Key Insights

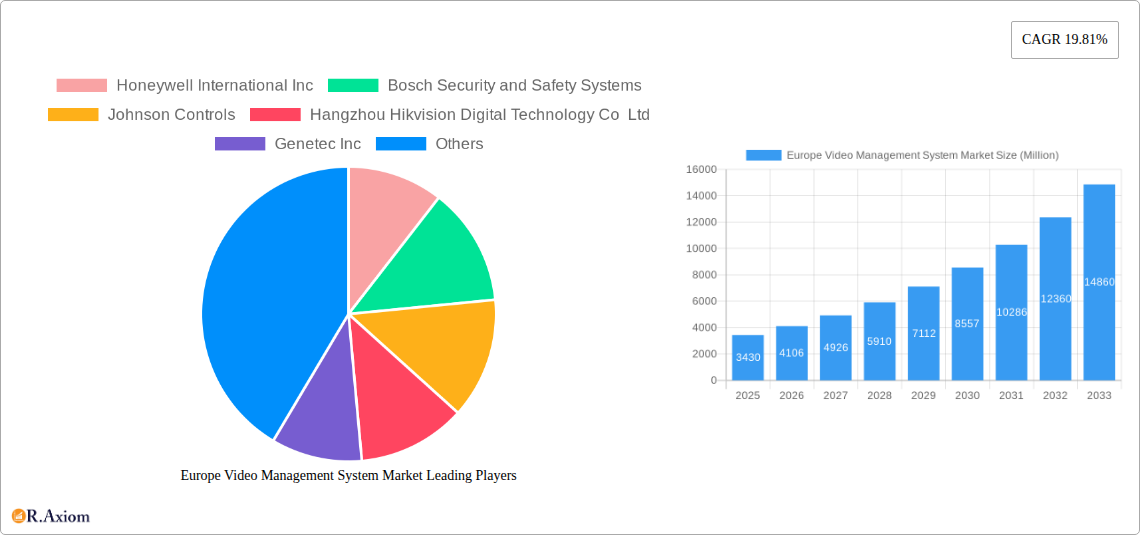

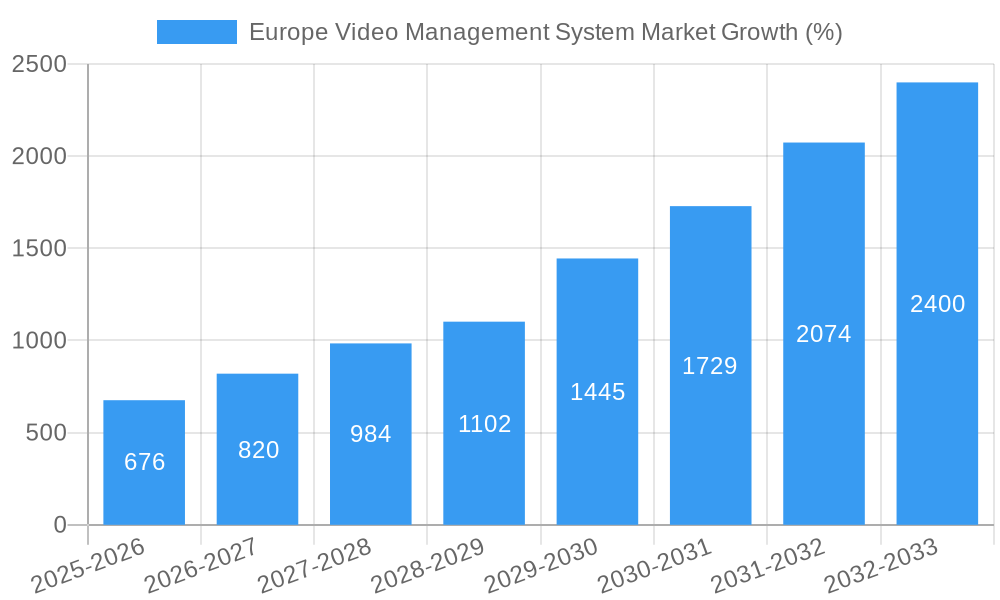

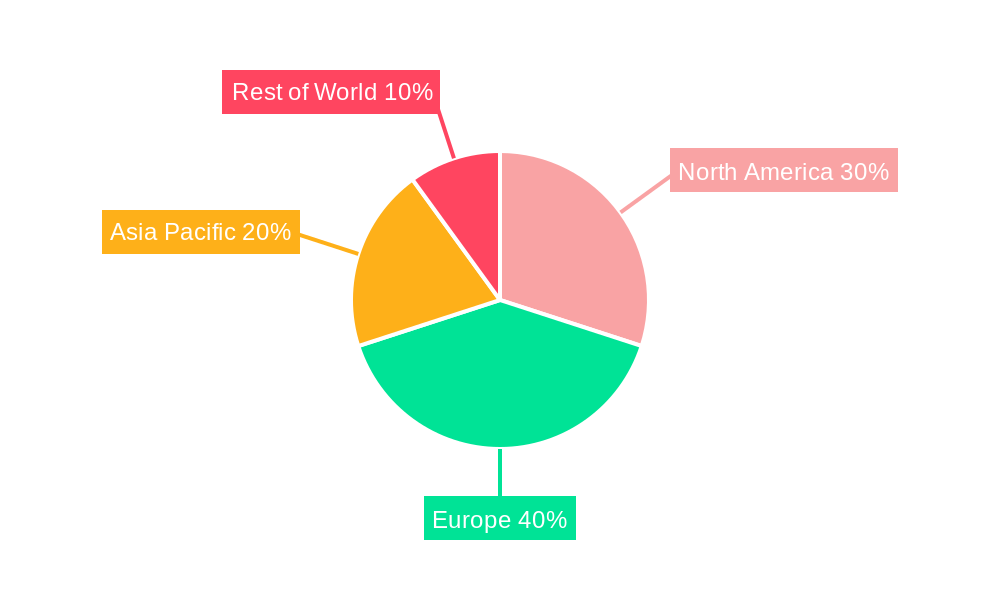

The European Video Management System (VMS) market is experiencing robust growth, driven by increasing demand for enhanced security and surveillance across various sectors. With a market size of €3.43 billion in 2025 and a Compound Annual Growth Rate (CAGR) of 19.81% projected from 2025 to 2033, the market is poised for significant expansion. This growth is fueled by several key factors. The rising adoption of cloud-based VMS solutions offers scalability, cost-effectiveness, and remote accessibility, appealing to businesses of all sizes. Furthermore, the increasing integration of advanced analytics, such as facial recognition and object detection, into VMS platforms is driving demand for more sophisticated systems capable of providing real-time insights and proactive threat detection. The growing need for improved cybersecurity measures within surveillance systems is also a significant driver, pushing the market towards more robust and secure VMS solutions. Government initiatives promoting public safety and infrastructure security are further contributing to market growth. Major players like Honeywell, Bosch, and Hikvision are competing intensely, leading to innovation and competitive pricing, making VMS solutions more accessible to a broader range of customers.

The competitive landscape is characterized by a mix of established players and emerging technology providers. Established players leverage their extensive experience and global reach to maintain market share, while emerging companies are disrupting the market with innovative solutions and competitive pricing. However, market expansion is somewhat constrained by the high initial investment costs associated with implementing and maintaining VMS infrastructure, particularly for smaller businesses. Data privacy regulations and concerns about potential misuse of surveillance technology also present challenges to the market's growth. Despite these restraints, the long-term outlook for the European VMS market remains positive, driven by the continued need for enhanced security, technological advancements, and expanding applications across diverse sectors such as transportation, retail, and critical infrastructure. The market is expected to witness significant consolidation and strategic partnerships in the coming years as companies strive to strengthen their market positions and expand their service offerings.

Europe Video Management System (VMS) Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the Europe Video Management System (VMS) market, covering historical data (2019-2024), the current market (2025), and future projections (2025-2033). The report offers invaluable insights for industry stakeholders, including manufacturers, investors, and regulatory bodies. The market is valued at XX Million in 2025 and is projected to reach XX Million by 2033, exhibiting a CAGR of XX% during the forecast period.

Europe Video Management System Market Market Concentration & Innovation

The European VMS market exhibits a moderately concentrated landscape, with key players such as Honeywell International Inc, Bosch Security and Safety Systems, and Johnson Controls holding significant market share. However, the presence of several mid-sized and smaller companies indicates a competitive environment. Market share data for 2025 suggests Honeywell holds approximately XX%, Bosch around XX%, and Johnson Controls at approximately XX%. The remaining market share is distributed among other players like Hangzhou Hikvision Digital Technology Co Ltd, Genetec Inc, Dahua Technology, AxxonSoft Inc, Axis Communications AB, Identiv Inc, Milestone Systems, Qognify Inc, and Verint Systems. Mergers and acquisitions (M&A) activity has been moderate, with total deal values reaching approximately XX Million in the last five years. Key drivers of innovation include the increasing demand for enhanced cybersecurity features, integration with other security systems (e.g., access control, fire alarms), and the adoption of cloud-based solutions. Stringent data privacy regulations (like GDPR) influence product development and market strategies. The market is also witnessing the emergence of AI-powered analytics and advanced video processing capabilities. Product substitutes, such as basic CCTV systems, are gradually losing market share due to the superior capabilities of VMS solutions. End-user trends show a shift towards cloud-based solutions and preference for integrated security systems providing comprehensive functionalities.

Europe Video Management System Market Industry Trends & Insights

The European VMS market is experiencing robust growth, driven by several factors. Increased security concerns across various sectors (e.g., transportation, retail, critical infrastructure) are fueling demand. Technological advancements like AI-powered video analytics, improved image quality, and cloud-based solutions are expanding market applications. Consumer preferences lean towards user-friendly interfaces, seamless integration with other systems, and cost-effective solutions. The market is witnessing significant competition, with companies focusing on product differentiation through enhanced features, innovative solutions, and strategic partnerships. This competition drives innovation and price optimization. The market penetration of VMS systems in various sectors is steadily increasing, with notable growth in the transportation and retail sectors. The market is further segmented by deployment type (cloud, on-premise), by application (retail, transportation, banking, etc.), and by end-user (government, commercial).

Dominant Markets & Segments in Europe Video Management System Market

The United Kingdom and Germany represent the largest markets within Europe, primarily due to strong economies, advanced infrastructure, and high security spending. Other key markets include France, Italy, and Spain.

- Key Drivers for UK & Germany:

- High levels of security spending by both government and private sectors.

- Well-developed infrastructure facilitating seamless deployment and integration of VMS systems.

- Stringent regulatory frameworks driving the adoption of advanced security solutions.

- Strong presence of major VMS vendors and integrators.

The dominance of these regions is attributable to several factors including:

- High security concerns: Both countries have witnessed a significant increase in security threats, compelling both public and private entities to invest heavily in surveillance infrastructure.

- Robust technological infrastructure: Well-established network infrastructure and technical expertise make the deployment and integration of advanced VMS systems relatively straightforward.

- Government regulations: Stringent government regulations pertaining to public safety and data protection are driving the adoption of sophisticated VMS systems.

- High levels of disposable income: The high level of disposable income in these regions translates to increased investments in security and safety technologies.

Europe Video Management System Market Product Developments

Recent innovations have focused on integrating AI-powered analytics for improved threat detection, facial recognition, and license plate recognition. Cloud-based solutions offer enhanced scalability, accessibility, and reduced infrastructure costs. These developments are tailored to meet the increasing demands for enhanced security, improved operational efficiency, and streamlined management of large-scale surveillance networks. The market is seeing the rise of unified security platforms that integrate VMS with other security systems like access control and intrusion detection, enhancing comprehensive security management. The focus is on creating user-friendly interfaces and intuitive dashboards that enable efficient monitoring and management of surveillance systems.

Report Scope & Segmentation Analysis

This report segments the European VMS market based on various factors.

- By Component: Hardware (cameras, recorders, servers, etc.) and Software. The software segment is expected to showcase higher growth due to increasing demand for advanced analytics and cloud-based solutions.

- By Deployment: Cloud-based and On-premise. Cloud-based deployments are gaining traction due to scalability and reduced infrastructure costs.

- By Application: Retail, Transportation, Banking, Government, Healthcare, and others. Growth is expected to be largely driven by demand from the retail and transportation segments.

- By End-User: Commercial and Residential. Commercial establishments comprise a significant part of the market due to the critical need for securing assets and employees.

Key Drivers of Europe Video Management System Market Growth

The growth of the European VMS market is driven by several factors: rising security concerns across various sectors, the increasing adoption of cloud-based solutions offering improved scalability and cost-effectiveness, and ongoing technological advancements such as AI-powered analytics and integration with other security systems. Government regulations mandating improved security measures in certain industries (e.g., transportation, critical infrastructure) further fuel market expansion. The demand for advanced features, including facial recognition and license plate recognition, is continuously driving the market forward.

Challenges in the Europe Video Management System Market Sector

The market faces challenges including stringent data privacy regulations, like GDPR, which necessitate robust data security and compliance measures, potentially increasing implementation costs. Supply chain disruptions and the rising cost of components can impact profitability. Intense competition among established players and the emergence of new entrants also create pressure on pricing and margins. The complex integration of VMS with other security systems can pose implementation challenges, especially for older or less standardized infrastructure. The need for skilled professionals to install, manage and maintain the system can increase initial and ongoing costs.

Emerging Opportunities in Europe Video Management System Market

Opportunities include the growing adoption of AI and machine learning for enhanced video analytics, leading to improved threat detection and predictive capabilities. The integration of VMS with IoT devices opens avenues for innovative applications and smart security solutions. Expansion into emerging markets within Europe and the development of tailored solutions for specific industry verticals present significant opportunities for growth. The focus on cybersecurity improvements and data protection also drives demand for advanced VMS solutions.

Leading Players in the Europe Video Management System Market Market

- Honeywell International Inc (Honeywell)

- Bosch Security and Safety Systems (Bosch Security)

- Johnson Controls (Johnson Controls)

- Hangzhou Hikvision Digital Technology Co Ltd (Hikvision)

- Genetec Inc (Genetec)

- Dahua Technology (Dahua Technology)

- AxxonSoft Inc (AxxonSoft)

- Axis Communications AB (Axis Communications)

- Identiv Inc (Identiv)

- Milestone Systems (Milestone Systems)

- Qognify Inc (Qognify)

- Verint Systems (Verint Systems)

- List Not Exhaustive

Key Developments in Europe Video Management System Market Industry

January 2024: AxxonSoft launched Axxon One VMS version 2.0, enhancing integration with various physical security systems, creating a unified VMS platform. This development signifies a move towards comprehensive security solutions that integrate multiple systems, enhancing efficiency and reducing complexity for users.

April 2024: Axis Communications launched Axis Cloud Connect, a cloud-based platform for more secure, adaptable, and scalable security solutions. This launch signals a significant shift towards cloud-based security, meeting the growing demand for remote accessibility, scalability, and reduced infrastructure costs.

Strategic Outlook for Europe Video Management System Market Market

The European VMS market is poised for significant growth, fueled by increasing security concerns, technological advancements, and evolving consumer preferences. The integration of AI and IoT technologies will drive the development of innovative solutions, enhancing security capabilities and creating new market opportunities. Focusing on cloud-based solutions, improved cybersecurity, and seamless integration with other security systems will be critical for success. The market will continue to see consolidation through M&A activity, leading to a more concentrated landscape dominated by a few key players. Companies that can adapt to regulatory changes and customer demands will be best positioned for long-term growth.

Europe Video Management System Market Segmentation

-

1. Component

- 1.1. System

- 1.2. Services

-

2. Technology

- 2.1. Analog-Based

- 2.2. IP- Based

-

3. Mode of Deployment

- 3.1. On-Premise

- 3.2. Cloud

-

4. End-user Industry

- 4.1. Banking and Financial Services

- 4.2. Education

- 4.3. Retail

- 4.4. Transportation

- 4.5. Logistics

- 4.6. Healthcare

- 4.7. Airports

Europe Video Management System Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Video Management System Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 19.81% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Security Cameras for Surveillence; Technological Advancement in New Product Development

- 3.3. Market Restrains

- 3.3.1. Increasing Security Cameras for Surveillence; Technological Advancement in New Product Development

- 3.4. Market Trends

- 3.4.1. Cloud Based Video Management System is Expected to Grow at a Significant Rate

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Video Management System Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. System

- 5.1.2. Services

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Analog-Based

- 5.2.2. IP- Based

- 5.3. Market Analysis, Insights and Forecast - by Mode of Deployment

- 5.3.1. On-Premise

- 5.3.2. Cloud

- 5.4. Market Analysis, Insights and Forecast - by End-user Industry

- 5.4.1. Banking and Financial Services

- 5.4.2. Education

- 5.4.3. Retail

- 5.4.4. Transportation

- 5.4.5. Logistics

- 5.4.6. Healthcare

- 5.4.7. Airports

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Honeywell International Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Bosch Security and Safety Systems

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Johnson Controls

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Hangzhou Hikvision Digital Technology Co Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Genetec Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Dahua Technology

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 AxxonSoft Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Axis Communications AB

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Identiv Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Milestone Systems

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Qognify Inc

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Verint Systems*List Not Exhaustive

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Honeywell International Inc

List of Figures

- Figure 1: Europe Video Management System Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Video Management System Market Share (%) by Company 2024

List of Tables

- Table 1: Europe Video Management System Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Video Management System Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: Europe Video Management System Market Revenue Million Forecast, by Component 2019 & 2032

- Table 4: Europe Video Management System Market Volume Billion Forecast, by Component 2019 & 2032

- Table 5: Europe Video Management System Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 6: Europe Video Management System Market Volume Billion Forecast, by Technology 2019 & 2032

- Table 7: Europe Video Management System Market Revenue Million Forecast, by Mode of Deployment 2019 & 2032

- Table 8: Europe Video Management System Market Volume Billion Forecast, by Mode of Deployment 2019 & 2032

- Table 9: Europe Video Management System Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 10: Europe Video Management System Market Volume Billion Forecast, by End-user Industry 2019 & 2032

- Table 11: Europe Video Management System Market Revenue Million Forecast, by Region 2019 & 2032

- Table 12: Europe Video Management System Market Volume Billion Forecast, by Region 2019 & 2032

- Table 13: Europe Video Management System Market Revenue Million Forecast, by Component 2019 & 2032

- Table 14: Europe Video Management System Market Volume Billion Forecast, by Component 2019 & 2032

- Table 15: Europe Video Management System Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 16: Europe Video Management System Market Volume Billion Forecast, by Technology 2019 & 2032

- Table 17: Europe Video Management System Market Revenue Million Forecast, by Mode of Deployment 2019 & 2032

- Table 18: Europe Video Management System Market Volume Billion Forecast, by Mode of Deployment 2019 & 2032

- Table 19: Europe Video Management System Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 20: Europe Video Management System Market Volume Billion Forecast, by End-user Industry 2019 & 2032

- Table 21: Europe Video Management System Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Europe Video Management System Market Volume Billion Forecast, by Country 2019 & 2032

- Table 23: United Kingdom Europe Video Management System Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: United Kingdom Europe Video Management System Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 25: Germany Europe Video Management System Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Germany Europe Video Management System Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 27: France Europe Video Management System Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: France Europe Video Management System Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 29: Italy Europe Video Management System Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Italy Europe Video Management System Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 31: Spain Europe Video Management System Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Spain Europe Video Management System Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 33: Netherlands Europe Video Management System Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Netherlands Europe Video Management System Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 35: Belgium Europe Video Management System Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Belgium Europe Video Management System Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 37: Sweden Europe Video Management System Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Sweden Europe Video Management System Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 39: Norway Europe Video Management System Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Norway Europe Video Management System Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 41: Poland Europe Video Management System Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Poland Europe Video Management System Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 43: Denmark Europe Video Management System Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Denmark Europe Video Management System Market Volume (Billion) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Video Management System Market?

The projected CAGR is approximately 19.81%.

2. Which companies are prominent players in the Europe Video Management System Market?

Key companies in the market include Honeywell International Inc, Bosch Security and Safety Systems, Johnson Controls, Hangzhou Hikvision Digital Technology Co Ltd, Genetec Inc, Dahua Technology, AxxonSoft Inc, Axis Communications AB, Identiv Inc, Milestone Systems, Qognify Inc, Verint Systems*List Not Exhaustive.

3. What are the main segments of the Europe Video Management System Market?

The market segments include Component, Technology, Mode of Deployment, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.43 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Security Cameras for Surveillence; Technological Advancement in New Product Development.

6. What are the notable trends driving market growth?

Cloud Based Video Management System is Expected to Grow at a Significant Rate.

7. Are there any restraints impacting market growth?

Increasing Security Cameras for Surveillence; Technological Advancement in New Product Development.

8. Can you provide examples of recent developments in the market?

April 2024: Axis Communications launched Axis Cloud Connect, an innovative cloud-based platform developed to deliver customers more secure, adaptable, and scalable security solutions. Axis Cloud Connect is customized to seamlessly integrate with Axis devices, empowering businesses with a comprehensive suite of managed services that support system and device management, video and data delivery, and meet the increasing demand for cybersecurity.January 2024: AxxonSoft announced the introduction of its Axxon One video management software (VMS), which is now version 2.0. This updated release boasts seamless integrations with various physical security systems, transforming the software into a comprehensive "unified" VMS. Axxon One 2.0 seamlessly incorporates ten physical security systems from diverse manufacturers and the universal OPC Data Access Wrapper interface. These integrations encompass access control systems, fire and security alarms, and perimeter intrusion detection systems.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Video Management System Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Video Management System Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Video Management System Market?

To stay informed about further developments, trends, and reports in the Europe Video Management System Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence