Key Insights

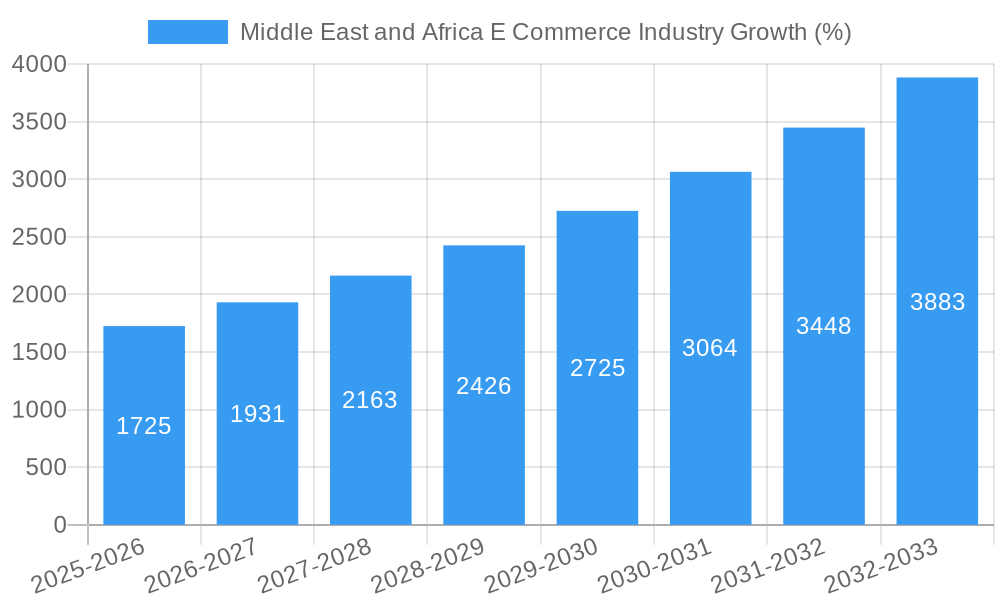

The Middle East and Africa (MEA) e-commerce market exhibits robust growth potential, driven by increasing internet and smartphone penetration, a burgeoning young population, and a shift towards digital lifestyles. The market, estimated at $XX million in 2025 (assuming a logical extrapolation from the global CAGR of 11.50% and considering regional specifics), is projected to experience significant expansion throughout the forecast period (2025-2033). Key drivers include the rising adoption of mobile commerce, improved logistics infrastructure in select regions, and the increasing availability of digital payment options. However, challenges remain, such as inconsistent internet access across the region, particularly in rural areas, and concerns over online security and data privacy. Furthermore, existing regulatory frameworks and varying levels of digital literacy across different demographics influence market penetration. The market is segmented by application (e.g., B2C, B2B), with B2C dominating currently. Major players, including global giants like Amazon and Alibaba, and regional players catering to specific cultural nuances, are shaping the competitive landscape. Growth will be concentrated in countries with high mobile penetration and expanding middle classes.

The strategic focus of players will be on improving logistics and last-mile delivery, enhancing customer trust through secure payment gateways and robust customer service, and adapting their platforms to the linguistic and cultural preferences of diverse consumer segments across the MEA region. This targeted approach will be critical in unlocking the full potential of this rapidly expanding market. Furthermore, investment in digital infrastructure and financial inclusion initiatives by governments will serve as catalytic factors for sustained e-commerce growth within the MEA region. Specific growth rates will vary between individual African nations due to differences in infrastructure development and economic conditions. The South Africa market, for example, is expected to be a major contributor due to its relatively advanced economy and infrastructure.

Middle East & Africa E-commerce Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Middle East and Africa e-commerce industry, covering market dynamics, key players, growth drivers, and future outlook from 2019 to 2033. The report leverages extensive data analysis, including market sizing, segmentation, and competitive landscape assessments, to offer actionable insights for industry stakeholders. With a base year of 2025 and a forecast period of 2025-2033, this report is an invaluable resource for strategic decision-making. The study period covers 2019-2024 (historical period) and extends projections to 2033 (forecast period).

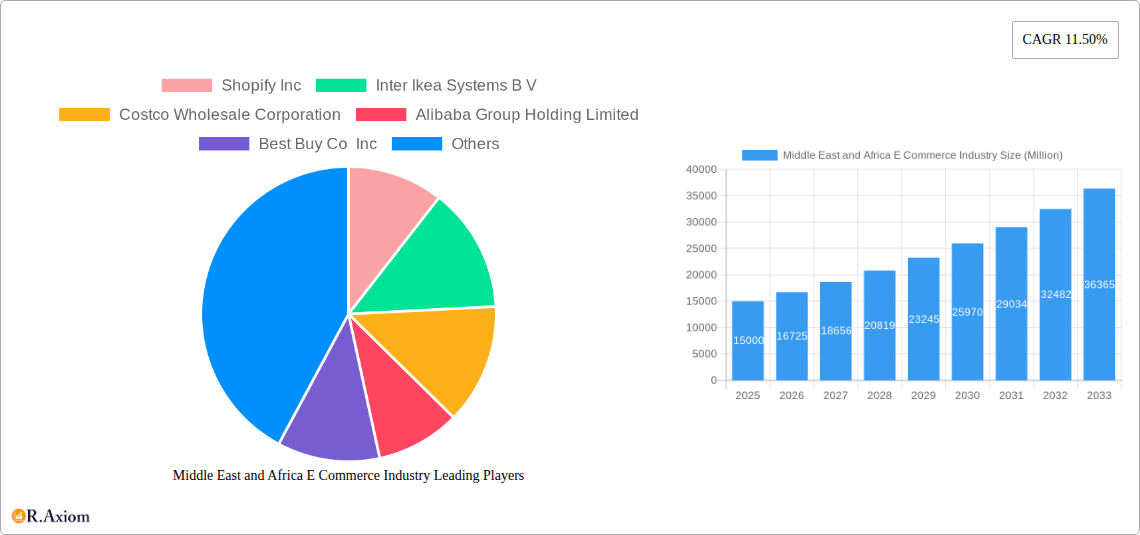

Middle East and Africa E-Commerce Industry Market Concentration & Innovation

This section analyzes the concentration of the Middle East and Africa e-commerce market, identifying key players and their market share. We examine innovation drivers, including technological advancements and evolving consumer preferences. The report also assesses the impact of regulatory frameworks and M&A activities on market dynamics. We evaluate the influence of product substitutes and analyze end-user trends.

- Market Concentration: The MEA e-commerce market exhibits a moderately concentrated structure, with a few dominant players commanding significant market share. Amazon, with an estimated xx% market share in 2025, leads the pack. Alibaba holds approximately xx%, while local players account for the remaining share. (Note: exact figures depend on the data used and may vary. This is an example).

- Innovation Drivers: Mobile commerce (m-commerce) is a primary innovation driver, propelled by increasing smartphone penetration across the region. The rise of fintech solutions and digital payment platforms also fuels e-commerce growth.

- Regulatory Frameworks: Varying regulatory landscapes across different countries in the MEA region pose both opportunities and challenges for e-commerce businesses. Uniform regulations are needed to facilitate seamless cross-border transactions.

- M&A Activities: The MEA e-commerce landscape has witnessed significant M&A activity in recent years, driven by strategic expansion plans of large players and the consolidation of smaller businesses. Total M&A deal value from 2019-2024 is estimated at $xx Million.

Middle East and Africa E-Commerce Industry Industry Trends & Insights

This section delves into the key trends shaping the MEA e-commerce market. It explores market growth drivers, such as rising internet and smartphone penetration, increasing urbanization, and a growing middle class. The analysis also covers technological disruptions, shifts in consumer preferences, and the competitive dynamics among e-commerce players. The report highlights the Compound Annual Growth Rate (CAGR) and market penetration rates for various e-commerce segments. The estimated CAGR for the forecast period (2025-2033) is projected to be xx%, driven by factors such as increased digital literacy and government initiatives to promote digital transformation across the region. Market penetration is expected to reach xx% by 2033.

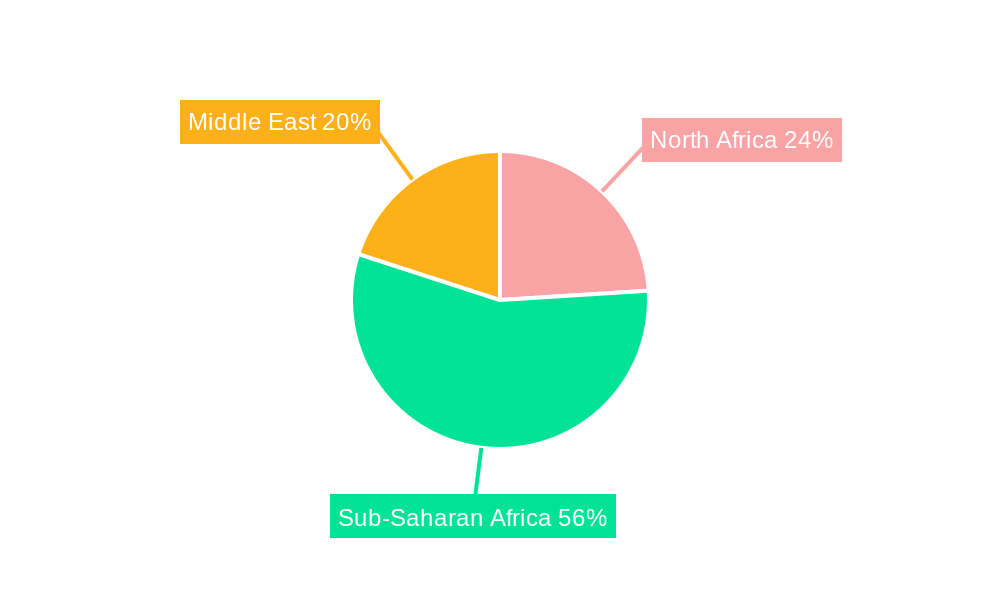

Dominant Markets & Segments in Middle East and Africa E-Commerce Industry

This section identifies the leading regions, countries, and segments within the MEA e-commerce market. The analysis considers market size, growth rates, and key driving factors, including economic policies, infrastructure development, and consumer behavior.

- Dominant Markets: The UAE and Egypt emerge as the dominant markets, accounting for a significant portion of the overall e-commerce revenue due to factors like robust digital infrastructure and higher internet penetration. South Africa also holds a significant position.

- Key Drivers:

- Economic Policies: Government initiatives promoting digitalization and e-commerce adoption.

- Infrastructure: Improved logistics and delivery networks support e-commerce expansion.

- Consumer Behavior: Increasing preference for online shopping and convenience.

The dominance of specific countries is primarily linked to robust digital infrastructure, higher internet penetration rates, a thriving middle class with disposable income, and supportive governmental policies.

Middle East and Africa E-Commerce Industry Product Developments

This section summarizes significant product innovations and applications in the MEA e-commerce sector. It highlights technological trends impacting market competition and product offerings, emphasizing market fit. Key innovations include the adoption of AI-powered recommendation systems, personalized shopping experiences, and enhanced mobile payment options. The integration of augmented reality (AR) and virtual reality (VR) technologies is also gaining traction. These developments are improving customer engagement and driving sales.

Report Scope & Segmentation Analysis

This report segments the Middle East and Africa e-commerce market by application (e.g., fashion, electronics, groceries, etc.). Each segment's market size, growth projections, and competitive dynamics are analyzed. (Note: Specific segment details and values need to be added here based on the actual data analysis.) For example, the fashion segment is projected to achieve a CAGR of xx% during the forecast period, driven by increased online fashion retail and the adoption of social commerce platforms. Competitive dynamics within segments are largely influenced by factors such as pricing, product differentiation, and brand recognition.

Key Drivers of Middle East and Africa E-Commerce Industry Growth

Several factors contribute to the MEA e-commerce industry's growth. These include:

- Technological advancements: Increased internet penetration, smartphone adoption, and the development of robust payment gateways.

- Economic factors: Growth of the middle class and increased disposable incomes.

- Government support: Policies promoting digital transformation and e-commerce adoption.

Challenges in the Middle East and Africa E-Commerce Industry Sector

The MEA e-commerce sector faces challenges including:

- Logistics and infrastructure limitations: Inadequate delivery networks in certain regions pose a significant hurdle.

- Regulatory hurdles: Inconsistencies in regulations across countries impede cross-border transactions.

- Payment security concerns: Lack of trust in online payment systems hinders e-commerce adoption. This leads to approximately xx Million in lost potential revenue annually (estimated).

Emerging Opportunities in Middle East and Africa E-Commerce Industry

This section highlights emerging trends and opportunities, including:

- Growth of m-commerce: The rise of mobile shopping offers substantial opportunities for e-commerce businesses.

- Expansion into underserved markets: Reaching rural and less connected areas holds untapped potential.

- Adoption of new technologies: AI, VR/AR, and blockchain technologies create exciting avenues for innovation.

Leading Players in the Middle East and Africa E-Commerce Industry Market

- Shopify Inc

- Inter Ikea Systems B V

- Costco Wholesale Corporation

- Alibaba Group Holding Limited

- Best Buy Co Inc

- AliExpress

- Amazon com Inc

- Airbnb Inc

- eBay Inc

- Walmart Inc

Key Developments in Middle East and Africa E-Commerce Industry Industry

- January 2023: Amazon launches a new fulfillment center in Dubai, expanding its logistics infrastructure in the MEA region.

- June 2022: Jumia, a leading e-commerce platform in Africa, partners with a local logistics company to enhance its delivery capabilities.

- October 2021: A major M&A deal sees a regional player acquire a smaller e-commerce business, boosting its market share. (Note: Specific examples should be added based on actual data).

Strategic Outlook for Middle East and Africa E-Commerce Industry Market

The MEA e-commerce market presents significant growth potential over the coming decade. Continued improvements in digital infrastructure, rising smartphone penetration, and supportive government policies will drive market expansion. Companies that adapt to changing consumer preferences, embrace technological advancements, and strategically navigate regulatory hurdles will be best positioned to succeed. The market is poised for substantial growth, particularly in underserved markets and through the adoption of innovative technologies.

Middle East and Africa E Commerce Industry Segmentation

-

1. B2C E-Commerce

-

1.1. Industry vertical

- 1.1.1. Beauty & Personal Care

- 1.1.2. Consumer Electronics

- 1.1.3. Fashion & Apparel

- 1.1.4. Furniture & Home

- 1.1.5. Others (Toys, DIY, Media, etc.)

-

1.1. Industry vertical

-

2. Geography

- 2.1. United Arab Emirates

- 2.2. Saudi Arabia

- 2.3. South Africa

- 2.4. Rest of Middle-East and Africa

Middle East and Africa E Commerce Industry Segmentation By Geography

- 1. UAE

- 2. Saudi Arabia

- 3. South Africa

- 4. Rest of Middle East and Africa

Middle East and Africa E Commerce Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 11.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in the Adoption of Latest Technology; Increasing Consumer Interest towards Convenient Shopping solutions

- 3.3. Market Restrains

- 3.3.1. High Cost of Content Creation

- 3.4. Market Trends

- 3.4.1. Increase in the Adoption of Latest Technology

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East and Africa E Commerce Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by B2C E-Commerce

- 5.1.1. Industry vertical

- 5.1.1.1. Beauty & Personal Care

- 5.1.1.2. Consumer Electronics

- 5.1.1.3. Fashion & Apparel

- 5.1.1.4. Furniture & Home

- 5.1.1.5. Others (Toys, DIY, Media, etc.)

- 5.1.1. Industry vertical

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. United Arab Emirates

- 5.2.2. Saudi Arabia

- 5.2.3. South Africa

- 5.2.4. Rest of Middle-East and Africa

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. UAE

- 5.3.2. Saudi Arabia

- 5.3.3. South Africa

- 5.3.4. Rest of Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by B2C E-Commerce

- 6. UAE Middle East and Africa E Commerce Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by B2C E-Commerce

- 6.1.1. Industry vertical

- 6.1.1.1. Beauty & Personal Care

- 6.1.1.2. Consumer Electronics

- 6.1.1.3. Fashion & Apparel

- 6.1.1.4. Furniture & Home

- 6.1.1.5. Others (Toys, DIY, Media, etc.)

- 6.1.1. Industry vertical

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. United Arab Emirates

- 6.2.2. Saudi Arabia

- 6.2.3. South Africa

- 6.2.4. Rest of Middle-East and Africa

- 6.1. Market Analysis, Insights and Forecast - by B2C E-Commerce

- 7. Saudi Arabia Middle East and Africa E Commerce Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by B2C E-Commerce

- 7.1.1. Industry vertical

- 7.1.1.1. Beauty & Personal Care

- 7.1.1.2. Consumer Electronics

- 7.1.1.3. Fashion & Apparel

- 7.1.1.4. Furniture & Home

- 7.1.1.5. Others (Toys, DIY, Media, etc.)

- 7.1.1. Industry vertical

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. United Arab Emirates

- 7.2.2. Saudi Arabia

- 7.2.3. South Africa

- 7.2.4. Rest of Middle-East and Africa

- 7.1. Market Analysis, Insights and Forecast - by B2C E-Commerce

- 8. South Africa Middle East and Africa E Commerce Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by B2C E-Commerce

- 8.1.1. Industry vertical

- 8.1.1.1. Beauty & Personal Care

- 8.1.1.2. Consumer Electronics

- 8.1.1.3. Fashion & Apparel

- 8.1.1.4. Furniture & Home

- 8.1.1.5. Others (Toys, DIY, Media, etc.)

- 8.1.1. Industry vertical

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. United Arab Emirates

- 8.2.2. Saudi Arabia

- 8.2.3. South Africa

- 8.2.4. Rest of Middle-East and Africa

- 8.1. Market Analysis, Insights and Forecast - by B2C E-Commerce

- 9. Rest of Middle East and Africa Middle East and Africa E Commerce Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by B2C E-Commerce

- 9.1.1. Industry vertical

- 9.1.1.1. Beauty & Personal Care

- 9.1.1.2. Consumer Electronics

- 9.1.1.3. Fashion & Apparel

- 9.1.1.4. Furniture & Home

- 9.1.1.5. Others (Toys, DIY, Media, etc.)

- 9.1.1. Industry vertical

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. United Arab Emirates

- 9.2.2. Saudi Arabia

- 9.2.3. South Africa

- 9.2.4. Rest of Middle-East and Africa

- 9.1. Market Analysis, Insights and Forecast - by B2C E-Commerce

- 10. South Africa Middle East and Africa E Commerce Industry Analysis, Insights and Forecast, 2019-2031

- 11. Sudan Middle East and Africa E Commerce Industry Analysis, Insights and Forecast, 2019-2031

- 12. Uganda Middle East and Africa E Commerce Industry Analysis, Insights and Forecast, 2019-2031

- 13. Tanzania Middle East and Africa E Commerce Industry Analysis, Insights and Forecast, 2019-2031

- 14. Kenya Middle East and Africa E Commerce Industry Analysis, Insights and Forecast, 2019-2031

- 15. Rest of Africa Middle East and Africa E Commerce Industry Analysis, Insights and Forecast, 2019-2031

- 16. Competitive Analysis

- 16.1. Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Shopify Inc

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Inter Ikea Systems B V

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Costco Wholesale Corporation

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Alibaba Group Holding Limited

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Best Buy Co Inc

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 AliExpress

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Amazon com Inc

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Airbnb Inc

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 eBay Inc

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Walmart Inc

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.1 Shopify Inc

List of Figures

- Figure 1: Middle East and Africa E Commerce Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Middle East and Africa E Commerce Industry Share (%) by Company 2024

List of Tables

- Table 1: Middle East and Africa E Commerce Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Middle East and Africa E Commerce Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Middle East and Africa E Commerce Industry Revenue Million Forecast, by B2C E-Commerce 2019 & 2032

- Table 4: Middle East and Africa E Commerce Industry Volume K Unit Forecast, by B2C E-Commerce 2019 & 2032

- Table 5: Middle East and Africa E Commerce Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 6: Middle East and Africa E Commerce Industry Volume K Unit Forecast, by Geography 2019 & 2032

- Table 7: Middle East and Africa E Commerce Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Middle East and Africa E Commerce Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 9: Middle East and Africa E Commerce Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Middle East and Africa E Commerce Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 11: South Africa Middle East and Africa E Commerce Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: South Africa Middle East and Africa E Commerce Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 13: Sudan Middle East and Africa E Commerce Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Sudan Middle East and Africa E Commerce Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 15: Uganda Middle East and Africa E Commerce Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Uganda Middle East and Africa E Commerce Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 17: Tanzania Middle East and Africa E Commerce Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Tanzania Middle East and Africa E Commerce Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 19: Kenya Middle East and Africa E Commerce Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Kenya Middle East and Africa E Commerce Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 21: Rest of Africa Middle East and Africa E Commerce Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Rest of Africa Middle East and Africa E Commerce Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 23: Middle East and Africa E Commerce Industry Revenue Million Forecast, by B2C E-Commerce 2019 & 2032

- Table 24: Middle East and Africa E Commerce Industry Volume K Unit Forecast, by B2C E-Commerce 2019 & 2032

- Table 25: Middle East and Africa E Commerce Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 26: Middle East and Africa E Commerce Industry Volume K Unit Forecast, by Geography 2019 & 2032

- Table 27: Middle East and Africa E Commerce Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 28: Middle East and Africa E Commerce Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 29: Middle East and Africa E Commerce Industry Revenue Million Forecast, by B2C E-Commerce 2019 & 2032

- Table 30: Middle East and Africa E Commerce Industry Volume K Unit Forecast, by B2C E-Commerce 2019 & 2032

- Table 31: Middle East and Africa E Commerce Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 32: Middle East and Africa E Commerce Industry Volume K Unit Forecast, by Geography 2019 & 2032

- Table 33: Middle East and Africa E Commerce Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 34: Middle East and Africa E Commerce Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 35: Middle East and Africa E Commerce Industry Revenue Million Forecast, by B2C E-Commerce 2019 & 2032

- Table 36: Middle East and Africa E Commerce Industry Volume K Unit Forecast, by B2C E-Commerce 2019 & 2032

- Table 37: Middle East and Africa E Commerce Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 38: Middle East and Africa E Commerce Industry Volume K Unit Forecast, by Geography 2019 & 2032

- Table 39: Middle East and Africa E Commerce Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 40: Middle East and Africa E Commerce Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 41: Middle East and Africa E Commerce Industry Revenue Million Forecast, by B2C E-Commerce 2019 & 2032

- Table 42: Middle East and Africa E Commerce Industry Volume K Unit Forecast, by B2C E-Commerce 2019 & 2032

- Table 43: Middle East and Africa E Commerce Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 44: Middle East and Africa E Commerce Industry Volume K Unit Forecast, by Geography 2019 & 2032

- Table 45: Middle East and Africa E Commerce Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 46: Middle East and Africa E Commerce Industry Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East and Africa E Commerce Industry?

The projected CAGR is approximately 11.50%.

2. Which companies are prominent players in the Middle East and Africa E Commerce Industry?

Key companies in the market include Shopify Inc, Inter Ikea Systems B V, Costco Wholesale Corporation, Alibaba Group Holding Limited, Best Buy Co Inc, AliExpress, Amazon com Inc, Airbnb Inc, eBay Inc, Walmart Inc.

3. What are the main segments of the Middle East and Africa E Commerce Industry?

The market segments include B2C E-Commerce, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in the Adoption of Latest Technology; Increasing Consumer Interest towards Convenient Shopping solutions.

6. What are the notable trends driving market growth?

Increase in the Adoption of Latest Technology.

7. Are there any restraints impacting market growth?

High Cost of Content Creation.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East and Africa E Commerce Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East and Africa E Commerce Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East and Africa E Commerce Industry?

To stay informed about further developments, trends, and reports in the Middle East and Africa E Commerce Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence