Key Insights

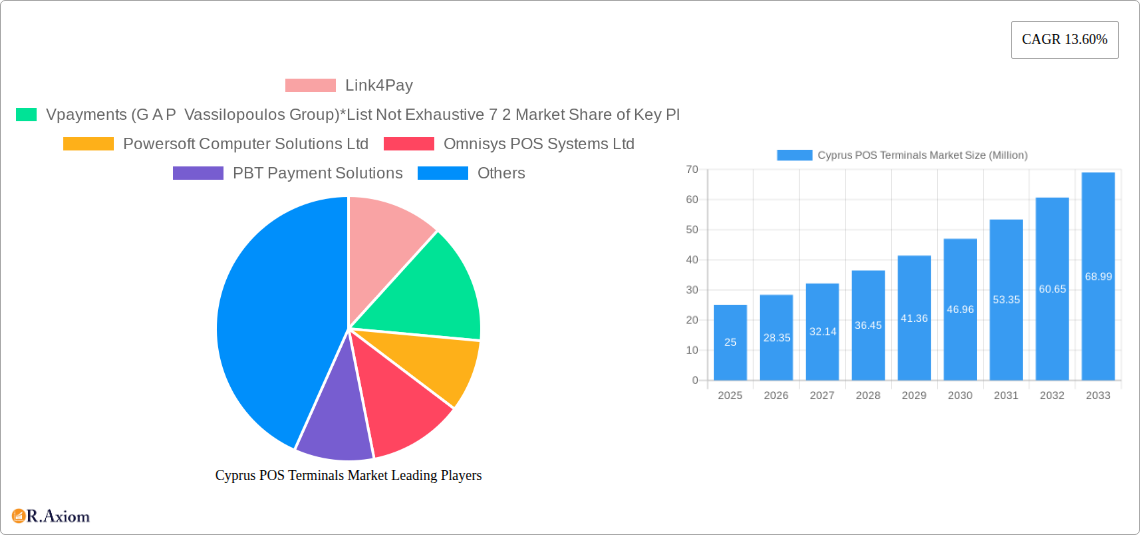

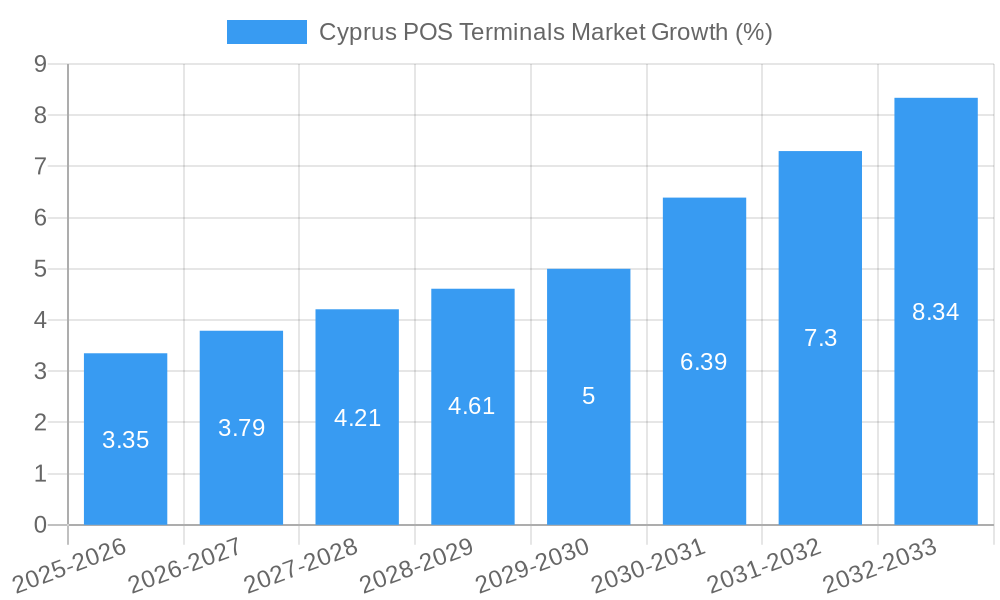

The Cyprus POS Terminals market, exhibiting a robust Compound Annual Growth Rate (CAGR) of 13.60% from 2019 to 2024, is poised for continued expansion throughout the forecast period (2025-2033). This growth is fueled by several key drivers. The increasing adoption of digital payment methods by businesses across various sectors, particularly retail and hospitality, is a significant factor. Furthermore, the rising demand for efficient and secure transaction processing solutions, coupled with government initiatives promoting digitalization, are bolstering market growth. The market segmentation reveals a strong preference for both fixed and mobile POS systems, with retail and hospitality leading the end-user industry adoption. While the precise market size for 2025 is not provided, considering the 13.60% CAGR and assuming a reasonable starting point based on industry averages for similar-sized economies, a conservative estimate places the market value in the tens of millions of euros. This estimation reflects a mature but still expanding market with significant potential for further growth as smaller businesses and specialized sectors increasingly adopt POS technology.

Competitive dynamics are shaped by a mix of international players like VeriFone Inc. and regional companies such as Link4Pay and Powersoft Computer Solutions Ltd. The presence of these diverse players indicates a healthy market with varied technological offerings and pricing strategies catering to diverse customer needs. Challenges include the potential for economic fluctuations impacting investment in new technology, and the need for continuous technological upgrades to maintain security and compliance with evolving payment regulations. However, the long-term outlook remains positive, driven by the increasing digitalization of the Cypriot economy and the enduring need for efficient and secure transaction processing across multiple industries. Continued growth is projected across all segments, with mobile POS systems likely witnessing faster growth due to increased mobility and flexibility offered to businesses.

Cyprus POS Terminals Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the Cyprus POS terminals market, covering market size, segmentation, key players, growth drivers, challenges, and future outlook. The study period spans from 2019 to 2033, with 2025 as the base and estimated year. The report offers actionable insights for industry stakeholders, investors, and businesses operating or planning to enter the Cypriot POS terminal market.

Cyprus POS Terminals Market Market Concentration & Innovation

The Cyprus POS terminals market exhibits a moderately concentrated landscape, with a few key players holding significant market share. Powersoft Computer Solutions Ltd, Omnisys POS Systems Ltd, and PBT Payment Solutions are among the established players, together accounting for an estimated xx% of the market in 2025. However, the market also features several smaller players, including Link4Pay, Vpayments (G A P Vassilopoulos Group), VeriFone Inc, DATECS Ltd, Vibrant, Pay Expert, and JCC Payment Systems Ltd, contributing to a dynamic competitive environment.

Market innovation is driven by the increasing adoption of mobile POS systems, fueled by the rising smartphone penetration and the need for flexible payment solutions. The regulatory framework in Cyprus, while relatively supportive of technological advancements in the payments industry, influences the pace of innovation and adoption. The emergence of Fintech companies like Vibrant signifies a shift towards more agile and customer-centric solutions. Substitutes for traditional POS terminals, such as mobile payment apps and online payment gateways, exert some competitive pressure, particularly in the lower-value transaction segments. Mergers and acquisitions (M&A) activity in the Cyprus POS terminals market has been relatively limited in recent years, with reported deal values totaling approximately xx Million in the past five years. This low level of M&A activity may be attributed to the market's moderate size and the presence of established players. End-user trends show a clear preference for systems offering seamless integration with existing business software and robust security features.

Cyprus POS Terminals Market Industry Trends & Insights

The Cyprus POS terminals market is projected to experience steady growth throughout the forecast period (2025-2033), with a compound annual growth rate (CAGR) estimated at xx%. This growth is primarily driven by the expanding retail and hospitality sectors, increasing tourism, a growing preference for cashless transactions, and government initiatives promoting digitalization. Technological disruptions, including the rise of contactless payments, mobile POS systems, and integrated payment gateways, are significantly impacting market dynamics. Consumer preferences are shifting towards user-friendly, secure, and versatile POS systems that offer features like loyalty programs and inventory management. The competitive landscape is characterized by both established players and emerging Fintech startups, resulting in increased innovation and price competition. Market penetration of POS terminals in Cyprus is currently estimated at approximately xx%, leaving considerable room for future growth, particularly in smaller businesses and underserved segments.

Dominant Markets & Segments in Cyprus POS Terminals Market

Dominant Segment by Type: Mobile/portable point-of-sale systems are expected to be the fastest-growing segment, driven by the increasing demand for flexible and convenient payment solutions among small businesses and merchants in the hospitality sector.

Dominant Segment by End-User Industry: The retail sector represents the largest segment of the Cyprus POS terminals market, accounting for an estimated xx% of the total market value in 2025. This is attributed to the relatively high density of retail establishments in Cyprus and the increasing adoption of technology to improve operational efficiency and enhance customer experience.

Key Drivers for Retail Segment Dominance:

- High concentration of retail businesses.

- Growing preference for cashless payments.

- Increasing need for efficient inventory management.

- Government initiatives promoting digitalization.

Key Drivers for Mobile/Portable POS System Growth:

- Rising smartphone penetration.

- Increased mobility of businesses.

- Demand for flexible and cost-effective solutions.

- Convenience for small businesses and merchants.

The hospitality sector also shows significant growth potential, due to increasing tourism and the adoption of mobile POS systems for table service and event payments. The healthcare sector remains relatively smaller compared to retail and hospitality, but it is expected to see moderate growth in the coming years as clinics and hospitals increasingly adopt electronic payment systems for improved billing and record-keeping.

Cyprus POS Terminals Market Product Developments

Recent product innovations in the Cyprus POS terminals market focus on enhancing security features, integrating loyalty programs, and improving user interfaces. The trend is toward cloud-based solutions offering remote management capabilities and improved data analytics. These developments cater to the growing demand for versatile, secure, and cost-effective POS systems that can seamlessly integrate with existing business operations. The market fit is strong, particularly for small and medium-sized businesses (SMBs) seeking to streamline their operations and improve customer experience.

Report Scope & Segmentation Analysis

By Type:

Fixed Point-of-Sale Systems: This segment encompasses traditional POS terminals installed in fixed locations. It is expected to witness steady growth due to the consistent need for reliable and secure payment processing in established businesses. Market size in 2025 is estimated at xx Million.

Mobile/Portable Point-of-Sale Systems: This segment is projected to experience the highest growth rate due to the increasing demand for flexible payment solutions among small businesses and merchants in mobile environments. Market size in 2025 is estimated at xx Million.

By End-User Industry:

Retail: This segment dominates the market, driven by the extensive use of POS systems in retail stores of all sizes. The projected growth reflects the increasing adoption of technology to enhance efficiency and customer experience. Market size in 2025 is estimated at xx Million.

Hospitality: This sector is experiencing rapid growth, fueled by the rise of mobile POS systems in restaurants, cafes, and hotels. Market size in 2025 is estimated at xx Million.

Healthcare: This segment is expected to exhibit moderate growth, as healthcare providers increasingly adopt electronic payment systems for streamlining billing and record-keeping. Market size in 2025 is estimated at xx Million.

Others: This includes various other sectors like transportation, entertainment, and education that use POS terminals for transactions. Market size in 2025 is estimated at xx Million.

Key Drivers of Cyprus POS Terminals Market Growth

Several factors contribute to the growth of the Cyprus POS terminals market. Technological advancements, particularly in mobile POS and contactless payment technologies, are driving adoption. The increasing preference for cashless transactions, both among consumers and businesses, is fueling demand. Furthermore, government initiatives aimed at promoting digitalization and supporting small businesses create a conducive environment for market expansion. The thriving tourism sector also contributes significantly to the demand for POS systems, particularly in the hospitality industry.

Challenges in the Cyprus POS Terminals Market Sector

The Cyprus POS terminals market faces some challenges, including the relatively high initial investment costs for some systems, which can be a barrier to entry for small businesses. Concerns over data security and the potential for fraud also need to be addressed. Competition from alternative payment methods, such as mobile payment apps, poses a challenge to traditional POS terminal providers. Furthermore, the economic climate and regulatory changes can impact market growth.

Emerging Opportunities in Cyprus POS Terminals Market

The Cyprus POS terminals market presents several opportunities for growth. The increasing adoption of cloud-based POS solutions offers opportunities for improved scalability and efficiency. The integration of loyalty programs and other value-added services creates potential for differentiation and increased customer engagement. Expansion into underserved sectors, such as smaller businesses and the informal economy, presents significant market potential. The growing focus on contactless payments and improved security features presents opportunities for vendors who can offer sophisticated and reliable systems.

Leading Players in the Cyprus POS Terminals Market Market

- Link4Pay

- Vpayments (G A P Vassilopoulos Group)

- Powersoft Computer Solutions Ltd

- Omnisys POS Systems Ltd

- PBT Payment Solutions

- VeriFone Inc

- DATECS Ltd

- Vibrant

- Pay Expert

- JCC Payment Systems Ltd

Key Developments in Cyprus POS Terminals Market Industry

- June 2022: Fintech startup Vibrant secured EUR 4 Million in seed funding to expand its Android-based mobile POS app across Europe, including Cyprus. This development highlights the growing interest in mobile POS solutions and signifies increased competition in the market.

Strategic Outlook for Cyprus POS Terminals Market Market

The Cyprus POS terminals market is poised for continued growth, driven by technological innovation, increasing cashless transactions, and government support for digitalization. The market's future potential lies in the expansion of mobile POS systems, the adoption of advanced security features, and the integration of value-added services. Companies that can effectively adapt to changing consumer preferences and technological advancements are best positioned to succeed in this dynamic market.

Cyprus POS Terminals Market Segmentation

-

1. Type

- 1.1. Fixed Point-of-sale Systems

- 1.2. Mobile/Portable Point-of-sale Systems

-

2. End-User Industry

- 2.1. Retail

- 2.2. Hospitality

- 2.3. Healthcare

- 2.4. Others

Cyprus POS Terminals Market Segmentation By Geography

- 1. Cyprus

Cyprus POS Terminals Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 13.60% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Low Total Cost of Ownership Compared to Other Channels of Payments; Mobile POS Payments is Expected to Drive the Market

- 3.3. Market Restrains

- 3.3.1. Security Concerns Related to Cyber Attacks and Data Breaches; Lack of Robust and Reliable Infrastructure in Remote Regions

- 3.4. Market Trends

- 3.4.1. Mobile/Portable Point-of-sale Systems are Expected to Hold the Largest Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Cyprus POS Terminals Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Fixed Point-of-sale Systems

- 5.1.2. Mobile/Portable Point-of-sale Systems

- 5.2. Market Analysis, Insights and Forecast - by End-User Industry

- 5.2.1. Retail

- 5.2.2. Hospitality

- 5.2.3. Healthcare

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Cyprus

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Link4Pay

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Vpayments (G A P Vassilopoulos Group)*List Not Exhaustive 7 2 Market Share of Key Player

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Powersoft Computer Solutions Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Omnisys POS Systems Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 PBT Payment Solutions

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 VeriFone Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 DATECS Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Vibrant

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Pay Expert

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 JCC Payment Systems Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Link4Pay

List of Figures

- Figure 1: Cyprus POS Terminals Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Cyprus POS Terminals Market Share (%) by Company 2024

List of Tables

- Table 1: Cyprus POS Terminals Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Cyprus POS Terminals Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Cyprus POS Terminals Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 4: Cyprus POS Terminals Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Cyprus POS Terminals Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Cyprus POS Terminals Market Revenue Million Forecast, by Type 2019 & 2032

- Table 7: Cyprus POS Terminals Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 8: Cyprus POS Terminals Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Cyprus POS Terminals Market?

The projected CAGR is approximately 13.60%.

2. Which companies are prominent players in the Cyprus POS Terminals Market?

Key companies in the market include Link4Pay, Vpayments (G A P Vassilopoulos Group)*List Not Exhaustive 7 2 Market Share of Key Player, Powersoft Computer Solutions Ltd, Omnisys POS Systems Ltd, PBT Payment Solutions, VeriFone Inc, DATECS Ltd, Vibrant, Pay Expert, JCC Payment Systems Ltd.

3. What are the main segments of the Cyprus POS Terminals Market?

The market segments include Type, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Low Total Cost of Ownership Compared to Other Channels of Payments; Mobile POS Payments is Expected to Drive the Market.

6. What are the notable trends driving market growth?

Mobile/Portable Point-of-sale Systems are Expected to Hold the Largest Share.

7. Are there any restraints impacting market growth?

Security Concerns Related to Cyber Attacks and Data Breaches; Lack of Robust and Reliable Infrastructure in Remote Regions.

8. Can you provide examples of recent developments in the market?

June 2022 - Fintech startup Vibrant announced raising EUR 4 million in seed funding for its Android smartphone app, allowing small business owners and merchants to turn their phones into point-of-sale (POS) payment systems. The company will use this latest round of funding to consolidate our position in our current markets of Denmark, Norway, Spain, Greece, and Cyprus while launching our app in Germany and Italy.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Cyprus POS Terminals Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Cyprus POS Terminals Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Cyprus POS Terminals Market?

To stay informed about further developments, trends, and reports in the Cyprus POS Terminals Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence