Key Insights

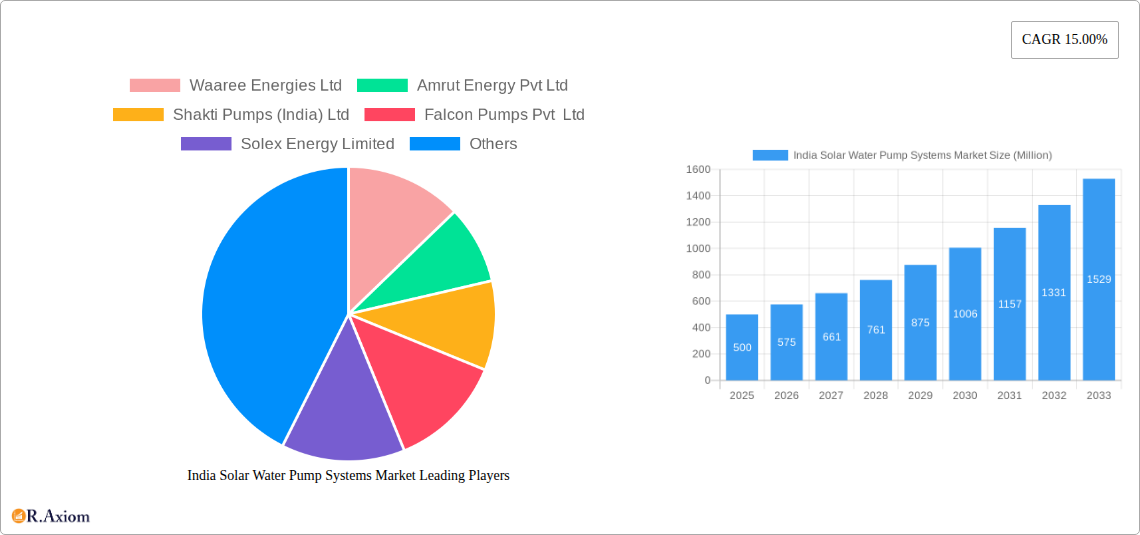

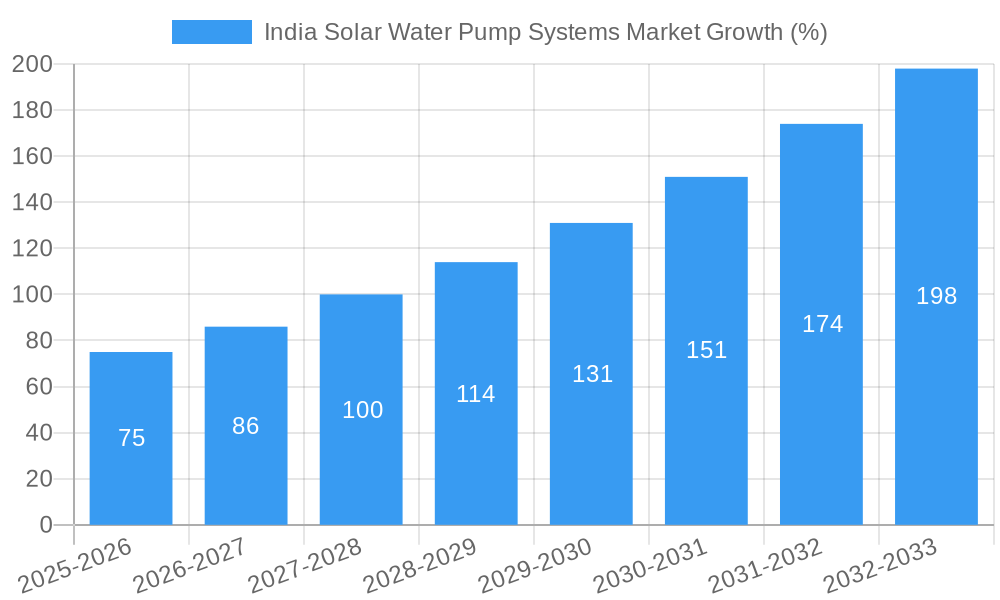

The India solar water pump systems market is experiencing robust growth, driven by increasing electricity costs, government initiatives promoting renewable energy adoption (like the KUSUM scheme), and the rising need for irrigation in agriculture. The market's 15% CAGR from 2019 to 2024 indicates strong momentum, and this growth is projected to continue through 2033. The market is segmented by application (irrigation dominating, followed by drinking water, industrial, and other uses) and pump technology (centrifugal and positive displacement). The irrigation segment's large share stems from the extensive agricultural sector in India and its reliance on efficient water management. Government subsidies and financing options are further bolstering market expansion, particularly in rural areas. Challenges include the initial high investment costs for solar pump systems and the need for reliable after-sales service and maintenance in geographically dispersed locations. However, decreasing solar panel prices and technological advancements in pump efficiency are mitigating these restraints. Leading players like Waaree Energies, Shakti Pumps, and others are strategically expanding their product portfolios and distribution networks to capitalize on the market's potential. The diverse geographical landscape of India presents both opportunities and challenges; tailored solutions and targeted marketing are necessary to address regional variations in electricity access and agricultural practices. The market is expected to witness increased adoption of smart irrigation systems and IoT-enabled monitoring, enhancing efficiency and optimizing water usage.

The forecast period (2025-2033) is expected to witness continued expansion, fueled by ongoing government support, technological improvements leading to cost reductions, and a heightened awareness of sustainable water management practices. While the initial market size for 2025 is not explicitly stated, a reasonable estimation based on the provided 15% CAGR and considering the market's growth trajectory indicates a significant market value. This growth will likely be further stimulated by the expanding rural electrification projects and the increased focus on water conservation in the face of climate change impacts. The competition among established players and new entrants will intensify, driving innovation and potentially lowering prices, benefiting consumers and accelerating market penetration.

India Solar Water Pump Systems Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the India Solar Water Pump Systems Market, covering the period 2019-2033. It offers actionable insights for industry stakeholders, investors, and businesses operating within this rapidly evolving sector. The report leverages rigorous research methodologies and incorporates data from the historical period (2019-2024), base year (2025), and estimated year (2025), to project the market's future trajectory (forecast period: 2025-2033). High-traffic keywords like "India solar water pump market," "solar irrigation pumps India," "PM KUSUM scheme impact," and "solar water pump technology" are integrated for enhanced search engine optimization. Market values are expressed in Millions.

India Solar Water Pump Systems Market Concentration & Innovation

The Indian solar water pump systems market exhibits a moderately concentrated landscape, with a few key players holding significant market share. Waaree Energies Ltd, Shakti Pumps (India) Ltd, and Solex Energy Limited are among the prominent companies, though precise market share figures for each are unavailable (xx%). Innovation is driven by the need for improved efficiency, cost reduction, and enhanced durability in challenging Indian conditions. The government's initiatives, such as the PM KUSUM scheme, strongly influence market dynamics. Regulatory frameworks, including those pertaining to renewable energy mandates and subsidies, play a pivotal role. Product substitutes, such as diesel-powered pumps, face increasing competition due to rising fuel costs and environmental concerns. End-user trends reveal a growing preference for solar-powered systems due to their long-term cost-effectiveness and reduced reliance on grid power. Mergers and acquisitions (M&A) activity in this sector has been relatively modest in recent years, with reported deal values totaling approximately xx Million over the past five years.

- Key Innovation Drivers: Improved pump technology, smart grid integration, energy storage solutions, and financing models.

- Regulatory Influence: PM KUSUM scheme, renewable energy policies, and grid connectivity regulations.

- M&A Activity: Limited but expected to increase with market growth.

India Solar Water Pump Systems Market Industry Trends & Insights

The India solar water pump systems market is experiencing robust growth, driven by increasing government support, rising energy costs, and the expanding adoption of renewable energy solutions across various sectors. The Compound Annual Growth Rate (CAGR) for the forecast period (2025-2033) is projected to be xx%, fueled by continuous technological advancements and favorable policy frameworks. Market penetration remains relatively low, indicating substantial untapped potential. Technological disruptions, such as the adoption of advanced solar panel technologies and smart pump control systems, further contribute to market expansion. Consumer preferences increasingly favor efficient, reliable, and easily maintainable systems. The competitive landscape is marked by both established players and emerging companies. This fierce competition fosters innovation and enhances product offerings.

Dominant Markets & Segments in India Solar Water Pump Systems Market

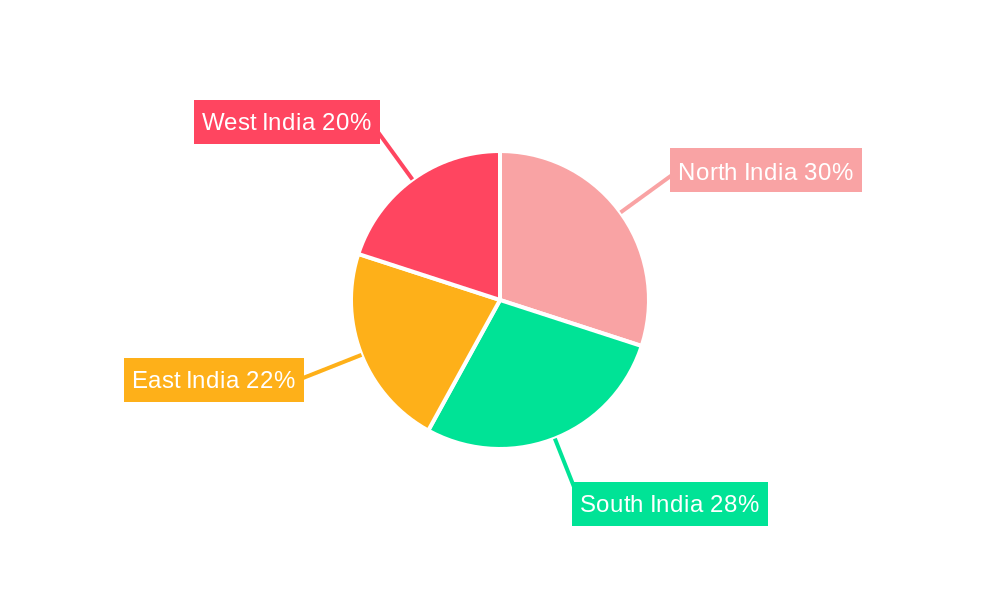

The irrigation segment dominates the Indian solar water pump systems market, driven by the vast agricultural sector and the government's focus on improving agricultural productivity. The states of Maharashtra, Gujarat, Andhra Pradesh, and Punjab are key contributors. Within pump technology, centrifugal pumps currently hold the largest market share, owing to their affordability and wide availability. However, positive displacement pumps are gaining traction due to their suitability for high-pressure applications.

- Irrigation Segment Drivers: Government incentives, increasing agricultural land under irrigation, and farmer awareness programs.

- Centrifugal Pump Dominance: Cost-effectiveness, widespread availability, and suitability for various applications.

- Positive Displacement Pump Growth: Superior performance in high-pressure applications and expanding industrial demand.

- Drinking and Cooking Water Supply: This segment is experiencing growth fueled by increasing rural electrification.

- Industrial Applications: This sector will also see growth driven by increased industrial water requirements.

India Solar Water Pump Systems Market Product Developments

Recent product innovations focus on enhancing efficiency, durability, and ease of maintenance. Advances in solar panel technology, coupled with improvements in pump design and motor efficiency, contribute to greater cost-effectiveness. Smart control systems allow for remote monitoring and optimization of water usage. These developments cater to specific needs within various applications. The integration of IoT capabilities for real-time monitoring and maintenance is another key trend that's boosting product innovation.

Report Scope & Segmentation Analysis

This report segments the India solar water pump systems market based on application (Irrigation, Drinking and Cooking Water Supply, Industrial, Other Applications) and pump technology (Centrifugal Pump Technology, Positive Displacement Technology). The irrigation segment is projected to maintain its dominance throughout the forecast period with growth driven by government schemes and rising farmer income, while drinking and cooking water will see steady growth propelled by government initiatives aimed at rural electrification and access to clean water. The industrial sector is also predicted to contribute significantly due to increased industrial activities and stringent water regulations. Centrifugal pumps' market share is likely to remain dominant, with positive displacement pumps gaining traction in niche applications due to their efficiency. Competitive dynamics are influenced by factors such as pricing, product features, and brand reputation.

Key Drivers of India Solar Water Pump Systems Market Growth

The growth of the Indian solar water pump systems market is propelled by several factors: the government's commitment to renewable energy through schemes like PM KUSUM, increasing electricity costs, and the rising awareness among farmers about the long-term benefits of solar irrigation. Technological advancements leading to improved efficiency and reduced costs also contribute significantly. Furthermore, favorable government policies and financial incentives are driving adoption rates.

Challenges in the India Solar Water Pump Systems Market Sector

Challenges include the high initial investment cost, inconsistent electricity grid reliability in some rural areas, and the need for skilled maintenance personnel. Supply chain disruptions and competition from established players can also impact market growth. The dependence on imported components adds to the cost of production, making affordability a challenge in some regions. Furthermore, fluctuating solar irradiance in different regions can impact efficiency and energy output. The estimated impact of these challenges leads to an xx% reduction in market potential.

Emerging Opportunities in India Solar Water Pump Systems Market

Emerging opportunities lie in expanding into underserved rural areas, integrating smart grid technologies, and developing innovative financing models to overcome affordability barriers. The potential for incorporating energy storage solutions to address intermittency issues is significant. Furthermore, growth can be enhanced by focusing on developing user-friendly and low-maintenance systems, along with creating efficient service and maintenance networks in rural areas.

Leading Players in the India Solar Water Pump Systems Market Market

- Waaree Energies Ltd

- Amrut Energy Pvt Ltd

- Shakti Pumps (India) Ltd

- Falcon Pumps Pvt Ltd

- Solex Energy Limited

- Aqua Group

- Mecwin Technologies India Pvt Ltd

- Greenmax Technology

- Novergy Energy Solutions Pvt Ltd

- Lubi Electronics

Key Developments in India Solar Water Pump Systems Market Industry

- August 2021: The Indian government launched the PM KUSUM program, aiming for 1.75 Million solar water pump installations for irrigation and 1 Million solar systems for grid-connected pumps by 2022. This significantly boosted market growth.

- 2021-2022: Shakti Pumps distributed approximately 30,000 solar water pumps under PM KUSUM.

- 2022-2023: Shakti Pumps plans to distribute 75,000 pumps, with 10,000 already distributed. This highlights significant market activity.

Strategic Outlook for India Solar Water Pump Systems Market Market

The India solar water pump systems market holds immense potential for growth, driven by continued government support, technological advancements, and rising awareness of the benefits of renewable energy. Focusing on cost reduction, improved efficiency, and the development of customized solutions tailored to specific regional needs will be crucial for future success. The market is poised for substantial expansion, driven by both organic growth and strategic partnerships among key players.

India Solar Water Pump Systems Market Segmentation

-

1. Pump Technology

- 1.1. Centrifugal Pump Technology

- 1.2. Positive Displacement Technology

-

2. Application

- 2.1. Irrigation

- 2.2. Drinking and Cooking Water Supply

- 2.3. Industrial

- 2.4. Other Applications

India Solar Water Pump Systems Market Segmentation By Geography

- 1. India

India Solar Water Pump Systems Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 15.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Rising Deep-Water Offshore Development Activity4.; Improved Viability of Offshore Oil and Gas Projects

- 3.3. Market Restrains

- 3.3.1. 4.; Competition from Crew Transfer Ships

- 3.4. Market Trends

- 3.4.1. Surface Pumps Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Solar Water Pump Systems Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Pump Technology

- 5.1.1. Centrifugal Pump Technology

- 5.1.2. Positive Displacement Technology

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Irrigation

- 5.2.2. Drinking and Cooking Water Supply

- 5.2.3. Industrial

- 5.2.4. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Pump Technology

- 6. North India India Solar Water Pump Systems Market Analysis, Insights and Forecast, 2019-2031

- 7. South India India Solar Water Pump Systems Market Analysis, Insights and Forecast, 2019-2031

- 8. East India India Solar Water Pump Systems Market Analysis, Insights and Forecast, 2019-2031

- 9. West India India Solar Water Pump Systems Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Waaree Energies Ltd

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Amrut Energy Pvt Ltd

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Shakti Pumps (India) Ltd

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Falcon Pumps Pvt Ltd

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Solex Energy Limited

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Aqua Group

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Mecwin Technologies India Pvt Ltd

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Greenmax Technology

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Novergy Energy Solutions Pvt Ltd

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Lubi Electronics

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Waaree Energies Ltd

List of Figures

- Figure 1: India Solar Water Pump Systems Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Solar Water Pump Systems Market Share (%) by Company 2024

List of Tables

- Table 1: India Solar Water Pump Systems Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Solar Water Pump Systems Market Revenue Million Forecast, by Pump Technology 2019 & 2032

- Table 3: India Solar Water Pump Systems Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: India Solar Water Pump Systems Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: India Solar Water Pump Systems Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: North India India Solar Water Pump Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: South India India Solar Water Pump Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: East India India Solar Water Pump Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: West India India Solar Water Pump Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: India Solar Water Pump Systems Market Revenue Million Forecast, by Pump Technology 2019 & 2032

- Table 11: India Solar Water Pump Systems Market Revenue Million Forecast, by Application 2019 & 2032

- Table 12: India Solar Water Pump Systems Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Solar Water Pump Systems Market?

The projected CAGR is approximately 15.00%.

2. Which companies are prominent players in the India Solar Water Pump Systems Market?

Key companies in the market include Waaree Energies Ltd, Amrut Energy Pvt Ltd, Shakti Pumps (India) Ltd, Falcon Pumps Pvt Ltd, Solex Energy Limited, Aqua Group, Mecwin Technologies India Pvt Ltd, Greenmax Technology, Novergy Energy Solutions Pvt Ltd, Lubi Electronics.

3. What are the main segments of the India Solar Water Pump Systems Market?

The market segments include Pump Technology, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Rising Deep-Water Offshore Development Activity4.; Improved Viability of Offshore Oil and Gas Projects.

6. What are the notable trends driving market growth?

Surface Pumps Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

4.; Competition from Crew Transfer Ships.

8. Can you provide examples of recent developments in the market?

August 2021: the Indian government decided to set a target of 1.75 million installations of solar water pumps for irrigation and installations of solar systems for another 1 million grid-connected pumps by 2022 under the PM KUSUM Program.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Solar Water Pump Systems Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Solar Water Pump Systems Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Solar Water Pump Systems Market?

To stay informed about further developments, trends, and reports in the India Solar Water Pump Systems Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence