Key Insights

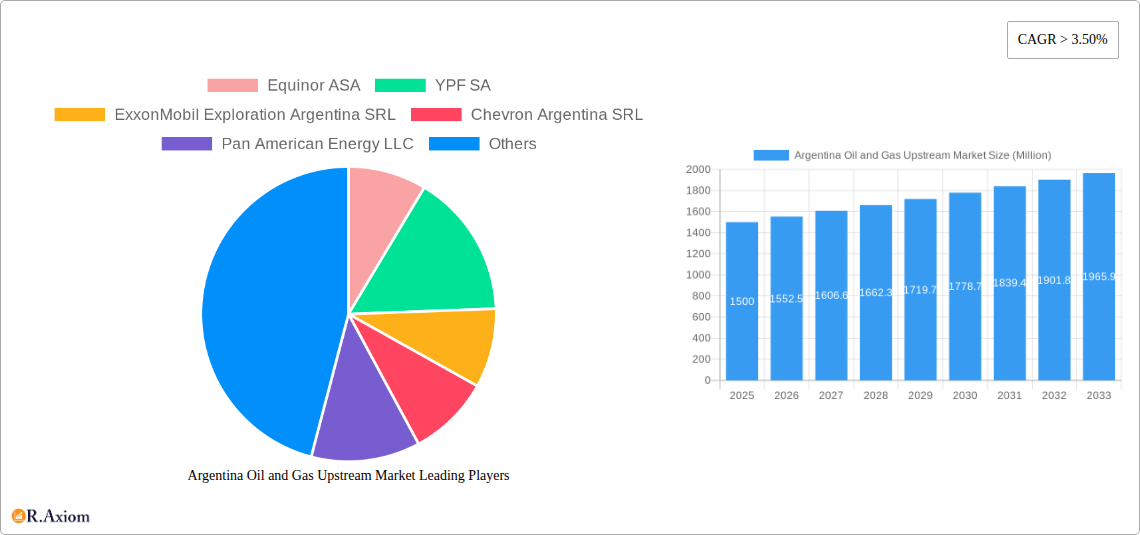

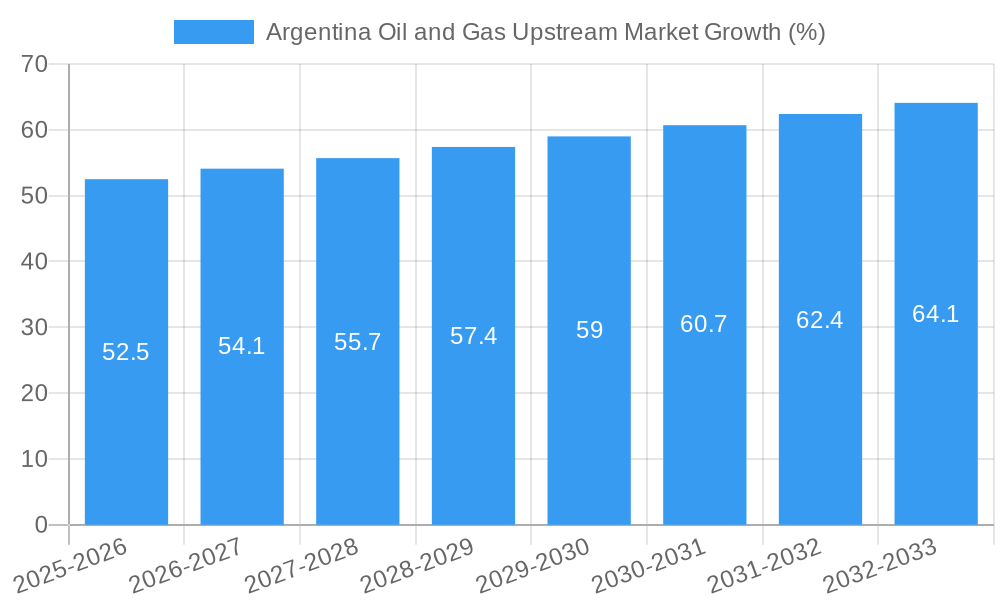

The Argentina Oil and Gas Upstream Market, valued at approximately $XX million in 2025, is projected to experience robust growth, with a Compound Annual Growth Rate (CAGR) exceeding 3.5% from 2025 to 2033. This expansion is driven by several factors. Firstly, increasing global energy demand, particularly for natural gas, presents a significant opportunity for Argentina, which possesses substantial reserves. Secondly, government initiatives aimed at attracting foreign investment and streamlining regulatory processes are fostering exploration and production activities. Furthermore, technological advancements in unconventional oil and gas extraction, such as shale gas development, are unlocking previously inaccessible resources and contributing to production growth. However, challenges remain. Fluctuations in global oil and gas prices pose a risk to investment and profitability. Furthermore, infrastructure limitations, including pipeline capacity constraints, hinder efficient transportation of resources to domestic and international markets. The market is segmented by resource type (conventional oil, unconventional oil, natural gas) and end-use application (power generation, industrial use, transportation). Key players like Equinor ASA, YPF SA, ExxonMobil, Chevron, and Pan American Energy are actively involved, shaping the competitive landscape.

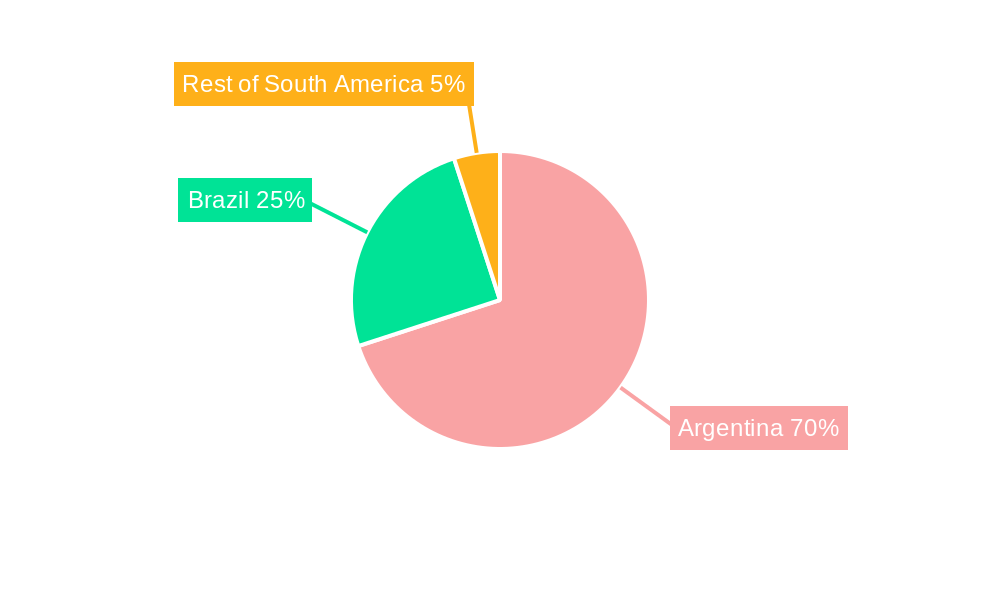

The South American nation's upstream sector growth is geographically concentrated, with Brazil and Argentina leading the way. While Argentina benefits from its resource base, the long-term success hinges on overcoming infrastructural bottlenecks and maintaining a stable regulatory environment to encourage continued investment. The market's future trajectory depends heavily on global energy prices, technological innovation, and the government's ability to successfully attract and retain international participation in exploration and production activities. The forecast period, 2025-2033, promises significant opportunities despite the inherent challenges, presenting a complex but potentially lucrative market for both domestic and international operators. Strategic partnerships and technological advancements will be critical determinants of success in this evolving sector.

Argentina Oil and Gas Upstream Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the Argentina oil and gas upstream market, offering invaluable insights for stakeholders across the energy sector. Covering the period from 2019 to 2033, with a focus on 2025, this research meticulously examines market trends, competitive dynamics, and future growth potential. The report incorporates extensive data analysis and expert insights to provide a clear understanding of this dynamic market.

Argentina Oil and Gas Upstream Market Market Concentration & Innovation

This section analyzes the competitive landscape of Argentina's oil and gas upstream market, encompassing market concentration, innovation drivers, regulatory frameworks, and M&A activities. Key players like YPF SA, Equinor ASA, ExxonMobil Exploration Argentina SRL, Chevron Argentina SRL, Pan American Energy LLC, Techint Group, TotalEnergies SE, and Tullow Oil PLC, shape the market dynamics. Market share analysis reveals the dominance of YPF SA, while other players compete intensely for market share. The report explores the influence of regulatory frameworks, including licensing processes and environmental regulations, on market concentration. Innovation in unconventional oil and gas extraction, particularly in the Vaca Muerta shale formation, is a significant growth driver. Furthermore, the report examines recent M&A activities, including deal values and their impact on market consolidation. For example, the USD 150 Million investment by Vista Energy and Trafigura Argentina in Vaca Muerta highlights the ongoing investment in unconventional resources. The analysis further delves into the impact of technological advancements, such as enhanced oil recovery techniques and improved drilling technologies, on market competitiveness. Finally, the report examines end-user trends and their influence on the demand for different oil and gas products.

Argentina Oil and Gas Upstream Market Industry Trends & Insights

This section delves into the key trends and insights shaping the Argentinian oil and gas upstream market. The analysis covers market growth drivers, technological advancements, and competitive dynamics, providing a comprehensive understanding of the market's evolution. We project a Compound Annual Growth Rate (CAGR) of xx% for the forecast period (2025-2033), driven by factors such as increasing domestic demand, exploration and production activities in the Vaca Muerta shale play, and government initiatives to boost energy independence. The report explores the market penetration of unconventional oil and gas resources, which are rapidly gaining prominence. Technological disruptions, such as advancements in horizontal drilling and hydraulic fracturing, are significantly impacting production efficiency and driving down costs. The competitive landscape is characterized by a mix of international and domestic players, with each employing unique strategies to gain a competitive edge. The analysis considers the impact of global energy prices on the Argentinian market and assesses the resilience of the sector against price volatility. The section also addresses the challenges posed by regulatory uncertainties and environmental concerns, providing a nuanced understanding of the market's growth trajectory and potential risks. The market penetration of specific technologies and their impact on production costs and efficiency are detailed, providing concrete data to support our analysis.

Dominant Markets & Segments in Argentina Oil and Gas Upstream Market

This section identifies the dominant segments within Argentina's oil and gas upstream market. The analysis focuses on the leading regions, resources (conventional oil, unconventional oil, natural gas), and end-use applications (power generation, industrial use, transportation).

Type of Resource: Unconventional oil, specifically from the Vaca Muerta shale formation, is experiencing significant growth, driven by large-scale investment and technological advancements. Conventional oil production remains substantial but faces challenges related to declining reserves and aging infrastructure. Natural gas production is also experiencing growth, particularly for domestic consumption and power generation.

End-Use Application: The power generation sector is a major consumer of natural gas, with significant potential for further growth. Industrial use of both oil and natural gas remains considerable, while the transportation sector’s reliance on oil is gradually diversifying to other sources.

Key Drivers of Segment Dominance:

Vaca Muerta Shale Formation: Abundant unconventional oil and gas reserves in the Vaca Muerta shale play are the primary driver for growth in unconventional oil and gas. The USD 706 Million Fenix gas project investment by TotalEnergies SE exemplifies this trend.

Government Policies: Government initiatives aimed at promoting energy independence and attracting foreign investment are playing a significant role.

Infrastructure Development: Ongoing investments in pipeline infrastructure and related projects significantly enhance the competitiveness of the Argentinian oil and gas sector.

This section provides a detailed breakdown of market size, growth projections, and competitive dynamics for each segment, providing a granular view of this complex market landscape.

Argentina Oil and Gas Upstream Market Product Developments

Recent product innovations focus on enhanced oil recovery techniques for conventional fields and improvements in horizontal drilling and hydraulic fracturing for unconventional resources. These advancements enhance production efficiency and reduce costs. Companies are also exploring opportunities in carbon capture and storage technologies to meet environmental sustainability goals. The market fit of these technologies is closely tied to improving production efficiency, reducing operational costs, and fulfilling environmental regulations.

Report Scope & Segmentation Analysis

This report segments the Argentina oil and gas upstream market based on Type of Resource (Conventional Oil, Unconventional Oil, Natural Gas) and End-Use Application (Power Generation, Industrial Use, Transportation). Each segment's market size, growth projections, and competitive dynamics are analyzed. For example, the unconventional oil segment, particularly from the Vaca Muerta formation, is projected to exhibit robust growth due to ongoing investments and technological advancements. The natural gas segment is expected to experience growth primarily driven by its consumption in the power generation sector. The report provides a detailed analysis of the growth opportunities and challenges present in each segment. The market size for each segment is estimated for the historical period (2019-2024), base year (2025), and forecast period (2025-2033).

Key Drivers of Argentina Oil and Gas Upstream Market Growth

The Argentinian oil and gas upstream market’s growth is driven by several key factors: the significant reserves in the Vaca Muerta shale formation, government policies encouraging investment and production, and the increasing domestic demand for energy. Technological advancements in exploration and extraction techniques, particularly in unconventional resources, contribute significantly to higher production efficiency and lower costs. Furthermore, rising global energy prices create favorable conditions for increased investment and production in Argentina.

Challenges in the Argentina Oil and Gas Upstream Market Sector

The Argentinian oil and gas upstream sector faces challenges including macroeconomic instability, regulatory uncertainties, and the need for further infrastructure development. Inflation and currency fluctuations impact investment decisions and operational costs. Supply chain disruptions, both domestic and international, can lead to production delays and increased costs. Furthermore, intense competition amongst existing players, both domestic and international, and environmental concerns create pressure on profit margins and necessitate careful risk management strategies.

Emerging Opportunities in Argentina Oil and Gas Upstream Market

Emerging opportunities exist in the further exploitation of the Vaca Muerta shale formation, the development of renewable energy integration strategies, and the implementation of carbon capture and storage technologies. The development of export infrastructure and market access to increase export revenues creates potential for growth. Additionally, technological innovations focused on improving efficiency and lowering environmental impact present significant growth opportunities.

Leading Players in the Argentina Oil and Gas Upstream Market Market

- Equinor ASA

- YPF SA

- ExxonMobil Exploration Argentina SRL

- Chevron Argentina SRL

- Pan American Energy LLC

- Techint Group

- TotalEnergies SE

- Tullow Oil PLC

Key Developments in Argentina Oil and Gas Upstream Market Industry

- October 2022: Vista Energy and Trafigura Argentina announced a USD 150 Million investment in the Vaca Muerta shale formation.

- September 2022: TotalEnergies SE approved a USD 706 Million final investment decision for the Fenix gas development project.

These developments signal a significant increase in investment and production within the Argentinian oil and gas upstream market, particularly in unconventional resources.

Strategic Outlook for Argentina Oil and Gas Upstream Market Market

The Argentinian oil and gas upstream market presents a promising outlook, driven by substantial reserves, supportive government policies, and ongoing technological advancements. The continued development of the Vaca Muerta shale formation will be a primary catalyst for growth. Further investments in infrastructure and a focus on efficient, environmentally conscious operations will ensure the long-term success and sustainability of the sector. The strategic focus on both conventional and unconventional resources, combined with a commitment to attract foreign investment, positions Argentina for sustained growth in the oil and gas sector.

Argentina Oil and Gas Upstream Market Segmentation

- 1. Onshore

- 2. Offshore

Argentina Oil and Gas Upstream Market Segmentation By Geography

- 1. Argentina

Argentina Oil and Gas Upstream Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 3.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Demand for Wood Pellets in Clean Energy Generation4.; Growing Wood Pellet Manufacturing Infrastructure

- 3.3. Market Restrains

- 3.3.1. 4.; The Adoption and Increasing Deployment of Alternative Renewable Energy

- 3.4. Market Trends

- 3.4.1. Onshore Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Argentina Oil and Gas Upstream Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Onshore

- 5.2. Market Analysis, Insights and Forecast - by Offshore

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Argentina

- 5.1. Market Analysis, Insights and Forecast - by Onshore

- 6. Brazil Argentina Oil and Gas Upstream Market Analysis, Insights and Forecast, 2019-2031

- 7. Argentina Argentina Oil and Gas Upstream Market Analysis, Insights and Forecast, 2019-2031

- 8. Rest of South America Argentina Oil and Gas Upstream Market Analysis, Insights and Forecast, 2019-2031

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2024

- 9.2. Company Profiles

- 9.2.1 Equinor ASA

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 YPF SA

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 ExxonMobil Exploration Argentina SRL

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Chevron Argentina SRL

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Pan American Energy LLC

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Techint Group*List Not Exhaustive

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 TotalEnergies SE

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Tullow Oil PLC

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.1 Equinor ASA

List of Figures

- Figure 1: Argentina Oil and Gas Upstream Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Argentina Oil and Gas Upstream Market Share (%) by Company 2024

List of Tables

- Table 1: Argentina Oil and Gas Upstream Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Argentina Oil and Gas Upstream Market Volume Tonnes Forecast, by Region 2019 & 2032

- Table 3: Argentina Oil and Gas Upstream Market Revenue Million Forecast, by Onshore 2019 & 2032

- Table 4: Argentina Oil and Gas Upstream Market Volume Tonnes Forecast, by Onshore 2019 & 2032

- Table 5: Argentina Oil and Gas Upstream Market Revenue Million Forecast, by Offshore 2019 & 2032

- Table 6: Argentina Oil and Gas Upstream Market Volume Tonnes Forecast, by Offshore 2019 & 2032

- Table 7: Argentina Oil and Gas Upstream Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Argentina Oil and Gas Upstream Market Volume Tonnes Forecast, by Region 2019 & 2032

- Table 9: Argentina Oil and Gas Upstream Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Argentina Oil and Gas Upstream Market Volume Tonnes Forecast, by Country 2019 & 2032

- Table 11: Brazil Argentina Oil and Gas Upstream Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Brazil Argentina Oil and Gas Upstream Market Volume (Tonnes) Forecast, by Application 2019 & 2032

- Table 13: Argentina Argentina Oil and Gas Upstream Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Argentina Argentina Oil and Gas Upstream Market Volume (Tonnes) Forecast, by Application 2019 & 2032

- Table 15: Rest of South America Argentina Oil and Gas Upstream Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Argentina Oil and Gas Upstream Market Volume (Tonnes) Forecast, by Application 2019 & 2032

- Table 17: Argentina Oil and Gas Upstream Market Revenue Million Forecast, by Onshore 2019 & 2032

- Table 18: Argentina Oil and Gas Upstream Market Volume Tonnes Forecast, by Onshore 2019 & 2032

- Table 19: Argentina Oil and Gas Upstream Market Revenue Million Forecast, by Offshore 2019 & 2032

- Table 20: Argentina Oil and Gas Upstream Market Volume Tonnes Forecast, by Offshore 2019 & 2032

- Table 21: Argentina Oil and Gas Upstream Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Argentina Oil and Gas Upstream Market Volume Tonnes Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Argentina Oil and Gas Upstream Market?

The projected CAGR is approximately > 3.50%.

2. Which companies are prominent players in the Argentina Oil and Gas Upstream Market?

Key companies in the market include Equinor ASA, YPF SA, ExxonMobil Exploration Argentina SRL, Chevron Argentina SRL, Pan American Energy LLC, Techint Group*List Not Exhaustive, TotalEnergies SE, Tullow Oil PLC.

3. What are the main segments of the Argentina Oil and Gas Upstream Market?

The market segments include Onshore, Offshore.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Demand for Wood Pellets in Clean Energy Generation4.; Growing Wood Pellet Manufacturing Infrastructure.

6. What are the notable trends driving market growth?

Onshore Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; The Adoption and Increasing Deployment of Alternative Renewable Energy.

8. Can you provide examples of recent developments in the market?

In October 2022, Vista Energy and Trafigura Argentina announced that the companies would invest around USD 150 million into the Vaca Muerta Shale formation. This announcement comes after the companies formed a joint venture in 2021 to jointly develop 20 wells in Vista's main oil development concessions in Vaca Muerta.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Tonnes.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Argentina Oil and Gas Upstream Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Argentina Oil and Gas Upstream Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Argentina Oil and Gas Upstream Market?

To stay informed about further developments, trends, and reports in the Argentina Oil and Gas Upstream Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence