Key Insights

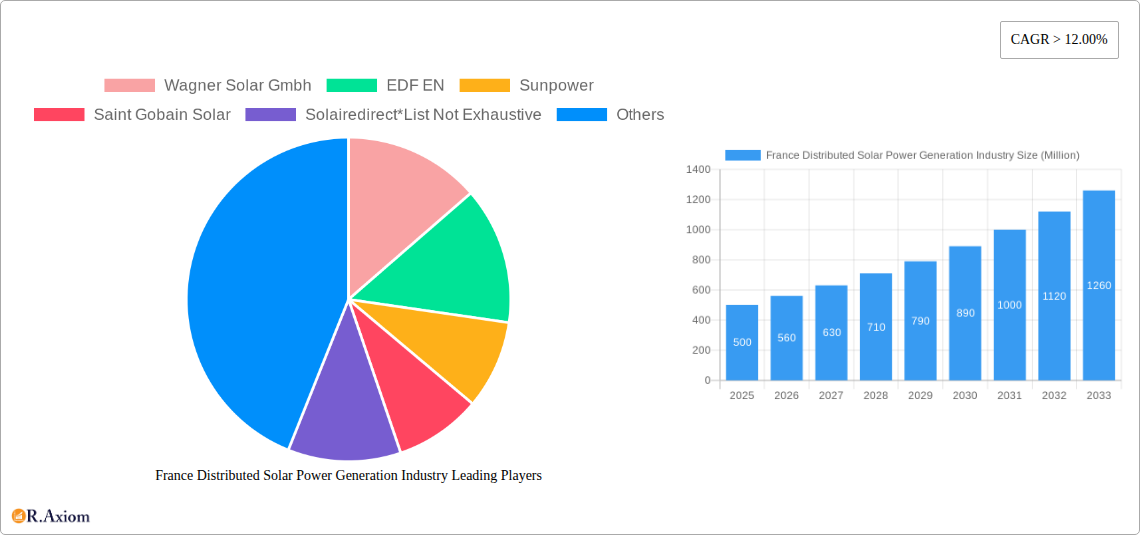

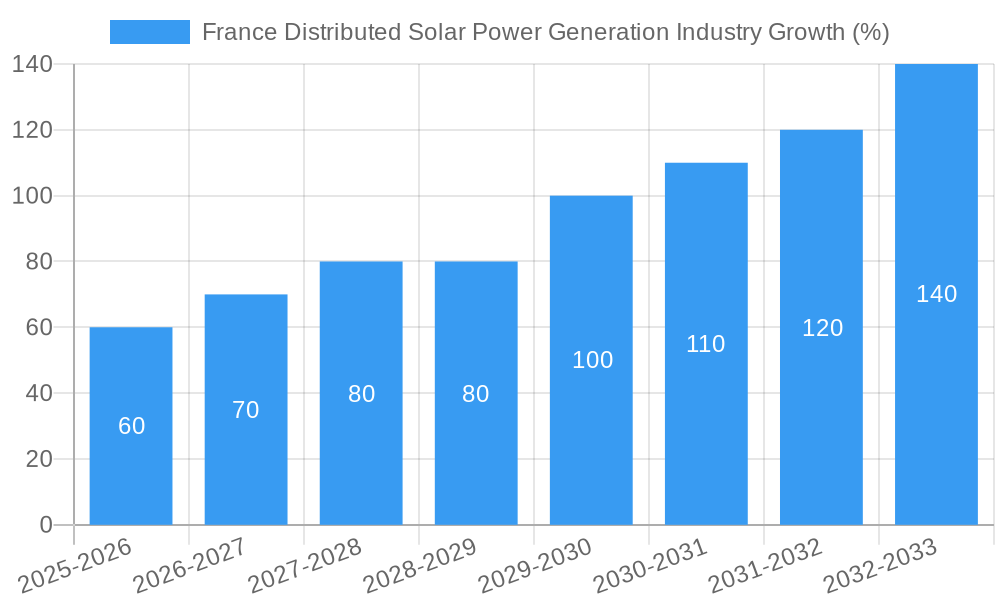

The French distributed solar power generation industry is experiencing robust growth, fueled by increasing government incentives promoting renewable energy adoption, falling solar panel prices, and rising energy costs. The market, valued at approximately €500 million in 2025 (estimated based on provided CAGR and value unit), is projected to expand significantly over the forecast period (2025-2033). A Compound Annual Growth Rate (CAGR) exceeding 12% indicates strong market momentum. Key drivers include the French government's ambitious renewable energy targets, coupled with a growing awareness of environmental sustainability among consumers and businesses. This is further bolstered by technological advancements leading to improved efficiency and reduced costs of solar panels and related equipment. Market segmentation reveals a diverse landscape, with various power ratings (large, medium, small), cooling types (air-cooled, oil-cooled), phases (single-phase, three-phase), and transformer types (power, distribution) catering to a wide range of applications, from residential rooftops to commercial and industrial installations. Leading players like Wagner Solar GmbH, EDF EN, and SunPower are actively shaping the market dynamics through innovative products and strategic partnerships.

However, the industry also faces challenges. Potential restraints include intermittent solar energy generation, requiring efficient energy storage solutions, and the initial high capital expenditure associated with solar installations. Regulatory hurdles and grid integration complexities could also hinder faster growth. Despite these constraints, the long-term outlook for the French distributed solar power generation market remains positive, given the strong government support, technological advancements, and increasing consumer demand for clean energy. The market's diverse segmentation offers significant opportunities for specialized players to target specific niches and capitalize on the ongoing growth trajectory. Further analysis reveals a consistent market expansion, with larger segments (e.g., commercial and industrial) exhibiting accelerated growth due to significant investment in renewable energy infrastructure.

France Distributed Solar Power Generation Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the France distributed solar power generation industry, covering market size, segmentation, growth drivers, challenges, and key players. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report offers valuable insights for industry stakeholders, investors, and strategic decision-makers seeking to understand and capitalize on the opportunities within this dynamic market. This report uses Million (M) as the unit for all values.

France Distributed Solar Power Generation Industry Market Concentration & Innovation

The France distributed solar power generation industry exhibits a moderately concentrated market structure, with a few dominant players holding significant market share. EDF EN, ENGIE, and Sunpower are among the leading companies, collectively accounting for an estimated xx% of the market share in 2025. However, the market is witnessing increased participation from smaller, specialized companies, driving innovation and competition.

- Market Concentration: The Herfindahl-Hirschman Index (HHI) for the industry is estimated at xx in 2025, suggesting a moderately concentrated market.

- Innovation Drivers: Government incentives, technological advancements (e.g., improved solar cell efficiency, smart grid integration), and rising energy costs are key innovation drivers.

- Regulatory Framework: The French government's supportive policies, including feed-in tariffs and tax benefits, have significantly encouraged investments in distributed solar power generation.

- Product Substitutes: While distributed solar power faces competition from other renewable energy sources (wind, hydro), its decentralized nature and ease of integration provide a competitive advantage.

- End-User Trends: Increasing awareness of environmental sustainability, coupled with declining solar panel costs, is driving strong end-user demand.

- M&A Activities: The industry has witnessed xx M&A deals in the historical period (2019-2024), with a total deal value of approximately xx Million. These transactions reflect consolidation trends and strategic expansion efforts.

France Distributed Solar Power Generation Industry Industry Trends & Insights

The French distributed solar power generation market is experiencing robust growth, driven by supportive government policies, decreasing technology costs, and rising environmental consciousness. The market is projected to achieve a CAGR of xx% during the forecast period (2025-2033), reaching a market size of xx Million by 2033. Technological advancements, such as the development of higher-efficiency solar panels and improved energy storage solutions, are further accelerating market growth. Consumer preferences are shifting towards sustainable energy solutions, boosting the demand for distributed solar power generation systems. The competitive landscape is becoming increasingly dynamic, with both established players and new entrants vying for market share. Market penetration of distributed solar power systems is steadily increasing, with residential and commercial sectors exhibiting strong growth.

Dominant Markets & Segments in France Distributed Solar Power Generation Industry

While data on specific regional dominance is not readily available, the Ile-de-France region, given its high population density and energy consumption, likely represents a significant portion of the market. Further research is needed for definitive conclusions on regional dominance. Segment-wise, the following observations can be made:

- By Power Rating: The medium-sized segment (xx kW to xx kW) currently holds the largest market share, owing to its suitability for both residential and commercial applications.

- By Cooling Type: Air-cooled systems dominate due to their lower cost and simpler maintenance.

- By Phase: Three-phase systems are more prevalent in commercial and industrial installations, while single-phase systems are common in residential settings.

- By Transformer Type: Distribution transformers are predominantly used due to their cost-effectiveness in smaller installations.

Key Drivers:

- Supportive Government Policies: Incentives and regulatory frameworks facilitating solar adoption.

- Declining Solar Panel Costs: Making solar power increasingly economically viable.

- Technological Advancements: Higher efficiency panels and advanced energy storage solutions.

- Growing Environmental Awareness: Increased consumer preference for clean energy.

France Distributed Solar Power Generation Industry Product Developments

Recent innovations include the development of more efficient solar panels with improved energy conversion rates and advanced energy storage systems which enhance the reliability and grid stability of distributed solar power systems. These advancements contribute to the increasing cost-competitiveness of solar power, broadening its market appeal and fostering wider adoption. New functionalities like smart grid integration and remote monitoring capabilities are also gaining traction.

Report Scope & Segmentation Analysis

This report comprehensively segments the France distributed solar power generation market across multiple parameters:

- By Power Rating: Large (> xx kW), Medium (xx kW – xx kW), Small (< xx kW)

- By Cooling Type: Air Cooled, Oil Cooled

- By Phase: Single Phase, Three Phase

- By Transformer Type: Power Transformer, Distribution Transformer

Each segment’s growth projections, market size estimates, and competitive dynamics are analyzed in detail within the full report.

Key Drivers of France Distributed Solar Power Generation Industry Growth

The French distributed solar power generation industry's growth is fueled by several factors: decreasing solar panel costs, government incentives (tax credits, feed-in tariffs), and rising environmental awareness among consumers and businesses. Technological innovations, such as improved battery storage and smart grid integration, further enhance the appeal of distributed solar power generation.

Challenges in the France Distributed Power Generation Industry Sector

The industry faces challenges such as intermittent solar power generation, requiring robust energy storage solutions. Furthermore, grid integration constraints and regulatory complexities can hinder market expansion. Competition from other renewable energy sources and fluctuating raw material prices also represent significant hurdles. These factors collectively contribute to project uncertainties and may impact market growth.

Emerging Opportunities in France Distributed Solar Power Generation Industry

Significant opportunities exist in developing advanced energy storage solutions for enhanced grid stability and self-consumption capabilities. Integrating distributed solar power with other renewable energy sources (hybrid systems) presents further opportunities. Expanding the market to rural and underserved areas, promoting community solar projects and targeting specific consumer segments, like agriculture and tourism, will unlock further market potential.

Leading Players in the France Distributed Solar Power Generation Industry Market

Key Developments in France Distributed Solar Power Generation Industry Industry

- 2022 Q4: Government announces new incentives for community solar projects.

- 2023 Q1: EDF EN launches a new range of high-efficiency solar panels.

- 2024 Q2: Merger between two smaller solar companies increases market concentration. (Further developments will be detailed in the complete report)

Strategic Outlook for France Distributed Solar Power Generation Industry Market

The French distributed solar power generation market exhibits robust growth potential, driven by favorable government policies, technological advancements, and heightened environmental awareness. Expanding into new market segments and leveraging technological innovations will be crucial for continued success. The market is expected to remain dynamic, with intense competition among established players and emerging companies. Focusing on value-added services like energy storage and smart grid integration will become increasingly important for securing a competitive advantage.

France Distributed Solar Power Generation Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

France Distributed Solar Power Generation Industry Segmentation By Geography

- 1. France

France Distributed Solar Power Generation Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 12.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Global Inclination toward Renewable-based Power Generation4.; Increased Power Demand in Line with the Increasing Population

- 3.3. Market Restrains

- 3.3.1. 4.; High Initial Cost

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Clean Electricity to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. France Distributed Solar Power Generation Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. France

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Wagner Solar Gmbh

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 EDF EN

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Sunpower

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Saint Gobain Solar

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Solairedirect*List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 ENGIE

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.1 Wagner Solar Gmbh

List of Figures

- Figure 1: France Distributed Solar Power Generation Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: France Distributed Solar Power Generation Industry Share (%) by Company 2024

List of Tables

- Table 1: France Distributed Solar Power Generation Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: France Distributed Solar Power Generation Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 3: France Distributed Solar Power Generation Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 4: France Distributed Solar Power Generation Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 5: France Distributed Solar Power Generation Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 6: France Distributed Solar Power Generation Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 7: France Distributed Solar Power Generation Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 8: France Distributed Solar Power Generation Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 9: France Distributed Solar Power Generation Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 10: France Distributed Solar Power Generation Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 11: France Distributed Solar Power Generation Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 12: France Distributed Solar Power Generation Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 13: France Distributed Solar Power Generation Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 14: France Distributed Solar Power Generation Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the France Distributed Solar Power Generation Industry?

The projected CAGR is approximately > 12.00%.

2. Which companies are prominent players in the France Distributed Solar Power Generation Industry?

Key companies in the market include Wagner Solar Gmbh, EDF EN, Sunpower, Saint Gobain Solar, Solairedirect*List Not Exhaustive, ENGIE.

3. What are the main segments of the France Distributed Solar Power Generation Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Global Inclination toward Renewable-based Power Generation4.; Increased Power Demand in Line with the Increasing Population.

6. What are the notable trends driving market growth?

Increasing Demand for Clean Electricity to Drive the Market.

7. Are there any restraints impacting market growth?

4.; High Initial Cost.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "France Distributed Solar Power Generation Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the France Distributed Solar Power Generation Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the France Distributed Solar Power Generation Industry?

To stay informed about further developments, trends, and reports in the France Distributed Solar Power Generation Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence