Key Insights

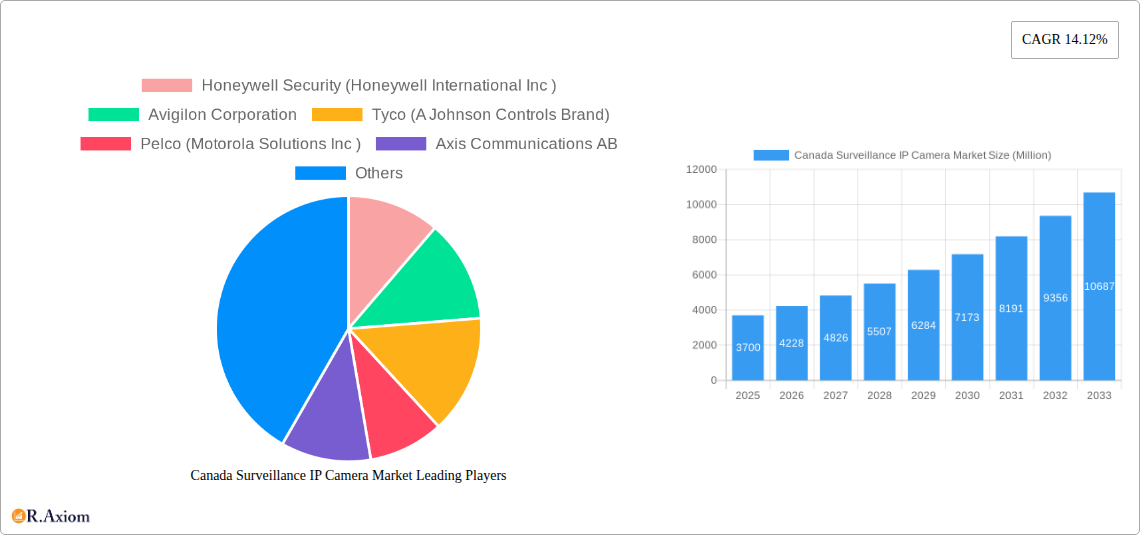

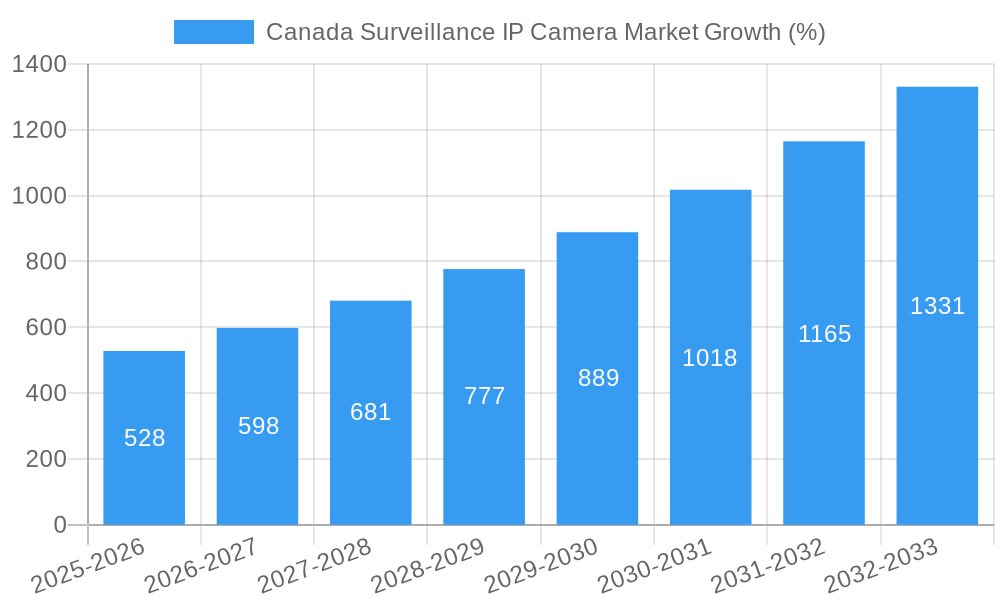

The Canada surveillance IP camera market is experiencing robust growth, projected to reach a market size of $3.70 billion in 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 14.12% from 2019 to 2033. This expansion is driven by several key factors. Increasing concerns about security and safety, particularly in urban centers and commercial establishments, fuel the demand for advanced surveillance solutions. The transition from analog to IP-based systems offers superior image quality, remote accessibility, and easier integration with other security technologies, further propelling market growth. Government initiatives promoting public safety and crime prevention also contribute to market expansion. Furthermore, technological advancements such as improved analytics capabilities (e.g., facial recognition, object detection), higher resolution cameras, and cloud-based storage solutions are creating new opportunities within the market. The rising adoption of smart city initiatives and the increasing use of IP cameras in various sectors, including retail, healthcare, and transportation, further bolster market expansion.

Competitive rivalry amongst major players like Honeywell, Avigilon, Tyco, Pelco, Axis Communications, and Hikvision shapes market dynamics. These companies compete based on factors like product features, pricing strategies, technological innovation, and service offerings. Market segmentation is likely significant, with distinctions between camera types (e.g., dome, bullet, PTZ), resolution, features (analytics, night vision), and application (residential, commercial, industrial). Regional variations in market growth are expected, with urban areas and regions with higher security concerns likely to demonstrate faster growth than rural areas. While specific regional data is unavailable, it is reasonable to assume that major metropolitan areas in Canada will represent the strongest market segments. The market's future trajectory will depend on factors such as technological innovation, government regulations, economic conditions, and the continuous evolution of cybersecurity concerns.

Canada Surveillance IP Camera Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Canada surveillance IP camera market, offering valuable insights for industry stakeholders, investors, and strategic decision-makers. The study period covers 2019-2033, with 2025 as the base and estimated year, and 2025-2033 as the forecast period. The historical period analyzed is 2019-2024. This report leverages extensive primary and secondary research to deliver actionable intelligence on market size, growth drivers, challenges, opportunities, and competitive dynamics. Key segments are analyzed, providing a granular understanding of the market landscape.

Canada Surveillance IP Camera Market Concentration & Innovation

The Canada surveillance IP camera market exhibits a moderately concentrated landscape, with a few key players holding significant market share. While precise market share figures for each company are proprietary data within the full report, the top 10 players—including Honeywell Security (Honeywell International Inc), Avigilon Corporation, Tyco (A Johnson Controls Brand), Pelco (Motorola Solutions Inc), Axis Communications AB, Hanwha Vision Co Ltd, Infinova Corporation, Hangzhou Hikvision Digital Technology Co Ltd, Uniview Technologies Co Ltd, Vivotek Inc (A Delta Group Company), and Lorex Corporation—dominate the market. The market concentration ratio (CR4 or CR8) is estimated to be xx, indicating a relatively competitive yet consolidated environment.

Innovation is a key driver, fueled by advancements in video analytics, artificial intelligence (AI), and high-resolution imaging technologies. The regulatory framework, particularly concerning data privacy and cybersecurity, significantly influences market dynamics. Product substitutes, such as traditional analog cameras, are gradually losing market share due to IP cameras' superior features. End-user trends favor integrated security solutions with advanced analytics capabilities, driving demand for sophisticated IP cameras. M&A activity in the sector has been moderate in recent years, with deal values averaging xx Million per transaction (based on reported deals). Recent mergers and acquisitions have primarily focused on expanding product portfolios and geographical reach.

Canada Surveillance IP Camera Market Industry Trends & Insights

The Canada surveillance IP camera market is experiencing robust growth, driven by increasing security concerns across various sectors, including residential, commercial, and government. The market is projected to witness a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is propelled by several factors, including rising adoption of smart city initiatives, increasing demand for video surveillance in public spaces, and a growing preference for high-definition and network-connected security systems. Technological advancements, such as the integration of AI and cloud-based solutions, are transforming the industry, enhancing the capabilities of surveillance systems and enabling advanced analytics. The market penetration rate for IP cameras in the residential and commercial sectors is currently at xx%, with significant room for future growth. Competitive dynamics are characterized by intense rivalry among established players and emerging companies, leading to continuous innovation and price competition. Consumer preferences are shifting toward user-friendly, cost-effective, and feature-rich IP camera systems with remote accessibility and advanced analytics.

Dominant Markets & Segments in Canada Surveillance IP Camera Market

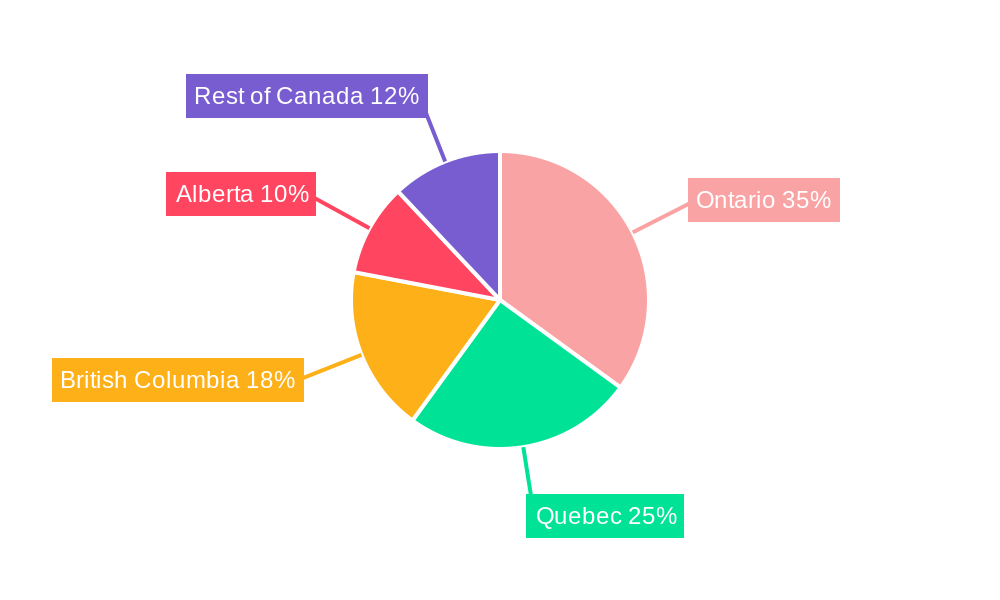

While the full breakdown of regional and segmental dominance is contained within the complete report, the Ontario region currently holds the largest market share in the Canada surveillance IP camera market. Key factors contributing to Ontario's dominance include its robust economy, high concentration of commercial and industrial establishments, and advanced infrastructure.

- Economic Factors: Strong economic growth in Ontario fuels investment in security systems across various sectors.

- Infrastructure Development: Extensive network infrastructure enables seamless integration and deployment of IP cameras.

- Government Initiatives: Government support for smart city projects and initiatives focused on public safety is fostering the adoption of surveillance technology.

The detailed dominance analysis within the full report provides a deeper understanding of why Ontario leads the market, outlining sub-regional performance, segmental contributions, and a predictive model for future dominance. Other provinces show strong potential for growth, particularly those with significant investments in infrastructure and security.

Canada Surveillance IP Camera Market Product Developments

Recent product innovations in the Canada surveillance IP camera market highlight a focus on enhanced image quality, advanced analytics, and improved connectivity. The integration of AI-powered features, such as object detection and facial recognition, is gaining traction. Manufacturers are emphasizing user-friendly interfaces, cloud-based platforms, and mobile accessibility to meet the growing demands of consumers and businesses. Products are also incorporating robust cybersecurity features to address privacy and security concerns. This focus on innovation and user experience is driving market growth and creating competitive advantages for companies able to deliver high-quality and feature-rich solutions.

Report Scope & Segmentation Analysis

This report segments the Canada surveillance IP camera market based on several key parameters.

By Product Type: This includes different types of IP cameras, such as dome cameras, bullet cameras, PTZ cameras, and others, each with its own growth projections and competitive dynamics.

By Resolution: This segment focuses on the various resolutions of IP cameras available in the market, analyzing their respective market sizes and growth potential.

By Application: This segment covers the different applications of IP cameras, including residential, commercial, industrial, and governmental use cases. Each is analyzed for specific market size and growth projections.

Each segment is characterized by varying growth rates and competitive dynamics, offering a detailed insight into the overall market structure.

Key Drivers of Canada Surveillance IP Camera Market Growth

Several key factors contribute to the expansion of the Canada surveillance IP camera market. These include technological advancements (e.g., the development of high-resolution cameras with advanced analytics and AI capabilities), increasing demand for enhanced security (driven by rising crime rates and concerns about public safety), and the growth of smart city initiatives (which necessitate extensive surveillance infrastructure). Furthermore, government regulations and policies concerning public safety and security are boosting the adoption of surveillance technologies. Finally, the decreasing cost of IP cameras compared to traditional analog systems makes them more accessible to a broader range of consumers and businesses.

Challenges in the Canada Surveillance IP Camera Market Sector

The Canada surveillance IP camera market faces several challenges, including concerns over data privacy and security, as well as the potential for misuse of surveillance technologies. Furthermore, supply chain disruptions and the increasing cost of components can impact production and pricing. Intense competition among vendors and the need to comply with stringent regulatory standards also pose challenges to market players. The exact quantifiable impacts of these challenges are included in the detailed analysis provided in the full report.

Emerging Opportunities in Canada Surveillance IP Camera Market

Several emerging opportunities exist within the Canadian surveillance IP camera market. The growing adoption of cloud-based video management systems (VMS) offers significant opportunities for expansion. The integration of advanced analytics, such as facial recognition and object detection, is opening new avenues for application development, particularly in the retail and transportation sectors. Furthermore, the increasing demand for cybersecurity solutions in conjunction with IP cameras presents a significant market opportunity. Finally, the rise of IoT-enabled surveillance systems is creating new possibilities for integrated security solutions.

Leading Players in the Canada Surveillance IP Camera Market Market

- Honeywell Security (Honeywell International Inc)

- Avigilon Corporation

- Tyco (A Johnson Controls Brand)

- Pelco (Motorola Solutions Inc)

- Axis Communications AB

- Hanwha Vision Co Ltd

- Infinova Corporation

- Hangzhou Hikvision Digital Technology Co Ltd

- Uniview Technologies Co Ltd

- Vivotek Inc (A Delta Group Company)

- Lorex Corporation

Key Developments in Canada Surveillance IP Camera Market Industry

- April 2024: Axis Communications launched a powerful 4K bullet camera with PoE, deep learning processing, and enhanced metadata capabilities, improving image quality and forensic search efficiency.

- December 2023: Hikvision introduced a new line of anti-corrosion cameras designed for harsh industrial and marine environments, reducing false alarms and improving object differentiation.

These developments highlight the ongoing innovation in image quality, durability, and intelligent features within the market.

Strategic Outlook for Canada Surveillance IP Camera Market Market

The Canada surveillance IP camera market is poised for continued growth, driven by technological innovation, increasing security concerns, and favorable government regulations. The integration of AI and cloud technologies will further enhance the capabilities of surveillance systems, creating new opportunities for market players. Focusing on advanced analytics, user-friendly interfaces, and robust cybersecurity features will be crucial for success. The market’s future hinges on adaptability and the ability to anticipate and respond to evolving security demands and technological advancements.

Canada Surveillance IP Camera Market Segmentation

-

1. End-User Industry

- 1.1. Government

- 1.2. Banking

- 1.3. Healthcare

- 1.4. Transportation and Logistics

- 1.5. Industrial

- 1.6. Others (

Canada Surveillance IP Camera Market Segmentation By Geography

- 1. Canada

Canada Surveillance IP Camera Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 14.12% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Government Initiatives for Public Safety and Security; Advancements in Surveillance IP Camera Technologies

- 3.3. Market Restrains

- 3.3.1. Increasing Government Initiatives for Public Safety and Security; Advancements in Surveillance IP Camera Technologies

- 3.4. Market Trends

- 3.4.1. Retractable Safety Syringes Segment Expected to Witness Significant Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada Surveillance IP Camera Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by End-User Industry

- 5.1.1. Government

- 5.1.2. Banking

- 5.1.3. Healthcare

- 5.1.4. Transportation and Logistics

- 5.1.5. Industrial

- 5.1.6. Others (

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by End-User Industry

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Honeywell Security (Honeywell International Inc )

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Avigilon Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Tyco (A Johnson Controls Brand)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Pelco (Motorola Solutions Inc )

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Axis Communications AB

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Hanwha Vision Co Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Infinova Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Hangzhou Hikvision Digital Technology Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Uniview Technologies Co Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Vivotek Inc (A Delta Group Company)

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Lorex Corporatio

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Honeywell Security (Honeywell International Inc )

List of Figures

- Figure 1: Canada Surveillance IP Camera Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Canada Surveillance IP Camera Market Share (%) by Company 2024

List of Tables

- Table 1: Canada Surveillance IP Camera Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Canada Surveillance IP Camera Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: Canada Surveillance IP Camera Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 4: Canada Surveillance IP Camera Market Volume Billion Forecast, by End-User Industry 2019 & 2032

- Table 5: Canada Surveillance IP Camera Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Canada Surveillance IP Camera Market Volume Billion Forecast, by Region 2019 & 2032

- Table 7: Canada Surveillance IP Camera Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 8: Canada Surveillance IP Camera Market Volume Billion Forecast, by End-User Industry 2019 & 2032

- Table 9: Canada Surveillance IP Camera Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Canada Surveillance IP Camera Market Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada Surveillance IP Camera Market?

The projected CAGR is approximately 14.12%.

2. Which companies are prominent players in the Canada Surveillance IP Camera Market?

Key companies in the market include Honeywell Security (Honeywell International Inc ), Avigilon Corporation, Tyco (A Johnson Controls Brand), Pelco (Motorola Solutions Inc ), Axis Communications AB, Hanwha Vision Co Ltd, Infinova Corporation, Hangzhou Hikvision Digital Technology Co Ltd, Uniview Technologies Co Ltd, Vivotek Inc (A Delta Group Company), Lorex Corporatio.

3. What are the main segments of the Canada Surveillance IP Camera Market?

The market segments include End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.70 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Government Initiatives for Public Safety and Security; Advancements in Surveillance IP Camera Technologies.

6. What are the notable trends driving market growth?

Retractable Safety Syringes Segment Expected to Witness Significant Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

Increasing Government Initiatives for Public Safety and Security; Advancements in Surveillance IP Camera Technologies.

8. Can you provide examples of recent developments in the market?

April 2024: Axis Communications introduced a powerful 4K bullet camera, focusing on superior image quality and exceptional light sensitivity. Equipped with PoE, it streamlines device connections and power supply, eliminating the need for extra cables. Due to a deep learning processing unit, the camera bolstered its processing capabilities, facilitating in-depth data collection and analysis on the device itself. Additionally, it offers crucial metadata, making forensic searches quicker and more effective.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada Surveillance IP Camera Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada Surveillance IP Camera Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada Surveillance IP Camera Market?

To stay informed about further developments, trends, and reports in the Canada Surveillance IP Camera Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence