Key Insights

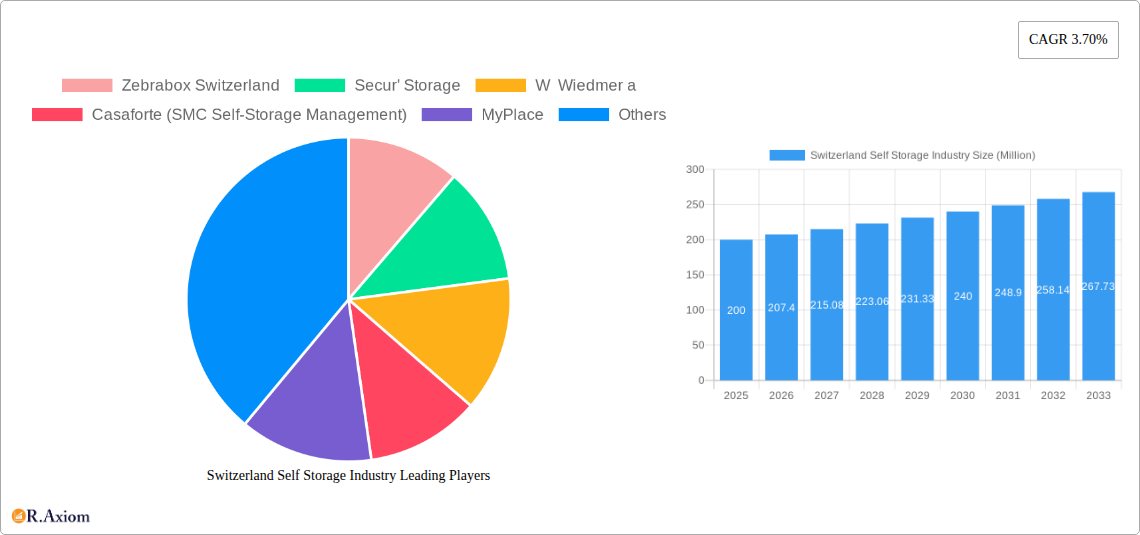

The Swiss self-storage market, valued at approximately CHF 200 million in 2025, is experiencing steady growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 3.70% from 2025 to 2033. This growth is fueled by several key factors. Increasing urbanization in Swiss cities like Zurich and Geneva leads to smaller living spaces and a greater need for external storage solutions. The rise of e-commerce and the resulting need for inventory storage by small businesses further contributes to market expansion. Additionally, a growing awareness of self-storage as a convenient and flexible solution for both personal and business needs is driving adoption. The market is segmented primarily into consumer and business storage, with both segments experiencing parallel growth. Companies like Zebrabox Switzerland, Secur' Storage, and MyPlace are key players, competing on factors such as location convenience, security features, and pricing strategies.

The market faces certain restraints, primarily land scarcity and associated high real estate costs in Switzerland, which limit expansion potential. However, innovative solutions such as multi-story storage facilities and optimized space utilization strategies are mitigating these challenges. Future trends suggest a continued increase in demand for secure, technologically advanced storage solutions, including features like online booking, 24/7 access, and enhanced security measures. The market is likely to see further consolidation as larger players acquire smaller competitors to expand their market share and geographical reach. This ongoing evolution presents opportunities for both established and emerging players to capitalize on the growing demand for self-storage in Switzerland.

This comprehensive report provides an in-depth analysis of the Switzerland self-storage industry, covering market size, segmentation, key players, trends, and future outlook from 2019 to 2033. The report is essential for industry stakeholders, investors, and businesses looking to understand and navigate this dynamic market. The study period is 2019-2033, with 2025 as the base and estimated year. The forecast period is 2025-2033, and the historical period is 2019-2024.

Switzerland Self Storage Industry Market Concentration & Innovation

The Swiss self-storage market exhibits a moderately concentrated landscape, with several key players vying for market share. While precise market share data for each company is unavailable (xx%), leading players include Zebrabox Switzerland, Secur' Storage, W Wiedmer a, Casaforte (SMC Self-Storage Management), MyPlace, and Homebox Switzerland. The market is characterized by ongoing innovation, driven by factors such as increasing urbanization, limited residential space, and the growth of e-commerce (impacting business storage needs). Regulatory frameworks, while not overly restrictive, influence aspects like building codes and safety regulations. Product substitutes, such as traditional warehousing or renting additional space, exist but are often less convenient or cost-effective. End-user trends show a preference for secure, easily accessible, and technologically advanced storage solutions. M&A activity in the Swiss self-storage sector has been relatively modest in recent years, with total deal values estimated at xx Million CHF over the historical period. Further consolidation is anticipated as larger players seek to expand their market reach.

Switzerland Self Storage Industry Industry Trends & Insights

The Swiss self-storage market is experiencing robust growth, with a projected Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is fuelled by several factors, including increasing urbanization and population density in major Swiss cities, leading to a shortage of residential and commercial space. The rise of e-commerce and the associated need for efficient warehousing and inventory management are also significant drivers. Technological disruptions, such as online booking platforms, smart access systems, and advanced security features, are enhancing customer experience and operational efficiency. Consumer preferences lean towards clean, secure, and technologically advanced facilities offering flexible lease terms and various storage unit sizes. Competitive dynamics are shaped by factors like pricing strategies, location, service quality, and technological differentiation. Market penetration is currently estimated at xx% and is projected to increase significantly due to rising demand and industry expansion.

Dominant Markets & Segments in Switzerland Self Storage Industry

The Swiss self-storage market exhibits strong growth across both consumer and business segments. While precise regional dominance is not clearly defined (xx), urban centers like Zurich, Geneva, and Basel are likely to represent the most significant markets due to higher population density and business activity.

Consumer Segment Key Drivers:

- Increasing urbanization and limited residential space.

- Rising demand for flexible storage solutions for personal belongings during relocation, renovations, or seasonal storage.

- Growing awareness of self-storage as a convenient and cost-effective alternative to traditional storage options.

Business Segment Key Drivers:

- Growth of e-commerce and related warehousing needs.

- Increasing demand for secure storage of business records and inventory.

- Need for flexible and scalable storage solutions to support business expansion.

The dominance of either segment is expected to remain relatively balanced throughout the forecast period, reflecting the diversified nature of the Swiss economy and its resilient consumer base.

Switzerland Self Storage Industry Product Developments

Recent product innovations in the Swiss self-storage market focus on enhancing security, convenience, and technology integration. This includes the implementation of sophisticated access control systems, improved surveillance technologies, and user-friendly online booking platforms. The integration of smart technology offers competitive advantages, such as remote access control and streamlined billing processes. These innovations enhance customer satisfaction and operational efficiency, aligning with the growing demand for convenient and secure self-storage solutions.

Report Scope & Segmentation Analysis

This report segments the Swiss self-storage market into two primary categories: Consumer and Business.

Consumer Segment: This segment comprises individuals utilizing self-storage for personal belongings, encompassing various unit sizes and lease durations. The market size is projected to reach xx Million CHF by 2033, driven by increasing urbanization and changing lifestyle patterns. Competitive dynamics are centered on providing convenient access, secure facilities, and flexible lease options.

Business Segment: This segment caters to businesses requiring storage for inventory, records, equipment, or other business assets. The projected market size is xx Million CHF by 2033, fueled by e-commerce expansion and the need for efficient warehouse management. Competition is fierce, with providers focusing on secure, technologically advanced facilities and flexible contract options.

Key Drivers of Switzerland Self Storage Industry Growth

The growth of the Swiss self-storage industry is driven by several interconnected factors. Increasing urbanization and population density in major cities lead to a scarcity of residential and commercial space, boosting demand for self-storage solutions. The rise of e-commerce necessitates efficient and secure warehousing, further fueling market expansion. Technological advancements, such as online booking platforms and smart access systems, enhance convenience and security, attracting more customers. Finally, favorable economic conditions and a stable regulatory environment contribute to sustained market growth.

Challenges in the Switzerland Self Storage Industry Sector

Challenges faced by the Swiss self-storage industry include acquiring suitable land for new facility construction in urban areas, competition from existing players and emerging market entrants, and stringent building codes and safety regulations that increase construction costs. Economic downturns can also impact demand, particularly within the business segment. These challenges require strategic planning, innovative solutions, and efficient management practices to navigate successfully.

Emerging Opportunities in Switzerland Self Storage Industry

Emerging opportunities include expanding into underserved regional markets, offering specialized storage solutions (e.g., climate-controlled units for sensitive goods), incorporating sustainable practices into facility operations, and leveraging technology to enhance the customer experience through AI-powered features and virtual tours. The growing trend towards environmentally conscious practices also presents opportunities for eco-friendly self-storage facilities.

Leading Players in the Switzerland Self Storage Industry Market

- Zebrabox Switzerland

- Secur' Storage

- W Wiedmer a

- Casaforte (SMC Self-Storage Management)

- MyPlace

- Homebox Switzerland

Key Developments in Switzerland Self Storage Industry Industry

- April 2020: Casaforte launched its "Hotel of Things" facility, incorporating advanced security features like video surveillance and personal access codes. This innovation enhances security and customer convenience, impacting market dynamics by setting a new standard for self-storage technology.

Strategic Outlook for Switzerland Self Storage Industry Market

The Swiss self-storage market is poised for continued growth driven by urbanization, e-commerce expansion, and technological advancements. Opportunities lie in expanding into less-saturated regions, developing innovative storage solutions, and leveraging technology to optimize operations and customer experience. Strategic partnerships and acquisitions will play a key role in shaping the market landscape and enhancing competitive positioning. The industry's future hinges on adapting to evolving consumer preferences and technological disruptions while maintaining a focus on security, convenience, and sustainability.

Switzerland Self Storage Industry Segmentation

-

1. Self-storage Type

- 1.1. Consumer

- 1.2. Business

Switzerland Self Storage Industry Segmentation By Geography

- 1. Switzerland

Switzerland Self Storage Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.70% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Favorable Demographic Trends Such as High Tourist Footfalls

- 3.2.2 High-income Population

- 3.2.3 Demand in Urban Areas and Growing Market Concentration; Steady Rise in Demand From the Consumer Segment

- 3.3. Market Restrains

- 3.3.1. Development of Alternate Labeling Methods

- 3.4. Market Trends

- 3.4.1 Increased Urbanization

- 3.4.2 Coupled with Smaller Living Spaces is Expected to Drive the Self-Storage Demand in the Coming Years

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Switzerland Self Storage Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Self-storage Type

- 5.1.1. Consumer

- 5.1.2. Business

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Switzerland

- 5.1. Market Analysis, Insights and Forecast - by Self-storage Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Zebrabox Switzerland

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Secur' Storage

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 W Wiedmer a

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Casaforte (SMC Self-Storage Management)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 MyPlace

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Homebox Switzerland

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.1 Zebrabox Switzerland

List of Figures

- Figure 1: Switzerland Self Storage Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Switzerland Self Storage Industry Share (%) by Company 2024

List of Tables

- Table 1: Switzerland Self Storage Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Switzerland Self Storage Industry Revenue Million Forecast, by Self-storage Type 2019 & 2032

- Table 3: Switzerland Self Storage Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Switzerland Self Storage Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Switzerland Self Storage Industry Revenue Million Forecast, by Self-storage Type 2019 & 2032

- Table 6: Switzerland Self Storage Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Switzerland Self Storage Industry?

The projected CAGR is approximately 3.70%.

2. Which companies are prominent players in the Switzerland Self Storage Industry?

Key companies in the market include Zebrabox Switzerland, Secur' Storage, W Wiedmer a, Casaforte (SMC Self-Storage Management), MyPlace, Homebox Switzerland.

3. What are the main segments of the Switzerland Self Storage Industry?

The market segments include Self-storage Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Favorable Demographic Trends Such as High Tourist Footfalls. High-income Population. Demand in Urban Areas and Growing Market Concentration; Steady Rise in Demand From the Consumer Segment.

6. What are the notable trends driving market growth?

Increased Urbanization. Coupled with Smaller Living Spaces is Expected to Drive the Self-Storage Demand in the Coming Years.

7. Are there any restraints impacting market growth?

Development of Alternate Labeling Methods.

8. Can you provide examples of recent developments in the market?

In April 2020, Casaforte, the self-storage company which has a significant presence in Switzerland and has developed the 'Hotel of Things' facility in a European country. Casaforte's 'Hotel of Things' is under video surveillance and integrated with alarm systems. The customers can access the self-storage rooms in full privacy by using a personal code.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Switzerland Self Storage Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Switzerland Self Storage Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Switzerland Self Storage Industry?

To stay informed about further developments, trends, and reports in the Switzerland Self Storage Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence