Key Insights

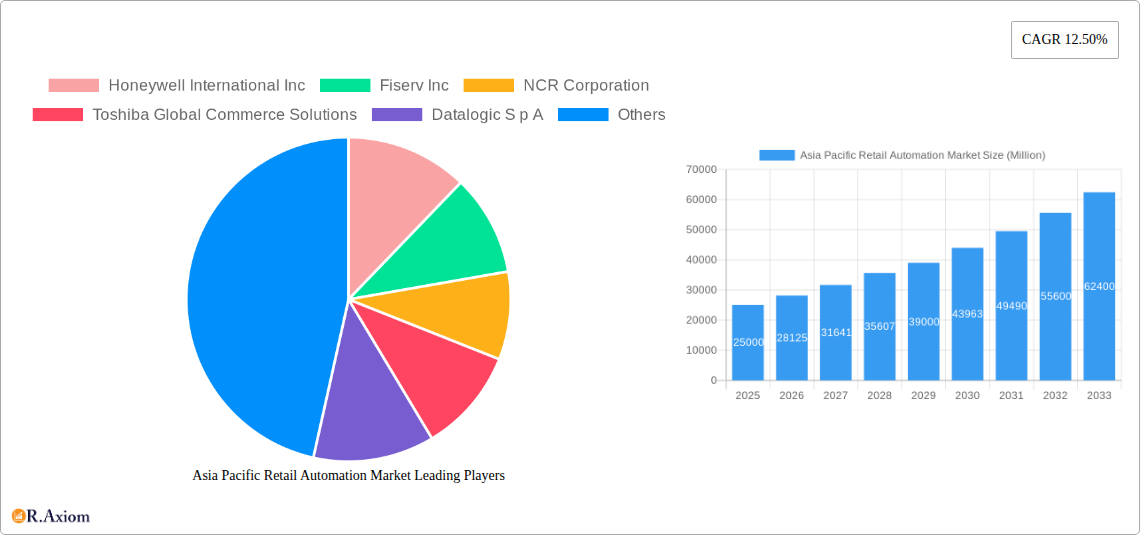

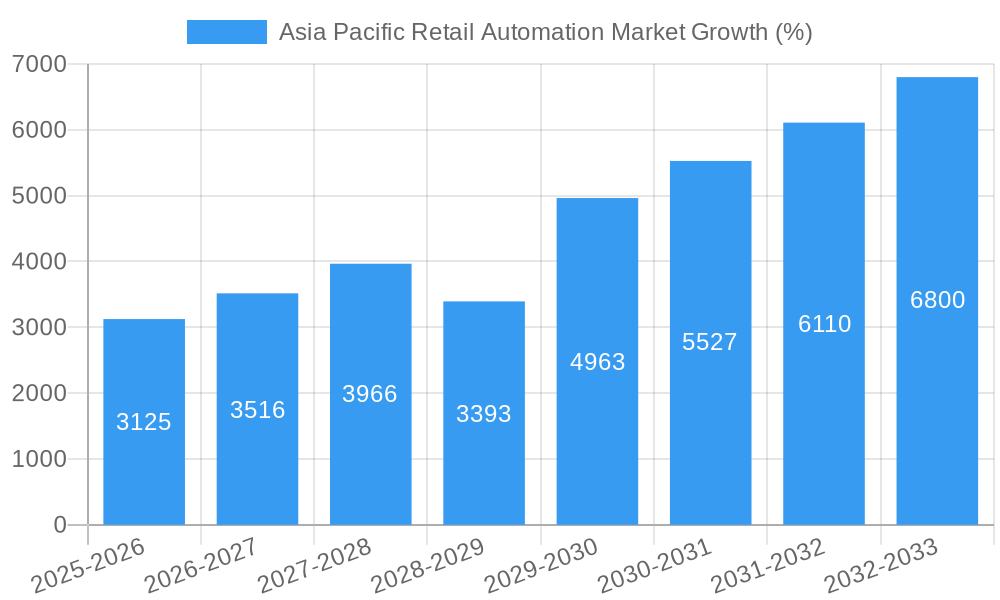

The Asia Pacific retail automation market is experiencing robust growth, driven by the increasing adoption of technology to enhance efficiency and customer experience. The market, valued at approximately $XX million in 2025 (estimated based on provided CAGR and market size), is projected to exhibit a compound annual growth rate (CAGR) of 12.50% from 2025 to 2033. This expansion is fueled by several key factors. Firstly, the burgeoning e-commerce sector in countries like China and India necessitates advanced automation solutions for order fulfillment and logistics. Secondly, the rising consumer demand for faster checkout processes and personalized shopping experiences is pushing retailers to invest in self-checkout kiosks, unattended terminals, and other automated systems. Furthermore, advancements in technologies such as artificial intelligence (AI) and the Internet of Things (IoT) are enabling the development of more sophisticated and integrated retail automation solutions. Finally, government initiatives promoting digitalization and technological advancements across the region are further accelerating market growth.

However, the market's growth trajectory is not without its challenges. High initial investment costs associated with implementing automated systems can act as a significant restraint, particularly for smaller retailers. Moreover, concerns regarding data security and privacy, along with the need for skilled labor to operate and maintain these complex systems, pose obstacles to widespread adoption. Despite these challenges, the long-term prospects for the Asia Pacific retail automation market remain positive, with continued growth anticipated across various segments, including point-of-sale systems, barcode readers, weighing scales, and self-checkout systems. The market’s segmentation by country (China, India, Japan, South Korea, and Rest of Asia Pacific) and product type reflects the diverse needs and technological advancements across the region, presenting ample opportunities for market players to cater to specific regional demands. The strong presence of established companies like Honeywell, Fiserv, and NCR, coupled with the emergence of innovative startups, ensures a dynamic and competitive landscape.

Asia Pacific Retail Automation Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Asia Pacific retail automation market, covering the period from 2019 to 2033. It offers invaluable insights for industry stakeholders, investors, and businesses seeking to navigate this dynamic and rapidly evolving sector. The report leverages extensive market research and data analysis to deliver actionable intelligence, forecasting significant growth and highlighting key trends. With a focus on market segmentation, competitive landscape, and future opportunities, this report is an essential resource for understanding and succeeding in the Asia Pacific retail automation market.

Asia Pacific Retail Automation Market Market Concentration & Innovation

The Asia Pacific retail automation market exhibits a moderately concentrated landscape, with several key players holding significant market share. However, the presence of numerous smaller, specialized firms also contributes to a dynamic competitive environment. Market share data for 2024 indicates that the top five players collectively hold approximately xx% of the market, highlighting the potential for both consolidation and innovative disruption. Mergers and acquisitions (M&A) activity has been relatively moderate in recent years, with deal values averaging approximately xx Million USD annually, suggesting a strategic approach to expansion and technological integration.

Key innovation drivers include the rising adoption of artificial intelligence (AI), machine learning (ML), and the Internet of Things (IoT) in retail operations. These technologies facilitate improved inventory management, personalized customer experiences, and streamlined checkout processes. Furthermore, supportive government regulations, particularly in countries like China and India, promoting digitalization and technological advancement, contribute to a favourable innovation ecosystem. However, regulatory frameworks vary across the region, posing challenges for market standardization. Existing product substitutes, such as manual processes, pose a competitive threat to automation solutions, although the cost and efficiency benefits of automation are increasingly outweighing these alternatives. End-user trends reveal a strong preference for efficient, user-friendly, and cost-effective solutions, driving the demand for sophisticated, integrated retail automation systems.

- Market Concentration: Top 5 players hold approximately xx% of market share (2024).

- M&A Activity: Average annual deal value approximately xx Million USD (2019-2024).

- Innovation Drivers: AI, ML, IoT, government regulations.

- Competitive Challenges: Manual processes, regulatory variations.

Asia Pacific Retail Automation Market Industry Trends & Insights

The Asia Pacific retail automation market is experiencing robust growth, driven by factors such as the expanding e-commerce sector, increasing consumer demand for convenience, and a growing focus on operational efficiency. The market is projected to exhibit a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), reaching a market value of xx Million USD by 2033. This growth is fuelled by technological advancements, including the integration of advanced analytics and cloud-based solutions, enhancing real-time data insights for improved decision-making and supply chain optimization. Market penetration is particularly high in urban areas and rapidly expanding in Tier 2 and Tier 3 cities across the region. Consumer preferences, particularly among millennials and Gen Z, are shifting towards seamless and personalized shopping experiences, further propelling the adoption of automated retail solutions. Competitive dynamics are marked by both fierce rivalry among established players and the emergence of innovative startups offering specialized solutions. This dynamism fosters continuous product innovation and service enhancements, ultimately benefiting consumers and driving overall market expansion.

Dominant Markets & Segments in Asia Pacific Retail Automation Market

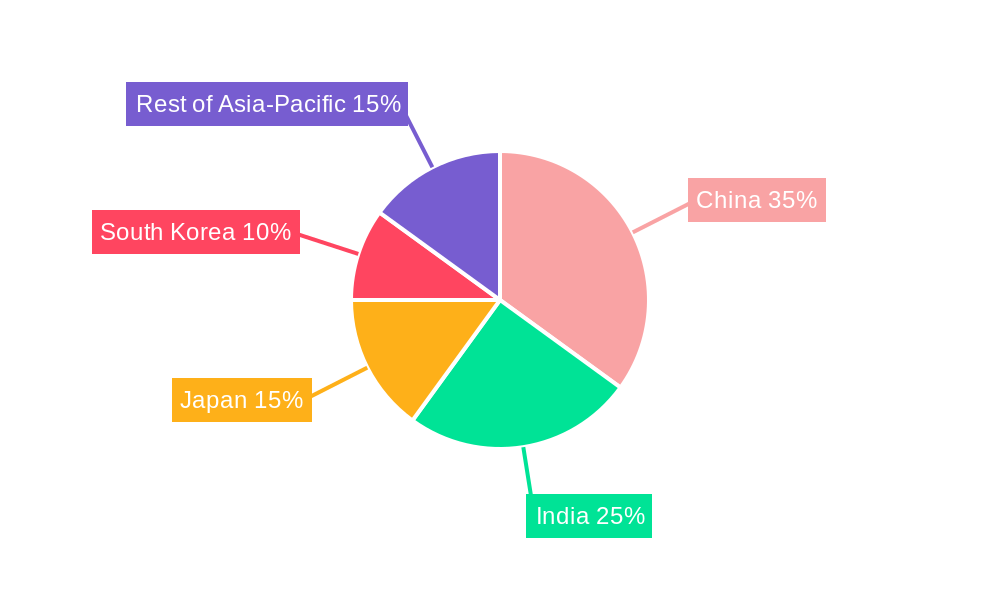

China dominates the Asia Pacific retail automation market, driven by its large consumer base, robust e-commerce sector, and government initiatives promoting digitalization. India follows as a significant market, exhibiting high growth potential due to its burgeoning middle class and rapidly expanding retail landscape. Japan and South Korea also represent substantial markets, characterized by technological advancements and a high level of consumer acceptance for automated solutions. The remaining Asia Pacific region shows promising growth potential, although at a slower pace than the leading nations.

- Dominant Country: China

- Key Drivers in China: Large consumer base, e-commerce boom, government support.

- Key Drivers in India: Growing middle class, expanding retail sector.

- Key Drivers in Japan: Technological advancement, consumer acceptance.

- Key Drivers in South Korea: Similar to Japan, plus strong focus on digital transformation.

In terms of product type, unattended terminals are witnessing the fastest growth, driven by the increasing demand for self-service options and the need to reduce operational costs. Point-of-sale (POS) systems requiring manual intervention, while still significant, are gradually losing market share to automated alternatives. Within individual product categories, barcode readers and self-checkout systems maintain high market penetration due to their widespread applicability and user-friendliness. Among end-user applications, the food and non-food retail sectors represent the largest segment, owing to the sheer volume of transactions and the need for efficient inventory management and checkout processes.

Asia Pacific Retail Automation Market Product Developments

Recent product innovations include the integration of AI-powered solutions for inventory management, predictive analytics for demand forecasting, and the development of advanced self-checkout systems with enhanced security features. These innovations aim to improve operational efficiency, enhance customer experience, and strengthen security. The competitive advantage lies in developing solutions that offer greater speed, accuracy, and user-friendliness, while maintaining cost-effectiveness and scalability. The market increasingly favors integrated, modular solutions that can be tailored to specific retail environments and business needs.

Report Scope & Segmentation Analysis

This report segments the Asia Pacific retail automation market based on country (China, India, Japan, South Korea, Rest of Asia Pacific), product type (Point-of-Sale Systems Requiring Manual Intervention, Unattended Terminals), product (Barcode reader, Weighing scale, Currency Counter, Bill Printer, Cash Register, Card Reader, Kiosks, Self-Checkout Systems, Others), and end-user application (Food/Non-Food, Oil and Gas, Transportation and Logistics, Health and Personal Care, Hospitality, Others). Each segment's growth projections, market size, and competitive dynamics are analyzed in detail. For instance, the unattended terminals segment is projected to grow at a faster rate than POS systems requiring manual intervention. Similarly, the Food and Non-food retail sector dominates the end-user application segment.

Key Drivers of Asia Pacific Retail Automation Market Growth

The Asia Pacific retail automation market's growth is driven by several key factors: The rise of e-commerce and omnichannel retailing necessitates efficient order fulfillment and inventory management. Labor cost pressures and the need to enhance operational efficiency are pushing retailers towards automation. Technological advancements, including AI, ML, and IoT, provide sophisticated solutions for various retail functions. Government initiatives promoting digitalization and technological adoption further fuel market growth.

Challenges in the Asia Pacific Retail Automation Market Sector

The market faces challenges including high initial investment costs for automation systems, which can be a barrier for small and medium-sized enterprises (SMEs). The need for skilled workforce to operate and maintain sophisticated automation equipment poses a challenge. Cybersecurity risks associated with data-driven automation solutions require robust mitigation strategies. Integration complexities with existing retail infrastructure and systems can also hinder wider adoption.

Emerging Opportunities in Asia Pacific Retail Automation Market

Emerging opportunities exist in the expansion of automation solutions into underserved markets, such as smaller towns and rural areas. The growing demand for personalized customer experiences and the increasing popularity of contactless payments create opportunities for innovative automation solutions. The integration of augmented reality (AR) and virtual reality (VR) technologies in retail spaces offers new avenues for automation.

Leading Players in the Asia Pacific Retail Automation Market Market

- Honeywell International Inc

- Fiserv Inc

- NCR Corporation

- Toshiba Global Commerce Solutions

- Datalogic S p A

- Fujitsu Limited

- Seiko Epson Corporation

- KUKA AG

- Zebra Technologies

- Diebold Nixdorf

Key Developments in Asia Pacific Retail Automation Market Industry

- December 2020: Fujitsu Limited partnered with Zippin to distribute its checkout-free solution in Japan, enhancing customer experience and operational efficiency.

- January 2020: Honeywell International Inc. collaborated with KOAMTAC Inc. to improve barcode scanner performance through the SwiftDecoderTM app.

Strategic Outlook for Asia Pacific Retail Automation Market Market

The Asia Pacific retail automation market holds immense potential for future growth, driven by technological innovations, evolving consumer preferences, and supportive government policies. The market is expected to witness increased adoption of AI, ML, and IoT-based solutions, leading to smarter, more efficient retail operations. The integration of these technologies with existing systems will be critical for seamless operations and enhanced customer experiences. Focus on sustainability and environmentally friendly solutions will also play a major role in shaping the future of the market.

Asia Pacific Retail Automation Market Segmentation

-

1. Product Type

- 1.1. Point-of

- 1.2. Unattended Terminals

-

2. Product

- 2.1. Barcode reader

- 2.2. Weighing scale

- 2.3. Currency Counter

- 2.4. Bill Printer

- 2.5. Cash Register

- 2.6. Card Reader

- 2.7. Kiosks

- 2.8. Self-Checkout Systems

- 2.9. Others

-

3. End-user Application

- 3.1. Food/Non-Food

- 3.2. Oil and Gas

- 3.3. Transportation and Logistics

- 3.4. Health and Personal Care

- 3.5. Hospitality

- 3.6. Others

Asia Pacific Retail Automation Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia Pacific Retail Automation Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 12.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing retail stores; Increase in the adoption of digitization across retail sector

- 3.3. Market Restrains

- 3.3.1 At unattended terminals

- 3.3.2 there is a risk of theft

- 3.4. Market Trends

- 3.4.1. Significant Upsurge in E-commerce Sector

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific Retail Automation Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Point-of

- 5.1.2. Unattended Terminals

- 5.2. Market Analysis, Insights and Forecast - by Product

- 5.2.1. Barcode reader

- 5.2.2. Weighing scale

- 5.2.3. Currency Counter

- 5.2.4. Bill Printer

- 5.2.5. Cash Register

- 5.2.6. Card Reader

- 5.2.7. Kiosks

- 5.2.8. Self-Checkout Systems

- 5.2.9. Others

- 5.3. Market Analysis, Insights and Forecast - by End-user Application

- 5.3.1. Food/Non-Food

- 5.3.2. Oil and Gas

- 5.3.3. Transportation and Logistics

- 5.3.4. Health and Personal Care

- 5.3.5. Hospitality

- 5.3.6. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. China Asia Pacific Retail Automation Market Analysis, Insights and Forecast, 2019-2031

- 7. Japan Asia Pacific Retail Automation Market Analysis, Insights and Forecast, 2019-2031

- 8. India Asia Pacific Retail Automation Market Analysis, Insights and Forecast, 2019-2031

- 9. South Korea Asia Pacific Retail Automation Market Analysis, Insights and Forecast, 2019-2031

- 10. Taiwan Asia Pacific Retail Automation Market Analysis, Insights and Forecast, 2019-2031

- 11. Australia Asia Pacific Retail Automation Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Asia-Pacific Asia Pacific Retail Automation Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Honeywell International Inc

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Fiserv Inc

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 NCR Corporation

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Toshiba Global Commerce Solutions

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Datalogic S p A

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Fujitsu Limited

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Seiko Epson Corporation

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 KUKA AG

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Zebra Technologies

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Diebold Nixdorf

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 Honeywell International Inc

List of Figures

- Figure 1: Asia Pacific Retail Automation Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Asia Pacific Retail Automation Market Share (%) by Company 2024

List of Tables

- Table 1: Asia Pacific Retail Automation Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Asia Pacific Retail Automation Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: Asia Pacific Retail Automation Market Revenue Million Forecast, by Product 2019 & 2032

- Table 4: Asia Pacific Retail Automation Market Revenue Million Forecast, by End-user Application 2019 & 2032

- Table 5: Asia Pacific Retail Automation Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Asia Pacific Retail Automation Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: China Asia Pacific Retail Automation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Japan Asia Pacific Retail Automation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: India Asia Pacific Retail Automation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: South Korea Asia Pacific Retail Automation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Taiwan Asia Pacific Retail Automation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Australia Asia Pacific Retail Automation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Asia-Pacific Asia Pacific Retail Automation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Asia Pacific Retail Automation Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 15: Asia Pacific Retail Automation Market Revenue Million Forecast, by Product 2019 & 2032

- Table 16: Asia Pacific Retail Automation Market Revenue Million Forecast, by End-user Application 2019 & 2032

- Table 17: Asia Pacific Retail Automation Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: China Asia Pacific Retail Automation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Japan Asia Pacific Retail Automation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: South Korea Asia Pacific Retail Automation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: India Asia Pacific Retail Automation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Australia Asia Pacific Retail Automation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: New Zealand Asia Pacific Retail Automation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Indonesia Asia Pacific Retail Automation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Malaysia Asia Pacific Retail Automation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Singapore Asia Pacific Retail Automation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Thailand Asia Pacific Retail Automation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Vietnam Asia Pacific Retail Automation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Philippines Asia Pacific Retail Automation Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Retail Automation Market?

The projected CAGR is approximately 12.50%.

2. Which companies are prominent players in the Asia Pacific Retail Automation Market?

Key companies in the market include Honeywell International Inc, Fiserv Inc, NCR Corporation, Toshiba Global Commerce Solutions, Datalogic S p A, Fujitsu Limited, Seiko Epson Corporation, KUKA AG, Zebra Technologies, Diebold Nixdorf.

3. What are the main segments of the Asia Pacific Retail Automation Market?

The market segments include Product Type, Product, End-user Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing retail stores; Increase in the adoption of digitization across retail sector.

6. What are the notable trends driving market growth?

Significant Upsurge in E-commerce Sector.

7. Are there any restraints impacting market growth?

At unattended terminals. there is a risk of theft.

8. Can you provide examples of recent developments in the market?

December 2020, Fujitsu Limited partnered with Zippin as a distributor of the company's checkout-free solution across Japan. The agreement enables Fujitsu to develop a retail solution to provide a novel customer experience, leveraging Zippin's checkout-free SaaS platform with cashless operations to enhance bandwidth and save staff time, which the businesses see as being especially important during the epidemic.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Retail Automation Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Retail Automation Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Retail Automation Market?

To stay informed about further developments, trends, and reports in the Asia Pacific Retail Automation Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence