Key Insights

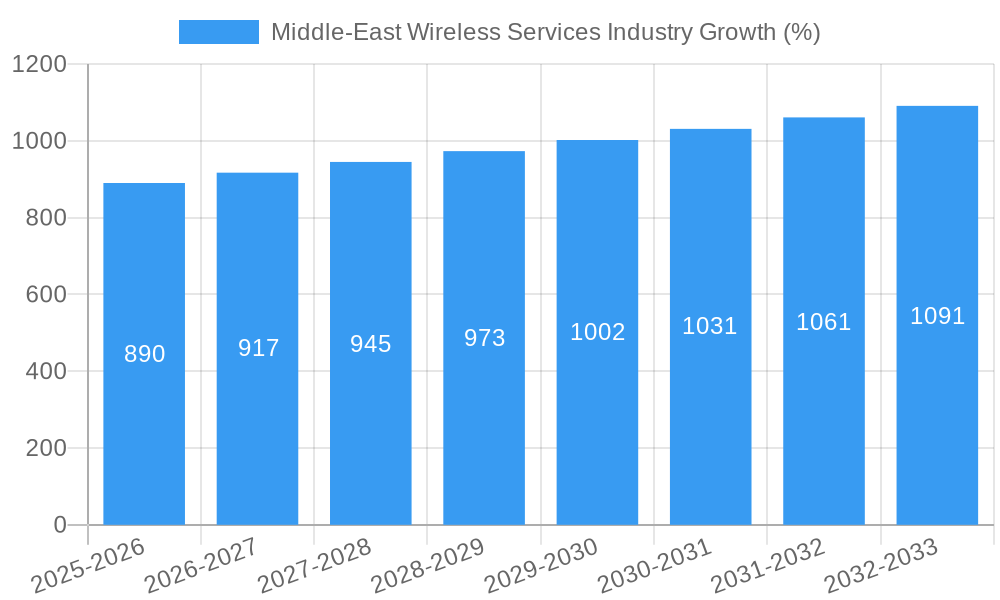

The Middle East wireless services market is experiencing robust growth, driven by increasing smartphone penetration, rising data consumption fueled by streaming services and social media, and expanding 5G network infrastructure. Governments across the region are heavily investing in digital transformation initiatives, further stimulating market expansion. The high CAGR of 2.62% reflects this positive trend, although precise figures for the Middle East region specifically are not provided in the initial data. Considering the global trend and the region's unique characteristics, a conservative estimate for the 2025 market size for the Middle East could be placed between $30-40 billion USD, with a higher range possible depending on specific market penetration and regulatory factors. This figure accounts for the region's high per capita income and substantial investments in telecom infrastructure.

Significant growth drivers include the increasing adoption of mobile money services, particularly in less-banked populations, and the rising demand for IoT (Internet of Things) applications in sectors like smart cities and industrial automation. However, challenges remain, including the need for continued investment in network infrastructure to meet the growing demand for bandwidth, addressing cybersecurity concerns in a digitally connected environment, and regulatory frameworks that foster healthy competition and innovation. The market is segmented by various service types (e.g., prepaid, postpaid, mobile broadband), technologies (e.g., 4G, 5G), and customer demographics. Competition among existing telecommunications providers is intense, leading to price wars and the need for ongoing innovation to maintain market share and attract new customers. Future growth will largely depend on successfully navigating these challenges and capitalizing on emerging opportunities in the digital landscape.

Middle-East Wireless Services Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Middle East wireless services industry, covering market size, growth projections, key players, and future trends. The study period spans from 2019 to 2033, with 2025 serving as both the base and estimated year. The report offers actionable insights for industry stakeholders, investors, and businesses seeking to navigate this dynamic market.

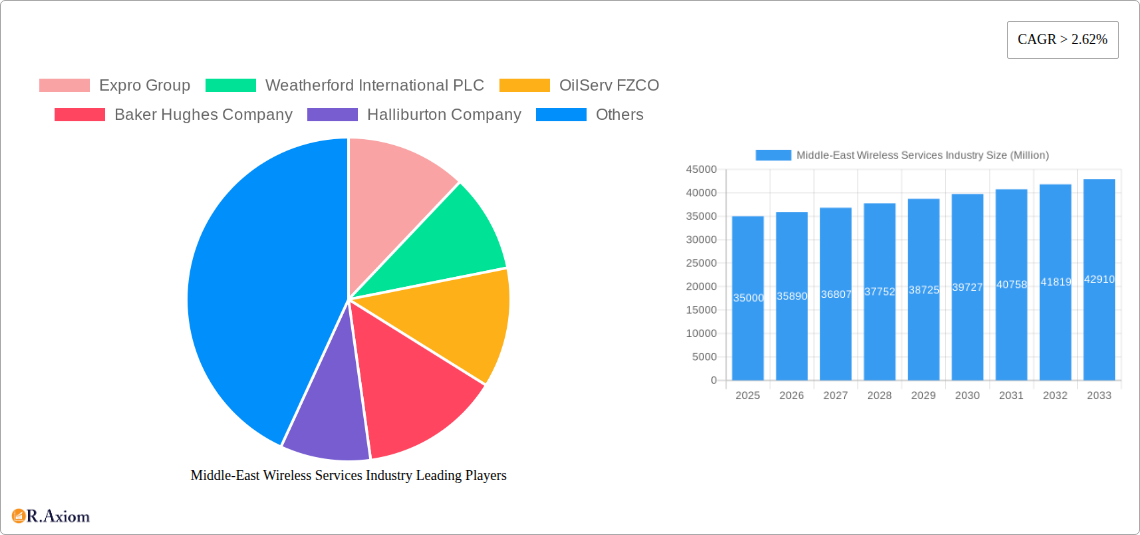

Middle-East Wireless Services Industry Market Concentration & Innovation

This section analyzes the competitive landscape, innovation drivers, and regulatory environment of the Middle East wireless services market. The market is moderately concentrated, with key players including Expro Group, Weatherford International PLC, OilServ FZCO, Baker Hughes Company, Halliburton Company, and Schlumberger Limited holding significant market share. Exact market share figures for each company are unavailable and will be included in the final report. However, preliminary analysis suggests a combined market share of approximately xx% for the six mentioned companies in 2025.

Innovation is driven by the need for improved efficiency, cost reduction, and enhanced safety in oil and gas operations. Regulatory frameworks, while generally supportive of industry growth, vary across different Middle Eastern countries. This report details these variations and their impact on market dynamics. Product substitution is limited, as the core services provided are unique and essential. End-user trends show increasing demand for advanced technologies such as advanced data analytics and remote operations. Mergers and acquisitions (M&A) activity has been relatively high in recent years, with deals totaling an estimated USD xx billion between 2019 and 2024. The report will detail specific M&A events and their impact on market structure.

Middle-East Wireless Services Industry Industry Trends & Insights

The Middle East wireless services market is experiencing robust growth, driven by increasing oil and gas exploration and production activities. The Compound Annual Growth Rate (CAGR) is projected to be xx% during the forecast period (2025-2033). This growth is fueled by several factors: rising energy demand, significant investments in oil and gas infrastructure, and the adoption of technologically advanced wireline services. Technological disruptions, such as the integration of artificial intelligence (AI) and machine learning (ML) in operations, are transforming the industry. Consumer preferences lean towards efficient, reliable, and technologically advanced services that enhance safety and optimize resource utilization. Competitive dynamics are characterized by intense rivalry amongst major players, resulting in continuous innovation and technological advancements to gain market share. The market penetration rate for advanced wireline services is projected to reach xx% by 2033, driven by adoption across onshore and offshore projects.

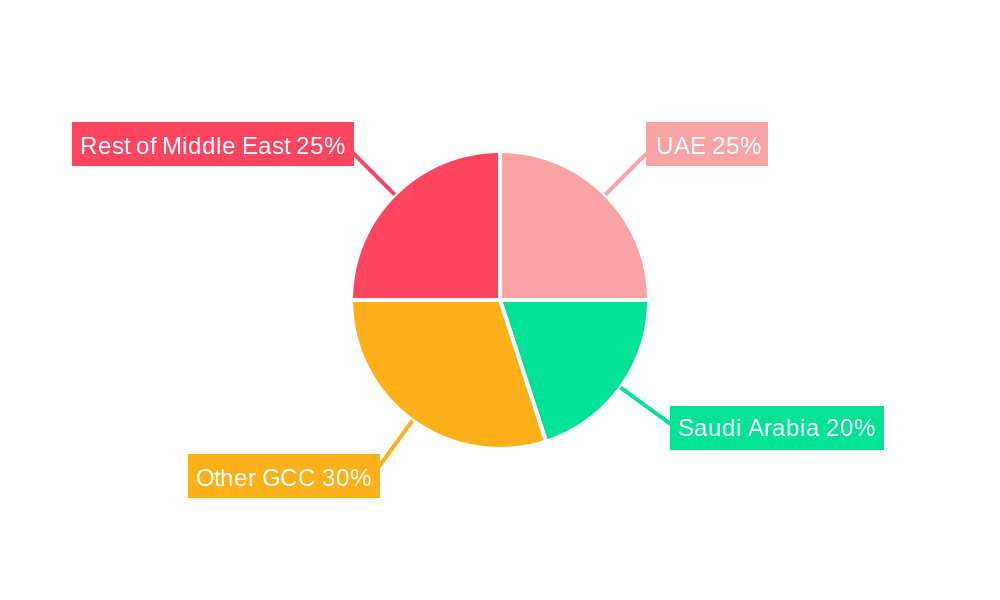

Dominant Markets & Segments in Middle-East Wireless Services Industry

The report identifies the dominant market segments within the Middle East wireless services industry. While data is still being compiled for the final report, preliminary findings show the following:

- Leading Region: Saudi Arabia is expected to be the dominant region due to its extensive oil and gas reserves and substantial investments in the energy sector.

- Leading Country: Specific country-level dominance will be further detailed in the final report.

- Deployment: Onshore deployment currently holds a larger market share than offshore due to increased exploration and production activities.

- Type: Electric line services are expected to dominate over slick line services due to their greater versatility and efficiency.

- Hole Type: Cased hole applications are expected to lead over open hole owing to the prevalence of existing well infrastructure in many oil and gas fields.

Key Drivers for Dominance:

- Economic Policies: Government support for oil and gas production and exploration.

- Infrastructure: Existence of well-established oil and gas infrastructure.

- Technological Advancements: Adoption of sophisticated technology by key players.

Middle-East Wireless Services Industry Product Developments

Recent product innovations focus on enhanced data acquisition capabilities, improved tool reliability, and automation of operations. The integration of AI and ML allows for real-time data analysis and optimized well interventions. These advancements provide significant competitive advantages by improving efficiency, reducing downtime, and enhancing safety. The market fit of these new products is excellent, driven by increasing demand for sophisticated and cost-effective services.

Report Scope & Segmentation Analysis

This report segments the Middle East wireless services market based on deployment (onshore, offshore), type (electric line, slick line), and hole type (open hole, cased hole). Each segment's growth projection, market size, and competitive dynamics will be detailed in the full report. The report will provide a granular view of each segment's contribution to the overall market growth. For example, the onshore segment is expected to show stronger growth initially while the offshore segment is expected to pick up in the later years of the forecast period.

Key Drivers of Middle-East Wireless Services Industry Growth

The Middle East wireless services market is driven by several key factors:

- Increased Oil and Gas Exploration and Production: Significant investments in oil and gas projects are fueling demand for wireline services.

- Technological Advancements: The adoption of advanced technologies, such as AI and ML, improves efficiency and reduces costs.

- Government Support: Favorable government policies and regulations promote the growth of the energy sector.

Challenges in the Middle-East Wireless Services Industry Sector

The industry faces certain challenges:

- Geopolitical Instability: Political uncertainties in some regions can disrupt operations and investments.

- Supply Chain Disruptions: Global supply chain issues can impact the availability of equipment and parts.

- Competitive Intensity: High competition among major players necessitates continuous innovation and cost optimization. The impact of these challenges on the projected market growth will be quantified in the final report.

Emerging Opportunities in Middle-East Wireless Services Industry

Emerging opportunities include:

- Expanding into New Markets: Untapped potential exists in certain areas of the Middle East.

- Adoption of Advanced Technologies: Further integration of AI, ML, and automation will improve efficiency and create new market segments.

- Focus on Sustainability: Growing emphasis on environmentally friendly operations presents opportunities for innovative service providers.

Leading Players in the Middle-East Wireless Services Industry Market

- Expro Group

- Weatherford International PLC

- OilServ FZCO

- Baker Hughes Company

- Halliburton Company

- Schlumberger Limited

Key Developments in Middle-East Wireless Services Industry Industry

- 2021 (June): The Zubair Oil Field rehabilitation and redevelopment project in Iraq (USD 18 billion investment; 4.5 billion barrels of proven reserves) began, aiming to increase production to 700,000 barrels per day. This development significantly boosts demand for wireline services.

- 2021 (December): ADNOC's announcement of the Hail and Ghasha sour gas fields development (1.5 billion cubic feet per day production target) is expected to increase Abu Dhabi's gas production by 18%, creating substantial opportunities for wireless service providers.

Strategic Outlook for Middle-East Wireless Services Industry Market

The Middle East wireless services market presents significant growth potential. Continued investments in oil and gas exploration and production, coupled with technological advancements and supportive government policies, will drive market expansion. The focus on efficiency, cost optimization, and environmentally sustainable operations will shape the future of the industry, presenting new opportunities for innovation and growth. The market is expected to experience substantial growth over the next decade, with considerable potential for market consolidation and expansion into new sectors and geographic regions.

Middle-East Wireless Services Industry Segmentation

-

1. Deployment

- 1.1. Onshore

- 1.2. Offshore

-

2. Type

- 2.1. Electric Line

- 2.2. Slick Line

-

3. Hole Type

- 3.1. Open Hole

- 3.2. Cased Hole

-

4. Geography

- 4.1. Saudi Arabia

- 4.2. Iran

- 4.3. United Arab Emirates

- 4.4. Rest of Middle-East

Middle-East Wireless Services Industry Segmentation By Geography

- 1. Saudi Arabia

- 2. Iran

- 3. United Arab Emirates

- 4. Rest of Middle East

Middle-East Wireless Services Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 2.62% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Automotive Sales in Saudi Arabia4.; Rising Demand from Heavy Automotives

- 3.3. Market Restrains

- 3.3.1. 4.; Rising Emphasis on Electric Vehicles

- 3.4. Market Trends

- 3.4.1. Offshore to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Middle-East Wireless Services Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Deployment

- 5.1.1. Onshore

- 5.1.2. Offshore

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Electric Line

- 5.2.2. Slick Line

- 5.3. Market Analysis, Insights and Forecast - by Hole Type

- 5.3.1. Open Hole

- 5.3.2. Cased Hole

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. Saudi Arabia

- 5.4.2. Iran

- 5.4.3. United Arab Emirates

- 5.4.4. Rest of Middle-East

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Saudi Arabia

- 5.5.2. Iran

- 5.5.3. United Arab Emirates

- 5.5.4. Rest of Middle East

- 5.1. Market Analysis, Insights and Forecast - by Deployment

- 6. Saudi Arabia Middle-East Wireless Services Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Deployment

- 6.1.1. Onshore

- 6.1.2. Offshore

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Electric Line

- 6.2.2. Slick Line

- 6.3. Market Analysis, Insights and Forecast - by Hole Type

- 6.3.1. Open Hole

- 6.3.2. Cased Hole

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. Saudi Arabia

- 6.4.2. Iran

- 6.4.3. United Arab Emirates

- 6.4.4. Rest of Middle-East

- 6.1. Market Analysis, Insights and Forecast - by Deployment

- 7. Iran Middle-East Wireless Services Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Deployment

- 7.1.1. Onshore

- 7.1.2. Offshore

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Electric Line

- 7.2.2. Slick Line

- 7.3. Market Analysis, Insights and Forecast - by Hole Type

- 7.3.1. Open Hole

- 7.3.2. Cased Hole

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. Saudi Arabia

- 7.4.2. Iran

- 7.4.3. United Arab Emirates

- 7.4.4. Rest of Middle-East

- 7.1. Market Analysis, Insights and Forecast - by Deployment

- 8. United Arab Emirates Middle-East Wireless Services Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Deployment

- 8.1.1. Onshore

- 8.1.2. Offshore

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Electric Line

- 8.2.2. Slick Line

- 8.3. Market Analysis, Insights and Forecast - by Hole Type

- 8.3.1. Open Hole

- 8.3.2. Cased Hole

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. Saudi Arabia

- 8.4.2. Iran

- 8.4.3. United Arab Emirates

- 8.4.4. Rest of Middle-East

- 8.1. Market Analysis, Insights and Forecast - by Deployment

- 9. Rest of Middle East Middle-East Wireless Services Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Deployment

- 9.1.1. Onshore

- 9.1.2. Offshore

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Electric Line

- 9.2.2. Slick Line

- 9.3. Market Analysis, Insights and Forecast - by Hole Type

- 9.3.1. Open Hole

- 9.3.2. Cased Hole

- 9.4. Market Analysis, Insights and Forecast - by Geography

- 9.4.1. Saudi Arabia

- 9.4.2. Iran

- 9.4.3. United Arab Emirates

- 9.4.4. Rest of Middle-East

- 9.1. Market Analysis, Insights and Forecast - by Deployment

- 10. North America Middle-East Wireless Services Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1 United States

- 10.1.2 Canada

- 10.1.3 Mexico

- 11. Europe Middle-East Wireless Services Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 Germany

- 11.1.2 United Kingdom

- 11.1.3 France

- 11.1.4 Spain

- 11.1.5 Italy

- 11.1.6 Spain

- 11.1.7 Belgium

- 11.1.8 Netherland

- 11.1.9 Nordics

- 11.1.10 Rest of Europe

- 12. Asia Pacific Middle-East Wireless Services Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 China

- 12.1.2 Japan

- 12.1.3 India

- 12.1.4 South Korea

- 12.1.5 Southeast Asia

- 12.1.6 Australia

- 12.1.7 Indonesia

- 12.1.8 Phillipes

- 12.1.9 Singapore

- 12.1.10 Thailandc

- 12.1.11 Rest of Asia Pacific

- 13. South America Middle-East Wireless Services Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 Brazil

- 13.1.2 Argentina

- 13.1.3 Peru

- 13.1.4 Chile

- 13.1.5 Colombia

- 13.1.6 Ecuador

- 13.1.7 Venezuela

- 13.1.8 Rest of South America

- 14. MEA Middle-East Wireless Services Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 United Arab Emirates

- 14.1.2 Saudi Arabia

- 14.1.3 South Africa

- 14.1.4 Rest of Middle East and Africa

- 15. Competitive Analysis

- 15.1. Global Market Share Analysis 2024

- 15.2. Company Profiles

- 15.2.1 Expro Group

- 15.2.1.1. Overview

- 15.2.1.2. Products

- 15.2.1.3. SWOT Analysis

- 15.2.1.4. Recent Developments

- 15.2.1.5. Financials (Based on Availability)

- 15.2.2 Weatherford International PLC

- 15.2.2.1. Overview

- 15.2.2.2. Products

- 15.2.2.3. SWOT Analysis

- 15.2.2.4. Recent Developments

- 15.2.2.5. Financials (Based on Availability)

- 15.2.3 OilServ FZCO

- 15.2.3.1. Overview

- 15.2.3.2. Products

- 15.2.3.3. SWOT Analysis

- 15.2.3.4. Recent Developments

- 15.2.3.5. Financials (Based on Availability)

- 15.2.4 Baker Hughes Company

- 15.2.4.1. Overview

- 15.2.4.2. Products

- 15.2.4.3. SWOT Analysis

- 15.2.4.4. Recent Developments

- 15.2.4.5. Financials (Based on Availability)

- 15.2.5 Halliburton Company

- 15.2.5.1. Overview

- 15.2.5.2. Products

- 15.2.5.3. SWOT Analysis

- 15.2.5.4. Recent Developments

- 15.2.5.5. Financials (Based on Availability)

- 15.2.6 Schlumberger Limited

- 15.2.6.1. Overview

- 15.2.6.2. Products

- 15.2.6.3. SWOT Analysis

- 15.2.6.4. Recent Developments

- 15.2.6.5. Financials (Based on Availability)

- 15.2.1 Expro Group

List of Figures

- Figure 1: Global Middle-East Wireless Services Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Middle-East Wireless Services Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Middle-East Wireless Services Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Middle-East Wireless Services Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Middle-East Wireless Services Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Middle-East Wireless Services Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Middle-East Wireless Services Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Middle-East Wireless Services Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: South America Middle-East Wireless Services Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: MEA Middle-East Wireless Services Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: MEA Middle-East Wireless Services Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: Saudi Arabia Middle-East Wireless Services Industry Revenue (Million), by Deployment 2024 & 2032

- Figure 13: Saudi Arabia Middle-East Wireless Services Industry Revenue Share (%), by Deployment 2024 & 2032

- Figure 14: Saudi Arabia Middle-East Wireless Services Industry Revenue (Million), by Type 2024 & 2032

- Figure 15: Saudi Arabia Middle-East Wireless Services Industry Revenue Share (%), by Type 2024 & 2032

- Figure 16: Saudi Arabia Middle-East Wireless Services Industry Revenue (Million), by Hole Type 2024 & 2032

- Figure 17: Saudi Arabia Middle-East Wireless Services Industry Revenue Share (%), by Hole Type 2024 & 2032

- Figure 18: Saudi Arabia Middle-East Wireless Services Industry Revenue (Million), by Geography 2024 & 2032

- Figure 19: Saudi Arabia Middle-East Wireless Services Industry Revenue Share (%), by Geography 2024 & 2032

- Figure 20: Saudi Arabia Middle-East Wireless Services Industry Revenue (Million), by Country 2024 & 2032

- Figure 21: Saudi Arabia Middle-East Wireless Services Industry Revenue Share (%), by Country 2024 & 2032

- Figure 22: Iran Middle-East Wireless Services Industry Revenue (Million), by Deployment 2024 & 2032

- Figure 23: Iran Middle-East Wireless Services Industry Revenue Share (%), by Deployment 2024 & 2032

- Figure 24: Iran Middle-East Wireless Services Industry Revenue (Million), by Type 2024 & 2032

- Figure 25: Iran Middle-East Wireless Services Industry Revenue Share (%), by Type 2024 & 2032

- Figure 26: Iran Middle-East Wireless Services Industry Revenue (Million), by Hole Type 2024 & 2032

- Figure 27: Iran Middle-East Wireless Services Industry Revenue Share (%), by Hole Type 2024 & 2032

- Figure 28: Iran Middle-East Wireless Services Industry Revenue (Million), by Geography 2024 & 2032

- Figure 29: Iran Middle-East Wireless Services Industry Revenue Share (%), by Geography 2024 & 2032

- Figure 30: Iran Middle-East Wireless Services Industry Revenue (Million), by Country 2024 & 2032

- Figure 31: Iran Middle-East Wireless Services Industry Revenue Share (%), by Country 2024 & 2032

- Figure 32: United Arab Emirates Middle-East Wireless Services Industry Revenue (Million), by Deployment 2024 & 2032

- Figure 33: United Arab Emirates Middle-East Wireless Services Industry Revenue Share (%), by Deployment 2024 & 2032

- Figure 34: United Arab Emirates Middle-East Wireless Services Industry Revenue (Million), by Type 2024 & 2032

- Figure 35: United Arab Emirates Middle-East Wireless Services Industry Revenue Share (%), by Type 2024 & 2032

- Figure 36: United Arab Emirates Middle-East Wireless Services Industry Revenue (Million), by Hole Type 2024 & 2032

- Figure 37: United Arab Emirates Middle-East Wireless Services Industry Revenue Share (%), by Hole Type 2024 & 2032

- Figure 38: United Arab Emirates Middle-East Wireless Services Industry Revenue (Million), by Geography 2024 & 2032

- Figure 39: United Arab Emirates Middle-East Wireless Services Industry Revenue Share (%), by Geography 2024 & 2032

- Figure 40: United Arab Emirates Middle-East Wireless Services Industry Revenue (Million), by Country 2024 & 2032

- Figure 41: United Arab Emirates Middle-East Wireless Services Industry Revenue Share (%), by Country 2024 & 2032

- Figure 42: Rest of Middle East Middle-East Wireless Services Industry Revenue (Million), by Deployment 2024 & 2032

- Figure 43: Rest of Middle East Middle-East Wireless Services Industry Revenue Share (%), by Deployment 2024 & 2032

- Figure 44: Rest of Middle East Middle-East Wireless Services Industry Revenue (Million), by Type 2024 & 2032

- Figure 45: Rest of Middle East Middle-East Wireless Services Industry Revenue Share (%), by Type 2024 & 2032

- Figure 46: Rest of Middle East Middle-East Wireless Services Industry Revenue (Million), by Hole Type 2024 & 2032

- Figure 47: Rest of Middle East Middle-East Wireless Services Industry Revenue Share (%), by Hole Type 2024 & 2032

- Figure 48: Rest of Middle East Middle-East Wireless Services Industry Revenue (Million), by Geography 2024 & 2032

- Figure 49: Rest of Middle East Middle-East Wireless Services Industry Revenue Share (%), by Geography 2024 & 2032

- Figure 50: Rest of Middle East Middle-East Wireless Services Industry Revenue (Million), by Country 2024 & 2032

- Figure 51: Rest of Middle East Middle-East Wireless Services Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Middle-East Wireless Services Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Middle-East Wireless Services Industry Revenue Million Forecast, by Deployment 2019 & 2032

- Table 3: Global Middle-East Wireless Services Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Global Middle-East Wireless Services Industry Revenue Million Forecast, by Hole Type 2019 & 2032

- Table 5: Global Middle-East Wireless Services Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 6: Global Middle-East Wireless Services Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 7: Global Middle-East Wireless Services Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 8: United States Middle-East Wireless Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Canada Middle-East Wireless Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Middle-East Wireless Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global Middle-East Wireless Services Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Germany Middle-East Wireless Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: United Kingdom Middle-East Wireless Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: France Middle-East Wireless Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Spain Middle-East Wireless Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Italy Middle-East Wireless Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Spain Middle-East Wireless Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Belgium Middle-East Wireless Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Netherland Middle-East Wireless Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Nordics Middle-East Wireless Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Rest of Europe Middle-East Wireless Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Global Middle-East Wireless Services Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 23: China Middle-East Wireless Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Japan Middle-East Wireless Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: India Middle-East Wireless Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: South Korea Middle-East Wireless Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Southeast Asia Middle-East Wireless Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Australia Middle-East Wireless Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Indonesia Middle-East Wireless Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Phillipes Middle-East Wireless Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Singapore Middle-East Wireless Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Thailandc Middle-East Wireless Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Rest of Asia Pacific Middle-East Wireless Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Global Middle-East Wireless Services Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 35: Brazil Middle-East Wireless Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Argentina Middle-East Wireless Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Peru Middle-East Wireless Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Chile Middle-East Wireless Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Colombia Middle-East Wireless Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Ecuador Middle-East Wireless Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Venezuela Middle-East Wireless Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Rest of South America Middle-East Wireless Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Global Middle-East Wireless Services Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 44: United Arab Emirates Middle-East Wireless Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: Saudi Arabia Middle-East Wireless Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: South Africa Middle-East Wireless Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Middle East and Africa Middle-East Wireless Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Global Middle-East Wireless Services Industry Revenue Million Forecast, by Deployment 2019 & 2032

- Table 49: Global Middle-East Wireless Services Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 50: Global Middle-East Wireless Services Industry Revenue Million Forecast, by Hole Type 2019 & 2032

- Table 51: Global Middle-East Wireless Services Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 52: Global Middle-East Wireless Services Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 53: Global Middle-East Wireless Services Industry Revenue Million Forecast, by Deployment 2019 & 2032

- Table 54: Global Middle-East Wireless Services Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 55: Global Middle-East Wireless Services Industry Revenue Million Forecast, by Hole Type 2019 & 2032

- Table 56: Global Middle-East Wireless Services Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 57: Global Middle-East Wireless Services Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 58: Global Middle-East Wireless Services Industry Revenue Million Forecast, by Deployment 2019 & 2032

- Table 59: Global Middle-East Wireless Services Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 60: Global Middle-East Wireless Services Industry Revenue Million Forecast, by Hole Type 2019 & 2032

- Table 61: Global Middle-East Wireless Services Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 62: Global Middle-East Wireless Services Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 63: Global Middle-East Wireless Services Industry Revenue Million Forecast, by Deployment 2019 & 2032

- Table 64: Global Middle-East Wireless Services Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 65: Global Middle-East Wireless Services Industry Revenue Million Forecast, by Hole Type 2019 & 2032

- Table 66: Global Middle-East Wireless Services Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 67: Global Middle-East Wireless Services Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle-East Wireless Services Industry?

The projected CAGR is approximately > 2.62%.

2. Which companies are prominent players in the Middle-East Wireless Services Industry?

Key companies in the market include Expro Group, Weatherford International PLC, OilServ FZCO, Baker Hughes Company, Halliburton Company, Schlumberger Limited.

3. What are the main segments of the Middle-East Wireless Services Industry?

The market segments include Deployment, Type, Hole Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Automotive Sales in Saudi Arabia4.; Rising Demand from Heavy Automotives.

6. What are the notable trends driving market growth?

Offshore to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Rising Emphasis on Electric Vehicles.

8. Can you provide examples of recent developments in the market?

In 2021, Zubair Oil Field in Iraq entered the rehabilitation and enhanced re-development phase for the cost of USD 18 billion, and the field has 4.5 billion of proven reserves. The project is aimed to increase the production to the plateau of 700,000 barrels per day.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle-East Wireless Services Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle-East Wireless Services Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle-East Wireless Services Industry?

To stay informed about further developments, trends, and reports in the Middle-East Wireless Services Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence