Key Insights

The Mexico masterbatch market is experiencing robust growth, driven by the expanding plastics processing industry and increasing demand for high-quality, colored plastics across various sectors. The period between 2019 and 2024 witnessed significant expansion, laying a strong foundation for continued growth projected through 2033. Factors such as the automotive industry's development, the construction boom, and the rising popularity of consumer goods packaged in plastic all contribute to the market's expansion. Furthermore, the focus on sustainability and the adoption of recycled plastics within the masterbatch manufacturing process present opportunities for innovation and growth. The market is witnessing a shift towards specialized masterbatches catering to specific applications and demanding performance characteristics. This includes the increased use of additive masterbatches to enhance product properties like UV resistance and flame retardancy, driving market segmentation and specialization. A crucial element influencing market dynamics is the price fluctuation of raw materials, a factor manufacturers constantly navigate to ensure profitability and competitiveness.

Looking ahead, the forecast period (2025-2033) shows a promising outlook. Government initiatives promoting industrial growth and foreign direct investment in Mexico will play a critical role in shaping the market's trajectory. The ongoing trend of product diversification, particularly in packaging and consumer goods, coupled with technological advancements in masterbatch production, will fuel market expansion. Competitive dynamics amongst manufacturers are anticipated to remain strong, emphasizing innovation and customer-centric solutions. As the market matures, we anticipate a consolidation phase, with larger players acquiring smaller ones to gain market share and vertical integration capabilities. This will further shape the competitive landscape, with emphasis on technological advancements and sustainable practices.

Mexico Masterbatch Market: A Comprehensive Market Report (2019-2033)

This detailed report provides a comprehensive analysis of the Mexico Masterbatch Market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this report meticulously examines market trends, competitive dynamics, and future growth potential. The report is structured to provide actionable intelligence, leveraging high-impact keywords for enhanced search visibility.

Mexico Masterbatch Market Concentration & Innovation

This section analyzes the competitive landscape of the Mexico masterbatch market, examining market concentration, innovation drivers, regulatory influences, and key industry activities. The market is moderately concentrated, with several major players holding significant market share. However, the presence of smaller, specialized players indicates opportunities for niche market penetration.

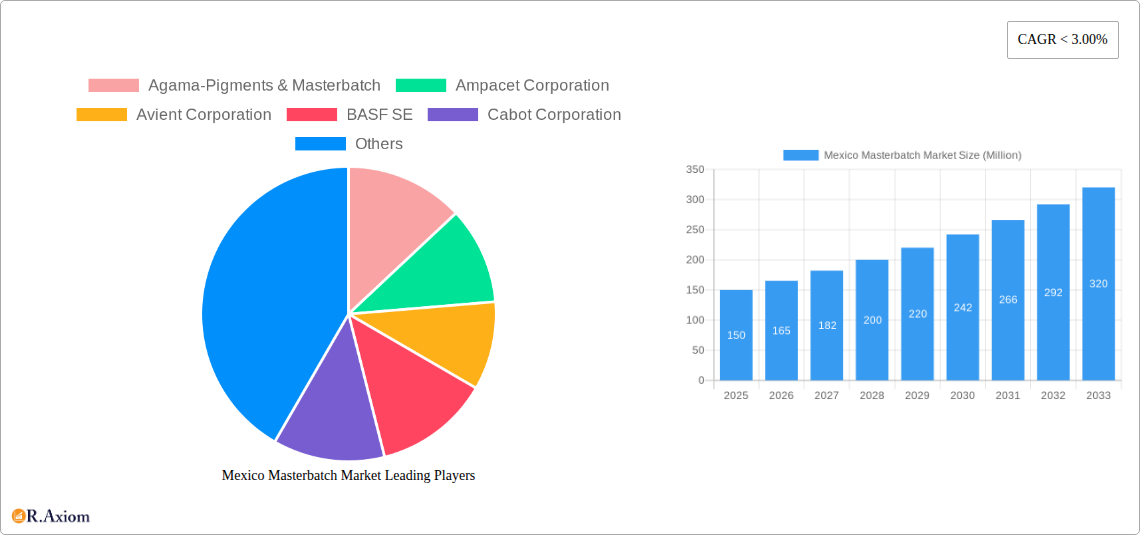

Market Concentration: The top five players, including Ampacet Corporation, Avient Corporation, BASF SE, Cabot Corporation, and Chroma Color Corporation, collectively hold an estimated xx% market share in 2025. Smaller players like Agama-Pigments & Masterbatch, Hubron International, LyondellBasell Industries Holdings BV, Sun Chemical, and TOYO INK CO LTD contribute to the remaining market share.

Innovation Drivers: Sustainability concerns and the growing demand for specialized masterbatches drive innovation. This includes the development of biodegradable, recyclable, and circular masterbatches. Technological advancements in color dispersion and additive incorporation are also key drivers.

Regulatory Framework: Mexican environmental regulations and safety standards significantly impact masterbatch manufacturing and use. Compliance with these regulations is crucial for market participation.

Product Substitutes: While direct substitutes are limited, alternative coloring and additive technologies are emerging as potential substitutes in specific applications.

End-User Trends: The increasing demand from packaging, automotive, and construction sectors fuels market growth. The preference for customized solutions necessitates innovation in product offerings.

M&A Activities: The Mexico masterbatch market has witnessed xx M&A deals in the historical period (2019-2024), with a total deal value of approximately xx Million USD. These activities primarily focused on consolidating market share and expanding product portfolios.

Mexico Masterbatch Market Industry Trends & Insights

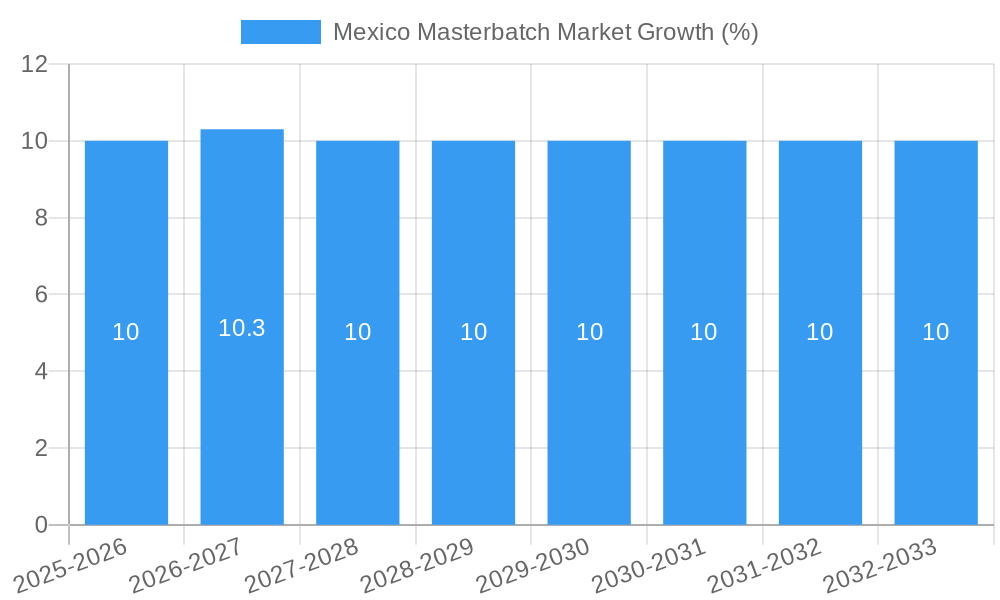

The Mexico masterbatch market is experiencing robust growth, driven by several key factors. The CAGR for the forecast period (2025-2033) is estimated at xx%. This growth is attributed to a rising demand for plastics across diverse sectors and increasing investments in infrastructure development. The market penetration rate for masterbatches in key end-use industries, such as packaging and automotive, is anticipated to increase by xx% by 2033. Technological advancements are leading to the development of high-performance masterbatches with enhanced properties. Shifting consumer preferences towards sustainable and eco-friendly products are also impacting the market. The competitive landscape is dynamic, with major players focusing on product innovation, expansion into new market segments, and strategic partnerships. Specific pricing strategies by players contribute to the competitive intensity. Government initiatives and policies that promote industrial growth further facilitate the expansion of the masterbatch market.

Dominant Markets & Segments in Mexico Masterbatch Market

The automotive sector represents the most dominant segment in the Mexico masterbatch market, accounting for approximately xx% of the total market value in 2025.

- Key Drivers for Automotive Dominance:

- Strong automotive manufacturing base in Mexico.

- Growing demand for lightweight and high-performance vehicles.

- Increasing adoption of advanced materials in automotive components.

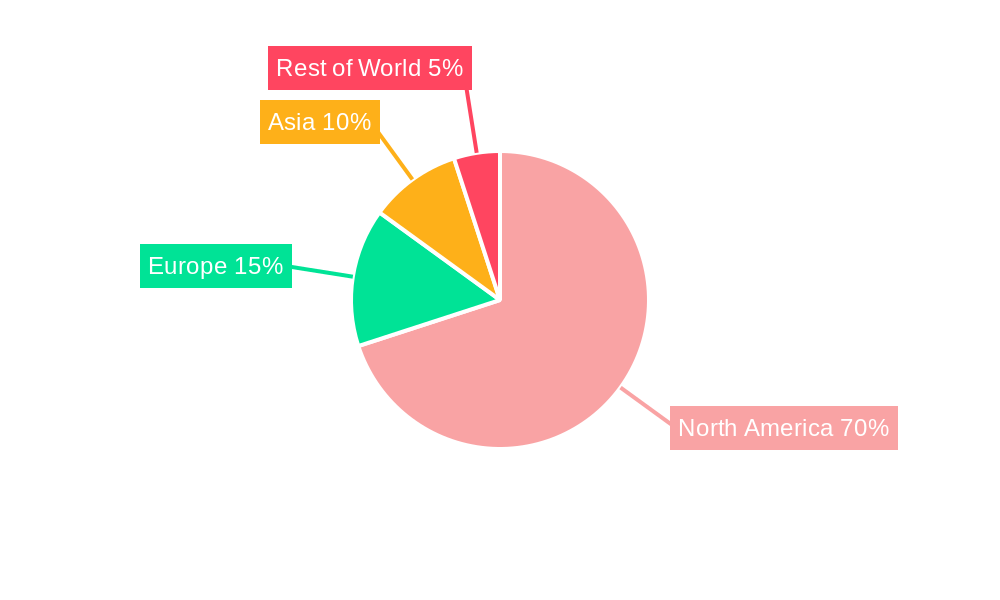

The analysis reveals a regional concentration, with the central and northern regions of Mexico demonstrating the highest growth rates due to higher industrial activity. This dominance is further reinforced by established infrastructure and favorable government policies. The dominance analysis also indicates that specific product types within the masterbatch category, such as those offering enhanced UV resistance or specific color properties, are achieving higher growth rates than other segments. This is primarily driven by the varying needs and requirements of the different industries.

Mexico Masterbatch Market Product Developments

Recent product innovations focus on enhanced performance characteristics, such as improved UV resistance, enhanced color stability, and better processability. The market is witnessing a trend toward sustainable and eco-friendly masterbatches made from recycled materials. These developments provide competitive advantages by meeting the increasing demand for sustainable products and improved functionality. Technological advancements like nanotechnology are being integrated to create masterbatches with specialized properties for various applications.

Report Scope & Segmentation Analysis

This report segments the Mexico masterbatch market based on resin type (polyethylene, polypropylene, PVC, etc.), application (packaging, automotive, construction, etc.), and color type (black, white, and others). Growth projections vary across these segments, with the packaging segment anticipated to show the highest growth rate during the forecast period due to the expanding packaging industry. Competitive intensity differs across segments, with certain segments demonstrating higher levels of competition than others based on the concentration of suppliers and the specificity of the product offerings.

Key Drivers of Mexico Masterbatch Market Growth

The growth of the Mexico masterbatch market is driven by several factors, including the expansion of the plastics processing industry, increasing demand for high-performance plastics, and growing investments in infrastructure development. Government initiatives promoting domestic manufacturing and sustainable practices are also contributing to market growth. Technological advancements leading to the production of more efficient and versatile masterbatches also fuels market expansion.

Challenges in the Mexico Masterbatch Market Sector

Challenges include fluctuating raw material prices, supply chain disruptions, and intense competition. Regulatory compliance and adherence to environmental standards also pose challenges to market players. The price volatility of raw materials directly impacts production costs and profitability, forcing companies to employ pricing strategies to offset these effects.

Emerging Opportunities in Mexico Masterbatch Market

Emerging opportunities lie in the development of bio-based and recycled masterbatches, catering to the growing demand for sustainable solutions. Expansion into niche applications, such as medical devices and electronics, also presents significant growth potential. Technological innovation will play a pivotal role in tapping into these opportunities.

Leading Players in the Mexico Masterbatch Market Market

- Agama-Pigments & Masterbatch

- Ampacet Corporation

- Avient Corporation

- BASF SE

- Cabot Corporation

- Chroma Color Corporation

- Hubron International

- LyondellBasell Industries Holdings BV

- Sun Chemical

- TOYO INK CO LTD

Key Developments in Mexico Masterbatch Market Industry

- May 2024: Ampacet expanded its ELTech portfolio with high-performance color masterbatches for optical fiber cable PBT jacketing, strengthening its market position.

- May 2024: Cabot Corporation launched REPLASBLAK universal circular black masterbatches from certified sustainable materials, setting a new industry standard for sustainability.

Strategic Outlook for Mexico Masterbatch Market Market

The Mexico masterbatch market presents substantial growth opportunities driven by increasing demand from diverse sectors, technological advancements, and a supportive regulatory environment. Focusing on innovation, sustainability, and strategic partnerships will be crucial for players to capture market share and capitalize on future growth potential. The market is poised for continued expansion, driven by the ongoing development of new applications and the adoption of sustainable materials.

Mexico Masterbatch Market Segmentation

-

1. Type

- 1.1. White Masterbatch

- 1.2. Black Masterbatch

- 1.3. Color Masterbatch

- 1.4. Additive Masterbatch

- 1.5. Special Effect Masterbatch

-

2. Polymer

- 2.1. Polypropylene

- 2.2. Polyethylene

- 2.3. High-impact Polystyrene

- 2.4. Polyvinyl Chloride

- 2.5. Polyethylene Terephthalate

- 2.6. Other Polymers

-

3. End-user Industry

- 3.1. Building and Construction

- 3.2. Packaging

- 3.3. Automotive and Transportation

- 3.4. Electrical and Electronics

- 3.5. Consumer Goods

- 3.6. Agriculture

- 3.7. Other End-user Industries

Mexico Masterbatch Market Segmentation By Geography

- 1. Mexico

Mexico Masterbatch Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of < 3.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand from the Packaging Industry; Growing Demand for Lighter-weight and More Fuel-efficient Vehicles

- 3.3. Market Restrains

- 3.3.1. Growing Demand from the Packaging Industry; Growing Demand for Lighter-weight and More Fuel-efficient Vehicles

- 3.4. Market Trends

- 3.4.1. Growing Demand from the Packaging Segment is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Mexico Masterbatch Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. White Masterbatch

- 5.1.2. Black Masterbatch

- 5.1.3. Color Masterbatch

- 5.1.4. Additive Masterbatch

- 5.1.5. Special Effect Masterbatch

- 5.2. Market Analysis, Insights and Forecast - by Polymer

- 5.2.1. Polypropylene

- 5.2.2. Polyethylene

- 5.2.3. High-impact Polystyrene

- 5.2.4. Polyvinyl Chloride

- 5.2.5. Polyethylene Terephthalate

- 5.2.6. Other Polymers

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Building and Construction

- 5.3.2. Packaging

- 5.3.3. Automotive and Transportation

- 5.3.4. Electrical and Electronics

- 5.3.5. Consumer Goods

- 5.3.6. Agriculture

- 5.3.7. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Agama-Pigments & Masterbatch

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Ampacet Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Avient Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 BASF SE

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Cabot Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Chroma Color Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Hubron International

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 LyondellBasell Industries Holdings BV

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Sun Chemical

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 TOYO INK CO LTD*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Agama-Pigments & Masterbatch

List of Figures

- Figure 1: Mexico Masterbatch Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Mexico Masterbatch Market Share (%) by Company 2024

List of Tables

- Table 1: Mexico Masterbatch Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Mexico Masterbatch Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Mexico Masterbatch Market Revenue Million Forecast, by Polymer 2019 & 2032

- Table 4: Mexico Masterbatch Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 5: Mexico Masterbatch Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Mexico Masterbatch Market Revenue Million Forecast, by Type 2019 & 2032

- Table 7: Mexico Masterbatch Market Revenue Million Forecast, by Polymer 2019 & 2032

- Table 8: Mexico Masterbatch Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 9: Mexico Masterbatch Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Mexico Masterbatch Market?

The projected CAGR is approximately < 3.00%.

2. Which companies are prominent players in the Mexico Masterbatch Market?

Key companies in the market include Agama-Pigments & Masterbatch, Ampacet Corporation, Avient Corporation, BASF SE, Cabot Corporation, Chroma Color Corporation, Hubron International, LyondellBasell Industries Holdings BV, Sun Chemical, TOYO INK CO LTD*List Not Exhaustive.

3. What are the main segments of the Mexico Masterbatch Market?

The market segments include Type, Polymer, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand from the Packaging Industry; Growing Demand for Lighter-weight and More Fuel-efficient Vehicles.

6. What are the notable trends driving market growth?

Growing Demand from the Packaging Segment is Driving the Market.

7. Are there any restraints impacting market growth?

Growing Demand from the Packaging Industry; Growing Demand for Lighter-weight and More Fuel-efficient Vehicles.

8. Can you provide examples of recent developments in the market?

May 2024: Ampacet expanded its ELTech portfolio, introducing a series of high-performance color masterbatches. These masterbatches utilize a polybutylene terephthalate (PBT) carrier resin and are specifically tailored for optical fiber cable PBT jacketing. The new product development is projected to benefit the company in establishing a stronger market position.May 2024: Cabot Corporation launched its REPLASBLAK universal circular black masterbatches crafted from certified sustainable materials. This launch marked the introduction of two pioneering products, poised to be the industry's inaugural universal circular black masterbatches boasting content certified by the International Sustainability & Carbon Certification (ISCC PLUS).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Mexico Masterbatch Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Mexico Masterbatch Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Mexico Masterbatch Market?

To stay informed about further developments, trends, and reports in the Mexico Masterbatch Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence