Key Insights

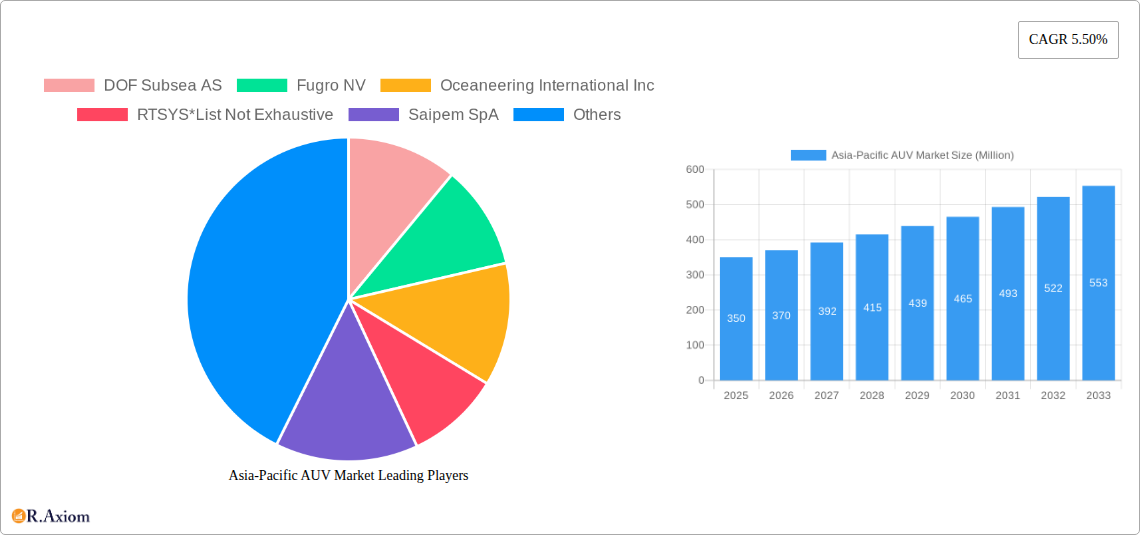

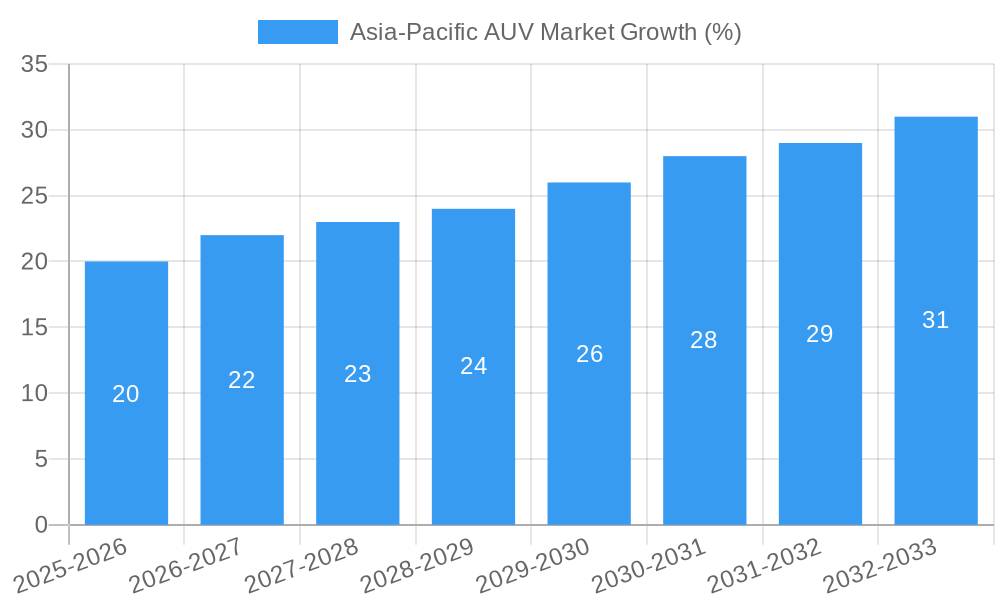

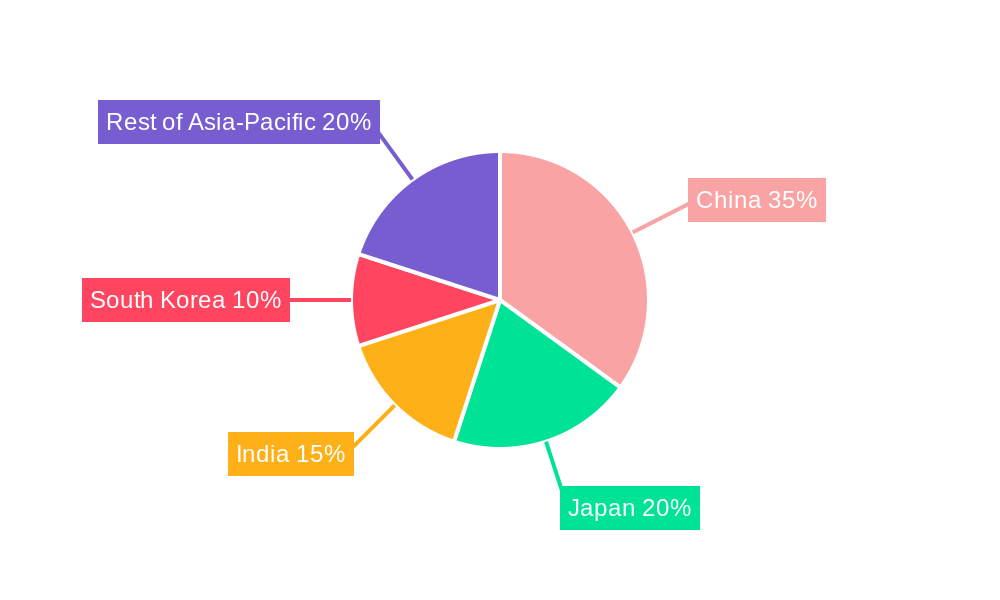

The Asia-Pacific Autonomous Underwater Vehicle (AUV) market is experiencing robust growth, driven by increasing demand across diverse sectors. The region's substantial investments in offshore oil and gas exploration, coupled with a burgeoning defense sector focused on underwater surveillance and mine countermeasures, are key propellants. Furthermore, the growing adoption of AUVs in scientific research, particularly oceanographic studies and marine environmental monitoring, contributes significantly to market expansion. A 5.50% Compound Annual Growth Rate (CAGR) from 2019 to 2024 suggests a continuously expanding market. While precise market sizing for 2025 is unavailable, extrapolating from the CAGR and considering the region's growth potential, a conservative estimate of the 2025 market value would be approximately $350 million. This figure considers a mature market with consistent year-over-year growth. The segment breakdown reveals significant contributions from all vehicle sizes (small, medium, large) with the medium-size AUVs potentially holding a larger share due to their versatility and suitability for various applications. China, Japan, South Korea, and India are expected to be the leading contributors due to their significant investments in related technologies and their coastal geographic characteristics. However, the "Rest of Asia-Pacific" segment also exhibits potential, fueled by growing governmental and private sector initiatives in marine exploration and research.

Looking ahead to 2033, the market is poised for further expansion, exceeding $600 million based on the projected CAGR. Continued technological advancements, particularly in areas such as improved battery life, sensor technology, and AI-powered navigation systems, will drive greater AUV adoption. Factors like increasing government regulations concerning marine environmental protection and the need for efficient underwater infrastructure inspection are also boosting market demand. While challenges exist in terms of operational costs and the need for skilled personnel, the overall growth trajectory is significantly positive, driven by the region's economic dynamism and increasing focus on maritime operations.

Asia-Pacific AUV Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Asia-Pacific Autonomous Underwater Vehicle (AUV) market, offering invaluable insights for stakeholders across the value chain. Covering the period from 2019 to 2033, with a focus on 2025, this report meticulously examines market trends, segmentation, competitive dynamics, and future growth potential. The report leverages extensive research and data analysis to offer actionable intelligence for strategic decision-making.

Asia-Pacific AUV Market Market Concentration & Innovation

The Asia-Pacific AUV market exhibits a moderately concentrated landscape, with a few key players holding significant market share. However, the emergence of innovative startups and technological advancements is fostering increased competition. Market share data from 2024 indicates that DOF Subsea AS, Fugro NV, and Oceaneering International Inc. collectively held approximately xx% of the market, while smaller players contributed the remaining xx%. The average M&A deal value in the sector during the historical period (2019-2024) was approximately $xx Million, showcasing significant investment in market consolidation and technological expansion.

- Innovation Drivers: Miniaturization, improved sensor technology, enhanced autonomy, and advancements in AI/machine learning are key drivers.

- Regulatory Framework: Varying regulatory landscapes across Asia-Pacific nations influence AUV deployment and operations. Harmonization efforts are underway to streamline approvals and boost adoption.

- Product Substitutes: Remotely Operated Vehicles (ROVs) and traditional manned submersibles pose some competition, although AUVs offer advantages in cost-effectiveness and operational efficiency for specific applications.

- End-User Trends: Increasing demand from defense, oil & gas, and research sectors are driving market growth, with defense applications showing particularly strong growth momentum.

- M&A Activities: Strategic acquisitions and mergers are expected to continue, shaping the competitive landscape and fostering technological innovation.

Asia-Pacific AUV Market Industry Trends & Insights

The Asia-Pacific AUV market is experiencing robust growth, propelled by escalating demand across diverse end-user applications. The market witnessed a Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024) and is projected to maintain a CAGR of xx% during the forecast period (2025-2033). This growth is fueled by several factors including increased investment in offshore oil and gas exploration, rising geopolitical tensions driving defense spending, growing interest in oceanographic research, and ongoing technological advancements enhancing AUV capabilities. Market penetration is increasing across diverse sectors with particular success in shallow-water applications which are opening up new avenues for cost-effective exploration and surveillance. Competitive dynamics are characterized by both established players focusing on technological enhancements and emerging players introducing innovative solutions.

Dominant Markets & Segments in Asia-Pacific AUV Market

China and Australia are currently the dominant markets within the Asia-Pacific region. The oil and gas sector continues to be a significant end-user, but defense applications are rapidly gaining traction, particularly in regions experiencing geopolitical uncertainty. Medium-sized AUVs dominate the market in terms of vehicle type due to their balance of payload capacity, operational range, and cost-effectiveness.

- Key Drivers for China: Robust government investment in maritime infrastructure, rapid economic growth, and an expanding offshore energy sector are major drivers.

- Key Drivers for Australia: Significant investment in defense capabilities and increased activity in marine research are shaping the growth trajectory.

- Oil & Gas Segment: High demand for subsea inspection, maintenance, and repair (IMR) services, coupled with increasing exploration activities in deeper waters are major driving forces.

- Defense Segment: Growing geopolitical instability and the need for enhanced maritime surveillance are driving adoption.

- Research Segment: Expanding scientific research activities focused on oceanography, marine biology, and climate change contribute to market growth.

Asia-Pacific AUV Market Product Developments

Recent product developments highlight a trend toward increased autonomy, improved sensor integration, and enhanced data processing capabilities. The focus on miniaturization and cost reduction is making AUVs more accessible to a broader range of users. AUVs equipped with advanced sensor packages, including high-resolution sonars and multibeam echo sounders, are gaining popularity for their superior data acquisition capabilities. The integration of AI and machine learning algorithms allows for more efficient data analysis and autonomous decision-making, improving the overall efficiency and effectiveness of AUV operations. This combination of improved sensor technology and advanced data processing techniques is proving highly effective across a wide variety of applications.

Report Scope & Segmentation Analysis

This report segments the Asia-Pacific AUV market by vehicle type (small-size, medium-size, large-size) and end-user application (oil and gas, defense, research, other). The small-size AUV segment is projected to experience significant growth due to their cost-effectiveness and suitability for shallow water operations. The medium-size segment currently holds the largest market share, while the large-size segment is expected to witness growth driven by deep-water exploration activities. The defense sector is anticipated to be a key growth driver due to its increasing demand for autonomous underwater surveillance and mine countermeasure systems.

Key Drivers of Asia-Pacific AUV Market Growth

Technological advancements in autonomy, sensor technology, and communication systems are driving market growth. Increasing government investment in defense and marine research, coupled with the expansion of the offshore oil and gas sector across the region, are bolstering demand. Favorable government policies promoting the development and adoption of AUVs are further accelerating market expansion. The rising need for subsea infrastructure inspection and maintenance, particularly in aging offshore oil and gas facilities, are contributing to increased market demand.

Challenges in the Asia-Pacific AUV Market Sector

High initial investment costs and the need for specialized technical expertise pose significant challenges. The complexities of operating AUVs in diverse and challenging underwater environments, including issues related to communication and navigation, are additional hurdles. Supply chain disruptions and geopolitical uncertainties can also impact the market. The need for robust regulatory frameworks that support innovation and ensure safety standards is crucial for long-term growth. Competition from alternative technologies, such as ROVs, also presents a challenge for market expansion.

Emerging Opportunities in Asia-Pacific AUV Market

The increasing adoption of AUVs in new applications, such as environmental monitoring, aquaculture, and underwater archaeology, presents significant opportunities. The integration of advanced technologies, such as AI and machine learning, is expected to enhance the capabilities and applications of AUVs. Expansion into new markets with strong growth potential in the region is expected to unlock significant revenue streams for market participants. The development of more robust and reliable communication systems, designed to address the challenges of underwater operation, is creating new opportunities for technological advancement.

Leading Players in the Asia-Pacific AUV Market Market

- DOF Subsea AS

- Fugro NV

- Oceaneering International Inc

- RTSYS

- Saipem SpA

- DeepOcean AS

Key Developments in Asia-Pacific AUV Market Industry

- October 2022: The Ministry of Defence (MoD) in India initiated a preliminary procedure to acquire autonomous underwater vehicles (AUVs) with dual observation and strike capabilities, significantly boosting the defense segment. The DRDO's efforts to improve submarine situational awareness underscore the growing strategic importance of AUV technology.

- January 2022: iXblue PLE Ltd successfully delivered a synthetic aperture sonar to IFREMER, demonstrating technological advancements and the growing collaboration within the AUV ecosystem. This highlights the increasing sophistication of AUV sensor technologies and their applications in scientific research.

Strategic Outlook for Asia-Pacific AUV Market Market

The Asia-Pacific AUV market is poised for substantial growth, driven by increasing demand from diverse sectors, technological advancements, and supportive government policies. Emerging applications in environmental monitoring, aquaculture, and underwater infrastructure inspection will further propel market expansion. Continuous innovation in AUV technology, including advancements in autonomy, sensor capabilities, and communication systems, will unlock new market opportunities and drive market growth in the coming years. The strategic focus on cost reduction and improved usability will expand the market’s reach to a wider range of users and applications.

Asia-Pacific AUV Market Segmentation

-

1. Vehicle Type

- 1.1. Small-Size

- 1.2. Medium-Size

- 1.3. Large-Size

-

2. End-User Applications

- 2.1. Oil and Gas

- 2.2. Defense

- 2.3. Research

- 2.4. Other End-User Applications

-

3. Geography

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Indonesia

- 3.5. Vietnam

- 3.6. Thailand

- 3.7. Philippines

- 3.8. Rest of Asia-Pacific

Asia-Pacific AUV Market Segmentation By Geography

- 1. China

- 2. Japan

- 3. India

- 4. Indonesia

- 5. Vietnam

- 6. Thailand

- 7. Philippines

- 8. Rest of Asia Pacific

Asia-Pacific AUV Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Number of Automobiles4.; The Government Policy Regarding Pollution Emission Control Parameters

- 3.3. Market Restrains

- 3.3.1. The Technological Limitations of Air Filters

- 3.4. Market Trends

- 3.4.1. Oil and Gas Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific AUV Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Small-Size

- 5.1.2. Medium-Size

- 5.1.3. Large-Size

- 5.2. Market Analysis, Insights and Forecast - by End-User Applications

- 5.2.1. Oil and Gas

- 5.2.2. Defense

- 5.2.3. Research

- 5.2.4. Other End-User Applications

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. China

- 5.3.2. Japan

- 5.3.3. India

- 5.3.4. Indonesia

- 5.3.5. Vietnam

- 5.3.6. Thailand

- 5.3.7. Philippines

- 5.3.8. Rest of Asia-Pacific

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.4.2. Japan

- 5.4.3. India

- 5.4.4. Indonesia

- 5.4.5. Vietnam

- 5.4.6. Thailand

- 5.4.7. Philippines

- 5.4.8. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. China Asia-Pacific AUV Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.1.1. Small-Size

- 6.1.2. Medium-Size

- 6.1.3. Large-Size

- 6.2. Market Analysis, Insights and Forecast - by End-User Applications

- 6.2.1. Oil and Gas

- 6.2.2. Defense

- 6.2.3. Research

- 6.2.4. Other End-User Applications

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. China

- 6.3.2. Japan

- 6.3.3. India

- 6.3.4. Indonesia

- 6.3.5. Vietnam

- 6.3.6. Thailand

- 6.3.7. Philippines

- 6.3.8. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7. Japan Asia-Pacific AUV Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.1.1. Small-Size

- 7.1.2. Medium-Size

- 7.1.3. Large-Size

- 7.2. Market Analysis, Insights and Forecast - by End-User Applications

- 7.2.1. Oil and Gas

- 7.2.2. Defense

- 7.2.3. Research

- 7.2.4. Other End-User Applications

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. China

- 7.3.2. Japan

- 7.3.3. India

- 7.3.4. Indonesia

- 7.3.5. Vietnam

- 7.3.6. Thailand

- 7.3.7. Philippines

- 7.3.8. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8. India Asia-Pacific AUV Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.1.1. Small-Size

- 8.1.2. Medium-Size

- 8.1.3. Large-Size

- 8.2. Market Analysis, Insights and Forecast - by End-User Applications

- 8.2.1. Oil and Gas

- 8.2.2. Defense

- 8.2.3. Research

- 8.2.4. Other End-User Applications

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. China

- 8.3.2. Japan

- 8.3.3. India

- 8.3.4. Indonesia

- 8.3.5. Vietnam

- 8.3.6. Thailand

- 8.3.7. Philippines

- 8.3.8. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9. Indonesia Asia-Pacific AUV Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.1.1. Small-Size

- 9.1.2. Medium-Size

- 9.1.3. Large-Size

- 9.2. Market Analysis, Insights and Forecast - by End-User Applications

- 9.2.1. Oil and Gas

- 9.2.2. Defense

- 9.2.3. Research

- 9.2.4. Other End-User Applications

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. China

- 9.3.2. Japan

- 9.3.3. India

- 9.3.4. Indonesia

- 9.3.5. Vietnam

- 9.3.6. Thailand

- 9.3.7. Philippines

- 9.3.8. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 10. Vietnam Asia-Pacific AUV Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 10.1.1. Small-Size

- 10.1.2. Medium-Size

- 10.1.3. Large-Size

- 10.2. Market Analysis, Insights and Forecast - by End-User Applications

- 10.2.1. Oil and Gas

- 10.2.2. Defense

- 10.2.3. Research

- 10.2.4. Other End-User Applications

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. China

- 10.3.2. Japan

- 10.3.3. India

- 10.3.4. Indonesia

- 10.3.5. Vietnam

- 10.3.6. Thailand

- 10.3.7. Philippines

- 10.3.8. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 11. Thailand Asia-Pacific AUV Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 11.1.1. Small-Size

- 11.1.2. Medium-Size

- 11.1.3. Large-Size

- 11.2. Market Analysis, Insights and Forecast - by End-User Applications

- 11.2.1. Oil and Gas

- 11.2.2. Defense

- 11.2.3. Research

- 11.2.4. Other End-User Applications

- 11.3. Market Analysis, Insights and Forecast - by Geography

- 11.3.1. China

- 11.3.2. Japan

- 11.3.3. India

- 11.3.4. Indonesia

- 11.3.5. Vietnam

- 11.3.6. Thailand

- 11.3.7. Philippines

- 11.3.8. Rest of Asia-Pacific

- 11.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 12. Philippines Asia-Pacific AUV Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 12.1.1. Small-Size

- 12.1.2. Medium-Size

- 12.1.3. Large-Size

- 12.2. Market Analysis, Insights and Forecast - by End-User Applications

- 12.2.1. Oil and Gas

- 12.2.2. Defense

- 12.2.3. Research

- 12.2.4. Other End-User Applications

- 12.3. Market Analysis, Insights and Forecast - by Geography

- 12.3.1. China

- 12.3.2. Japan

- 12.3.3. India

- 12.3.4. Indonesia

- 12.3.5. Vietnam

- 12.3.6. Thailand

- 12.3.7. Philippines

- 12.3.8. Rest of Asia-Pacific

- 12.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 13. Rest of Asia Pacific Asia-Pacific AUV Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 13.1.1. Small-Size

- 13.1.2. Medium-Size

- 13.1.3. Large-Size

- 13.2. Market Analysis, Insights and Forecast - by End-User Applications

- 13.2.1. Oil and Gas

- 13.2.2. Defense

- 13.2.3. Research

- 13.2.4. Other End-User Applications

- 13.3. Market Analysis, Insights and Forecast - by Geography

- 13.3.1. China

- 13.3.2. Japan

- 13.3.3. India

- 13.3.4. Indonesia

- 13.3.5. Vietnam

- 13.3.6. Thailand

- 13.3.7. Philippines

- 13.3.8. Rest of Asia-Pacific

- 13.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 14. China Asia-Pacific AUV Market Analysis, Insights and Forecast, 2019-2031

- 15. Japan Asia-Pacific AUV Market Analysis, Insights and Forecast, 2019-2031

- 16. India Asia-Pacific AUV Market Analysis, Insights and Forecast, 2019-2031

- 17. South Korea Asia-Pacific AUV Market Analysis, Insights and Forecast, 2019-2031

- 18. Taiwan Asia-Pacific AUV Market Analysis, Insights and Forecast, 2019-2031

- 19. Australia Asia-Pacific AUV Market Analysis, Insights and Forecast, 2019-2031

- 20. Rest of Asia-Pacific Asia-Pacific AUV Market Analysis, Insights and Forecast, 2019-2031

- 21. Competitive Analysis

- 21.1. Market Share Analysis 2024

- 21.2. Company Profiles

- 21.2.1 DOF Subsea AS

- 21.2.1.1. Overview

- 21.2.1.2. Products

- 21.2.1.3. SWOT Analysis

- 21.2.1.4. Recent Developments

- 21.2.1.5. Financials (Based on Availability)

- 21.2.2 Fugro NV

- 21.2.2.1. Overview

- 21.2.2.2. Products

- 21.2.2.3. SWOT Analysis

- 21.2.2.4. Recent Developments

- 21.2.2.5. Financials (Based on Availability)

- 21.2.3 Oceaneering International Inc

- 21.2.3.1. Overview

- 21.2.3.2. Products

- 21.2.3.3. SWOT Analysis

- 21.2.3.4. Recent Developments

- 21.2.3.5. Financials (Based on Availability)

- 21.2.4 RTSYS*List Not Exhaustive

- 21.2.4.1. Overview

- 21.2.4.2. Products

- 21.2.4.3. SWOT Analysis

- 21.2.4.4. Recent Developments

- 21.2.4.5. Financials (Based on Availability)

- 21.2.5 Saipem SpA

- 21.2.5.1. Overview

- 21.2.5.2. Products

- 21.2.5.3. SWOT Analysis

- 21.2.5.4. Recent Developments

- 21.2.5.5. Financials (Based on Availability)

- 21.2.6 DeepOcean AS

- 21.2.6.1. Overview

- 21.2.6.2. Products

- 21.2.6.3. SWOT Analysis

- 21.2.6.4. Recent Developments

- 21.2.6.5. Financials (Based on Availability)

- 21.2.1 DOF Subsea AS

List of Figures

- Figure 1: Asia-Pacific AUV Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Asia-Pacific AUV Market Share (%) by Company 2024

List of Tables

- Table 1: Asia-Pacific AUV Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Asia-Pacific AUV Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Asia-Pacific AUV Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 4: Asia-Pacific AUV Market Volume K Unit Forecast, by Vehicle Type 2019 & 2032

- Table 5: Asia-Pacific AUV Market Revenue Million Forecast, by End-User Applications 2019 & 2032

- Table 6: Asia-Pacific AUV Market Volume K Unit Forecast, by End-User Applications 2019 & 2032

- Table 7: Asia-Pacific AUV Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 8: Asia-Pacific AUV Market Volume K Unit Forecast, by Geography 2019 & 2032

- Table 9: Asia-Pacific AUV Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Asia-Pacific AUV Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 11: Asia-Pacific AUV Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Asia-Pacific AUV Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 13: China Asia-Pacific AUV Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: China Asia-Pacific AUV Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 15: Japan Asia-Pacific AUV Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Japan Asia-Pacific AUV Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 17: India Asia-Pacific AUV Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: India Asia-Pacific AUV Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 19: South Korea Asia-Pacific AUV Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: South Korea Asia-Pacific AUV Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 21: Taiwan Asia-Pacific AUV Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Taiwan Asia-Pacific AUV Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 23: Australia Asia-Pacific AUV Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Australia Asia-Pacific AUV Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 25: Rest of Asia-Pacific Asia-Pacific AUV Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Rest of Asia-Pacific Asia-Pacific AUV Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 27: Asia-Pacific AUV Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 28: Asia-Pacific AUV Market Volume K Unit Forecast, by Vehicle Type 2019 & 2032

- Table 29: Asia-Pacific AUV Market Revenue Million Forecast, by End-User Applications 2019 & 2032

- Table 30: Asia-Pacific AUV Market Volume K Unit Forecast, by End-User Applications 2019 & 2032

- Table 31: Asia-Pacific AUV Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 32: Asia-Pacific AUV Market Volume K Unit Forecast, by Geography 2019 & 2032

- Table 33: Asia-Pacific AUV Market Revenue Million Forecast, by Country 2019 & 2032

- Table 34: Asia-Pacific AUV Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 35: Asia-Pacific AUV Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 36: Asia-Pacific AUV Market Volume K Unit Forecast, by Vehicle Type 2019 & 2032

- Table 37: Asia-Pacific AUV Market Revenue Million Forecast, by End-User Applications 2019 & 2032

- Table 38: Asia-Pacific AUV Market Volume K Unit Forecast, by End-User Applications 2019 & 2032

- Table 39: Asia-Pacific AUV Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 40: Asia-Pacific AUV Market Volume K Unit Forecast, by Geography 2019 & 2032

- Table 41: Asia-Pacific AUV Market Revenue Million Forecast, by Country 2019 & 2032

- Table 42: Asia-Pacific AUV Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 43: Asia-Pacific AUV Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 44: Asia-Pacific AUV Market Volume K Unit Forecast, by Vehicle Type 2019 & 2032

- Table 45: Asia-Pacific AUV Market Revenue Million Forecast, by End-User Applications 2019 & 2032

- Table 46: Asia-Pacific AUV Market Volume K Unit Forecast, by End-User Applications 2019 & 2032

- Table 47: Asia-Pacific AUV Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 48: Asia-Pacific AUV Market Volume K Unit Forecast, by Geography 2019 & 2032

- Table 49: Asia-Pacific AUV Market Revenue Million Forecast, by Country 2019 & 2032

- Table 50: Asia-Pacific AUV Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 51: Asia-Pacific AUV Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 52: Asia-Pacific AUV Market Volume K Unit Forecast, by Vehicle Type 2019 & 2032

- Table 53: Asia-Pacific AUV Market Revenue Million Forecast, by End-User Applications 2019 & 2032

- Table 54: Asia-Pacific AUV Market Volume K Unit Forecast, by End-User Applications 2019 & 2032

- Table 55: Asia-Pacific AUV Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 56: Asia-Pacific AUV Market Volume K Unit Forecast, by Geography 2019 & 2032

- Table 57: Asia-Pacific AUV Market Revenue Million Forecast, by Country 2019 & 2032

- Table 58: Asia-Pacific AUV Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 59: Asia-Pacific AUV Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 60: Asia-Pacific AUV Market Volume K Unit Forecast, by Vehicle Type 2019 & 2032

- Table 61: Asia-Pacific AUV Market Revenue Million Forecast, by End-User Applications 2019 & 2032

- Table 62: Asia-Pacific AUV Market Volume K Unit Forecast, by End-User Applications 2019 & 2032

- Table 63: Asia-Pacific AUV Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 64: Asia-Pacific AUV Market Volume K Unit Forecast, by Geography 2019 & 2032

- Table 65: Asia-Pacific AUV Market Revenue Million Forecast, by Country 2019 & 2032

- Table 66: Asia-Pacific AUV Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 67: Asia-Pacific AUV Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 68: Asia-Pacific AUV Market Volume K Unit Forecast, by Vehicle Type 2019 & 2032

- Table 69: Asia-Pacific AUV Market Revenue Million Forecast, by End-User Applications 2019 & 2032

- Table 70: Asia-Pacific AUV Market Volume K Unit Forecast, by End-User Applications 2019 & 2032

- Table 71: Asia-Pacific AUV Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 72: Asia-Pacific AUV Market Volume K Unit Forecast, by Geography 2019 & 2032

- Table 73: Asia-Pacific AUV Market Revenue Million Forecast, by Country 2019 & 2032

- Table 74: Asia-Pacific AUV Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 75: Asia-Pacific AUV Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 76: Asia-Pacific AUV Market Volume K Unit Forecast, by Vehicle Type 2019 & 2032

- Table 77: Asia-Pacific AUV Market Revenue Million Forecast, by End-User Applications 2019 & 2032

- Table 78: Asia-Pacific AUV Market Volume K Unit Forecast, by End-User Applications 2019 & 2032

- Table 79: Asia-Pacific AUV Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 80: Asia-Pacific AUV Market Volume K Unit Forecast, by Geography 2019 & 2032

- Table 81: Asia-Pacific AUV Market Revenue Million Forecast, by Country 2019 & 2032

- Table 82: Asia-Pacific AUV Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 83: Asia-Pacific AUV Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 84: Asia-Pacific AUV Market Volume K Unit Forecast, by Vehicle Type 2019 & 2032

- Table 85: Asia-Pacific AUV Market Revenue Million Forecast, by End-User Applications 2019 & 2032

- Table 86: Asia-Pacific AUV Market Volume K Unit Forecast, by End-User Applications 2019 & 2032

- Table 87: Asia-Pacific AUV Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 88: Asia-Pacific AUV Market Volume K Unit Forecast, by Geography 2019 & 2032

- Table 89: Asia-Pacific AUV Market Revenue Million Forecast, by Country 2019 & 2032

- Table 90: Asia-Pacific AUV Market Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific AUV Market?

The projected CAGR is approximately 5.50%.

2. Which companies are prominent players in the Asia-Pacific AUV Market?

Key companies in the market include DOF Subsea AS, Fugro NV, Oceaneering International Inc, RTSYS*List Not Exhaustive, Saipem SpA, DeepOcean AS.

3. What are the main segments of the Asia-Pacific AUV Market?

The market segments include Vehicle Type, End-User Applications, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Number of Automobiles4.; The Government Policy Regarding Pollution Emission Control Parameters.

6. What are the notable trends driving market growth?

Oil and Gas Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

The Technological Limitations of Air Filters.

8. Can you provide examples of recent developments in the market?

October 2022: The Ministry of Defence (MoD) initiated a preliminary procedure to acquire autonomous underwater vehicles (AUVs) with dual observation and strike capabilities. The Defense Research and Development Organisation (DRDO) of India is attempting to improve submarine situational awareness and real-time imagery.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific AUV Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific AUV Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific AUV Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific AUV Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence