Key Insights

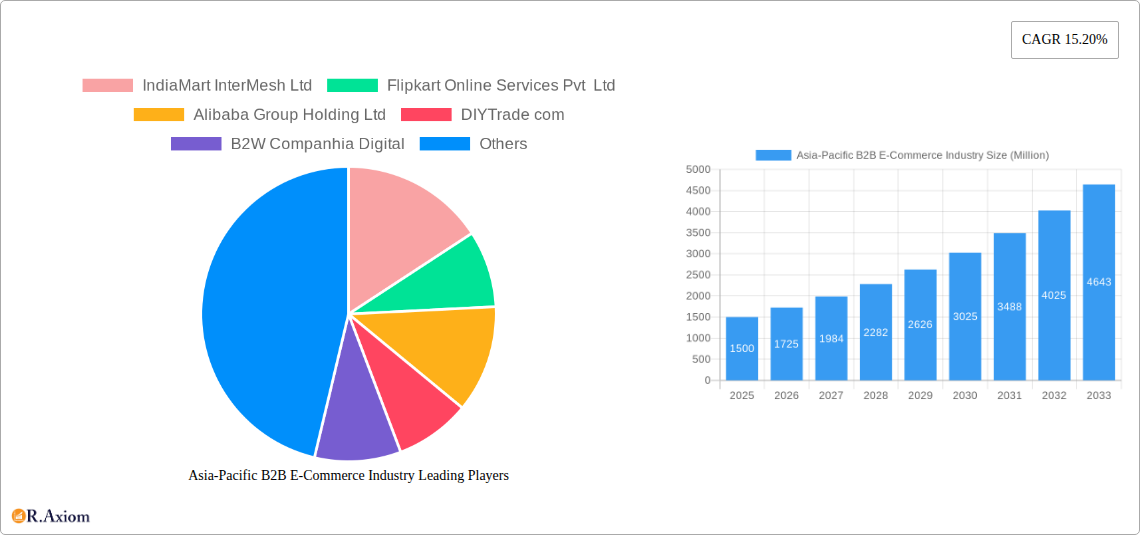

The Asia-Pacific B2B e-commerce market is experiencing robust growth, driven by increasing internet penetration, the rising adoption of digital technologies by businesses, and a preference for streamlined procurement processes. The region's diverse economies and burgeoning manufacturing sectors contribute significantly to this expansion. A Compound Annual Growth Rate (CAGR) of 15.20% from 2019 to 2024 suggests a substantial market expansion. While precise figures for market size in 2024 are unavailable, extrapolating from the provided CAGR and a hypothetical 2019 market size of $500 million (a reasonable estimate given the scale of the APAC economies), the market size in 2024 would have reached approximately $1.1 billion. This growth trajectory is expected to continue through 2033. Key players like Alibaba, Amazon, and Flipkart are leveraging their established platforms to capture significant market share, while regional players like IndiaMart are focusing on niche markets to gain a competitive edge. The rise of mobile commerce and the increasing sophistication of B2B e-commerce platforms also contribute to the market's dynamism.

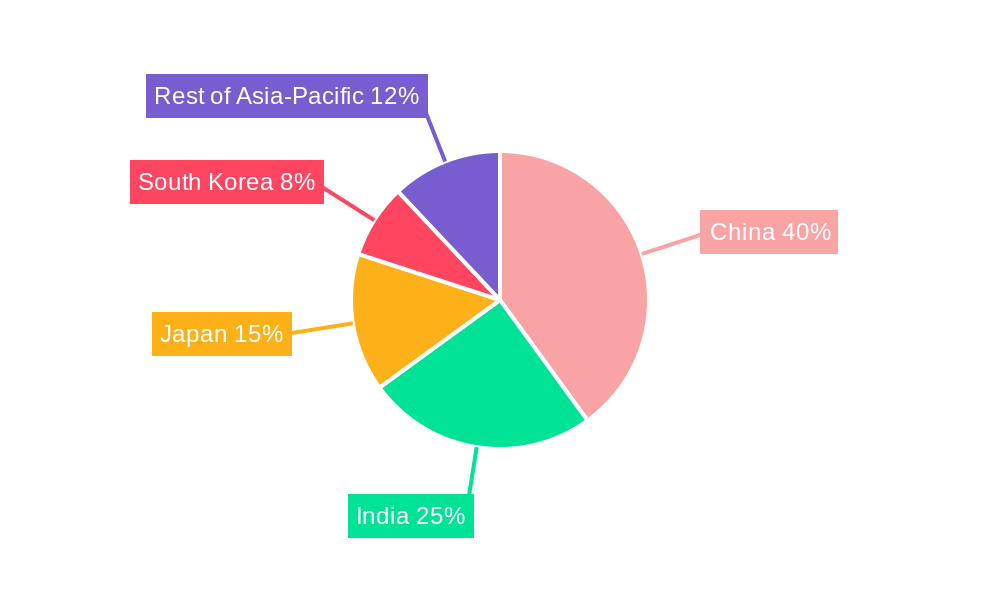

The segments within the Asia-Pacific B2B e-commerce market showcase distinct growth patterns. Direct sales channels are likely to maintain a significant market share, reflecting the established relationships and trust between buyers and sellers in many industries. However, Marketplace sales are experiencing accelerated growth, fueled by increased convenience, broader product selection, and cost-effectiveness. China, India, Japan, and South Korea are leading the charge, benefiting from their large economies and rapidly developing digital infrastructures. However, other countries in the Asia-Pacific region also offer significant growth opportunities, particularly as digital infrastructure improves and businesses become increasingly comfortable with online transactions. The market faces challenges such as cybersecurity concerns, data privacy regulations, and the need for robust logistics and payment solutions. However, ongoing technological advancements and government initiatives aimed at boosting digital adoption are expected to mitigate these restraints.

This comprehensive report provides an in-depth analysis of the Asia-Pacific B2B e-commerce industry, covering market size, growth drivers, key players, and future trends. The study period spans from 2019 to 2033, with 2025 as the base and estimated year. The forecast period is 2025-2033, and the historical period is 2019-2024. This report is essential for businesses, investors, and stakeholders seeking to understand and capitalize on the opportunities within this rapidly evolving market.

Asia-Pacific B2B E-Commerce Industry Market Concentration & Innovation

This section analyzes the competitive landscape of the Asia-Pacific B2B e-commerce market, examining market concentration, innovation drivers, regulatory frameworks, and market dynamics. The report assesses market share amongst key players like Alibaba Group Holding Ltd, Amazon.com Inc, and IndiaMart InterMesh Ltd, revealing a moderately concentrated market with significant opportunities for new entrants and innovative business models.

- Market Concentration: The market exhibits a moderately concentrated structure, with the top five players holding approximately xx% of the market share in 2024. This concentration is expected to slightly decrease to xx% by 2033 due to the emergence of new players and increased competition.

- Innovation Drivers: Technological advancements, including AI-powered solutions for inventory management and personalized recommendations, are driving innovation. The increasing adoption of mobile commerce and the integration of blockchain technology for secure transactions are also significant drivers.

- Regulatory Frameworks: Varying regulatory frameworks across the Asia-Pacific region present both challenges and opportunities. Clearer regulatory guidelines for data privacy and cross-border transactions are crucial for continued growth.

- Product Substitutes: Traditional wholesale and retail channels remain significant competitors. However, the convenience and efficiency of B2B e-commerce platforms are driving market penetration.

- End-User Trends: Businesses are increasingly adopting B2B e-commerce for streamlined procurement processes, improved supply chain management, and access to a wider range of suppliers. The shift towards digital transformation across industries is a primary driver.

- M&A Activities: The Asia-Pacific B2B e-commerce sector has witnessed significant M&A activity in recent years, with deal values totaling approximately $xx Million in 2024. Consolidation is expected to continue as larger players seek to expand their market share and capabilities.

Asia-Pacific B2B E-Commerce Industry Industry Trends & Insights

This section delves into the key trends and insights shaping the Asia-Pacific B2B e-commerce market. The report analyzes market growth drivers, technological disruptions, consumer preferences, and competitive dynamics, providing a comprehensive overview of the market's evolution.

The Asia-Pacific B2B e-commerce market is experiencing robust growth, driven by the increasing adoption of digital technologies across businesses of all sizes. The market's Compound Annual Growth Rate (CAGR) is projected to be xx% during the forecast period (2025-2033), with market penetration expected to reach xx% by 2033. This growth is fueled by factors such as rising internet and smartphone penetration, improving digital infrastructure, and supportive government policies promoting digitalization. Technological disruptions, including the emergence of artificial intelligence (AI), machine learning (ML), and the Internet of Things (IoT), are transforming the industry, creating new opportunities for efficiency gains and improved customer experiences. Furthermore, changing consumer preferences, including a growing preference for online purchasing and personalized services, are shaping the competitive landscape, pushing businesses to adapt and innovate to stay ahead of the curve. The competitive dynamics are characterized by intense competition among established players and emerging startups, leading to innovative solutions and increased price competitiveness.

Dominant Markets & Segments in Asia-Pacific B2B E-Commerce Industry

This section identifies the leading regions, countries, and segments within the Asia-Pacific B2B e-commerce market. It provides detailed analysis of the dominance of specific markets and segments, highlighting factors such as economic policies, infrastructure development, and consumer behavior.

Dominant Region: China is currently the dominant market, accounting for xx% of the total market value in 2024. India is expected to show strong growth and emerge as a major player in the coming years.

Dominant Country: China’s large and rapidly growing B2B e-commerce market is driven by factors including a substantial manufacturing base, strong infrastructure development, and a supportive regulatory environment.

Dominant Segment (By Channel): Marketplace sales currently dominate the market, accounting for xx% of the total revenue in 2024. This is largely due to the ease of access and wider reach offered by marketplace platforms. However, direct sales are expected to witness significant growth in the forecast period due to the increasing adoption of D2C models by manufacturers and brands.

Key Drivers for Dominant Markets:

- China: Robust economic growth, extensive digital infrastructure, and government support for e-commerce have all contributed to China's dominance.

- India: A large and young population, increasing internet and smartphone penetration, and a burgeoning middle class are fueling India's rapid growth.

Asia-Pacific B2B E-Commerce Industry Product Developments

The Asia-Pacific B2B e-commerce industry is witnessing rapid product innovation, driven by technological advancements and evolving customer needs. New products and services are emerging to enhance efficiency, improve security, and personalize the buying experience. These developments include AI-powered recommendation engines, integrated payment gateways, and sophisticated logistics solutions to optimize supply chain management. Furthermore, the adoption of blockchain technology and other secure payment methods is enhancing trust and facilitating cross-border transactions. These innovations are proving highly effective in meeting the demands of the modern business environment, creating a competitive advantage for early adopters and shaping the future of the industry.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the Asia-Pacific B2B e-commerce market, segmented by channel:

Direct Sales: This segment encompasses businesses selling directly to their customers through their own e-commerce platforms. The growth in this segment is driven by an increase in businesses establishing a direct-to-consumer model. The market size for Direct Sales in 2024 was approximately $xx Million and is projected to reach $xx Million by 2033, showing a CAGR of xx%.

Marketplace Sales: This segment includes businesses that sell their products through online marketplaces like Alibaba, Amazon, and Flipkart. Marketplace sales dominate the market in 2024, due to the vast reach and established customer base. The market size for Marketplace Sales in 2024 was $xx Million and is expected to reach $xx Million by 2033. The segment exhibits a competitive landscape with numerous players vying for market share.

Key Drivers of Asia-Pacific B2B E-Commerce Industry Growth

The growth of the Asia-Pacific B2B e-commerce industry is driven by several factors:

- Technological advancements: The widespread adoption of mobile commerce, AI, and big data analytics enhances efficiency and customer experience.

- Economic growth: Rising disposable incomes and increased business investments fuel demand for online B2B solutions.

- Supportive government policies: Many governments in the region are actively promoting digitalization and e-commerce through various initiatives.

Challenges in the Asia-Pacific B2B E-Commerce Industry Sector

The Asia-Pacific B2B e-commerce industry faces several challenges:

- Cybersecurity threats: The increasing reliance on online platforms raises concerns about data security and fraud.

- Logistics and infrastructure limitations: Inadequate infrastructure in some regions hinders efficient delivery and supply chain management.

- Digital literacy: Limited digital literacy among some businesses presents a barrier to adoption.

Emerging Opportunities in Asia-Pacific B2B E-Commerce Industry

The Asia-Pacific B2B e-commerce industry offers numerous opportunities:

- Expansion into underserved markets: Significant growth potential exists in smaller cities and rural areas.

- New technologies: The integration of AR/VR and blockchain technology can create novel business models and enhance customer experiences.

- Cross-border e-commerce: Growing regional trade agreements facilitate cross-border B2B e-commerce.

Leading Players in the Asia-Pacific B2B E-Commerce Industry Market

- IndiaMart InterMesh Ltd

- Flipkart Online Services Pvt Ltd

- Alibaba Group Holding Ltd

- DIYTrade.com

- B2W Companhia Digital

- KOMPASS

- ChinaAseanTrade.com

- Amazon.com Inc

- EWORLDTRADE Inc

- eBay Inc

Key Developments in Asia-Pacific B2B E-Commerce Industry Industry

June 2022: Vertiv launched its official store on Tokopedia, expanding its reach in Southeast Asia's e-commerce market. This highlights the growing importance of online marketplaces for reaching B2B customers.

June 2022: Ramagya Mart added home appliance categories to its B2B platform, expanding its product offerings and attracting more manufacturers. This demonstrates the ongoing efforts by B2B e-commerce platforms to increase their product range and attract more businesses.

Strategic Outlook for Asia-Pacific B2B E-Commerce Industry Market

The Asia-Pacific B2B e-commerce market presents substantial long-term growth potential. Continued technological innovation, expanding internet penetration, and supportive government policies will drive market expansion. Businesses that effectively leverage technology, adapt to changing consumer preferences, and navigate regulatory challenges will be well-positioned to succeed in this dynamic market. The focus on enhancing cybersecurity measures, improving logistics infrastructure, and addressing digital literacy gaps will be crucial for sustainable growth in the years to come.

Asia-Pacific B2B E-Commerce Industry Segmentation

-

1. Channel

- 1.1. Direct Sales

- 1.2. Marketplace Sales

-

2. Geography

- 2.1. China

- 2.2. Japan

- 2.3. India

- 2.4. South Korea

- 2.5. Rest of APAC

Asia-Pacific B2B E-Commerce Industry Segmentation By Geography

- 1. China

- 2. Japan

- 3. India

- 4. South Korea

- 5. Rest of APAC

Asia-Pacific B2B E-Commerce Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 15.20% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Advancement in Technologies; Increasing Business Interest towards Convenient Shopping solutions; Regulatory and Government Support

- 3.3. Market Restrains

- 3.3.1. Risk of Data Breach in Storing and Processing Large Data in Next-gen Computing; High operational challenges in Implementing the Solution

- 3.4. Market Trends

- 3.4.1. Advancement in Technologies Plays a Significant Role in Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific B2B E-Commerce Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Channel

- 5.1.1. Direct Sales

- 5.1.2. Marketplace Sales

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. China

- 5.2.2. Japan

- 5.2.3. India

- 5.2.4. South Korea

- 5.2.5. Rest of APAC

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.3.2. Japan

- 5.3.3. India

- 5.3.4. South Korea

- 5.3.5. Rest of APAC

- 5.1. Market Analysis, Insights and Forecast - by Channel

- 6. China Asia-Pacific B2B E-Commerce Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Channel

- 6.1.1. Direct Sales

- 6.1.2. Marketplace Sales

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. China

- 6.2.2. Japan

- 6.2.3. India

- 6.2.4. South Korea

- 6.2.5. Rest of APAC

- 6.1. Market Analysis, Insights and Forecast - by Channel

- 7. Japan Asia-Pacific B2B E-Commerce Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Channel

- 7.1.1. Direct Sales

- 7.1.2. Marketplace Sales

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. China

- 7.2.2. Japan

- 7.2.3. India

- 7.2.4. South Korea

- 7.2.5. Rest of APAC

- 7.1. Market Analysis, Insights and Forecast - by Channel

- 8. India Asia-Pacific B2B E-Commerce Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Channel

- 8.1.1. Direct Sales

- 8.1.2. Marketplace Sales

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. China

- 8.2.2. Japan

- 8.2.3. India

- 8.2.4. South Korea

- 8.2.5. Rest of APAC

- 8.1. Market Analysis, Insights and Forecast - by Channel

- 9. South Korea Asia-Pacific B2B E-Commerce Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Channel

- 9.1.1. Direct Sales

- 9.1.2. Marketplace Sales

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. China

- 9.2.2. Japan

- 9.2.3. India

- 9.2.4. South Korea

- 9.2.5. Rest of APAC

- 9.1. Market Analysis, Insights and Forecast - by Channel

- 10. Rest of APAC Asia-Pacific B2B E-Commerce Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Channel

- 10.1.1. Direct Sales

- 10.1.2. Marketplace Sales

- 10.2. Market Analysis, Insights and Forecast - by Geography

- 10.2.1. China

- 10.2.2. Japan

- 10.2.3. India

- 10.2.4. South Korea

- 10.2.5. Rest of APAC

- 10.1. Market Analysis, Insights and Forecast - by Channel

- 11. China Asia-Pacific B2B E-Commerce Industry Analysis, Insights and Forecast, 2019-2031

- 12. Japan Asia-Pacific B2B E-Commerce Industry Analysis, Insights and Forecast, 2019-2031

- 13. India Asia-Pacific B2B E-Commerce Industry Analysis, Insights and Forecast, 2019-2031

- 14. South Korea Asia-Pacific B2B E-Commerce Industry Analysis, Insights and Forecast, 2019-2031

- 15. Taiwan Asia-Pacific B2B E-Commerce Industry Analysis, Insights and Forecast, 2019-2031

- 16. Australia Asia-Pacific B2B E-Commerce Industry Analysis, Insights and Forecast, 2019-2031

- 17. Rest of Asia-Pacific Asia-Pacific B2B E-Commerce Industry Analysis, Insights and Forecast, 2019-2031

- 18. Competitive Analysis

- 18.1. Market Share Analysis 2024

- 18.2. Company Profiles

- 18.2.1 IndiaMart InterMesh Ltd

- 18.2.1.1. Overview

- 18.2.1.2. Products

- 18.2.1.3. SWOT Analysis

- 18.2.1.4. Recent Developments

- 18.2.1.5. Financials (Based on Availability)

- 18.2.2 Flipkart Online Services Pvt Ltd

- 18.2.2.1. Overview

- 18.2.2.2. Products

- 18.2.2.3. SWOT Analysis

- 18.2.2.4. Recent Developments

- 18.2.2.5. Financials (Based on Availability)

- 18.2.3 Alibaba Group Holding Ltd

- 18.2.3.1. Overview

- 18.2.3.2. Products

- 18.2.3.3. SWOT Analysis

- 18.2.3.4. Recent Developments

- 18.2.3.5. Financials (Based on Availability)

- 18.2.4 DIYTrade com

- 18.2.4.1. Overview

- 18.2.4.2. Products

- 18.2.4.3. SWOT Analysis

- 18.2.4.4. Recent Developments

- 18.2.4.5. Financials (Based on Availability)

- 18.2.5 B2W Companhia Digital

- 18.2.5.1. Overview

- 18.2.5.2. Products

- 18.2.5.3. SWOT Analysis

- 18.2.5.4. Recent Developments

- 18.2.5.5. Financials (Based on Availability)

- 18.2.6 KOMPASS

- 18.2.6.1. Overview

- 18.2.6.2. Products

- 18.2.6.3. SWOT Analysis

- 18.2.6.4. Recent Developments

- 18.2.6.5. Financials (Based on Availability)

- 18.2.7 ChinaAseanTrade com

- 18.2.7.1. Overview

- 18.2.7.2. Products

- 18.2.7.3. SWOT Analysis

- 18.2.7.4. Recent Developments

- 18.2.7.5. Financials (Based on Availability)

- 18.2.8 Amazon com Inc

- 18.2.8.1. Overview

- 18.2.8.2. Products

- 18.2.8.3. SWOT Analysis

- 18.2.8.4. Recent Developments

- 18.2.8.5. Financials (Based on Availability)

- 18.2.9 EWORLDTRADE Inc

- 18.2.9.1. Overview

- 18.2.9.2. Products

- 18.2.9.3. SWOT Analysis

- 18.2.9.4. Recent Developments

- 18.2.9.5. Financials (Based on Availability)

- 18.2.10 eBay Inc

- 18.2.10.1. Overview

- 18.2.10.2. Products

- 18.2.10.3. SWOT Analysis

- 18.2.10.4. Recent Developments

- 18.2.10.5. Financials (Based on Availability)

- 18.2.1 IndiaMart InterMesh Ltd

List of Figures

- Figure 1: Asia-Pacific B2B E-Commerce Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Asia-Pacific B2B E-Commerce Industry Share (%) by Company 2024

List of Tables

- Table 1: Asia-Pacific B2B E-Commerce Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Asia-Pacific B2B E-Commerce Industry Revenue Million Forecast, by Channel 2019 & 2032

- Table 3: Asia-Pacific B2B E-Commerce Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 4: Asia-Pacific B2B E-Commerce Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Asia-Pacific B2B E-Commerce Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: China Asia-Pacific B2B E-Commerce Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Japan Asia-Pacific B2B E-Commerce Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: India Asia-Pacific B2B E-Commerce Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: South Korea Asia-Pacific B2B E-Commerce Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Taiwan Asia-Pacific B2B E-Commerce Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Australia Asia-Pacific B2B E-Commerce Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Asia-Pacific Asia-Pacific B2B E-Commerce Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Asia-Pacific B2B E-Commerce Industry Revenue Million Forecast, by Channel 2019 & 2032

- Table 14: Asia-Pacific B2B E-Commerce Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 15: Asia-Pacific B2B E-Commerce Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Asia-Pacific B2B E-Commerce Industry Revenue Million Forecast, by Channel 2019 & 2032

- Table 17: Asia-Pacific B2B E-Commerce Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 18: Asia-Pacific B2B E-Commerce Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 19: Asia-Pacific B2B E-Commerce Industry Revenue Million Forecast, by Channel 2019 & 2032

- Table 20: Asia-Pacific B2B E-Commerce Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 21: Asia-Pacific B2B E-Commerce Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Asia-Pacific B2B E-Commerce Industry Revenue Million Forecast, by Channel 2019 & 2032

- Table 23: Asia-Pacific B2B E-Commerce Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 24: Asia-Pacific B2B E-Commerce Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 25: Asia-Pacific B2B E-Commerce Industry Revenue Million Forecast, by Channel 2019 & 2032

- Table 26: Asia-Pacific B2B E-Commerce Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 27: Asia-Pacific B2B E-Commerce Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific B2B E-Commerce Industry?

The projected CAGR is approximately 15.20%.

2. Which companies are prominent players in the Asia-Pacific B2B E-Commerce Industry?

Key companies in the market include IndiaMart InterMesh Ltd, Flipkart Online Services Pvt Ltd, Alibaba Group Holding Ltd, DIYTrade com, B2W Companhia Digital, KOMPASS, ChinaAseanTrade com, Amazon com Inc, EWORLDTRADE Inc, eBay Inc.

3. What are the main segments of the Asia-Pacific B2B E-Commerce Industry?

The market segments include Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Advancement in Technologies; Increasing Business Interest towards Convenient Shopping solutions; Regulatory and Government Support.

6. What are the notable trends driving market growth?

Advancement in Technologies Plays a Significant Role in Market Growth.

7. Are there any restraints impacting market growth?

Risk of Data Breach in Storing and Processing Large Data in Next-gen Computing; High operational challenges in Implementing the Solution.

8. Can you provide examples of recent developments in the market?

June 2022 - Vertiv, a provider of critical digital infrastructure and continuity solutions, announced opening its official store in Tokopedia, Indonesia's e-commerce platform. This is part of Vertiv's continuous expansion into the e-commerce space in Southeast Asia, reaching more customers looking to buy small to medium-sized uninterruptible power supply (UPS) solutions.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific B2B E-Commerce Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific B2B E-Commerce Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific B2B E-Commerce Industry?

To stay informed about further developments, trends, and reports in the Asia-Pacific B2B E-Commerce Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence