Key Insights

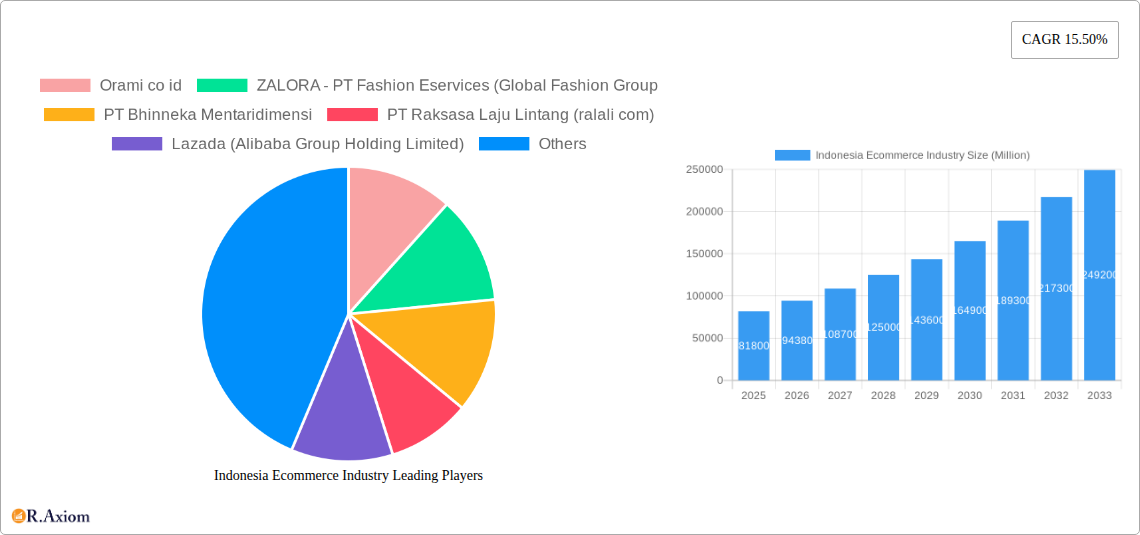

The Indonesian e-commerce market is experiencing robust growth, projected to reach a market size of $81.80 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 15.50% from 2025 to 2033. This expansion is fueled by several key factors. Increasing internet and smartphone penetration across the vast Indonesian archipelago provides a wider reach for e-commerce platforms. A burgeoning young and digitally savvy population readily embraces online shopping, driving demand for diverse goods and services. Furthermore, the development of robust logistics infrastructure, including improved delivery networks and payment gateways, has significantly enhanced the consumer experience and facilitated market expansion. Government initiatives promoting digitalization also play a crucial role in supporting the sector's development.

However, challenges persist. Competition among established players like Tokopedia, Shopee, Lazada, and Blibli remains fierce, leading to price wars and impacting profitability. Concerns around data security and consumer trust, particularly in relation to online payment security, need to be addressed to build greater consumer confidence. Infrastructure limitations in certain remote areas still hinder market penetration, while the digital literacy gap within certain demographics continues to represent a barrier to widespread adoption. The market's future trajectory depends on continued investment in infrastructure, ongoing efforts to build consumer trust, and successful navigation of the competitive landscape. The strategic focus of major players on tailored marketing campaigns and expansion into niche segments will play a key role in shaping the market in the years to come.

Indonesia Ecommerce Industry: A Comprehensive Market Report (2019-2033)

This detailed report provides a comprehensive analysis of the Indonesian e-commerce industry, covering its historical performance (2019-2024), current state (2025), and future projections (2025-2033). The report utilizes robust data and insightful analysis to offer actionable intelligence for businesses, investors, and policymakers operating within or considering entry into this dynamic market. The Base Year is 2025 and the Estimated Year is 2025. Market values are expressed in Millions.

Indonesia Ecommerce Industry Market Concentration & Innovation

This section analyzes the competitive landscape of the Indonesian e-commerce industry, examining market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user trends, and merger & acquisition (M&A) activities.

Indonesia's e-commerce market exhibits a high degree of concentration, with a few dominant players commanding significant market share. While precise figures for 2025 are still being compiled, preliminary estimates suggest that the top five players likely account for over 70% of the total market volume (xx Million). This concentration is driven by strong network effects, substantial investments in logistics and technology, and aggressive marketing strategies. Innovation is fueled by intense competition, forcing companies to continually improve their platforms, payment gateways, and logistics capabilities to enhance user experience and attract new customers.

- Market Share (Estimated 2025): The exact market share of each player requires further investigation and may vary depending on the methodology used.

- M&A Activity: The recent merger between Tokopedia and TikTok Shop (February 2024) exemplifies the significant M&A activity within the industry, driven by a desire to expand market reach and enhance capabilities. The deal valued at over USD 1.5 Billion demonstrates the substantial investment potential within this sector. Further analysis on historical M&A deals (2019-2024) and projected future transactions will be included in the full report.

- Regulatory Framework: The Indonesian government's regulatory policies play a crucial role in shaping the industry's growth and development. The report will analyze the impact of existing regulations and potential future changes on market dynamics.

Indonesia Ecommerce Industry Industry Trends & Insights

This section delves into the key trends and insights shaping the Indonesian e-commerce landscape. We examine growth drivers, technological disruptions, evolving consumer preferences, and competitive dynamics.

The Indonesian e-commerce market is experiencing robust growth, driven by factors such as rising internet and smartphone penetration, increasing urbanization, a burgeoning middle class, and a preference for convenience. The Compound Annual Growth Rate (CAGR) from 2019 to 2024 is estimated to be xx%, indicating a significant expansion. The market penetration rate, which measures the percentage of the population actively engaging in e-commerce, is projected to reach xx% by 2025. Technological advancements, including improvements in mobile payment systems and logistics infrastructure, are further accelerating market growth. However, competition is fierce, with players constantly striving to differentiate themselves through innovative features, personalized experiences, and competitive pricing strategies. Consumer preferences are evolving rapidly, demanding greater convenience, faster delivery times, and a wider range of products and services.

Dominant Markets & Segments in Indonesia Ecommerce Industry

This section identifies the leading regions, countries, and segments within the Indonesian e-commerce market, focusing on Market Segmentation - by B2C Application.

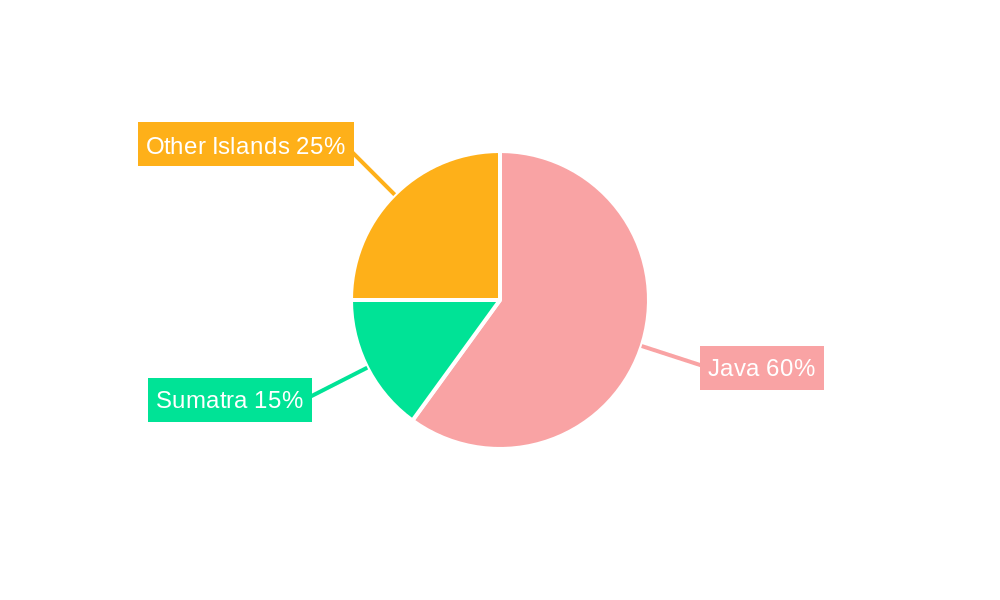

The Indonesian e-commerce market is geographically diverse, with growth occurring across various regions. However, Java, with its high population density and established infrastructure, remains the dominant market. The dominance of Java is primarily due to several factors:

- Economic Policies: Government initiatives promoting digitalization and e-commerce adoption have significantly aided the growth of the sector.

- Infrastructure: Java benefits from relatively well-developed infrastructure, including reliable internet connectivity and advanced logistics networks.

- Population Density: The high population density of Java ensures a large pool of potential customers.

Further analysis will detail the dominance of specific segments within the B2C application sector, providing detailed breakdowns based on product categories, user demographics, and transaction values.

Indonesia Ecommerce Industry Product Developments

Recent product innovations in the Indonesian e-commerce space focus heavily on enhancing the customer experience through personalized recommendations, improved payment gateways, and seamless delivery options. The integration of social commerce features, exemplified by the Tokopedia-TikTok merger, underscores the trend towards omnichannel strategies. Technological advancements like AI-powered chatbots for customer service and the adoption of advanced logistics solutions are driving efficiency gains and boosting competitiveness.

Report Scope & Segmentation Analysis

This report covers the Indonesian e-commerce market for the period 2019-2033, with a focus on Market Segmentation - by B2C Application. Several key segments are identified based on the types of applications used, including but not limited to online marketplaces, online retail, travel, food delivery, and other services. Each segment's size, growth projections, and competitive dynamics will be detailed in the full report, providing a complete picture of the industry's structure. Growth projections for each segment will be provided, incorporating market size estimations and competitive landscape analyses.

Key Drivers of Indonesia Ecommerce Industry Growth

The growth of Indonesia's e-commerce industry is propelled by several key factors. A rapidly expanding internet and smartphone penetration rate among the population fuels digital adoption. The rise of a burgeoning middle class with increased disposable income increases the spending capacity for online purchases. Government initiatives supporting the digital economy provide a favorable regulatory environment. Finally, advancements in payment technology and logistics infrastructure enhance the convenience and reliability of online transactions.

Challenges in the Indonesia Ecommerce Industry Sector

Despite considerable potential, the Indonesian e-commerce sector faces challenges. Logistics infrastructure in some areas remains underdeveloped, leading to higher delivery costs and longer delivery times. Cybersecurity threats and the need for robust consumer data protection measures pose significant concerns. Intense competition and the need for substantial investment in technology and marketing present operational and financial barriers.

Emerging Opportunities in Indonesia Ecommerce Industry

Several emerging opportunities exist within the Indonesian e-commerce sector. The growth of mobile commerce, particularly through mobile wallets and payment apps, presents significant expansion possibilities. The increasing adoption of social commerce, as seen with the Tokopedia-TikTok deal, creates new avenues for marketing and sales. The development of e-commerce solutions tailored to specific regions and demographic groups allows for specialized market penetration.

Leading Players in the Indonesia Ecommerce Industry Market

- Orami co id

- ZALORA - PT Fashion Eservices (Global Fashion Group)

- PT Bhinneka Mentaridimensi

- PT Raksasa Laju Lintang (ralali com)

- Lazada (Alibaba Group Holding Limited)

- Blibli (PT Global Digital Niaga TBK)

- PT Bukalapak com Tbk

- PT Tokopedia (PT GOTO GOJEK TOKOPEDIA TBK)

- PT Sociolla Ritel Indonesia

- PT Shopee International Indonesia (Shopee sea limited)

Key Developments in Indonesia Ecommerce Industry Industry

- February 2024: Tokopedia merges with TikTok Shop, creating a significant player in the Indonesian e-commerce landscape and signaling a major shift in the competitive dynamics. TikTok's USD 1.5 Billion investment signifies its commitment to the Indonesian market.

- January 2024: SIRCLO collaborates with Shopify, integrating advanced e-commerce infrastructure and enhancing the omnichannel capabilities of Indonesian businesses. This partnership is poised to significantly improve the e-commerce experience for Indonesian consumers.

Strategic Outlook for Indonesia Ecommerce Industry Market

The Indonesian e-commerce industry is poised for continued strong growth, driven by increasing digital adoption, rising disposable incomes, and ongoing improvements in infrastructure. The strategic focus for players will be on enhancing customer experience, expanding logistics networks, and capitalizing on emerging opportunities in mobile commerce and social commerce. The market's dynamic nature and the significant investments being made point towards a bright outlook for the years to come, despite existing challenges.

Indonesia Ecommerce Industry Segmentation

-

1. B2C Ecommerce

-

1.1. Market Segmentation - by B2C Application

- 1.1.1. Beauty and Personal Care

- 1.1.2. Consumer Electronics

- 1.1.3. Fashion and Apparel

- 1.1.4. Food and Beverage

- 1.1.5. Furniture and Home

- 1.1.6. Other B2C Applications (Toys, DIY, Media, Etc.)

-

1.1. Market Segmentation - by B2C Application

-

2. B2C Application

- 2.1. Beauty and Personal Care

- 2.2. Consumer Electronics

- 2.3. Fashion and Apparel

- 2.4. Food and Beverage

- 2.5. Furniture and Home

- 2.6. Other B2C Applications (Toys, DIY, Media, Etc.)

- 3. Beauty and Personal Care

- 4. Consumer Electronics

- 5. Fashion and Apparel

- 6. Food and Beverage

- 7. Furniture and Home

- 8. Other B2C Applications (Toys, DIY, Media, Etc.)

- 9. B2B E-commerce

Indonesia Ecommerce Industry Segmentation By Geography

- 1. Indonesia

Indonesia Ecommerce Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 15.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand from Fashion Industry; Penetration of Internet and Smartphone Usage

- 3.3. Market Restrains

- 3.3.1. ; Lack of Infrastructure and Limited Awareness about E-learning

- 3.4. Market Trends

- 3.4.1. Penetration of Internet and Smartphone Usage Drives the Indonesia ecommerce Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Indonesia Ecommerce Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by B2C Ecommerce

- 5.1.1. Market Segmentation - by B2C Application

- 5.1.1.1. Beauty and Personal Care

- 5.1.1.2. Consumer Electronics

- 5.1.1.3. Fashion and Apparel

- 5.1.1.4. Food and Beverage

- 5.1.1.5. Furniture and Home

- 5.1.1.6. Other B2C Applications (Toys, DIY, Media, Etc.)

- 5.1.1. Market Segmentation - by B2C Application

- 5.2. Market Analysis, Insights and Forecast - by B2C Application

- 5.2.1. Beauty and Personal Care

- 5.2.2. Consumer Electronics

- 5.2.3. Fashion and Apparel

- 5.2.4. Food and Beverage

- 5.2.5. Furniture and Home

- 5.2.6. Other B2C Applications (Toys, DIY, Media, Etc.)

- 5.3. Market Analysis, Insights and Forecast - by Beauty and Personal Care

- 5.4. Market Analysis, Insights and Forecast - by Consumer Electronics

- 5.5. Market Analysis, Insights and Forecast - by Fashion and Apparel

- 5.6. Market Analysis, Insights and Forecast - by Food and Beverage

- 5.7. Market Analysis, Insights and Forecast - by Furniture and Home

- 5.8. Market Analysis, Insights and Forecast - by Other B2C Applications (Toys, DIY, Media, Etc.)

- 5.9. Market Analysis, Insights and Forecast - by B2B E-commerce

- 5.10. Market Analysis, Insights and Forecast - by Region

- 5.10.1. Indonesia

- 5.1. Market Analysis, Insights and Forecast - by B2C Ecommerce

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Orami co id

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 ZALORA - PT Fashion Eservices (Global Fashion Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 PT Bhinneka Mentaridimensi

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 PT Raksasa Laju Lintang (ralali com)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Lazada (Alibaba Group Holding Limited)

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Blibli (PT Global Digital Niaga TBK)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 PT Bukalapak com Tbk

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 PT Tokopedia (PT GOTO GOJEK TOKOPEDIA TBK)

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 PT Sociolla Ritel Indonesia

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 PT Shopee International Indonesia (Shopee sea limited)

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Orami co id

List of Figures

- Figure 1: Indonesia Ecommerce Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Indonesia Ecommerce Industry Share (%) by Company 2024

List of Tables

- Table 1: Indonesia Ecommerce Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Indonesia Ecommerce Industry Revenue Million Forecast, by B2C Ecommerce 2019 & 2032

- Table 3: Indonesia Ecommerce Industry Revenue Million Forecast, by B2C Application 2019 & 2032

- Table 4: Indonesia Ecommerce Industry Revenue Million Forecast, by Beauty and Personal Care 2019 & 2032

- Table 5: Indonesia Ecommerce Industry Revenue Million Forecast, by Consumer Electronics 2019 & 2032

- Table 6: Indonesia Ecommerce Industry Revenue Million Forecast, by Fashion and Apparel 2019 & 2032

- Table 7: Indonesia Ecommerce Industry Revenue Million Forecast, by Food and Beverage 2019 & 2032

- Table 8: Indonesia Ecommerce Industry Revenue Million Forecast, by Furniture and Home 2019 & 2032

- Table 9: Indonesia Ecommerce Industry Revenue Million Forecast, by Other B2C Applications (Toys, DIY, Media, Etc.) 2019 & 2032

- Table 10: Indonesia Ecommerce Industry Revenue Million Forecast, by B2B E-commerce 2019 & 2032

- Table 11: Indonesia Ecommerce Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 12: Indonesia Ecommerce Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 13: Indonesia Ecommerce Industry Revenue Million Forecast, by B2C Ecommerce 2019 & 2032

- Table 14: Indonesia Ecommerce Industry Revenue Million Forecast, by B2C Application 2019 & 2032

- Table 15: Indonesia Ecommerce Industry Revenue Million Forecast, by Beauty and Personal Care 2019 & 2032

- Table 16: Indonesia Ecommerce Industry Revenue Million Forecast, by Consumer Electronics 2019 & 2032

- Table 17: Indonesia Ecommerce Industry Revenue Million Forecast, by Fashion and Apparel 2019 & 2032

- Table 18: Indonesia Ecommerce Industry Revenue Million Forecast, by Food and Beverage 2019 & 2032

- Table 19: Indonesia Ecommerce Industry Revenue Million Forecast, by Furniture and Home 2019 & 2032

- Table 20: Indonesia Ecommerce Industry Revenue Million Forecast, by Other B2C Applications (Toys, DIY, Media, Etc.) 2019 & 2032

- Table 21: Indonesia Ecommerce Industry Revenue Million Forecast, by B2B E-commerce 2019 & 2032

- Table 22: Indonesia Ecommerce Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Indonesia Ecommerce Industry?

The projected CAGR is approximately 15.50%.

2. Which companies are prominent players in the Indonesia Ecommerce Industry?

Key companies in the market include Orami co id, ZALORA - PT Fashion Eservices (Global Fashion Group, PT Bhinneka Mentaridimensi, PT Raksasa Laju Lintang (ralali com), Lazada (Alibaba Group Holding Limited), Blibli (PT Global Digital Niaga TBK), PT Bukalapak com Tbk, PT Tokopedia (PT GOTO GOJEK TOKOPEDIA TBK), PT Sociolla Ritel Indonesia, PT Shopee International Indonesia (Shopee sea limited).

3. What are the main segments of the Indonesia Ecommerce Industry?

The market segments include B2C Ecommerce, B2C Application, Beauty and Personal Care, Consumer Electronics, Fashion and Apparel, Food and Beverage, Furniture and Home, Other B2C Applications (Toys, DIY, Media, Etc.), B2B E-commerce.

4. Can you provide details about the market size?

The market size is estimated to be USD 81.80 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand from Fashion Industry; Penetration of Internet and Smartphone Usage.

6. What are the notable trends driving market growth?

Penetration of Internet and Smartphone Usage Drives the Indonesia ecommerce Industry.

7. Are there any restraints impacting market growth?

; Lack of Infrastructure and Limited Awareness about E-learning.

8. Can you provide examples of recent developments in the market?

February 2024 - Tokopedia, the e-commerce subsidiary of GoTo Group, officially concluded its merger with TikTok, signifying the return of TikTok Shop to Indonesia. This deal absorbs TikTok Shop's Indonesia business into the Tokopedia entity, with Tokopedia now jointly owned by TikTok and GoTo. As previously announced, TikTok will invest over USD 1.5 billion in the enlarged entity over time to provide future funding for the business.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Indonesia Ecommerce Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Indonesia Ecommerce Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Indonesia Ecommerce Industry?

To stay informed about further developments, trends, and reports in the Indonesia Ecommerce Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence