Key Insights

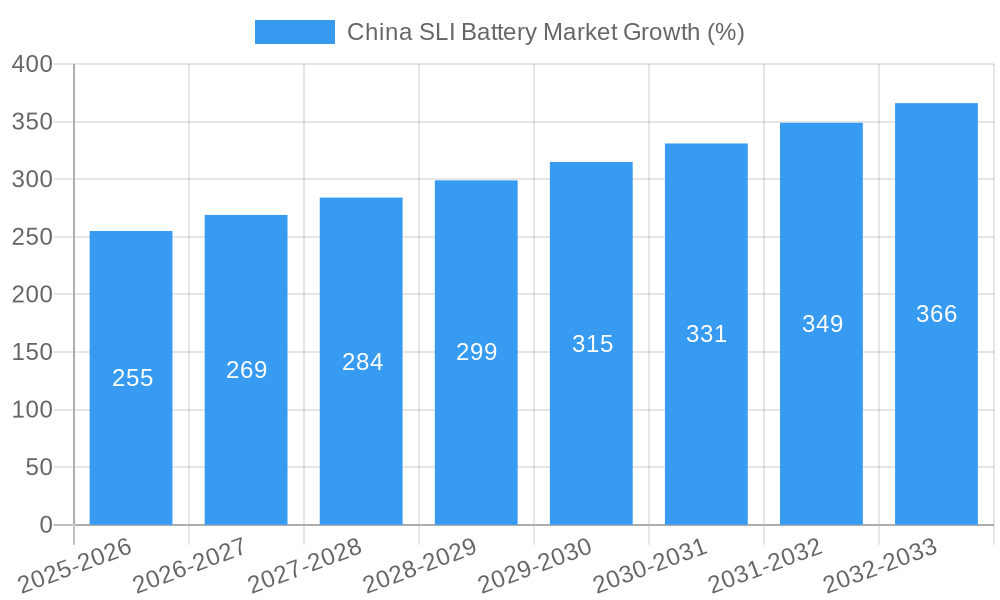

The China SLI (Starting, Lighting, and Ignition) battery market, valued at $5.62 billion in 2025, is projected to experience robust growth, driven by a burgeoning automotive sector and increasing demand for reliable power solutions. A compound annual growth rate (CAGR) of 4.46% from 2025 to 2033 indicates a significant expansion of this market. This growth is fueled by several factors, including the rising sales of passenger vehicles and commercial vehicles within China, government initiatives promoting electric vehicle adoption (indirectly impacting the SLI market through hybrid and conventional vehicle sales), and advancements in battery technology leading to enhanced performance and longevity. However, challenges remain, including fluctuating raw material prices, intense competition among domestic and international players, and environmental concerns related to battery disposal and recycling. These challenges will necessitate strategic innovation and responsible manufacturing practices to ensure sustainable market growth.

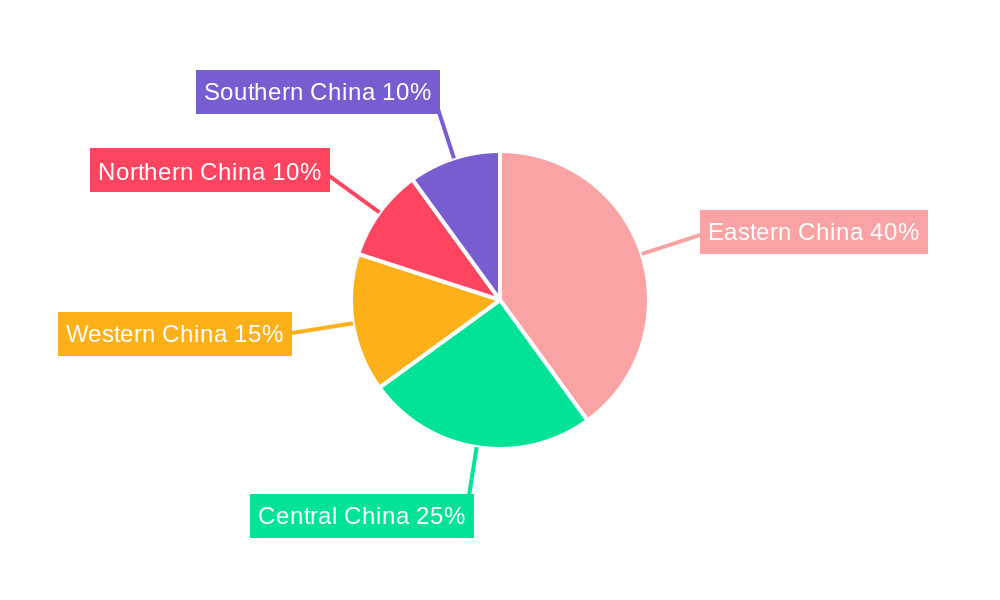

Leading players such as GS Yuasa, Tianneng, and Contemporary Amperex Technology (CATL) are actively engaged in expanding their production capacities and diversifying their product portfolios to cater to the evolving market needs. The market segmentation likely encompasses various battery chemistries (lead-acid, advanced lead-acid, etc.), vehicle types (passenger cars, commercial vehicles, motorcycles), and distribution channels (OEMs, aftermarket). Regional variations in demand are expected, with significant contributions from major automotive hubs and rapidly developing economies within China. Analyzing these segments and regional trends will be crucial for companies seeking to capitalize on the market's growth potential. Successful strategies will emphasize product differentiation, cost optimization, robust supply chain management, and a strong focus on sustainability.

This in-depth report provides a comprehensive analysis of the China SLI (Starting, Lighting, and Ignition) battery market, covering the period from 2019 to 2033. It offers invaluable insights into market dynamics, competitive landscapes, technological advancements, and future growth prospects, enabling stakeholders to make informed strategic decisions. The report utilizes rigorous data analysis and incorporates recent industry developments to provide a precise and timely overview of this rapidly evolving sector.

China SLI Battery Market Market Concentration & Innovation

This section analyzes the market concentration, innovation drivers, regulatory landscape, and competitive dynamics within the Chinese SLI battery market. The level of market concentration is currently assessed as moderately high, with a few dominant players holding significant market share. However, the market is witnessing increased competition from new entrants and smaller players. Innovation in SLI battery technology is driven by the demand for higher energy density, improved lifespan, and enhanced performance under extreme conditions. Stringent government regulations concerning environmental protection and safety standards are shaping the industry. The emergence of alternative technologies, such as advanced lead-acid batteries and lithium-ion batteries, is presenting both opportunities and challenges. The M&A landscape has seen several significant deals in recent years, with deal values totaling approximately xx Million USD in the past five years. Several key players have engaged in strategic partnerships and acquisitions to enhance their market position and technological capabilities.

- Market Share Analysis: Top 5 players hold approximately xx% of the market share.

- M&A Activity: Significant M&A activity observed in the past five years, with an average deal value of approximately xx Million USD.

- Innovation Drivers: Demand for higher energy density, improved lifespan, and enhanced performance.

- Regulatory Framework: Stringent environmental and safety regulations impacting market growth.

China SLI Battery Market Industry Trends & Insights

The China SLI battery market experienced significant growth during the historical period (2019-2024), with a Compound Annual Growth Rate (CAGR) of xx%. This growth is attributed to several factors, including the increasing demand for automobiles, motorcycles, and other vehicles, rising disposable income, and government initiatives promoting electric vehicle adoption. Technological disruptions, such as the development of advanced lead-acid batteries and the increasing adoption of lithium-ion batteries, are reshaping the competitive landscape. Consumer preferences are shifting towards high-performance, long-lasting, and environmentally friendly batteries. The market penetration of advanced lead-acid batteries is steadily increasing, while the adoption of lithium-ion batteries is expected to accelerate in the forecast period (2025-2033). Intense competition among existing and new players fuels innovation and price wars, impacting overall market dynamics. Market forecasts predict a CAGR of xx% during the forecast period, driven by factors mentioned above.

Dominant Markets & Segments in China SLI Battery Market

The eastern region of China currently dominates the SLI battery market, accounting for approximately xx% of the total market share. This dominance is attributed to a combination of factors: a high concentration of automobile manufacturing, robust infrastructure, and favorable government policies promoting economic growth in this area.

- Key Drivers for Eastern Region Dominance:

- High concentration of automotive manufacturing plants.

- Well-developed distribution networks.

- Favorable government policies supporting industrial growth.

- High population density and vehicle ownership.

Detailed analysis reveals a strong correlation between economic activity and SLI battery demand, suggesting that future growth will largely depend on maintaining economic stability and continued infrastructure development. Further segmentation shows that the automotive segment holds the largest market share within the SLI battery market, followed by the motorcycle and other vehicle segments.

China SLI Battery Market Product Developments

Recent product innovations include the development of advanced lead-acid batteries with enhanced performance and extended lifespan. These improvements are driven by technological advancements in materials science and manufacturing processes. Manufacturers are also focusing on improving the safety features of SLI batteries, meeting stringent regulatory requirements. The market sees increasing adoption of Absorbent Glass Mat (AGM) and Enhanced Flooded batteries (EFB), offering improved performance and reduced maintenance compared to conventional flooded lead-acid batteries. These advancements are enhancing product offerings and contributing to increased market appeal.

Report Scope & Segmentation Analysis

This report segments the China SLI battery market by battery type (conventional flooded, AGM, EFB, etc.), vehicle type (passenger cars, commercial vehicles, motorcycles, etc.), and region (East, North, South, West, and Central China). Each segment is analyzed based on market size, growth projections, competitive intensity, and key trends. Detailed analysis of each segment provides granular insights into market dynamics.

Key Drivers of China SLI Battery Market Growth

The China SLI battery market is experiencing robust growth driven by several factors. Firstly, the booming automotive sector, particularly the expansion of the electric vehicle (EV) and hybrid electric vehicle (HEV) markets, fuels a strong demand for SLI batteries. Secondly, economic growth and rising disposable incomes lead to increased vehicle ownership and demand for replacement batteries. Lastly, supportive government policies promoting energy efficiency and environmental protection incentivize the adoption of technologically advanced SLI batteries.

Challenges in the China SLI Battery Market Sector

The China SLI battery market faces certain challenges. Stringent environmental regulations necessitate compliance costs and impact production processes. Fluctuations in raw material prices, especially lead, create uncertainty in manufacturing costs and profitability. Furthermore, intense competition among domestic and international players puts pressure on pricing and profit margins.

Emerging Opportunities in China SLI Battery Market

Emerging opportunities lie in the growing demand for high-performance SLI batteries for electric and hybrid vehicles. Advancements in battery technology, including the development of more energy-dense and environmentally friendly options, present significant growth potential. Expansion into niche markets, such as specialized vehicles and industrial applications, offers further opportunities for market penetration.

Leading Players in the China SLI Battery Market Market

- GS Yuasa International Ltd

- Tianneng Battery Group Co

- Leoch International Technology Limited Inc

- Contemporary Amperex Technology Co Limited

- Gotion Inc

- Farasis Energy (GanZhou) Co Ltd

- Clarios International Inc

- Guangzhou NPP Power Co Ltd

- Qingyuan Yiyuan Power Supply Co Ltd

- EVE Energy Co Ltd

- List Not Exhaustive

Key Developments in China SLI Battery Market Industry

- January 2024: BYD announced a USD 1.4 billion investment in a new battery facility with an annual capacity of 30 GWh, targeting micro vehicles and scooters.

- March 2024: Narada Power secured a USD 45 million contract from China Tower for VRLA batteries for backup power systems.

Strategic Outlook for China SLI Battery Market Market

The future of the China SLI battery market looks promising, driven by sustained growth in the automotive industry, increasing demand for advanced battery technologies, and supportive government policies. The market is expected to witness a substantial increase in the adoption of advanced lead-acid and lithium-ion batteries. Opportunities for growth exist in developing innovative solutions that address environmental concerns and enhance battery performance, leading to a highly dynamic and competitive market landscape.

China SLI Battery Market Segmentation

-

1. Type

- 1.1. Flooded Battery

- 1.2. VRLA Battery

- 1.3. EBF Battery

-

2. End User

- 2.1. Automotive

- 2.2. Other End Users

China SLI Battery Market Segmentation By Geography

- 1. China

China SLI Battery Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.46% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growing Automotive Industry4.; Supportive Government Policies

- 3.3. Market Restrains

- 3.3.1. 4.; Growing Automotive Industry4.; Supportive Government Policies

- 3.4. Market Trends

- 3.4.1. VRLA Battery to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China SLI Battery Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Flooded Battery

- 5.1.2. VRLA Battery

- 5.1.3. EBF Battery

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Automotive

- 5.2.2. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 GS Yuasa International Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Tianneng Battery Group Co

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Leoch International Technology Limited Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Contemporary Amperex Technology Co Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Gotion Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Farasis Energy (GanZhou) Co Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Clarios International Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Guangzhou NPP Power Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Qingyuan Yiyuan Power Supply Co Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 EVE Energy Co Ltd*List Not Exhaustive 6 4 List of Other Prominent Companies6 5 Market Ranking/Share (%) Analysi

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 GS Yuasa International Ltd

List of Figures

- Figure 1: China SLI Battery Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: China SLI Battery Market Share (%) by Company 2024

List of Tables

- Table 1: China SLI Battery Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: China SLI Battery Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: China SLI Battery Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: China SLI Battery Market Volume Billion Forecast, by Type 2019 & 2032

- Table 5: China SLI Battery Market Revenue Million Forecast, by End User 2019 & 2032

- Table 6: China SLI Battery Market Volume Billion Forecast, by End User 2019 & 2032

- Table 7: China SLI Battery Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: China SLI Battery Market Volume Billion Forecast, by Region 2019 & 2032

- Table 9: China SLI Battery Market Revenue Million Forecast, by Type 2019 & 2032

- Table 10: China SLI Battery Market Volume Billion Forecast, by Type 2019 & 2032

- Table 11: China SLI Battery Market Revenue Million Forecast, by End User 2019 & 2032

- Table 12: China SLI Battery Market Volume Billion Forecast, by End User 2019 & 2032

- Table 13: China SLI Battery Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: China SLI Battery Market Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China SLI Battery Market?

The projected CAGR is approximately 4.46%.

2. Which companies are prominent players in the China SLI Battery Market?

Key companies in the market include GS Yuasa International Ltd, Tianneng Battery Group Co, Leoch International Technology Limited Inc, Contemporary Amperex Technology Co Limited, Gotion Inc, Farasis Energy (GanZhou) Co Ltd, Clarios International Inc, Guangzhou NPP Power Co Ltd, Qingyuan Yiyuan Power Supply Co Ltd, EVE Energy Co Ltd*List Not Exhaustive 6 4 List of Other Prominent Companies6 5 Market Ranking/Share (%) Analysi.

3. What are the main segments of the China SLI Battery Market?

The market segments include Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.62 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Growing Automotive Industry4.; Supportive Government Policies.

6. What are the notable trends driving market growth?

VRLA Battery to Witness Significant Growth.

7. Are there any restraints impacting market growth?

4.; Growing Automotive Industry4.; Supportive Government Policies.

8. Can you provide examples of recent developments in the market?

March 2024: Narada Power secured a USD 45 million contract from China Tower for VRLA batteries. This deal focuses on providing backup power systems to the state-owned telecoms giant. Narada emphasized that this contract highlights the strategic importance of its collaborative lead battery chemistry development, which is tailored for a diverse set of industrial applications, including SLI.January 2024: Chinese automotive giant BYD initiated the construction of a new battery facility in Xuzhou, China. With an impressive investment of USD 1.4 billion, this facility is set to boast an annual capacity of 30 gigawatt-hours (GWh). The batteries manufactured here are earmarked for automotive use, specifically targeting micro vehicles and scooters. BYD's subsidiary, Findreams Battery, and tricycle manufacturer Huaihai Group inked the agreement for this venture.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China SLI Battery Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China SLI Battery Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China SLI Battery Market?

To stay informed about further developments, trends, and reports in the China SLI Battery Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence