Key Insights

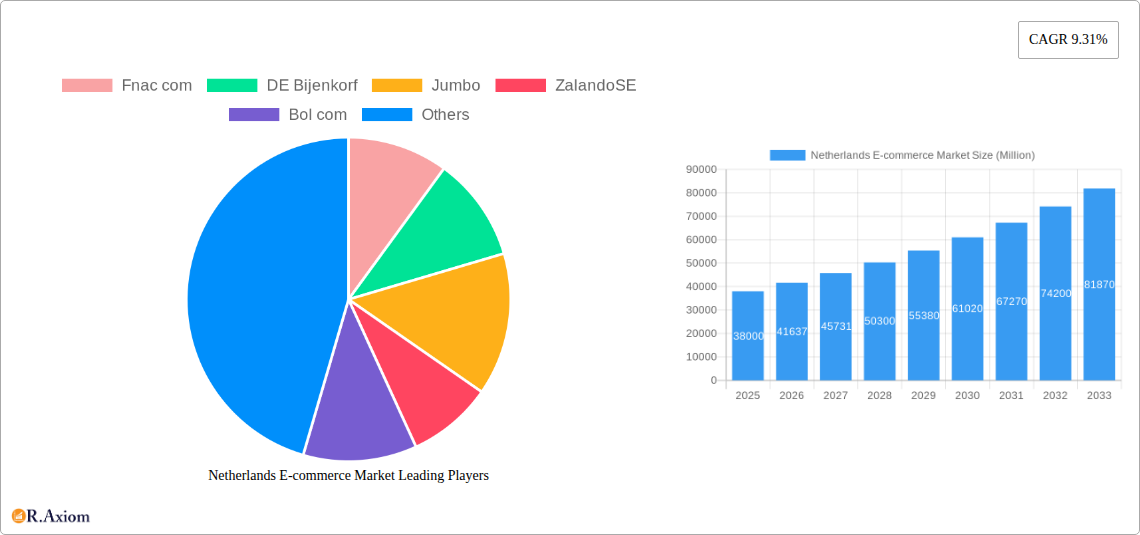

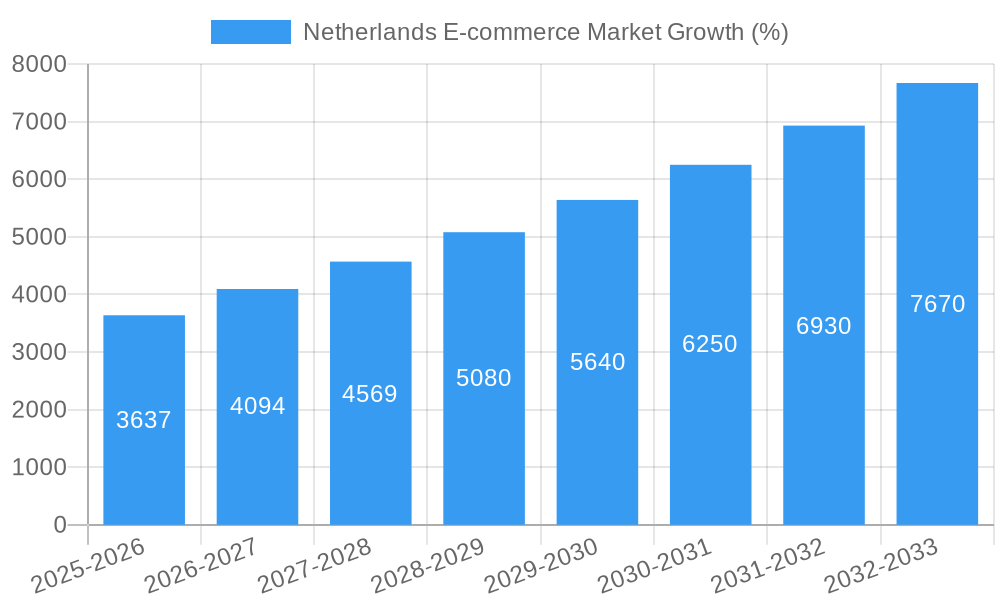

The Netherlands e-commerce market, valued at €33.43 billion in 2028 (extrapolated based on the provided 2018-2028 CAGR of 9.31%), demonstrates robust growth potential. Driven by increasing internet and smartphone penetration, a digitally savvy population, and convenient online shopping experiences, the market is projected to continue its upward trajectory. Strong logistics infrastructure and a competitive landscape featuring both international giants like Amazon and prominent local players such as Bol.com, Coolblue, and Albert Heijn, contribute to this growth. While precise segment breakdowns for B2B and B2C e-commerce are unavailable, it's reasonable to assume a significant share is held by B2C, given the strong consumer preference for online shopping in the Netherlands. The market's growth is also fueled by the increasing adoption of mobile commerce and the rising popularity of omnichannel strategies that blend online and offline shopping experiences. Challenges might include maintaining competitive pricing strategies, managing logistics and delivery efficiency, and adapting to evolving consumer preferences and technological advancements. The continued focus on improving customer experience, personalized marketing, and secure payment gateways will be crucial for success within this dynamic market.

Looking ahead to 2033, the Netherlands e-commerce market is poised for sustained expansion, propelled by innovative technologies like AI-powered personalization and augmented reality shopping experiences. The projected CAGR indicates a significant increase in market value over the next decade. However, potential headwinds such as economic fluctuations and increasing competition could influence the overall growth rate. Nevertheless, the long-term outlook remains positive, with opportunities for both established players and new entrants to capitalize on the burgeoning demand for online shopping within the Dutch market. Strategies focused on targeted marketing, enhancing website usability, and delivering seamless customer service will be essential for navigating the competitive landscape and maximizing market share.

Netherlands E-commerce Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the Netherlands e-commerce market, covering market size, segmentation, key players, growth drivers, challenges, and future opportunities. The study period spans from 2019 to 2033, with 2025 as the base and estimated year. The report utilizes data from the historical period (2019-2024) and projects the market's trajectory through the forecast period (2025-2033). This in-depth analysis is crucial for businesses operating in or considering entry into the dynamic Dutch e-commerce landscape.

Netherlands E-commerce Market Market Concentration & Innovation

The Netherlands e-commerce market showcases a blend of established giants and agile newcomers. Market concentration is moderate, with several dominant players controlling significant market share, while smaller businesses and specialized e-tailers occupy niche segments. Bol.com and Amazon.com Inc. consistently rank among the top players, although precise market share data requires further proprietary research. The market exhibits a high level of innovation, driven by advancements in mobile commerce, personalized shopping experiences, and the increasing adoption of technologies like AI and big data analytics for improved customer targeting and fulfillment optimization.

Regulatory frameworks, while generally supportive of e-commerce growth, continue to evolve, impacting areas like data privacy (GDPR compliance) and consumer protection. Product substitutes, especially in the fast-moving consumer goods (FMCG) sector, pose a competitive challenge. The increasing popularity of subscription boxes and direct-to-consumer brands indicates consumers’ preference for convenience and personalized offerings. Mergers and acquisitions (M&A) activity is significant, with deal values fluctuating based on market conditions and strategic goals. Recent M&A activity has focused on enhancing logistics capabilities, expanding product portfolios, and strengthening market positions.

Netherlands E-commerce Market Industry Trends & Insights

The Netherlands e-commerce market demonstrates robust growth, fueled by factors such as rising internet penetration, increasing smartphone usage, and a shift towards online shopping convenience. The compound annual growth rate (CAGR) for the period 2019-2024 is estimated to be xx%, indicating considerable market expansion. This growth is particularly evident in the B2C segment, reflecting a preference for online purchases of diverse products and services. The market penetration rate exceeds xx%, demonstrating the widespread adoption of e-commerce among the Dutch population.

Technological disruptions, such as the growth of mobile commerce and the increasing use of omnichannel strategies, are transforming the competitive landscape. Consumer preferences for personalized experiences and seamless online journeys are shaping e-retailer strategies. Competitive dynamics are intensely competitive, with major players investing heavily in technology, logistics, and marketing to gain a market edge. The rise of social commerce and influencer marketing is further reshaping the ways businesses engage with consumers.

Dominant Markets & Segments in Netherlands E-commerce Market

The Netherlands e-commerce market is broadly segmented into B2B and B2C categories, with several sub-segments within each.

By B2B E-commerce: Market size for 2018-2028 is projected to reach xx Million, with steady growth anticipated throughout the forecast period. The growth is driven by increasing business adoption of digital tools for procurement, supply chain management, and customer relationship management. Key industry segments include wholesale, manufacturing, and services.

By B2C E-commerce: Market size (GMV) from 2018 onwards showcases a continuously expanding trend, with the market expected to reach xx Million by 2028. Strong consumer confidence, coupled with a well-developed digital infrastructure and easy access to high-speed internet, has fostered rapid growth in online shopping across diverse product categories.

By Application: While precise segmentation data by application requires further research, initial observation suggests strong growth in various application areas, including fashion, electronics, groceries, and home goods. The high degree of internet usage in the country is expected to lead to high growth in online food sales, indicating the rise of online grocery shopping.

The Netherlands, as a whole, dominates the market due to high internet penetration, robust digital infrastructure, and a high level of consumer trust in online transactions. Key drivers include government initiatives promoting digitalization, a highly skilled workforce, and a strong logistics network.

Netherlands E-commerce Market Product Developments

Product innovations in the Netherlands e-commerce market are characterized by a focus on personalization, convenience, and seamless customer experiences. The integration of AI-powered recommendation engines and chatbots enhance customer interaction, while advancements in logistics, like same-day delivery and click-and-collect options, improve order fulfillment. These innovations enable e-retailers to stand out in a competitive market, increase customer satisfaction, and boost sales. Technological trends such as AR/VR applications are beginning to emerge in areas such as furniture and clothing retail.

Report Scope & Segmentation Analysis

This report covers the entire Netherlands e-commerce market, segmented by B2B and B2C, further broken down by industry vertical and product category. The B2B segment includes wholesale, retail, and manufacturing sectors, with varying growth rates reflecting the digital maturity of each. The B2C segment is categorized by product types (e.g., fashion, electronics, groceries), showing significant variation in market size and growth. Detailed data on each specific segment's market size and growth projections is not available for this description, but can be found within the full report.

Key Drivers of Netherlands E-commerce Market Growth

Several factors drive the growth of the Netherlands e-commerce market. High internet penetration and smartphone ownership provide a massive consumer base for online shopping. A well-developed logistics network ensures efficient and timely delivery of goods. Government initiatives promoting digitalization and e-commerce adoption further stimulate market growth. Increasing consumer comfort with online transactions and the convenience of online shopping are key contributing factors.

Challenges in the Netherlands E-commerce Market Sector

Despite its growth potential, the Netherlands e-commerce market faces challenges. Maintaining high customer satisfaction is crucial given the competitive landscape. The need for sophisticated logistics and last-mile delivery solutions to cope with high demand is a continuous challenge, as are issues related to fraud and data security. The ongoing evolution of regulatory frameworks and maintaining compliance requires constant adaptation.

Emerging Opportunities in Netherlands E-commerce Market

The Netherlands e-commerce market presents significant opportunities for businesses. The expanding use of mobile commerce, omnichannel strategies, and personalized shopping experiences create new avenues for growth. The increased adoption of subscription models and the rise of social commerce presents fertile ground for innovation. Expansion into niche markets and the development of sustainable and ethical e-commerce practices offer further opportunities for differentiation and market penetration.

Leading Players in the Netherlands E-commerce Market Market

- Fnac com

- DE Bijenkorf

- Jumbo

- Zalando SE

- Bol.com

- Coolblue

- Amazon.com Inc

- Wehkamp

- About you

- Albert Heijn

Key Developments in Netherlands E-commerce Market Industry

February 2023: According to Eurostat, the Netherlands recorded the highest share (92%) of internet users aged 16-74 who ordered goods or services online in 2022, reflecting the country's high e-commerce adoption rate. This highlights the significant market potential for e-retailers.

September 2022: DHL's majority investment in Monta signifies a significant development in the e-fulfillment sector. This collaboration strengthens the logistics infrastructure, particularly benefiting small and medium-sized e-commerce businesses, improving their ability to compete with larger players.

Strategic Outlook for Netherlands E-commerce Market Market

The Netherlands e-commerce market is poised for continued growth, driven by increasing digital adoption, technological advancements, and evolving consumer preferences. The focus on enhancing customer experience, improving logistics, and innovating in areas such as personalized shopping and sustainable practices will be crucial for success. Businesses that adapt quickly to changing market dynamics and leverage new technologies will be well-positioned to capitalize on the significant growth potential.

Netherlands E-commerce Market Segmentation

-

1. Application

- 1.1. Beauty and Personal Care

- 1.2. Consumer Electronics

- 1.3. Fashion and Apparel

- 1.4. Food and Beverage

- 1.5. Furniture and Home

- 1.6. Other Applications (Toys, DIY, Media, etc.)

Netherlands E-commerce Market Segmentation By Geography

- 1. Netherlands

Netherlands E-commerce Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.31% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Adoption of Digitalization; Growing Interest of Consumers to Shop Clothes Through E-commerce Channels

- 3.3. Market Restrains

- 3.3.1. Ethical Issues associated with Deployment of AI-based Systems in Military and Defense

- 3.4. Market Trends

- 3.4.1. Increase in Adoption of Digitalization is Expected to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Netherlands E-commerce Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Beauty and Personal Care

- 5.1.2. Consumer Electronics

- 5.1.3. Fashion and Apparel

- 5.1.4. Food and Beverage

- 5.1.5. Furniture and Home

- 5.1.6. Other Applications (Toys, DIY, Media, etc.)

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Netherlands

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Fnac com

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 DE Bijenkorf

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Jumbo

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 ZalandoSE

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Bol com

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Coolblue

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Amazon com Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Wehkamp

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 About you

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Albert Heijn

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Fnac com

List of Figures

- Figure 1: Netherlands E-commerce Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Netherlands E-commerce Market Share (%) by Company 2024

List of Tables

- Table 1: Netherlands E-commerce Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Netherlands E-commerce Market Revenue Million Forecast, by Application 2019 & 2032

- Table 3: Netherlands E-commerce Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Netherlands E-commerce Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Netherlands E-commerce Market Revenue Million Forecast, by Application 2019 & 2032

- Table 6: Netherlands E-commerce Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Netherlands E-commerce Market?

The projected CAGR is approximately 9.31%.

2. Which companies are prominent players in the Netherlands E-commerce Market?

Key companies in the market include Fnac com, DE Bijenkorf, Jumbo, ZalandoSE, Bol com, Coolblue, Amazon com Inc, Wehkamp, About you, Albert Heijn.

3. What are the main segments of the Netherlands E-commerce Market?

The market segments include Application .

4. Can you provide details about the market size?

The market size is estimated to be USD 33.43 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in Adoption of Digitalization; Growing Interest of Consumers to Shop Clothes Through E-commerce Channels.

6. What are the notable trends driving market growth?

Increase in Adoption of Digitalization is Expected to Drive the Market.

7. Are there any restraints impacting market growth?

Ethical Issues associated with Deployment of AI-based Systems in Military and Defense.

8. Can you provide examples of recent developments in the market?

February 2023: According to Eurostat, In 2022, 91% of EU citizens aged 16 to 74 had accessed the internet, with 75% purchasing or ordering products or services for personal use. The proportion of e-shoppers increased by 20 percentage points (pp) from 55% in 2012 to 75% in 2022. The highest shares of internet users who ordered goods or services or bought over the internet in 2022 were recorded in the Netherlands (92%)

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Netherlands E-commerce Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Netherlands E-commerce Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Netherlands E-commerce Market?

To stay informed about further developments, trends, and reports in the Netherlands E-commerce Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence