Key Insights

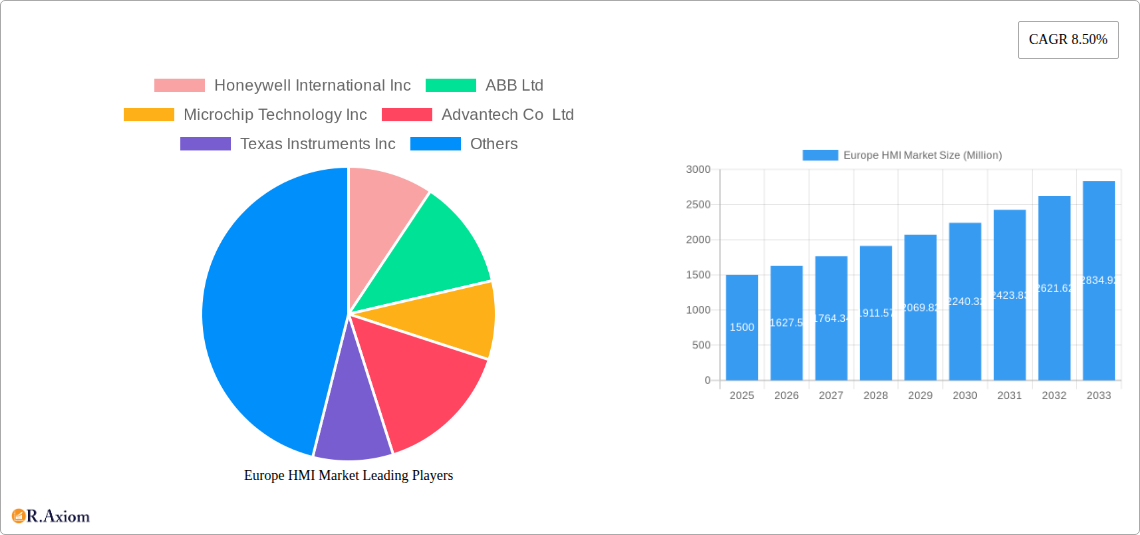

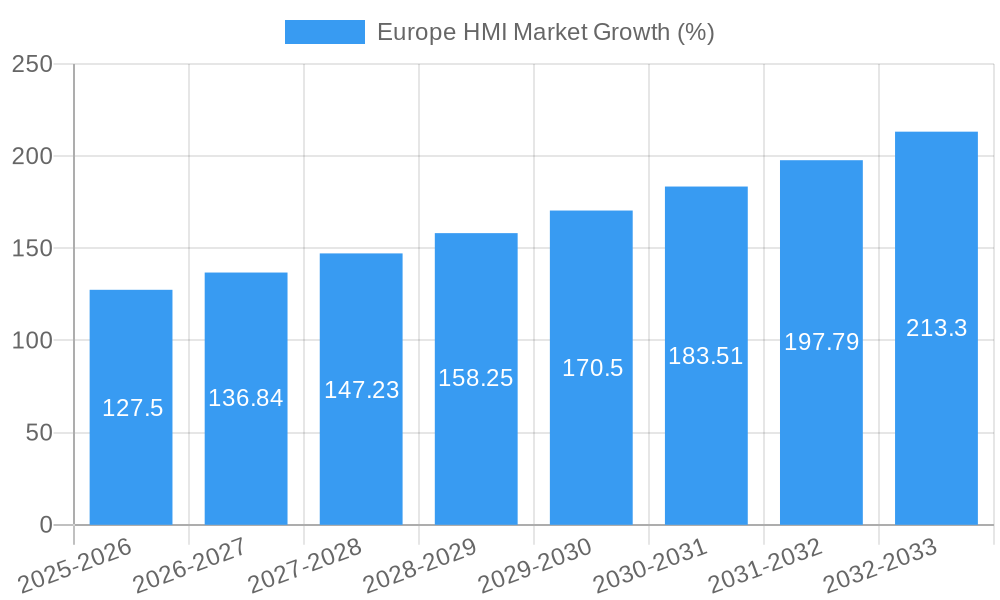

The European Human-Machine Interface (HMI) market is experiencing robust growth, driven by increasing automation across diverse industries and the rising adoption of Industry 4.0 technologies. The market, valued at approximately €1.5 billion in 2025, is projected to exhibit a Compound Annual Growth Rate (CAGR) of 8.5% from 2025 to 2033, reaching an estimated €3.1 billion by 2033. This expansion is fueled by several key factors. Firstly, the automotive sector's continuous push for advanced driver-assistance systems (ADAS) and electric vehicle (EV) development significantly boosts HMI demand. Secondly, the food and beverage, pharmaceutical, and packaging industries are increasingly adopting sophisticated HMI solutions for enhanced process control, improved efficiency, and better quality assurance. Furthermore, the growing need for real-time data monitoring and analysis across various industrial processes is driving the adoption of advanced HMI technologies, including cloud-based and AI-powered solutions. The market is segmented by offering type (hardware, software, services) and end-user industry, with Germany, France, and the United Kingdom representing the largest regional markets within Europe.

However, market growth faces certain restraints. The high initial investment cost of implementing advanced HMI systems can be a barrier for smaller companies. Additionally, the complexity of integrating HMI systems with existing legacy systems and the need for skilled personnel to manage and maintain these systems pose challenges. Despite these limitations, the long-term outlook for the European HMI market remains positive, driven by ongoing technological advancements, increasing digitalization across industries, and the growing demand for improved operational efficiency and productivity. Competition is intense, with major players like Honeywell, ABB, and Siemens vying for market share through innovation and strategic partnerships. The continuous development of user-friendly interfaces and the integration of artificial intelligence (AI) and machine learning (ML) are expected to further shape the market's trajectory in the coming years.

This in-depth report provides a comprehensive analysis of the Europe HMI (Human-Machine Interface) market, covering the period 2019-2033. It offers valuable insights into market dynamics, segmentation, key players, and future growth opportunities, enabling stakeholders to make informed strategic decisions. The report incorporates extensive data analysis, covering market size, growth rates, and competitive landscapes, and features forecasts up to 2033.

Europe HMI Market Concentration & Innovation

The European HMI market is characterized by a moderately concentrated landscape, with several major players holding significant market share. Honeywell International Inc., ABB Ltd., and Siemens AG are among the leading companies, collectively accounting for an estimated xx% of the market in 2025. However, the market also features a number of smaller, specialized firms, fostering innovation and competition.

Market innovation is driven by several factors:

- Advancements in technology: The integration of artificial intelligence (AI), machine learning (ML), and the Internet of Things (IoT) is transforming HMI systems, leading to more intuitive and efficient interfaces.

- Growing demand for automation: Across various end-user industries, automation is driving the adoption of advanced HMI solutions for improved process control and efficiency.

- Stringent regulatory frameworks: Compliance with industry-specific regulations (e.g., safety standards in automotive and pharmaceutical sectors) is pushing the development of sophisticated and secure HMI systems.

- Emergence of substitute technologies: While traditional HMI technologies remain dominant, the rise of virtual and augmented reality (VR/AR) interfaces is gradually impacting the market.

- End-user trends: The increasing demand for user-friendly, customizable, and mobile-accessible HMI systems is shaping product development and market dynamics.

Mergers and acquisitions (M&A) activity has been moderate in recent years, with deal values totaling approximately xx Million in 2024. These activities are primarily focused on expanding product portfolios, strengthening technological capabilities, and gaining access to new markets.

Europe HMI Market Industry Trends & Insights

The Europe HMI market is experiencing robust growth, driven by increasing industrial automation, digitalization initiatives, and the growing adoption of Industry 4.0 technologies. The market exhibited a CAGR of xx% during the historical period (2019-2024) and is projected to maintain a healthy growth trajectory during the forecast period (2025-2033), with a projected CAGR of xx%. This growth is largely attributed to several key factors:

- Rising demand for advanced process control and monitoring: Across industries like automotive, food and beverage, and pharmaceuticals, the need for precise control and real-time monitoring of operations is fuelling HMI adoption.

- Technological advancements: The integration of AI, cloud computing, and big data analytics into HMI systems is leading to more intelligent and data-driven decision-making capabilities.

- Enhanced user experience: Modern HMI systems are increasingly designed with intuitive interfaces and user-friendly features, catering to the demands of a diverse workforce.

- Competitive landscape: The presence of numerous established players and innovative startups is fostering a dynamic and competitive environment, resulting in continuous product innovation and price optimization.

- Government initiatives: Policy support for digitalization and industrial automation in several European countries is accelerating HMI market adoption. Market penetration for advanced HMI technologies is steadily increasing, reaching approximately xx% in 2025.

Dominant Markets & Segments in Europe HMI Market

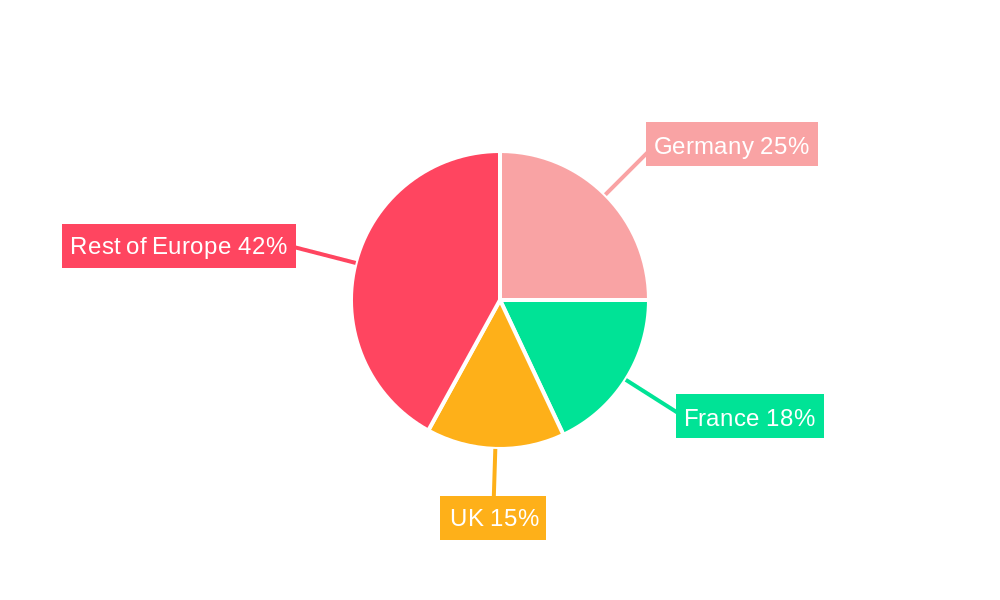

The automotive industry remains the largest end-user segment for HMI systems in Europe, owing to the increasing complexity of vehicle electronics and the growing need for driver-assistance systems. Germany, followed by the United Kingdom and France, represent the largest national markets, primarily due to their strong manufacturing sectors and significant investments in industrial automation.

Key Drivers for Dominant Segments and Countries:

- Automotive: High vehicle production, stringent safety regulations, and advancements in autonomous driving technology.

- Germany: Strong industrial base, high technological expertise, and government support for digitalization.

- United Kingdom: Significant investments in manufacturing automation and growing adoption of smart factory technologies.

- France: Increasing demand for advanced HMI systems across various industries, particularly in the automotive and energy sectors.

Dominance Analysis: Germany's well-established automotive and manufacturing industries contribute significantly to its leading position in the European HMI market. The UK and France also hold substantial market shares, fueled by their relatively advanced industrial infrastructure and ongoing investments in digitalization initiatives. The rest of Europe is expected to experience steady growth, driven by increasing automation adoption across various industrial sectors.

Europe HMI Market Product Developments

Recent product innovations focus on improved user interfaces, enhanced connectivity, and integration with advanced analytics platforms. This includes the development of intuitive touchscreens, voice-controlled interfaces, and augmented reality overlays for improved operator interaction. These developments offer significant competitive advantages, facilitating improved operational efficiency and enhanced safety across diverse applications. The focus is on creating HMI systems that are more user-friendly, adaptable, and integrated with other industrial automation components.

Report Scope & Segmentation Analysis

This report segments the Europe HMI market based on:

Type of Offering:

- Hardware: This segment includes panels, displays, controllers, and other physical components. The market is estimated at xx Million in 2025, with projected growth driven by increasing demand for advanced display technologies and robust industrial hardware.

- Software: This segment comprises HMI software platforms, development tools, and related applications. This segment is projected to witness significant growth, fueled by advancements in software functionality and ease of integration with other systems, with a value of xx Million in 2025.

- Services: This includes installation, maintenance, and support services for HMI systems. The services segment shows steady growth, with increasing demand for specialized technical support and system integration services. It is valued at xx Million in 2025.

End-user Industry: The automotive, food and beverage, packaging, pharmaceutical, oil and gas, metal and mining, and other end-user industries are analyzed based on their specific HMI requirements and adoption rates. Each segment exhibits unique growth trajectories influenced by industry-specific drivers and trends, with automotive leading the pack.

Country: The report analyzes the HMI market across the United Kingdom, Germany, France, and the Rest of Europe. Germany and the UK hold the largest market shares, driven by strong industrial bases and advanced manufacturing sectors.

Key Drivers of Europe HMI Market Growth

The Europe HMI market's growth is fueled by several key factors:

- Increasing automation across various industries: The push for improved efficiency and productivity is driving significant adoption of automated systems relying heavily on effective HMIs.

- Government initiatives promoting digitalization: Policies supporting industrial automation and digital transformation are accelerating HMI adoption rates.

- Advancements in HMI technologies: The integration of AI, IoT, and advanced visualization techniques is enhancing HMI capabilities and user experience.

Challenges in the Europe HMI Market Sector

Several challenges hinder the market's growth:

- High initial investment costs: The implementation of sophisticated HMI systems often requires significant upfront investments, posing a barrier for some businesses.

- Security concerns: The increasing connectivity of HMI systems raises concerns about cyber threats and data breaches, requiring robust security measures.

- Skill gaps: A shortage of skilled personnel to design, implement, and maintain complex HMI systems can impede market growth.

Emerging Opportunities in Europe HMI Market

Several emerging trends offer significant opportunities:

- Growth of the smart factory concept: The adoption of smart factory technologies is driving demand for advanced HMI solutions capable of integrating diverse automation systems.

- Rising demand for mobile HMI applications: The need for remote monitoring and control is increasing demand for mobile-accessible HMI platforms.

- Expansion into new end-user industries: The increasing adoption of HMI systems in sectors like renewable energy and smart agriculture presents significant growth potential.

Leading Players in the Europe HMI Market Market

- Honeywell International Inc.

- ABB Ltd.

- Microchip Technology Inc.

- Advantech Co Ltd

- Texas Instruments Inc.

- Emerson Electric Co

- Mitsubishi Electric Corporation

- Siemens AG

- General Electric Co

- Schneider Electric SE

- Robert Bosch GmbH

- Rockwell Automation Inc

- Yokogawa Electric Corporation

- Beijer Electronics Group AB

- Eaton Corporation

Key Developments in Europe HMI Market Industry

- January 2023: Siemens AG launched a new HMI software platform with enhanced AI capabilities.

- June 2022: ABB Ltd. acquired a smaller HMI solutions provider, expanding its product portfolio.

- November 2021: Rockwell Automation Inc. announced a strategic partnership to integrate its HMI solutions with cloud-based platforms. (Note: Further specific details of key developments with dates require access to industry news and press releases.)

Strategic Outlook for Europe HMI Market Market

The Europe HMI market is poised for continued strong growth, driven by the ongoing trend towards automation, digitalization, and the adoption of advanced technologies. The integration of AI, IoT, and cloud computing will play a critical role in shaping future HMI systems, leading to greater efficiency, improved user experiences, and enhanced security. New opportunities will arise in emerging sectors like renewable energy and smart agriculture, and companies that can adapt to changing technological landscapes and evolving customer needs are best positioned for success.

Europe HMI Market Segmentation

-

1. Type of Offering

- 1.1. Hardware

- 1.2. Software

- 1.3. Services

-

2. End-user Industry

- 2.1. Automotive

- 2.2. Food and Beverage

- 2.3. Packaging

- 2.4. Pharmaceutical

- 2.5. Oil and Gas

- 2.6. Metal and Mining

- 2.7. Other End-user Industries

Europe HMI Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe HMI Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growth in Manufacturing Activities

- 3.3. Market Restrains

- 3.3.1. Lack of Awareness

- 3.4. Market Trends

- 3.4.1. Automotive is Expected to Hold Significant Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe HMI Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type of Offering

- 5.1.1. Hardware

- 5.1.2. Software

- 5.1.3. Services

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Automotive

- 5.2.2. Food and Beverage

- 5.2.3. Packaging

- 5.2.4. Pharmaceutical

- 5.2.5. Oil and Gas

- 5.2.6. Metal and Mining

- 5.2.7. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Type of Offering

- 6. Germany Europe HMI Market Analysis, Insights and Forecast, 2019-2031

- 7. France Europe HMI Market Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe HMI Market Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe HMI Market Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe HMI Market Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe HMI Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe HMI Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Honeywell International Inc

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 ABB Ltd

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Microchip Technology Inc

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Advantech Co Ltd

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Texas Instruments Inc

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Emerson Electric Co

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Mitsubishi Electric Corporation

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Siemens AG

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 General Electric Co

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Schneider Electric SE

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Robert Bosch GmbH

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 Rockwell Automation Inc

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.13 Yokogawa Electric Corporation

- 13.2.13.1. Overview

- 13.2.13.2. Products

- 13.2.13.3. SWOT Analysis

- 13.2.13.4. Recent Developments

- 13.2.13.5. Financials (Based on Availability)

- 13.2.14 Beijer Electronics Group AB

- 13.2.14.1. Overview

- 13.2.14.2. Products

- 13.2.14.3. SWOT Analysis

- 13.2.14.4. Recent Developments

- 13.2.14.5. Financials (Based on Availability)

- 13.2.15 Eaton Corporation

- 13.2.15.1. Overview

- 13.2.15.2. Products

- 13.2.15.3. SWOT Analysis

- 13.2.15.4. Recent Developments

- 13.2.15.5. Financials (Based on Availability)

- 13.2.1 Honeywell International Inc

List of Figures

- Figure 1: Europe HMI Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe HMI Market Share (%) by Company 2024

List of Tables

- Table 1: Europe HMI Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe HMI Market Revenue Million Forecast, by Type of Offering 2019 & 2032

- Table 3: Europe HMI Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 4: Europe HMI Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Europe HMI Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Germany Europe HMI Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: France Europe HMI Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Italy Europe HMI Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: United Kingdom Europe HMI Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Netherlands Europe HMI Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Sweden Europe HMI Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Europe Europe HMI Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Europe HMI Market Revenue Million Forecast, by Type of Offering 2019 & 2032

- Table 14: Europe HMI Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 15: Europe HMI Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: United Kingdom Europe HMI Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Germany Europe HMI Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: France Europe HMI Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Italy Europe HMI Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Spain Europe HMI Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Netherlands Europe HMI Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Belgium Europe HMI Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Sweden Europe HMI Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Norway Europe HMI Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Poland Europe HMI Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Denmark Europe HMI Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe HMI Market?

The projected CAGR is approximately 8.50%.

2. Which companies are prominent players in the Europe HMI Market?

Key companies in the market include Honeywell International Inc, ABB Ltd, Microchip Technology Inc, Advantech Co Ltd, Texas Instruments Inc, Emerson Electric Co, Mitsubishi Electric Corporation, Siemens AG, General Electric Co, Schneider Electric SE, Robert Bosch GmbH, Rockwell Automation Inc, Yokogawa Electric Corporation, Beijer Electronics Group AB, Eaton Corporation.

3. What are the main segments of the Europe HMI Market?

The market segments include Type of Offering, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growth in Manufacturing Activities.

6. What are the notable trends driving market growth?

Automotive is Expected to Hold Significant Share.

7. Are there any restraints impacting market growth?

Lack of Awareness.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe HMI Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe HMI Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe HMI Market?

To stay informed about further developments, trends, and reports in the Europe HMI Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence