Key Insights

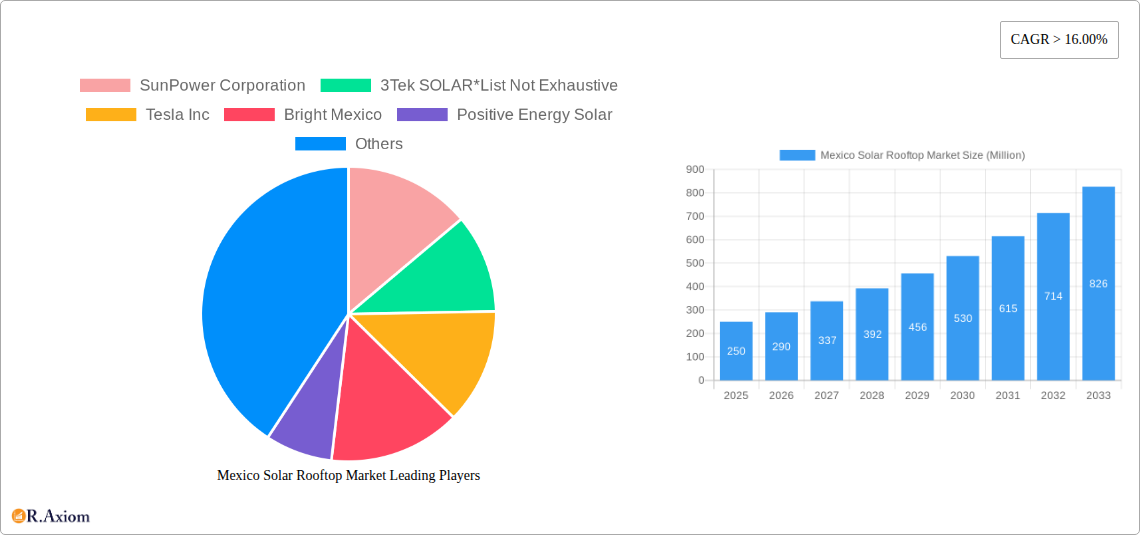

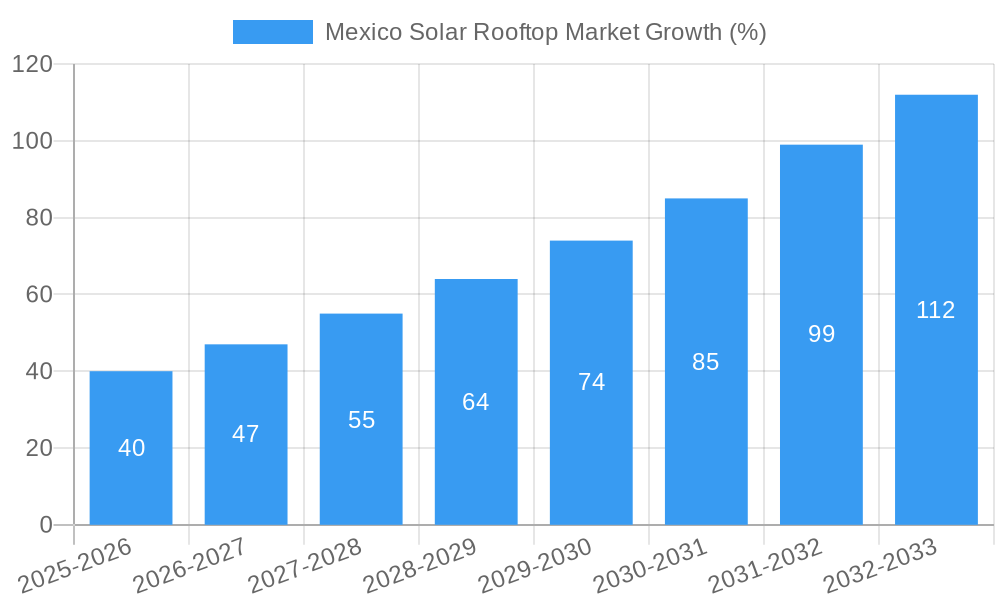

The Mexico solar rooftop market is experiencing robust growth, driven by increasing electricity prices, government incentives promoting renewable energy adoption, and a growing awareness of environmental sustainability among residential and commercial consumers. The market's Compound Annual Growth Rate (CAGR) exceeding 16% from 2019 to 2024 indicates significant momentum. This growth is further fueled by technological advancements leading to lower solar panel costs and improved energy efficiency, making solar rooftop installations more financially attractive. The residential segment currently holds a substantial market share, but the commercial and industrial sectors are expected to witness accelerated growth in the coming years due to large-scale energy consumption needs and the potential for significant cost savings. Key players like SunPower Corporation, Tesla Inc., and local companies such as Bright Mexico and Positive Energy Solar are actively contributing to market expansion through innovative products, competitive pricing, and improved installation services. Government policies, including feed-in tariffs and tax credits, are also playing a crucial role in stimulating market demand.

However, challenges remain. Initial investment costs can still be a barrier for some consumers, and inconsistent grid infrastructure in certain regions might hinder widespread adoption. Overcoming these obstacles through financing options, improved grid stability, and continued technological advancements will be vital for sustaining the market's impressive growth trajectory. The forecast period of 2025-2033 anticipates a continuation of this upward trend, with increasing demand from all segments pushing the market size to substantial heights. The market is expected to consolidate further, with larger players acquiring smaller companies and expanding their service portfolios. The focus will shift towards integrated solutions that include energy storage systems and smart grid technologies to maximize efficiency and grid stability.

Mexico Solar Rooftop Market: A Comprehensive Analysis (2019-2033)

This meticulously researched report provides an in-depth analysis of the Mexico solar rooftop market, offering invaluable insights for industry stakeholders, investors, and policymakers. Covering the period from 2019 to 2033, with a focus on 2025, this report unveils the market's current state, future trajectory, and key players shaping its evolution. The report leverages extensive data analysis and expert insights to provide actionable intelligence, empowering informed decision-making.

Mexico Solar Rooftop Market Concentration & Innovation

The Mexico solar rooftop market exhibits a moderately fragmented landscape, with several established players and emerging entrants vying for market share. SunPower Corporation, Tesla Inc., Bright Mexico, Positive Energy Solar, and Enlight Mexico are key players, though market concentration remains relatively low. Market share data for 2025 estimates SunPower Corporation at xx%, Tesla Inc. at xx%, and the remaining players sharing the balance. Innovation is driven by advancements in solar panel technology, energy storage solutions, and smart grid integration. The regulatory framework, while supportive, still faces challenges in streamlining approvals and incentivizing adoption. Product substitutes, such as traditional grid electricity, face increasing competition due to declining solar energy costs and rising environmental concerns. M&A activity has been moderate, with deal values in the range of xx Million USD in the last 5 years. End-user trends indicate a growing preference for rooftop solar among both residential and commercial consumers driven by cost savings and environmental sustainability.

- Market Share (2025 Estimate): SunPower Corporation (xx%), Tesla Inc. (xx%), Others (xx%)

- M&A Deal Value (2019-2024): xx Million USD

- Key Innovation Drivers: Improved solar panel efficiency, battery storage integration, smart home energy management systems.

Mexico Solar Rooftop Market Industry Trends & Insights

The Mexico solar rooftop market is experiencing robust growth, fueled by government incentives, declining solar panel costs, and increasing awareness of climate change. The Compound Annual Growth Rate (CAGR) from 2025 to 2033 is projected at xx%, with market penetration steadily increasing. Technological disruptions, such as the emergence of Perovskite solar cells and advancements in energy storage, are expected to further enhance the sector's growth trajectory. Consumer preferences are shifting towards aesthetically pleasing and highly efficient systems, driving demand for innovative products and services. Competitive dynamics are characterized by intense rivalry, with companies focusing on differentiation through superior technology, service offerings, and financing options.

Dominant Markets & Segments in Mexico Solar Rooftop Market

The commercial and industrial segment dominates the Mexico solar rooftop market, driven by significant energy consumption and the potential for substantial cost savings. The residential segment is also witnessing strong growth, fueled by rising electricity prices and government support programs.

Commercial and Industrial Segment Dominance Drivers:

- High energy consumption in industrial facilities.

- Significant potential for cost reduction through solar power adoption.

- Government incentives and tax benefits specifically targeted at businesses.

- Growing corporate social responsibility (CSR) initiatives.

Residential Segment Growth Drivers:

- Rising electricity tariffs.

- Increased environmental awareness among homeowners.

- Availability of financing options, such as solar loans and leases.

- Government subsidies and tax credits.

The state of Mexico and other regions with strong industrial activity exhibit highest market concentration due to favorable policies and high energy demand.

Mexico Solar Rooftop Market Product Developments

Recent advancements include the integration of energy storage systems for improved grid reliability and enhanced self-consumption rates. The focus is on increasing efficiency, reducing costs, and improving aesthetics to cater to diverse consumer needs. These improvements have boosted market penetration. Technological trends point toward greater automation, smarter grid integration, and enhanced monitoring capabilities.

Report Scope & Segmentation Analysis

This report segments the Mexico solar rooftop market by end-user: residential, commercial, and industrial. Each segment's growth projections, market size, and competitive dynamics are analyzed in detail. The residential segment is expected to witness a steady CAGR of xx% driven by increasing awareness and government initiatives. The commercial segment is projected to exhibit a CAGR of xx%, with large enterprises driving the growth. The industrial segment, with its considerable energy demand, anticipates a CAGR of xx%.

Key Drivers of Mexico Solar Rooftop Market Growth

The market's growth is driven by several factors including favorable government policies promoting renewable energy adoption (such as the Clean Energy Transition Law), declining solar energy costs making it increasingly cost-competitive with traditional grid electricity, rising electricity prices compelling consumers and businesses to seek alternative sources, and growing environmental concerns pushing consumers towards sustainable solutions.

Challenges in the Mexico Solar Rooftop Market Sector

Significant challenges include the relatively high initial investment cost of solar rooftop systems, complex permitting and approval processes hindering project timelines, and inconsistent electricity grid infrastructure in certain areas affecting system integration. Supply chain disruptions, particularly from global events, have also impacted project costs and timelines. The intermittent nature of solar energy requires effective energy storage solutions, leading to higher upfront costs.

Emerging Opportunities in Mexico Solar Rooftop Market

Opportunities abound in the integration of smart energy management systems, expansion into underserved rural areas, exploring hybrid solar-wind solutions, and offering comprehensive financing options to broaden accessibility. The growing demand for energy storage solutions to increase self-consumption presents a significant opportunity.

Leading Players in the Mexico Solar Rooftop Market Market

- SunPower Corporation

- 3Tek SOLAR

- Tesla Inc.

- Bright Mexico

- Positive Energy Solar

- Enlight Mexico

Key Developments in Mexico Solar Rooftop Market Industry

- 2023 Q3: Tesla announced expansion of its energy storage solutions in Mexico.

- 2022 Q4: New government incentives boosted residential solar installations.

- 2021 Q2: Several major solar projects commenced in the industrial sector.

Strategic Outlook for Mexico Solar Rooftop Market Market

The Mexico solar rooftop market holds immense potential for future growth. Continued government support, declining technology costs, and increasing consumer awareness of sustainability are all major catalysts. Opportunities for innovation in energy storage, grid integration, and financing models promise even greater market expansion in the coming years. The market is poised to become a significant contributor to Mexico's renewable energy goals.

Mexico Solar Rooftop Market Segmentation

-

1. End-User

- 1.1. Residential

- 1.2. Commercial and Industrial

Mexico Solar Rooftop Market Segmentation By Geography

- 1. Mexico

Mexico Solar Rooftop Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 16.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Higher Demand for Oil and Gas in the Country4.; Growing Infrastructure Development

- 3.3. Market Restrains

- 3.3.1. 4.; Competition from Renewable Energy

- 3.4. Market Trends

- 3.4.1. Residential Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Mexico Solar Rooftop Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by End-User

- 5.1.1. Residential

- 5.1.2. Commercial and Industrial

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Mexico

- 5.1. Market Analysis, Insights and Forecast - by End-User

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 SunPower Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 3Tek SOLAR*List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Tesla Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Bright Mexico

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Positive Energy Solar

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Enlight Mexico

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.1 SunPower Corporation

List of Figures

- Figure 1: Mexico Solar Rooftop Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Mexico Solar Rooftop Market Share (%) by Company 2024

List of Tables

- Table 1: Mexico Solar Rooftop Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Mexico Solar Rooftop Market Volume Gigawatt Forecast, by Region 2019 & 2032

- Table 3: Mexico Solar Rooftop Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 4: Mexico Solar Rooftop Market Volume Gigawatt Forecast, by End-User 2019 & 2032

- Table 5: Mexico Solar Rooftop Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Mexico Solar Rooftop Market Volume Gigawatt Forecast, by Region 2019 & 2032

- Table 7: Mexico Solar Rooftop Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Mexico Solar Rooftop Market Volume Gigawatt Forecast, by Country 2019 & 2032

- Table 9: Mexico Solar Rooftop Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 10: Mexico Solar Rooftop Market Volume Gigawatt Forecast, by End-User 2019 & 2032

- Table 11: Mexico Solar Rooftop Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Mexico Solar Rooftop Market Volume Gigawatt Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Mexico Solar Rooftop Market?

The projected CAGR is approximately > 16.00%.

2. Which companies are prominent players in the Mexico Solar Rooftop Market?

Key companies in the market include SunPower Corporation, 3Tek SOLAR*List Not Exhaustive, Tesla Inc, Bright Mexico, Positive Energy Solar, Enlight Mexico.

3. What are the main segments of the Mexico Solar Rooftop Market?

The market segments include End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Higher Demand for Oil and Gas in the Country4.; Growing Infrastructure Development.

6. What are the notable trends driving market growth?

Residential Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Competition from Renewable Energy.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Gigawatt.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Mexico Solar Rooftop Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Mexico Solar Rooftop Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Mexico Solar Rooftop Market?

To stay informed about further developments, trends, and reports in the Mexico Solar Rooftop Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence