Key Insights

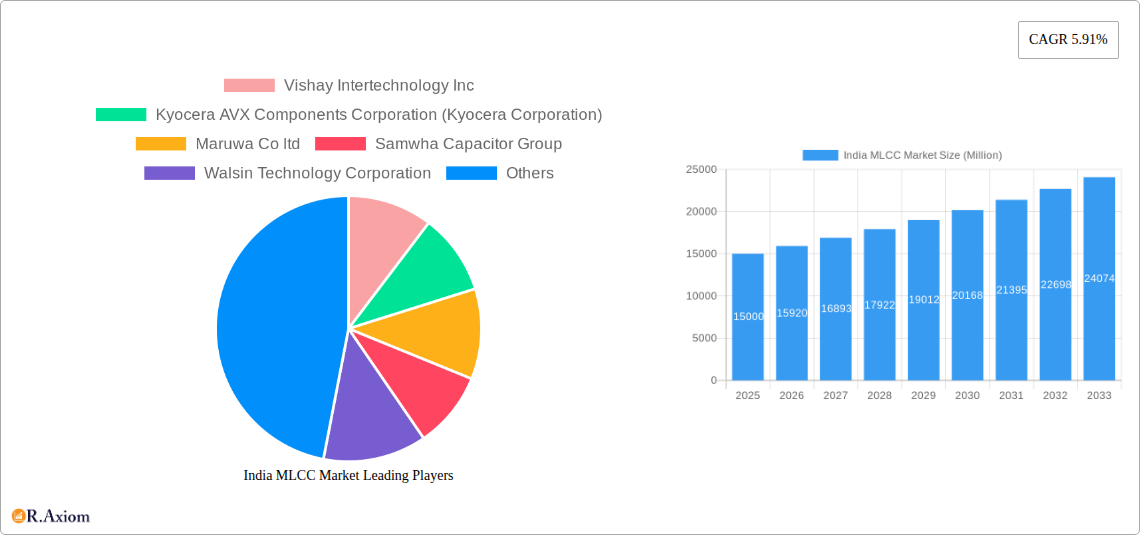

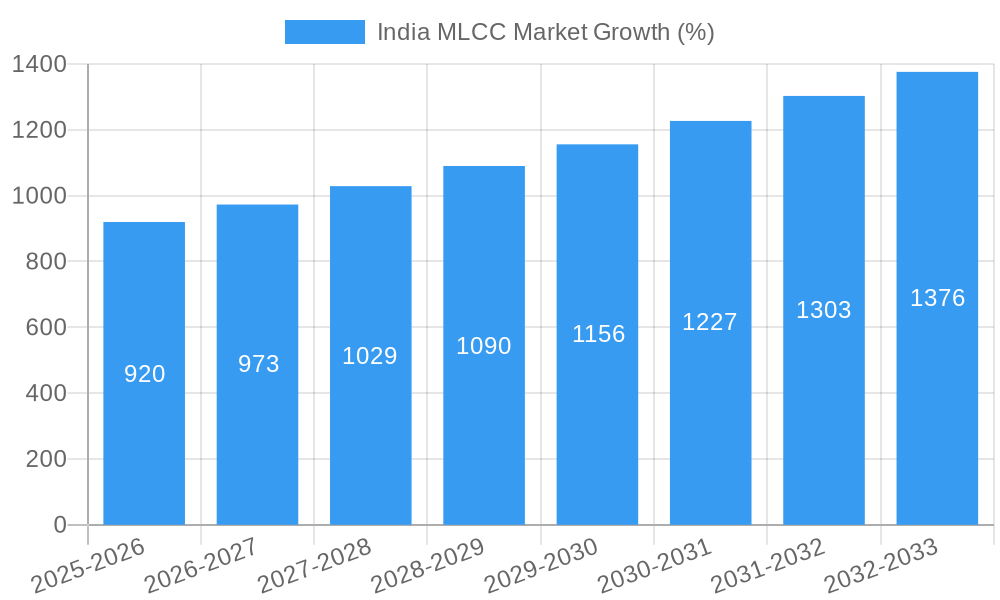

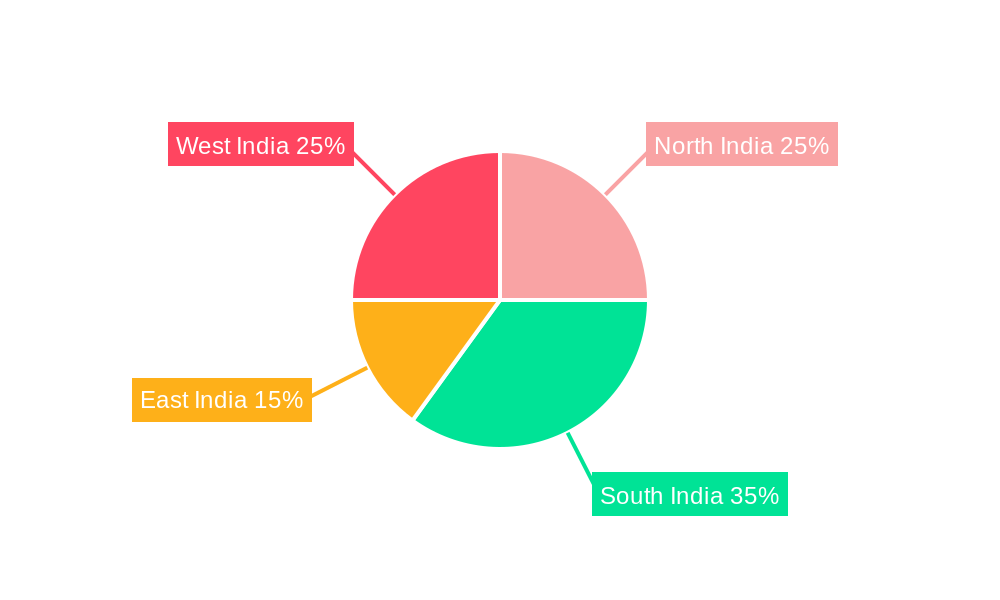

The India Multilayer Ceramic Capacitor (MLCC) market, valued at approximately ₹15 billion (estimated based on global market trends and India's electronics manufacturing growth) in 2025, is projected to experience robust growth with a Compound Annual Growth Rate (CAGR) of 5.91% from 2025 to 2033. This expansion is driven by the burgeoning Indian electronics industry, particularly in consumer electronics, automotive, and telecommunications sectors. Increased demand for high-performance electronics, miniaturization trends, and the government's initiatives to promote domestic manufacturing (e.g., PLI schemes) are key growth catalysts. Significant market segments include surface mount MLCCs due to their suitability for compact designs, capacitances between 100µF and 1000µF, which cater to a wide range of applications, and voltage ranges below 500V, prevalent in consumer electronics. However, challenges such as price volatility of raw materials and dependence on imports of certain components could potentially restrain market growth. The market is fragmented, with key players including Vishay Intertechnology, Kyocera AVX, and Murata Manufacturing competing alongside domestic manufacturers. Regional variations exist, with the South and West regions expected to demonstrate faster growth due to higher concentrations of electronics manufacturing hubs and technological advancements.

The forecast period (2025-2033) anticipates significant expansion across all MLCC segments. The automotive and industrial sectors are poised for substantial growth, driven by the adoption of advanced driver-assistance systems (ADAS) and smart manufacturing technologies. The growing penetration of 5G and IoT devices will also fuel demand, particularly for high-capacitance MLCCs. Competitive dynamics will intensify, with both domestic and international players vying for market share through product innovation, strategic partnerships, and enhanced supply chain efficiencies. Long-term growth prospects are highly positive, contingent on continuous technological advancements and favorable government policies supporting the growth of the electronics industry in India.

India MLCC Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the India MLCC (Multilayer Ceramic Capacitor) market, encompassing market size, segmentation, growth drivers, challenges, and key players. The study period covers 2019-2033, with 2025 as the base and estimated year. The report offers actionable insights for industry stakeholders, investors, and businesses seeking to capitalize on the growth opportunities within this dynamic market.

India MLCC Market Concentration & Innovation

The India MLCC market exhibits a moderately concentrated landscape, with a few dominant players and several smaller regional companies. Market share data for 2024 suggests that Murata Manufacturing Co Ltd, TDK Corporation, and Samsung Electro-Mechanics hold a significant portion of the overall market, cumulatively accounting for approximately xx%. However, the market is characterized by intense competition, driven by continuous innovation and product differentiation.

Key Innovation Drivers:

- Miniaturization: The ongoing demand for smaller, high-performance MLCCs across various applications fuels innovation in materials and manufacturing processes.

- High Voltage Capacitors: The burgeoning electric vehicle (EV) sector and the adoption of higher voltage systems are driving the development of high-voltage MLCCs.

- Improved Dielectric Materials: Research and development efforts are focused on enhancing dielectric materials to achieve higher capacitance, lower ESR (Equivalent Series Resistance), and improved temperature stability.

Regulatory Frameworks: The Indian government's initiatives to promote domestic manufacturing and the adoption of stringent quality standards are shaping the market dynamics.

Product Substitutes: While MLCCs dominate the market, alternative capacitor technologies, such as film capacitors and electrolytic capacitors, compete in specific niches. However, MLCCs maintain their dominance due to their superior performance in several applications.

End-User Trends: The increasing adoption of electronics across various sectors, including consumer electronics, automotive, and industrial automation, is a primary driver of market growth.

M&A Activities: While the exact deal values are not publicly disclosed in many cases, the past few years have seen several strategic mergers and acquisitions (M&A) within the MLCC sector, particularly to enhance manufacturing capacity and expand product portfolios in India. These activities have resulted in market consolidation, with leading players consolidating their presence and expertise. The total value of these deals in the past 5 years is estimated at xx Million.

India MLCC Market Industry Trends & Insights

The India MLCC market is experiencing robust growth, propelled by several key factors. The Compound Annual Growth Rate (CAGR) for the period 2025-2033 is projected to be xx%, primarily driven by rising demand from the consumer electronics, automotive, and industrial sectors. Market penetration is increasing as MLCCs become increasingly vital components in a wider range of applications.

Technological disruptions, such as the development of advanced dielectric materials and innovative manufacturing processes, have significantly enhanced MLCC performance and reduced costs. Consumer preference for miniaturized and energy-efficient electronic devices continues to drive the demand for smaller and higher-performance MLCCs. Intense competition among major players leads to continuous innovation and price reductions, benefiting end-users.

Dominant Markets & Segments in India MLCC Market

Dominant Segments:

- By Capacitance: The "Less than 100µF" segment currently holds the largest market share, followed by the "100µF to 1000µF" segment. Growth in the "More than 1000µF" segment is projected to be substantial during the forecast period.

- By MLCC Mounting Type: The Surface Mount segment dominates due to its suitability for automated assembly processes and space-saving design in modern electronics.

- By End-User: The Consumer Electronics segment is the leading end-user, followed by the Automotive segment, which is expected to experience significant growth owing to the increasing adoption of EVs and advanced driver-assistance systems (ADAS).

- By Dielectric Type: Class I and Class II dielectrics are both significant segments, with Class II being more widely used due to its higher capacitance.

- By Case Size: The 0 sizes currently dominate, however, higher case sizes are seeing increases in demand due to larger capacitance requirements in specific niche industries.

- By Voltage: The "Less than 500V" segment holds a significant market share; however, the growing demand for high-voltage applications in EVs is driving growth in the "500V to 1000V" segment.

Key Drivers of Segment Dominance:

- Consumer Electronics: Growing smartphone and electronics manufacturing.

- Automotive: Electric vehicle (EV) adoption and increasing electronics content in vehicles.

- Industrial: Automation and the rise of smart factories.

India MLCC Market Product Developments

Recent product innovations have focused on enhancing performance metrics such as capacitance, voltage rating, and temperature stability. Manufacturers are also focusing on developing MLCCs with smaller case sizes to meet the demands of miniaturization in consumer electronics and other applications. Companies are emphasizing the development of specialized MLCCs for high-voltage applications in the automotive sector, particularly for EVs and hybrid vehicles. This addresses the growing need for reliable and efficient components in next-generation vehicles. The competitive advantage lies in superior performance, miniaturization capabilities, and ability to meet specialized application requirements.

Report Scope & Segmentation Analysis

This report provides a detailed segmentation analysis of the India MLCC market based on capacitance, mounting type, end-user, dielectric type, case size, and voltage. Each segment's market size, growth projections, and competitive dynamics are analyzed separately. The report projects significant growth across all segments, driven by the increasing demand for electronics across various sectors. Competitive dynamics within each segment vary, with several major players vying for market share.

Key Drivers of India MLCC Market Growth

The India MLCC market is propelled by several key factors:

- Rapid Growth of Electronics Manufacturing: India's burgeoning electronics manufacturing sector is a major driver.

- Government Initiatives: "Make in India" initiatives and supportive government policies are encouraging domestic production.

- Automotive Sector Expansion: The rapid growth of the automotive industry, particularly the EV segment, fuels demand.

- Technological Advancements: Innovations in materials and manufacturing processes constantly improve MLCC performance and reduce costs.

Challenges in the India MLCC Market Sector

The India MLCC market faces some challenges:

- Supply Chain Disruptions: Global supply chain volatility affects component availability and pricing.

- Raw Material Price Fluctuations: Price fluctuations in raw materials impact production costs.

- Competition from Imported Products: Competition from established international players remains strong.

- Stringent Quality Standards: Meeting stringent quality and reliability standards adds to production costs and complexities.

Emerging Opportunities in India MLCC Market

Several promising opportunities exist:

- Growth of the EV Sector: The EV revolution presents immense growth potential for high-voltage MLCCs.

- 5G Infrastructure Development: The rollout of 5G networks increases demand for high-performance MLCCs.

- Increasing Adoption of IoT Devices: The proliferation of IoT devices fuels the need for miniature, high-performance components.

- Focus on Domestic Manufacturing: Government support for domestic manufacturing creates opportunities for local players.

Leading Players in the India MLCC Market Market

- Vishay Intertechnology Inc

- Kyocera AVX Components Corporation (Kyocera Corporation)

- Maruwa Co ltd

- Samwha Capacitor Group

- Walsin Technology Corporation

- Samsung Electro-Mechanics

- Würth Elektronik GmbH & Co KG

- Yageo Corporation

- Taiyo Yuden Co Ltd

- TDK Corporation

- Murata Manufacturing Co Ltd

- Nippon Chemi-Con Corporation

Key Developments in India MLCC Market Industry

- July 2023: KEMET (Yageo Corporation) launched the X7R automotive-grade MLCC, designed for high-voltage automotive applications (500V-1kV), addressing the growing needs of the EV sector.

- June 2023: An unnamed company introduced the NTS/NTF Series of SMD MLCCs for industrial applications, catering to the rising demand for industrial equipment.

- May 2023: Murata introduced the EVA series MLCCs, versatile for EV applications (OBC, inverters, DC/DC converters, BMS, WPT), demonstrating technological advancement to meet the requirements of the EV sector's shift towards 800V powertrains.

Strategic Outlook for India MLCC Market Market

The India MLCC market is poised for continued strong growth, driven by the expansion of electronics manufacturing, government initiatives, and technological advancements. The growing demand from the automotive and consumer electronics sectors will remain key drivers. Opportunities lie in developing specialized MLCCs for high-growth segments like EVs and 5G infrastructure. Companies focusing on innovation, cost optimization, and meeting the specific requirements of various applications are well-positioned to capture significant market share in the coming years.

India MLCC Market Segmentation

-

1. Dielectric Type

- 1.1. Class 1

- 1.2. Class 2

-

2. Case Size

- 2.1. 0 201

- 2.2. 0 402

- 2.3. 0 603

- 2.4. 1 005

- 2.5. 1 210

- 2.6. Others

-

3. Voltage

- 3.1. 500V to 1000V

- 3.2. Less than 500V

- 3.3. More than 1000V

-

4. Capacitance

- 4.1. 100µF to 1000µF

- 4.2. Less than 100µF

- 4.3. More than 1000µF

-

5. Mlcc Mounting Type

- 5.1. Metal Cap

- 5.2. Radial Lead

- 5.3. Surface Mount

-

6. End User

- 6.1. Aerospace and Defence

- 6.2. Automotive

- 6.3. Consumer Electronics

- 6.4. Industrial

- 6.5. Medical Devices

- 6.6. Power and Utilities

- 6.7. Telecommunication

- 6.8. Others

India MLCC Market Segmentation By Geography

- 1. India

India MLCC Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.91% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in the Applications of Semiconductors; Advancement in Technology Such as Magnetron Sputtering Technology

- 3.3. Market Restrains

- 3.3.1. Rise of Alternative Technologies Such as Thermal Evaporation

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India MLCC Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Dielectric Type

- 5.1.1. Class 1

- 5.1.2. Class 2

- 5.2. Market Analysis, Insights and Forecast - by Case Size

- 5.2.1. 0 201

- 5.2.2. 0 402

- 5.2.3. 0 603

- 5.2.4. 1 005

- 5.2.5. 1 210

- 5.2.6. Others

- 5.3. Market Analysis, Insights and Forecast - by Voltage

- 5.3.1. 500V to 1000V

- 5.3.2. Less than 500V

- 5.3.3. More than 1000V

- 5.4. Market Analysis, Insights and Forecast - by Capacitance

- 5.4.1. 100µF to 1000µF

- 5.4.2. Less than 100µF

- 5.4.3. More than 1000µF

- 5.5. Market Analysis, Insights and Forecast - by Mlcc Mounting Type

- 5.5.1. Metal Cap

- 5.5.2. Radial Lead

- 5.5.3. Surface Mount

- 5.6. Market Analysis, Insights and Forecast - by End User

- 5.6.1. Aerospace and Defence

- 5.6.2. Automotive

- 5.6.3. Consumer Electronics

- 5.6.4. Industrial

- 5.6.5. Medical Devices

- 5.6.6. Power and Utilities

- 5.6.7. Telecommunication

- 5.6.8. Others

- 5.7. Market Analysis, Insights and Forecast - by Region

- 5.7.1. India

- 5.1. Market Analysis, Insights and Forecast - by Dielectric Type

- 6. North India India MLCC Market Analysis, Insights and Forecast, 2019-2031

- 7. South India India MLCC Market Analysis, Insights and Forecast, 2019-2031

- 8. East India India MLCC Market Analysis, Insights and Forecast, 2019-2031

- 9. West India India MLCC Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Vishay Intertechnology Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Kyocera AVX Components Corporation (Kyocera Corporation)

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Maruwa Co ltd

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Samwha Capacitor Group

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Walsin Technology Corporation

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Samsung Electro-Mechanics

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Würth Elektronik GmbH & Co KG

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Yageo Corporatio

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Taiyo Yuden Co Ltd

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 TDK Corporation

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Murata Manufacturing Co Ltd

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Nippon Chemi-Con Corporation

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.1 Vishay Intertechnology Inc

List of Figures

- Figure 1: India MLCC Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India MLCC Market Share (%) by Company 2024

List of Tables

- Table 1: India MLCC Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India MLCC Market Revenue Million Forecast, by Dielectric Type 2019 & 2032

- Table 3: India MLCC Market Revenue Million Forecast, by Case Size 2019 & 2032

- Table 4: India MLCC Market Revenue Million Forecast, by Voltage 2019 & 2032

- Table 5: India MLCC Market Revenue Million Forecast, by Capacitance 2019 & 2032

- Table 6: India MLCC Market Revenue Million Forecast, by Mlcc Mounting Type 2019 & 2032

- Table 7: India MLCC Market Revenue Million Forecast, by End User 2019 & 2032

- Table 8: India MLCC Market Revenue Million Forecast, by Region 2019 & 2032

- Table 9: India MLCC Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: North India India MLCC Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: South India India MLCC Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: East India India MLCC Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: West India India MLCC Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: India MLCC Market Revenue Million Forecast, by Dielectric Type 2019 & 2032

- Table 15: India MLCC Market Revenue Million Forecast, by Case Size 2019 & 2032

- Table 16: India MLCC Market Revenue Million Forecast, by Voltage 2019 & 2032

- Table 17: India MLCC Market Revenue Million Forecast, by Capacitance 2019 & 2032

- Table 18: India MLCC Market Revenue Million Forecast, by Mlcc Mounting Type 2019 & 2032

- Table 19: India MLCC Market Revenue Million Forecast, by End User 2019 & 2032

- Table 20: India MLCC Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India MLCC Market?

The projected CAGR is approximately 5.91%.

2. Which companies are prominent players in the India MLCC Market?

Key companies in the market include Vishay Intertechnology Inc, Kyocera AVX Components Corporation (Kyocera Corporation), Maruwa Co ltd, Samwha Capacitor Group, Walsin Technology Corporation, Samsung Electro-Mechanics, Würth Elektronik GmbH & Co KG, Yageo Corporatio, Taiyo Yuden Co Ltd, TDK Corporation, Murata Manufacturing Co Ltd, Nippon Chemi-Con Corporation.

3. What are the main segments of the India MLCC Market?

The market segments include Dielectric Type, Case Size, Voltage, Capacitance, Mlcc Mounting Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rise in the Applications of Semiconductors; Advancement in Technology Such as Magnetron Sputtering Technology.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Rise of Alternative Technologies Such as Thermal Evaporation.

8. Can you provide examples of recent developments in the market?

July 2023: KEMET, part of the Yageo Corporation developed the X7R automotive grade MLCC X7R. This MLCC is designed to meet the high voltage requirements of automotive subsystems, ranging from 100pF-0.1uF and with a DC voltage range of 500V-1kV. The range of cases available is EIA 0603-1210, and is suitable for both automotive under hoods and in-cabin applications. These MLCCs demonstrate the essential and reliable nature of capacitors, which are essential for the mission and safety of automotive subsystems.June 2023: The growing demand for industrial equipments has driven the company to introduce NTS/NTF NTS/NTF Series of SMD type MLCC. These capacitors are rated with 25 to 500 Vdc with a capacitance ranging from 0.010 to 47µF. These MLCCs are used in on-board power supplies,voltage regulators for computers,smoothing circuit of DC-DC converters,etc.May 2023: Murata has introduced the EVA series of MLCC, which are beneficial to EV manufacturers due to their versatility. These MLCC's can be used in a variety of applications, including OBC (On-Board Charger), inverter and DC/DC Converter, BMS (Battery Management System), and WPT (Wireless Power Transfer) implementations. As a result, they are ideal to the increased isolation that the 800V powertrain migration will require, while also meeting the miniaturization requirements of modern automotive systems.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India MLCC Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India MLCC Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India MLCC Market?

To stay informed about further developments, trends, and reports in the India MLCC Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence