Key Insights

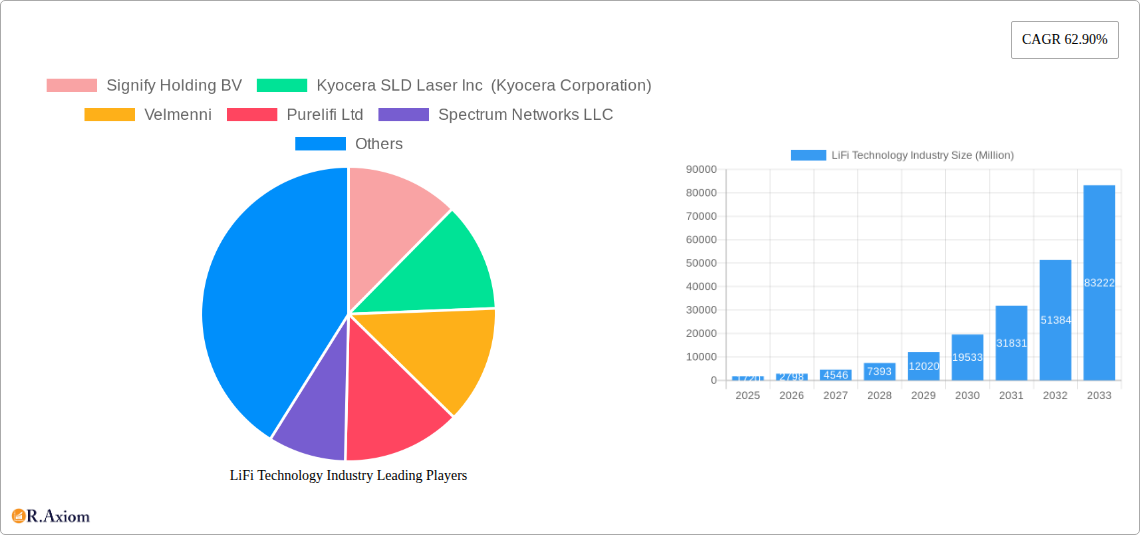

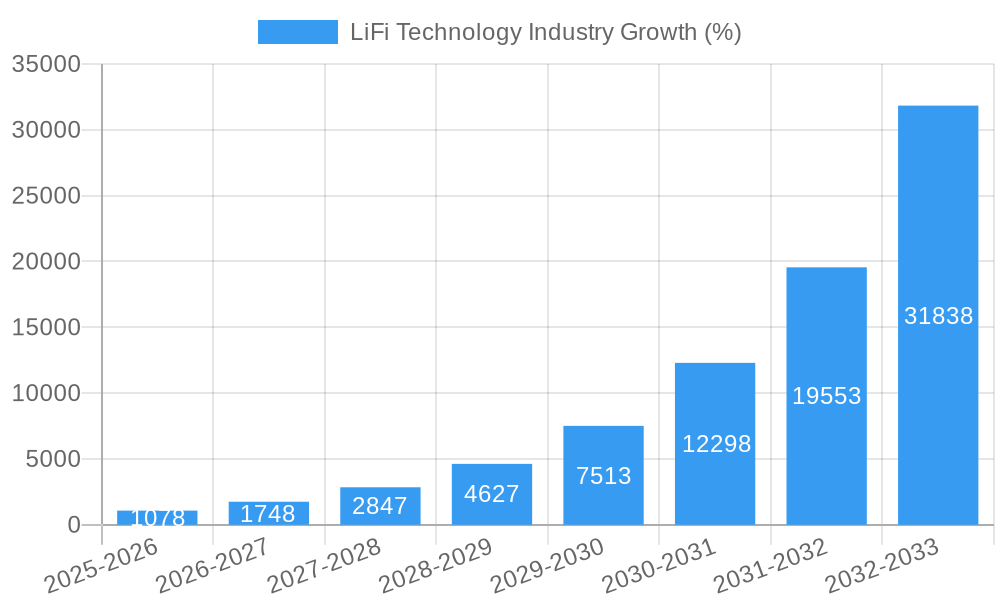

The LiFi technology market is experiencing explosive growth, projected to reach $1.72 billion in 2025 and exhibiting a remarkable Compound Annual Growth Rate (CAGR) of 62.90% from 2025 to 2033. This surge is driven by several key factors. The increasing demand for high-speed, secure, and energy-efficient wireless communication solutions across various sectors fuels this expansion. LiFi's inherent advantages, such as its immunity to radio frequency interference, high bandwidth capacity, and enhanced security features, are proving particularly attractive to industries facing bandwidth constraints or stringent security requirements, like healthcare and finance. Furthermore, the growing adoption of smart devices and the Internet of Things (IoT) is creating a significant opportunity for LiFi deployment, as it can seamlessly integrate into existing infrastructure and offer a robust solution for connecting numerous devices simultaneously. The market is segmented by end-user industry, with notable growth anticipated in sectors such as healthcare (for secure medical data transmission), industrial automation (for real-time data exchange in manufacturing), and corporate buildings (for enhanced connectivity and network security). Technological advancements, including improved LED light sources and more efficient data transmission protocols, are further accelerating market expansion.

While the market presents immense potential, challenges remain. High initial investment costs associated with LiFi infrastructure deployment can act as a restraint, particularly for smaller businesses and in regions with limited technological infrastructure. Furthermore, the limited range of LiFi signals compared to Wi-Fi and the necessity for a line-of-sight connection between the transmitter and receiver might restrict its widespread adoption in certain environments. Nevertheless, ongoing research and development efforts focused on expanding LiFi's range and reducing its cost are expected to mitigate these limitations and drive wider acceptance. The competitive landscape is dynamic, with key players like Signify, Kyocera, and Velmenni actively innovating and expanding their product portfolios to cater to the growing demand. The market's strong growth trajectory indicates that LiFi is poised to become a significant player in the future of wireless communication.

This in-depth report provides a comprehensive analysis of the LiFi technology industry, covering market size, growth projections, key players, emerging trends, and future outlook. The study period spans from 2019 to 2033, with 2025 as the base and estimated year. The forecast period is 2025-2033, and the historical period is 2019-2024. This report is crucial for industry stakeholders, investors, and researchers seeking actionable insights into this rapidly evolving sector. The global LiFi technology market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

LiFi Technology Industry Market Concentration & Innovation

The LiFi technology market exhibits a moderately concentrated landscape, with a few key players holding significant market share. Signify Holding BV, Kyocera SLD Laser Inc (Kyocera Corporation), and Velmenni are among the leading companies driving innovation and market growth. Market share distribution varies across segments, with certain players dominating specific end-user industries. The industry is characterized by intense R&D efforts, leading to continuous product improvements and the emergence of new applications. Regulatory frameworks, particularly concerning spectrum allocation and safety standards, play a vital role in shaping market dynamics. While there aren't direct substitutes for LiFi in all applications, competing technologies such as Wi-Fi and 5G present some challenges. End-user trends, such as the increasing demand for high-speed, secure, and reliable wireless connectivity in various sectors, are driving industry growth. M&A activities have been relatively low in recent years, with deal values estimated at around xx Million annually. However, strategic partnerships and collaborations are common, signifying a collaborative approach to market expansion.

- Market Leaders: Signify Holding BV, Kyocera SLD Laser Inc, Velmenni

- Innovation Drivers: Increased R&D investment, demand for high-speed data transmission, growing adoption in diverse industries

- Regulatory Landscape: Evolving standards for safety and spectrum allocation

- M&A Activity: Relatively low frequency, xx Million annual deal value (estimated)

LiFi Technology Industry Industry Trends & Insights

The LiFi technology market is experiencing rapid growth, fueled by several key factors. The increasing demand for high-bandwidth, low-latency connectivity across various sectors is a major driver. Technological advancements, such as improved LED technology and advanced modulation techniques, are enhancing LiFi's capabilities and expanding its potential applications. Consumer preferences are shifting towards seamless connectivity, secure data transmission, and energy-efficient solutions, making LiFi an attractive alternative to traditional wireless technologies. Competitive dynamics are intense, with companies focusing on innovation, strategic partnerships, and market expansion strategies. The global market is projected to reach xx Million by 2033, with a CAGR of xx%. Market penetration remains relatively low compared to Wi-Fi but is steadily increasing across several key segments. The rising adoption of IoT devices and the need for robust wireless connectivity in industrial settings are also contributing significantly to market growth. Technological disruptions are occurring as companies strive to increase data rates and range. Consumer preference for secure and reliable communication is fostering increased demand for LiFi in high-security applications.

Dominant Markets & Segments in LiFi Technology Industry

The LiFi technology market demonstrates strong growth potential across various end-user industries. However, certain segments are experiencing more rapid adoption than others. Currently, the Corporate Buildings segment exhibits significant dominance, driven by the need for high-speed data connectivity and improved security in office environments. The Industrial sector follows closely, with LiFi adoption being driven by the need for reliable communication in harsh environments where other wireless technologies may struggle.

Key Drivers for Dominant Segments:

- Corporate Buildings: High demand for high-speed, secure data; improved network efficiency; cost savings on cabling infrastructure.

- Industrial: Need for reliable connectivity in hazardous environments; elimination of interference and improved security in industrial automation.

Dominance Analysis: The dominance of Corporate Buildings and Industrial sectors stems from their high data needs, existing infrastructure suitable for LiFi integration (lighting systems), and the higher budgets allocated for technological upgrades compared to residential or smaller-scale segments.

Other Significant Segments: Healthcare (due to safety and security concerns), Retail (enhanced customer experience and inventory management), and Automotive and Transportation (vehicle-to-infrastructure communication and in-cabin connectivity) are experiencing significant growth, although they lag behind Corporate Buildings and Industrial in terms of market size.

LiFi Technology Industry Product Developments

Recent product innovations in the LiFi technology space focus on enhancing data rates, expanding coverage areas, and improving energy efficiency. New LED chips, advanced modulation techniques, and intelligent software are driving these advancements. LiFi systems are finding applications in various sectors, from industrial automation and healthcare to smart homes and office spaces. Competitive advantages lie in achieving superior data rates, enhanced security features, improved power efficiency, and ease of integration with existing infrastructure. The market is witnessing the introduction of hybrid solutions combining LiFi with other wireless technologies to offer a comprehensive connectivity solution.

Report Scope & Segmentation Analysis

This report segments the LiFi technology market by end-user industry: Industrial, Healthcare, Retail, Corporate Buildings, Education, Residential, Aerospace and Defense, Automotive and Transportation, and Other End-user Industries (Hospitality, Disaster Management, and Others). Each segment is analyzed based on market size, growth projections, and competitive dynamics. Growth projections vary significantly based on factors such as technology adoption rates, infrastructure development, and regulatory policies. The Corporate Buildings and Industrial segments are projected to exhibit the highest growth rates during the forecast period, driven by the high demand for high-speed, secure, and reliable wireless connectivity in these sectors. Competitive dynamics within each segment vary, with some segments exhibiting greater market concentration than others.

Key Drivers of LiFi Technology Industry Growth

Several key factors drive the growth of the LiFi technology industry. Technological advancements, such as increased data rates and improved power efficiency, are making LiFi a more attractive option for various applications. Economic drivers include the increasing demand for high-speed data and the cost-effectiveness of LiFi compared to traditional wired solutions in some cases. Regulatory frameworks, while still evolving, are supportive of the development and adoption of LiFi technology. Government initiatives aimed at fostering innovation and deploying advanced communication technologies are also contributing to market growth. For instance, the development of 6G in India, as highlighted by the IBEF and TIG-6G's Bharat 6G Vision, indirectly supports the development of LiFi technology as a complementary connectivity solution.

Challenges in the LiFi Technology Industry Sector

The LiFi technology industry faces several challenges hindering its widespread adoption. Regulatory hurdles regarding spectrum allocation and safety standards create uncertainty and can slow down market penetration. Supply chain issues and the high initial investment cost associated with implementing LiFi systems are also significant obstacles. Competition from established wireless technologies such as Wi-Fi and 5G, which have significantly larger market shares and established ecosystems, is a major factor impacting LiFi growth. Lack of interoperability standards also creates barriers to wider adoption. The limited range compared to other technologies is another factor affecting growth.

Emerging Opportunities in LiFi Technology Industry

The LiFi technology market presents several promising opportunities for future growth. New markets, such as underwater communication and in-vehicle applications, are emerging as potential areas for LiFi deployment. Technological advancements in LED technology and modulation techniques promise further improvements in data rates and range. Changes in consumer preferences toward secure and energy-efficient solutions will also drive the adoption of LiFi in various applications. The increasing use of LiFi in hybrid connectivity solutions combining it with other technologies presents further opportunities for expansion.

Leading Players in the LiFi Technology Industry Market

- Signify Holding BV

- Kyocera SLD Laser Inc (Kyocera Corporation)

- Velmenni

- Purelifi Ltd

- Spectrum Networks LLC

- IDRO Co Ltd

- Zero

- LVX System

- Renesas Electronics Corporation

- To Be Sr

- Slux

- Oledcomm SAS

- Lightbee Corp

- Panasonic Corporation

Key Developments in LiFi Technology Industry Industry

- September 2023: Getac successfully integrated LiFi technology into its rugged devices in collaboration with Signify, highlighting the growing adoption of LiFi in specialized hardware. This collaboration, through the Light Communication Alliance (LCA), demonstrates the industry's collective effort toward Optical Wireless Communication advancement.

- August 2023: India's focus on developing 6G technology, as outlined by IBEF and TIG-6G's Bharat 6G Vision, indirectly creates opportunities for LiFi as a complementary technology for high-speed, secure connectivity.

Strategic Outlook for LiFi Technology Industry Market

The future of the LiFi technology market appears promising. Continued technological advancements, coupled with increasing demand for high-speed and secure wireless connectivity, will drive significant market growth. The emergence of new applications and expansion into untapped markets will further fuel market expansion. Strategic partnerships and collaborations between industry players are likely to accelerate innovation and market penetration. The development of robust industry standards and regulatory frameworks will contribute to wider adoption. While challenges remain, the overall outlook for the LiFi technology industry is positive, indicating substantial growth potential in the coming years.

LiFi Technology Industry Segmentation

-

1. End-user Industry

- 1.1. Industrial

- 1.2. Healthcare

- 1.3. Retail

- 1.4. Corporate Buildings

- 1.5. Education

- 1.6. Residential

- 1.7. Aerospace and Defense

- 1.8. Automotive and Transportation

- 1.9. Other En

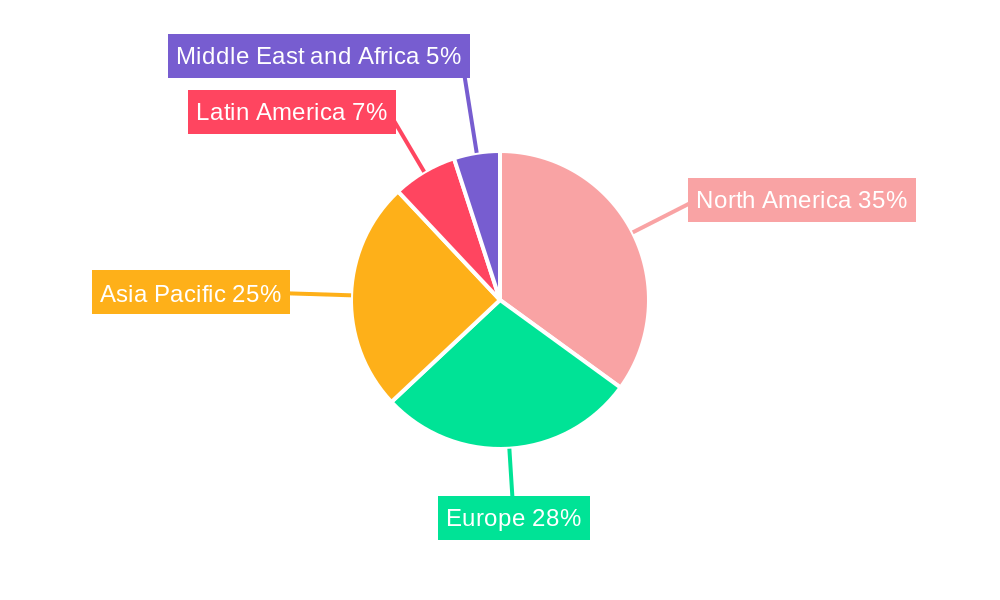

LiFi Technology Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

LiFi Technology Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 62.90% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand For High-Speed Network; Increasing Demand for Energy-efficient Solutions

- 3.3. Market Restrains

- 3.3.1. Limited Range and Connectivity and Lack of Awareness about the Technology

- 3.4. Market Trends

- 3.4.1. Automotive and Transportation to be the Fastest Growing End-user Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global LiFi Technology Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 5.1.1. Industrial

- 5.1.2. Healthcare

- 5.1.3. Retail

- 5.1.4. Corporate Buildings

- 5.1.5. Education

- 5.1.6. Residential

- 5.1.7. Aerospace and Defense

- 5.1.8. Automotive and Transportation

- 5.1.9. Other En

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Latin America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 6. North America LiFi Technology Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by End-user Industry

- 6.1.1. Industrial

- 6.1.2. Healthcare

- 6.1.3. Retail

- 6.1.4. Corporate Buildings

- 6.1.5. Education

- 6.1.6. Residential

- 6.1.7. Aerospace and Defense

- 6.1.8. Automotive and Transportation

- 6.1.9. Other En

- 6.1. Market Analysis, Insights and Forecast - by End-user Industry

- 7. Europe LiFi Technology Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by End-user Industry

- 7.1.1. Industrial

- 7.1.2. Healthcare

- 7.1.3. Retail

- 7.1.4. Corporate Buildings

- 7.1.5. Education

- 7.1.6. Residential

- 7.1.7. Aerospace and Defense

- 7.1.8. Automotive and Transportation

- 7.1.9. Other En

- 7.1. Market Analysis, Insights and Forecast - by End-user Industry

- 8. Asia Pacific LiFi Technology Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by End-user Industry

- 8.1.1. Industrial

- 8.1.2. Healthcare

- 8.1.3. Retail

- 8.1.4. Corporate Buildings

- 8.1.5. Education

- 8.1.6. Residential

- 8.1.7. Aerospace and Defense

- 8.1.8. Automotive and Transportation

- 8.1.9. Other En

- 8.1. Market Analysis, Insights and Forecast - by End-user Industry

- 9. Latin America LiFi Technology Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by End-user Industry

- 9.1.1. Industrial

- 9.1.2. Healthcare

- 9.1.3. Retail

- 9.1.4. Corporate Buildings

- 9.1.5. Education

- 9.1.6. Residential

- 9.1.7. Aerospace and Defense

- 9.1.8. Automotive and Transportation

- 9.1.9. Other En

- 9.1. Market Analysis, Insights and Forecast - by End-user Industry

- 10. Middle East and Africa LiFi Technology Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by End-user Industry

- 10.1.1. Industrial

- 10.1.2. Healthcare

- 10.1.3. Retail

- 10.1.4. Corporate Buildings

- 10.1.5. Education

- 10.1.6. Residential

- 10.1.7. Aerospace and Defense

- 10.1.8. Automotive and Transportation

- 10.1.9. Other En

- 10.1. Market Analysis, Insights and Forecast - by End-user Industry

- 11. North America LiFi Technology Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Europe LiFi Technology Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Asia Pacific LiFi Technology Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Latin America LiFi Technology Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Middle East and Africa LiFi Technology Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Signify Holding BV

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Kyocera SLD Laser Inc (Kyocera Corporation)

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Velmenni

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Purelifi Ltd

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Spectrum Networks LLC

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 IDRO Co Ltd

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Zero

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 LVX System

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Renesas Electronics Corporation

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 To Be Sr

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 Slux

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.12 Oledcomm SAS

- 16.2.12.1. Overview

- 16.2.12.2. Products

- 16.2.12.3. SWOT Analysis

- 16.2.12.4. Recent Developments

- 16.2.12.5. Financials (Based on Availability)

- 16.2.13 Lightbee Corp

- 16.2.13.1. Overview

- 16.2.13.2. Products

- 16.2.13.3. SWOT Analysis

- 16.2.13.4. Recent Developments

- 16.2.13.5. Financials (Based on Availability)

- 16.2.14 Panasonic Corporation

- 16.2.14.1. Overview

- 16.2.14.2. Products

- 16.2.14.3. SWOT Analysis

- 16.2.14.4. Recent Developments

- 16.2.14.5. Financials (Based on Availability)

- 16.2.1 Signify Holding BV

List of Figures

- Figure 1: Global LiFi Technology Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America LiFi Technology Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America LiFi Technology Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe LiFi Technology Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe LiFi Technology Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific LiFi Technology Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific LiFi Technology Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Latin America LiFi Technology Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Latin America LiFi Technology Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East and Africa LiFi Technology Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East and Africa LiFi Technology Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America LiFi Technology Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 13: North America LiFi Technology Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 14: North America LiFi Technology Industry Revenue (Million), by Country 2024 & 2032

- Figure 15: North America LiFi Technology Industry Revenue Share (%), by Country 2024 & 2032

- Figure 16: Europe LiFi Technology Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 17: Europe LiFi Technology Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 18: Europe LiFi Technology Industry Revenue (Million), by Country 2024 & 2032

- Figure 19: Europe LiFi Technology Industry Revenue Share (%), by Country 2024 & 2032

- Figure 20: Asia Pacific LiFi Technology Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 21: Asia Pacific LiFi Technology Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 22: Asia Pacific LiFi Technology Industry Revenue (Million), by Country 2024 & 2032

- Figure 23: Asia Pacific LiFi Technology Industry Revenue Share (%), by Country 2024 & 2032

- Figure 24: Latin America LiFi Technology Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 25: Latin America LiFi Technology Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 26: Latin America LiFi Technology Industry Revenue (Million), by Country 2024 & 2032

- Figure 27: Latin America LiFi Technology Industry Revenue Share (%), by Country 2024 & 2032

- Figure 28: Middle East and Africa LiFi Technology Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 29: Middle East and Africa LiFi Technology Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 30: Middle East and Africa LiFi Technology Industry Revenue (Million), by Country 2024 & 2032

- Figure 31: Middle East and Africa LiFi Technology Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global LiFi Technology Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global LiFi Technology Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 3: Global LiFi Technology Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Global LiFi Technology Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 5: LiFi Technology Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Global LiFi Technology Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: LiFi Technology Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Global LiFi Technology Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 9: LiFi Technology Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global LiFi Technology Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 11: LiFi Technology Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global LiFi Technology Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 13: LiFi Technology Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Global LiFi Technology Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 15: Global LiFi Technology Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Global LiFi Technology Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 17: Global LiFi Technology Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Global LiFi Technology Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 19: Global LiFi Technology Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Global LiFi Technology Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 21: Global LiFi Technology Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Global LiFi Technology Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 23: Global LiFi Technology Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the LiFi Technology Industry?

The projected CAGR is approximately 62.90%.

2. Which companies are prominent players in the LiFi Technology Industry?

Key companies in the market include Signify Holding BV, Kyocera SLD Laser Inc (Kyocera Corporation), Velmenni, Purelifi Ltd, Spectrum Networks LLC, IDRO Co Ltd, Zero, LVX System, Renesas Electronics Corporation, To Be Sr, Slux, Oledcomm SAS, Lightbee Corp, Panasonic Corporation.

3. What are the main segments of the LiFi Technology Industry?

The market segments include End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.72 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand For High-Speed Network; Increasing Demand for Energy-efficient Solutions.

6. What are the notable trends driving market growth?

Automotive and Transportation to be the Fastest Growing End-user Industry.

7. Are there any restraints impacting market growth?

Limited Range and Connectivity and Lack of Awareness about the Technology.

8. Can you provide examples of recent developments in the market?

September 2023 - Getac announced it had successfully implanted LiFi technology into its rugged devices as part of a recent innovation project with Signify, the global player in lighting. Signify and Getac is part of the Light Communication Alliance (LCA), a community of industry players, researchers, and innovators who feel in Optical Wireless Communication's power to transform how organizations connect and communicate.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "LiFi Technology Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the LiFi Technology Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the LiFi Technology Industry?

To stay informed about further developments, trends, and reports in the LiFi Technology Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence