Key Insights

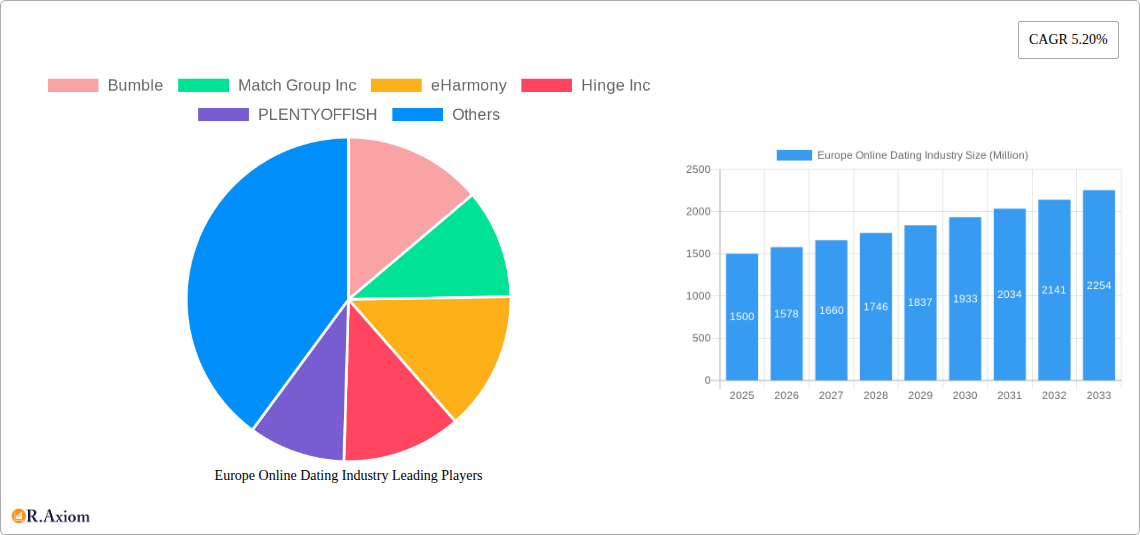

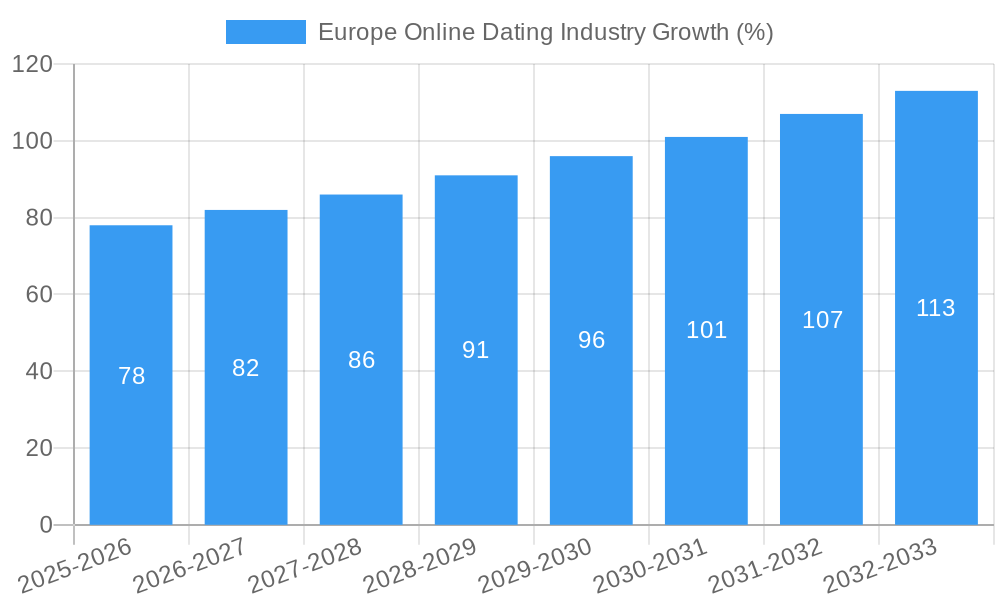

The European online dating market, valued at approximately €X million in 2025 (assuming a logical extrapolation based on the provided CAGR and market size), is experiencing robust growth, projected to expand at a compound annual growth rate (CAGR) of 5.20% from 2025 to 2033. This growth is fueled by several key drivers. Increased smartphone penetration and internet access across Europe, particularly among younger demographics, has significantly broadened the user base. The evolving social landscape, with more individuals seeking connections online, also contributes significantly. Furthermore, the innovative features offered by dating apps, such as advanced matching algorithms, video chat functionalities, and enhanced safety measures, cater to a wider range of user preferences and increase engagement. The market's segmentation reveals a strong presence of both free and paid online dating services, with the paid segment expected to continue its upward trajectory driven by premium features and a more targeted user experience. Germany, the United Kingdom, and France represent the largest national markets, reflecting their larger populations and higher digital adoption rates.

However, the market also faces certain restraints. Growing concerns regarding data privacy and online safety are prompting regulatory scrutiny and influencing user behavior. Competition among numerous established players and new entrants remains fierce, leading to pressure on pricing and profitability. Market saturation in some key regions could also limit growth potential in the later years of the forecast period. To mitigate these challenges, online dating companies are investing in robust security measures, personalized experiences, and innovative marketing strategies to maintain user engagement and attract new customers. Future market growth will heavily depend on successfully navigating these challenges while capitalizing on the continued expansion of the digital landscape and the increasing popularity of online dating within European society. The regional variations in market penetration and user behaviour will also significantly affect future growth dynamics.

This comprehensive report provides a detailed analysis of the European online dating industry, covering market size, segmentation, competitive landscape, and future growth prospects from 2019 to 2033. With a base year of 2025 and a forecast period spanning 2025-2033, this report is an essential resource for industry stakeholders, investors, and anyone seeking to understand this dynamic market. The report incorporates data from the historical period (2019-2024) and leverages extensive primary and secondary research to deliver actionable insights. All values are expressed in Millions.

Europe Online Dating Industry Market Concentration & Innovation

This section analyzes the level of market concentration, examining the market share of key players like Bumble, Match Group Inc, eHarmony, Hinge Inc, PLENTYOFFISH, LOVOO GmbH, Meetic, Badoo, Tinder, happn, and OkCupid. The report also explores innovation drivers such as technological advancements (AI-powered matching algorithms, augmented reality features), evolving consumer preferences (focus on inclusivity and authenticity), and regulatory changes impacting data privacy and user safety.

The impact of mergers and acquisitions (M&A) activities, such as Bumble's acquisition of Fruitz in February 2022, is assessed, including the deal values and their influence on market dynamics. Metrics like market share concentration ratios (e.g., CR4, CR8) and Herfindahl-Hirschman Index (HHI) will quantify market concentration. The report analyzes the regulatory frameworks across different European countries and their impact on the industry, considering the influence of data protection regulations (e.g., GDPR) on the operations of online dating platforms. Furthermore, the report discusses potential product substitutes (e.g., traditional dating methods, niche social media platforms) and their influence on market competition. Finally, the evolving end-user trends in the European online dating market are explored, including shifting demographics, evolving expectations regarding online interactions, and the increasing demand for safety and security features.

Europe Online Dating Industry Industry Trends & Insights

This section delves into the key trends shaping the European online dating market. It examines the compound annual growth rate (CAGR) of the market during the historical and forecast periods, providing detailed analysis on market growth drivers, including increasing smartphone penetration, changing social norms regarding online dating, and the rising popularity of mobile dating apps.

The report discusses the impact of technological disruptions, such as the integration of AI and machine learning in matching algorithms and personalized user experiences. It explores the evolving consumer preferences in online dating, analyzing the factors influencing app selection, usage patterns, and subscription choices. This section also provides a comprehensive overview of the competitive dynamics of the industry, focusing on the strategies employed by leading players, including pricing models, marketing campaigns, and product differentiation. It considers factors such as the market penetration rate of online dating services, user demographics and segmentation, and the competitive intensity across different geographic regions of Europe. The impact of macro-economic factors (e.g., economic downturns or upturns) on user spending and industry performance is also analyzed. The estimated market size for 2025 is XX Million, with a projected size of YY Million by 2033.

Dominant Markets & Segments in Europe Online Dating Industry

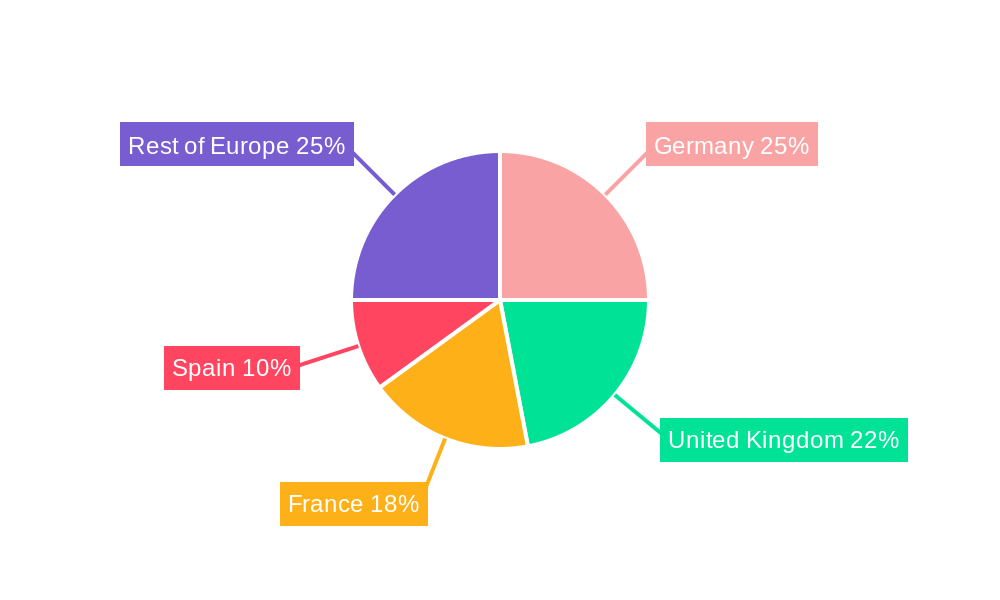

This section identifies the dominant regions, countries, and segments within the European online dating market. It focuses on the market dynamics in Germany, the United Kingdom, France, and Spain, comparing them to the "Rest of Europe" segment. The analysis includes quantitative data such as the number of users and market penetration rates for both paying and non-paying online dating services in each region.

- Key Drivers of Dominance:

- Germany: Strong technological infrastructure, high internet penetration, and a relatively open attitude towards online dating.

- United Kingdom: Large and affluent population, high smartphone penetration, and a mature online dating market.

- France: Significant population base, increasing acceptance of online dating, and a growing mobile app usage.

- Spain: Increasing internet and smartphone penetration, along with a younger population engaging with online dating services.

- Rest of Europe: A diverse range of markets with varying levels of online dating adoption; further segmented analysis is provided within the report, considering factors like cultural norms and economic conditions.

Detailed analysis will be provided for each country/segment including the economic and social factors influencing market growth, and a comparison of market characteristics across the different segments. The report will identify the leading segment based on revenue generation and user base.

Europe Online Dating Industry Product Developments

The online dating industry is continuously evolving, incorporating new technologies and features to enhance the user experience. Recent innovations include AI-driven matching algorithms, augmented reality features for virtual dates, and improved safety and security protocols. These advancements cater to evolving user preferences, seeking more personalized and secure dating experiences. Companies are increasingly focusing on creating niche dating apps to target specific demographics or interests. The successful market fit of new products hinges on their ability to address unmet needs, improve user engagement, and stand out in a competitive landscape.

Report Scope & Segmentation Analysis

This report segments the European online dating market by type (non-paying and paying online dating) and by country (Germany, United Kingdom, France, Spain, and Rest of Europe).

By Type:

Non-paying Online Dating: This segment analyzes the growth of free dating apps and their user base. The report details the competitive dynamics within this segment, focusing on user acquisition and monetization strategies (e.g., in-app advertisements). Growth projections and market sizes for the forecast period are provided.

Paying Online Dating: This section explores the revenue generation and user patterns of subscription-based dating apps. It examines the pricing strategies, feature offerings, and competitive dynamics within the paying segment. Growth projections and market sizes are detailed, considering the factors influencing subscription rates and customer retention.

By Country: Each country segment provides detailed market size estimates, growth projections, and competitive landscapes for the forecast period. Key market characteristics and specific drivers are highlighted.

Key Drivers of Europe Online Dating Industry Growth

The growth of the European online dating industry is driven by several factors. Increasing smartphone penetration and internet access have made online dating more accessible. Changing social norms and the increasing acceptance of online dating as a legitimate way to meet partners are also contributing to growth. Technological advancements, such as improved matching algorithms and enhanced user interfaces, have made the user experience more efficient and appealing.

Challenges in the Europe Online Dating Industry Sector

The European online dating industry faces several challenges, including regulatory hurdles related to data privacy and consumer protection, as well as competition from established and emerging players. The prevalence of fake profiles and scams poses a challenge to user trust and safety. Furthermore, the industry needs to address concerns about mental health issues and potentially harmful effects for certain users, which impacts the public perception and regulatory scrutiny.

Emerging Opportunities in Europe Online Dating Industry

Opportunities exist for expansion into niche markets (e.g., senior dating, LGBTQ+ dating), personalization of the user experience through AI, and enhanced safety measures. The incorporation of virtual and augmented reality features to enhance user interaction is another promising area. Moreover, expanding to markets with lower online dating penetration rates within Europe presents a considerable growth opportunity.

Leading Players in the Europe Online Dating Industry Market

- Bumble

- Match Group Inc

- eHarmony

- Hinge Inc

- PLENTYOFFISH

- LOVOO GmbH

- Meetic

- Badoo

- Tinder

- happn

- OkCupid

Key Developments in Europe Online Dating Industry Industry

- February 2022: Bumble Inc. announced the acquisition of Fruitz, a Gen Z-focused dating app. This highlights the ongoing consolidation in the industry and the focus on younger demographics.

Strategic Outlook for Europe Online Dating Industry Market

The European online dating industry is poised for continued growth, driven by increasing adoption rates, technological advancements, and evolving consumer preferences. The market will likely witness further consolidation and diversification, with players focusing on niche segments and personalized experiences. Opportunities exist for innovative features and services that enhance user safety, improve matchmaking accuracy, and create more engaging experiences. The industry's success will depend on addressing challenges related to data privacy, competition, and user trust.

Europe Online Dating Industry Segmentation

-

1. Type

- 1.1. Non- paying online dating

- 1.2. Paying Online Dating

Europe Online Dating Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Online Dating Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.20% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Continuous Innovation in Service Offerings; Growing Penetration of Smartphones and Mobile Devices

- 3.3. Market Restrains

- 3.3.1. Rising fake accounts is set to create hurdles for the Online Dating Services Market.

- 3.4. Market Trends

- 3.4.1. Non Paying Online Dating to Show Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Online Dating Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Non- paying online dating

- 5.1.2. Paying Online Dating

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Germany Europe Online Dating Industry Analysis, Insights and Forecast, 2019-2031

- 7. France Europe Online Dating Industry Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe Online Dating Industry Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe Online Dating Industry Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe Online Dating Industry Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe Online Dating Industry Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe Online Dating Industry Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Bumble

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Match Group Inc

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 eHarmony

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Hinge Inc

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 PLENTYOFFISH

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 LOVOO GmbH

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Meetic

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Badoo

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Tinder

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 happn

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Ok Cupid*List Not Exhaustive

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.1 Bumble

List of Figures

- Figure 1: Europe Online Dating Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Online Dating Industry Share (%) by Company 2024

List of Tables

- Table 1: Europe Online Dating Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Online Dating Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Europe Online Dating Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Europe Online Dating Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Germany Europe Online Dating Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: France Europe Online Dating Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Italy Europe Online Dating Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: United Kingdom Europe Online Dating Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Netherlands Europe Online Dating Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Sweden Europe Online Dating Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Rest of Europe Europe Online Dating Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Europe Online Dating Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 13: Europe Online Dating Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 14: United Kingdom Europe Online Dating Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Germany Europe Online Dating Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: France Europe Online Dating Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Italy Europe Online Dating Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Spain Europe Online Dating Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Netherlands Europe Online Dating Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Belgium Europe Online Dating Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Sweden Europe Online Dating Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Norway Europe Online Dating Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Poland Europe Online Dating Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Denmark Europe Online Dating Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Online Dating Industry?

The projected CAGR is approximately 5.20%.

2. Which companies are prominent players in the Europe Online Dating Industry?

Key companies in the market include Bumble, Match Group Inc, eHarmony, Hinge Inc, PLENTYOFFISH, LOVOO GmbH, Meetic, Badoo, Tinder, happn, Ok Cupid*List Not Exhaustive.

3. What are the main segments of the Europe Online Dating Industry?

The market segments include Type .

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Continuous Innovation in Service Offerings; Growing Penetration of Smartphones and Mobile Devices.

6. What are the notable trends driving market growth?

Non Paying Online Dating to Show Significant Growth.

7. Are there any restraints impacting market growth?

Rising fake accounts is set to create hurdles for the Online Dating Services Market..

8. Can you provide examples of recent developments in the market?

February 2022 - Bumble Inc announced the acquisition of Fruitz, one of Europe's fastest-growing dating apps. The dating app is popular with Gen Z, a growing segment of online dating consumers. Such acquisitions by the major players in the region are promoting the growth of inline dating app services.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Online Dating Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Online Dating Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Online Dating Industry?

To stay informed about further developments, trends, and reports in the Europe Online Dating Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence