Key Insights

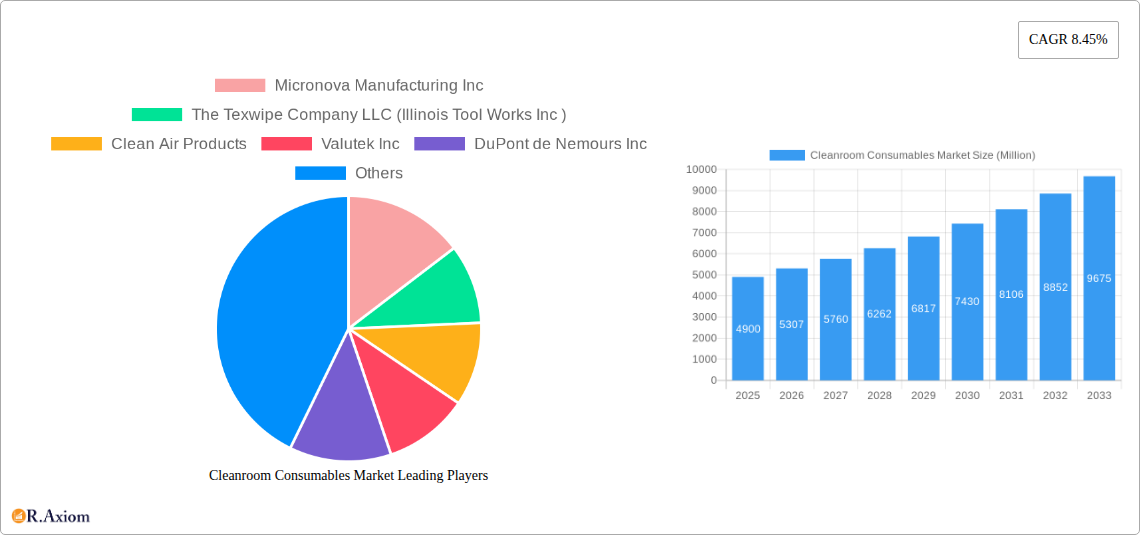

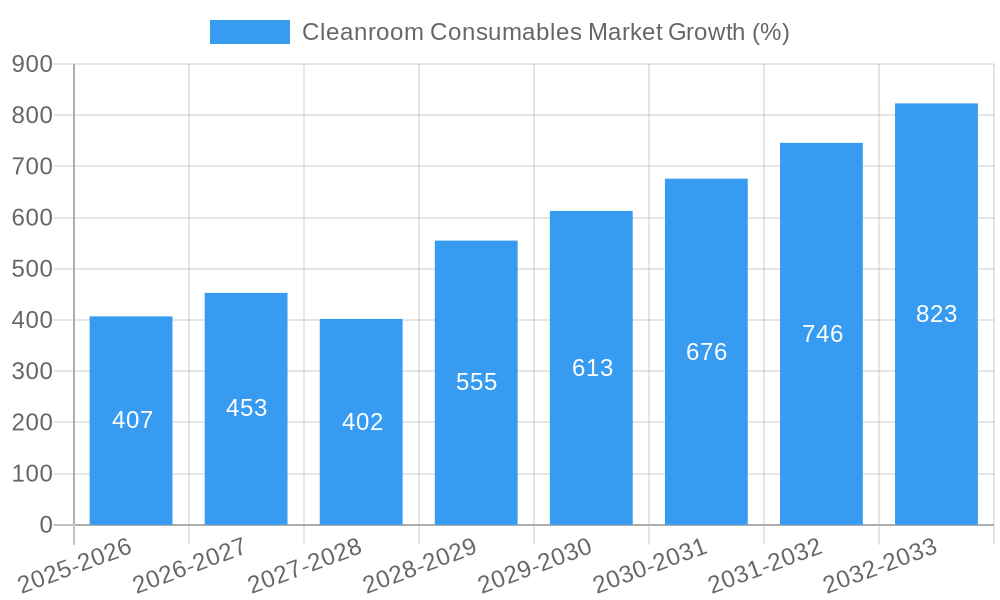

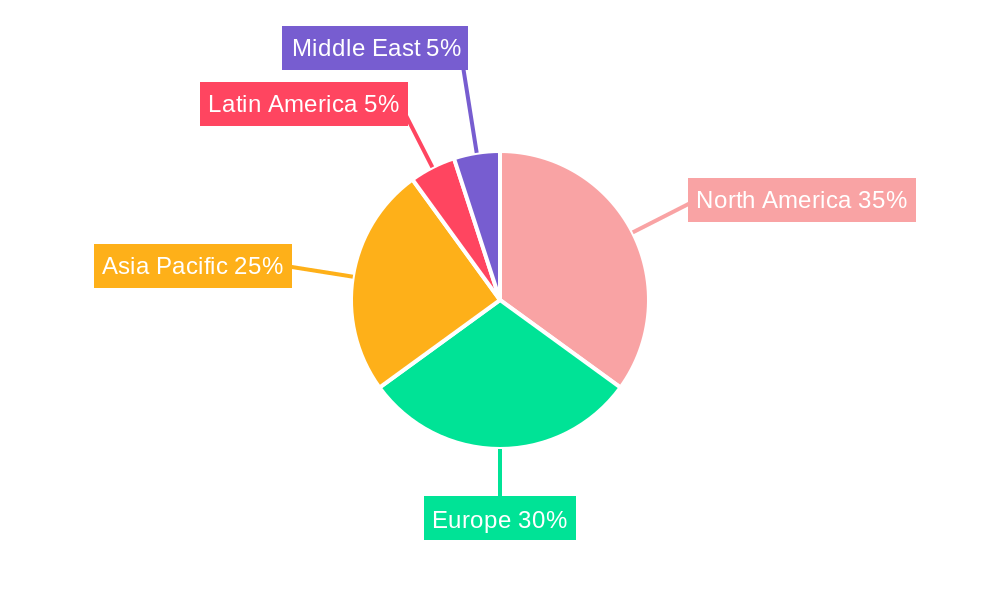

The Cleanroom Consumables market, valued at $4.90 billion in 2025, is projected to experience robust growth, driven by a Compound Annual Growth Rate (CAGR) of 8.45% from 2025 to 2033. This expansion is fueled by several key factors. The burgeoning pharmaceutical and biotechnology sectors, along with the increasing demand for advanced electronics and medical devices, are major contributors. Stringent regulatory requirements for contamination control in these industries necessitate the consistent use of high-quality cleanroom consumables. Furthermore, the growing focus on process efficiency and yield optimization within manufacturing settings is driving adoption of innovative consumable solutions designed to minimize contamination risks and maximize productivity. The market segmentation reveals a significant demand for safety consumables, including cleaning consumables and cleanroom stationery, across various application areas. North America and Europe currently hold substantial market shares, but the Asia-Pacific region is poised for significant growth driven by expanding manufacturing capabilities and investments in advanced technologies. Competition is fierce, with established players like DuPont, Kimberly-Clark, and 3M vying for market dominance alongside specialized cleanroom consumable manufacturers. Continued innovation in materials science, automation, and sustainable solutions will further shape the market landscape in the coming years.

The forecast period (2025-2033) anticipates sustained growth, particularly in emerging economies. The market will witness the introduction of advanced materials and technologies aimed at improving performance and reducing environmental impact. The integration of smart sensors and data analytics within cleanroom environments will further enhance efficiency and reduce costs. However, price fluctuations in raw materials and potential economic slowdowns could pose challenges. Nevertheless, the long-term outlook for the cleanroom consumables market remains positive, driven by the continued expansion of high-growth industries and the unwavering need for contamination control in critical manufacturing and research environments. Factors such as increased automation in cleanroom processes and the rising adoption of single-use consumables will contribute to this growth.

Cleanroom Consumables Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Cleanroom Consumables market, offering invaluable insights for stakeholders across the industry. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The forecast period covers 2025-2033, and the historical period analyzed is 2019-2024. Key players analyzed include Micronova Manufacturing Inc, The Texwipe Company LLC (Illinois Tool Works Inc), Clean Air Products, Valutek Inc, DuPont de Nemours Inc, Nitritex Ltd (Ansell Limited), Micronclean Ltd, Azbil Corporation, Kimberly-Clark Corporation, and Contec Inc (list not exhaustive). The report segments the market by product (Safety Consumables, Cleaning Consumables, Cleanroom Stationery) and application (Electronics, Pharmaceutical and Biotechnology, Food and Beverage, Aerospace and Defense, University Research, Automotive, Medical Device).

Cleanroom Consumables Market Concentration & Innovation

The Cleanroom Consumables market exhibits a moderately concentrated landscape, with a few major players holding significant market share. The exact market share for each company is xx%, but the top five companies are estimated to collectively hold approximately 60% of the global market. Innovation is a key driver, fueled by the increasing demand for advanced cleanroom technologies across various industries. Regulatory frameworks, such as GMP (Good Manufacturing Practices) and ISO standards, significantly influence product development and adoption. The market is also witnessing increased M&A activity, with deal values ranging from xx Million to xx Million in recent years. These activities are driven by a need to expand product portfolios, enhance technological capabilities, and achieve geographic reach.

- Market Concentration: Moderate, with top 5 players holding ~60% market share (estimated).

- Innovation Drivers: Stringent regulatory compliance, demand for advanced materials, and technological advancements.

- Regulatory Frameworks: GMP, ISO standards, and regional-specific regulations.

- Product Substitutes: Limited substitutes exist due to stringent quality and purity requirements.

- End-User Trends: Growing demand from pharmaceutical and biotechnology sectors.

- M&A Activities: Increasing consolidation through acquisitions and mergers.

Cleanroom Consumables Market Industry Trends & Insights

The Cleanroom Consumables market is experiencing robust growth, with a projected Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is primarily driven by the expansion of various end-use industries, particularly pharmaceuticals and biotechnology, along with the increasing adoption of advanced cleanroom technologies. Technological disruptions, such as the introduction of innovative materials and automation solutions, are further enhancing market dynamics. Consumer preference for sustainable and eco-friendly products is also gaining traction. The market penetration of advanced cleanroom consumables is steadily increasing, particularly in emerging economies. Competitive dynamics are characterized by both intense rivalry and collaborative partnerships, with companies focusing on product differentiation, technological advancements, and strategic alliances.

Dominant Markets & Segments in Cleanroom Consumables Market

The pharmaceutical and biotechnology sector represents the dominant application segment in the Cleanroom Consumables market, driven by stringent regulatory requirements and the growing demand for high-quality consumables. North America and Europe currently hold the largest market share due to the high concentration of pharmaceutical and technology companies. However, Asia-Pacific is projected to witness significant growth during the forecast period driven by the expanding pharmaceutical and electronics industries.

- Dominant Application Segment: Pharmaceutical and Biotechnology

- Key Drivers: Stringent regulatory compliance, high demand for sterile environments, high R&D investments.

- Dominant Product Segment: Cleaning Consumables

- Key Drivers: Regular cleaning and disinfection needs in cleanrooms.

- Dominant Region: North America and Europe currently lead, with Asia-Pacific poised for rapid growth.

- Key Drivers: Established pharmaceutical industries (North America & Europe) and rising manufacturing capabilities (Asia-Pacific).

Cleanroom Consumables Market Product Developments

Recent product innovations focus on enhancing efficiency, reducing costs, and improving sustainability. New materials with improved cleanliness, durability, and compatibility with various cleaning agents are being introduced. The integration of smart sensors and automation features is also gaining traction, enabling better monitoring and control of cleanroom environments. These developments align with the growing demand for enhanced cleanliness, reduced contamination risks, and improved cost-effectiveness.

Report Scope & Segmentation Analysis

This report comprehensively analyzes the Cleanroom Consumables market across various segments:

- Product: Safety Consumables (growth projection xx%, market size xx Million in 2025), Cleaning Consumables (growth projection xx%, market size xx Million in 2025), Cleanroom Stationery (growth projection xx%, market size xx Million in 2025). Each segment displays varied competitive dynamics influenced by specialized technologies and application-specific needs.

- Application: Electronics (growth projection xx%, market size xx Million in 2025), Pharmaceutical and Biotechnology (growth projection xx%, market size xx Million in 2025), Food and Beverage (growth projection xx%, market size xx Million in 2025), Aerospace and Defense (growth projection xx%, market size xx Million in 2025), University Research (growth projection xx%, market size xx Million in 2025), Automotive (growth projection xx%, market size xx Million in 2025), Medical Device (growth projection xx%, market size xx Million in 2025). The varying growth rates reflect the unique needs and regulatory landscapes of each sector.

Key Drivers of Cleanroom Consumables Market Growth

The Cleanroom Consumables market is driven by several key factors: increasing demand for high-quality products from various end-use industries, stringent regulatory compliance requirements, technological advancements leading to more efficient and cost-effective consumables, and rising awareness about contamination control. The growing emphasis on data integrity and automation further fuels market expansion.

Challenges in the Cleanroom Consumables Market Sector

The Cleanroom Consumables market faces challenges such as fluctuating raw material prices, stringent regulatory compliance costs, and intense competition among established players and emerging entrants. Supply chain disruptions, particularly concerning specific raw materials, can also impact production and cost-effectiveness. These factors can negatively impact profitability and market growth if not managed effectively. The estimated impact of these challenges on overall market growth is a reduction of approximately xx% in the forecast period.

Emerging Opportunities in Cleanroom Consumables Market

Emerging opportunities include the growing demand for sustainable and eco-friendly consumables, the increasing adoption of advanced materials with enhanced performance characteristics, and the expansion of the cleanroom market in emerging economies. The integration of smart technologies and data analytics in cleanroom management offers further opportunities for value-added solutions and service offerings.

Leading Players in the Cleanroom Consumables Market Market

- Micronova Manufacturing Inc

- The Texwipe Company LLC (Illinois Tool Works Inc)

- Clean Air Products

- Valutek Inc

- DuPont de Nemours Inc

- Nitritex Ltd (Ansell Limited)

- Micronclean Ltd

- Azbil Corporation

- Kimberly-Clark Corporation

- Contec Inc

Key Developments in Cleanroom Consumables Market Industry

- March 2023: Millstone Medical Outsourcing expanded its cleanroom space by 5,000 square feet, indicating a rise in demand for sterile packaging services.

- April 2023: ABN Cleanroom Technology launched DryCell, a ready-to-use low dewpoint cleanroom solution in the EU, highlighting innovation in cleanroom technology.

Strategic Outlook for Cleanroom Consumables Market Market

The Cleanroom Consumables market presents significant growth potential, driven by increasing demand across diverse end-use sectors, technological advancements, and the adoption of sustainable practices. Strategic partnerships, acquisitions, and focused investments in R&D will be crucial for companies seeking to capitalize on this market's expansion and maintain a competitive edge. The market is expected to remain dynamic, requiring companies to adapt to evolving regulatory landscapes and consumer preferences.

Cleanroom Consumables Market Segmentation

-

1. Product

-

1.1. Safety Consumables

- 1.1.1. Frocks

- 1.1.2. Boot Covers

- 1.1.3. Shoe Covers

- 1.1.4. Bouffants

- 1.1.5. Pants and Face Masks

- 1.1.6. Other Safety Consumables

-

1.2. Cleaning Consumables

- 1.2.1. Mops

- 1.2.2. Buckets

- 1.2.3. Wringers

- 1.2.4. Squeegees

- 1.2.5. Validation Swabs

- 1.2.6. Other Cleaning Consumables

-

1.3. Cleanroom Stationery

- 1.3.1. Papers

- 1.3.2. Notebooks

- 1.3.3. Adhesive Pads

- 1.3.4. Binder

- 1.3.5. Clipboards

- 1.3.6. Labels

- 1.3.7. Other Cleanroom Stationeries

-

1.1. Safety Consumables

-

2. Application

- 2.1. Electronics

- 2.2. Pharmaceutical and Biotechnology

- 2.3. Food and Beverage

- 2.4. Aerospace and Defense

- 2.5. University Research

- 2.6. Automotive

- 2.7. Medical Device

Cleanroom Consumables Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East

Cleanroom Consumables Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.45% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Safe and Better-Quality Pharmaceutical Drugs; Compulsory Regulations by Regulatory Authorities for Production and Packaging of Medical Products

- 3.3. Market Restrains

- 3.3.1. High Raw Materials and Manufacturing Cost; Complicated and Variable Regulations of Cleanroom

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Safe and Better-Quality Pharmaceutical Drugs is Expected to Drives the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Cleanroom Consumables Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Safety Consumables

- 5.1.1.1. Frocks

- 5.1.1.2. Boot Covers

- 5.1.1.3. Shoe Covers

- 5.1.1.4. Bouffants

- 5.1.1.5. Pants and Face Masks

- 5.1.1.6. Other Safety Consumables

- 5.1.2. Cleaning Consumables

- 5.1.2.1. Mops

- 5.1.2.2. Buckets

- 5.1.2.3. Wringers

- 5.1.2.4. Squeegees

- 5.1.2.5. Validation Swabs

- 5.1.2.6. Other Cleaning Consumables

- 5.1.3. Cleanroom Stationery

- 5.1.3.1. Papers

- 5.1.3.2. Notebooks

- 5.1.3.3. Adhesive Pads

- 5.1.3.4. Binder

- 5.1.3.5. Clipboards

- 5.1.3.6. Labels

- 5.1.3.7. Other Cleanroom Stationeries

- 5.1.1. Safety Consumables

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Electronics

- 5.2.2. Pharmaceutical and Biotechnology

- 5.2.3. Food and Beverage

- 5.2.4. Aerospace and Defense

- 5.2.5. University Research

- 5.2.6. Automotive

- 5.2.7. Medical Device

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. North America Cleanroom Consumables Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Safety Consumables

- 6.1.1.1. Frocks

- 6.1.1.2. Boot Covers

- 6.1.1.3. Shoe Covers

- 6.1.1.4. Bouffants

- 6.1.1.5. Pants and Face Masks

- 6.1.1.6. Other Safety Consumables

- 6.1.2. Cleaning Consumables

- 6.1.2.1. Mops

- 6.1.2.2. Buckets

- 6.1.2.3. Wringers

- 6.1.2.4. Squeegees

- 6.1.2.5. Validation Swabs

- 6.1.2.6. Other Cleaning Consumables

- 6.1.3. Cleanroom Stationery

- 6.1.3.1. Papers

- 6.1.3.2. Notebooks

- 6.1.3.3. Adhesive Pads

- 6.1.3.4. Binder

- 6.1.3.5. Clipboards

- 6.1.3.6. Labels

- 6.1.3.7. Other Cleanroom Stationeries

- 6.1.1. Safety Consumables

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Electronics

- 6.2.2. Pharmaceutical and Biotechnology

- 6.2.3. Food and Beverage

- 6.2.4. Aerospace and Defense

- 6.2.5. University Research

- 6.2.6. Automotive

- 6.2.7. Medical Device

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. Europe Cleanroom Consumables Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Safety Consumables

- 7.1.1.1. Frocks

- 7.1.1.2. Boot Covers

- 7.1.1.3. Shoe Covers

- 7.1.1.4. Bouffants

- 7.1.1.5. Pants and Face Masks

- 7.1.1.6. Other Safety Consumables

- 7.1.2. Cleaning Consumables

- 7.1.2.1. Mops

- 7.1.2.2. Buckets

- 7.1.2.3. Wringers

- 7.1.2.4. Squeegees

- 7.1.2.5. Validation Swabs

- 7.1.2.6. Other Cleaning Consumables

- 7.1.3. Cleanroom Stationery

- 7.1.3.1. Papers

- 7.1.3.2. Notebooks

- 7.1.3.3. Adhesive Pads

- 7.1.3.4. Binder

- 7.1.3.5. Clipboards

- 7.1.3.6. Labels

- 7.1.3.7. Other Cleanroom Stationeries

- 7.1.1. Safety Consumables

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Electronics

- 7.2.2. Pharmaceutical and Biotechnology

- 7.2.3. Food and Beverage

- 7.2.4. Aerospace and Defense

- 7.2.5. University Research

- 7.2.6. Automotive

- 7.2.7. Medical Device

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Asia Pacific Cleanroom Consumables Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Safety Consumables

- 8.1.1.1. Frocks

- 8.1.1.2. Boot Covers

- 8.1.1.3. Shoe Covers

- 8.1.1.4. Bouffants

- 8.1.1.5. Pants and Face Masks

- 8.1.1.6. Other Safety Consumables

- 8.1.2. Cleaning Consumables

- 8.1.2.1. Mops

- 8.1.2.2. Buckets

- 8.1.2.3. Wringers

- 8.1.2.4. Squeegees

- 8.1.2.5. Validation Swabs

- 8.1.2.6. Other Cleaning Consumables

- 8.1.3. Cleanroom Stationery

- 8.1.3.1. Papers

- 8.1.3.2. Notebooks

- 8.1.3.3. Adhesive Pads

- 8.1.3.4. Binder

- 8.1.3.5. Clipboards

- 8.1.3.6. Labels

- 8.1.3.7. Other Cleanroom Stationeries

- 8.1.1. Safety Consumables

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Electronics

- 8.2.2. Pharmaceutical and Biotechnology

- 8.2.3. Food and Beverage

- 8.2.4. Aerospace and Defense

- 8.2.5. University Research

- 8.2.6. Automotive

- 8.2.7. Medical Device

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Latin America Cleanroom Consumables Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. Safety Consumables

- 9.1.1.1. Frocks

- 9.1.1.2. Boot Covers

- 9.1.1.3. Shoe Covers

- 9.1.1.4. Bouffants

- 9.1.1.5. Pants and Face Masks

- 9.1.1.6. Other Safety Consumables

- 9.1.2. Cleaning Consumables

- 9.1.2.1. Mops

- 9.1.2.2. Buckets

- 9.1.2.3. Wringers

- 9.1.2.4. Squeegees

- 9.1.2.5. Validation Swabs

- 9.1.2.6. Other Cleaning Consumables

- 9.1.3. Cleanroom Stationery

- 9.1.3.1. Papers

- 9.1.3.2. Notebooks

- 9.1.3.3. Adhesive Pads

- 9.1.3.4. Binder

- 9.1.3.5. Clipboards

- 9.1.3.6. Labels

- 9.1.3.7. Other Cleanroom Stationeries

- 9.1.1. Safety Consumables

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Electronics

- 9.2.2. Pharmaceutical and Biotechnology

- 9.2.3. Food and Beverage

- 9.2.4. Aerospace and Defense

- 9.2.5. University Research

- 9.2.6. Automotive

- 9.2.7. Medical Device

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. Middle East Cleanroom Consumables Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. Safety Consumables

- 10.1.1.1. Frocks

- 10.1.1.2. Boot Covers

- 10.1.1.3. Shoe Covers

- 10.1.1.4. Bouffants

- 10.1.1.5. Pants and Face Masks

- 10.1.1.6. Other Safety Consumables

- 10.1.2. Cleaning Consumables

- 10.1.2.1. Mops

- 10.1.2.2. Buckets

- 10.1.2.3. Wringers

- 10.1.2.4. Squeegees

- 10.1.2.5. Validation Swabs

- 10.1.2.6. Other Cleaning Consumables

- 10.1.3. Cleanroom Stationery

- 10.1.3.1. Papers

- 10.1.3.2. Notebooks

- 10.1.3.3. Adhesive Pads

- 10.1.3.4. Binder

- 10.1.3.5. Clipboards

- 10.1.3.6. Labels

- 10.1.3.7. Other Cleanroom Stationeries

- 10.1.1. Safety Consumables

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Electronics

- 10.2.2. Pharmaceutical and Biotechnology

- 10.2.3. Food and Beverage

- 10.2.4. Aerospace and Defense

- 10.2.5. University Research

- 10.2.6. Automotive

- 10.2.7. Medical Device

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. North America Cleanroom Consumables Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Europe Cleanroom Consumables Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Asia Pacific Cleanroom Consumables Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Latin America Cleanroom Consumables Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Middle East Cleanroom Consumables Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Competitive Analysis

- 16.1. Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Micronova Manufacturing Inc

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 The Texwipe Company LLC (Illinois Tool Works Inc )

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Clean Air Products

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Valutek Inc

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 DuPont de Nemours Inc

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Nitritex Ltd (Ansell Limited)

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Micronclean Ltd

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Azbil Corporation

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Kimberly-Clark Corporation

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Contec Inc *List Not Exhaustive

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.1 Micronova Manufacturing Inc

List of Figures

- Figure 1: Cleanroom Consumables Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Cleanroom Consumables Market Share (%) by Company 2024

List of Tables

- Table 1: Cleanroom Consumables Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Cleanroom Consumables Market Revenue Million Forecast, by Product 2019 & 2032

- Table 3: Cleanroom Consumables Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Cleanroom Consumables Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Cleanroom Consumables Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Cleanroom Consumables Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Cleanroom Consumables Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Cleanroom Consumables Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Cleanroom Consumables Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Cleanroom Consumables Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Cleanroom Consumables Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Cleanroom Consumables Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Cleanroom Consumables Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Cleanroom Consumables Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Cleanroom Consumables Market Revenue Million Forecast, by Product 2019 & 2032

- Table 16: Cleanroom Consumables Market Revenue Million Forecast, by Application 2019 & 2032

- Table 17: Cleanroom Consumables Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Cleanroom Consumables Market Revenue Million Forecast, by Product 2019 & 2032

- Table 19: Cleanroom Consumables Market Revenue Million Forecast, by Application 2019 & 2032

- Table 20: Cleanroom Consumables Market Revenue Million Forecast, by Country 2019 & 2032

- Table 21: Cleanroom Consumables Market Revenue Million Forecast, by Product 2019 & 2032

- Table 22: Cleanroom Consumables Market Revenue Million Forecast, by Application 2019 & 2032

- Table 23: Cleanroom Consumables Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: Cleanroom Consumables Market Revenue Million Forecast, by Product 2019 & 2032

- Table 25: Cleanroom Consumables Market Revenue Million Forecast, by Application 2019 & 2032

- Table 26: Cleanroom Consumables Market Revenue Million Forecast, by Country 2019 & 2032

- Table 27: Cleanroom Consumables Market Revenue Million Forecast, by Product 2019 & 2032

- Table 28: Cleanroom Consumables Market Revenue Million Forecast, by Application 2019 & 2032

- Table 29: Cleanroom Consumables Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Cleanroom Consumables Market?

The projected CAGR is approximately 8.45%.

2. Which companies are prominent players in the Cleanroom Consumables Market?

Key companies in the market include Micronova Manufacturing Inc, The Texwipe Company LLC (Illinois Tool Works Inc ), Clean Air Products, Valutek Inc, DuPont de Nemours Inc, Nitritex Ltd (Ansell Limited), Micronclean Ltd, Azbil Corporation, Kimberly-Clark Corporation, Contec Inc *List Not Exhaustive.

3. What are the main segments of the Cleanroom Consumables Market?

The market segments include Product, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.90 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Safe and Better-Quality Pharmaceutical Drugs; Compulsory Regulations by Regulatory Authorities for Production and Packaging of Medical Products.

6. What are the notable trends driving market growth?

Increasing Demand for Safe and Better-Quality Pharmaceutical Drugs is Expected to Drives the Market Growth.

7. Are there any restraints impacting market growth?

High Raw Materials and Manufacturing Cost; Complicated and Variable Regulations of Cleanroom.

8. Can you provide examples of recent developments in the market?

March 2023 - Millstone Medical Outsourcing, the foremost preferred partner for medical manufacturers' post-manufacturing and aftermarket services, officially began expanding its cleanroom space. The expansion project, initiated in Autumn 2022, has augmented the facility by an additional 5,000 square feet of Class 10,000/ISO7-rated cleanroom space dedicated to medical device packaging operations. This expansion has resulted in a total cleanroom footprint of 20,000 square feet for Millstone. Due to increasing demand for sterile and cleanroom packaging services, the company has expanded its operations, resources, and workforce.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Cleanroom Consumables Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Cleanroom Consumables Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Cleanroom Consumables Market?

To stay informed about further developments, trends, and reports in the Cleanroom Consumables Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence