Key Insights

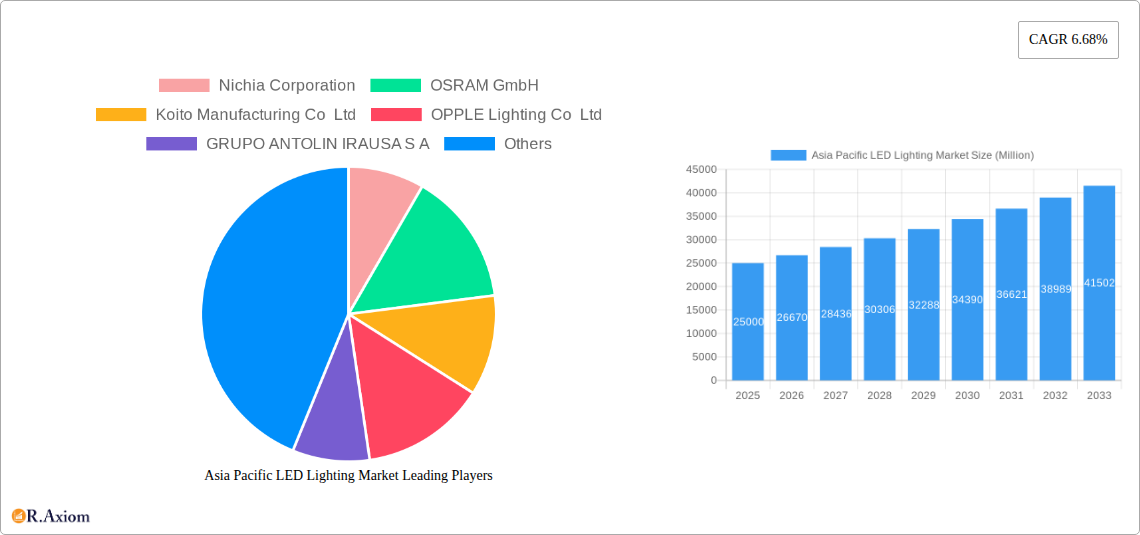

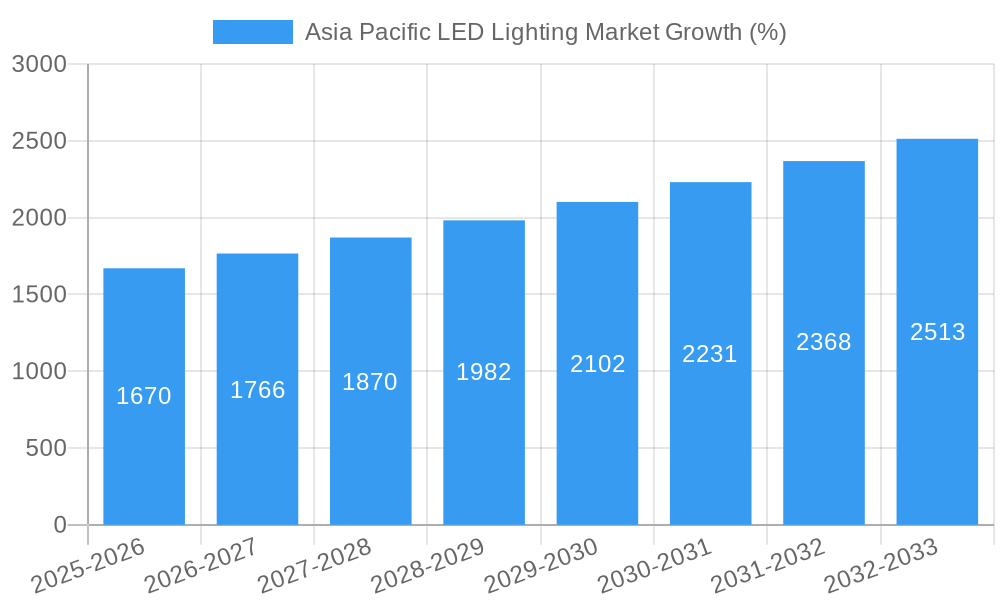

The Asia-Pacific LED lighting market, valued at approximately $XX million in 2025 (assuming a logical extrapolation from the provided CAGR and market size), is poised for robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 6.68% from 2025 to 2033. This expansion is driven by several key factors. Firstly, increasing government initiatives promoting energy efficiency and sustainable practices across various sectors, including residential, commercial, and industrial, are significantly boosting LED adoption. Secondly, the continuous decline in LED prices, coupled with advancements in technology leading to improved lumen output and longer lifespans, makes LED lighting a cost-effective and attractive alternative to traditional lighting solutions. Furthermore, the rising urbanization across the region, particularly in countries like China and India, is fueling demand for enhanced street and public space lighting. The automotive sector also contributes significantly, with the growing adoption of LED headlights, taillights, and daytime running lights in both passenger cars and commercial vehicles. Finally, the expanding agricultural sector's adoption of LED lighting for optimized plant growth further contributes to market expansion.

However, certain restraints exist. While the initial investment cost for LED lighting can be higher than traditional options, the long-term cost savings from reduced energy consumption outweigh this initial expense. Moreover, issues related to light pollution and the proper disposal of end-of-life LED products need careful consideration and sustainable solutions. Despite these limitations, the overwhelming advantages of LED technology in terms of energy efficiency, longevity, and superior light quality suggest that the Asia-Pacific LED lighting market will continue its impressive growth trajectory throughout the forecast period, with significant contributions from key segments like automotive lighting and industrial applications within countries such as China, India, and Japan. The market segmentation highlights the diverse applications of LED technology, from residential to automotive and industrial settings, emphasizing the wide-ranging potential for continued expansion.

Asia Pacific LED Lighting Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Asia Pacific LED lighting market, covering market size, growth drivers, competitive landscape, and future outlook. The study period spans from 2019 to 2033, with 2025 as the base and estimated year. The forecast period is 2025-2033, and the historical period is 2019-2024. Key players like Nichia Corporation, OSRAM GmbH, and Signify Holding (Philips) are analyzed, along with market segmentation by application (indoor, outdoor, automotive) and geography (China, India, Japan, and Rest of Asia-Pacific). This report is essential for stakeholders seeking actionable insights to navigate this dynamic market.

Asia Pacific LED Lighting Market Concentration & Innovation

The Asia Pacific LED lighting market exhibits a moderately concentrated structure, with a few major players holding significant market share. While precise market share figures require in-depth analysis within the full report, leading companies like Nichia Corporation, OSRAM GmbH, and Signify Holding (Philips) command substantial portions. Smaller, regional players also contribute significantly, particularly in specific segments or countries. The market is characterized by intense innovation, driven by the constant quest for higher energy efficiency, improved light quality, smart features, and cost reduction.

Regulatory frameworks, such as energy efficiency standards and environmental regulations, play a significant role in shaping market dynamics, prompting manufacturers to continuously innovate. Furthermore, the growing popularity of smart lighting solutions and the Internet of Things (IoT) integration further accelerate innovation. Product substitutes, such as OLEDs and other emerging lighting technologies, pose a potential challenge, although LED’s cost-effectiveness and mature technology currently maintain its market dominance.

The market shows significant M&A activity. While exact deal values are detailed in the full report, these transactions reflect the desire for companies to expand their product portfolios, enhance their geographic reach, and gain access to new technologies. This trend will likely continue, potentially leading to further market consolidation. Finally, end-user preferences, such as the rising demand for customized lighting solutions and environmentally friendly products, significantly influence market trends.

Asia Pacific LED Lighting Market Industry Trends & Insights

The Asia Pacific LED lighting market is experiencing robust growth, driven by several key factors. The region's rapid urbanization and infrastructure development have created significant demand for energy-efficient lighting solutions. Governments across the region are actively promoting energy conservation initiatives, further fueling the adoption of LED lighting. Technological advancements, such as the development of higher-lumen output LEDs and improved control systems, contribute to enhanced performance and broader application possibilities. Consumer preferences are shifting towards smart, connected lighting solutions, integrating with smart homes and IoT ecosystems.

The market's competitive dynamics are characterized by both established players and emerging competitors vying for market share. Price competition is intense, forcing companies to optimize their manufacturing processes and supply chains. Product differentiation through innovative features and superior performance is crucial for success. The market is expected to witness a Compound Annual Growth Rate (CAGR) of xx% during the forecast period. Market penetration of LED lighting is expected to reach xx% by 2033, indicating substantial growth potential.

Dominant Markets & Segments in Asia Pacific LED Lighting Market

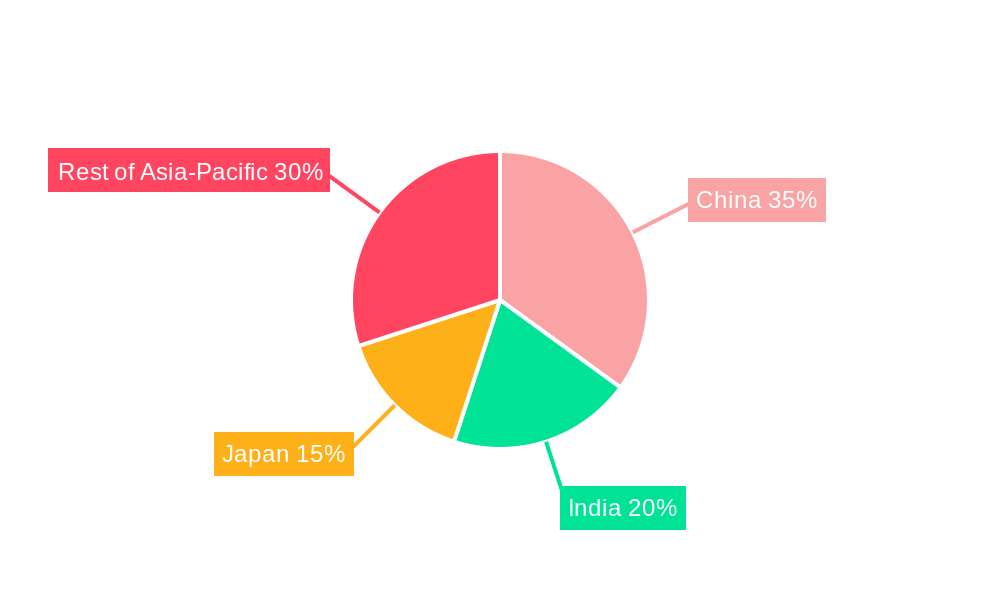

Leading Region: China holds the largest market share in the Asia Pacific region due to its massive infrastructure projects, expanding urbanization, and government support for energy efficiency initiatives.

Leading Country: China's dominance is further highlighted by its substantial market size, surpassing other countries in the region. India is a rapidly growing market, exhibiting strong potential due to its expanding economy and increasing infrastructure investments.

Dominant Segments:

- Indoor Lighting: The commercial segment within indoor lighting demonstrates the strongest growth due to the widespread adoption of LED lighting in offices, retail spaces, and industrial facilities.

- Outdoor Lighting: Public places and roadways within the outdoor segment are experiencing significant expansion, driven by government initiatives to enhance public safety and energy efficiency.

- Automotive Lighting: Passenger cars segment within automotive lighting is showing substantial growth fueled by increasing vehicle production and the integration of advanced lighting technologies.

The dominance of China and India is primarily attributed to their large populations, rapid economic growth, and significant infrastructure development. Government policies promoting energy efficiency and sustainable practices further accelerate LED adoption.

Asia Pacific LED Lighting Market Product Developments

Recent product developments emphasize miniaturization, increased efficacy, and smart features. Manufacturers are focusing on advanced LED technologies, such as high-power LEDs and micro-LEDs, to enhance lighting performance. The integration of smart controls and sensors enables remote monitoring and customized lighting settings. The market is witnessing the emergence of innovative applications, such as horticultural lighting and human-centric lighting, targeting specific user needs and environmental conditions. These developments aim to provide improved energy efficiency, enhanced light quality, and customized lighting solutions tailored to diverse applications.

Report Scope & Segmentation Analysis

This report segments the Asia Pacific LED lighting market across various parameters:

By Application: Indoor Lighting (Residential, Commercial, Agricultural), Outdoor Lighting (Public Places, Streets and Roadways, Others), Automotive Lighting (Automotive Utility Lighting - Daytime Running Lights (DRL), Directional Signal Lights, Headlights, Reverse Light, Stop Light, Tail Light, Others; Automotive Vehicle Lighting - 2 Wheelers, Commercial Vehicles, Passenger Cars). Each segment shows varying growth rates and competitive dynamics. For instance, the automotive segment shows strong growth due to rising vehicle sales.

By Geography: China, India, Japan, and Rest of Asia-Pacific. Each country’s market size, growth projections, and key drivers are analyzed. China and India are leading markets, while Japan is characterized by high technological advancements. The Rest of Asia-Pacific exhibits significant growth potential.

Market sizes and growth projections are provided for each segment and region, offering a granular view of market opportunities. Competitive landscapes are analyzed for each segment, identifying major players and their strategic initiatives.

Key Drivers of Asia Pacific LED Lighting Market Growth

Several factors drive the Asia Pacific LED lighting market’s growth:

- Government Initiatives: Energy efficiency regulations and incentives promote LED adoption. For example, China's stringent energy efficiency standards have significantly boosted LED penetration.

- Technological Advancements: Continuous improvements in LED technology lead to higher efficacy, improved light quality, and reduced costs. The development of smart lighting solutions has broadened the market appeal.

- Economic Growth: Rapid economic expansion in several Asian countries fuels construction and infrastructure projects, creating demand for lighting products.

These factors collectively contribute to a positive outlook for market growth.

Challenges in the Asia Pacific LED Lighting Market Sector

Despite the robust growth, certain challenges exist:

- Price Competition: Intense competition from manufacturers puts downward pressure on prices, affecting profit margins.

- Supply Chain Disruptions: Global supply chain vulnerabilities can impact the availability and cost of raw materials.

- Counterfeit Products: The presence of counterfeit LED products can harm market integrity and consumer trust. Estimated losses from counterfeit products are approximately xx Million annually. These factors create uncertainty in the market and need to be managed effectively.

Emerging Opportunities in Asia Pacific LED Lighting Market

The Asia Pacific LED lighting market presents several emerging opportunities:

- Smart Lighting: Growing demand for connected lighting solutions opens new avenues for innovation and market expansion.

- Human-Centric Lighting: The integration of lighting solutions with human health and well-being creates new product categories.

- Agricultural Lighting: The use of LEDs in agriculture has significant growth potential, particularly for controlled environment agriculture.

These emerging trends indicate that the market is evolving toward more integrated and specialized applications.

Leading Players in the Asia Pacific LED Lighting Market Market

- Nichia Corporation

- OSRAM GmbH

- Koito Manufacturing Co Ltd

- OPPLE Lighting Co Ltd

- GRUPO ANTOLIN IRAUSA S A

- EGLO Leuchten GmbH

- Marelli Holdings Co Ltd

- Stanley Electric Co Ltd

- Signify Holding (Philips)

- Panasonic Holdings Corporation

Key Developments in Asia Pacific LED Lighting Market Industry

- June 2023: Panasonic illuminated the Tokyo Dome using approximately 400 LED floodlights, each equivalent to 2KW. This highlights the growing use of high-power LEDs in large-scale installations.

- March 2023: Signify's expanded collaboration with Perfect Plants on grow lights showcases the growing market for specialized LED applications in horticulture and medicinal cannabis cultivation.

- March 2023: Nichia and OSRAM's expanded IP license collaboration demonstrates the importance of intellectual property in the LED industry and signals further technological advancements and potential for innovation.

Strategic Outlook for Asia Pacific LED Lighting Market Market

The Asia Pacific LED lighting market is poised for continued expansion, driven by technological innovation, supportive government policies, and rising consumer demand. The increasing adoption of smart lighting, specialized applications, and focus on energy efficiency will shape future market trends. Opportunities exist for companies to invest in R&D, develop innovative products, and expand their market presence in high-growth segments. The market's future potential is bright, particularly in emerging economies and rapidly developing infrastructure projects.

Asia Pacific LED Lighting Market Segmentation

-

1. Indoor Lighting

- 1.1. Agricultural Lighting

-

1.2. Commercial

- 1.2.1. Office

- 1.2.2. Retail

- 1.2.3. Others

- 1.3. Industrial and Warehouse

- 1.4. Residential

-

2. Outdoor Lighting

- 2.1. Public Places

- 2.2. Streets and Roadways

- 2.3. Others

-

3. Automotive Utility Lighting

- 3.1. Daytime Running Lights (DRL)

- 3.2. Directional Signal Lights

- 3.3. Headlights

- 3.4. Reverse Light

- 3.5. Stop Light

- 3.6. Tail Light

- 3.7. Others

-

4. Automotive Vehicle Lighting

- 4.1. 2 Wheelers

- 4.2. Commercial Vehicles

- 4.3. Passenger Cars

Asia Pacific LED Lighting Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia Pacific LED Lighting Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.68% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Construction Boom Owing to the Growing Clout of Multinational Conglomerates; Increasing Emphasis on Green Building Practices; Growing Demand for Soft FM Practices

- 3.3. Market Restrains

- 3.3.1. Regulator and Legal Challenges; Growing Concentration of FM Vendors to Impact Margins

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific LED Lighting Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Indoor Lighting

- 5.1.1. Agricultural Lighting

- 5.1.2. Commercial

- 5.1.2.1. Office

- 5.1.2.2. Retail

- 5.1.2.3. Others

- 5.1.3. Industrial and Warehouse

- 5.1.4. Residential

- 5.2. Market Analysis, Insights and Forecast - by Outdoor Lighting

- 5.2.1. Public Places

- 5.2.2. Streets and Roadways

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by Automotive Utility Lighting

- 5.3.1. Daytime Running Lights (DRL)

- 5.3.2. Directional Signal Lights

- 5.3.3. Headlights

- 5.3.4. Reverse Light

- 5.3.5. Stop Light

- 5.3.6. Tail Light

- 5.3.7. Others

- 5.4. Market Analysis, Insights and Forecast - by Automotive Vehicle Lighting

- 5.4.1. 2 Wheelers

- 5.4.2. Commercial Vehicles

- 5.4.3. Passenger Cars

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Indoor Lighting

- 6. China Asia Pacific LED Lighting Market Analysis, Insights and Forecast, 2019-2031

- 7. Japan Asia Pacific LED Lighting Market Analysis, Insights and Forecast, 2019-2031

- 8. India Asia Pacific LED Lighting Market Analysis, Insights and Forecast, 2019-2031

- 9. South Korea Asia Pacific LED Lighting Market Analysis, Insights and Forecast, 2019-2031

- 10. Taiwan Asia Pacific LED Lighting Market Analysis, Insights and Forecast, 2019-2031

- 11. Australia Asia Pacific LED Lighting Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Asia-Pacific Asia Pacific LED Lighting Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Nichia Corporation

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 OSRAM GmbH

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Koito Manufacturing Co Ltd

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 OPPLE Lighting Co Ltd

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 GRUPO ANTOLIN IRAUSA S A

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 EGLO Leuchten GmbH

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Marelli Holdings Co Ltd

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Stanley Electric Co Ltd

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Signify Holding (Philips)

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Panasonic Holdings Corporation

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 Nichia Corporation

List of Figures

- Figure 1: Asia Pacific LED Lighting Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Asia Pacific LED Lighting Market Share (%) by Company 2024

List of Tables

- Table 1: Asia Pacific LED Lighting Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Asia Pacific LED Lighting Market Revenue Million Forecast, by Indoor Lighting 2019 & 2032

- Table 3: Asia Pacific LED Lighting Market Revenue Million Forecast, by Outdoor Lighting 2019 & 2032

- Table 4: Asia Pacific LED Lighting Market Revenue Million Forecast, by Automotive Utility Lighting 2019 & 2032

- Table 5: Asia Pacific LED Lighting Market Revenue Million Forecast, by Automotive Vehicle Lighting 2019 & 2032

- Table 6: Asia Pacific LED Lighting Market Revenue Million Forecast, by Region 2019 & 2032

- Table 7: Asia Pacific LED Lighting Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: China Asia Pacific LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Japan Asia Pacific LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: India Asia Pacific LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: South Korea Asia Pacific LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Taiwan Asia Pacific LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Australia Asia Pacific LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Rest of Asia-Pacific Asia Pacific LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Asia Pacific LED Lighting Market Revenue Million Forecast, by Indoor Lighting 2019 & 2032

- Table 16: Asia Pacific LED Lighting Market Revenue Million Forecast, by Outdoor Lighting 2019 & 2032

- Table 17: Asia Pacific LED Lighting Market Revenue Million Forecast, by Automotive Utility Lighting 2019 & 2032

- Table 18: Asia Pacific LED Lighting Market Revenue Million Forecast, by Automotive Vehicle Lighting 2019 & 2032

- Table 19: Asia Pacific LED Lighting Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: China Asia Pacific LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Japan Asia Pacific LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: South Korea Asia Pacific LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: India Asia Pacific LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Australia Asia Pacific LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: New Zealand Asia Pacific LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Indonesia Asia Pacific LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Malaysia Asia Pacific LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Singapore Asia Pacific LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Thailand Asia Pacific LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Vietnam Asia Pacific LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Philippines Asia Pacific LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific LED Lighting Market?

The projected CAGR is approximately 6.68%.

2. Which companies are prominent players in the Asia Pacific LED Lighting Market?

Key companies in the market include Nichia Corporation, OSRAM GmbH, Koito Manufacturing Co Ltd, OPPLE Lighting Co Ltd, GRUPO ANTOLIN IRAUSA S A, EGLO Leuchten GmbH, Marelli Holdings Co Ltd, Stanley Electric Co Ltd, Signify Holding (Philips), Panasonic Holdings Corporation.

3. What are the main segments of the Asia Pacific LED Lighting Market?

The market segments include Indoor Lighting, Outdoor Lighting, Automotive Utility Lighting, Automotive Vehicle Lighting.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Construction Boom Owing to the Growing Clout of Multinational Conglomerates; Increasing Emphasis on Green Building Practices; Growing Demand for Soft FM Practices.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Regulator and Legal Challenges; Growing Concentration of FM Vendors to Impact Margins.

8. Can you provide examples of recent developments in the market?

June 2023: The company light up the Tokyo Dome with around 400 Panasonic LED floodlights, 2KW equivalent. In March 2017, 300 LED floodlights installed in the infield.March 2023: Signify, and Perfect Plants has expanded their collaboration on grow lights. Driving this partnership is Perfect Plant’s ambition to become a prominent manufacturer of starting materials for medicinal cannabis cultivation. Perfect Plants has branches in the Netherlands, Canada, and South Africa.March 2023: Nichia(HQ in japan) and OSRAM emphasize the importance of intellectual property (IP) in their respective business domains and announce plans to expand their license collaboration. As a result, each company is permitted to use the patents licensed under the relevant agreement in its nitride-based semiconductor products, such as blue, green, and white LED and laser components.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific LED Lighting Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific LED Lighting Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific LED Lighting Market?

To stay informed about further developments, trends, and reports in the Asia Pacific LED Lighting Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence