Key Insights

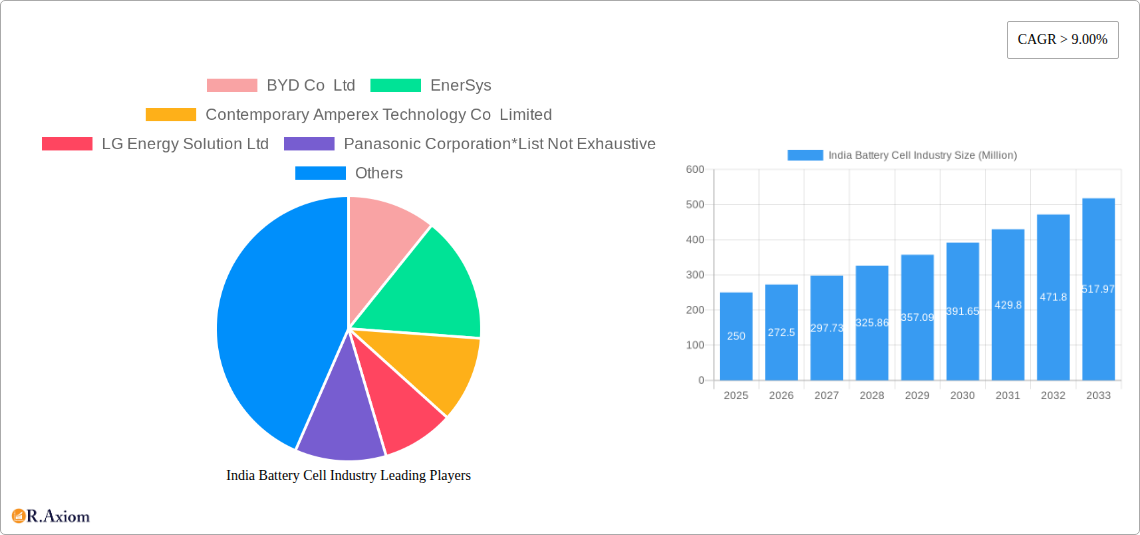

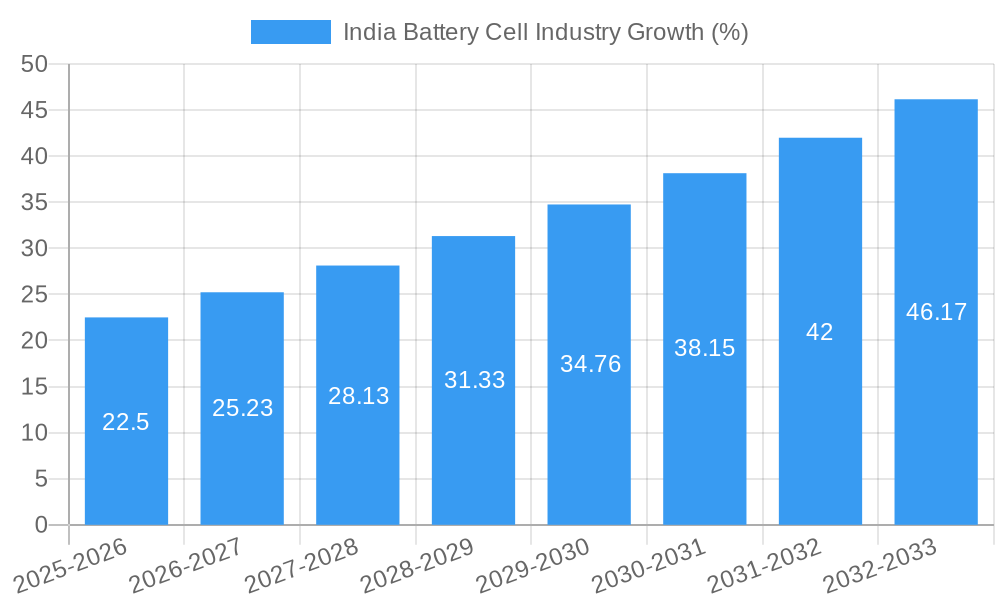

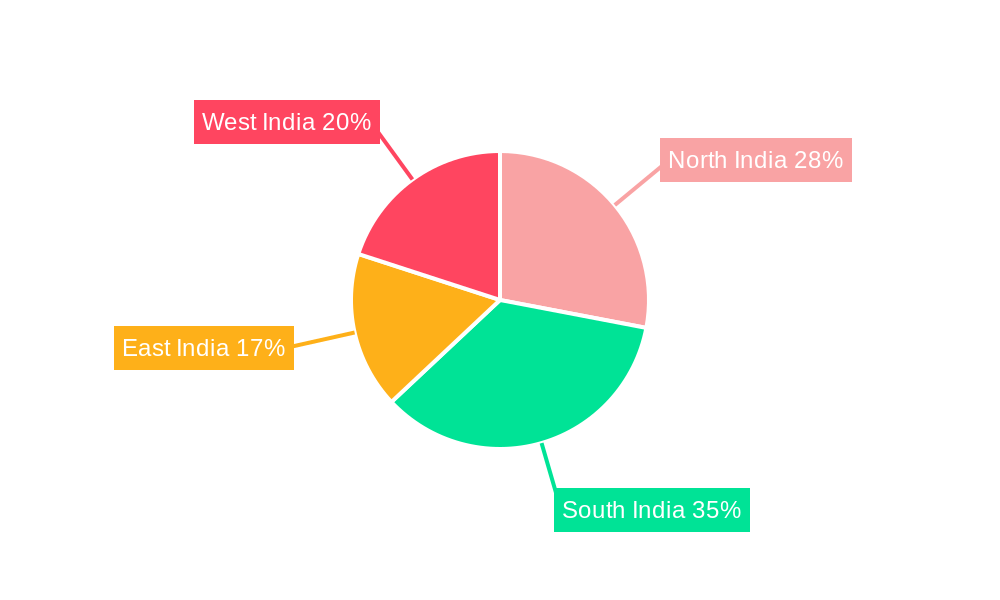

The India battery cell industry is experiencing robust growth, driven by the increasing demand for electric vehicles (EVs), renewable energy storage, and portable electronic devices. With a Compound Annual Growth Rate (CAGR) exceeding 9% and a market size in the hundreds of millions (precise figures unavailable, but estimated based on global trends and India's economic growth), the sector presents significant investment opportunities. Key drivers include government initiatives promoting EV adoption, rapid urbanization leading to increased energy consumption, and a growing focus on renewable energy integration. The market is segmented by battery type (prismatic, cylindrical, pouch) and application (automotive, industrial, portable, power tools, SLI, others). While the automotive battery segment currently dominates, significant growth is anticipated across all applications, particularly in industrial and renewable energy storage solutions. Challenges include the high initial investment costs associated with battery cell manufacturing and the need for a robust supply chain to ensure reliable sourcing of raw materials. However, the long-term prospects are positive, with India aiming to become a major player in the global battery cell market. Leading players like BYD, EnerSys, CATL, LG Energy Solution, Panasonic, GS Yuasa, and Duracell are actively investing in the Indian market, showcasing its potential. Regional variations exist within India, with states like Maharashtra, Tamil Nadu, and Gujarat anticipated to drive significant growth due to existing manufacturing infrastructure and government support.

The diverse applications of battery cells fuel market expansion. The growth in the automotive sector, particularly two-wheelers and three-wheelers, is a substantial driver, coupled with the rising popularity of electric cars. Furthermore, the increasing adoption of renewable energy sources like solar and wind power necessitates efficient energy storage solutions, propelling demand for battery cells in the industrial and grid-scale applications. The continuous advancements in battery technology, focusing on enhanced energy density, longer lifespan, and improved safety features, are further stimulating market growth. While challenges remain regarding raw material sourcing and the need for advanced manufacturing capabilities, strategic partnerships, government incentives, and technological breakthroughs are mitigating these challenges, paving the way for a promising future for the India battery cell market.

India Battery Cell Industry: A Comprehensive Market Report (2019-2033)

This detailed report provides a comprehensive analysis of the India battery cell industry, covering market size, segmentation, growth drivers, challenges, and key players. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The forecast period is 2025-2033, and the historical period covers 2019-2024. The report is crucial for stakeholders including investors, manufacturers, and government agencies seeking to understand and participate in this rapidly evolving market.

India Battery Cell Industry Market Concentration & Innovation

This section analyzes the level of market concentration, key innovation drivers, regulatory landscape, product substitutes, end-user trends, and mergers and acquisitions (M&A) activities within the Indian battery cell industry. The Indian battery cell market is currently characterized by a mix of established international players and emerging domestic companies. While a few large players hold significant market share (xx%), the market is fragmented with numerous smaller players contributing to the overall landscape.

Market Concentration Metrics:

- Market Share of Top 5 Players: xx% (2024)

- Herfindahl-Hirschman Index (HHI): xx (2024)

Innovation Drivers:

- Government incentives promoting EV adoption and domestic manufacturing.

- Technological advancements in battery chemistry (e.g., sodium-ion, solid-state).

- Growing demand for energy storage solutions across diverse sectors.

Regulatory Frameworks:

- Policies encouraging localization of battery manufacturing.

- Safety and environmental regulations impacting battery production and disposal.

Product Substitutes:

- Fuel cells and other energy storage technologies compete for market share.

End-User Trends:

- Rising demand for electric vehicles (EVs) significantly drives growth.

- Increased adoption of battery-powered devices in consumer electronics and industrial applications.

M&A Activities:

- Reliance Industries' acquisition of Faradion (Jan 2022) for USD 135 Million, showcasing significant interest in sodium-ion battery technology. Further investment of USD 35 Million is planned for commercialization. Other notable M&A activities are anticipated with values estimated at xx Million USD in the forecast period.

India Battery Cell Industry Industry Trends & Insights

The Indian battery cell industry is experiencing robust growth, driven by the government's push for electric mobility, increasing demand for portable electronics, and the expanding industrial automation sector. The Compound Annual Growth Rate (CAGR) for the period 2025-2033 is projected at xx%, reflecting substantial market expansion. Key factors propelling this growth include:

- Government initiatives such as Production Linked Incentive (PLI) schemes for battery manufacturing are significantly attracting investments and boosting domestic production.

- Technological advancements, particularly in lithium-ion battery technology and the emergence of alternative battery chemistries such as sodium-ion, are improving energy density, lifespan, and affordability.

- The increasing adoption of renewable energy sources is fuelling the demand for energy storage solutions, making battery cells a crucial component of grid-scale energy storage systems.

- Consumer preferences are shifting toward eco-friendly and sustainable products, further driving the uptake of electric vehicles and battery-powered devices.

Market penetration of battery cells in various applications shows promising results. The automotive battery segment is expected to witness the highest penetration, driven by the rapidly expanding EV market. The market penetration rate of battery cells in the automotive sector is projected to reach xx% by 2033. Furthermore, the industrial and portable battery segments are also expected to demonstrate considerable growth driven by increased automation and the demand for portable electronics.

Competitive dynamics are marked by a blend of both domestic and international players. International companies are entering the Indian market through joint ventures or setting up manufacturing facilities to cater to the rising demand. The competitive landscape is intense with focus on technological advancements, cost optimization, and supply chain management.

Dominant Markets & Segments in India Battery Cell Industry

The Indian battery cell market exhibits diverse segments based on battery type and application. While the precise dominance will fluctuate during the forecast period, initial trends suggest:

Dominant Segments:

- By Type: Lithium-ion batteries (Prismatic, Cylindrical, and Pouch) will dominate, with prismatic cells gaining significant traction due to their suitability for EVs and energy storage systems. The market share for prismatic, cylindrical and pouch cells in 2025 is estimated at xx%, xx% and xx%, respectively.

- By Application: The automotive battery segment is projected to lead the market in terms of revenue contribution and growth rate, driven by the government's ambitious EV adoption targets. Other application segments including industrial, portable, power tools, and SLI batteries are also expected to contribute significantly to the market growth.

Key Drivers for Dominance:

- Automotive Batteries: Government policies promoting EV adoption, expanding EV infrastructure (charging stations), and rising consumer preference for electric vehicles are key drivers.

- Industrial Batteries: Increasing automation in various industries, particularly manufacturing and warehousing, is bolstering the demand for reliable and efficient industrial battery solutions.

- Portable Batteries: The proliferation of smartphones, laptops, and other portable electronic devices fuels the consistent demand for high-performance and long-lasting batteries.

- Economic Policies: The Indian government's focus on 'Make in India' and PLI schemes are critical in attracting investments and fostering domestic manufacturing capacity.

- Infrastructure Development: Investments in charging infrastructure for EVs and advancements in power grid management are critical to supporting the growth of the automotive battery segment.

India Battery Cell Industry Product Developments

Recent years have witnessed significant advancements in battery cell technology in India. The introduction of Aluminum-Graphene pouch cell batteries by Nordische Technologies (May 2022) represents a notable development, targeting consumer electronics and future EV applications. This innovation highlights the focus on enhancing energy density and performance. Furthermore, Reliance Industries' acquisition of Faradion showcases the interest in alternative battery chemistries like sodium-ion, offering potentially safer and more cost-effective solutions. These developments underline a strong focus on improving battery performance, enhancing safety features, and exploring more sustainable and cost-effective battery technologies to meet the growing market demands.

Report Scope & Segmentation Analysis

This report comprehensively analyzes the India battery cell industry across various segments.

By Type:

- Prismatic: This segment is expected to exhibit significant growth due to its suitability for EVs and large-scale energy storage. The market size is predicted to reach xx Million by 2033. Competitive dynamics are intense, with both domestic and international players vying for market share.

- Cylindrical: This segment maintains a considerable market share, primarily driven by its application in portable electronics. Market size is projected at xx Million by 2033.

- Pouch: This segment is rapidly expanding, driven by its flexibility and use in diverse applications. The market size is expected to reach xx Million by 2033.

By Application:

- Automotive Batteries: The largest and fastest-growing segment, driven by the government’s EV push. Expected to reach xx Million by 2033.

- Industrial Batteries: Steady growth due to increasing industrial automation. Expected market size: xx Million by 2033.

- Portable Batteries: Consistent growth driven by consumer electronics. Expected market size: xx Million by 2033.

- Power Tools Batteries: Moderate growth, linked to the construction and DIY sectors. Expected market size: xx Million by 2033.

- SLI Batteries: Relatively stable growth. Expected market size: xx Million by 2033.

- Others: Includes niche applications with modest growth potential. Expected market size: xx Million by 2033.

Key Drivers of India Battery Cell Industry Growth

The growth of the Indian battery cell industry is propelled by several key factors:

- Government initiatives such as the Production Linked Incentive (PLI) scheme to boost domestic manufacturing.

- Rapid expansion of the electric vehicle (EV) market.

- Increasing demand for energy storage solutions in various sectors (e.g., renewable energy).

- Technological advancements leading to higher energy density, longer lifespan, and improved safety features of batteries.

Challenges in the India Battery Cell Industry Sector

The Indian battery cell industry faces several challenges:

- High initial investment costs for setting up manufacturing facilities.

- Dependence on imports for raw materials, leading to supply chain vulnerabilities.

- Lack of skilled workforce in battery manufacturing and technology.

- Stringent safety and environmental regulations.

Emerging Opportunities in India Battery Cell Industry

Several opportunities exist for growth:

- Exploration and adoption of alternative battery technologies (e.g., sodium-ion).

- Growth of the energy storage system (ESS) market for grid-scale applications.

- Development of battery recycling infrastructure to address environmental concerns.

- Expansion into new applications and markets, particularly in rural areas.

Leading Players in the India Battery Cell Industry Market

- BYD Co Ltd

- EnerSys

- Contemporary Amperex Technology Co Limited

- LG Energy Solution Ltd

- Panasonic Corporation

- GS Yuasa Corporation

- Duracell Inc

Key Developments in India Battery Cell Industry Industry

- May 2022: Nordische Technologies launches Aluminium-Graphene pouch cell battery.

- Jan 2022: Reliance Industries acquires Faradion for USD 135 Million, planning further investment of USD 35 Million.

Strategic Outlook for India Battery Cell Industry Market

The Indian battery cell industry is poised for significant growth over the forecast period, driven by supportive government policies, technological advancements, and increasing demand from various sectors. The focus on domestic manufacturing and the exploration of alternative battery technologies will shape the industry's future. Continued investment in research and development, coupled with strategic partnerships, will be crucial for players seeking to capitalize on this burgeoning market.

India Battery Cell Industry Segmentation

-

1. Type

- 1.1. Prismatic

- 1.2. Cylindrical

- 1.3. Pouch

-

2. Application

- 2.1. Automotive Batteries

- 2.2. Industrial Batteries

- 2.3. Portable Batteries

- 2.4. Power Tools Batteries

- 2.5. SLI Batteries

- 2.6. Others

India Battery Cell Industry Segmentation By Geography

- 1. India

India Battery Cell Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 9.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Demand for Natural Gas and Developing Gas Infrastructure 4.; Increasing Offshore Oil & Gas Exploration Activities

- 3.3. Market Restrains

- 3.3.1. 4.; Adoption of Cleaner Alternatives4.; High Volatility of Crude Oil Prices

- 3.4. Market Trends

- 3.4.1. Prismatic cell Segment is Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Battery Cell Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Prismatic

- 5.1.2. Cylindrical

- 5.1.3. Pouch

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Automotive Batteries

- 5.2.2. Industrial Batteries

- 5.2.3. Portable Batteries

- 5.2.4. Power Tools Batteries

- 5.2.5. SLI Batteries

- 5.2.6. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North India India Battery Cell Industry Analysis, Insights and Forecast, 2019-2031

- 7. South India India Battery Cell Industry Analysis, Insights and Forecast, 2019-2031

- 8. East India India Battery Cell Industry Analysis, Insights and Forecast, 2019-2031

- 9. West India India Battery Cell Industry Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 BYD Co Ltd

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 EnerSys

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Contemporary Amperex Technology Co Limited

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 LG Energy Solution Ltd

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Panasonic Corporation*List Not Exhaustive

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 GS Yuasa Corporation

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Duracell Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.1 BYD Co Ltd

List of Figures

- Figure 1: India Battery Cell Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Battery Cell Industry Share (%) by Company 2024

List of Tables

- Table 1: India Battery Cell Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Battery Cell Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: India Battery Cell Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 4: India Battery Cell Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: India Battery Cell Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: North India India Battery Cell Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: South India India Battery Cell Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: East India India Battery Cell Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: West India India Battery Cell Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: India Battery Cell Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 11: India Battery Cell Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 12: India Battery Cell Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Battery Cell Industry?

The projected CAGR is approximately > 9.00%.

2. Which companies are prominent players in the India Battery Cell Industry?

Key companies in the market include BYD Co Ltd, EnerSys, Contemporary Amperex Technology Co Limited, LG Energy Solution Ltd, Panasonic Corporation*List Not Exhaustive, GS Yuasa Corporation, Duracell Inc.

3. What are the main segments of the India Battery Cell Industry?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Demand for Natural Gas and Developing Gas Infrastructure 4.; Increasing Offshore Oil & Gas Exploration Activities.

6. What are the notable trends driving market growth?

Prismatic cell Segment is Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Adoption of Cleaner Alternatives4.; High Volatility of Crude Oil Prices.

8. Can you provide examples of recent developments in the market?

In May 2022, India-based start-up, Nordische Technologies, have launched an Aluminium-Graphene pouch cell battery for consumer electronics, gadgets, and future EV technology in association with the Central Institute of Petrochemicals Engineering and Technology (CIPET), Bengaluru.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Battery Cell Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Battery Cell Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Battery Cell Industry?

To stay informed about further developments, trends, and reports in the India Battery Cell Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence