Key Insights

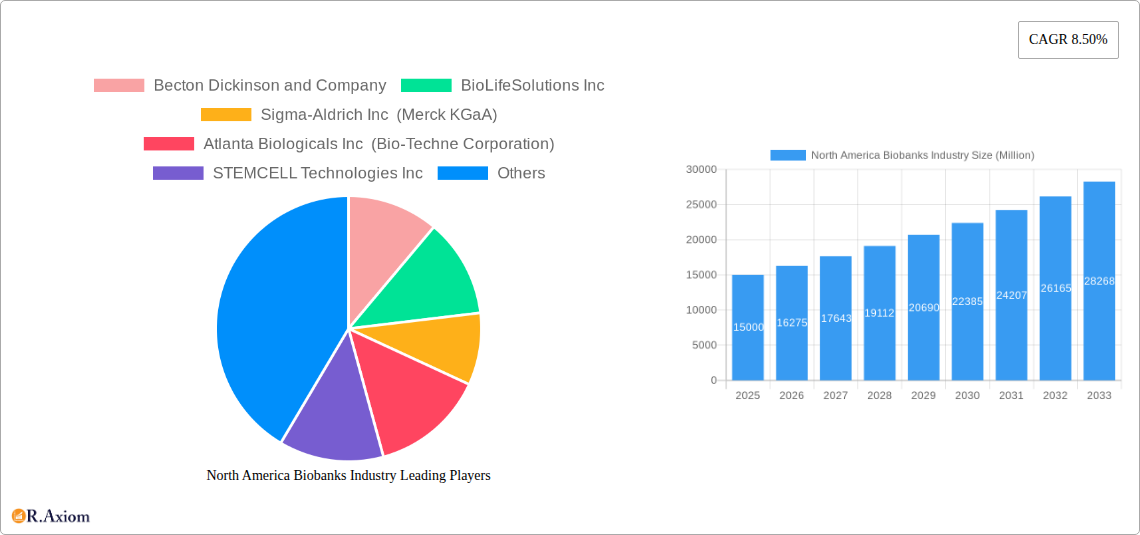

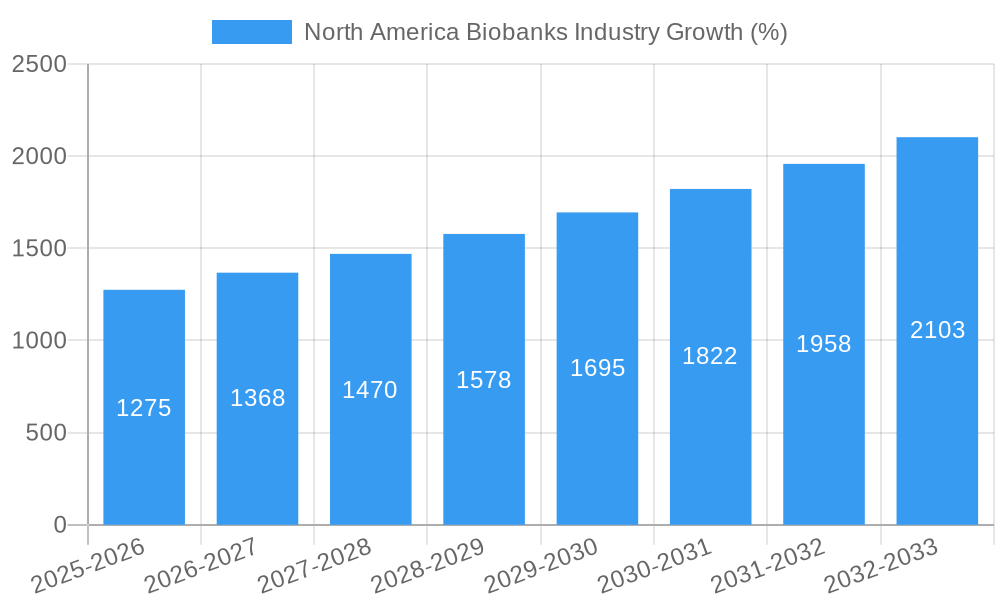

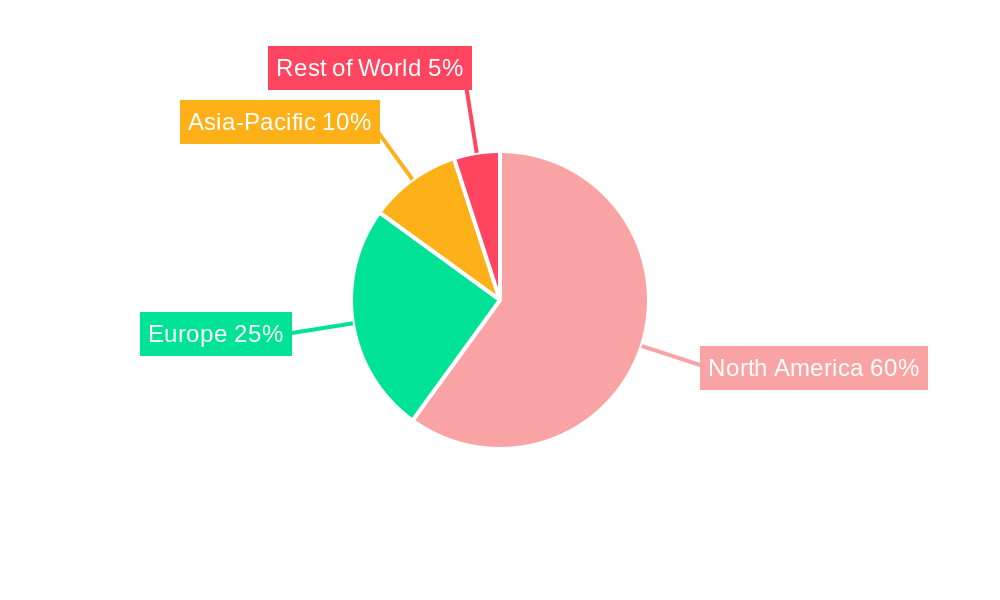

The North American biobanking market, encompassing cryogenic storage, optimized and non-optimized media, and diverse biobanking services (human tissue, stem cells, cord blood, DNA/RNA), is experiencing robust growth. Driven by advancements in regenerative medicine, drug discovery, and disease research, the market is projected to maintain a healthy Compound Annual Growth Rate (CAGR) of 8.5% from 2025 to 2033. This expansion is fueled by the increasing demand for high-quality biospecimens for research and development, coupled with technological innovations in sample storage and management. Key players like Becton Dickinson, BioLife Solutions, and Thermo Fisher Scientific are leading this growth through strategic investments in innovative technologies and expanded service offerings. The United States, being a major hub for biomedical research and pharmaceutical development, dominates the North American market, followed by Canada and Mexico. However, regulatory considerations and the high cost associated with establishing and maintaining biobanks could act as potential restraints on market growth. The segment focusing on regenerative medicine is predicted to demonstrate significant growth due to its burgeoning applications in treating various diseases and injuries. Furthermore, the increasing adoption of optimized media is expected to drive market expansion, owing to its enhanced performance and reliability in preserving biospecimens.

The forecast period from 2025 to 2033 shows a promising outlook for the North American biobanking sector. Continued growth in research funding, the rise of personalized medicine, and an expanding understanding of the human genome will likely contribute to further market expansion. The market will see significant investment in automation, improved data management systems, and advanced storage technologies. The growing awareness of the importance of ethical biobanking practices and data security will also drive demand for sophisticated biobanking solutions. Competition among key players will remain intense, leading to further innovation and enhanced service offerings to cater to the evolving needs of research institutions and pharmaceutical companies. Analyzing the individual segments reveals that the services sector will continue to be the largest contributor, due to the rising demand for specialized biobanking expertise across various applications.

North America Biobanks Industry: 2019-2033 Market Analysis and Forecast Report

This comprehensive report provides an in-depth analysis of the North America biobanks industry, covering the period from 2019 to 2033. It offers actionable insights into market size, segmentation, growth drivers, challenges, and emerging opportunities, empowering stakeholders to make informed strategic decisions. The report leverages extensive primary and secondary research, encompassing detailed financial data and expert opinions, to deliver a robust and reliable forecast. The Base Year is 2025, and the Estimated Year is 2025, with a Forecast Period of 2025-2033 and a Historical Period of 2019-2024. The total market value in 2025 is estimated at $XX Million.

North America Biobanks Industry Market Concentration & Innovation

The North American biobanks industry exhibits a moderately concentrated market structure, with several major players holding significant market share. Companies such as Becton Dickinson and Company, BioLife Solutions Inc, Sigma-Aldrich Inc (Merck KGaA), Atlanta Biologicals Inc (Bio-Techne Corporation), STEMCELL Technologies Inc, Thermo Fisher Scientific Inc, Chart Industries Inc, VWR International LLC, Hamilton Company, and Qiagen NV contribute significantly to the overall market. These companies compete based on factors like product innovation, technological advancements, and service offerings.

- Market Share: Thermo Fisher Scientific and Becton Dickinson collectively hold an estimated 35% market share in 2025, while other key players hold shares ranging from 5% to 15%.

- M&A Activity: The industry has witnessed several mergers and acquisitions in recent years, with deal values exceeding $XX Million annually. These activities are driven by a desire to expand product portfolios, enhance technological capabilities, and increase market reach. Consolidation is expected to continue, further shaping the market landscape.

- Innovation Drivers: The industry is driven by innovation in cryogenic storage technologies, automation in sample handling, and the development of advanced biobanking software. Regulatory frameworks, such as those governing data privacy and sample security, significantly impact industry practices. Product substitutes, such as alternative sample preservation methods, present competitive challenges. End-user trends, particularly the increasing demand for personalized medicine and advanced research, significantly drive market growth.

North America Biobanks Industry Industry Trends & Insights

The North America biobanks industry is experiencing robust growth, projected to reach $XX Million by 2033, with a Compound Annual Growth Rate (CAGR) of XX% during the forecast period. This growth is propelled by several key factors:

- Increased Investments in R&D: Pharmaceutical and biotech companies are increasingly investing in biobanking to support their drug discovery and development programs.

- Growing Adoption of Regenerative Medicine: The burgeoning regenerative medicine field significantly increases the demand for high-quality biospecimens and efficient biobanking services.

- Technological Advancements: The introduction of advanced cryopreservation techniques and automation solutions is improving the efficiency and reliability of biobanking operations.

- Rising Prevalence of Chronic Diseases: The rising prevalence of chronic diseases like cancer and diabetes fuels the demand for biobanks to facilitate research into disease etiology and treatment development.

Market penetration rates for advanced biobanking services, like stem cell biobanking, are expected to increase substantially, reflecting growing adoption across various research and clinical applications. Competition is intensifying, with existing players expanding their service offerings and new entrants entering the market.

Dominant Markets & Segments in North America Biobanks Industry

The United States currently dominates the North American biobanks market, driven by robust funding for research, established regulatory frameworks, and a strong presence of major players.

- Dominant Segments:

- Equipment: Cryogenic storage systems account for the largest segment of the equipment market, driven by a need for secure and long-term storage of biospecimens.

- Media: Optimized media holds a larger market share compared to non-optimized media due to its superior performance in preserving sample quality.

- Services: Human tissue biobanking commands the largest share of the services segment, followed by DNA/RNA biobanking. The stem cell and cord blood banking segments are showing significant growth potential.

- Application: Drug discovery and disease research represent the largest application segments, driven by the increased use of biobanks in preclinical and clinical studies. Regenerative medicine applications are also experiencing significant growth.

Key Drivers for Dominance:

- Strong Research Infrastructure: The presence of well-funded research institutions and universities significantly influences the growth of the US biobanks market.

- Favorable Regulatory Environment: Relatively clear regulatory guidelines have enabled the growth of the biobanks sector in the United States.

- High Healthcare Spending: The high healthcare expenditure in the US supports extensive investments in research and development, including biobanking.

North America Biobanks Industry Product Developments

Recent product innovations include advanced cryogenic storage systems offering improved temperature uniformity and automation capabilities, as well as novel media formulations that enhance sample integrity. Companies are focusing on integrating advanced technologies, such as artificial intelligence and machine learning, into their biobanking solutions to improve efficiency and data analysis. This focus on technological advancements ensures superior market fit and competitive advantage.

Report Scope & Segmentation Analysis

This report comprehensively segments the North America biobanks market across several key dimensions:

- Equipment: Cryogenic storage systems, automated sample management systems, and other specialized equipment. Growth projections indicate a steady increase in demand for advanced equipment.

- Media: Optimized and non-optimized media for sample preservation and storage. The optimized segment is experiencing higher growth driven by superior performance.

- Services: Human tissue biobanking, stem cell biobanking, cord blood banking, DNA/RNA biobanking, and other specialized services. The human tissue biobanking segment holds the largest market share.

- Application: Regenerative medicine, drug discovery, disease research, and other applications. The drug discovery and disease research segments are dominant in terms of market size.

Each segment's market size and competitive dynamics are analyzed in detail, including projections for future growth.

Key Drivers of North America Biobanks Industry Growth

Several key factors are driving the growth of the North America biobanks industry:

- Increased Government Funding for Research: Significant investments in biomedical research are fueling the expansion of biobanking initiatives.

- Technological Advancements in Cryopreservation and Automation: Innovative technologies are enhancing the efficiency and reliability of biobanks.

- Growing Adoption of Personalized Medicine: The rise of personalized medicine is driving the demand for large-scale biobanks to support tailored therapies.

- Stringent Regulatory Frameworks: Well-defined regulations regarding sample management and data security instill confidence among researchers and patients.

Challenges in the North America Biobanks Industry Sector

The North America biobanks industry faces several challenges:

- High Infrastructure Costs: Establishing and maintaining biobanks requires substantial investments in infrastructure and technology.

- Regulatory Compliance: Adherence to stringent regulatory requirements (e.g., HIPAA, GDPR) adds complexity to operations and increases costs.

- Data Security Concerns: Protecting sensitive patient data is crucial, requiring robust security measures and compliance with data privacy regulations. Data breaches could result in losses exceeding $XX Million in reputational damage and legal fees.

- Competition: Intense competition from established players and emerging companies puts pressure on pricing and margins.

Emerging Opportunities in North America Biobanks Industry

The North America biobanks industry presents several promising opportunities:

- Expansion into Emerging Markets: Developing countries are increasingly investing in biobanking infrastructure, presenting significant growth potential.

- Integration of Artificial Intelligence and Machine Learning: Leveraging AI and ML can enhance data analysis and decision-making within biobanks.

- Development of Novel Preservation Technologies: Innovation in sample preservation methods can further improve sample quality and storage efficiency.

- Personalized Medicine Initiatives: The increasing focus on personalized medicine is driving demand for tailored biobanking solutions.

Leading Players in the North America Biobanks Industry Market

- Becton Dickinson and Company

- BioLifeSolutions Inc

- Sigma-Aldrich Inc (Merck KGaA)

- Atlanta Biologicals Inc (Bio-Techne Corporation)

- STEMCELL Technologies Inc

- Thermo Fisher Scientific Inc

- Chart Industries Inc

- VWR International LLC

- Hamilton Company

- Qiagen NV

Key Developments in North America Biobanks Industry Industry

- January 2023: Thermo Fisher Scientific launched a new automated cryogenic storage system.

- March 2022: BioLife Solutions secured a major contract for its cryopreservation solutions with a leading research institution.

- June 2021: Becton Dickinson acquired a smaller biobanking company, expanding its product portfolio. (Further developments can be added here).

Strategic Outlook for North America Biobanks Industry Market

The North America biobanks industry is poised for continued growth driven by increasing investment in life sciences research, technological innovations, and the expanding application of biobanks in personalized medicine and regenerative medicine. Opportunities exist for companies to expand their service offerings, invest in advanced technologies, and consolidate their market position through strategic acquisitions. The long-term outlook remains positive, reflecting a growing need for efficient and reliable biobanking solutions to support advancements in medical research and clinical care.

North America Biobanks Industry Segmentation

-

1. Equipment

-

1.1. Cryogenic Storage Systems

- 1.1.1. Refrigerators

- 1.1.2. Ice Machines

- 1.1.3. Freezers

- 1.2. Alarm Monitoring Systems

- 1.3. Other Equipment

-

1.1. Cryogenic Storage Systems

-

2. Media

- 2.1. Optimized Media

- 2.2. Non-optimized Media

-

3. Services

- 3.1. Human Tissue Biobanking

- 3.2. Stem Cell Biobanking

- 3.3. Cord Banking

- 3.4. DNA/RNA Biobanking

- 3.5. Other Services

-

4. Application

- 4.1. Regenerative Medicine

- 4.2. Drug Discovery

- 4.3. Disease Research

-

5. Geography

-

5.1. North America

- 5.1.1. United States

- 5.1.2. Canada

- 5.1.3. Mexico

-

5.1. North America

North America Biobanks Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Biobanks Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Rising Burden of Chronic Diseases; Advancements in Stem Cell and Regenerative Medicine Research; Increasing Healthcare Expenditure

- 3.3. Market Restrains

- 3.3.1. ; Regulatory Issues

- 3.4. Market Trends

- 3.4.1. Alarm Monitoring Systems Segment is Expected to Show Better Growth in the Forecast Years

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Biobanks Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Equipment

- 5.1.1. Cryogenic Storage Systems

- 5.1.1.1. Refrigerators

- 5.1.1.2. Ice Machines

- 5.1.1.3. Freezers

- 5.1.2. Alarm Monitoring Systems

- 5.1.3. Other Equipment

- 5.1.1. Cryogenic Storage Systems

- 5.2. Market Analysis, Insights and Forecast - by Media

- 5.2.1. Optimized Media

- 5.2.2. Non-optimized Media

- 5.3. Market Analysis, Insights and Forecast - by Services

- 5.3.1. Human Tissue Biobanking

- 5.3.2. Stem Cell Biobanking

- 5.3.3. Cord Banking

- 5.3.4. DNA/RNA Biobanking

- 5.3.5. Other Services

- 5.4. Market Analysis, Insights and Forecast - by Application

- 5.4.1. Regenerative Medicine

- 5.4.2. Drug Discovery

- 5.4.3. Disease Research

- 5.5. Market Analysis, Insights and Forecast - by Geography

- 5.5.1. North America

- 5.5.1.1. United States

- 5.5.1.2. Canada

- 5.5.1.3. Mexico

- 5.5.1. North America

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Equipment

- 6. North America North America Biobanks Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 6.1.1. undefined

- 7. United States North America Biobanks Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 7.1.1. undefined

- 8. Canada North America Biobanks Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 8.1.1. undefined

- 9. Mexico North America Biobanks Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 9.1.1. undefined

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Becton Dickinson and Company

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 BioLifeSolutions Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Sigma-Aldrich Inc (Merck KGaA)

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Atlanta Biologicals Inc (Bio-Techne Corporation)

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 STEMCELL Technologies Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Thermo Fisher Scientific Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Chart Industries Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 VWR International LLC

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Hamilton Company

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Qiagen NV

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Becton Dickinson and Company

List of Figures

- Figure 1: North America Biobanks Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Biobanks Industry Share (%) by Company 2024

List of Tables

- Table 1: North America Biobanks Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Biobanks Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: North America Biobanks Industry Revenue Million Forecast, by Equipment 2019 & 2032

- Table 4: North America Biobanks Industry Volume K Unit Forecast, by Equipment 2019 & 2032

- Table 5: North America Biobanks Industry Revenue Million Forecast, by Media 2019 & 2032

- Table 6: North America Biobanks Industry Volume K Unit Forecast, by Media 2019 & 2032

- Table 7: North America Biobanks Industry Revenue Million Forecast, by Services 2019 & 2032

- Table 8: North America Biobanks Industry Volume K Unit Forecast, by Services 2019 & 2032

- Table 9: North America Biobanks Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 10: North America Biobanks Industry Volume K Unit Forecast, by Application 2019 & 2032

- Table 11: North America Biobanks Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 12: North America Biobanks Industry Volume K Unit Forecast, by Geography 2019 & 2032

- Table 13: North America Biobanks Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 14: North America Biobanks Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 15: North America Biobanks Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: North America Biobanks Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 17: North America Biobanks Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: North America Biobanks Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 19: North America Biobanks Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 20: North America Biobanks Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 21: North America Biobanks Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 22: North America Biobanks Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 23: North America Biobanks Industry Revenue Million Forecast, by Equipment 2019 & 2032

- Table 24: North America Biobanks Industry Volume K Unit Forecast, by Equipment 2019 & 2032

- Table 25: North America Biobanks Industry Revenue Million Forecast, by Media 2019 & 2032

- Table 26: North America Biobanks Industry Volume K Unit Forecast, by Media 2019 & 2032

- Table 27: North America Biobanks Industry Revenue Million Forecast, by Services 2019 & 2032

- Table 28: North America Biobanks Industry Volume K Unit Forecast, by Services 2019 & 2032

- Table 29: North America Biobanks Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 30: North America Biobanks Industry Volume K Unit Forecast, by Application 2019 & 2032

- Table 31: North America Biobanks Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 32: North America Biobanks Industry Volume K Unit Forecast, by Geography 2019 & 2032

- Table 33: North America Biobanks Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 34: North America Biobanks Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 35: United States North America Biobanks Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: United States North America Biobanks Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 37: Canada North America Biobanks Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Canada North America Biobanks Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 39: Mexico North America Biobanks Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Mexico North America Biobanks Industry Volume (K Unit) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Biobanks Industry?

The projected CAGR is approximately 8.50%.

2. Which companies are prominent players in the North America Biobanks Industry?

Key companies in the market include Becton Dickinson and Company, BioLifeSolutions Inc, Sigma-Aldrich Inc (Merck KGaA), Atlanta Biologicals Inc (Bio-Techne Corporation), STEMCELL Technologies Inc, Thermo Fisher Scientific Inc, Chart Industries Inc, VWR International LLC, Hamilton Company, Qiagen NV.

3. What are the main segments of the North America Biobanks Industry?

The market segments include Equipment, Media, Services, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Rising Burden of Chronic Diseases; Advancements in Stem Cell and Regenerative Medicine Research; Increasing Healthcare Expenditure.

6. What are the notable trends driving market growth?

Alarm Monitoring Systems Segment is Expected to Show Better Growth in the Forecast Years.

7. Are there any restraints impacting market growth?

; Regulatory Issues.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Biobanks Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Biobanks Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Biobanks Industry?

To stay informed about further developments, trends, and reports in the North America Biobanks Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence