Key Insights

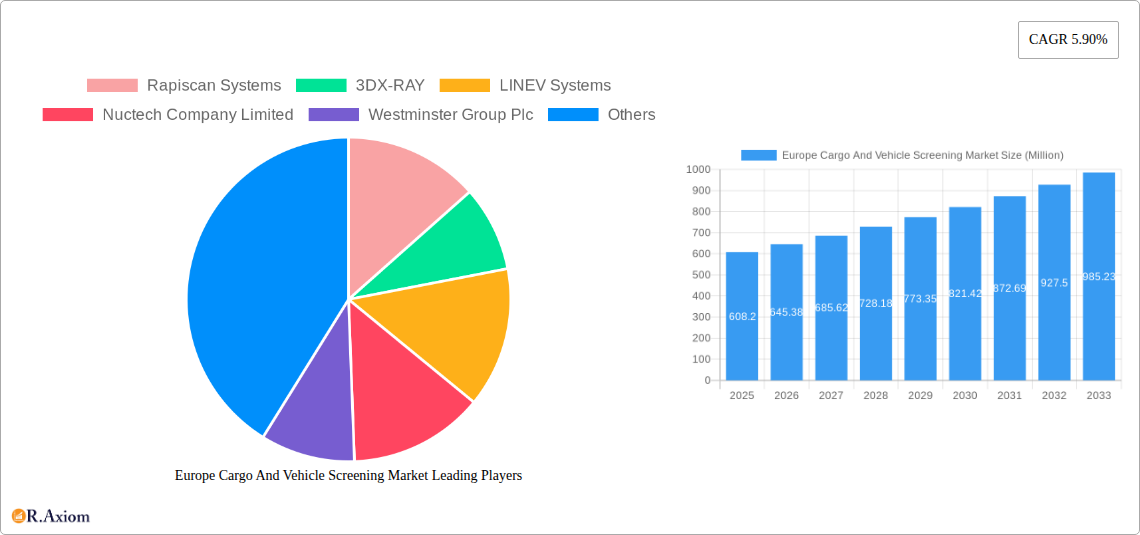

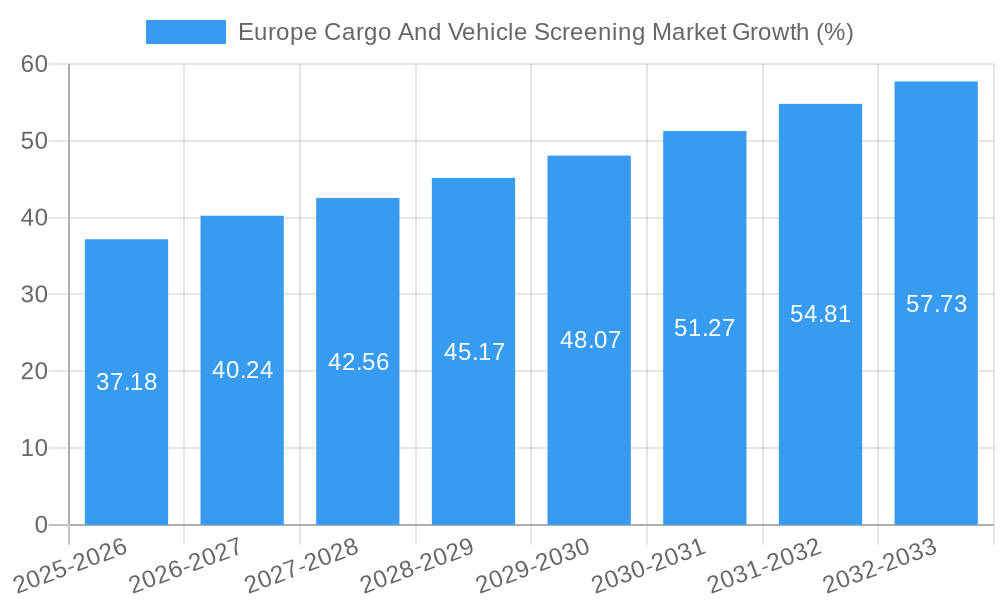

The Europe Cargo and Vehicle Screening market, valued at €608.20 million in 2025, is projected to experience robust growth, driven by increasing security concerns across borders and within transportation hubs. A Compound Annual Growth Rate (CAGR) of 5.90% from 2025 to 2033 indicates a significant market expansion. This growth is fueled by several key factors. Firstly, heightened regulatory scrutiny and stringent security protocols post-pandemic and the evolving geopolitical landscape are mandating enhanced screening technologies across various sectors, including logistics, transportation, and border control. Secondly, technological advancements in screening technologies—such as improved X-ray systems, millimeter-wave scanners, and advanced analytics—are enhancing detection capabilities and efficiency, driving adoption. Furthermore, the rising adoption of automated and AI-powered screening solutions promises to streamline operations and improve accuracy, further fueling market expansion. Leading players such as Rapiscan Systems, 3DX-RAY, and Smiths Detection are investing significantly in research and development, contributing to innovation and market growth. However, high initial investment costs associated with implementing new technologies and the ongoing need for skilled personnel to operate and maintain these systems may pose challenges to wider market penetration.

The market segmentation, although not explicitly provided, likely encompasses various screening technologies (e.g., X-ray, millimeter-wave, explosives trace detection), vehicle types (e.g., trucks, cars, trains), and end-user sectors (e.g., airports, seaports, border control agencies). Regional variations within Europe are expected, with regions experiencing higher levels of trade and tourism likely demonstrating faster growth. The forecast period of 2025-2033 provides ample opportunity for companies to capitalize on the growing demand for advanced and reliable cargo and vehicle screening solutions. Future market success will hinge on companies' abilities to offer innovative, cost-effective solutions tailored to specific security needs and regulatory requirements. The competitive landscape is characterized by both established players and emerging innovators, leading to intense competition and a focus on technological differentiation.

This comprehensive report provides an in-depth analysis of the Europe Cargo and Vehicle Screening Market, covering the period from 2019 to 2033. It offers actionable insights into market dynamics, competitive landscape, and future growth opportunities, empowering stakeholders to make informed strategic decisions. The report utilizes data from 2019-2024 (Historical Period), with 2025 serving as the Base Year and Estimated Year. The forecast period extends from 2025 to 2033.

Europe Cargo and Vehicle Screening Market: Market Concentration & Innovation

The European cargo and vehicle screening market exhibits a moderately consolidated structure, with a few major players holding significant market share. While exact market share figures for each company are proprietary and vary across segments, leading companies such as Rapiscan Systems, 3DX-RAY, and Smiths Detection Group Ltd. likely hold a combined xx% share in 2025. However, the market also features numerous smaller, specialized providers, indicating a dynamic competitive landscape.

Innovation is a key driver, fueled by advancements in technologies like AI-powered threat detection, improved image processing, and the development of more efficient and compact screening systems. Stringent regulatory frameworks, particularly concerning security and data privacy within the EU, heavily influence market innovation. The market faces some substitution pressure from alternative security technologies, although their effectiveness and cost-effectiveness often fall short of dedicated screening systems. End-user trends indicate a growing preference for integrated systems offering comprehensive screening capabilities and data analytics. Mergers and acquisitions (M&A) activities have played a role in shaping market consolidation, with deal values in recent years reaching up to xx Million USD (estimated). Examples include strategic partnerships focused on technology integration and geographical expansion.

Europe Cargo and Vehicle Screening Market: Industry Trends & Insights

The Europe Cargo and Vehicle Screening Market is poised for robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is driven by several factors. Increased security concerns in the wake of geopolitical instability and terrorist threats are paramount, demanding more sophisticated screening solutions. Furthermore, growing e-commerce necessitates efficient and secure cargo handling, stimulating demand. Technological advancements, specifically AI and advanced imaging techniques, are enhancing the accuracy and speed of screening processes, driving market penetration. However, economic fluctuations and supply chain disruptions can influence market growth, and competitive dynamics are intense, with players continuously striving for differentiation through innovation and strategic partnerships. Market penetration for advanced technologies, like AI-powered screening, is projected to reach xx% by 2033.

Dominant Markets & Segments in Europe Cargo and Vehicle Screening Market

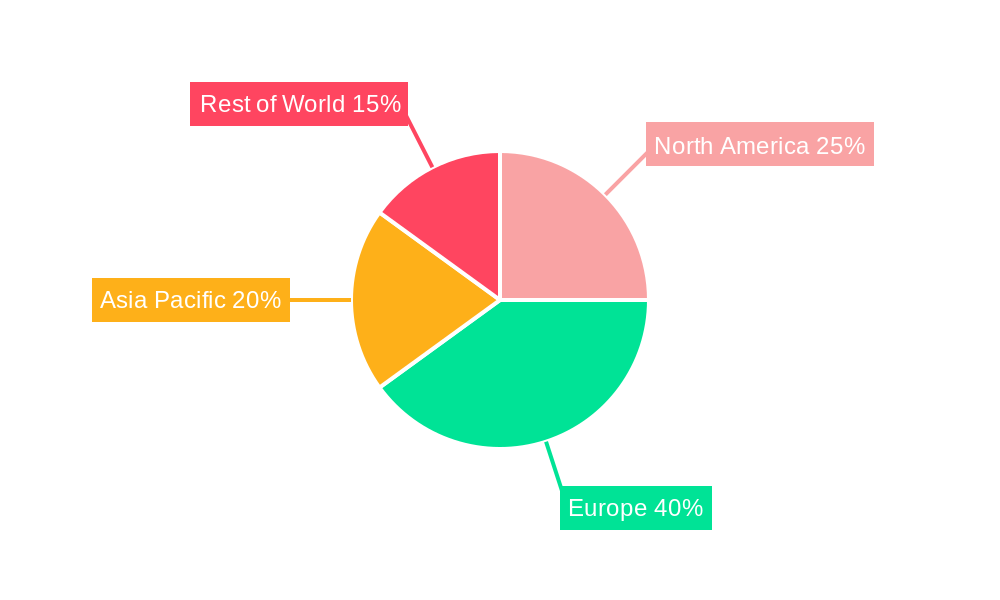

Leading Region: Western Europe is the dominant region within the European market due to high investments in security infrastructure, stringent regulatory requirements, and high traffic volumes at major airports and ports.

Leading Country: Germany likely holds the largest market share among European countries due to its robust economy, extensive logistics infrastructure, and strategic location within Europe.

Leading Segment: The cargo screening segment is expected to dominate owing to the significant increase in global trade and the associated need for efficient and secure screening procedures. The vehicle screening segment also experiences notable growth fueled by security concerns at border crossings and high-profile events.

Key Drivers for Dominance:

- Robust economic conditions: Strong economies fuel investments in advanced security infrastructure.

- Stringent security regulations: Strict compliance requirements drive adoption of technologically advanced screening solutions.

- Well-developed infrastructure: Extensive transportation networks facilitate the deployment and utilization of screening systems.

- Strategic geopolitical position: Germany's central location in Europe attracts high volumes of cargo and vehicle traffic.

Europe Cargo and Vehicle Screening Market: Product Developments

Recent product innovations focus on enhancing speed, accuracy, and efficiency of screening processes. AI-powered systems offer improved threat detection and reduced false positives. Compact and modular designs are gaining traction for ease of deployment and integration into existing infrastructure. The market sees competition based on technology (e.g., X-ray, millimeter-wave), ease of use, integration capabilities, and cost-effectiveness. These developments are designed to meet the growing demand for efficient and secure screening solutions while adapting to evolving security threats and regulatory changes.

Report Scope & Segmentation Analysis

This report segments the Europe Cargo and Vehicle Screening Market by:

Technology: X-ray, millimeter-wave, and other technologies. The X-ray segment is expected to hold the largest market share initially, but millimeter-wave technology is projected to grow at a faster rate due to its non-ionizing radiation.

Application: Cargo screening and vehicle screening. The cargo segment is expected to dominate initially, though vehicle screening is expected to show rapid growth.

End-user: Airports, ports, border control agencies, and others. Airports and ports will remain major end-users due to high traffic volumes.

Geography: The report covers key European countries, broken down by region.

Growth projections for each segment vary, with X-ray and cargo screening anticipated to witness substantial growth throughout the forecast period. Competitive dynamics are influenced by technological advancements, regulatory compliance, and cost-effectiveness.

Key Drivers of Europe Cargo and Vehicle Screening Market Growth

Several factors propel market growth:

- Heightened security concerns: Rising global threats necessitate advanced screening technologies.

- Stringent regulations: EU directives mandate improved security measures for cargo and vehicles.

- E-commerce expansion: Increased online shopping drives a surge in cargo shipments, requiring efficient screening.

- Technological advancements: AI and improved imaging enhance detection accuracy and speed.

Challenges in the Europe Cargo and Vehicle Screening Market Sector

Challenges include:

- High initial investment costs: Advanced screening systems require substantial upfront investments.

- Regulatory complexities: Navigating diverse and evolving EU regulations can be difficult.

- Supply chain disruptions: Global events can impact the availability of components and lead to delays.

- Intense competition: A competitive landscape pressures profit margins. The market experiences price pressures in specific segments.

Emerging Opportunities in Europe Cargo and Vehicle Screening Market

Emerging opportunities include:

- Integration of AI and machine learning: This enhances threat detection and reduces false positives.

- Development of compact and portable screening systems: This improves accessibility and deployment flexibility.

- Expansion into new markets: The market offers expansion opportunities in less developed European regions and specific applications.

- Focus on cybersecurity: Secure data management and protection are becoming crucial aspects of these systems.

Leading Players in the Europe Cargo and Vehicle Screening Market Market

- Rapiscan Systems

- 3DX-RAY

- LINEV Systems

- Nuctech Company Limited

- Westminster Group Plc

- Leidos Inc

- OSI Systems

- Braun & Co Limited

- Smiths Detection Group Ltd

- Vantage Security

- Intertek Group plc

- MION Technologies

- L3 Security & Detection Systems

- List Not Exhaustive

Key Developments in Europe Cargo and Vehicle Screening Market Industry

- September 2023: Leidos partnered with Sofia Airport in Bulgaria to enhance hold baggage screening systems, aligning with EU regulations.

- March 2024: OSI Systems secured a USD 5 Million contract to deploy 920CT baggage screening technology at a major European airport.

Strategic Outlook for Europe Cargo and Vehicle Screening Market Market

The Europe Cargo and Vehicle Screening Market presents significant growth potential driven by ongoing security concerns, evolving regulations, and technological advancements. The market is expected to continue its expansion, fueled by increasing adoption of advanced screening technologies and the demand for improved security measures across various sectors. Opportunities exist for companies that can offer innovative, cost-effective solutions that meet the evolving needs of end-users and comply with stringent regulatory requirements. Strategic partnerships and technological innovation will play crucial roles in shaping the future of this dynamic market.

Europe Cargo And Vehicle Screening Market Segmentation

-

1. Type of Screening System

- 1.1. Stationary Screening

- 1.2. Mobile Screening

-

2. End User Vertical

- 2.1. Airports

- 2.2. Ports and Borders

- 2.3. Government and Defense

- 2.4. Critical Infrastructure

- 2.5. Commercial

Europe Cargo And Vehicle Screening Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Cargo And Vehicle Screening Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.90% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Need to Improve Air Cargo Security and Superior Threat Detection; The Rising Need to Deteriorate the Impact of Terrorist Activities in EU

- 3.3. Market Restrains

- 3.3.1. Rising Need to Improve Air Cargo Security and Superior Threat Detection; The Rising Need to Deteriorate the Impact of Terrorist Activities in EU

- 3.4. Market Trends

- 3.4.1. Mobile Screening Devices to Witness Substantial Growth in Demand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Cargo And Vehicle Screening Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type of Screening System

- 5.1.1. Stationary Screening

- 5.1.2. Mobile Screening

- 5.2. Market Analysis, Insights and Forecast - by End User Vertical

- 5.2.1. Airports

- 5.2.2. Ports and Borders

- 5.2.3. Government and Defense

- 5.2.4. Critical Infrastructure

- 5.2.5. Commercial

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Type of Screening System

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Rapiscan Systems

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 3DX-RAY

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 LINEV Systems

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Nuctech Company Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Westminster Group Plc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Leidos Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 OSI Systems

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Braun & Co Limited

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Smiths Detection Group Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Vantage Security

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Intertek Group plc

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 MION Technologies

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 L3 Security & Detection Systems*List Not Exhaustive

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 Rapiscan Systems

List of Figures

- Figure 1: Europe Cargo And Vehicle Screening Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Cargo And Vehicle Screening Market Share (%) by Company 2024

List of Tables

- Table 1: Europe Cargo And Vehicle Screening Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Cargo And Vehicle Screening Market Volume Million Forecast, by Region 2019 & 2032

- Table 3: Europe Cargo And Vehicle Screening Market Revenue Million Forecast, by Type of Screening System 2019 & 2032

- Table 4: Europe Cargo And Vehicle Screening Market Volume Million Forecast, by Type of Screening System 2019 & 2032

- Table 5: Europe Cargo And Vehicle Screening Market Revenue Million Forecast, by End User Vertical 2019 & 2032

- Table 6: Europe Cargo And Vehicle Screening Market Volume Million Forecast, by End User Vertical 2019 & 2032

- Table 7: Europe Cargo And Vehicle Screening Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Europe Cargo And Vehicle Screening Market Volume Million Forecast, by Region 2019 & 2032

- Table 9: Europe Cargo And Vehicle Screening Market Revenue Million Forecast, by Type of Screening System 2019 & 2032

- Table 10: Europe Cargo And Vehicle Screening Market Volume Million Forecast, by Type of Screening System 2019 & 2032

- Table 11: Europe Cargo And Vehicle Screening Market Revenue Million Forecast, by End User Vertical 2019 & 2032

- Table 12: Europe Cargo And Vehicle Screening Market Volume Million Forecast, by End User Vertical 2019 & 2032

- Table 13: Europe Cargo And Vehicle Screening Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Europe Cargo And Vehicle Screening Market Volume Million Forecast, by Country 2019 & 2032

- Table 15: United Kingdom Europe Cargo And Vehicle Screening Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: United Kingdom Europe Cargo And Vehicle Screening Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 17: Germany Europe Cargo And Vehicle Screening Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Germany Europe Cargo And Vehicle Screening Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 19: France Europe Cargo And Vehicle Screening Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: France Europe Cargo And Vehicle Screening Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 21: Italy Europe Cargo And Vehicle Screening Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Italy Europe Cargo And Vehicle Screening Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 23: Spain Europe Cargo And Vehicle Screening Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Spain Europe Cargo And Vehicle Screening Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 25: Netherlands Europe Cargo And Vehicle Screening Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Netherlands Europe Cargo And Vehicle Screening Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 27: Belgium Europe Cargo And Vehicle Screening Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Belgium Europe Cargo And Vehicle Screening Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 29: Sweden Europe Cargo And Vehicle Screening Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Sweden Europe Cargo And Vehicle Screening Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 31: Norway Europe Cargo And Vehicle Screening Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Norway Europe Cargo And Vehicle Screening Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 33: Poland Europe Cargo And Vehicle Screening Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Poland Europe Cargo And Vehicle Screening Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 35: Denmark Europe Cargo And Vehicle Screening Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Denmark Europe Cargo And Vehicle Screening Market Volume (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Cargo And Vehicle Screening Market?

The projected CAGR is approximately 5.90%.

2. Which companies are prominent players in the Europe Cargo And Vehicle Screening Market?

Key companies in the market include Rapiscan Systems, 3DX-RAY, LINEV Systems, Nuctech Company Limited, Westminster Group Plc, Leidos Inc, OSI Systems, Braun & Co Limited, Smiths Detection Group Ltd, Vantage Security, Intertek Group plc, MION Technologies, L3 Security & Detection Systems*List Not Exhaustive.

3. What are the main segments of the Europe Cargo And Vehicle Screening Market?

The market segments include Type of Screening System, End User Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 608.20 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Need to Improve Air Cargo Security and Superior Threat Detection; The Rising Need to Deteriorate the Impact of Terrorist Activities in EU.

6. What are the notable trends driving market growth?

Mobile Screening Devices to Witness Substantial Growth in Demand.

7. Are there any restraints impacting market growth?

Rising Need to Improve Air Cargo Security and Superior Threat Detection; The Rising Need to Deteriorate the Impact of Terrorist Activities in EU.

8. Can you provide examples of recent developments in the market?

March 2024 - OSI Systems Inc. announced a significant milestone as its Security division secured a USD 5 million contract. The deal entails deploying 920CT baggage screening technology at key passenger checkpoints within a prominent European international airport.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Cargo And Vehicle Screening Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Cargo And Vehicle Screening Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Cargo And Vehicle Screening Market?

To stay informed about further developments, trends, and reports in the Europe Cargo And Vehicle Screening Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence