Key Insights

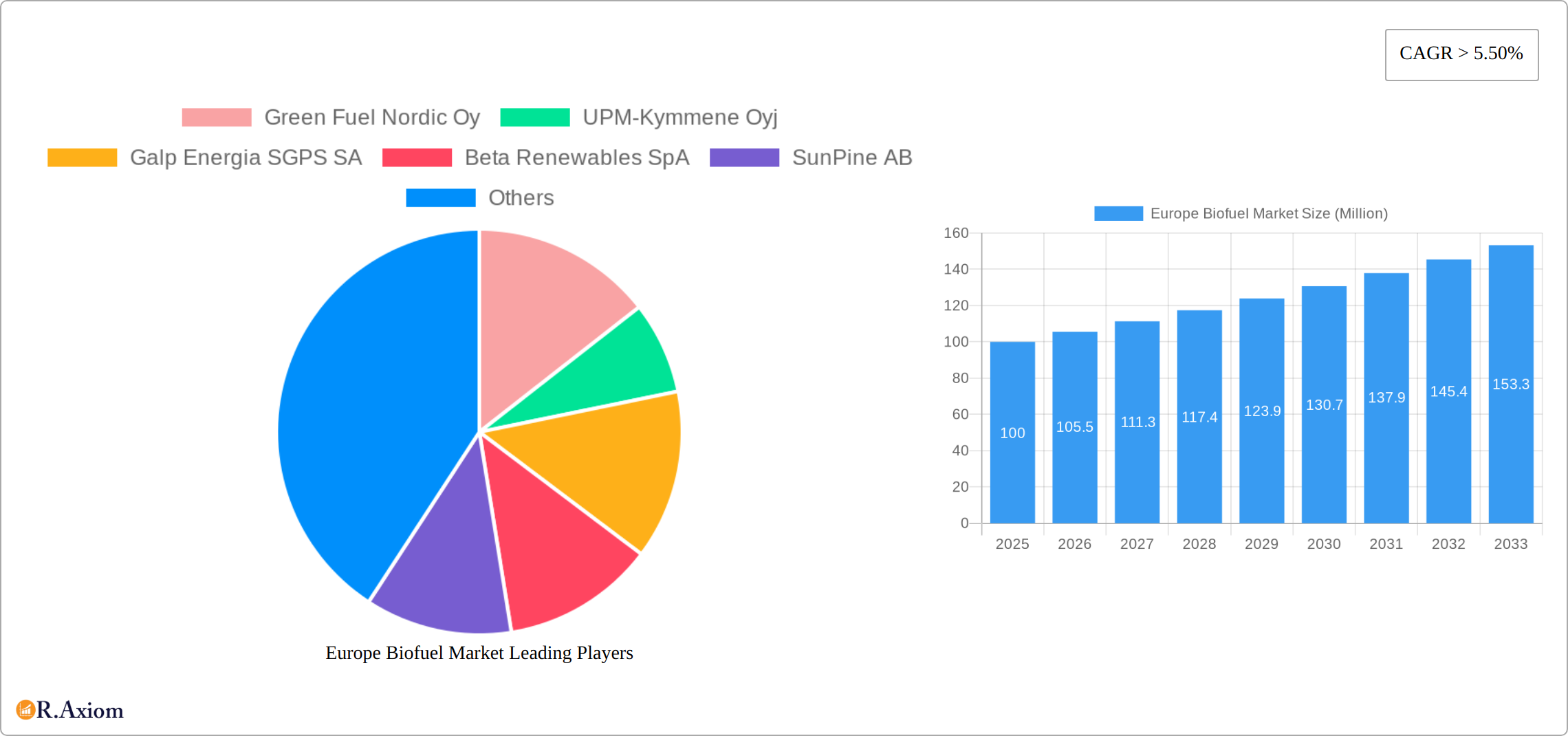

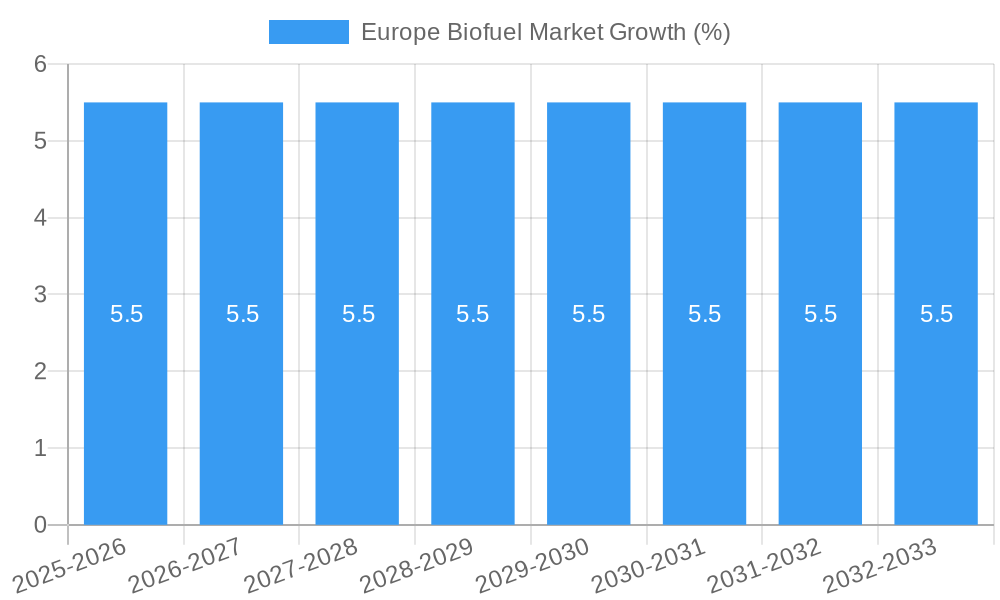

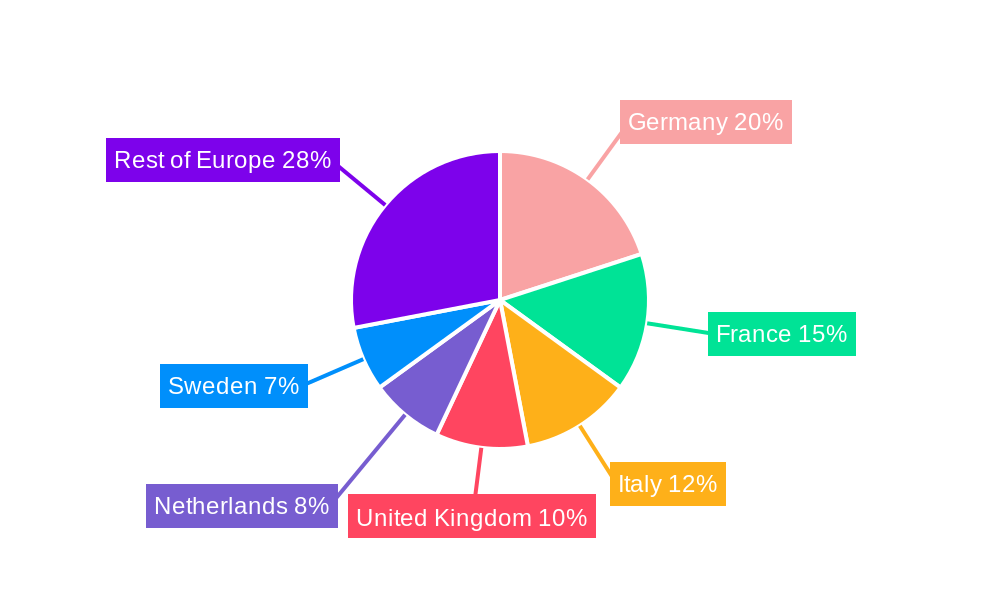

The European biofuel market, valued at approximately €[Estimate based on market size XX and value unit million. For example, if XX were 100, the value would be €100 million in 2025] in 2025, is projected to experience robust growth, exceeding a 5.5% compound annual growth rate (CAGR) through 2033. This expansion is driven by stringent environmental regulations aimed at reducing greenhouse gas emissions from the transportation sector, coupled with increasing consumer demand for sustainable and renewable energy sources. Government incentives, such as subsidies and tax credits for biofuel production and consumption, further bolster market growth. Key feedstocks fueling this market include coarse grains, sugar crops, and vegetable oils, with biodiesel and ethanol representing the dominant biofuel types. The market is geographically concentrated, with Germany, France, Italy, the United Kingdom, and the Netherlands accounting for a significant share of the overall demand. Leading players such as Green Fuel Nordic Oy, UPM-Kymmene Oyj, and Galp Energia SGPS SA are strategically investing in research and development to improve biofuel production efficiency and explore new feedstock options to maintain their competitive edge.

However, market growth is not without its challenges. Fluctuations in agricultural commodity prices and land-use changes associated with biofuel feedstock cultivation represent significant constraints. Furthermore, technological advancements in the development of second-generation biofuels are crucial for overcoming challenges related to feedstock availability and cost-effectiveness. Competition from fossil fuels and the need to ensure biofuel sustainability—avoiding deforestation and promoting biodiversity—also pose ongoing hurdles. Nevertheless, the long-term outlook for the European biofuel market remains positive, driven by unwavering commitment to environmental goals and the ongoing search for renewable energy alternatives. Innovation in feedstock and production technologies will be critical for sustained expansion and meeting the increasing demand for sustainable transportation fuels.

This comprehensive report provides an in-depth analysis of the Europe biofuel market, encompassing historical data (2019-2024), current estimates (2025), and future forecasts (2025-2033). It offers crucial insights for industry stakeholders, investors, and policymakers seeking to navigate this dynamic sector. The report leverages detailed market segmentation, examining key players and emerging trends, to present a holistic view of the European biofuel landscape. With a focus on market concentration, innovation, and future growth potential, this report is an essential resource for understanding and capitalizing on opportunities within the European biofuel market.

Europe Biofuel Market Market Concentration & Innovation

The European biofuel market presents a dynamic interplay of competition, innovation, and regulation. While exhibiting a moderately concentrated structure with several key players commanding significant market share, the presence of numerous smaller, specialized producers fosters a vibrant competitive landscape. This section delves into the market's competitive dynamics, exploring market concentration, innovation drivers, regulatory influences, substitute products, end-user trends, and mergers and acquisitions (M&A) activity.

Innovation within the sector is fueled by the imperative to enhance efficiency, curtail production costs, and develop sustainable feedstock sources. The stringent environmental regulations prevalent across Europe act as powerful catalysts for innovation, compelling companies to adopt cleaner and more efficient biofuel production methods. The diverse availability of feedstocks and the escalating demand for renewable energy sources further contribute to the continuous technological advancements within the industry. M&A activity has played a notable role in shaping the market landscape, although the specific deal values fluctuate yearly, reflecting broader economic and regulatory shifts. While precise figures are often proprietary, estimates suggest a total deal value in the range of xx million over the assessed period.

- Market Share: Dominant players like UPM-Kymmene Oyj and Neste hold substantial market shares, their influence amplified by partnerships and large-scale adoption (e.g., Liebherr's use of Neste MY Renewable Diesel). Smaller players, such as Green Fuel Nordic Oy and SunPine AB, occupy niche positions, often specializing in particular feedstocks or biofuel types. Detailed market share data for individual companies is often considered proprietary information.

- M&A Activity: Recent years have witnessed a moderate level of consolidation, with larger companies strategically acquiring smaller entities to expand production capacity and market reach. The number and scale of deals completed show yearly variation, reflecting the influence of economic fluctuations and regulatory changes.

Europe Biofuel Market Industry Trends & Insights

The Europe biofuel market is experiencing robust growth, driven by stringent environmental regulations promoting renewable energy sources and a growing consumer preference for sustainable transportation fuels. The market's Compound Annual Growth Rate (CAGR) during the forecast period (2025-2033) is estimated at xx%, indicating significant expansion. Market penetration of biofuels is steadily increasing, reaching xx% in 2025 and projected to reach xx% by 2033, as government policies incentivize the use of biofuels and industries seek to reduce their carbon footprint. Technological disruptions, such as the development of advanced biofuel production technologies and improvements in feedstock efficiency, further fuel market growth. Intense competition among established players and emerging startups also drives innovation and improves the overall value proposition for consumers. Consumer preferences are shifting towards sustainable and environmentally friendly products, leading to increased demand for biofuels with lower carbon emissions.

Dominant Markets & Segments in Europe Biofuel Market

The Europe biofuel market showcases regional variations in dominance, with significant production and consumption concentrated in specific areas. While exact data on market dominance across all segments require detailed analysis within the full report, some notable observations can be made.

Feedstock: Vegetable oil currently constitutes a significant portion of feedstock utilized in the European biofuel market due to readily available sources and established supply chains. However, coarse grain and sugar crops are also significant contributors, with their respective importance fluctuating based on agricultural production and pricing.

Type: Biodiesel maintains a significant portion of the market, driven by its compatibility with existing infrastructure and high demand from the transportation sector. Ethanol is also a substantial segment, primarily used as a gasoline additive. Other types of biofuels, like biogas and bio-jet fuel, are emerging with strong growth potential as technology advances and their applications broaden.

- Key Drivers (by Segment):

- Vegetable Oil: Established supply chains, relatively high yield per unit of land, and existing processing infrastructure.

- Coarse Grain: Agricultural abundance in certain European regions, established processing infrastructure.

- Sugar Crops: Strong agricultural base in specific regions, potential for by-product utilization.

- Biodiesel: High demand from the transportation sector, compatibility with existing infrastructure.

- Ethanol: Wide compatibility as a gasoline additive, established production processes.

Europe Biofuel Market Product Developments

Recent product innovations in the European biofuel market focus on enhancing efficiency, reducing emissions, and expanding feedstock options. Advancements in conversion technologies, including enzyme-based processes, are increasing the yield and efficiency of biofuel production. Furthermore, research is ongoing into advanced biofuels derived from non-food sources, promoting sustainable development. These innovations enhance the competitiveness of biofuels against traditional fossil fuels by offering comparable performance with a substantially smaller environmental footprint. The market is witnessing an increased focus on second-generation biofuels, utilizing agricultural residues and waste materials to minimize competition with food production.

Report Scope & Segmentation Analysis

This report segments the European biofuel market based on feedstock (Coarse Grain, Sugar Crop, Vegetable Oil, Other Feedstocks) and type (Biodiesel, Ethanol, Other Types). Each segment's growth projections, market sizes, and competitive dynamics are comprehensively analyzed. For instance, the vegetable oil segment is expected to experience significant growth driven by increased production and readily available supply, while the "Other Feedstocks" segment may present a considerable opportunity given the focus on sustainability and the utilization of waste biomass. Similarly, the biodiesel segment is currently dominant but faces competition from ethanol and other advanced biofuels.

Key Drivers of Europe Biofuel Market Growth

The Europe biofuel market's growth is propelled by several factors. Stringent environmental regulations, like the EU's Renewable Energy Directive, mandate the incorporation of renewable energy sources, including biofuels, in the energy mix. Government incentives and subsidies further promote biofuel adoption. The increasing focus on reducing greenhouse gas emissions and combating climate change is a major driver, pushing both consumers and industries toward greener alternatives. Technological advancements, resulting in enhanced efficiency and cost reductions in biofuel production, have also played a vital role in market expansion.

Challenges in the Europe Biofuel Market Sector

The Europe biofuel market faces several challenges. Fluctuating feedstock prices and supply chain disruptions can impact profitability and stability. Competition from established fossil fuels, coupled with the high initial investment required for biofuel production facilities, present significant barriers to entry for new players. Furthermore, land-use conflicts and concerns regarding food security associated with the use of food crops as feedstock represent ongoing challenges demanding innovative, sustainable solutions.

Emerging Opportunities in Europe Biofuel Market

Emerging opportunities lie in the development of advanced biofuels derived from non-food sources, such as algae and waste biomass. The expansion into new applications, such as bio-jet fuel and bio-plastics, presents significant market potential. Furthermore, the growing demand for sustainable aviation fuel and the potential for carbon capture and storage technologies associated with biofuel production offer exciting prospects for future growth.

Leading Players in the Europe Biofuel Market Market

- Green Fuel Nordic Oy

- UPM-Kymmene Oyj

- Galp Energia SGPS SA

- Beta Renewables SpA

- SunPine AB

- Preem AB

- Svenska Cellulosa AB (Note: This is the research arm; a direct company link wasn't readily found)

- Borregaard ASA

- Biomethanol Chemie Nederland BV

Key Developments in Europe Biofuel Market Industry

March 2022: Rossi Biofuel Zrt, a subsidiary of the ENVIEN Group, inaugurated a new biodiesel plant in Komárom, Hungary, with a capacity of 60,000 tons per annum, increasing its total biodiesel production capacity to 210,000 tons per annum. This expansion signifies growing investment and production capacity in the European biofuel sector.

January 2022: Liebherr, a major equipment manufacturer, announced plans to increase its use of Neste MY Renewable Diesel at its Kirchdorf, Germany plant. This showcases the growing adoption of renewable diesel by large industrial consumers, stimulating demand for sustainable fuels.

January 2022: Repsol SA selected Honeywell Technologies to supply an integrated control and safety system (ICSS) for Spain's first advanced biofuel production plant. This highlights the technological advancements and growing investments in advanced biofuel production within Europe.

Strategic Outlook for Europe Biofuel Market Market

The Europe biofuel market holds immense potential for future growth, driven by sustained demand for renewable energy and tightening environmental regulations. Technological advancements, increasing efficiency, and the development of advanced biofuels derived from sustainable feedstocks will further stimulate expansion. Continued government support and investment in research and development will play a key role in fostering the market's evolution. The market is poised for significant expansion as it continues to adapt to evolving environmental concerns and technological breakthroughs.

Europe Biofuel Market Segmentation

-

1. Type

- 1.1. Biodiesel

- 1.2. Ethanol

- 1.3. Other Types

-

2. Feedstock

- 2.1. Coarse Grain

- 2.2. Sugar Crop

- 2.3. Vegetable Oil

- 2.4. Other Feedstocks

Europe Biofuel Market Segmentation By Geography

- 1. Germany

- 2. United Kingdom

- 3. France

- 4. Rest of Europe

Europe Biofuel Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 5.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Favorable Government Policies4.; Reduced Cost of Solar Energy Systems

- 3.3. Market Restrains

- 3.3.1. 4.; Lack of Financing Options Coupled with Difficulties in Integrating Residential Solar PV Systems in Regions like Africa

- 3.4. Market Trends

- 3.4.1. Biodiesel is Likely to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Biofuel Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Biodiesel

- 5.1.2. Ethanol

- 5.1.3. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Feedstock

- 5.2.1. Coarse Grain

- 5.2.2. Sugar Crop

- 5.2.3. Vegetable Oil

- 5.2.4. Other Feedstocks

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.3.2. United Kingdom

- 5.3.3. France

- 5.3.4. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Germany Europe Biofuel Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Biodiesel

- 6.1.2. Ethanol

- 6.1.3. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Feedstock

- 6.2.1. Coarse Grain

- 6.2.2. Sugar Crop

- 6.2.3. Vegetable Oil

- 6.2.4. Other Feedstocks

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. United Kingdom Europe Biofuel Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Biodiesel

- 7.1.2. Ethanol

- 7.1.3. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Feedstock

- 7.2.1. Coarse Grain

- 7.2.2. Sugar Crop

- 7.2.3. Vegetable Oil

- 7.2.4. Other Feedstocks

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. France Europe Biofuel Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Biodiesel

- 8.1.2. Ethanol

- 8.1.3. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Feedstock

- 8.2.1. Coarse Grain

- 8.2.2. Sugar Crop

- 8.2.3. Vegetable Oil

- 8.2.4. Other Feedstocks

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of Europe Europe Biofuel Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Biodiesel

- 9.1.2. Ethanol

- 9.1.3. Other Types

- 9.2. Market Analysis, Insights and Forecast - by Feedstock

- 9.2.1. Coarse Grain

- 9.2.2. Sugar Crop

- 9.2.3. Vegetable Oil

- 9.2.4. Other Feedstocks

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Germany Europe Biofuel Market Analysis, Insights and Forecast, 2019-2031

- 11. France Europe Biofuel Market Analysis, Insights and Forecast, 2019-2031

- 12. Italy Europe Biofuel Market Analysis, Insights and Forecast, 2019-2031

- 13. United Kingdom Europe Biofuel Market Analysis, Insights and Forecast, 2019-2031

- 14. Netherlands Europe Biofuel Market Analysis, Insights and Forecast, 2019-2031

- 15. Sweden Europe Biofuel Market Analysis, Insights and Forecast, 2019-2031

- 16. Rest of Europe Europe Biofuel Market Analysis, Insights and Forecast, 2019-2031

- 17. Competitive Analysis

- 17.1. Market Share Analysis 2024

- 17.2. Company Profiles

- 17.2.1 Green Fuel Nordic Oy

- 17.2.1.1. Overview

- 17.2.1.2. Products

- 17.2.1.3. SWOT Analysis

- 17.2.1.4. Recent Developments

- 17.2.1.5. Financials (Based on Availability)

- 17.2.2 UPM-Kymmene Oyj

- 17.2.2.1. Overview

- 17.2.2.2. Products

- 17.2.2.3. SWOT Analysis

- 17.2.2.4. Recent Developments

- 17.2.2.5. Financials (Based on Availability)

- 17.2.3 Galp Energia SGPS SA

- 17.2.3.1. Overview

- 17.2.3.2. Products

- 17.2.3.3. SWOT Analysis

- 17.2.3.4. Recent Developments

- 17.2.3.5. Financials (Based on Availability)

- 17.2.4 Beta Renewables SpA

- 17.2.4.1. Overview

- 17.2.4.2. Products

- 17.2.4.3. SWOT Analysis

- 17.2.4.4. Recent Developments

- 17.2.4.5. Financials (Based on Availability)

- 17.2.5 SunPine AB

- 17.2.5.1. Overview

- 17.2.5.2. Products

- 17.2.5.3. SWOT Analysis

- 17.2.5.4. Recent Developments

- 17.2.5.5. Financials (Based on Availability)

- 17.2.6 Preem AB

- 17.2.6.1. Overview

- 17.2.6.2. Products

- 17.2.6.3. SWOT Analysis

- 17.2.6.4. Recent Developments

- 17.2.6.5. Financials (Based on Availability)

- 17.2.7 Svenska Cellulosa AB

- 17.2.7.1. Overview

- 17.2.7.2. Products

- 17.2.7.3. SWOT Analysis

- 17.2.7.4. Recent Developments

- 17.2.7.5. Financials (Based on Availability)

- 17.2.8 Borregaard ASA*List Not Exhaustive

- 17.2.8.1. Overview

- 17.2.8.2. Products

- 17.2.8.3. SWOT Analysis

- 17.2.8.4. Recent Developments

- 17.2.8.5. Financials (Based on Availability)

- 17.2.9 Biomethanol Chemie Nederland BV

- 17.2.9.1. Overview

- 17.2.9.2. Products

- 17.2.9.3. SWOT Analysis

- 17.2.9.4. Recent Developments

- 17.2.9.5. Financials (Based on Availability)

- 17.2.1 Green Fuel Nordic Oy

List of Figures

- Figure 1: Europe Biofuel Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Biofuel Market Share (%) by Company 2024

List of Tables

- Table 1: Europe Biofuel Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Biofuel Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Europe Biofuel Market Revenue Million Forecast, by Feedstock 2019 & 2032

- Table 4: Europe Biofuel Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Europe Biofuel Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Germany Europe Biofuel Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: France Europe Biofuel Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Italy Europe Biofuel Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: United Kingdom Europe Biofuel Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Netherlands Europe Biofuel Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Sweden Europe Biofuel Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Europe Europe Biofuel Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Europe Biofuel Market Revenue Million Forecast, by Type 2019 & 2032

- Table 14: Europe Biofuel Market Revenue Million Forecast, by Feedstock 2019 & 2032

- Table 15: Europe Biofuel Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Europe Biofuel Market Revenue Million Forecast, by Type 2019 & 2032

- Table 17: Europe Biofuel Market Revenue Million Forecast, by Feedstock 2019 & 2032

- Table 18: Europe Biofuel Market Revenue Million Forecast, by Country 2019 & 2032

- Table 19: Europe Biofuel Market Revenue Million Forecast, by Type 2019 & 2032

- Table 20: Europe Biofuel Market Revenue Million Forecast, by Feedstock 2019 & 2032

- Table 21: Europe Biofuel Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Europe Biofuel Market Revenue Million Forecast, by Type 2019 & 2032

- Table 23: Europe Biofuel Market Revenue Million Forecast, by Feedstock 2019 & 2032

- Table 24: Europe Biofuel Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Biofuel Market?

The projected CAGR is approximately > 5.50%.

2. Which companies are prominent players in the Europe Biofuel Market?

Key companies in the market include Green Fuel Nordic Oy, UPM-Kymmene Oyj, Galp Energia SGPS SA, Beta Renewables SpA, SunPine AB, Preem AB, Svenska Cellulosa AB, Borregaard ASA*List Not Exhaustive, Biomethanol Chemie Nederland BV.

3. What are the main segments of the Europe Biofuel Market?

The market segments include Type, Feedstock.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Favorable Government Policies4.; Reduced Cost of Solar Energy Systems.

6. What are the notable trends driving market growth?

Biodiesel is Likely to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Lack of Financing Options Coupled with Difficulties in Integrating Residential Solar PV Systems in Regions like Africa.

8. Can you provide examples of recent developments in the market?

March 2022: Rossi Biofuel Zrt, a subsidiary of the ENVIEN Group, inaugurated a new biodiesel plant in Hungary. This plant was built by BDI-BioEnergy International GmbH. The facility is a multi-feedstock plant in Komárom, Hungary. The new plant has a capacity of 60,000 tons per annum, and thus, the total biodiesel production capacity of the company has increased from 150,000 to 210,000 tons per annum.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Biofuel Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Biofuel Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Biofuel Market?

To stay informed about further developments, trends, and reports in the Europe Biofuel Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence