Key Insights

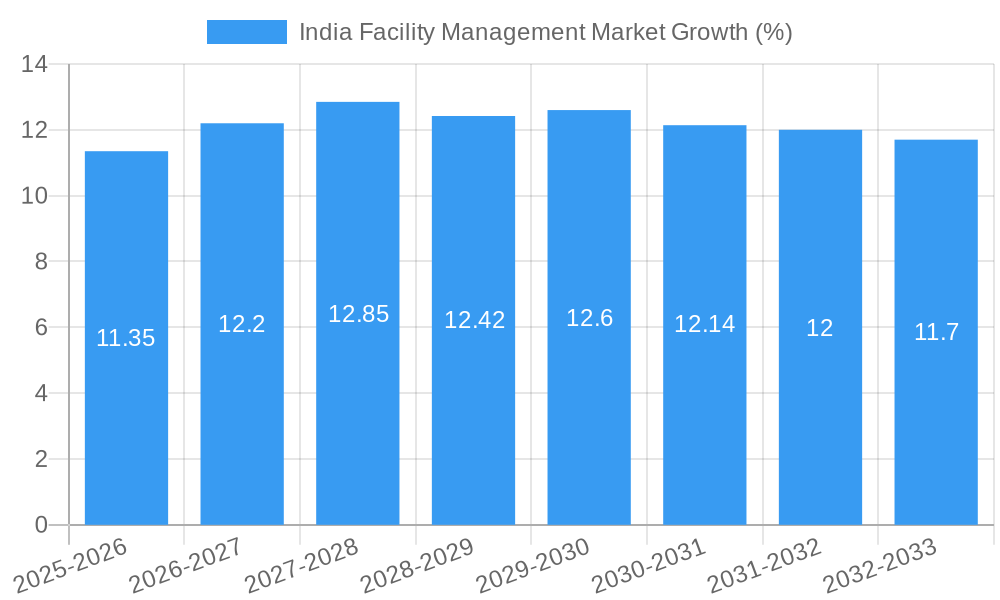

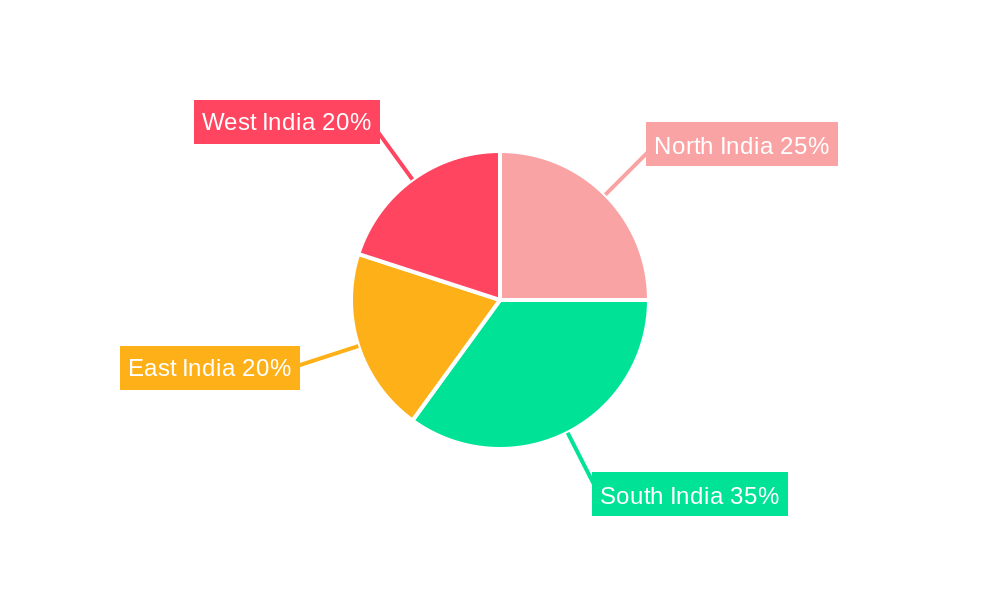

The India Facility Management (FM) market is experiencing robust growth, projected to reach a market size of $148.65 million in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 7.37% from 2025 to 2033. This expansion is driven by several key factors. The increasing adoption of outsourced facility services by both organized and unorganized sectors – particularly within the commercial and industrial segments – is a major contributor. Rising urbanization, coupled with the growth of burgeoning industries and a focus on improving operational efficiency, fuels demand for professional FM services. Furthermore, a growing awareness of sustainability and the need for efficient resource management is compelling businesses to invest in sophisticated FM solutions, encompassing hard services (maintenance, repairs) and soft services (cleaning, security). The organized sector is expected to exhibit faster growth compared to the unorganized segment due to increased investment in technology and adoption of best practices. Regional variations exist, with South and West India potentially leading in market share due to higher concentrations of commercial and industrial activity.

However, the market also faces certain challenges. A significant portion of the market remains unorganized, characterized by fragmented players and potentially inconsistent service quality. Finding and retaining skilled manpower continues to be a constraint. Furthermore, fluctuating energy prices and evolving regulatory compliance requirements can impact overall market dynamics. The market's future hinges on overcoming these hurdles through technological advancements, consolidation within the industry, and the development of skilled professionals. Companies like Quess Corporation, ISS Facility Management, and others, are well-positioned to capitalize on these trends, offering specialized services that cater to specific sector needs. The increasing focus on data-driven decision-making and the adoption of smart technologies within FM further indicates a promising outlook for the sector's future growth in India.

India Facility Management Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the India Facility Management market, covering the period 2019-2033. It offers actionable insights for industry stakeholders, investors, and businesses seeking to understand this dynamic sector. The report leverages extensive research and data analysis to provide a thorough overview of market size, segmentation, growth drivers, challenges, and key players. With a focus on high-impact keywords like "India Facility Management Market," "Facility Management Services India," "Hard Services," "Soft Services," and "Commercial Facility Management," this report ensures maximum search engine visibility. Estimated market values are presented in Millions (USD).

India Facility Management Market Concentration & Innovation

The India Facility Management market exhibits a moderately concentrated landscape, with a few large players dominating alongside numerous smaller, regional firms. Market share data reveals that Quess Corporation, ISS Facility Management, and Sodexo Facilities Management Services India Private Limited hold significant portions of the market, though precise figures are not publicly available. The market is witnessing increasing consolidation through mergers and acquisitions (M&A) activity, as evidenced by the acquisition of Facilities Management LLC and Peltz Services Inc. by Tech24 in May 2022. The deal value for this acquisition is undisclosed (xx Million). This trend is expected to continue, driven by the pursuit of economies of scale and expansion into new service segments.

Innovation in the sector is driven by several factors:

- Technological advancements: Adoption of smart building technologies, IoT-enabled solutions, and data analytics for predictive maintenance and improved efficiency.

- Changing end-user demands: Growing focus on sustainability, operational efficiency, and improved occupant experience.

- Regulatory frameworks: Government initiatives promoting green buildings and sustainable practices.

- Product substitution: The emergence of cloud-based facility management software and integrated service offerings.

Ongoing M&A activity, while creating larger players, also fosters innovation through the integration of diverse technologies and expertise. The competitive landscape demands continuous innovation to meet evolving customer requirements and stay ahead of competitors. The regulatory environment, although not overly restrictive, influences the adoption of sustainable practices.

India Facility Management Market Industry Trends & Insights

The India Facility Management market is experiencing robust growth, driven by rapid urbanization, expanding commercial real estate, and rising demand for efficient and cost-effective facility management solutions. The market's Compound Annual Growth Rate (CAGR) during the historical period (2019-2024) is estimated at xx%. The forecast period (2025-2033) projects a CAGR of xx%, indicating sustained growth momentum. Market penetration remains relatively low in certain sectors, particularly within the unorganized segment, presenting substantial untapped potential.

Technological disruptions are significantly impacting the market, with the adoption of smart building technologies, predictive maintenance, and data analytics gaining traction. Consumer preferences are shifting towards integrated services, sustainability, and customized solutions that optimize cost and efficiency. Competitive dynamics are characterized by intense competition among large multinational corporations and smaller, specialized providers. The market is witnessing increasing adoption of cloud-based software solutions, creating new opportunities for growth. The increasing adoption of green building standards and regulations is further driving growth, especially within the organized sector.

Dominant Markets & Segments in India Facility Management Market

The Indian Facility Management market is geographically diverse, with significant presence across major metropolitan areas and Tier-1 cities. However, the commercial sector dominates the market, owing to its size and higher demand for sophisticated facility management services. Within the segmentation, analysis reveals the following:

- By Facility Management Type: Hard services (e.g., HVAC, electrical) and soft services (e.g., cleaning, security) both contribute significantly. Hard services are experiencing faster growth due to increased demand for technological upgrades.

- By Sector Type: The organized sector dominates, driven by larger corporations' need for professional facility management. However, the unorganized sector presents a significant growth opportunity with increasing awareness and demand.

- By End-User: Commercial (offices, malls) and industrial (manufacturing, warehousing) segments are the leading end-users, with infrastructure projects contributing to increasing market size.

Key Drivers for Dominant Segments:

- Commercial: Robust growth in commercial real estate, increasing corporate focus on efficiency, and rising demand for premium services.

- Organized Sector: Higher adoption of professional services, willingness to invest in advanced technologies, and stricter regulatory compliance.

India Facility Management Market Product Developments

Recent product innovations focus on integrating technology to improve efficiency and cost savings. Cloud-based facility management platforms, AI-powered predictive maintenance tools, and IoT-enabled sensors are gaining prominence. These technologies offer significant competitive advantages by providing real-time data analysis, optimized resource allocation, and improved decision-making. The focus is on developing scalable, adaptable solutions catering to diverse customer needs and promoting sustainability.

Report Scope & Segmentation Analysis

This report segments the India Facility Management market across three key dimensions:

By Facility Management Type: Hard Services, encompassing electrical, HVAC, plumbing; and Soft Services, including cleaning, security, and landscaping. Growth projections for hard services are higher due to technological advancements.

By Sector Type: Organized, comprising large corporations and institutional clients; and Unorganized, representing smaller businesses and individual clients. The organized sector dominates in terms of market size, but the unorganized sector offers significant growth potential.

By End-User: Commercial, encompassing office spaces, retail, and hospitality; Industrial, including manufacturing plants and warehouses; and Infrastructure, covering transportation, utilities, and government facilities. Commercial and Industrial sectors are currently the largest contributors to market revenue.

Key Drivers of India Facility Management Market Growth

The growth of the India Facility Management market is propelled by several factors:

- Rapid urbanization and infrastructure development: Increased construction activity fuels demand for facility management services.

- Growth of the organized sector: Large corporations increasingly outsource facility management to focus on core business activities.

- Technological advancements: Adoption of smart building technologies and innovative solutions enhances efficiency and reduces costs.

- Government initiatives: Policies promoting sustainable buildings and improved infrastructure further accelerate market growth.

Challenges in the India Facility Management Market Sector

The India Facility Management market faces several challenges:

- Lack of skilled workforce: A shortage of qualified professionals hinders service delivery and quality.

- High labor costs: Increasing wages pose a significant challenge for cost-effective operations.

- Competition from unorganized players: Small players often undercut prices, impacting margins for larger firms.

- Stringent regulatory compliance: Adherence to environmental and safety regulations can increase operational costs.

Emerging Opportunities in India Facility Management Market

Several emerging opportunities exist for growth:

- Expanding into Tier-2 and Tier-3 cities: Untapped potential in smaller cities as businesses expand their presence.

- Focus on sustainable facility management: Growing emphasis on green building practices creates demand for specialized services.

- Adoption of advanced technologies: Smart building solutions and data analytics offer opportunities for innovation and differentiation.

- Integrated facility management solutions: Bundling multiple services enhances value and attracts clients.

Leading Players in the India Facility Management Market Market

- Quess Corporation

- ISS Facility Management

- Updater Services Private Limited

- BVG India Limited

- Dusters Total Solutions Limited

- ServiceMax Facility Management Private Limited

- EFS Facilities Services

- Mortice Group PLC (TenonFM)

- G4S India

- Sodexo Facilities Management Services India Private Limited

Key Developments in India Facility Management Market Industry

- Apr 2023: Sodexo Facilities Management Services India Private Limited partnered with the Ministry of Skill Development to offer employment opportunities in the facilities management sector. This initiative significantly impacts the industry by addressing the skills gap.

- May 2022: Tech24's acquisition of Facilities Management LLC and Peltz Services Inc. expands its service offerings and market reach. This signifies the ongoing consolidation trend within the sector.

Strategic Outlook for India Facility Management Market Market

The India Facility Management market exhibits strong growth potential, driven by sustained economic growth, urbanization, and technological advancements. Opportunities abound for players that focus on innovation, sustainability, and providing integrated solutions. The market is expected to see continued consolidation, with larger players acquiring smaller firms. Companies investing in technology, skilled workforce development, and sustainable practices will be best positioned for future success. The focus on skill development and technological advancements will significantly shape the market's future trajectory.

India Facility Management Market Segmentation

-

1. Facility Management Type

- 1.1. Hard Services

- 1.2. Soft Services

-

2. Sector Type

- 2.1. Unorganized

- 2.2. Organized

-

3. End-User

- 3.1. Commercial

- 3.2. Industrial

- 3.3. Infrastructure

-

4. Geography

- 4.1. North

- 4.2. West

- 4.3. South

- 4.4. East

India Facility Management Market Segmentation By Geography

- 1. North

- 2. West

- 3. South

- 4. East

India Facility Management Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.37% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Emphasis on Outsourcing of Non-core Operations; Steady Growth in Commercial Real Estate Sector; Strong Emphasis on Green Practices and Safety Awareness

- 3.3. Market Restrains

- 3.3.1. Skilled Manpower Shortage and Macro Level Fluctuations

- 3.4. Market Trends

- 3.4.1. Soft Services to Drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Facility Management Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Facility Management Type

- 5.1.1. Hard Services

- 5.1.2. Soft Services

- 5.2. Market Analysis, Insights and Forecast - by Sector Type

- 5.2.1. Unorganized

- 5.2.2. Organized

- 5.3. Market Analysis, Insights and Forecast - by End-User

- 5.3.1. Commercial

- 5.3.2. Industrial

- 5.3.3. Infrastructure

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. North

- 5.4.2. West

- 5.4.3. South

- 5.4.4. East

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North

- 5.5.2. West

- 5.5.3. South

- 5.5.4. East

- 5.1. Market Analysis, Insights and Forecast - by Facility Management Type

- 6. North India Facility Management Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Facility Management Type

- 6.1.1. Hard Services

- 6.1.2. Soft Services

- 6.2. Market Analysis, Insights and Forecast - by Sector Type

- 6.2.1. Unorganized

- 6.2.2. Organized

- 6.3. Market Analysis, Insights and Forecast - by End-User

- 6.3.1. Commercial

- 6.3.2. Industrial

- 6.3.3. Infrastructure

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. North

- 6.4.2. West

- 6.4.3. South

- 6.4.4. East

- 6.1. Market Analysis, Insights and Forecast - by Facility Management Type

- 7. West India Facility Management Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Facility Management Type

- 7.1.1. Hard Services

- 7.1.2. Soft Services

- 7.2. Market Analysis, Insights and Forecast - by Sector Type

- 7.2.1. Unorganized

- 7.2.2. Organized

- 7.3. Market Analysis, Insights and Forecast - by End-User

- 7.3.1. Commercial

- 7.3.2. Industrial

- 7.3.3. Infrastructure

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. North

- 7.4.2. West

- 7.4.3. South

- 7.4.4. East

- 7.1. Market Analysis, Insights and Forecast - by Facility Management Type

- 8. South India Facility Management Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Facility Management Type

- 8.1.1. Hard Services

- 8.1.2. Soft Services

- 8.2. Market Analysis, Insights and Forecast - by Sector Type

- 8.2.1. Unorganized

- 8.2.2. Organized

- 8.3. Market Analysis, Insights and Forecast - by End-User

- 8.3.1. Commercial

- 8.3.2. Industrial

- 8.3.3. Infrastructure

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. North

- 8.4.2. West

- 8.4.3. South

- 8.4.4. East

- 8.1. Market Analysis, Insights and Forecast - by Facility Management Type

- 9. East India Facility Management Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Facility Management Type

- 9.1.1. Hard Services

- 9.1.2. Soft Services

- 9.2. Market Analysis, Insights and Forecast - by Sector Type

- 9.2.1. Unorganized

- 9.2.2. Organized

- 9.3. Market Analysis, Insights and Forecast - by End-User

- 9.3.1. Commercial

- 9.3.2. Industrial

- 9.3.3. Infrastructure

- 9.4. Market Analysis, Insights and Forecast - by Geography

- 9.4.1. North

- 9.4.2. West

- 9.4.3. South

- 9.4.4. East

- 9.1. Market Analysis, Insights and Forecast - by Facility Management Type

- 10. North India India Facility Management Market Analysis, Insights and Forecast, 2019-2031

- 11. South India India Facility Management Market Analysis, Insights and Forecast, 2019-2031

- 12. East India India Facility Management Market Analysis, Insights and Forecast, 2019-2031

- 13. West India India Facility Management Market Analysis, Insights and Forecast, 2019-2031

- 14. Competitive Analysis

- 14.1. Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 Quess Corporation

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 ISS Facility Management

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Updater Services Private Limited*List Not Exhaustive

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 BVG India Limited

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Dusters Total Solutions Limited

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 ServiceMax Facility Management Private Limited

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 EFS Facilities Services

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 Mortice Group PLC (TenonFM)

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 G4S India

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 Sodexo Facilities Management Services India Private Limited

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.1 Quess Corporation

List of Figures

- Figure 1: India Facility Management Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Facility Management Market Share (%) by Company 2024

List of Tables

- Table 1: India Facility Management Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Facility Management Market Revenue Million Forecast, by Facility Management Type 2019 & 2032

- Table 3: India Facility Management Market Revenue Million Forecast, by Sector Type 2019 & 2032

- Table 4: India Facility Management Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 5: India Facility Management Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 6: India Facility Management Market Revenue Million Forecast, by Region 2019 & 2032

- Table 7: India Facility Management Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: North India India Facility Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: South India India Facility Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: East India India Facility Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: West India India Facility Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: India Facility Management Market Revenue Million Forecast, by Facility Management Type 2019 & 2032

- Table 13: India Facility Management Market Revenue Million Forecast, by Sector Type 2019 & 2032

- Table 14: India Facility Management Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 15: India Facility Management Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 16: India Facility Management Market Revenue Million Forecast, by Country 2019 & 2032

- Table 17: India Facility Management Market Revenue Million Forecast, by Facility Management Type 2019 & 2032

- Table 18: India Facility Management Market Revenue Million Forecast, by Sector Type 2019 & 2032

- Table 19: India Facility Management Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 20: India Facility Management Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 21: India Facility Management Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: India Facility Management Market Revenue Million Forecast, by Facility Management Type 2019 & 2032

- Table 23: India Facility Management Market Revenue Million Forecast, by Sector Type 2019 & 2032

- Table 24: India Facility Management Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 25: India Facility Management Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 26: India Facility Management Market Revenue Million Forecast, by Country 2019 & 2032

- Table 27: India Facility Management Market Revenue Million Forecast, by Facility Management Type 2019 & 2032

- Table 28: India Facility Management Market Revenue Million Forecast, by Sector Type 2019 & 2032

- Table 29: India Facility Management Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 30: India Facility Management Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 31: India Facility Management Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Facility Management Market?

The projected CAGR is approximately 7.37%.

2. Which companies are prominent players in the India Facility Management Market?

Key companies in the market include Quess Corporation, ISS Facility Management, Updater Services Private Limited*List Not Exhaustive, BVG India Limited, Dusters Total Solutions Limited, ServiceMax Facility Management Private Limited, EFS Facilities Services, Mortice Group PLC (TenonFM), G4S India, Sodexo Facilities Management Services India Private Limited.

3. What are the main segments of the India Facility Management Market?

The market segments include Facility Management Type, Sector Type, End-User, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 148.65 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Emphasis on Outsourcing of Non-core Operations; Steady Growth in Commercial Real Estate Sector; Strong Emphasis on Green Practices and Safety Awareness.

6. What are the notable trends driving market growth?

Soft Services to Drive the Market Growth.

7. Are there any restraints impacting market growth?

Skilled Manpower Shortage and Macro Level Fluctuations.

8. Can you provide examples of recent developments in the market?

Apr 2023: Sodexo Facilities Management Services India Private Limited Sodexo signed an MOU with the Ministry of Skill Development of India and launched the Tourism & Hospitality Skill Council (THSC) and Deen Dayal Upadhyaya Grameen Kaushalya Yojana (DDU-GKY) under the aegis of NSDC and India Skill Development Initiative to offer first-time employment opportunities to the frontline workforce working in the food & catering and facilities management spaces.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Facility Management Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Facility Management Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Facility Management Market?

To stay informed about further developments, trends, and reports in the India Facility Management Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence