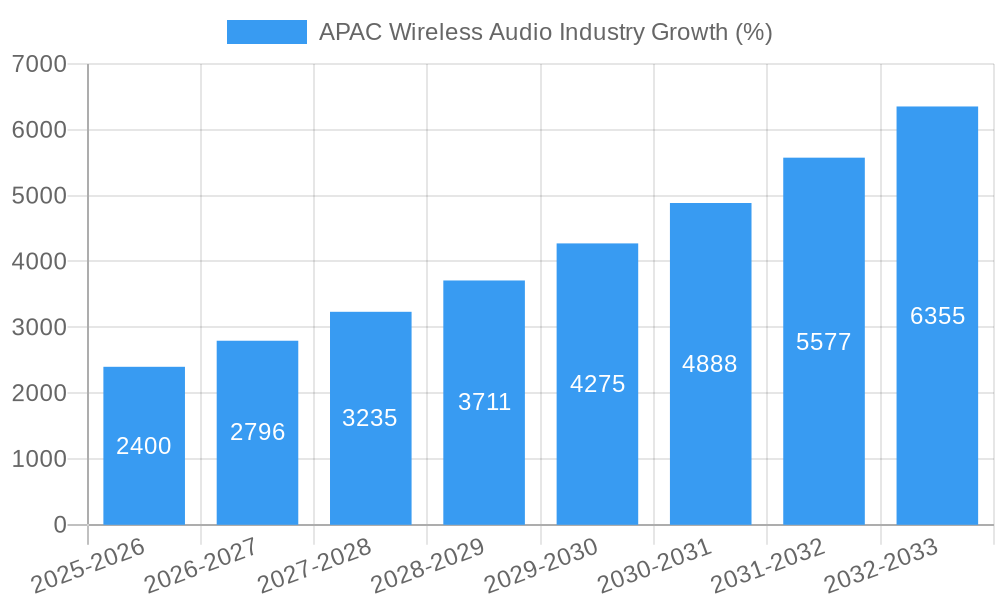

The Asia-Pacific (APAC) wireless audio market is experiencing robust growth, fueled by increasing smartphone penetration, rising disposable incomes, and a burgeoning demand for high-quality audio experiences. The region's diverse consumer base, encompassing both price-sensitive and premium segments, presents significant opportunities for various players. The 16% CAGR indicates a substantial expansion, projected to continue throughout the forecast period (2025-2033). Key drivers include the popularity of true wireless stereo (TWS) earbuds, the integration of smart features in speakers and headphones, and the growing adoption of streaming services. While the market is competitive, with established players like Apple, Samsung, and Bose alongside emerging Chinese brands like Xiaomi and Realme, the significant market size and rapid expansion offer substantial potential for both existing and new entrants. Segmentation by device type (TWS, wireless headphones, wireless speakers) and country (China, Japan, South Korea, India, Southeast Asia) reveals specific market dynamics within the broader APAC landscape. For instance, China and India represent significant growth markets due to their large populations and rising middle class, while mature markets like Japan and South Korea show a focus on premium products and advanced features. The continued technological advancements in audio quality, battery life, and connectivity, coupled with innovative marketing strategies, will further shape the competitive dynamics and overall market trajectory.

The restraints to growth primarily involve supply chain challenges, fluctuating component prices, and potential trade restrictions impacting certain regions. However, the strong underlying demand and innovative capabilities within the APAC region are likely to mitigate these challenges. The increasing focus on customization, personalized audio experiences, and health-related features (noise cancellation, hearing protection) within the product offerings will continue to drive innovation and consumer adoption. The projected market size for APAC wireless audio in 2025 is estimated to be substantially large (given a 16% CAGR and unspecified initial market size XX), with a continued expansion throughout the forecast period, reflecting the strong growth trajectory of this dynamic sector. This growth will be unevenly distributed across the various countries in the region, shaped by economic conditions, consumer preferences and the competitive strategies of leading brands.

APAC Wireless Audio Industry: 2019-2033 Market Analysis & Forecast Report

This comprehensive report provides an in-depth analysis of the Asia-Pacific (APAC) wireless audio industry, covering the period 2019-2033. It offers detailed insights into market trends, competitive dynamics, and growth opportunities across various segments, including smart speakers, wireless earphones, and headsets. The report utilizes data from the base year 2025 and presents forecasts until 2033, incorporating historical data from 2019-2024. Key market players such as Apple Inc, Samsung Electronics Co Ltd, Xiaomi Corp, and Bose Corporation are analyzed, along with emerging players shaping the industry landscape. The report provides actionable insights for industry stakeholders, investors, and businesses seeking to navigate this dynamic market.

APAC Wireless Audio Industry Market Concentration & Innovation

This section analyzes the market concentration within the APAC wireless audio industry, examining the market share held by leading players like Apple, Samsung, and Xiaomi. We explore the role of innovation in driving market growth, identifying key technological advancements impacting product development and consumer preferences. The regulatory landscape is assessed, considering its influence on market dynamics and the adoption of new technologies. The influence of substitute products, evolving end-user trends, and mergers & acquisitions (M&A) activities are also examined, with insights into deal values and their impact on market structure. For example, the estimated M&A activity in 2024 totalled xx Million, highlighting the consolidation trend.

- Market Concentration: Analysis of market share distribution among top players reveals a moderately concentrated market with a few dominant players and a long tail of smaller niche brands.

- Innovation Drivers: Key drivers include advancements in audio technology (e.g., noise cancellation, spatial audio), integration with smart assistants, and the rise of connected devices.

- Regulatory Frameworks: Government policies and regulations regarding data privacy, e-commerce, and product safety play a crucial role in influencing market growth.

- Product Substitutes: Competition from wired audio products and alternative entertainment mediums continues to impact overall market growth.

- End-User Trends: A growing preference for wireless convenience, portability, and high-quality audio experiences drives demand.

- M&A Activities: Strategic acquisitions and mergers are reshaping the market, leading to increased market consolidation and expansion into new product categories.

APAC Wireless Audio Industry Industry Trends & Insights

This section delves into the prevailing trends shaping the APAC wireless audio industry. We analyze the factors driving market growth, including rising disposable incomes, increasing smartphone penetration, and a growing preference for on-the-go entertainment. Technological disruptions such as the advent of advanced audio codecs and improved battery technologies are also examined. Consumer preferences are analyzed, emphasizing the shift towards premium audio experiences, personalized features, and integrated smart functionalities. The competitive landscape is comprehensively explored, examining the strategies of key players and their impact on the industry’s competitive dynamics. The report projects a Compound Annual Growth Rate (CAGR) of xx% for the forecast period (2025-2033), with market penetration expected to reach xx% by 2033.

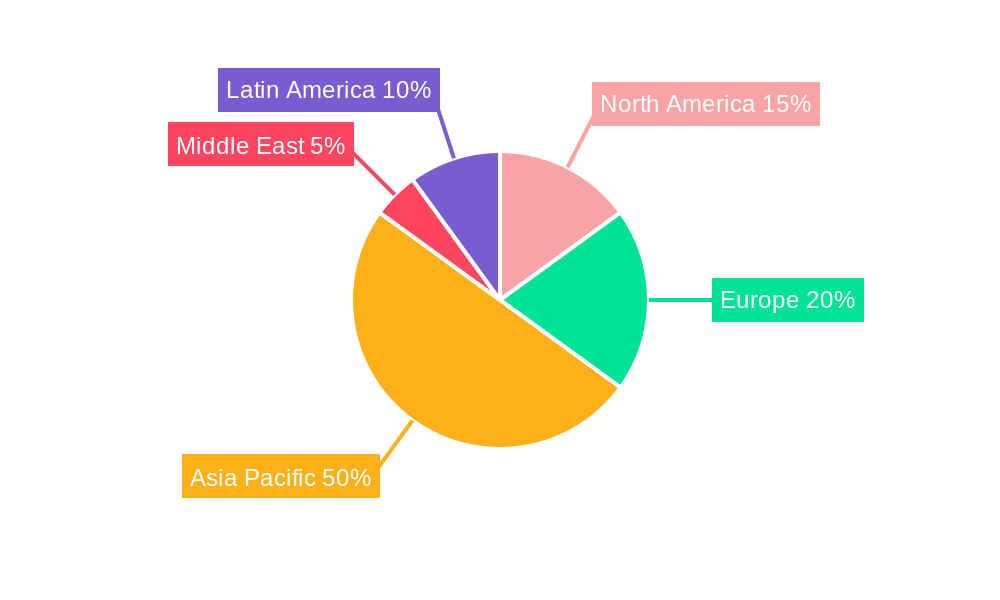

Dominant Markets & Segments in APAC Wireless Audio Industry

This section identifies the dominant markets and segments within the APAC wireless audio industry. We analyze regional market performance, highlighting leading countries based on market size and growth rates, including China, South Korea, Japan, India, and Southeast Asia. The leading segments are identified based on market share and growth potential, focusing on Wireless Speakers, Wi-Fi Speakers, Wireless Earphones, Wireless Headsets, and True Wireless Stereo (TWS) devices.

- China: Dominates the APAC wireless audio market due to its large population, robust e-commerce infrastructure, and a thriving domestic manufacturing base. Key drivers include:

- Strong economic growth driving consumer spending.

- High smartphone penetration rates fueling demand for wireless audio accessories.

- Government initiatives supporting technological innovation and digitalization.

- South Korea: High adoption of advanced technology and strong brand loyalty drive high market penetration.

- Japan: Mature market with a focus on high-quality audio products and brand reputation.

- India: Rapidly growing market, characterized by price sensitivity and increasing affordability of wireless audio devices.

- Southeast Asia: High growth potential driven by rising disposable incomes, increasing smartphone ownership, and a young, tech-savvy population.

- Segment Dominance: True Wireless Stereo (TWS) earphones demonstrate the highest growth rate, followed by wireless earphones and smart speakers. The market for Wi-Fi speakers (excluding smart speakers) is experiencing steady growth.

APAC Wireless Audio Industry Product Developments

This section summarizes recent product innovations, examining the technological advancements that enhance audio quality, battery life, and user experience. The competitive advantages offered by various products are highlighted, discussing features like noise cancellation, water resistance, and seamless integration with smart devices. The market fit of new product introductions is assessed based on consumer demand and market trends. Technological trends toward miniaturization, improved battery technology, and enhanced connectivity are driving innovation.

Report Scope & Segmentation Analysis

This report segments the APAC wireless audio market based on device type (Wireless Speakers, Wi-Fi Speakers, Wireless Earphones, Wireless Headsets, TWS), country (China, South Korea, Japan, India, Southeast Asia), and vendor ranking for smart speakers and smart personal audio devices within each major market. Each segment's growth projections, market size, and competitive landscape are analyzed. The report considers both historical data and forecasts to provide a holistic view.

Key Drivers of APAC Wireless Audio Industry Growth

Several key factors drive the growth of the APAC wireless audio industry. These include rapid technological advancements in audio quality and functionality, increasing disposable incomes across various APAC countries, and the rising popularity of streaming audio services. Government initiatives promoting digital infrastructure and technological innovation further contribute to market expansion. The increased adoption of smartphones and other smart devices also fuels demand for wireless audio accessories.

Challenges in the APAC Wireless Audio Industry Sector

The APAC wireless audio industry faces several challenges. Intense competition among numerous global and regional players leads to price pressures and thin margins. Supply chain disruptions can impact production and availability of products, particularly given the reliance on global manufacturing networks. The increasing importance of data privacy and security necessitates robust measures to protect consumer data. Furthermore, evolving consumer preferences and technological advancements necessitate constant innovation to remain competitive.

Emerging Opportunities in APAC Wireless Audio Industry

The APAC wireless audio industry presents several emerging opportunities. The expansion into rural markets with increasing smartphone penetration presents a significant growth avenue. The development of new audio technologies, such as spatial audio and advanced noise cancellation, offers opportunities for premium product differentiation. Furthermore, integrating wireless audio devices with other smart home technologies and fitness trackers creates new market segments with high growth potential.

Leading Players in the APAC Wireless Audio Industry Market

- Baidu Inc

- Bose Corporation

- Realme Chongqing Mobile Telecommunications Corp Ltd

- Google LLC

- LINE Corporation

- Apple Inc (Including Beats Electronics LLC)

- Samsung Electronics Co Ltd

- Xiaomi Corp

- Skullcandy Inc

- Amazon com Inc

- Alibaba Group

- GN Audio AS (Jabra)

- Harman International Industries Incorporated (JBL)

- Huawei Device Co Ltd

- Sony Corporation

Key Developments in APAC Wireless Audio Industry Industry

- 2023-Q4: Apple launches new AirPods Pro with improved noise cancellation.

- 2023-Q3: Samsung expands its Galaxy Buds series with new models targeting the budget market.

- 2022-Q4: Xiaomi releases a new line of affordable true wireless earbuds.

- 2022-Q2: Bose introduces advanced noise cancellation technology for its wireless headphones.

- (Add more recent developments as available)

Strategic Outlook for APAP Wireless Audio Industry Market

The APAC wireless audio market shows strong growth potential driven by technological innovations, rising disposable incomes, and the increasing penetration of smartphones. Continued growth is projected, driven by the expanding adoption of TWS earbuds and smart speakers. Strategic focus on emerging markets, premium features, and seamless integration with smart ecosystems will be crucial for success in this competitive industry. Further developments in audio codecs, enhanced battery life, and improved connectivity are expected to shape the future of the APAC wireless audio market.

APAC Wireless Audio Industry Segmentation

-

1. Type of Device

-

1.1. Wireless Speakers

- 1.1.1. Bluetooth-Only

- 1.1.2. Smart Speakers

- 1.1.3. Wi-Fi Sp

- 1.2. Wireless Earphones

- 1.3. Wireless Headsets

- 1.4. True Wireless Stereo

-

1.1. Wireless Speakers

APAC Wireless Audio Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

APAC Wireless Audio Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 16.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing usage for IoT based connected devices; Increased 5G and advanced networks infrastructure development

- 3.3. Market Restrains

- 3.3.1. High costs associated with software and procurement

- 3.4. Market Trends

- 3.4.1. Bluetooth Speakers to Witness Higest Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global APAC Wireless Audio Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type of Device

- 5.1.1. Wireless Speakers

- 5.1.1.1. Bluetooth-Only

- 5.1.1.2. Smart Speakers

- 5.1.1.3. Wi-Fi Sp

- 5.1.2. Wireless Earphones

- 5.1.3. Wireless Headsets

- 5.1.4. True Wireless Stereo

- 5.1.1. Wireless Speakers

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type of Device

- 6. North America APAC Wireless Audio Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type of Device

- 6.1.1. Wireless Speakers

- 6.1.1.1. Bluetooth-Only

- 6.1.1.2. Smart Speakers

- 6.1.1.3. Wi-Fi Sp

- 6.1.2. Wireless Earphones

- 6.1.3. Wireless Headsets

- 6.1.4. True Wireless Stereo

- 6.1.1. Wireless Speakers

- 6.1. Market Analysis, Insights and Forecast - by Type of Device

- 7. South America APAC Wireless Audio Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type of Device

- 7.1.1. Wireless Speakers

- 7.1.1.1. Bluetooth-Only

- 7.1.1.2. Smart Speakers

- 7.1.1.3. Wi-Fi Sp

- 7.1.2. Wireless Earphones

- 7.1.3. Wireless Headsets

- 7.1.4. True Wireless Stereo

- 7.1.1. Wireless Speakers

- 7.1. Market Analysis, Insights and Forecast - by Type of Device

- 8. Europe APAC Wireless Audio Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type of Device

- 8.1.1. Wireless Speakers

- 8.1.1.1. Bluetooth-Only

- 8.1.1.2. Smart Speakers

- 8.1.1.3. Wi-Fi Sp

- 8.1.2. Wireless Earphones

- 8.1.3. Wireless Headsets

- 8.1.4. True Wireless Stereo

- 8.1.1. Wireless Speakers

- 8.1. Market Analysis, Insights and Forecast - by Type of Device

- 9. Middle East & Africa APAC Wireless Audio Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type of Device

- 9.1.1. Wireless Speakers

- 9.1.1.1. Bluetooth-Only

- 9.1.1.2. Smart Speakers

- 9.1.1.3. Wi-Fi Sp

- 9.1.2. Wireless Earphones

- 9.1.3. Wireless Headsets

- 9.1.4. True Wireless Stereo

- 9.1.1. Wireless Speakers

- 9.1. Market Analysis, Insights and Forecast - by Type of Device

- 10. Asia Pacific APAC Wireless Audio Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type of Device

- 10.1.1. Wireless Speakers

- 10.1.1.1. Bluetooth-Only

- 10.1.1.2. Smart Speakers

- 10.1.1.3. Wi-Fi Sp

- 10.1.2. Wireless Earphones

- 10.1.3. Wireless Headsets

- 10.1.4. True Wireless Stereo

- 10.1.1. Wireless Speakers

- 10.1. Market Analysis, Insights and Forecast - by Type of Device

- 11. North America APAC Wireless Audio Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Europe APAC Wireless Audio Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Asia Pacific APAC Wireless Audio Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Middle East APAC Wireless Audio Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Latin America APAC Wireless Audio Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Baidu Inc

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Bose Corporation

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Realme Chongqing Mobile Telecommunications Corp Ltd

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Google LLC

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 LINE Corporation

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Apple Inc (Including Beats Electronics LLC)

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Samsung Electronics Co Ltd

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Xiaomi Corp

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Skullcandy Inc

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Amazon com Inc

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 Alibaba Group

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.12 GN Audio AS (Jabra)

- 16.2.12.1. Overview

- 16.2.12.2. Products

- 16.2.12.3. SWOT Analysis

- 16.2.12.4. Recent Developments

- 16.2.12.5. Financials (Based on Availability)

- 16.2.13 Harman International Industries Incorporated (JBL)

- 16.2.13.1. Overview

- 16.2.13.2. Products

- 16.2.13.3. SWOT Analysis

- 16.2.13.4. Recent Developments

- 16.2.13.5. Financials (Based on Availability)

- 16.2.14 Huawei Device Co Ltd

- 16.2.14.1. Overview

- 16.2.14.2. Products

- 16.2.14.3. SWOT Analysis

- 16.2.14.4. Recent Developments

- 16.2.14.5. Financials (Based on Availability)

- 16.2.15 Sony Corporation

- 16.2.15.1. Overview

- 16.2.15.2. Products

- 16.2.15.3. SWOT Analysis

- 16.2.15.4. Recent Developments

- 16.2.15.5. Financials (Based on Availability)

- 16.2.1 Baidu Inc

List of Figures

- Figure 1: Global APAC Wireless Audio Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America APAC Wireless Audio Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America APAC Wireless Audio Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe APAC Wireless Audio Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe APAC Wireless Audio Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific APAC Wireless Audio Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific APAC Wireless Audio Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Middle East APAC Wireless Audio Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Middle East APAC Wireless Audio Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: Latin America APAC Wireless Audio Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: Latin America APAC Wireless Audio Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America APAC Wireless Audio Industry Revenue (Million), by Type of Device 2024 & 2032

- Figure 13: North America APAC Wireless Audio Industry Revenue Share (%), by Type of Device 2024 & 2032

- Figure 14: North America APAC Wireless Audio Industry Revenue (Million), by Country 2024 & 2032

- Figure 15: North America APAC Wireless Audio Industry Revenue Share (%), by Country 2024 & 2032

- Figure 16: South America APAC Wireless Audio Industry Revenue (Million), by Type of Device 2024 & 2032

- Figure 17: South America APAC Wireless Audio Industry Revenue Share (%), by Type of Device 2024 & 2032

- Figure 18: South America APAC Wireless Audio Industry Revenue (Million), by Country 2024 & 2032

- Figure 19: South America APAC Wireless Audio Industry Revenue Share (%), by Country 2024 & 2032

- Figure 20: Europe APAC Wireless Audio Industry Revenue (Million), by Type of Device 2024 & 2032

- Figure 21: Europe APAC Wireless Audio Industry Revenue Share (%), by Type of Device 2024 & 2032

- Figure 22: Europe APAC Wireless Audio Industry Revenue (Million), by Country 2024 & 2032

- Figure 23: Europe APAC Wireless Audio Industry Revenue Share (%), by Country 2024 & 2032

- Figure 24: Middle East & Africa APAC Wireless Audio Industry Revenue (Million), by Type of Device 2024 & 2032

- Figure 25: Middle East & Africa APAC Wireless Audio Industry Revenue Share (%), by Type of Device 2024 & 2032

- Figure 26: Middle East & Africa APAC Wireless Audio Industry Revenue (Million), by Country 2024 & 2032

- Figure 27: Middle East & Africa APAC Wireless Audio Industry Revenue Share (%), by Country 2024 & 2032

- Figure 28: Asia Pacific APAC Wireless Audio Industry Revenue (Million), by Type of Device 2024 & 2032

- Figure 29: Asia Pacific APAC Wireless Audio Industry Revenue Share (%), by Type of Device 2024 & 2032

- Figure 30: Asia Pacific APAC Wireless Audio Industry Revenue (Million), by Country 2024 & 2032

- Figure 31: Asia Pacific APAC Wireless Audio Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global APAC Wireless Audio Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global APAC Wireless Audio Industry Revenue Million Forecast, by Type of Device 2019 & 2032

- Table 3: Global APAC Wireless Audio Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Global APAC Wireless Audio Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 5: APAC Wireless Audio Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Global APAC Wireless Audio Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: APAC Wireless Audio Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Global APAC Wireless Audio Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 9: APAC Wireless Audio Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global APAC Wireless Audio Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 11: APAC Wireless Audio Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global APAC Wireless Audio Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 13: APAC Wireless Audio Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Global APAC Wireless Audio Industry Revenue Million Forecast, by Type of Device 2019 & 2032

- Table 15: Global APAC Wireless Audio Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: United States APAC Wireless Audio Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Canada APAC Wireless Audio Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Mexico APAC Wireless Audio Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Global APAC Wireless Audio Industry Revenue Million Forecast, by Type of Device 2019 & 2032

- Table 20: Global APAC Wireless Audio Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 21: Brazil APAC Wireless Audio Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Argentina APAC Wireless Audio Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Rest of South America APAC Wireless Audio Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Global APAC Wireless Audio Industry Revenue Million Forecast, by Type of Device 2019 & 2032

- Table 25: Global APAC Wireless Audio Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 26: United Kingdom APAC Wireless Audio Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Germany APAC Wireless Audio Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: France APAC Wireless Audio Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Italy APAC Wireless Audio Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Spain APAC Wireless Audio Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Russia APAC Wireless Audio Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Benelux APAC Wireless Audio Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Nordics APAC Wireless Audio Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Rest of Europe APAC Wireless Audio Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Global APAC Wireless Audio Industry Revenue Million Forecast, by Type of Device 2019 & 2032

- Table 36: Global APAC Wireless Audio Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 37: Turkey APAC Wireless Audio Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Israel APAC Wireless Audio Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: GCC APAC Wireless Audio Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: North Africa APAC Wireless Audio Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: South Africa APAC Wireless Audio Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Rest of Middle East & Africa APAC Wireless Audio Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Global APAC Wireless Audio Industry Revenue Million Forecast, by Type of Device 2019 & 2032

- Table 44: Global APAC Wireless Audio Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 45: China APAC Wireless Audio Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: India APAC Wireless Audio Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Japan APAC Wireless Audio Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: South Korea APAC Wireless Audio Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: ASEAN APAC Wireless Audio Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Oceania APAC Wireless Audio Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: Rest of Asia Pacific APAC Wireless Audio Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the APAC Wireless Audio Industry?

The projected CAGR is approximately 16.00%.

2. Which companies are prominent players in the APAC Wireless Audio Industry?

Key companies in the market include Baidu Inc, Bose Corporation, Realme Chongqing Mobile Telecommunications Corp Ltd, Google LLC, LINE Corporation, Apple Inc (Including Beats Electronics LLC), Samsung Electronics Co Ltd, Xiaomi Corp, Skullcandy Inc, Amazon com Inc, Alibaba Group, GN Audio AS (Jabra), Harman International Industries Incorporated (JBL), Huawei Device Co Ltd, Sony Corporation.

3. What are the main segments of the APAC Wireless Audio Industry?

The market segments include Type of Device.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing usage for IoT based connected devices; Increased 5G and advanced networks infrastructure development.

6. What are the notable trends driving market growth?

Bluetooth Speakers to Witness Higest Market Growth.

7. Are there any restraints impacting market growth?

High costs associated with software and procurement.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "APAC Wireless Audio Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the APAC Wireless Audio Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the APAC Wireless Audio Industry?

To stay informed about further developments, trends, and reports in the APAC Wireless Audio Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence