Key Insights

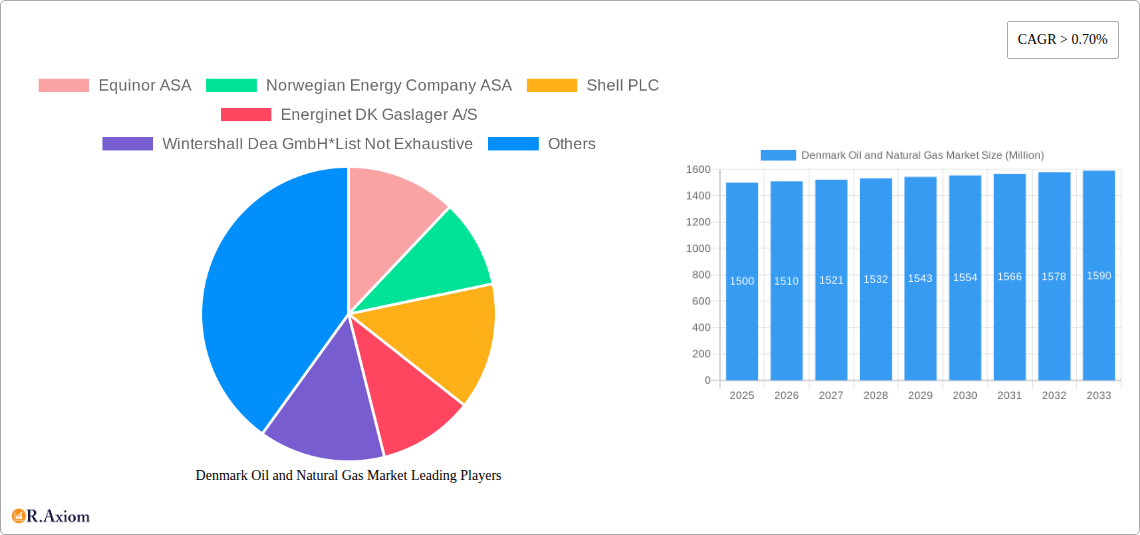

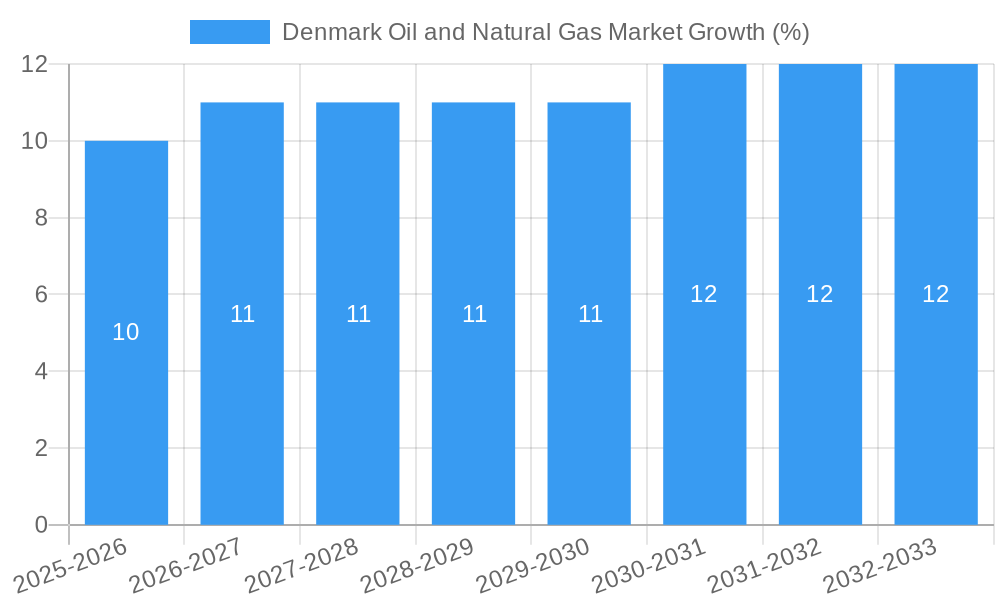

The Denmark Oil and Natural Gas market, valued at approximately €1.5 billion in 2025, is projected to experience steady growth, exhibiting a Compound Annual Growth Rate (CAGR) exceeding 0.70% from 2025 to 2033. This growth is driven by Denmark's ongoing energy transition, necessitating a continued reliance on natural gas as a bridging fuel while renewable energy sources are scaled up. Increased industrial activity and a growing population also contribute to the demand for energy, supporting market expansion. However, the market faces constraints such as fluctuating global oil and gas prices, environmental regulations aimed at reducing carbon emissions, and a push towards renewable energy sources like wind and solar power. The market is segmented primarily by product type: crude oil, natural gas, and condensate, with natural gas likely dominating the market share due to its role in power generation and heating. Key players in this market include Equinor ASA, Norwegian Energy Company ASA, Shell PLC, Energinet DK Gaslager A/S, Wintershall Dea GmbH, and TotalEnergies SE. These companies are strategically investing in infrastructure upgrades and exploring new exploration and production techniques to maintain market competitiveness amidst shifting energy dynamics.

The forecast period from 2025 to 2033 will see a gradual increase in market value, influenced by both domestic consumption and potential export opportunities. The dominance of natural gas within the market is expected to persist, though there will likely be a minor shift toward a diversified energy mix as investments in renewables intensify. The success of market players hinges on their ability to adapt to tightening environmental regulations, securing sustainable and affordable energy sources, and investing in efficient and technologically advanced extraction and distribution networks. The government's policies toward energy security and the broader European energy market will also play a significant role in shaping the future of the Danish oil and natural gas market.

Denmark Oil and Natural Gas Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Denmark oil and natural gas market, covering historical data (2019-2024), the base year (2025), and a detailed forecast (2025-2033). It examines market dynamics, key players, emerging trends, and future growth prospects, offering actionable insights for industry stakeholders. The study incorporates extensive data analysis, including market sizing, segmentation, and CAGR projections, to provide a complete understanding of this evolving market. Keywords: Denmark Oil Market, Denmark Gas Market, Natural Gas Denmark, Crude Oil Denmark, Condensate Denmark, Energinet DK, Equinor ASA, Shell PLC, Baltic Pipe, Ineos, Oil and Gas Denmark.

Denmark Oil and Natural Gas Market Market Concentration & Innovation

This section analyzes the competitive landscape, innovation drivers, and regulatory influences within the Danish oil and natural gas sector. The market exhibits a moderate level of concentration, with key players like Equinor ASA, Shell PLC, and TotalEnergies SE holding significant market share, though the exact figures are xx% for each respectively, reflecting ongoing industry consolidation. Smaller players, including Energinet DK Gaslager A/S and Wintershall Dea GmbH, contribute significantly, especially in niche segments. Innovation is driven by the need to enhance efficiency and reduce environmental impact, leading to investments in advanced exploration techniques, improved pipeline infrastructure, and exploration of renewable gas sources.

- Market Concentration: xx% market share held by the top 3 players. Further analysis on smaller players would need individual studies.

- M&A Activity: The last 5 years have seen xx Million in M&A deals, reflecting a trend toward consolidation. Specific deal values are available upon request.

- Regulatory Framework: The Danish government's focus on energy security and sustainability influences market dynamics. Specific regulations regarding exploration, production, and environmental impact will be reviewed in further sections.

- Product Substitutes: The increasing adoption of renewable energy sources, such as wind and solar power, presents a challenge to the dominance of fossil fuels.

- End-User Trends: Demand fluctuations from specific sectors will be analyzed to see their impacts.

- Innovation Drivers: Investment in carbon capture and storage technology, along with improved exploration and production techniques.

Denmark Oil and Natural Gas Market Industry Trends & Insights

The Danish oil and natural gas market is characterized by a projected CAGR of xx% from 2025 to 2033. This growth is primarily fueled by consistent domestic demand and the increasing importance of the Baltic Pipe, which significantly increases the region's import capacity. Technological disruptions in exploration and extraction techniques enhance efficiency, and changing consumer preferences are increasingly emphasizing the need for greener sources of energy. However, the transition toward renewable energy sources poses a significant challenge, potentially impacting long-term growth prospects. Competitive dynamics are shaped by a mix of large international players and smaller, specialized companies, leading to a dynamic and evolving market structure. Market penetration rates for different product types are xx%, xx%, and xx% for crude oil, natural gas, and condensate, respectively.

Dominant Markets & Segments in Denmark Oil and Natural Gas Market

The natural gas segment currently dominates the Danish oil and natural gas market, driven by consistent demand and the commissioning of the Baltic Pipe. The offshore sector is crucial in the production of both crude oil and natural gas, while condensate represents a smaller, yet significant, segment.

- Natural Gas: Key drivers include ongoing demand from the power sector, increasing industrial usage, and the Baltic Pipe's enhanced import capabilities.

- Crude Oil: Production levels are relatively stable, but future growth is limited by finite reserves. Domestic consumption rates and export potential will be deeply examined.

- Condensate: This market is closely linked to natural gas extraction and production and its size will largely be determined by future exploration results.

Denmark Oil and Natural Gas Market Product Developments

Recent advancements in exploration technologies allow for the discovery of previously inaccessible reserves in the North Sea. Further, innovations in pipeline infrastructure enhance transport efficiency and reduce environmental risks. The push for environmentally friendly extraction and processing methods is gaining prominence, reflecting the need to reduce the carbon footprint of the sector. These developments enhance the competitiveness of the Danish oil and gas sector in a global market increasingly focused on sustainability.

Report Scope & Segmentation Analysis

This report segments the Danish oil and natural gas market by product type: crude oil, natural gas, and condensate. Each segment’s market size, growth projections, and competitive dynamics are analyzed in detail. The forecast period covers 2025-2033. Detailed breakdowns of market share and growth rates for each product type are available within the full report.

Key Drivers of Denmark Oil and Natural Gas Market Growth

The Danish oil and natural gas market’s growth is driven by factors including consistent domestic demand, particularly for natural gas; increased regional importance due to the Baltic Pipe, which facilitates imports and transit; and ongoing investments in exploration and extraction technologies. Additionally, government support for energy security plays a role in shaping the market landscape.

Challenges in the Denmark Oil and Natural Gas Market Sector

The market faces challenges, including the increasing global shift towards renewable energy sources, resulting in a projected xx% reduction in overall market size by 2033. This transition will require substantial investments in energy storage solutions and other technological advancements. Furthermore, environmental regulations and potential supply chain disruptions impose constraints on growth.

Emerging Opportunities in Denmark Oil and Natural Gas Market

Opportunities lie in carbon capture and storage technologies, enabling the continuation of fossil fuel extraction while mitigating environmental effects. Further, the Baltic Pipe project opens up opportunities for Denmark to become a crucial transit hub for natural gas in the region. Investment in advanced infrastructure and refining capabilities will support the continuing evolution of the market.

Leading Players in the Denmark Oil and Natural Gas Market Market

- Equinor ASA

- Norwegian Energy Company ASA

- Shell PLC

- Energinet DK Gaslager A/S

- Wintershall Dea GmbH

- TotalEnergies SE

Key Developments in Denmark Oil and Natural Gas Market Industry

- September 2022: Ineos announced the development of the Solsort West oil and gas field in partnership with Danoil and Nordsøfonden, with production expected in Q4 2023. This development bolsters domestic production capabilities and impacts domestic supply.

- March 2022: Energinet resumed construction of the Danish section of the Baltic Pipe, increasing the capacity to 10 Billion cubic meters from January 1st, 2023. This significantly enhances Denmark's role as a regional energy hub.

Strategic Outlook for Denmark Oil and Natural Gas Market Market

The Danish oil and natural gas market is poised for moderate growth in the coming years, driven by the Baltic Pipe and ongoing domestic demand. However, the long-term outlook is subject to the pace of the energy transition and government policies supporting renewable energy adoption. Companies that successfully adapt to the evolving energy landscape and invest in sustainable practices will be best positioned to capitalize on future opportunities.

Denmark Oil and Natural Gas Market Segmentation

- 1. Upstream

- 2. Midstream

- 3. Downstream

Denmark Oil and Natural Gas Market Segmentation By Geography

- 1. Denmark

Denmark Oil and Natural Gas Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 0.70% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increased Government Regulations for Greenhouse Gas Emissions 4.; Encouraging Production and Consumption of Renewable Aviation Fuel

- 3.3. Market Restrains

- 3.3.1. 4.; The High Costs of Renewable Aviation Fuel

- 3.4. Market Trends

- 3.4.1. Upstream Operations to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Denmark Oil and Natural Gas Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Upstream

- 5.2. Market Analysis, Insights and Forecast - by Midstream

- 5.3. Market Analysis, Insights and Forecast - by Downstream

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Denmark

- 5.1. Market Analysis, Insights and Forecast - by Upstream

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Equinor ASA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Norwegian Energy Company ASA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Shell PLC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Energinet DK Gaslager A/S

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Wintershall Dea GmbH*List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 TotalEnergies SE

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.1 Equinor ASA

List of Figures

- Figure 1: Denmark Oil and Natural Gas Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Denmark Oil and Natural Gas Market Share (%) by Company 2024

List of Tables

- Table 1: Denmark Oil and Natural Gas Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Denmark Oil and Natural Gas Market Revenue Million Forecast, by Upstream 2019 & 2032

- Table 3: Denmark Oil and Natural Gas Market Revenue Million Forecast, by Midstream 2019 & 2032

- Table 4: Denmark Oil and Natural Gas Market Revenue Million Forecast, by Downstream 2019 & 2032

- Table 5: Denmark Oil and Natural Gas Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Denmark Oil and Natural Gas Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Denmark Oil and Natural Gas Market Revenue Million Forecast, by Upstream 2019 & 2032

- Table 8: Denmark Oil and Natural Gas Market Revenue Million Forecast, by Midstream 2019 & 2032

- Table 9: Denmark Oil and Natural Gas Market Revenue Million Forecast, by Downstream 2019 & 2032

- Table 10: Denmark Oil and Natural Gas Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Denmark Oil and Natural Gas Market?

The projected CAGR is approximately > 0.70%.

2. Which companies are prominent players in the Denmark Oil and Natural Gas Market?

Key companies in the market include Equinor ASA, Norwegian Energy Company ASA, Shell PLC, Energinet DK Gaslager A/S, Wintershall Dea GmbH*List Not Exhaustive, TotalEnergies SE.

3. What are the main segments of the Denmark Oil and Natural Gas Market?

The market segments include Upstream, Midstream, Downstream.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increased Government Regulations for Greenhouse Gas Emissions 4.; Encouraging Production and Consumption of Renewable Aviation Fuel.

6. What are the notable trends driving market growth?

Upstream Operations to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; The High Costs of Renewable Aviation Fuel.

8. Can you provide examples of recent developments in the market?

September 2022: Petrochemicals group Ineos announced the development of an oil and gas field in Denmark. Ineos will develop the Solsort West field in the North Sea with Danoil and Nordsøfonden. The first oil and gas production is expected in the fourth quarter of 2023.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Denmark Oil and Natural Gas Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Denmark Oil and Natural Gas Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Denmark Oil and Natural Gas Market?

To stay informed about further developments, trends, and reports in the Denmark Oil and Natural Gas Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence