Key Insights

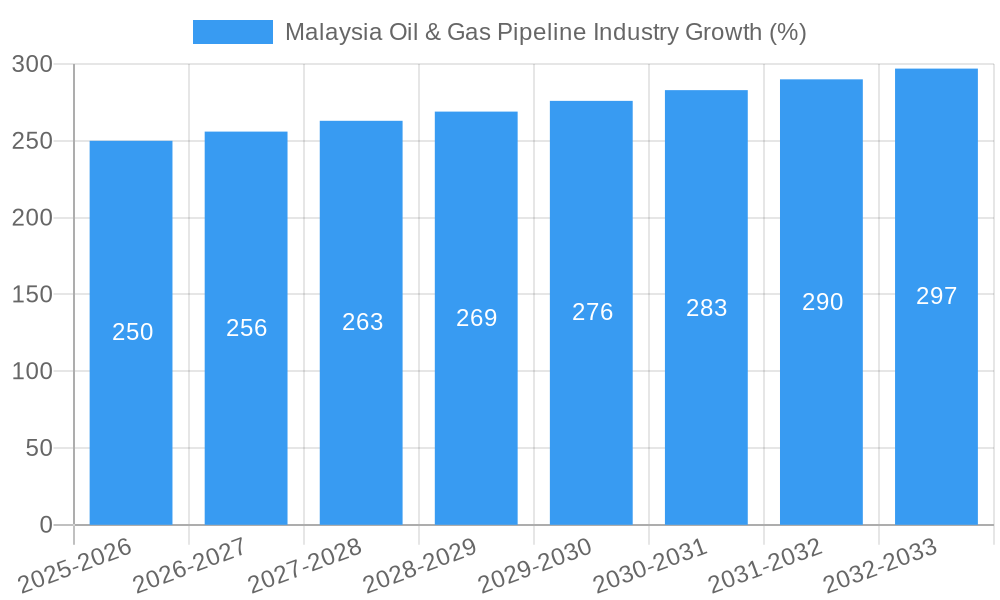

The Malaysian oil and gas pipeline industry, currently valued at an estimated RM 10 billion (assuming a reasonable market size based on regional comparisons and the provided CAGR), is experiencing robust growth, projected to maintain a Compound Annual Growth Rate (CAGR) exceeding 2.50% from 2025 to 2033. This expansion is driven by several factors, including increasing domestic energy demand fueled by Malaysia's economic growth and ongoing infrastructure development projects. The government's continued investment in energy infrastructure, coupled with rising natural gas consumption for power generation and industrial use, significantly contributes to this positive outlook. The industry is segmented into onshore and offshore deployments, catering to both crude oil and gas pipelines. Key players like Petronas, Sapura Energy Berhad, and international companies are actively involved, fostering competition and innovation within the sector. While potential constraints include fluctuating global oil and gas prices and environmental regulations, the long-term outlook remains positive due to the nation's strategic focus on energy security and diversification.

However, the market faces challenges. Maintaining pipeline integrity and ensuring environmental safety are paramount concerns. The industry needs to adopt advanced technologies for leak detection and pipeline monitoring to mitigate environmental risks and enhance operational efficiency. Furthermore, securing skilled labor and navigating complex regulatory frameworks will be crucial for sustained growth. The focus on sustainable practices, including carbon capture and storage technologies, is likely to shape future investments and influence the technological advancements within the industry. The growth trajectory will likely be influenced by global economic conditions, the price of oil and gas, and the success of government initiatives to promote sustainable energy development. The onshore segment is expected to dominate due to the higher density of population and industrial centers, while offshore projects will continue to be driven by exploration and production activities in Malaysia's maritime territories.

Malaysia Oil & Gas Pipeline Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Malaysian oil & gas pipeline industry, covering the period 2019-2033. With a focus on market size, segmentation, competitive landscape, and future growth prospects, this report is an essential resource for industry stakeholders, investors, and strategic decision-makers. The report leverages extensive primary and secondary research to deliver actionable insights and forecasts.

Malaysia Oil & Gas Pipeline Industry Market Concentration & Innovation

This section analyzes the market concentration, innovation drivers, regulatory landscape, and competitive dynamics within the Malaysian oil and gas pipeline industry. The study period is 2019-2033, with 2025 serving as both the base and estimated year. The forecast period spans 2025-2033, while the historical period covers 2019-2024.

Market concentration is moderately high, with a few dominant players holding significant market share. PETRONAS, for example, holds a substantial portion of the market, due to its role in national energy production and infrastructure development. However, several smaller players also contribute significantly, resulting in a competitive landscape. Innovation is driven by the need for improved efficiency, enhanced safety, and reduced environmental impact. Key areas of innovation include the use of advanced materials, smart pipeline technologies, and digitalization of pipeline operations.

Regulatory Frameworks: The Malaysian government plays a vital role through regulatory frameworks and incentives that affect investment and innovation. These frameworks impact pipeline construction, maintenance, and operation, influencing overall market dynamics.

Product Substitutes: While pipelines remain the dominant method for transporting oil and gas, alternative technologies are emerging, such as LNG shipping. These substitutes influence market growth and create pressure on pipeline operators to improve efficiency and reduce costs.

End-User Trends: Increasing energy demand and the expansion of the oil and gas sector are driving the need for pipeline infrastructure expansion and modernization.

M&A Activities: The industry has witnessed several mergers and acquisitions (M&A) in recent years. While specific deal values are not publicly disclosed in many instances, and data is not consistently available for a precise M&A value calculation, we estimate a total M&A deal value of approximately xx Million USD during the historical period (2019-2024). This activity reflects industry consolidation and the pursuit of economies of scale.

Malaysia Oil & Gas Pipeline Industry Industry Trends & Insights

The Malaysian oil & gas pipeline industry exhibits a dynamic environment shaped by several key trends. The Compound Annual Growth Rate (CAGR) for the forecast period (2025-2033) is estimated at xx%, driven primarily by increasing domestic energy demand and government initiatives to expand energy infrastructure. This growth is expected to lead to increased market penetration of advanced pipeline technologies, fostering a rise in the adoption of smart pipeline solutions and digitalization.

Technological disruption is another key trend, with significant investment in advanced materials and pipeline monitoring technologies aiming to improve efficiency, safety, and environmental performance. The sector is also witnessing a gradual shift towards more sustainable practices in line with global environmental concerns.

Consumer preferences increasingly focus on reliable and efficient energy delivery, pushing operators to invest in robust and resilient pipeline infrastructure. Competitive dynamics are characterized by both cooperation and rivalry among players, with both mergers & acquisitions and intense competition for contracts shaping the market.

Dominant Markets & Segments in Malaysia Oil & Gas Pipeline Industry

The Malaysian oil & gas pipeline market is dominated by the offshore segment due to the country's extensive offshore oil and gas reserves. The gas pipeline segment is also showing strong growth, driven by rising demand for natural gas.

Key Drivers for Offshore Segment Dominance:

- Extensive offshore oil and gas reserves.

- Government focus on offshore exploration and production.

- Technological advancements in deepwater pipeline construction and maintenance.

Key Drivers for Gas Pipeline Segment Dominance:

- Increasing demand for natural gas as a cleaner energy source.

- Government initiatives to promote natural gas usage.

- Development of new gas fields and infrastructure projects.

While the onshore segment also plays a significant role, the offshore segment's growth is projected to outpace the onshore segment in the forecast period, due to the factors listed above. The dominance of these segments highlights the importance of investment in offshore infrastructure and gas-related projects.

Malaysia Oil & Gas Pipeline Industry Product Developments

Recent product innovations focus on enhancing pipeline safety, reliability, and efficiency. This includes the integration of advanced sensors and monitoring systems, allowing for real-time pipeline integrity management. The use of corrosion-resistant materials and smart coatings extends pipeline lifespan and minimizes maintenance requirements. These developments align perfectly with the industry's need for improved safety and operational efficiency, making them highly competitive in the market.

Report Scope & Segmentation Analysis

This report segments the Malaysian oil & gas pipeline industry based on:

Location of Deployment:

Onshore: This segment comprises pipelines laid on land, experiencing moderate growth driven by upgrading existing infrastructure. Market size is estimated at xx Million USD in 2025, with projected growth of xx% during the forecast period.

Offshore: This segment represents a larger market share due to Malaysia's significant offshore resources. The 2025 market size is estimated at xx Million USD, with projected growth of xx% due to exploration and production in deepwater fields.

Type:

Crude Oil Pipeline: The crude oil pipeline segment is expected to witness steady growth, driven by the ongoing production and transportation needs of the country’s oil fields. The 2025 market size is predicted to be xx Million USD with a projected CAGR of xx%.

Gas Pipeline: This segment exhibits the highest growth potential due to increasing natural gas demand and new gas field developments. The 2025 market size is estimated at xx Million USD, with a projected CAGR of xx%. Competitive dynamics are strong in this segment.

Key Drivers of Malaysia Oil & Gas Pipeline Industry Growth

Several factors drive the growth of Malaysia's oil and gas pipeline industry. Increasing domestic energy demand fueled by economic growth is a primary factor, requiring expansion of existing pipeline infrastructure. Government initiatives promoting energy sector development, including incentives for pipeline projects, also stimulate growth. Technological advancements in pipeline design, construction, and maintenance improve efficiency and reduce costs, thereby boosting market expansion. The discovery of new oil and gas reserves further fuels demand for pipeline infrastructure.

Challenges in the Malaysia Oil & Gas Pipeline Industry Sector

Several challenges hinder the growth of the Malaysian oil & gas pipeline industry. Securing regulatory approvals for pipeline projects can be time-consuming and complex, leading to delays and increased costs. Supply chain disruptions, especially for specialized equipment and materials, can affect project timelines and budgets. Intense competition among pipeline operators and contractors necessitates efficient cost management and optimized operations.

Emerging Opportunities in Malaysia Oil & Gas Pipeline Industry

The industry presents several emerging opportunities. The growing demand for natural gas presents significant potential for gas pipeline development. Technological advancements, particularly in digitalization and smart pipeline technologies, offer substantial opportunities for improving efficiency and safety. Increased focus on environmental sustainability provides impetus for the development of environmentally friendly pipeline solutions.

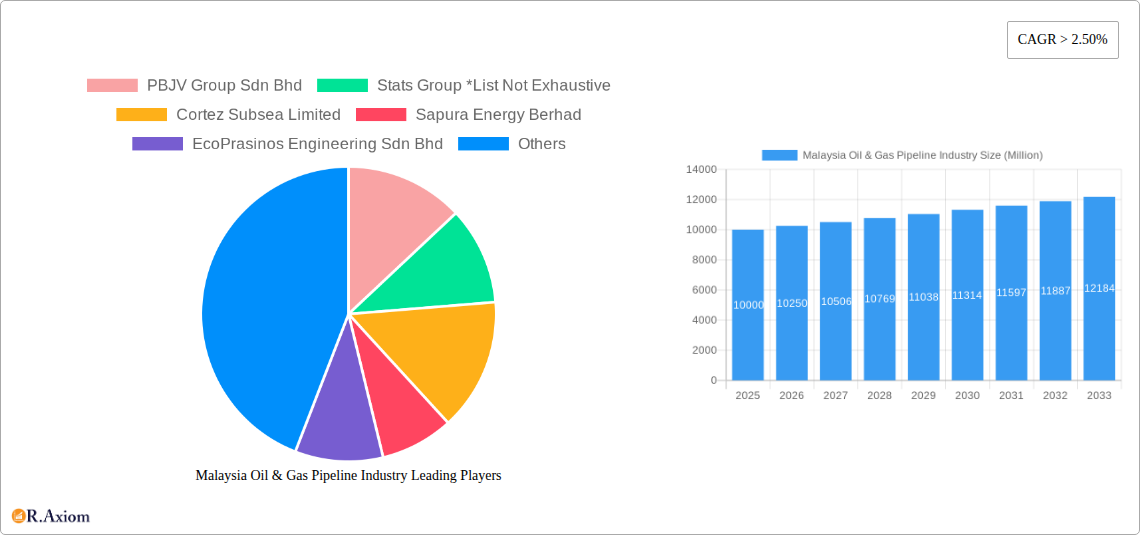

Leading Players in the Malaysia Oil & Gas Pipeline Industry Market

- PBJV Group Sdn Bhd

- Stats Group

- Cortez Subsea Limited

- Sapura Energy Berhad

- EcoPrasinos Engineering Sdn Bhd

- Petroliam Nasional Berhad (PETRONAS)

- Yokogawa Kontrol (Malaysia) Sdn Bhd

- Punj Lloyd Limited

- JFE Engineering Corporation

Key Developments in Malaysia Oil & Gas Pipeline Industry Industry

March 2022: Mubadala Petroleum commences natural gas production from the Pegaga offshore field, utilizing a new 4-kilometer subsea pipeline connecting to the Petronas LNG Complex in Bintulu. This development significantly expands gas transportation capacity.

July 2020: Vestigo Petroleum completes a 68-km subsea pipelay for the Tembikai natural gas development, enhancing offshore gas production and transportation capabilities.

June 2020: Sapura Energy secures a USD 180 Million contract to replace pipelines for Brunei Shell Petroleum, showcasing significant investment in pipeline infrastructure upgrades.

Strategic Outlook for Malaysia Oil & Gas Pipeline Industry Market

The Malaysian oil & gas pipeline industry is poised for sustained growth driven by increasing domestic energy demand, government support, and technological advancements. Opportunities exist in expanding gas pipeline infrastructure, adopting smart pipeline technologies, and enhancing operational efficiency. The industry's strategic focus on improving safety, sustainability, and cost-effectiveness will shape its future trajectory.

Malaysia Oil & Gas Pipeline Industry Segmentation

-

1. Location of Deployment

- 1.1. Onshore

- 1.2. Offshore

-

2. Type

- 2.1. Crude Oil Pipeline

- 2.2. Gas Pipeline

Malaysia Oil & Gas Pipeline Industry Segmentation By Geography

- 1. Malaysia

Malaysia Oil & Gas Pipeline Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 2.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Gas Production and Infrastructure4.; Increasing Exploration and Production Activities

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Adoption of Clean Power Sources

- 3.4. Market Trends

- 3.4.1. Natural Gas Pipeline Segment is Expected to Witness Significant Development

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Malaysia Oil & Gas Pipeline Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 5.1.1. Onshore

- 5.1.2. Offshore

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Crude Oil Pipeline

- 5.2.2. Gas Pipeline

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Malaysia

- 5.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 PBJV Group Sdn Bhd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Stats Group *List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Cortez Subsea Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Sapura Energy Berhad

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 EcoPrasinos Engineering Sdn Bhd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Petroliam Nasional Berhad (PETRONAS)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Yokogawa Kontrol (Malaysia) Sdn Bhd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Punj Lloyd Limited

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 JFE Engineering Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 PBJV Group Sdn Bhd

List of Figures

- Figure 1: Malaysia Oil & Gas Pipeline Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Malaysia Oil & Gas Pipeline Industry Share (%) by Company 2024

List of Tables

- Table 1: Malaysia Oil & Gas Pipeline Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Malaysia Oil & Gas Pipeline Industry Revenue Million Forecast, by Location of Deployment 2019 & 2032

- Table 3: Malaysia Oil & Gas Pipeline Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Malaysia Oil & Gas Pipeline Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Malaysia Oil & Gas Pipeline Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Malaysia Oil & Gas Pipeline Industry Revenue Million Forecast, by Location of Deployment 2019 & 2032

- Table 7: Malaysia Oil & Gas Pipeline Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 8: Malaysia Oil & Gas Pipeline Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Malaysia Oil & Gas Pipeline Industry?

The projected CAGR is approximately > 2.50%.

2. Which companies are prominent players in the Malaysia Oil & Gas Pipeline Industry?

Key companies in the market include PBJV Group Sdn Bhd, Stats Group *List Not Exhaustive, Cortez Subsea Limited, Sapura Energy Berhad, EcoPrasinos Engineering Sdn Bhd, Petroliam Nasional Berhad (PETRONAS), Yokogawa Kontrol (Malaysia) Sdn Bhd, Punj Lloyd Limited, JFE Engineering Corporation.

3. What are the main segments of the Malaysia Oil & Gas Pipeline Industry?

The market segments include Location of Deployment, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Gas Production and Infrastructure4.; Increasing Exploration and Production Activities.

6. What are the notable trends driving market growth?

Natural Gas Pipeline Segment is Expected to Witness Significant Development.

7. Are there any restraints impacting market growth?

4.; Increasing Adoption of Clean Power Sources.

8. Can you provide examples of recent developments in the market?

In March 2022, the Abu Dhabi-based Mubadala Petroleum began producing natural gas from the Pegaga offshore field in Malaysia. It has the capacity to produce about 550 million standard cubic feet of gas per day in addition to the condensate. Gas produced will be directed through a new 4-kilometer, 38-inch subsea pipeline tying into an existing offshore gas network and subsequently to the onshore Petronas LNG Complex in Bintulu.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Malaysia Oil & Gas Pipeline Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Malaysia Oil & Gas Pipeline Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Malaysia Oil & Gas Pipeline Industry?

To stay informed about further developments, trends, and reports in the Malaysia Oil & Gas Pipeline Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence