Key Insights

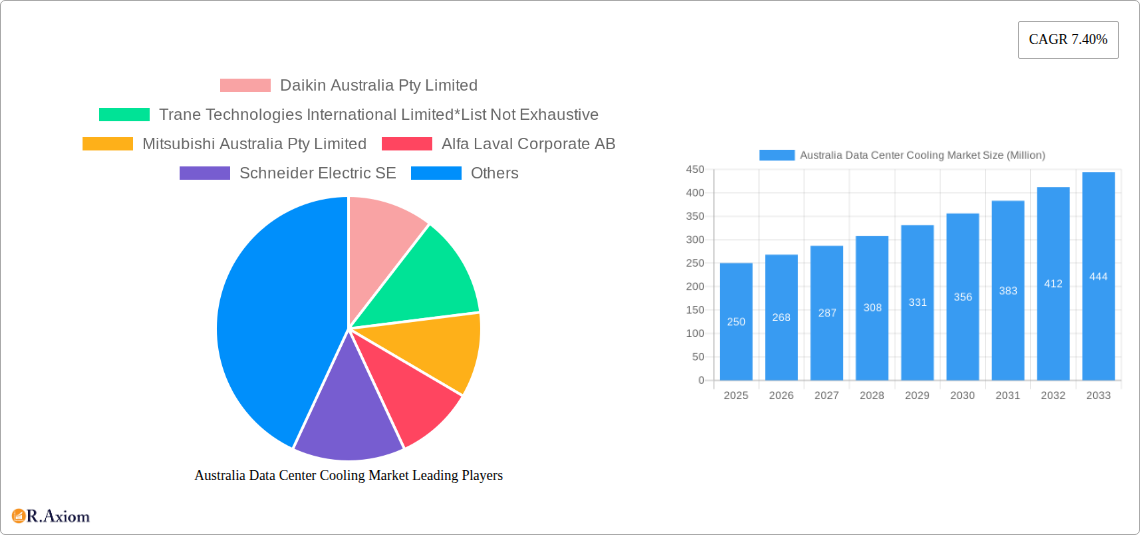

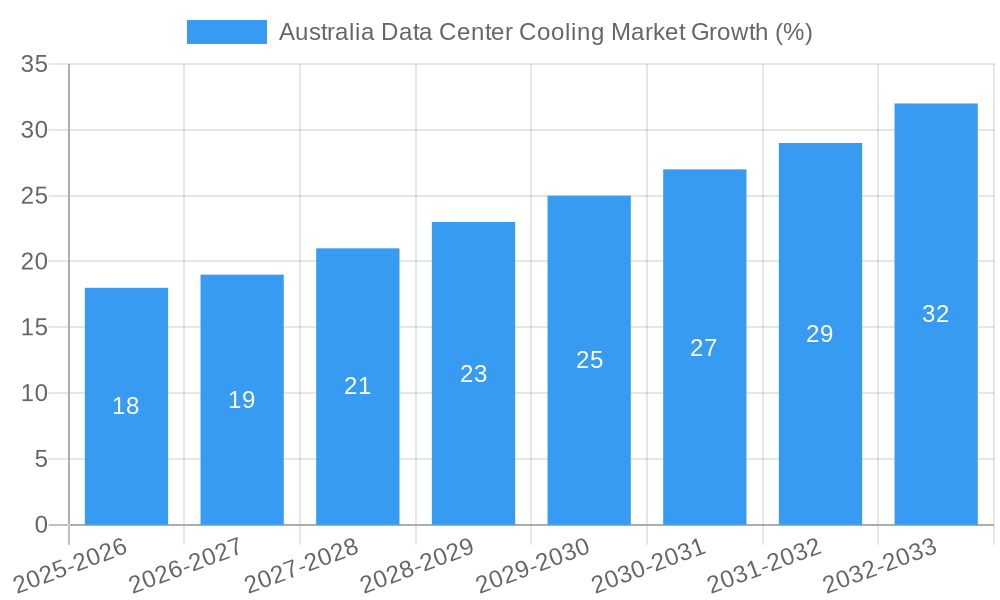

The Australian data center cooling market is experiencing robust growth, driven by the increasing adoption of cloud computing, the proliferation of data centers, and the rising demand for high-performance computing. The market, valued at approximately $XXX million in 2025 (estimated based on provided CAGR and market trends), is projected to maintain a Compound Annual Growth Rate (CAGR) of 7.40% from 2025 to 2033. This growth is fueled by several key trends, including the increasing focus on energy efficiency in data centers, the adoption of advanced cooling technologies such as liquid-based and evaporative cooling, and the stringent regulatory requirements for environmental sustainability. Key segments driving market expansion include the IT & Telecommunication, BFSI (Banking, Financial Services, and Insurance), and Government sectors, all of which are rapidly digitalizing their operations and consequently expanding their data center footprints. While the market faces challenges such as high initial investment costs associated with advanced cooling systems and potential skill shortages in specialized installation and maintenance, the overall growth trajectory remains positive. Competition in the market is intense, with both global and regional players vying for market share. This competitive landscape is pushing innovation in cooling technologies and service offerings, leading to more efficient and cost-effective solutions for data center operators.

The competitive landscape involves established players like Daikin, Trane, Mitsubishi, Alfa Laval, Schneider Electric, Rittal, Johnson Controls, Stulz, Vertiv, and Asetek, each offering a diverse portfolio of cooling solutions tailored to specific data center needs. The increasing demand for optimized cooling solutions is driving the adoption of sophisticated technologies like precision cooling and AI-powered thermal management systems. This push for efficiency and improved performance is further accentuated by the increasing focus on reducing the environmental impact of data centers, leading to greater demand for sustainable and energy-efficient cooling solutions. The continued growth in data center infrastructure across Australia is projected to fuel significant market expansion throughout the forecast period, with substantial growth opportunities across all major segments and regions within the country. Understanding these dynamics and technological advancements is critical for businesses operating in or considering investment in this thriving market segment.

Australia Data Center Cooling Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Australia Data Center Cooling market, offering valuable insights for stakeholders across the industry. The study covers the period from 2019 to 2033, with a focus on the forecast period from 2025 to 2033 and a base year of 2025. We delve into market size, segmentation, key players, growth drivers, challenges, and emerging opportunities, providing actionable intelligence for informed decision-making. The report leverages data from various credible sources, utilizing both qualitative and quantitative analysis to present a well-rounded perspective on this dynamic market. The total market size is predicted to reach xx Million by 2033.

Australia Data Center Cooling Market Concentration & Innovation

This section analyzes the competitive landscape of the Australian data center cooling market, examining market concentration, innovation drivers, regulatory frameworks, and recent M&A activity. The market exhibits a moderately concentrated structure, with several major players holding significant market share. However, the emergence of innovative cooling technologies is fostering competition and driving market fragmentation.

- Market Concentration: While precise market share data for individual companies is proprietary, it's estimated that the top five players hold approximately xx% of the market share in 2025. This concentration is expected to slightly decrease by 2033 due to increased competition from smaller players and new entrants.

- Innovation Drivers: Stringent environmental regulations, the increasing demand for energy-efficient data centers, and the proliferation of high-performance computing are key drivers of innovation in cooling technologies. Significant R&D investment is being directed towards liquid-based and immersion cooling solutions, pushing the boundaries of energy efficiency and cooling capacity.

- Regulatory Framework: Australian government initiatives promoting sustainable practices and energy efficiency within the IT sector significantly influence the market. Compliance requirements drive the adoption of environmentally friendly cooling solutions.

- Product Substitutes: While traditional air-based cooling remains prevalent, the market is witnessing a rise in liquid-based and evaporative cooling systems as viable substitutes. These offer improved efficiency and reduced environmental impact, challenging the dominance of established technologies.

- M&A Activities: The past five years have seen a modest level of M&A activity, with deal values averaging approximately xx Million per transaction. These activities primarily involved strategic acquisitions aimed at expanding product portfolios and market reach. The forecast period is predicted to experience a further increase of xx Million in M&A activity due to strategic mergers for gaining a competitive advantage.

Australia Data Center Cooling Market Industry Trends & Insights

The Australian data center cooling market is experiencing robust growth driven by several key factors. The increasing adoption of cloud computing and the expanding digital economy are fueling the demand for data centers, consequently driving the need for advanced cooling solutions. The market’s Compound Annual Growth Rate (CAGR) is projected to be xx% from 2025 to 2033.

Technological advancements, such as liquid immersion cooling and innovative air-cooling systems, are revolutionizing the industry. The market penetration rate of liquid-based cooling systems is expected to increase from xx% in 2025 to xx% by 2033. Consumer preferences are shifting towards energy-efficient and environmentally friendly options. Competitive dynamics are shaping the market, with established players facing challenges from innovative startups and niche players offering specialized cooling solutions. This competitive landscape is further intensified by government regulations promoting sustainable technologies and energy efficiency targets.

Dominant Markets & Segments in Australia Data Center Cooling Market

The IT & Telecommunication sector is the dominant end-user segment in the Australian data center cooling market, accounting for the largest share of revenue. This dominance is driven by the sector's significant investment in data infrastructure and its high energy consumption.

End-User Segments:

- IT & Telecommunication: High data center density and continuous expansion drive demand.

- BFSI: Growing focus on data security and regulatory compliance.

- Government: Increasing digitalization initiatives and public sector cloud adoption.

- Media & Entertainment: High-bandwidth requirements for content delivery and streaming services.

- Other End-Users: Includes education, healthcare and other sectors using data centers.

Cooling Technology Segments:

- Air-based Cooling: Still the most prevalent technology, but facing challenges from energy efficiency concerns.

- Liquid-based Cooling: Rapid growth driven by superior efficiency and capacity.

- Evaporative Cooling: Strong presence in certain climates, offers cost-effective solutions.

Key drivers for the dominance of these segments include strong economic growth, robust IT infrastructure development, and supportive government policies that facilitate digital transformation.

Australia Data Center Cooling Market Product Developments

Recent years have witnessed significant advancements in data center cooling technologies. The shift towards higher density data centers necessitates more efficient cooling solutions. This has propelled the development of liquid cooling, immersion cooling, and advanced air-cooling systems, all designed to minimize energy consumption and optimize cooling performance. These innovations are driven by the need for improved energy efficiency, reduced operational costs, and a smaller environmental footprint, leading to a competitive landscape marked by constant technological upgrades and improved market fit.

Report Scope & Segmentation Analysis

This report provides a detailed segmentation of the Australia Data Center Cooling market by end-user and cooling technology. Each segment is analyzed based on historical data (2019-2024), current estimates (2025), and future projections (2025-2033).

End-User Segmentation: The report details the market size, growth rate, and competitive dynamics for each end-user segment (IT & Telecommunication, BFSI, Government, Media & Entertainment, Other End-Users).

Cooling Technology Segmentation: The report similarly analyzes the market size, growth rate, and competitive landscape for each cooling technology segment (Air-based Cooling, Liquid-based Cooling, Evaporative Cooling). Growth projections reflect the anticipated adoption of more efficient and sustainable cooling solutions.

Key Drivers of Australia Data Center Cooling Market Growth

The growth of the Australia Data Center Cooling market is propelled by several key factors:

- Rising Data Center Density: The increasing demand for data storage and processing leads to higher density data centers, requiring more efficient cooling solutions.

- Government Regulations: Environmental regulations and policies promoting energy efficiency incentivize the adoption of advanced cooling technologies.

- Technological Advancements: Continuous innovations in cooling technologies are offering improved energy efficiency and reduced operational costs.

Challenges in the Australia Data Center Cooling Market Sector

The Australia Data Center Cooling market faces several challenges:

- High Initial Investment Costs: Advanced cooling systems can have high upfront costs, posing a barrier for smaller organizations.

- Supply Chain Disruptions: Global supply chain issues can impact the availability and cost of cooling equipment.

- Competition: The market is competitive, with established players and new entrants vying for market share.

Emerging Opportunities in Australia Data Center Cooling Market

Several emerging opportunities exist in the Australia Data Center Cooling market:

- Adoption of Sustainable Cooling Technologies: Growing demand for environmentally friendly solutions creates opportunities for innovative cooling technologies.

- Expansion in Regional Markets: Opportunities for expansion exist in emerging regional data center hubs.

- Integration of AI and IoT: The integration of AI and IoT technologies into cooling systems can optimize energy efficiency and performance.

Leading Players in the Australia Data Center Cooling Market Market

- Daikin Australia Pty Limited

- Trane Technologies International Limited

- Mitsubishi Australia Pty Limited

- Alfa Laval Corporate AB

- Schneider Electric SE

- Rittal GmbH & Co KG

- Johnson Controls Inc

- Stulz GmbH

- Vertiv Group Corp

- Asetek AS

Key Developments in Australia Data Center Cooling Market Industry

March 2023: Interactive launched its Immersion Data Center Cooling system with Vertiv, showcasing GRC tanks for high-performance computing. This signifies a significant step towards more efficient and sustainable cooling.

March 2023: LiquidStack secured investment from Trane Technologies, accelerating the adoption of immersion cooling technology. This collaboration underlines the growing importance of sustainable and efficient cooling solutions. This investment demonstrates a substantial commitment to sustainable data center practices and signifies a potential shift in market dynamics towards immersion cooling technology.

Strategic Outlook for Australia Data Center Cooling Market Market

The Australian data center cooling market is poised for continued growth, driven by increasing demand for data storage and processing, technological advancements, and supportive government policies. The focus on sustainability and energy efficiency will drive the adoption of innovative cooling technologies, creating opportunities for both established players and new entrants. The market's future growth hinges on the successful integration of sustainable solutions and the ability to address challenges related to cost and supply chain resilience.

Australia Data Center Cooling Market Segmentation

-

1. Cooling Technology

-

1.1. Air-based Cooling

- 1.1.1. Chiller and Economizer

- 1.1.2. CRAH

- 1.1.3. Cooling

- 1.1.4. Other Air-based Cooling Technologies

-

1.2. Liquid-based Cooling

- 1.2.1. Immersion Cooling

- 1.2.2. Direct-to-Chip Cooling

- 1.2.3. Rear-Door Heat Exchanger

-

1.1. Air-based Cooling

-

2. Type

- 2.1. Hyperscale (Owned and Leased)

- 2.2. Enterprise (On-premise)

- 2.3. Colocation

-

3. End-user Industry

- 3.1. IT and Telecom

- 3.2. Retail and Consumer Goods

- 3.3. Healthcare

- 3.4. Media and Entertainment

- 3.5. Federal and Institutional Agencies

- 3.6. Other End-user Industries

Australia Data Center Cooling Market Segmentation By Geography

- 1. Australia

Australia Data Center Cooling Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.40% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Volume of Digital Data; Emergence of Green Data Centers

- 3.3. Market Restrains

- 3.3.1 Costs

- 3.3.2 Adaptability Requirements

- 3.3.3 and Power Outages

- 3.4. Market Trends

- 3.4.1. Liquid-based Cooling is the Fastest Growing Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Australia Data Center Cooling Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Cooling Technology

- 5.1.1. Air-based Cooling

- 5.1.1.1. Chiller and Economizer

- 5.1.1.2. CRAH

- 5.1.1.3. Cooling

- 5.1.1.4. Other Air-based Cooling Technologies

- 5.1.2. Liquid-based Cooling

- 5.1.2.1. Immersion Cooling

- 5.1.2.2. Direct-to-Chip Cooling

- 5.1.2.3. Rear-Door Heat Exchanger

- 5.1.1. Air-based Cooling

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Hyperscale (Owned and Leased)

- 5.2.2. Enterprise (On-premise)

- 5.2.3. Colocation

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. IT and Telecom

- 5.3.2. Retail and Consumer Goods

- 5.3.3. Healthcare

- 5.3.4. Media and Entertainment

- 5.3.5. Federal and Institutional Agencies

- 5.3.6. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Australia

- 5.1. Market Analysis, Insights and Forecast - by Cooling Technology

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Daikin Australia Pty Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Trane Technologies International Limited*List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Mitsubishi Australia Pty Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Alfa Laval Corporate AB

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Schneider Electric SE

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Rittal GmbH & Co KG

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Johnson Controls Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Stulz GmbH

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Vertiv Group Corp

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Asetek AS

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Daikin Australia Pty Limited

List of Figures

- Figure 1: Australia Data Center Cooling Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Australia Data Center Cooling Market Share (%) by Company 2024

List of Tables

- Table 1: Australia Data Center Cooling Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Australia Data Center Cooling Market Revenue Million Forecast, by Cooling Technology 2019 & 2032

- Table 3: Australia Data Center Cooling Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Australia Data Center Cooling Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 5: Australia Data Center Cooling Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Australia Data Center Cooling Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Australia Data Center Cooling Market Revenue Million Forecast, by Cooling Technology 2019 & 2032

- Table 8: Australia Data Center Cooling Market Revenue Million Forecast, by Type 2019 & 2032

- Table 9: Australia Data Center Cooling Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 10: Australia Data Center Cooling Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Australia Data Center Cooling Market?

The projected CAGR is approximately 7.40%.

2. Which companies are prominent players in the Australia Data Center Cooling Market?

Key companies in the market include Daikin Australia Pty Limited, Trane Technologies International Limited*List Not Exhaustive, Mitsubishi Australia Pty Limited, Alfa Laval Corporate AB, Schneider Electric SE, Rittal GmbH & Co KG, Johnson Controls Inc, Stulz GmbH, Vertiv Group Corp, Asetek AS.

3. What are the main segments of the Australia Data Center Cooling Market?

The market segments include Cooling Technology, Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Volume of Digital Data; Emergence of Green Data Centers.

6. What are the notable trends driving market growth?

Liquid-based Cooling is the Fastest Growing Segment.

7. Are there any restraints impacting market growth?

Costs. Adaptability Requirements. and Power Outages.

8. Can you provide examples of recent developments in the market?

March 2023: Interactive, a managed service provider, unveiled its cutting-edge Immersion Data Center Cooling system, designed to enhance high-performance computing (HPC) capabilities for its clientele. In collaboration with digital infrastructure provider Vertiv, Interactive has integrated green revolution cooling (GRC) tanks into their solution. These tanks employ a single-phase, non-conductive coolant that is safe for electrical components and boasts a remarkable heat transfer capacity, exceeding that of air by a factor of 1200.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Australia Data Center Cooling Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Australia Data Center Cooling Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Australia Data Center Cooling Market?

To stay informed about further developments, trends, and reports in the Australia Data Center Cooling Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence