Key Insights

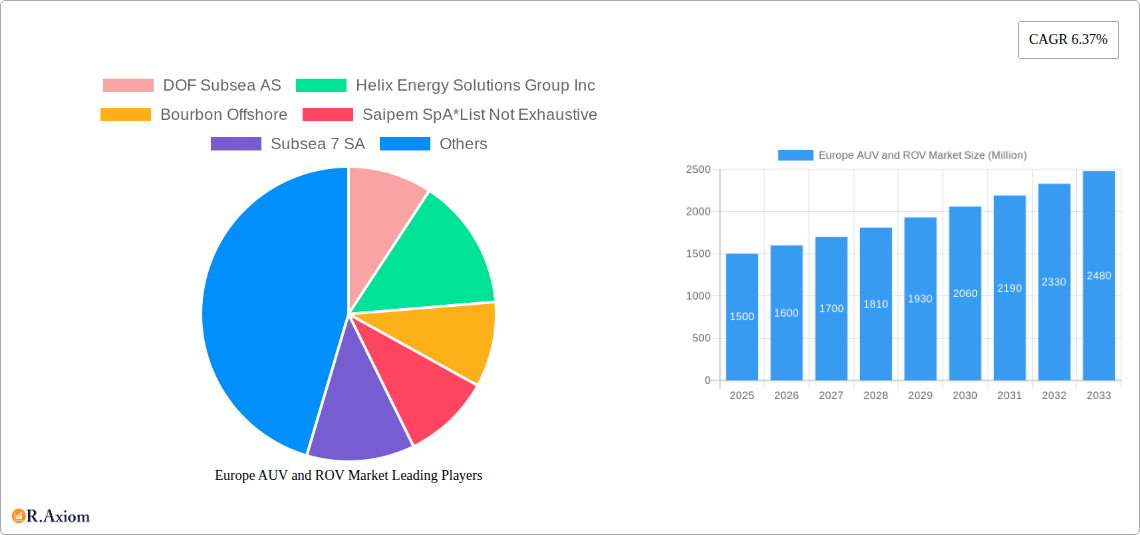

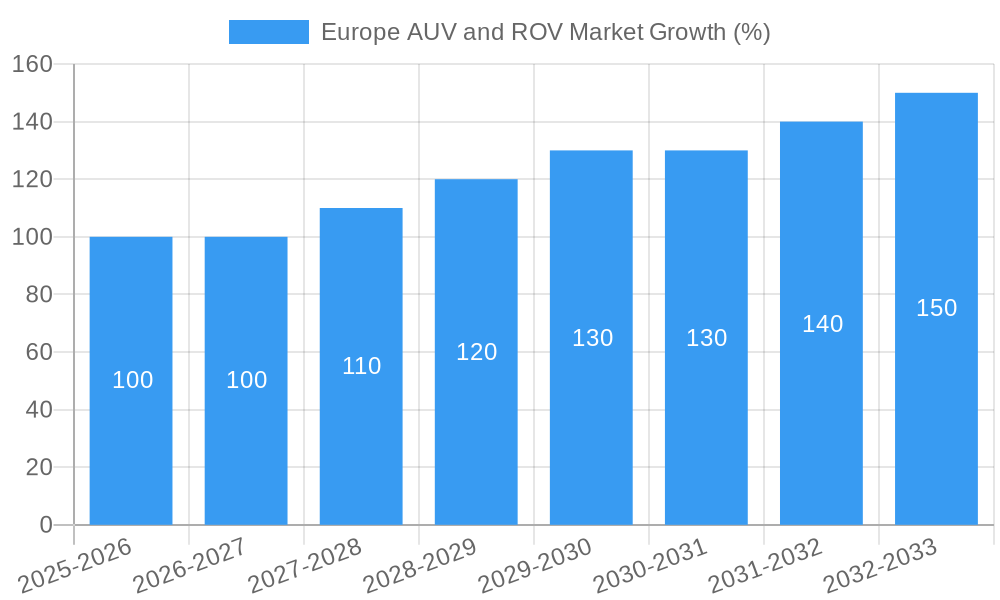

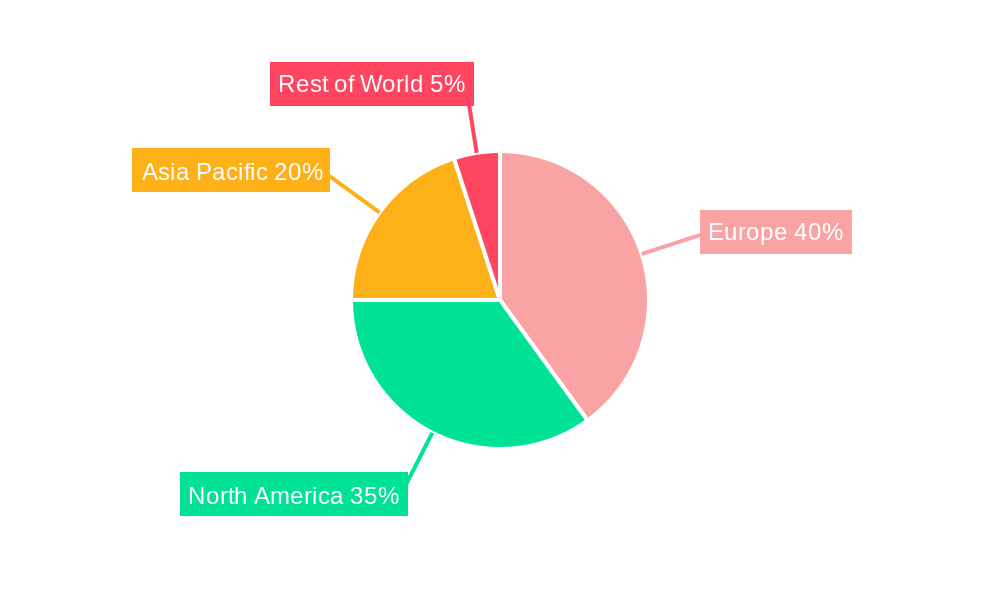

The European Autonomous Underwater Vehicle (AUV) and Remotely Operated Vehicle (ROV) market is experiencing robust growth, driven by increasing offshore oil and gas exploration and production activities, coupled with rising demand for subsea infrastructure inspection and maintenance. The market's Compound Annual Growth Rate (CAGR) of 6.37% from 2019 to 2024 indicates a consistent upward trajectory, and this positive momentum is projected to continue throughout the forecast period (2025-2033). The substantial investments in renewable energy projects, particularly offshore wind farms, are further fueling market expansion. Within the segment breakdown, the work-class vehicle category dominates due to its versatility and applicability in diverse tasks, from heavy-duty operations in the oil and gas sector to complex underwater construction projects. The oil and gas application segment remains the largest revenue generator, although the defense sector's contribution is showing considerable promise and is expected to experience faster growth due to increased governmental spending on maritime security and underwater surveillance technologies. Geographical segmentation reveals a strong market presence across key European nations like the UK, Germany, and France, reflecting substantial offshore infrastructure and operational activity.

While the market enjoys substantial growth, challenges remain. Fluctuations in oil and gas prices can impact investment decisions, potentially slowing down the adoption rate of advanced AUVs and ROVs. Furthermore, regulatory hurdles and stringent safety standards related to underwater operations can pose logistical and financial constraints. However, ongoing technological advancements, such as improved sensor technologies, increased autonomy, and enhanced operational capabilities, are expected to overcome these limitations and sustain market expansion. The emergence of innovative solutions like hybrid AUV/ROV systems and the integration of Artificial Intelligence (AI) for improved data analysis and decision-making are likely to be key factors in future market growth. The competitive landscape includes both established players like DOF Subsea AS, Helix Energy Solutions Group Inc., and Subsea 7 SA, alongside emerging technology providers. These players are continuously investing in research and development to enhance their product offerings and maintain their market share in this dynamic and evolving sector.

Europe AUV and ROV Market: A Comprehensive Market Analysis (2019-2033)

This comprehensive report provides an in-depth analysis of the European AUV and ROV market, offering invaluable insights for stakeholders across the industry. With a detailed examination of market trends, segment performance, leading players, and future growth prospects, this report is an essential resource for strategic decision-making. The study period covers 2019-2033, with 2025 as the base and estimated year.

Europe AUV and ROV Market Market Concentration & Innovation

The European AUV and ROV market exhibits a moderately concentrated landscape, with a few major players holding significant market share. However, the presence of numerous smaller, specialized companies fosters innovation and competition. Market share data for 2024 indicates DOF Subsea AS holds approximately xx% market share, followed by Helix Energy Solutions Group Inc. with xx%, and Bourbon Offshore with xx%. Saipem SpA, Subsea 7 SA, and TechnipFMC PLC also hold substantial, albeit smaller, shares. The exact figures are proprietary to the full report. M&A activity has been relatively moderate in recent years, with deal values averaging xx Million annually in the historical period. However, increased industry consolidation is anticipated given the considerable capital expenditure required for AUV/ROV development and deployment. Regulatory frameworks, primarily focused on safety and environmental protection, impact operational costs. Technological advancements, such as improved sensor technology, AI integration, and hybrid AUV/ROV designs, act as key innovation drivers. The increasing demand for subsea data in the renewable energy sector is further fueling market growth and attracting investment. Substitutes for AUVs and ROVs are limited; however, advancements in remotely operated underwater drones (ROUDs) might pose a future challenge. The rise of offshore wind energy and the growing need for subsea inspection, repair, and maintenance (IRM) are key end-user trends driving market expansion.

Europe AUV and ROV Market Industry Trends & Insights

The European AUV and ROV market is witnessing robust growth, driven by the increasing demand for subsea operations across various sectors. The market is projected to achieve a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is primarily fueled by the burgeoning offshore wind energy sector, which is significantly increasing the need for subsea surveys, cable installation, and maintenance. Technological disruptions, such as the development of more autonomous and intelligent AUVs and ROVs with improved sensor capabilities, are enhancing operational efficiency and reducing costs. The adoption of these advanced systems is improving market penetration. Consumer preferences are shifting towards versatile, cost-effective, and highly reliable subsea vehicles capable of performing multiple tasks. Competitive dynamics are shaped by technological advancements, cost-optimization strategies, and the ability to provide comprehensive service packages. The integration of advanced technologies like artificial intelligence (AI) and machine learning (ML) in AUV and ROV systems is improving decision-making and operational efficacy. Market penetration of these high-tech AUVs and ROVs will increase steadily, reaching xx% by 2033.

Dominant Markets & Segments in Europe AUV and ROV Market

The North Sea region is the dominant market for AUVs and ROVs in Europe, fueled by significant activity in the oil & gas and offshore wind sectors. The UK and Norway are leading countries, driven by robust oil and gas exploration and a rapidly expanding offshore renewable energy infrastructure.

By Activity: Inspection, Repair, and Maintenance (IRM) is the largest segment, accounting for the largest market share, owing to the high demand for subsea infrastructure inspection and repair in existing oil & gas fields and emerging renewable energy installations. Construction activities are projected to witness strong growth during the forecast period driven by expansion in offshore wind farms and related infrastructure projects.

By Vehicle Type: ROVs currently hold the largest market share, due to their versatility and ability to perform a wide range of tasks. However, the AUV segment is expected to witness significant growth driven by technological advancements and the increasing demand for autonomous survey operations.

By Vehicle Class: Work-class vehicles dominate the market, reflecting their capabilities in demanding subsea operations. Observatory-class vehicles show potential growth for scientific and environmental monitoring.

By Application: The Oil and Gas sector remains the largest application segment for AUVs and ROVs. However, the rapid expansion of offshore wind power is quickly becoming a major driver of growth, projected to outpace oil & gas by 2030. The defense sector is a niche but significant segment, focusing primarily on underwater surveillance and mine countermeasures.

Key drivers for this dominance include favorable government policies promoting renewable energy, substantial investments in offshore wind infrastructure, and a well-established oil and gas industry. The supportive regulatory environment, skilled workforce, and strategic geographic location further enhance the region's dominance.

Europe AUV and ROV Market Product Developments

Recent product innovations focus on enhanced autonomy, improved sensor technology, and greater operational efficiency. The launch of the Kongsberg Maritime HUGIN Edge AUV exemplifies the trend towards more compact, versatile, and easily deployable AUVs. Competitive advantages are increasingly based on the integration of AI and advanced data analytics capabilities, providing enhanced decision-making and operational insights. Market fit is driven by the ability of these systems to address the specific needs of various end-users, including cost-effectiveness, reliability, and suitability for challenging subsea conditions.

Report Scope & Segmentation Analysis

This report provides a comprehensive segmentation analysis of the European AUV and ROV market, considering various factors such as activity type, vehicle type, vehicle class, and application. Growth projections, market sizes, and competitive dynamics are provided for each segment. Each segment showcases distinct growth trajectories and competitive landscapes, reflecting their unique technological and market requirements. For example, the ROV market is characterized by a large number of players offering diverse solutions, while the AUV market exhibits a stronger concentration of technology providers focused on autonomous operations.

Key Drivers of Europe AUV and ROV Market Growth

The growth of the European AUV and ROV market is propelled by several factors:

- Technological Advancements: Improved sensor technology, AI integration, and advanced control systems.

- Renewables Push: Growing investments in offshore wind farms are driving a surge in demand for subsea surveys and maintenance.

- Regulatory Support: Government policies promoting renewable energy are creating favorable market conditions.

- Oil & Gas Exploration: Ongoing exploration and development activities in mature oil and gas fields contribute to sustained demand.

Challenges in the Europe AUV and ROV Market Sector

The market faces challenges including:

- High Initial Investment Costs: The high capital expenditure required for AUV/ROV acquisition and maintenance limits market entry for smaller companies.

- Technological Complexity: Advanced systems require specialized skills and expertise for operation and maintenance, leading to potential skills shortages.

- Environmental Regulations: Stringent environmental regulations necessitate compliance efforts impacting operational costs.

- Geopolitical Uncertainty: Geopolitical factors such as sanctions and political instability can influence project timelines and investment decisions.

Emerging Opportunities in Europe AUV and ROV Market

Emerging opportunities include:

- Hybrid AUV/ROV Systems: Offering the benefits of both technologies in one platform.

- Integration of AI and ML: Enhancing operational efficiency and data analysis capabilities.

- Subsea Robotics Expansion: Growing interest in automating subsea tasks in other applications such as aquaculture and subsea cable maintenance.

- Expansion into new markets: Exploration of the seabed for valuable minerals and other resources is opening new opportunities for the use of AUVs and ROVs.

Leading Players in the Europe AUV and ROV Market Market

- DOF Subsea AS

- Helix Energy Solutions Group Inc

- Bourbon Offshore

- Saipem SpA

- Subsea 7 SA

- TechnipFMC PLC

Key Developments in Europe AUV and ROV Market Industry

January 2022: Fugro secured a contract for cable route surveys for Denmark's North Sea Energy Island project, showcasing the growing role of ROVs in offshore wind farm development.

March 2022: Kongsberg Maritime launched the HUGIN Edge AUV, highlighting advancements in AUV design and deployment flexibility.

Strategic Outlook for Europe AUV and ROV Market Market

The European AUV and ROV market is poised for substantial growth, driven by the continued expansion of offshore renewable energy, advancements in subsea technology, and supportive regulatory frameworks. The integration of AI and other advanced technologies will play a crucial role in driving efficiency and market expansion. The market's strategic outlook is extremely positive, with significant growth expected over the next decade.

Europe AUV and ROV Market Segmentation

-

1. Vehicle Type

- 1.1. ROV

- 1.2. AUV

-

2. Vehicle Class

- 2.1. Work Class Vehicle

- 2.2. Observatory Class Vehicle

-

3. Application

- 3.1. Oil and Gas

- 3.2. Defense

- 3.3. Other Application Types

-

4. Activity

- 4.1. Drilling and Development

- 4.2. Construction

- 4.3. Inspection, Repair, and Maintenance

- 4.4. Decommisioning

- 4.5. Other Activity Types

Europe AUV and ROV Market Segmentation By Geography

- 1. United Kingdom

- 2. Norway

- 3. Denmark

- 4. Rest of Europe

Europe AUV and ROV Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.37% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Number of Automobiles4.; The Government Policy Regarding Pollution Emission Control Parameters

- 3.3. Market Restrains

- 3.3.1. 4.; The Technological Limitations of Air Filters

- 3.4. Market Trends

- 3.4.1. ROV Vehicle Type Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe AUV and ROV Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. ROV

- 5.1.2. AUV

- 5.2. Market Analysis, Insights and Forecast - by Vehicle Class

- 5.2.1. Work Class Vehicle

- 5.2.2. Observatory Class Vehicle

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Oil and Gas

- 5.3.2. Defense

- 5.3.3. Other Application Types

- 5.4. Market Analysis, Insights and Forecast - by Activity

- 5.4.1. Drilling and Development

- 5.4.2. Construction

- 5.4.3. Inspection, Repair, and Maintenance

- 5.4.4. Decommisioning

- 5.4.5. Other Activity Types

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. United Kingdom

- 5.5.2. Norway

- 5.5.3. Denmark

- 5.5.4. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. United Kingdom Europe AUV and ROV Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.1.1. ROV

- 6.1.2. AUV

- 6.2. Market Analysis, Insights and Forecast - by Vehicle Class

- 6.2.1. Work Class Vehicle

- 6.2.2. Observatory Class Vehicle

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Oil and Gas

- 6.3.2. Defense

- 6.3.3. Other Application Types

- 6.4. Market Analysis, Insights and Forecast - by Activity

- 6.4.1. Drilling and Development

- 6.4.2. Construction

- 6.4.3. Inspection, Repair, and Maintenance

- 6.4.4. Decommisioning

- 6.4.5. Other Activity Types

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7. Norway Europe AUV and ROV Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.1.1. ROV

- 7.1.2. AUV

- 7.2. Market Analysis, Insights and Forecast - by Vehicle Class

- 7.2.1. Work Class Vehicle

- 7.2.2. Observatory Class Vehicle

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Oil and Gas

- 7.3.2. Defense

- 7.3.3. Other Application Types

- 7.4. Market Analysis, Insights and Forecast - by Activity

- 7.4.1. Drilling and Development

- 7.4.2. Construction

- 7.4.3. Inspection, Repair, and Maintenance

- 7.4.4. Decommisioning

- 7.4.5. Other Activity Types

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8. Denmark Europe AUV and ROV Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.1.1. ROV

- 8.1.2. AUV

- 8.2. Market Analysis, Insights and Forecast - by Vehicle Class

- 8.2.1. Work Class Vehicle

- 8.2.2. Observatory Class Vehicle

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Oil and Gas

- 8.3.2. Defense

- 8.3.3. Other Application Types

- 8.4. Market Analysis, Insights and Forecast - by Activity

- 8.4.1. Drilling and Development

- 8.4.2. Construction

- 8.4.3. Inspection, Repair, and Maintenance

- 8.4.4. Decommisioning

- 8.4.5. Other Activity Types

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9. Rest of Europe Europe AUV and ROV Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.1.1. ROV

- 9.1.2. AUV

- 9.2. Market Analysis, Insights and Forecast - by Vehicle Class

- 9.2.1. Work Class Vehicle

- 9.2.2. Observatory Class Vehicle

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Oil and Gas

- 9.3.2. Defense

- 9.3.3. Other Application Types

- 9.4. Market Analysis, Insights and Forecast - by Activity

- 9.4.1. Drilling and Development

- 9.4.2. Construction

- 9.4.3. Inspection, Repair, and Maintenance

- 9.4.4. Decommisioning

- 9.4.5. Other Activity Types

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 10. Germany Europe AUV and ROV Market Analysis, Insights and Forecast, 2019-2031

- 11. France Europe AUV and ROV Market Analysis, Insights and Forecast, 2019-2031

- 12. Italy Europe AUV and ROV Market Analysis, Insights and Forecast, 2019-2031

- 13. United Kingdom Europe AUV and ROV Market Analysis, Insights and Forecast, 2019-2031

- 14. Netherlands Europe AUV and ROV Market Analysis, Insights and Forecast, 2019-2031

- 15. Sweden Europe AUV and ROV Market Analysis, Insights and Forecast, 2019-2031

- 16. Rest of Europe Europe AUV and ROV Market Analysis, Insights and Forecast, 2019-2031

- 17. Competitive Analysis

- 17.1. Market Share Analysis 2024

- 17.2. Company Profiles

- 17.2.1 DOF Subsea AS

- 17.2.1.1. Overview

- 17.2.1.2. Products

- 17.2.1.3. SWOT Analysis

- 17.2.1.4. Recent Developments

- 17.2.1.5. Financials (Based on Availability)

- 17.2.2 Helix Energy Solutions Group Inc

- 17.2.2.1. Overview

- 17.2.2.2. Products

- 17.2.2.3. SWOT Analysis

- 17.2.2.4. Recent Developments

- 17.2.2.5. Financials (Based on Availability)

- 17.2.3 Bourbon Offshore

- 17.2.3.1. Overview

- 17.2.3.2. Products

- 17.2.3.3. SWOT Analysis

- 17.2.3.4. Recent Developments

- 17.2.3.5. Financials (Based on Availability)

- 17.2.4 Saipem SpA*List Not Exhaustive

- 17.2.4.1. Overview

- 17.2.4.2. Products

- 17.2.4.3. SWOT Analysis

- 17.2.4.4. Recent Developments

- 17.2.4.5. Financials (Based on Availability)

- 17.2.5 Subsea 7 SA

- 17.2.5.1. Overview

- 17.2.5.2. Products

- 17.2.5.3. SWOT Analysis

- 17.2.5.4. Recent Developments

- 17.2.5.5. Financials (Based on Availability)

- 17.2.6 TechnipFMC PLC

- 17.2.6.1. Overview

- 17.2.6.2. Products

- 17.2.6.3. SWOT Analysis

- 17.2.6.4. Recent Developments

- 17.2.6.5. Financials (Based on Availability)

- 17.2.1 DOF Subsea AS

List of Figures

- Figure 1: Europe AUV and ROV Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe AUV and ROV Market Share (%) by Company 2024

List of Tables

- Table 1: Europe AUV and ROV Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe AUV and ROV Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Europe AUV and ROV Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 4: Europe AUV and ROV Market Volume K Unit Forecast, by Vehicle Type 2019 & 2032

- Table 5: Europe AUV and ROV Market Revenue Million Forecast, by Vehicle Class 2019 & 2032

- Table 6: Europe AUV and ROV Market Volume K Unit Forecast, by Vehicle Class 2019 & 2032

- Table 7: Europe AUV and ROV Market Revenue Million Forecast, by Application 2019 & 2032

- Table 8: Europe AUV and ROV Market Volume K Unit Forecast, by Application 2019 & 2032

- Table 9: Europe AUV and ROV Market Revenue Million Forecast, by Activity 2019 & 2032

- Table 10: Europe AUV and ROV Market Volume K Unit Forecast, by Activity 2019 & 2032

- Table 11: Europe AUV and ROV Market Revenue Million Forecast, by Region 2019 & 2032

- Table 12: Europe AUV and ROV Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 13: Europe AUV and ROV Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Europe AUV and ROV Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 15: Germany Europe AUV and ROV Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Germany Europe AUV and ROV Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 17: France Europe AUV and ROV Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: France Europe AUV and ROV Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 19: Italy Europe AUV and ROV Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Italy Europe AUV and ROV Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 21: United Kingdom Europe AUV and ROV Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: United Kingdom Europe AUV and ROV Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 23: Netherlands Europe AUV and ROV Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Netherlands Europe AUV and ROV Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 25: Sweden Europe AUV and ROV Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Sweden Europe AUV and ROV Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 27: Rest of Europe Europe AUV and ROV Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Europe AUV and ROV Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 29: Europe AUV and ROV Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 30: Europe AUV and ROV Market Volume K Unit Forecast, by Vehicle Type 2019 & 2032

- Table 31: Europe AUV and ROV Market Revenue Million Forecast, by Vehicle Class 2019 & 2032

- Table 32: Europe AUV and ROV Market Volume K Unit Forecast, by Vehicle Class 2019 & 2032

- Table 33: Europe AUV and ROV Market Revenue Million Forecast, by Application 2019 & 2032

- Table 34: Europe AUV and ROV Market Volume K Unit Forecast, by Application 2019 & 2032

- Table 35: Europe AUV and ROV Market Revenue Million Forecast, by Activity 2019 & 2032

- Table 36: Europe AUV and ROV Market Volume K Unit Forecast, by Activity 2019 & 2032

- Table 37: Europe AUV and ROV Market Revenue Million Forecast, by Country 2019 & 2032

- Table 38: Europe AUV and ROV Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 39: Europe AUV and ROV Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 40: Europe AUV and ROV Market Volume K Unit Forecast, by Vehicle Type 2019 & 2032

- Table 41: Europe AUV and ROV Market Revenue Million Forecast, by Vehicle Class 2019 & 2032

- Table 42: Europe AUV and ROV Market Volume K Unit Forecast, by Vehicle Class 2019 & 2032

- Table 43: Europe AUV and ROV Market Revenue Million Forecast, by Application 2019 & 2032

- Table 44: Europe AUV and ROV Market Volume K Unit Forecast, by Application 2019 & 2032

- Table 45: Europe AUV and ROV Market Revenue Million Forecast, by Activity 2019 & 2032

- Table 46: Europe AUV and ROV Market Volume K Unit Forecast, by Activity 2019 & 2032

- Table 47: Europe AUV and ROV Market Revenue Million Forecast, by Country 2019 & 2032

- Table 48: Europe AUV and ROV Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 49: Europe AUV and ROV Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 50: Europe AUV and ROV Market Volume K Unit Forecast, by Vehicle Type 2019 & 2032

- Table 51: Europe AUV and ROV Market Revenue Million Forecast, by Vehicle Class 2019 & 2032

- Table 52: Europe AUV and ROV Market Volume K Unit Forecast, by Vehicle Class 2019 & 2032

- Table 53: Europe AUV and ROV Market Revenue Million Forecast, by Application 2019 & 2032

- Table 54: Europe AUV and ROV Market Volume K Unit Forecast, by Application 2019 & 2032

- Table 55: Europe AUV and ROV Market Revenue Million Forecast, by Activity 2019 & 2032

- Table 56: Europe AUV and ROV Market Volume K Unit Forecast, by Activity 2019 & 2032

- Table 57: Europe AUV and ROV Market Revenue Million Forecast, by Country 2019 & 2032

- Table 58: Europe AUV and ROV Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 59: Europe AUV and ROV Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 60: Europe AUV and ROV Market Volume K Unit Forecast, by Vehicle Type 2019 & 2032

- Table 61: Europe AUV and ROV Market Revenue Million Forecast, by Vehicle Class 2019 & 2032

- Table 62: Europe AUV and ROV Market Volume K Unit Forecast, by Vehicle Class 2019 & 2032

- Table 63: Europe AUV and ROV Market Revenue Million Forecast, by Application 2019 & 2032

- Table 64: Europe AUV and ROV Market Volume K Unit Forecast, by Application 2019 & 2032

- Table 65: Europe AUV and ROV Market Revenue Million Forecast, by Activity 2019 & 2032

- Table 66: Europe AUV and ROV Market Volume K Unit Forecast, by Activity 2019 & 2032

- Table 67: Europe AUV and ROV Market Revenue Million Forecast, by Country 2019 & 2032

- Table 68: Europe AUV and ROV Market Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe AUV and ROV Market?

The projected CAGR is approximately 6.37%.

2. Which companies are prominent players in the Europe AUV and ROV Market?

Key companies in the market include DOF Subsea AS, Helix Energy Solutions Group Inc, Bourbon Offshore, Saipem SpA*List Not Exhaustive, Subsea 7 SA, TechnipFMC PLC.

3. What are the main segments of the Europe AUV and ROV Market?

The market segments include Vehicle Type, Vehicle Class, Application, Activity.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Number of Automobiles4.; The Government Policy Regarding Pollution Emission Control Parameters.

6. What are the notable trends driving market growth?

ROV Vehicle Type Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

4.; The Technological Limitations of Air Filters.

8. Can you provide examples of recent developments in the market?

January 2022: Fugro won a contract from Denmark's Energinet to undertake cable route surveys for the North Sea Energy Island project, which will serve as a power plant distributing up to 10 GW of offshore wind to Denmark and other neighboring markets. Fugro will conduct a combination of geophysical, geotechnical services, and laboratory testing using ROV inspections and other geotechnical survey systems.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe AUV and ROV Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe AUV and ROV Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe AUV and ROV Market?

To stay informed about further developments, trends, and reports in the Europe AUV and ROV Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence