Key Insights

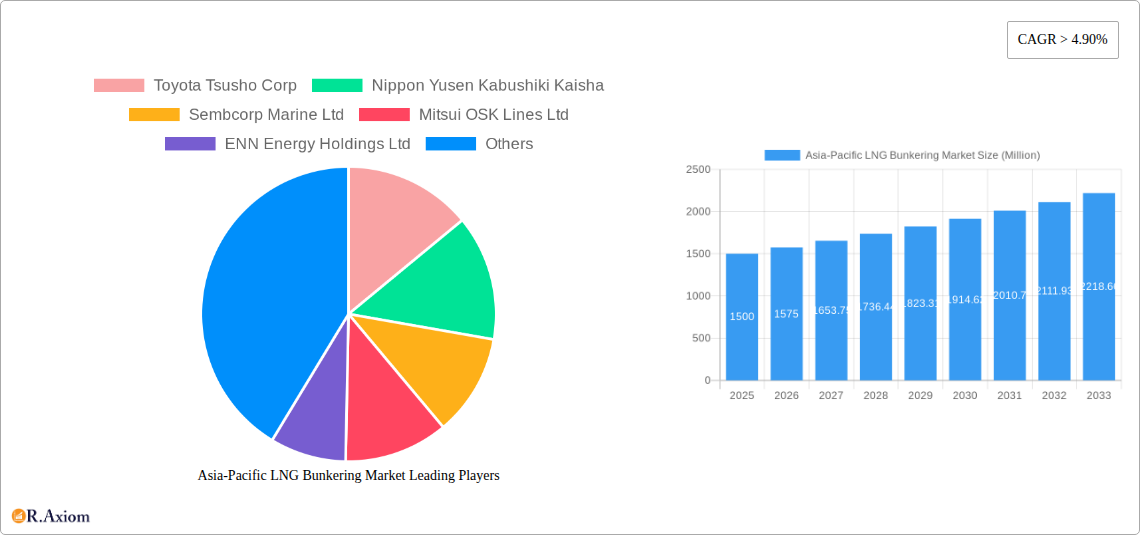

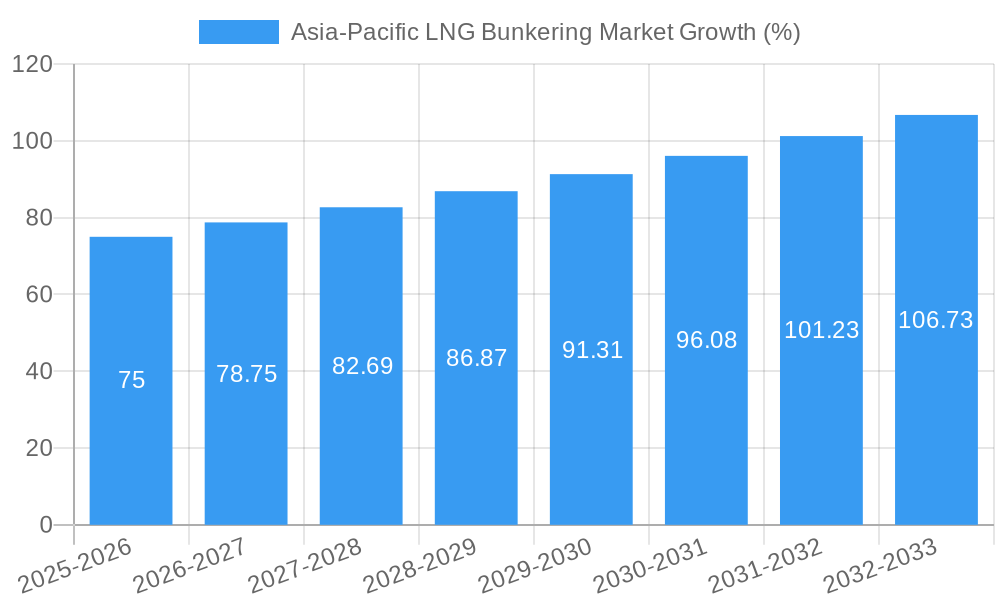

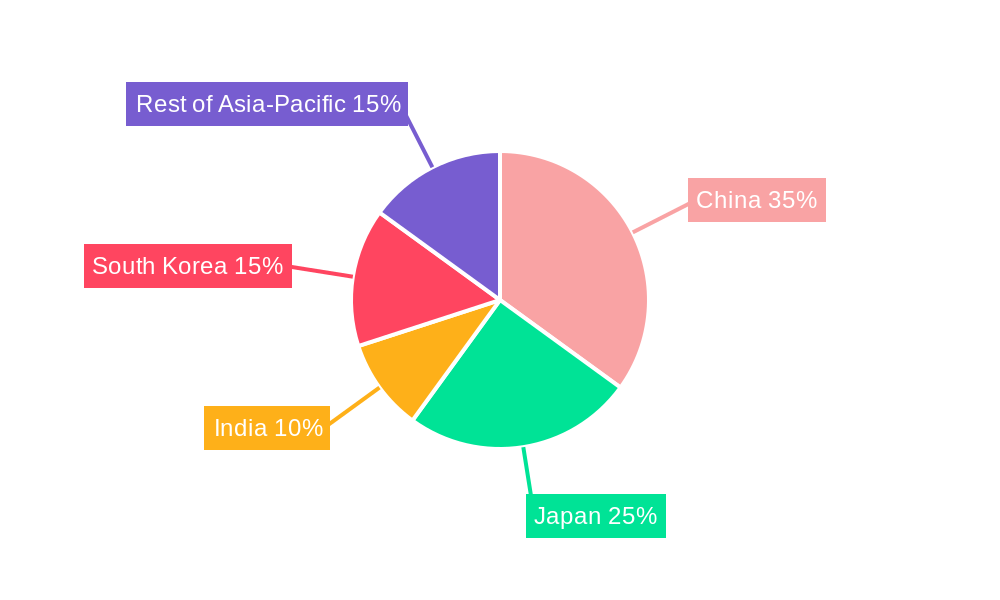

The Asia-Pacific LNG bunkering market is experiencing robust growth, fueled by increasing demand for cleaner marine fuels and stringent environmental regulations. With a current market size (2025) estimated at $XX million (assuming a reasonable value based on similar markets and the provided CAGR) and a compound annual growth rate (CAGR) exceeding 4.90%, the market is projected to reach significant value by 2033. Key drivers include the growing adoption of LNG as a marine fuel to meet International Maritime Organization (IMO) 2020 sulfur emission regulations and subsequent stricter targets, coupled with increasing investments in LNG bunkering infrastructure across major ports in the region. The expanding tanker, container, and bulk carrier fleets in Asia-Pacific are significantly contributing to the market's expansion. Furthermore, government initiatives promoting cleaner shipping and incentives for LNG adoption are accelerating market growth. China, Japan, South Korea, and India are major contributors, driven by their significant shipping activities and proactive environmental policies.

However, challenges remain. High initial investment costs associated with LNG bunkering infrastructure and the relatively higher price of LNG compared to traditional marine fuels are acting as restraints. The development of the LNG bunkering infrastructure needs further support from stakeholders to ensure adequate availability for the rising demand. Moreover, the geographical limitations of LNG bunkering infrastructure and its accessibility to different vessel types and sizes needs improvement to further drive adoption. Nevertheless, the long-term outlook for the Asia-Pacific LNG bunkering market remains positive, driven by sustained environmental regulations, burgeoning trade, and the increasing preference for cleaner and more sustainable shipping solutions. Segmentation analysis reveals a significant contribution from tanker fleets, followed by container fleets and bulk carriers. Major players like Toyota Tsusho Corp, Nippon Yusen Kabushiki Kaisha, and Sembcorp Marine Ltd are actively shaping market dynamics through investments and technological advancements.

Asia-Pacific LNG Bunkering Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Asia-Pacific LNG bunkering market, covering the period from 2019 to 2033. The report leverages extensive primary and secondary research to offer actionable insights for industry stakeholders, including market sizing, growth projections, competitive landscapes, and emerging trends. The study period spans 2019-2033, with 2025 serving as the base and estimated year. The forecast period extends from 2025 to 2033, and the historical period encompasses 2019-2024. Key players analyzed include Toyota Tsusho Corp, Nippon Yusen Kabushiki Kaisha, Sembcorp Marine Ltd, Mitsui OSK Lines Ltd, ENN Energy Holdings Ltd, Central LNG Marine Fuel Japan Corporation, Petronas Gas Bhd, Chubu Electric Power Co Inc, and others. The report segments the market by end-user: Tanker Fleet, Container Fleet, Bulk and General Cargo Fleet, Ferries and OSV, and Others.

Asia-Pacific LNG Bunkering Market Market Concentration & Innovation

This section analyzes the market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user trends, and M&A activities within the Asia-Pacific LNG bunkering market. The market exhibits moderate concentration, with the top five players holding an estimated xx% market share in 2025. Innovation is driven by the need for cleaner shipping fuels and advancements in LNG bunkering infrastructure. Regulatory frameworks, varying across countries, significantly impact market growth, while the lack of readily available substitutes for LNG as a marine fuel limits alternative options. End-user trends show a growing preference for LNG bunkering due to environmental regulations and cost efficiency in specific segments. M&A activity has been relatively low in recent years, with a total deal value of approximately $xx Million between 2019 and 2024. Future M&A activity is expected to increase, driven by the need for consolidation and expansion into new markets.

- Key Metrics:

- Top 5 players market share (2025): xx%

- Total M&A deal value (2019-2024): $xx Million

- Average deal size (2019-2024): $xx Million

Asia-Pacific LNG Bunkering Market Industry Trends & Insights

The Asia-Pacific LNG bunkering market is experiencing robust growth, driven by stringent environmental regulations aimed at reducing greenhouse gas emissions from shipping. The CAGR is projected to be xx% during the forecast period (2025-2033), fueled by increasing adoption of LNG as a cleaner alternative to traditional marine fuels. Technological disruptions, such as the development of more efficient LNG bunkering vessels and improved storage technologies, are further accelerating market expansion. Consumer preferences are shifting towards environmentally friendly shipping solutions, driving demand for LNG bunkering services. However, competitive dynamics remain intense, with established players and new entrants vying for market share. Market penetration of LNG as a marine fuel is expected to reach xx% by 2033, indicating significant growth potential.

Dominant Markets & Segments in Asia-Pacific LNG Bunkering Market

The report identifies [Specific Country/Region - e.g., Singapore or South Korea] as the dominant market within the Asia-Pacific region due to its well-established port infrastructure, strategic location, and supportive government policies promoting cleaner shipping. The Tanker Fleet segment represents the largest end-user segment, driven by the high fuel consumption of large vessels and increasing regulatory pressure.

Key Drivers for Dominant Market:

- Developed port infrastructure

- Supportive government policies (provide specific example of policy)

- High vessel traffic

Key Drivers for Dominant Segment (Tanker Fleet):

- High fuel consumption

- Stringent environmental regulations

- Growing demand for long-haul transportation

Asia-Pacific LNG Bunkering Market Product Developments

Recent product innovations focus on developing more efficient and cost-effective LNG bunkering technologies, including improved bunkering vessels and automated systems. These advancements aim to reduce bunkering time and improve safety, enhancing the overall competitiveness of LNG as a marine fuel. New applications are emerging, including the use of LNG as a fuel for smaller vessels like ferries and OSVs, driving further market expansion.

Report Scope & Segmentation Analysis

The report provides a comprehensive segmentation of the Asia-Pacific LNG bunkering market based on end-user.

Tanker Fleet: This segment is projected to experience significant growth due to increasing demand for LNG transportation and stringent environmental regulations targeting large vessels. Competitive dynamics are intense, with several major players vying for market share. Market size in 2025 is estimated at $xx Million, with a projected growth to $xx Million by 2033.

Container Fleet: Growth in this segment is driven by the increasing volume of containerized goods and the adoption of LNG-fueled container ships. Market size in 2025 is estimated at $xx Million, with a projected growth to $xx Million by 2033.

Bulk and General Cargo Fleet: This segment shows moderate growth, driven by the increasing adoption of LNG-fueled vessels in this sector. Market size in 2025 is estimated at $xx Million, with a projected growth to $xx Million by 2033.

Ferries and OSV: Growth in this segment is driven by the increasing demand for environmentally friendly solutions in the ferry and OSV sectors. Market size in 2025 is estimated at $xx Million, with a projected growth to $xx Million by 2033.

Others: This segment encompasses various other end-users of LNG bunkering services and is expected to witness steady growth, with market size in 2025 estimated at $xx Million and projected to reach $xx Million by 2033.

Key Drivers of Asia-Pacific LNG Bunkering Market Growth

The market's growth is primarily driven by stringent environmental regulations aimed at reducing sulfur emissions from shipping, increasing awareness of the environmental benefits of LNG, growing investments in LNG bunkering infrastructure, and rising demand for cleaner shipping fuels across the Asia-Pacific region. Government incentives and supportive policies further accelerate adoption.

Challenges in the Asia-Pacific LNG Bunkering Market Sector

Key challenges include the high initial investment costs associated with LNG bunkering infrastructure, limited availability of LNG bunkering facilities in certain regions, price volatility of LNG, and the need for establishing robust safety and handling procedures. These factors can hinder market growth and increase operational costs. The lack of standardization across different LNG bunkering technologies also poses a challenge.

Emerging Opportunities in Asia-Pacific LNG Bunkering Market

Emerging opportunities include the expansion of LNG bunkering infrastructure in underserved regions, the development of innovative LNG bunkering technologies, and the increasing adoption of LNG as a fuel for smaller vessels. The growing focus on carbon reduction targets presents significant opportunities for LNG bunkering services.

Leading Players in the Asia-Pacific LNG Bunkering Market Market

- Toyota Tsusho Corp

- Nippon Yusen Kabushiki Kaisha

- Sembcorp Marine Ltd

- Mitsui OSK Lines Ltd

- ENN Energy Holdings Ltd

- Central LNG Marine Fuel Japan Corporation

- Petronas Gas Bhd

- Chubu Electric Power Co Inc

Key Developments in Asia-Pacific LNG LNG Bunkering Market Industry

- [Month, Year]: [Company Name] launched a new LNG bunkering vessel in [Port].

- [Month, Year]: [Government Agency] announced new regulations regarding sulfur emissions from ships.

- [Month, Year]: [Company A] and [Company B] signed a joint venture agreement to develop LNG bunkering infrastructure in [Region].

- [Month, Year]: [Company] introduced a new LNG bunkering technology improving efficiency.

Strategic Outlook for Asia-Pacific LNG Bunkering Market Market

The Asia-Pacific LNG bunkering market is poised for significant growth over the forecast period, driven by sustained demand for cleaner shipping fuels and increasing environmental regulations. Further investments in LNG bunkering infrastructure, coupled with technological advancements, will unlock new opportunities and accelerate market expansion. The market is expected to witness consolidation among key players, leading to increased efficiency and service optimization.

Asia-Pacific LNG Bunkering Market Segmentation

-

1. End-User

- 1.1. Tanker Fleet

- 1.2. Container Fleet

- 1.3. Bulk and General Cargo Fleet

- 1.4. Ferries and OSV

- 1.5. Others

-

2. Geography

- 2.1. India

- 2.2. China

- 2.3. Japan

- 2.4. Rest of Asia-Pacific

Asia-Pacific LNG Bunkering Market Segmentation By Geography

- 1. India

- 2. China

- 3. Japan

- 4. Rest of Asia Pacific

Asia-Pacific LNG Bunkering Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 4.90% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Supply and Consumption of Gas-based Systems in Various End-user Industry4.; Implementation of stricter emission regulations worldwide

- 3.3. Market Restrains

- 3.3.1. 4.; Growing Inclination towards Renewable Sources

- 3.4. Market Trends

- 3.4.1. Ferries and OSV Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific LNG Bunkering Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by End-User

- 5.1.1. Tanker Fleet

- 5.1.2. Container Fleet

- 5.1.3. Bulk and General Cargo Fleet

- 5.1.4. Ferries and OSV

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. India

- 5.2.2. China

- 5.2.3. Japan

- 5.2.4. Rest of Asia-Pacific

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.3.2. China

- 5.3.3. Japan

- 5.3.4. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by End-User

- 6. India Asia-Pacific LNG Bunkering Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by End-User

- 6.1.1. Tanker Fleet

- 6.1.2. Container Fleet

- 6.1.3. Bulk and General Cargo Fleet

- 6.1.4. Ferries and OSV

- 6.1.5. Others

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. India

- 6.2.2. China

- 6.2.3. Japan

- 6.2.4. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by End-User

- 7. China Asia-Pacific LNG Bunkering Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by End-User

- 7.1.1. Tanker Fleet

- 7.1.2. Container Fleet

- 7.1.3. Bulk and General Cargo Fleet

- 7.1.4. Ferries and OSV

- 7.1.5. Others

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. India

- 7.2.2. China

- 7.2.3. Japan

- 7.2.4. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by End-User

- 8. Japan Asia-Pacific LNG Bunkering Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by End-User

- 8.1.1. Tanker Fleet

- 8.1.2. Container Fleet

- 8.1.3. Bulk and General Cargo Fleet

- 8.1.4. Ferries and OSV

- 8.1.5. Others

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. India

- 8.2.2. China

- 8.2.3. Japan

- 8.2.4. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by End-User

- 9. Rest of Asia Pacific Asia-Pacific LNG Bunkering Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by End-User

- 9.1.1. Tanker Fleet

- 9.1.2. Container Fleet

- 9.1.3. Bulk and General Cargo Fleet

- 9.1.4. Ferries and OSV

- 9.1.5. Others

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. India

- 9.2.2. China

- 9.2.3. Japan

- 9.2.4. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by End-User

- 10. China Asia-Pacific LNG Bunkering Market Analysis, Insights and Forecast, 2019-2031

- 11. Japan Asia-Pacific LNG Bunkering Market Analysis, Insights and Forecast, 2019-2031

- 12. India Asia-Pacific LNG Bunkering Market Analysis, Insights and Forecast, 2019-2031

- 13. South Korea Asia-Pacific LNG Bunkering Market Analysis, Insights and Forecast, 2019-2031

- 14. Taiwan Asia-Pacific LNG Bunkering Market Analysis, Insights and Forecast, 2019-2031

- 15. Australia Asia-Pacific LNG Bunkering Market Analysis, Insights and Forecast, 2019-2031

- 16. Rest of Asia-Pacific Asia-Pacific LNG Bunkering Market Analysis, Insights and Forecast, 2019-2031

- 17. Competitive Analysis

- 17.1. Market Share Analysis 2024

- 17.2. Company Profiles

- 17.2.1 Toyota Tsusho Corp

- 17.2.1.1. Overview

- 17.2.1.2. Products

- 17.2.1.3. SWOT Analysis

- 17.2.1.4. Recent Developments

- 17.2.1.5. Financials (Based on Availability)

- 17.2.2 Nippon Yusen Kabushiki Kaisha

- 17.2.2.1. Overview

- 17.2.2.2. Products

- 17.2.2.3. SWOT Analysis

- 17.2.2.4. Recent Developments

- 17.2.2.5. Financials (Based on Availability)

- 17.2.3 Sembcorp Marine Ltd

- 17.2.3.1. Overview

- 17.2.3.2. Products

- 17.2.3.3. SWOT Analysis

- 17.2.3.4. Recent Developments

- 17.2.3.5. Financials (Based on Availability)

- 17.2.4 Mitsui OSK Lines Ltd

- 17.2.4.1. Overview

- 17.2.4.2. Products

- 17.2.4.3. SWOT Analysis

- 17.2.4.4. Recent Developments

- 17.2.4.5. Financials (Based on Availability)

- 17.2.5 ENN Energy Holdings Ltd

- 17.2.5.1. Overview

- 17.2.5.2. Products

- 17.2.5.3. SWOT Analysis

- 17.2.5.4. Recent Developments

- 17.2.5.5. Financials (Based on Availability)

- 17.2.6 Central LNG Marine Fuel Japan Corporation

- 17.2.6.1. Overview

- 17.2.6.2. Products

- 17.2.6.3. SWOT Analysis

- 17.2.6.4. Recent Developments

- 17.2.6.5. Financials (Based on Availability)

- 17.2.7 Petronas Gas Bhd*List Not Exhaustive

- 17.2.7.1. Overview

- 17.2.7.2. Products

- 17.2.7.3. SWOT Analysis

- 17.2.7.4. Recent Developments

- 17.2.7.5. Financials (Based on Availability)

- 17.2.8 Chubu Electric Power Co Inc

- 17.2.8.1. Overview

- 17.2.8.2. Products

- 17.2.8.3. SWOT Analysis

- 17.2.8.4. Recent Developments

- 17.2.8.5. Financials (Based on Availability)

- 17.2.1 Toyota Tsusho Corp

List of Figures

- Figure 1: Asia-Pacific LNG Bunkering Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Asia-Pacific LNG Bunkering Market Share (%) by Company 2024

List of Tables

- Table 1: Asia-Pacific LNG Bunkering Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Asia-Pacific LNG Bunkering Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 3: Asia-Pacific LNG Bunkering Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 4: Asia-Pacific LNG Bunkering Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Asia-Pacific LNG Bunkering Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: China Asia-Pacific LNG Bunkering Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Japan Asia-Pacific LNG Bunkering Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: India Asia-Pacific LNG Bunkering Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: South Korea Asia-Pacific LNG Bunkering Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Taiwan Asia-Pacific LNG Bunkering Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Australia Asia-Pacific LNG Bunkering Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Asia-Pacific Asia-Pacific LNG Bunkering Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Asia-Pacific LNG Bunkering Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 14: Asia-Pacific LNG Bunkering Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 15: Asia-Pacific LNG Bunkering Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Asia-Pacific LNG Bunkering Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 17: Asia-Pacific LNG Bunkering Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 18: Asia-Pacific LNG Bunkering Market Revenue Million Forecast, by Country 2019 & 2032

- Table 19: Asia-Pacific LNG Bunkering Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 20: Asia-Pacific LNG Bunkering Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 21: Asia-Pacific LNG Bunkering Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Asia-Pacific LNG Bunkering Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 23: Asia-Pacific LNG Bunkering Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 24: Asia-Pacific LNG Bunkering Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific LNG Bunkering Market?

The projected CAGR is approximately > 4.90%.

2. Which companies are prominent players in the Asia-Pacific LNG Bunkering Market?

Key companies in the market include Toyota Tsusho Corp, Nippon Yusen Kabushiki Kaisha, Sembcorp Marine Ltd, Mitsui OSK Lines Ltd, ENN Energy Holdings Ltd, Central LNG Marine Fuel Japan Corporation, Petronas Gas Bhd*List Not Exhaustive, Chubu Electric Power Co Inc.

3. What are the main segments of the Asia-Pacific LNG Bunkering Market?

The market segments include End-User, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Supply and Consumption of Gas-based Systems in Various End-user Industry4.; Implementation of stricter emission regulations worldwide.

6. What are the notable trends driving market growth?

Ferries and OSV Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Growing Inclination towards Renewable Sources.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific LNG Bunkering Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific LNG Bunkering Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific LNG Bunkering Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific LNG Bunkering Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence