Key Insights

The European clinical trials market is experiencing robust growth, driven by a confluence of factors. Increased prevalence of chronic diseases like cancer and cardiovascular conditions fuels demand for new treatments, leading to a rise in clinical trials across various therapeutic areas. Furthermore, supportive regulatory frameworks within the European Union, such as the Clinical Trials Regulation (CTR), aim to streamline the approval process, attracting further investment and accelerating research. Technological advancements in data analytics and digital technologies are significantly impacting trial design and execution, optimizing efficiency and reducing costs. This includes the increased use of telehealth and remote monitoring, making trials more accessible and inclusive. While challenges persist, such as high costs associated with conducting trials and potential recruitment difficulties, the overall market trajectory points towards sustained expansion.

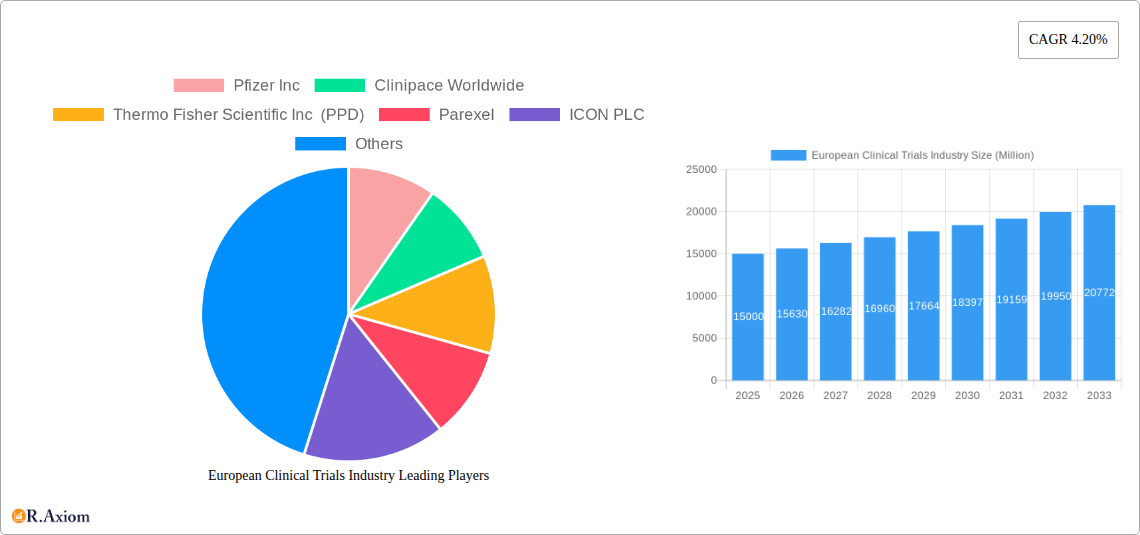

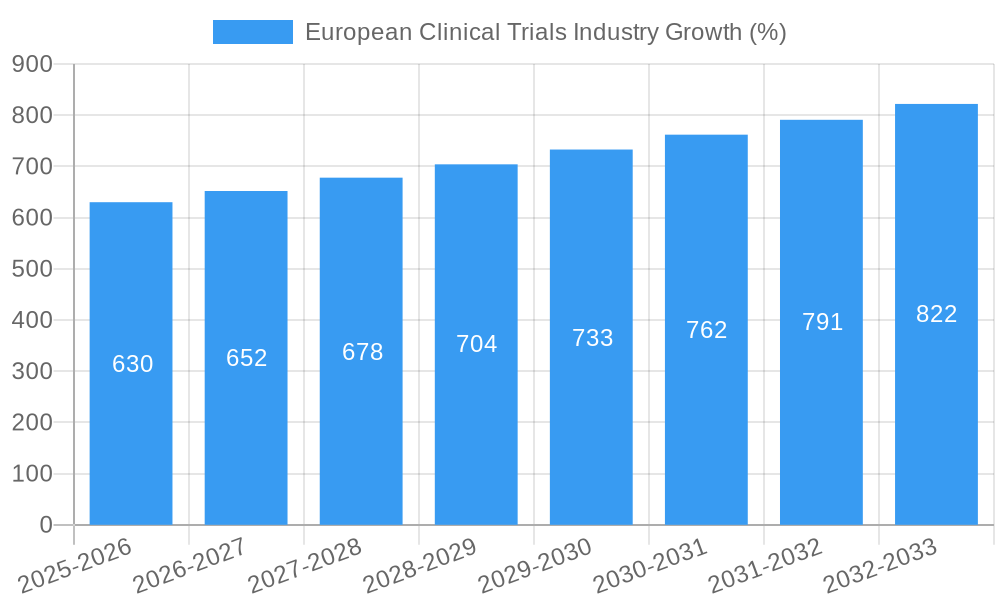

The market segmentation reveals a dynamic landscape. Phase III trials, crucial for regulatory approval, constitute a significant portion of the market. Treatment studies generally dominate due to their potential for generating strong evidence. Observational studies, while offering valuable real-world data, typically represent a smaller segment. Major players, including Pfizer, Sanofi, Roche, and others, leverage their extensive experience and resources to dominate market share. However, smaller specialized CROs (Contract Research Organizations) like Clinipace and Parexel play a crucial role in supporting various trial aspects. Germany, France, and the UK remain key markets within Europe, owing to their robust healthcare infrastructure and research capabilities. Considering a CAGR of 4.20% from 2019-2033 and a base year market size in the millions, a reasonable projection shows significant growth, with substantial increases anticipated across all phases and trial types over the forecast period (2025-2033). This consistent growth is projected to continue, driven by the aforementioned factors.

European Clinical Trials Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the European clinical trials industry, covering market size, growth drivers, key players, and future outlook. The report utilizes data from the historical period (2019-2024), base year (2025), and forecasts through 2033. It offers actionable insights for stakeholders across the industry, including pharmaceutical companies, CROs, and regulatory bodies.

European Clinical Trials Industry Market Concentration & Innovation

This section analyzes the competitive landscape of the European clinical trials market, exploring market concentration, innovation drivers, regulatory frameworks, and key industry activities. The market is characterized by a mix of large multinational corporations and specialized CROs. While precise market share figures for each company vary and are not publicly available in their entirety, Pfizer Inc, Pfizer Inc, Sanofi, Sanofi, Eli Lilly and Company, Eli Lilly and Company, and Roche hold significant market share, estimated at xx Million USD collectively in 2025. Other key players include:

- Clinipace Worldwide

- Thermo Fisher Scientific Inc (PPD)

- Parexel

- ICON PLC

- F Hoffmann-La Roche AG

- IQVIA

- Novo Nordisk

European Clinical Trials Industry Industry Trends & Insights

The European clinical trials market is experiencing robust growth, driven by several factors. The increasing prevalence of chronic diseases such as cancer, diabetes, and cardiovascular diseases is significantly boosting demand for new therapies, driving a considerable volume of clinical trials. Technological advancements in areas like genomics and personalized medicine are also contributing to the market expansion. These trends facilitate the development of targeted therapies and improved trial designs, leading to increased efficiency and accuracy. The market's compound annual growth rate (CAGR) is estimated at xx% between 2025 and 2033. The market penetration of advanced technologies such as AI and big data analytics within clinical trials continues to grow, further enhancing efficiency and reducing costs. However, regulatory hurdles and competitive pressures remain significant challenges. Consumer preferences are evolving, with a growing emphasis on patient-centric trial designs, data privacy, and ethical considerations. Competitive dynamics are intensifying with an increase in the number of CROs and the emergence of new technologies, pushing for continuous innovation and efficiency improvements. The market is also witnessing an increasing focus on specialized therapeutic areas, driven by breakthroughs in research and unmet medical needs.

Dominant Markets & Segments in European Clinical Trials Industry

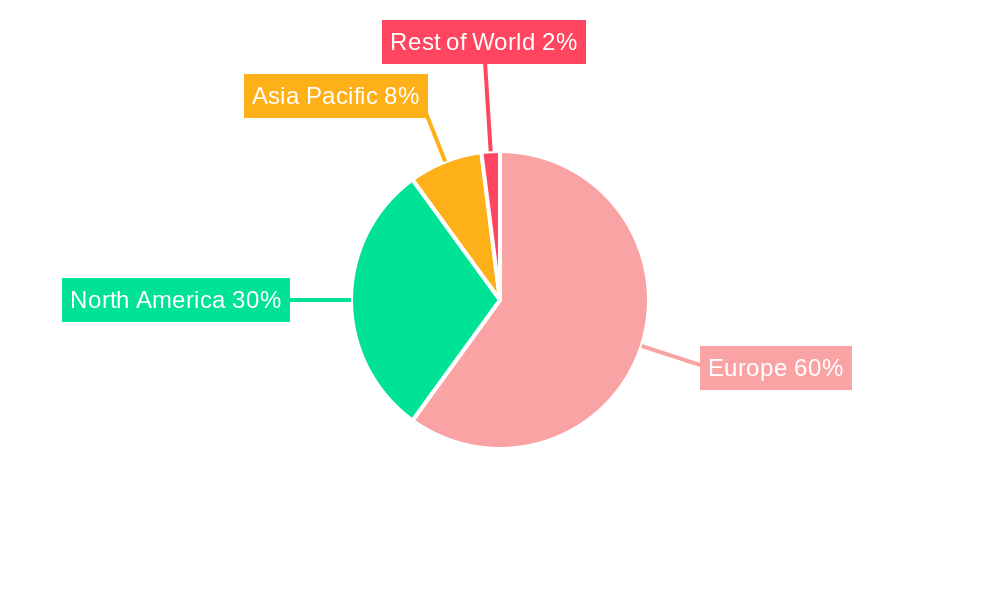

Germany, the UK, and France are the dominant markets within Europe, accounting for a significant portion of the overall clinical trial activity. Their strong healthcare infrastructure, high R&D investment, and substantial pharmaceutical industry presence contribute to this dominance.

- Key Drivers of Market Dominance:

- Well-established regulatory frameworks.

- High concentration of pharmaceutical companies and CROs.

- Extensive healthcare infrastructure.

- Significant government funding for research and development.

Segment Analysis:

- Phase I Trials: These early-stage trials primarily focus on safety and dosage, often conducted in smaller populations.

- Phase II Trials: Focuses on evaluating the efficacy and safety of the drug on a larger population.

- Phase III Trials: Larger-scale studies to confirm effectiveness and monitor side effects. This segment is expected to show the highest growth over the forecast period.

- Phase IV Trials: Post-market surveillance, focusing on long-term safety and efficacy.

- Treatment Studies: This segment dominates the market due to the inherent demand for effective therapies.

- Observational Studies: While smaller than treatment studies, observational studies are increasingly utilized for real-world data collection and long-term monitoring.

Germany's robust healthcare system and pharmaceutical industry contribute significantly to its dominance across all trial phases. The UK, despite Brexit-related uncertainties, remains a key player, while France's strong public health infrastructure supports a robust clinical trial landscape.

European Clinical Trials Industry Product Developments

Recent product innovations center around advanced technologies designed to enhance efficiency, reduce costs, and improve data quality within clinical trials. This includes the integration of AI and machine learning algorithms for data analysis, remote patient monitoring technologies for decentralized trials, and improved electronic data capture (EDC) systems. These innovations are improving trial design, reducing timelines, and enhancing patient engagement. The market fit for these innovations is strong due to the inherent pressures within the industry to improve efficiency and data quality while addressing increasing patient expectations for better trial experiences.

Report Scope & Segmentation Analysis

This report provides a comprehensive market segmentation analyzing the European clinical trials industry across various phases (I-IV) and designs (Treatment Studies and Observational Studies). Each segment's growth projections, market size, and competitive dynamics are thoroughly analyzed within the report. Market size for each segment is projected based on historical data, current trends, and growth forecasts, with values ranging from xx Million to xx Million USD depending on the segment. For instance, the Phase III market is projected to be significantly larger than Phase I due to the greater volume of late-stage trials. Competitive dynamics differ across each segment, with larger players dominating in Phase III and IV studies, while smaller, specialized companies may focus on niche areas in earlier phases.

Key Drivers of European Clinical Trials Industry Growth

The industry's growth is fueled by several factors:

- Increased prevalence of chronic diseases: The aging population and rising incidence of chronic illnesses such as cancer, diabetes, and cardiovascular disease fuels the need for new therapies, creating a high demand for clinical trials.

- Technological advancements: Innovations in areas such as genomics, AI, and remote monitoring have significantly improved trial designs and data analysis.

- Regulatory support: The supportive regulatory environment in Europe, coupled with incentives to encourage innovation, fosters the growth of the clinical trials market.

Challenges in the European Clinical Trials Industry Sector

The industry faces significant challenges:

- Regulatory hurdles: The complexities and lengthy processes associated with regulatory approvals pose a substantial barrier to timely trial completion.

- High costs: The substantial financial investments required for clinical trials can be prohibitive for smaller companies.

- Patient recruitment: Recruiting a sufficient number of eligible patients for trials remains a consistent challenge.

Emerging Opportunities in European Clinical Trials Industry

Several emerging opportunities exist:

- Personalized medicine: Tailoring treatment to individual patients based on their genetic makeup is poised for significant growth.

- Decentralized clinical trials: Remote monitoring and virtual visits offer the potential for increased patient access and reduced costs.

- Real-world data: Utilizing data from electronic health records and other sources can provide valuable insights into drug effectiveness.

Leading Players in the European Clinical Trials Industry Market

- Pfizer Inc, Pfizer Inc

- Clinipace Worldwide

- Thermo Fisher Scientific Inc (PPD), Thermo Fisher Scientific

- Parexel, Parexel

- ICON PLC, ICON PLC

- Sanofi, Sanofi

- Eli Lilly and Company, Eli Lilly and Company

- F Hoffmann-La Roche AG, F Hoffmann-La Roche AG

- IQVIA, IQVIA

- Novo Nordisk, Novo Nordisk

Key Developments in European Clinical Trials Industry Industry

- June 2022: Eli Lilly and Company released phase III clinical trial AWARDS-PEDS results for Trulicity (dulaglutide), demonstrating superior A1C reductions in youth and adolescents with type 2 diabetes. This positive outcome significantly impacted the market, strengthening the drug's position and potentially driving further research.

- January 2022: Pfizer-BioNTech launched a clinical trial for a COVID-19 Omicron variant-specific vaccine. This highlights the industry's responsiveness to emerging health threats and the continuous need for vaccine development and clinical trials.

Strategic Outlook for European Clinical Trials Industry Market

The European clinical trials market shows strong potential for continued growth, driven by technological advancements, increased investment in R&D, and the rising prevalence of chronic diseases. Opportunities exist in personalized medicine, decentralized trials, and real-world data utilization. Companies that embrace innovation, adapt to evolving regulatory landscapes, and prioritize patient-centric approaches are well-positioned to succeed in this dynamic and expanding market. The market is expected to witness significant expansion throughout the forecast period (2025-2033), driven by a continued increase in drug development and advancements in clinical trial technologies.

European Clinical Trials Industry Segmentation

-

1. Phase

- 1.1. Phase I

- 1.2. Phase II

- 1.3. Phase III

- 1.4. Phase IV

-

2. Design

-

2.1. Treatment Studies

- 2.1.1. Randomized Control Trial

- 2.1.2. Adaptive Clinical Trial

- 2.1.3. Non-randomized Control Trial

-

2.2. Observational Studies

- 2.2.1. Cohort Study

- 2.2.2. Case Control Study

- 2.2.3. Cross Sectional Study

- 2.2.4. Ecological Study

-

2.1. Treatment Studies

European Clinical Trials Industry Segmentation By Geography

- 1. Germany

- 2. United Kingdom

- 3. France

- 4. Spain

- 5. Italy

- 6. Rest of Europe

European Clinical Trials Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.20% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. High Research and Development Spending of the Healthcare Industry; Increasing Prevalence of Chronic and Infectious Diseases; Rising Focus on Rare Diseases and Multiple Orphan Drugs

- 3.3. Market Restrains

- 3.3.1. Lower Healthcare Reimbursement in Developing Countries; Stringent Regulations for Patient Enrollment

- 3.4. Market Trends

- 3.4.1. Phase III Segment is Expected to Hold the Major Revenue Share During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. European Clinical Trials Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Phase

- 5.1.1. Phase I

- 5.1.2. Phase II

- 5.1.3. Phase III

- 5.1.4. Phase IV

- 5.2. Market Analysis, Insights and Forecast - by Design

- 5.2.1. Treatment Studies

- 5.2.1.1. Randomized Control Trial

- 5.2.1.2. Adaptive Clinical Trial

- 5.2.1.3. Non-randomized Control Trial

- 5.2.2. Observational Studies

- 5.2.2.1. Cohort Study

- 5.2.2.2. Case Control Study

- 5.2.2.3. Cross Sectional Study

- 5.2.2.4. Ecological Study

- 5.2.1. Treatment Studies

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.3.2. United Kingdom

- 5.3.3. France

- 5.3.4. Spain

- 5.3.5. Italy

- 5.3.6. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Phase

- 6. Germany European Clinical Trials Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Phase

- 6.1.1. Phase I

- 6.1.2. Phase II

- 6.1.3. Phase III

- 6.1.4. Phase IV

- 6.2. Market Analysis, Insights and Forecast - by Design

- 6.2.1. Treatment Studies

- 6.2.1.1. Randomized Control Trial

- 6.2.1.2. Adaptive Clinical Trial

- 6.2.1.3. Non-randomized Control Trial

- 6.2.2. Observational Studies

- 6.2.2.1. Cohort Study

- 6.2.2.2. Case Control Study

- 6.2.2.3. Cross Sectional Study

- 6.2.2.4. Ecological Study

- 6.2.1. Treatment Studies

- 6.1. Market Analysis, Insights and Forecast - by Phase

- 7. United Kingdom European Clinical Trials Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Phase

- 7.1.1. Phase I

- 7.1.2. Phase II

- 7.1.3. Phase III

- 7.1.4. Phase IV

- 7.2. Market Analysis, Insights and Forecast - by Design

- 7.2.1. Treatment Studies

- 7.2.1.1. Randomized Control Trial

- 7.2.1.2. Adaptive Clinical Trial

- 7.2.1.3. Non-randomized Control Trial

- 7.2.2. Observational Studies

- 7.2.2.1. Cohort Study

- 7.2.2.2. Case Control Study

- 7.2.2.3. Cross Sectional Study

- 7.2.2.4. Ecological Study

- 7.2.1. Treatment Studies

- 7.1. Market Analysis, Insights and Forecast - by Phase

- 8. France European Clinical Trials Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Phase

- 8.1.1. Phase I

- 8.1.2. Phase II

- 8.1.3. Phase III

- 8.1.4. Phase IV

- 8.2. Market Analysis, Insights and Forecast - by Design

- 8.2.1. Treatment Studies

- 8.2.1.1. Randomized Control Trial

- 8.2.1.2. Adaptive Clinical Trial

- 8.2.1.3. Non-randomized Control Trial

- 8.2.2. Observational Studies

- 8.2.2.1. Cohort Study

- 8.2.2.2. Case Control Study

- 8.2.2.3. Cross Sectional Study

- 8.2.2.4. Ecological Study

- 8.2.1. Treatment Studies

- 8.1. Market Analysis, Insights and Forecast - by Phase

- 9. Spain European Clinical Trials Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Phase

- 9.1.1. Phase I

- 9.1.2. Phase II

- 9.1.3. Phase III

- 9.1.4. Phase IV

- 9.2. Market Analysis, Insights and Forecast - by Design

- 9.2.1. Treatment Studies

- 9.2.1.1. Randomized Control Trial

- 9.2.1.2. Adaptive Clinical Trial

- 9.2.1.3. Non-randomized Control Trial

- 9.2.2. Observational Studies

- 9.2.2.1. Cohort Study

- 9.2.2.2. Case Control Study

- 9.2.2.3. Cross Sectional Study

- 9.2.2.4. Ecological Study

- 9.2.1. Treatment Studies

- 9.1. Market Analysis, Insights and Forecast - by Phase

- 10. Italy European Clinical Trials Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Phase

- 10.1.1. Phase I

- 10.1.2. Phase II

- 10.1.3. Phase III

- 10.1.4. Phase IV

- 10.2. Market Analysis, Insights and Forecast - by Design

- 10.2.1. Treatment Studies

- 10.2.1.1. Randomized Control Trial

- 10.2.1.2. Adaptive Clinical Trial

- 10.2.1.3. Non-randomized Control Trial

- 10.2.2. Observational Studies

- 10.2.2.1. Cohort Study

- 10.2.2.2. Case Control Study

- 10.2.2.3. Cross Sectional Study

- 10.2.2.4. Ecological Study

- 10.2.1. Treatment Studies

- 10.1. Market Analysis, Insights and Forecast - by Phase

- 11. Rest of Europe European Clinical Trials Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Phase

- 11.1.1. Phase I

- 11.1.2. Phase II

- 11.1.3. Phase III

- 11.1.4. Phase IV

- 11.2. Market Analysis, Insights and Forecast - by Design

- 11.2.1. Treatment Studies

- 11.2.1.1. Randomized Control Trial

- 11.2.1.2. Adaptive Clinical Trial

- 11.2.1.3. Non-randomized Control Trial

- 11.2.2. Observational Studies

- 11.2.2.1. Cohort Study

- 11.2.2.2. Case Control Study

- 11.2.2.3. Cross Sectional Study

- 11.2.2.4. Ecological Study

- 11.2.1. Treatment Studies

- 11.1. Market Analysis, Insights and Forecast - by Phase

- 12. Germany European Clinical Trials Industry Analysis, Insights and Forecast, 2019-2031

- 13. France European Clinical Trials Industry Analysis, Insights and Forecast, 2019-2031

- 14. Italy European Clinical Trials Industry Analysis, Insights and Forecast, 2019-2031

- 15. United Kingdom European Clinical Trials Industry Analysis, Insights and Forecast, 2019-2031

- 16. Netherlands European Clinical Trials Industry Analysis, Insights and Forecast, 2019-2031

- 17. Sweden European Clinical Trials Industry Analysis, Insights and Forecast, 2019-2031

- 18. Rest of Europe European Clinical Trials Industry Analysis, Insights and Forecast, 2019-2031

- 19. Competitive Analysis

- 19.1. Market Share Analysis 2024

- 19.2. Company Profiles

- 19.2.1 Pfizer Inc

- 19.2.1.1. Overview

- 19.2.1.2. Products

- 19.2.1.3. SWOT Analysis

- 19.2.1.4. Recent Developments

- 19.2.1.5. Financials (Based on Availability)

- 19.2.2 Clinipace Worldwide

- 19.2.2.1. Overview

- 19.2.2.2. Products

- 19.2.2.3. SWOT Analysis

- 19.2.2.4. Recent Developments

- 19.2.2.5. Financials (Based on Availability)

- 19.2.3 Thermo Fisher Scientific Inc (PPD)

- 19.2.3.1. Overview

- 19.2.3.2. Products

- 19.2.3.3. SWOT Analysis

- 19.2.3.4. Recent Developments

- 19.2.3.5. Financials (Based on Availability)

- 19.2.4 Parexel

- 19.2.4.1. Overview

- 19.2.4.2. Products

- 19.2.4.3. SWOT Analysis

- 19.2.4.4. Recent Developments

- 19.2.4.5. Financials (Based on Availability)

- 19.2.5 ICON PLC

- 19.2.5.1. Overview

- 19.2.5.2. Products

- 19.2.5.3. SWOT Analysis

- 19.2.5.4. Recent Developments

- 19.2.5.5. Financials (Based on Availability)

- 19.2.6 Sanofi

- 19.2.6.1. Overview

- 19.2.6.2. Products

- 19.2.6.3. SWOT Analysis

- 19.2.6.4. Recent Developments

- 19.2.6.5. Financials (Based on Availability)

- 19.2.7 Eli Lilly and Company

- 19.2.7.1. Overview

- 19.2.7.2. Products

- 19.2.7.3. SWOT Analysis

- 19.2.7.4. Recent Developments

- 19.2.7.5. Financials (Based on Availability)

- 19.2.8 F Hoffmann-La Roche AG

- 19.2.8.1. Overview

- 19.2.8.2. Products

- 19.2.8.3. SWOT Analysis

- 19.2.8.4. Recent Developments

- 19.2.8.5. Financials (Based on Availability)

- 19.2.9 IQVIA

- 19.2.9.1. Overview

- 19.2.9.2. Products

- 19.2.9.3. SWOT Analysis

- 19.2.9.4. Recent Developments

- 19.2.9.5. Financials (Based on Availability)

- 19.2.10 Novo Nordisk

- 19.2.10.1. Overview

- 19.2.10.2. Products

- 19.2.10.3. SWOT Analysis

- 19.2.10.4. Recent Developments

- 19.2.10.5. Financials (Based on Availability)

- 19.2.1 Pfizer Inc

List of Figures

- Figure 1: European Clinical Trials Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: European Clinical Trials Industry Share (%) by Company 2024

List of Tables

- Table 1: European Clinical Trials Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: European Clinical Trials Industry Revenue Million Forecast, by Phase 2019 & 2032

- Table 3: European Clinical Trials Industry Revenue Million Forecast, by Design 2019 & 2032

- Table 4: European Clinical Trials Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: European Clinical Trials Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Germany European Clinical Trials Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: France European Clinical Trials Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Italy European Clinical Trials Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: United Kingdom European Clinical Trials Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Netherlands European Clinical Trials Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Sweden European Clinical Trials Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Europe European Clinical Trials Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: European Clinical Trials Industry Revenue Million Forecast, by Phase 2019 & 2032

- Table 14: European Clinical Trials Industry Revenue Million Forecast, by Design 2019 & 2032

- Table 15: European Clinical Trials Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: European Clinical Trials Industry Revenue Million Forecast, by Phase 2019 & 2032

- Table 17: European Clinical Trials Industry Revenue Million Forecast, by Design 2019 & 2032

- Table 18: European Clinical Trials Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 19: European Clinical Trials Industry Revenue Million Forecast, by Phase 2019 & 2032

- Table 20: European Clinical Trials Industry Revenue Million Forecast, by Design 2019 & 2032

- Table 21: European Clinical Trials Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 22: European Clinical Trials Industry Revenue Million Forecast, by Phase 2019 & 2032

- Table 23: European Clinical Trials Industry Revenue Million Forecast, by Design 2019 & 2032

- Table 24: European Clinical Trials Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 25: European Clinical Trials Industry Revenue Million Forecast, by Phase 2019 & 2032

- Table 26: European Clinical Trials Industry Revenue Million Forecast, by Design 2019 & 2032

- Table 27: European Clinical Trials Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 28: European Clinical Trials Industry Revenue Million Forecast, by Phase 2019 & 2032

- Table 29: European Clinical Trials Industry Revenue Million Forecast, by Design 2019 & 2032

- Table 30: European Clinical Trials Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the European Clinical Trials Industry?

The projected CAGR is approximately 4.20%.

2. Which companies are prominent players in the European Clinical Trials Industry?

Key companies in the market include Pfizer Inc, Clinipace Worldwide, Thermo Fisher Scientific Inc (PPD), Parexel, ICON PLC, Sanofi, Eli Lilly and Company, F Hoffmann-La Roche AG, IQVIA, Novo Nordisk.

3. What are the main segments of the European Clinical Trials Industry?

The market segments include Phase, Design.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

High Research and Development Spending of the Healthcare Industry; Increasing Prevalence of Chronic and Infectious Diseases; Rising Focus on Rare Diseases and Multiple Orphan Drugs.

6. What are the notable trends driving market growth?

Phase III Segment is Expected to Hold the Major Revenue Share During the Forecast Period.

7. Are there any restraints impacting market growth?

Lower Healthcare Reimbursement in Developing Countries; Stringent Regulations for Patient Enrollment.

8. Can you provide examples of recent developments in the market?

In June 2022, Eli Lilly and Company released phase III clinicals trail AWARDS-PEDS results for the drug Trulicity (dulaglutide) that it led to the superior A1C reductions at 26 weeks versus placebo in youth and adolescents with type 2 diabetes.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "European Clinical Trials Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the European Clinical Trials Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the European Clinical Trials Industry?

To stay informed about further developments, trends, and reports in the European Clinical Trials Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence