Key Insights

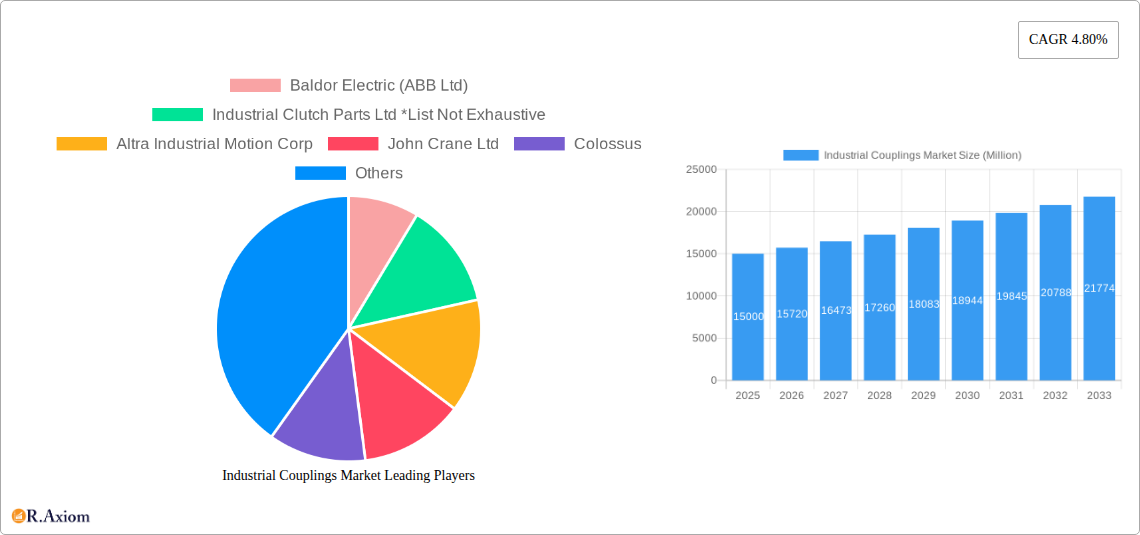

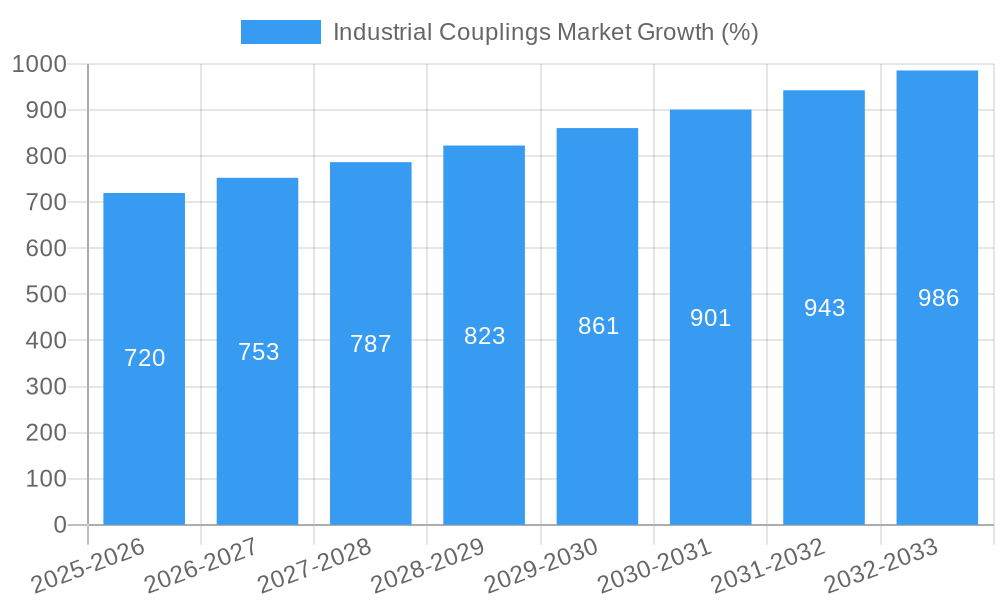

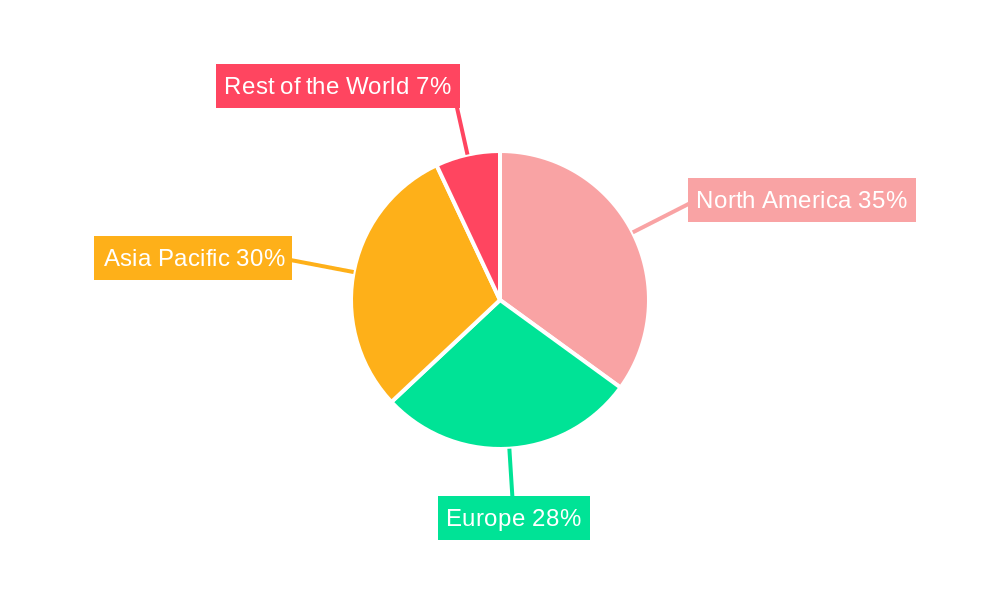

The global industrial couplings market is experiencing steady growth, projected to reach a substantial size driven by increasing automation across various industries. The 4.80% CAGR from 2019-2024 suggests a robust market performance, indicating consistent demand for efficient power transmission solutions. Key drivers include the expanding automotive sector, particularly electric vehicles requiring advanced coupling technologies, and the growth of renewable energy projects, which necessitate reliable couplings for wind turbines and solar power systems. Furthermore, the aerospace and defense sectors, known for their stringent quality and performance requirements, contribute significantly to market expansion. Flexible couplings, offering adaptability and shock absorption, hold a larger market share compared to rigid couplings, due to their suitability in applications with misalignment issues. The market is segmented by type (flexible and rigid) and end-user industry (automotive, healthcare, aerospace & defense, oil & gas, metal & mining, and others). Competitive rivalry is high, with major players like ABB, Altra Industrial Motion, and Emerson Electric actively innovating to enhance product features and expand their market reach. Geographic distribution shows strong growth in Asia-Pacific, fueled by industrialization and rising manufacturing activity, while North America and Europe maintain significant market presence due to established industrial bases. Challenges include fluctuating raw material prices and the need for continuous technological advancements to meet evolving industrial needs.

The forecast period (2025-2033) anticipates continued growth, albeit at a potentially moderated pace due to factors such as economic cycles and global geopolitical uncertainties. However, long-term prospects remain positive due to the ongoing expansion of industrial automation and the increasing demand for sophisticated power transmission technologies across diverse sectors. Technological advancements, such as the development of smart couplings with integrated sensors and predictive maintenance capabilities, are set to reshape the market landscape, further enhancing efficiency and reducing downtime. The continuous adoption of Industry 4.0 principles is expected to augment demand for high-performance couplings capable of supporting advanced automation systems. Furthermore, stricter regulations concerning safety and efficiency in industrial settings are likely to stimulate the adoption of high-quality, durable couplings, resulting in sustained market growth throughout the forecast period.

Industrial Couplings Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Industrial Couplings Market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with 2025 as the base and estimated year, this report meticulously examines market trends, competitive dynamics, and future growth potential. The market is segmented by type (Flexible Coupling, Rigid Coupling) and end-user industry (Automotive, Healthcare, Aerospace & Defence, Oil & Gas, Metal & Mining, Other). The report projects a xx Million market value by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033).

Industrial Couplings Market Market Concentration & Innovation

The Industrial Couplings market demonstrates a moderately concentrated landscape, with a few major players holding significant market share. However, the presence of numerous smaller players, particularly in niche segments, fosters healthy competition. Market share analysis reveals that [Insert Market Share Data if available, otherwise use estimated values, e.g., ABB Ltd holds approximately xx%, Altra Industrial Motion Corp holds xx%, etc.]. Innovation is driven by the need for higher efficiency, durability, and customized solutions for diverse applications. Regulatory frameworks, particularly concerning safety and environmental standards, influence product design and manufacturing processes. The emergence of advanced materials and smart technologies, such as sensor integration, is reshaping the industry. Key product substitutes include alternative power transmission mechanisms, but their adoption is limited due to cost and performance considerations. End-user trends towards automation and increased productivity are driving demand for high-performance couplings. M&A activity has been relatively moderate in recent years, with deal values averaging approximately xx Million per transaction [Insert actual data if available, otherwise use estimated values]. Significant transactions include [insert example M&A activity, if data is available].

- Market Concentration: Moderately concentrated, with a few dominant players.

- Innovation Drivers: Efficiency, durability, customization, advanced materials, and smart technologies.

- Regulatory Frameworks: Safety and environmental standards significantly impact the industry.

- Product Substitutes: Limited substitutes exist, with restricted adoption due to cost-performance trade-offs.

- End-User Trends: Automation and increased productivity are driving market demand.

- M&A Activity: Moderate activity with an average deal value of approximately xx Million.

Industrial Couplings Market Industry Trends & Insights

The Industrial Couplings market is experiencing robust growth, propelled by several key factors. The expanding global industrial sector, particularly in developing economies, is a significant driver. The increasing adoption of automation and robotics across various industries necessitates efficient and reliable power transmission solutions, fueling the demand for industrial couplings. Technological advancements, such as the development of lightweight, high-strength materials and improved designs, are enhancing the performance and lifespan of these couplings. Consumer preferences are shifting towards couplings with longer service life, reduced maintenance requirements, and enhanced energy efficiency. Competitive dynamics are characterized by both intense rivalry among established players and the emergence of innovative startups offering niche solutions. Market penetration of advanced couplings, featuring smart functionalities, is gradually increasing, reaching approximately xx% in 2024 and projected to reach xx% by 2033. The market's overall growth is expected to maintain a steady CAGR of xx% throughout the forecast period.

Dominant Markets & Segments in Industrial Couplings Market

The Oil & Gas sector currently represents the largest end-user segment for industrial couplings, owing to the extensive use of machinery and equipment in drilling, refining, and transportation. This segment is projected to maintain its dominance throughout the forecast period, driven by ongoing exploration and production activities globally. The Automotive industry also shows significant demand, driven by the rising production of vehicles and the increasing complexity of powertrain systems. The Metal and Mining industry also contributes considerably to the demand, due to the large-scale use of industrial machinery in extraction and processing.

By Type: Flexible couplings hold a larger market share compared to rigid couplings due to their ability to accommodate misalignment and vibration.

By End-User Industry:

- Oil & Gas: Largest segment due to extensive machinery use. Key drivers include increasing exploration and production activities, and the need for reliable power transmission in harsh environments.

- Automotive: Strong demand driven by vehicle production and sophisticated powertrain systems. Expansion is linked to the growth of electric and hybrid vehicles.

- Metal & Mining: Significant demand due to heavy machinery use in extraction and processing. Growth depends on global mining output and technological advancements.

- Aerospace & Defence: A smaller but significant niche segment, with high demand for durable and reliable couplings. Growth is closely tied to defence budgets and aerospace projects.

- Healthcare: A niche segment with specialized applications, growing steadily with increased use of medical devices.

Leading Regions/Countries: [Insert data on leading regions/countries based on market size and growth rates. If data is unavailable, use estimations.] The [region/country] region is expected to dominate due to [specify reasons – economic growth, infrastructural development, etc.].

Industrial Couplings Market Product Developments

Recent product innovations focus on enhancing efficiency, durability, and ease of maintenance. New materials, such as high-performance polymers and composites, are being incorporated to improve coupling strength and reduce weight. Smart couplings, integrated with sensors for real-time monitoring and predictive maintenance, are gaining traction. These advancements aim to reduce downtime, optimize operational efficiency, and lower overall lifecycle costs, making them attractive propositions across various industrial sectors. The market is witnessing a shift towards modular and customizable designs to cater to specific application needs.

Report Scope & Segmentation Analysis

This report comprehensively covers the global Industrial Couplings market, segmented by type and end-user industry. The “By Type” segment encompasses Flexible Couplings and Rigid Couplings, each with detailed analysis of market size, growth projections, and competitive landscapes. Similarly, the “By End-User Industry” segment analyzes the market across Automotive, Healthcare, Aerospace & Defence, Oil & Gas, Metal & Mining, and Other industries, providing granular insights into growth drivers, challenges, and opportunities within each sector. The report also incorporates a thorough competitive analysis, including market share estimates for major players, and explores the impact of emerging technologies on the market’s trajectory.

Key Drivers of Industrial Couplings Market Growth

Several factors drive the growth of the Industrial Couplings market. The expansion of industrial automation across diverse sectors increases the demand for reliable power transmission solutions. Technological advancements, such as the development of lighter and more efficient couplings, further contribute to market expansion. Government initiatives promoting industrial modernization and infrastructure development in various regions significantly boost demand. The increasing adoption of renewable energy sources, with their associated power transmission needs, represents an emerging growth driver.

Challenges in the Industrial Couplings Market Sector

The Industrial Couplings market faces challenges such as fluctuations in raw material prices, impacting manufacturing costs. Supply chain disruptions can lead to production delays and affect market availability. Intense competition among established players and the emergence of new entrants creates pressure on pricing and margins. Stringent safety and environmental regulations require manufacturers to adopt costlier technologies and processes.

Emerging Opportunities in Industrial Couplings Market

Emerging opportunities lie in the development of smart couplings with integrated sensors for predictive maintenance. The growing adoption of automation and robotics in various sectors presents significant growth potential. Expansion into new and emerging markets with developing industrial sectors holds promising prospects. The increasing focus on energy efficiency and sustainability presents opportunities for eco-friendly coupling designs.

Leading Players in the Industrial Couplings Market Market

- Baldor Electric (ABB Ltd)

- Industrial Clutch Parts Ltd

- Altra Industrial Motion Corp

- John Crane Ltd

- Colossus

- Emerson Electric Co

- Siemens AG

- KTR Systems

- Baker Hughes Company

- Rexnord Corporation

Key Developments in Industrial Couplings Market Industry

- July 2022: Altra Industrial Motion Corporation announced the development of custom gearboxes and gear couplings for the San Francisco Cable Car System. The Cable Car Barn Propulsion Gearbox Rehabilitation Project was recently finished by the San Francisco Municipal Transportation Agency (SFMTA). This highlights the increasing demand for customized solutions in specialized applications.

- May 2022: ASC Engineered Solutions announced a new flexible Gruvlok Fig. 70 SlideFLEX coupling. These couplings are ideal for use in mechanical and mining systems with an operating pressure of up to 1,000 psi. This showcases ongoing innovation in flexible coupling technology for demanding industrial applications.

Strategic Outlook for Industrial Couplings Market Market

The Industrial Couplings market is poised for continued growth, driven by the expanding global industrial landscape and technological advancements. The increasing adoption of automation, smart technologies, and the focus on energy efficiency will shape future market dynamics. The development of specialized couplings for niche applications and the expansion into emerging markets present significant opportunities for growth and innovation. Strategic partnerships, technological collaborations, and investments in R&D will be crucial for companies to maintain a competitive edge and capitalize on the market's future potential.

Industrial Couplings Market Segmentation

-

1. Type

- 1.1. Flexible Coupling

- 1.2. Rigid Coupling

-

2. End-user Industry

- 2.1. Automotive

- 2.2. Healthcare

- 2.3. Aerospace and Defence

- 2.4. Oil and Gas

- 2.5. Metal and Mining

- 2.6. Other End-user Industries

Industrial Couplings Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Industrial Couplings Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.80% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Applications in Various End-user Industries; Increased Investment in R&D leading to better Functionality

- 3.3. Market Restrains

- 3.3.1. ; High Initial Costs of Advanced Flow Sensor Products

- 3.4. Market Trends

- 3.4.1. Automotive Sector to Register a Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Industrial Couplings Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Flexible Coupling

- 5.1.2. Rigid Coupling

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Automotive

- 5.2.2. Healthcare

- 5.2.3. Aerospace and Defence

- 5.2.4. Oil and Gas

- 5.2.5. Metal and Mining

- 5.2.6. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Industrial Couplings Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Flexible Coupling

- 6.1.2. Rigid Coupling

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Automotive

- 6.2.2. Healthcare

- 6.2.3. Aerospace and Defence

- 6.2.4. Oil and Gas

- 6.2.5. Metal and Mining

- 6.2.6. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Industrial Couplings Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Flexible Coupling

- 7.1.2. Rigid Coupling

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Automotive

- 7.2.2. Healthcare

- 7.2.3. Aerospace and Defence

- 7.2.4. Oil and Gas

- 7.2.5. Metal and Mining

- 7.2.6. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Industrial Couplings Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Flexible Coupling

- 8.1.2. Rigid Coupling

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Automotive

- 8.2.2. Healthcare

- 8.2.3. Aerospace and Defence

- 8.2.4. Oil and Gas

- 8.2.5. Metal and Mining

- 8.2.6. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of the World Industrial Couplings Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Flexible Coupling

- 9.1.2. Rigid Coupling

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Automotive

- 9.2.2. Healthcare

- 9.2.3. Aerospace and Defence

- 9.2.4. Oil and Gas

- 9.2.5. Metal and Mining

- 9.2.6. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. North America Industrial Couplings Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1.

- 11. Europe Industrial Couplings Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Asia Pacific Industrial Couplings Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Rest of the World Industrial Couplings Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Competitive Analysis

- 14.1. Global Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 Baldor Electric (ABB Ltd)

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 Industrial Clutch Parts Ltd *List Not Exhaustive

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Altra Industrial Motion Corp

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 John Crane Ltd

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Colossus

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Emerson Electric Co

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 Siemens AG

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 KTR Systems

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 Baker Hughes Company

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 Rexnord Corporation

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.1 Baldor Electric (ABB Ltd)

List of Figures

- Figure 1: Global Industrial Couplings Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Industrial Couplings Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Industrial Couplings Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Industrial Couplings Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Industrial Couplings Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Industrial Couplings Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Industrial Couplings Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Rest of the World Industrial Couplings Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Rest of the World Industrial Couplings Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America Industrial Couplings Market Revenue (Million), by Type 2024 & 2032

- Figure 11: North America Industrial Couplings Market Revenue Share (%), by Type 2024 & 2032

- Figure 12: North America Industrial Couplings Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 13: North America Industrial Couplings Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 14: North America Industrial Couplings Market Revenue (Million), by Country 2024 & 2032

- Figure 15: North America Industrial Couplings Market Revenue Share (%), by Country 2024 & 2032

- Figure 16: Europe Industrial Couplings Market Revenue (Million), by Type 2024 & 2032

- Figure 17: Europe Industrial Couplings Market Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Industrial Couplings Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 19: Europe Industrial Couplings Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 20: Europe Industrial Couplings Market Revenue (Million), by Country 2024 & 2032

- Figure 21: Europe Industrial Couplings Market Revenue Share (%), by Country 2024 & 2032

- Figure 22: Asia Pacific Industrial Couplings Market Revenue (Million), by Type 2024 & 2032

- Figure 23: Asia Pacific Industrial Couplings Market Revenue Share (%), by Type 2024 & 2032

- Figure 24: Asia Pacific Industrial Couplings Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 25: Asia Pacific Industrial Couplings Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 26: Asia Pacific Industrial Couplings Market Revenue (Million), by Country 2024 & 2032

- Figure 27: Asia Pacific Industrial Couplings Market Revenue Share (%), by Country 2024 & 2032

- Figure 28: Rest of the World Industrial Couplings Market Revenue (Million), by Type 2024 & 2032

- Figure 29: Rest of the World Industrial Couplings Market Revenue Share (%), by Type 2024 & 2032

- Figure 30: Rest of the World Industrial Couplings Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 31: Rest of the World Industrial Couplings Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 32: Rest of the World Industrial Couplings Market Revenue (Million), by Country 2024 & 2032

- Figure 33: Rest of the World Industrial Couplings Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Industrial Couplings Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Industrial Couplings Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Global Industrial Couplings Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 4: Global Industrial Couplings Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Industrial Couplings Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Industrial Couplings Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Global Industrial Couplings Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Industrial Couplings Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Industrial Couplings Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Industrial Couplings Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global Industrial Couplings Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Industrial Couplings Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global Industrial Couplings Market Revenue Million Forecast, by Type 2019 & 2032

- Table 14: Global Industrial Couplings Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 15: Global Industrial Couplings Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Global Industrial Couplings Market Revenue Million Forecast, by Type 2019 & 2032

- Table 17: Global Industrial Couplings Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 18: Global Industrial Couplings Market Revenue Million Forecast, by Country 2019 & 2032

- Table 19: Global Industrial Couplings Market Revenue Million Forecast, by Type 2019 & 2032

- Table 20: Global Industrial Couplings Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 21: Global Industrial Couplings Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Global Industrial Couplings Market Revenue Million Forecast, by Type 2019 & 2032

- Table 23: Global Industrial Couplings Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 24: Global Industrial Couplings Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Industrial Couplings Market?

The projected CAGR is approximately 4.80%.

2. Which companies are prominent players in the Industrial Couplings Market?

Key companies in the market include Baldor Electric (ABB Ltd), Industrial Clutch Parts Ltd *List Not Exhaustive, Altra Industrial Motion Corp, John Crane Ltd, Colossus, Emerson Electric Co, Siemens AG, KTR Systems, Baker Hughes Company, Rexnord Corporation.

3. What are the main segments of the Industrial Couplings Market?

The market segments include Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Applications in Various End-user Industries; Increased Investment in R&D leading to better Functionality.

6. What are the notable trends driving market growth?

Automotive Sector to Register a Significant Growth.

7. Are there any restraints impacting market growth?

; High Initial Costs of Advanced Flow Sensor Products.

8. Can you provide examples of recent developments in the market?

July 2022 - Altra Industrial Motion Corporation announced the development of custom gearboxes and gear couplings for the San Francisco Cable Car System. The Cable Car Barn Propulsion Gearbox Rehabilitation Project was recently finished by the San Francisco Municipal Transportation Agency (SFMTA).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Industrial Couplings Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Industrial Couplings Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Industrial Couplings Market?

To stay informed about further developments, trends, and reports in the Industrial Couplings Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence