Key Insights

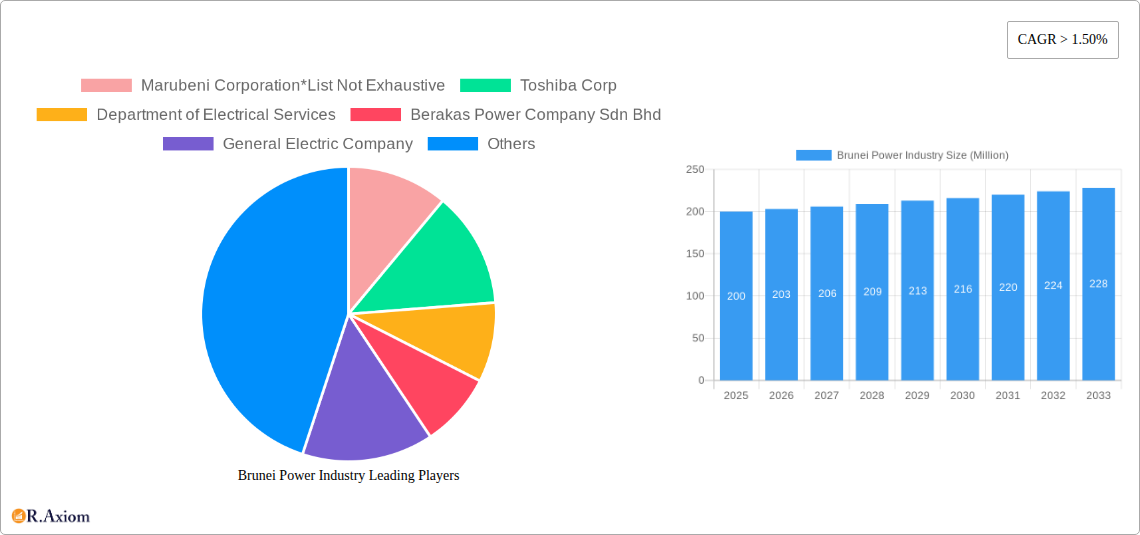

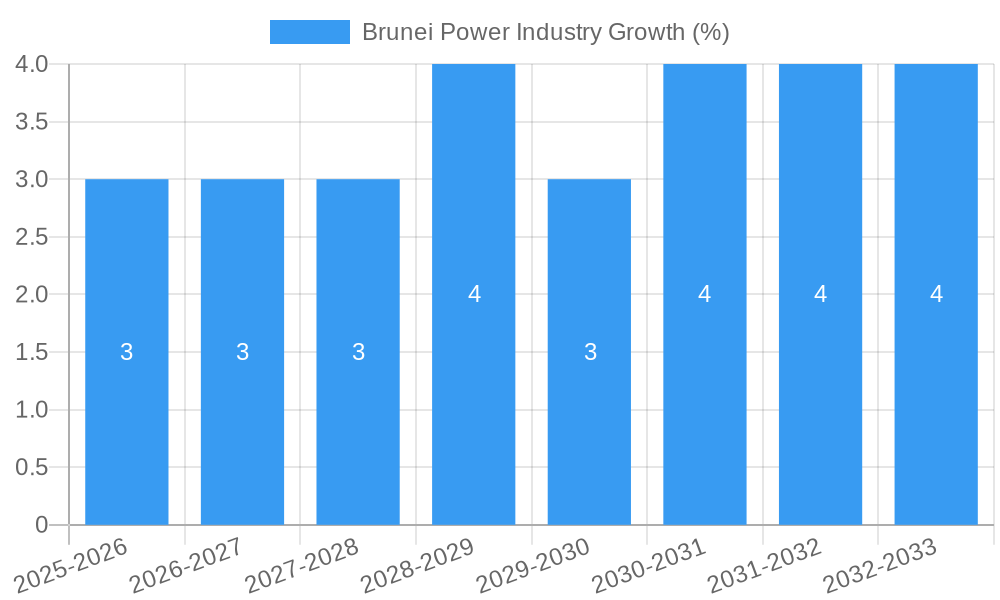

The Brunei power industry, valued at approximately $XX million in 2025, is projected to experience steady growth, driven by increasing energy demand from a growing population and industrial expansion. A compound annual growth rate (CAGR) exceeding 1.5% is anticipated from 2025 to 2033, indicating a promising outlook for investors and stakeholders. Key drivers include the nation's ongoing infrastructure development initiatives, particularly in the energy sector, as well as government policies promoting renewable energy sources to diversify the energy mix and enhance energy security. The thermal power generation segment currently dominates the market, fueled by robust industrial activity. However, the renewables sector is poised for significant expansion, driven by government investment in solar, wind, and potentially other renewable energy technologies. Challenges, such as the relatively small size of the domestic market and potential reliance on imported fuels, might constrain growth to a certain extent. However, strategic partnerships with international energy companies and continuous technological advancements in renewable energy are likely to mitigate these risks. The segmentation of the market into thermal, renewable, and other sources of power generation provides opportunities for specialized players to target specific niches within the industry. Companies like Marubeni Corporation, Toshiba Corp, and General Electric are already active players, indicating the industry's attractiveness.

The forecast for the Brunei power industry reveals a trajectory of consistent, albeit moderate, expansion over the next decade. This growth will be primarily fueled by ongoing economic development and a rising energy consumption pattern. The shift towards renewable energy sources is a significant trend, expected to gain momentum over the projection period. While the thermal power segment will continue to play a crucial role, the increasing share of renewable energy is likely to reshape the industry landscape, fostering a more sustainable and environmentally conscious energy mix for Brunei. This transition will require substantial investments in infrastructure and technology, creating potential avenues for domestic and international companies to participate in the market’s evolution. Government support and policy initiatives will be pivotal in facilitating the adoption of renewable energy technologies and achieving the country's energy sustainability goals.

Brunei Power Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Brunei power industry, covering market dynamics, key players, and future growth prospects from 2019 to 2033. The report utilizes data from the historical period (2019-2024), the base year (2025), and provides forecasts for the period 2025-2033. It is an invaluable resource for industry stakeholders, investors, and policymakers seeking to understand and navigate this evolving market.

Brunei Power Industry Market Concentration & Innovation

This section analyzes the competitive landscape of Brunei's power industry, examining market concentration, innovation drivers, regulatory frameworks, and M&A activity. The historical period reveals a moderate level of market concentration, with a few dominant players controlling a significant portion – estimated at xx% - of the market share. However, the emergence of renewable energy sources is fostering increased competition and driving innovation.

Market Concentration Metrics (2024):

- Market Share of Top 3 Players: xx%

- Average Deal Value of M&A Activities (2019-2024): xx Million USD

Innovation Drivers:

- Government initiatives promoting renewable energy adoption.

- Technological advancements in solar and other renewable energy technologies.

- Increasing demand for cleaner and more sustainable energy solutions.

Regulatory Framework:

The regulatory framework plays a crucial role in shaping the industry, influencing investment decisions and promoting innovation. The Department of Electrical Services plays a central role in this framework, influencing standards and approvals.

Product Substitutes: While traditional thermal power generation remains dominant, the increasing penetration of renewable energy sources presents a significant substitute.

End-User Trends: Industrial and commercial consumers are increasingly adopting renewable energy solutions driven by sustainability concerns and cost savings, while household consumption patterns are influenced by government incentives and increasing awareness of sustainability.

Brunei Power Industry Industry Trends & Insights

This section delves into the key trends and insights shaping the Brunei power industry's trajectory. The market is experiencing robust growth, fueled by rising energy demand from both residential and industrial sectors. This growth is further accelerated by government initiatives encouraging renewable energy adoption and diversification. The country’s strategic focus on energy security and sustainable development has fueled significant investments in the sector.

The Compound Annual Growth Rate (CAGR) for the Brunei power industry during the forecast period (2025-2033) is projected to be xx%, driven primarily by expansion in renewable energy capacity and increasing industrialization. Market penetration of renewable energy sources is anticipated to rise from xx% in 2025 to xx% by 2033. Technological disruptions, particularly in solar photovoltaic (PV) technology, are contributing to cost reductions and improved efficiency, enhancing the competitiveness of renewable energy sources. The shift in consumer preferences towards cleaner energy sources is further boosting the adoption of renewables. Competitive dynamics are characterized by the interplay between established thermal power generators and new entrants focused on renewable energy solutions.

Dominant Markets & Segments in Brunei Power Industry

The Brunei power industry is largely dominated by the thermal power generation segment, accounting for a significant share of the total installed capacity. However, the renewable energy segment is experiencing rapid growth driven by government support and technological advancements. Other power generation sources are currently comparatively minimal but have potential for future development.

Key Drivers of Segment Dominance:

- Thermal: Established infrastructure, readily available resources (natural gas), and existing energy production framework.

- Renewables: Government policies supporting renewable energy integration, decreasing technology costs, and increasing awareness of sustainability.

- Other Power Generation Sources: Limited current presence; potential for growth depending on technological advancements and government strategies.

Dominance Analysis: While thermal power generation remains the dominant segment, the share of renewables is increasing rapidly, indicating a potential shift in market dynamics in the coming years. This is driven by government investment, such as the planned 30 MW solar plant in Kampung Sungai Akar.

Brunei Power Industry Product Developments

Recent product innovations have largely focused on enhancing the efficiency and cost-effectiveness of renewable energy technologies, particularly solar PV systems. Companies are also developing smart grid technologies to optimize power distribution and enhance grid stability as renewable energy sources become more prominent. This focus on technological advancements aligns with the market’s growing demand for sustainable and cost-effective energy solutions. The competitive advantage in this space rests on offering innovative, efficient, and environmentally friendly technologies that meet the evolving needs of the Brunei power sector.

Report Scope & Segmentation Analysis

This report segments the Brunei power industry based on Power Generation Sources: Thermal, Renewables, and Other Power Generation Sources.

Thermal: This segment comprises the bulk of existing power generation capacity in Brunei. The market size for thermal power generation is estimated at xx Million USD in 2025, with projections of steady, albeit modest, growth. Competitive dynamics are relatively stable, with a few established players dominating the market.

Renewables: This segment is experiencing rapid expansion due to government support and declining costs of renewable energy technologies. Market size in 2025 is estimated at xx Million USD, exhibiting a high growth trajectory. Competition in this segment is intensifying as more players enter the market.

Other Power Generation Sources: This segment currently plays a minimal role but holds potential for future development, depending on technological breakthroughs and government policy.

Key Drivers of Brunei Power Industry Growth

Several factors are driving the growth of the Brunei power industry. Government initiatives promoting renewable energy, such as the development of the 30 MW solar plant and the support for the Brunei Shell Petroleum (BSP) solar power plant, play a crucial role. Increasing energy demand from residential and industrial sectors contributes to the industry's expansion. Furthermore, technological advancements in renewable energy technologies, leading to cost reductions and improved efficiency, also fuel the growth.

Challenges in the Brunei Power Industry Sector

The Brunei power industry faces challenges in integrating high shares of intermittent renewable energy sources into the grid. Maintaining grid stability while incorporating fluctuating renewable energy output requires sophisticated grid management systems. Supply chain disruptions could impact the timely delivery of equipment and materials needed for new projects. Competition is also increasing with new players entering the market, necessitating continuous innovation and efficiency improvements to maintain a competitive edge.

Emerging Opportunities in Brunei Power Industry

Significant opportunities exist in the renewable energy sector, particularly solar and potentially other sources. The growing demand for sustainable energy solutions presents an opportunity for companies to invest in renewable energy projects and provide innovative technologies. Government initiatives to support the development of renewable energy sources represent significant growth opportunities. The development of smart grid technologies offers opportunities to improve grid efficiency and integrate renewable energy more effectively.

Leading Players in the Brunei Power Industry Market

- Marubeni Corporation

- Toshiba Corp

- Department of Electrical Services

- Berakas Power Company Sdn Bhd

- General Electric Company

- Brunei LNG Sdn Bhd

Key Developments in Brunei Power Industry Industry

- April 2021: Brunei Shell Petroleum (BSP) launched a 3.3 MWp solar power plant in Panaga.

- February 2021: Brunei's energy ministry announced plans for a 30 MW solar power plant in Kampung Sungai Akar.

These developments signal a clear shift towards renewable energy adoption in Brunei and are significantly impacting market dynamics, driving innovation and fostering competition within the sector.

Strategic Outlook for Brunei Power Industry Market

The Brunei power industry is poised for continued growth, driven by rising energy demand, government support for renewable energy, and technological advancements. The strategic focus on diversifying the energy mix and promoting sustainability creates significant opportunities for investment and growth in the renewable energy sector. The market will witness increasing competition as new players enter, requiring existing companies to innovate and enhance efficiency to maintain their market position. The future of the Brunei power industry rests on successfully integrating renewable energy sources, improving grid infrastructure, and embracing sustainable energy practices.

Brunei Power Industry Segmentation

-

1. Power Generation from Sources

- 1.1. Thermal

- 1.2. Renewables

- 1.3. Other Power Generation Sources

- 2. Transmission and Distribution (T&D)

Brunei Power Industry Segmentation By Geography

- 1. Brunei

Brunei Power Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 1.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 4.; Increasing Offshore Oil and Gas Exploration Activities in the American

- 3.2.2 Asia-Pacific

- 3.2.3 and Middle-East and African Regions4.; Growing Offshore Renewable Technologies

- 3.3. Market Restrains

- 3.3.1. 4.; Ban on Offshore Exploration and Production Activities in Multiple Regions

- 3.4. Market Trends

- 3.4.1. Thermal Power Source is Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Brunei Power Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Power Generation from Sources

- 5.1.1. Thermal

- 5.1.2. Renewables

- 5.1.3. Other Power Generation Sources

- 5.2. Market Analysis, Insights and Forecast - by Transmission and Distribution (T&D)

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Brunei

- 5.1. Market Analysis, Insights and Forecast - by Power Generation from Sources

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Marubeni Corporation*List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Toshiba Corp

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Department of Electrical Services

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Berakas Power Company Sdn Bhd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 General Electric Company

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Brunei LNG Sdn Bhd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.1 Marubeni Corporation*List Not Exhaustive

List of Figures

- Figure 1: Brunei Power Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Brunei Power Industry Share (%) by Company 2024

List of Tables

- Table 1: Brunei Power Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Brunei Power Industry Volume gigawatts Forecast, by Region 2019 & 2032

- Table 3: Brunei Power Industry Revenue Million Forecast, by Power Generation from Sources 2019 & 2032

- Table 4: Brunei Power Industry Volume gigawatts Forecast, by Power Generation from Sources 2019 & 2032

- Table 5: Brunei Power Industry Revenue Million Forecast, by Transmission and Distribution (T&D) 2019 & 2032

- Table 6: Brunei Power Industry Volume gigawatts Forecast, by Transmission and Distribution (T&D) 2019 & 2032

- Table 7: Brunei Power Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Brunei Power Industry Volume gigawatts Forecast, by Region 2019 & 2032

- Table 9: Brunei Power Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Brunei Power Industry Volume gigawatts Forecast, by Country 2019 & 2032

- Table 11: Brunei Power Industry Revenue Million Forecast, by Power Generation from Sources 2019 & 2032

- Table 12: Brunei Power Industry Volume gigawatts Forecast, by Power Generation from Sources 2019 & 2032

- Table 13: Brunei Power Industry Revenue Million Forecast, by Transmission and Distribution (T&D) 2019 & 2032

- Table 14: Brunei Power Industry Volume gigawatts Forecast, by Transmission and Distribution (T&D) 2019 & 2032

- Table 15: Brunei Power Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Brunei Power Industry Volume gigawatts Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Brunei Power Industry?

The projected CAGR is approximately > 1.50%.

2. Which companies are prominent players in the Brunei Power Industry?

Key companies in the market include Marubeni Corporation*List Not Exhaustive, Toshiba Corp, Department of Electrical Services, Berakas Power Company Sdn Bhd, General Electric Company, Brunei LNG Sdn Bhd.

3. What are the main segments of the Brunei Power Industry?

The market segments include Power Generation from Sources, Transmission and Distribution (T&D).

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Offshore Oil and Gas Exploration Activities in the American. Asia-Pacific. and Middle-East and African Regions4.; Growing Offshore Renewable Technologies.

6. What are the notable trends driving market growth?

Thermal Power Source is Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Ban on Offshore Exploration and Production Activities in Multiple Regions.

8. Can you provide examples of recent developments in the market?

In April 2021, Brunei Shell Petroleum (BSP) launched the country's second solar power plant of capacity 3.3 MWp in Panaga to power its Seria headquarters and reduce its environmental footprint. The solar power plant will provide enough power to supply 600 households and will be connected to the national grid to offset some power usage in the BSP headquarters on Jalan Utara.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in gigawatts.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Brunei Power Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Brunei Power Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Brunei Power Industry?

To stay informed about further developments, trends, and reports in the Brunei Power Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence