Key Insights

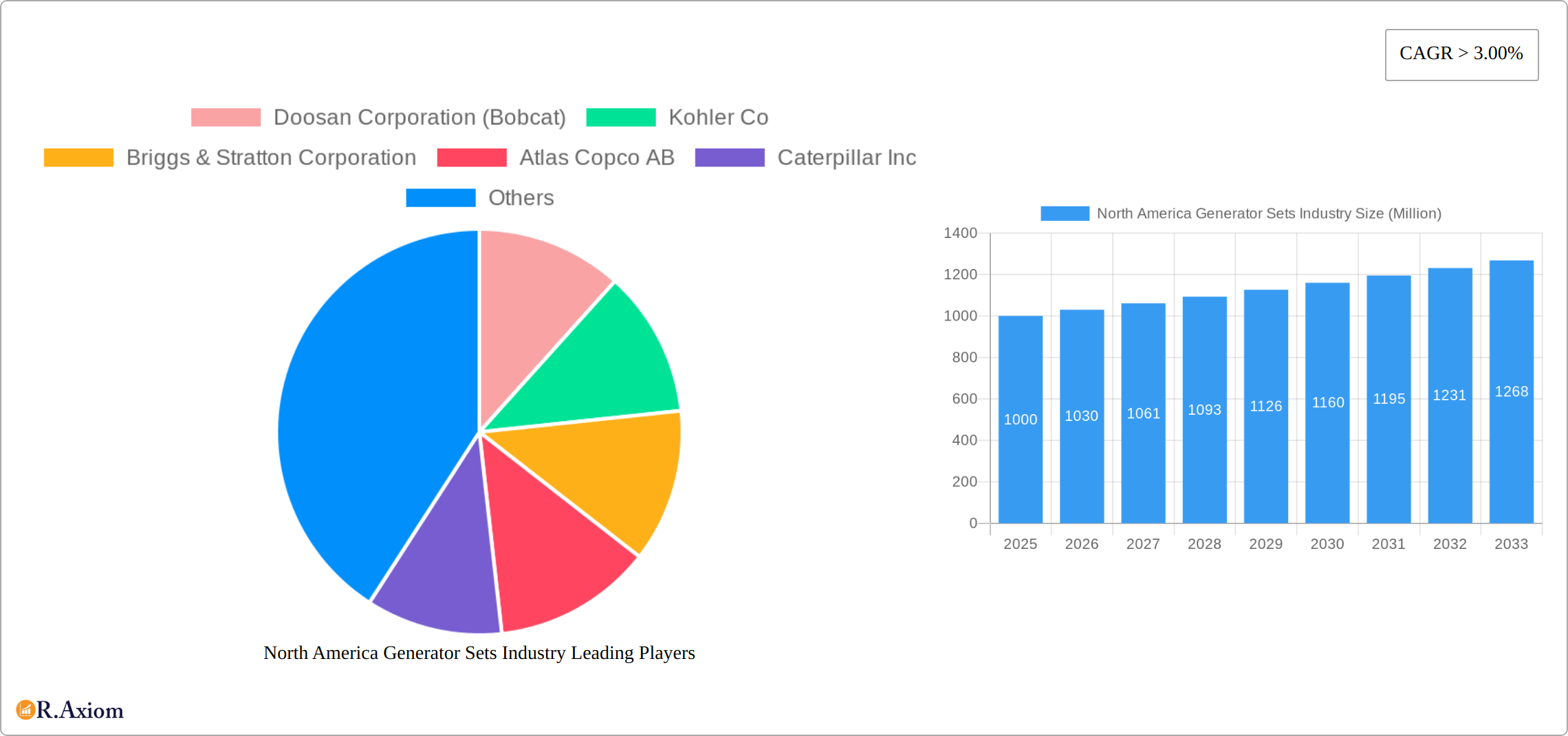

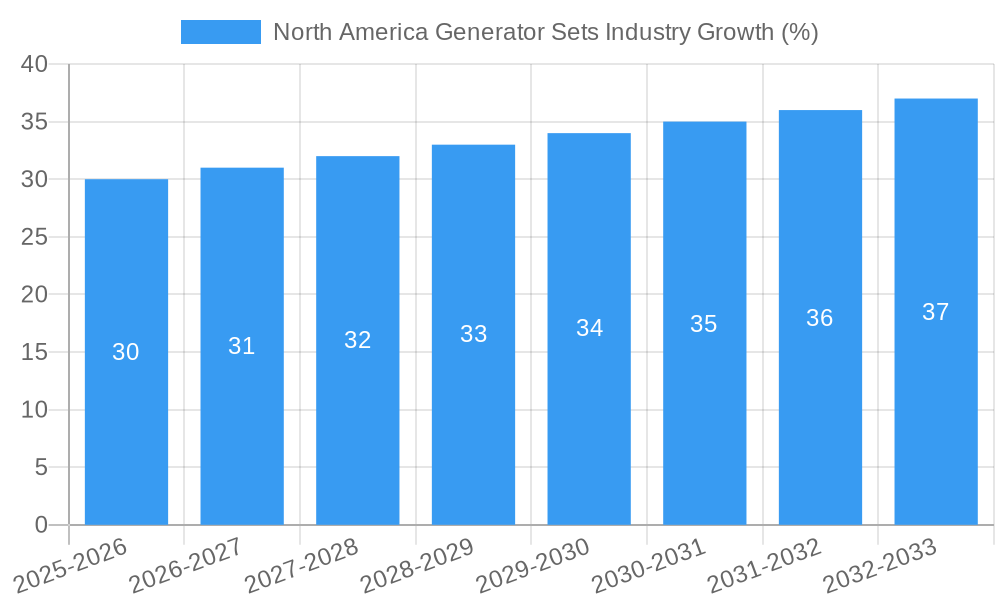

The North American generator sets market, valued at approximately $XX million in 2025, is projected to experience robust growth, exceeding a 3% CAGR through 2033. This expansion is fueled by several key factors. Increasing demand for reliable backup power across residential, commercial, and industrial sectors, particularly in regions prone to natural disasters and power outages, is a primary driver. The rising adoption of renewable energy sources, while posing a potential long-term challenge, currently presents opportunities for hybrid generator systems, combining renewable energy with traditional fuel sources to enhance grid stability and resilience. Furthermore, stringent emission regulations are pushing the market towards cleaner fuel options like natural gas, contributing to market segmentation and technological advancements. Leading players like Generac, Cummins, and Caterpillar are driving innovation through advanced technologies such as smart controls, remote monitoring, and improved fuel efficiency, catering to diverse customer needs and boosting market growth.

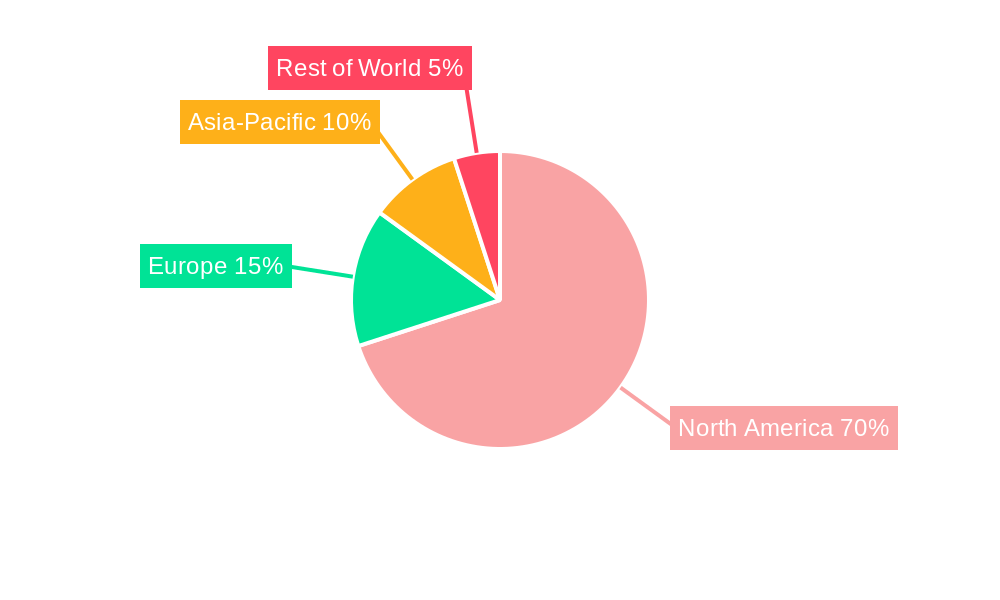

However, certain restraints are influencing market dynamics. Fluctuations in fuel prices, particularly diesel, can significantly impact operational costs and consumer demand. The relatively high upfront investment cost of generator sets can act as a barrier for smaller businesses and individual consumers. Furthermore, the increasing prevalence of microgrids and distributed generation could eventually lead to a slower growth rate compared to the current projections, necessitating manufacturers to adapt their product offerings and strategies to remain competitive. The market is segmented based on end-user (residential, commercial, industrial) and fuel type (diesel, natural gas, others), with the residential segment currently displaying strong growth potential due to rising concerns about power reliability. Regional variations are expected, with the United States likely holding the largest share of the North American market, followed by Canada and Mexico. Growth will hinge on manufacturers' ability to innovate, adapt to regulatory changes, and offer cost-effective, efficient, and environmentally friendly solutions.

This in-depth report provides a comprehensive analysis of the North America generator sets industry, encompassing market size, segmentation, key players, growth drivers, challenges, and future outlook. The study period covers 2019-2033, with 2025 as the base and estimated year. This report is an indispensable resource for industry stakeholders, investors, and anyone seeking to understand this dynamic market.

North America Generator Sets Industry Market Concentration & Innovation

The North America generator sets market exhibits a moderately concentrated landscape, with a handful of major players holding significant market share. Generac Holdings Inc., Cummins Inc., and Caterpillar Inc. are among the dominant players, collectively accounting for an estimated xx% of the market in 2025. However, the presence of several smaller, specialized companies fosters innovation and competition. Market share fluctuations are influenced by factors such as product launches, technological advancements, and M&A activities. Recent M&A deals, while not publicly disclosed in their full value, have involved smaller players being acquired by larger corporations, further consolidating the market.

- Innovation Drivers: Growing demand for reliable backup power, increasing adoption of renewable energy sources, and stringent emission regulations are driving innovation in generator set technology. This includes the development of more efficient, cleaner, and quieter generators.

- Regulatory Frameworks: Environmental regulations, particularly those related to emissions, significantly impact the industry. Compliance costs influence pricing and product development strategies.

- Product Substitutes: Uninterruptible Power Supplies (UPS) systems and other alternative power solutions present some level of competition, particularly in niche segments. However, generator sets still maintain dominance in many applications due to their high power output capabilities.

- End-User Trends: The industrial sector accounts for the largest share of generator set demand, followed by the commercial sector. The residential segment is also showing growth, driven by increased awareness of power outage risks.

- M&A Activities: Consolidation through mergers and acquisitions is expected to continue, further shaping the market landscape and leading to increased competitiveness. The estimated value of M&A deals within this sector for 2024 was approximately xx Million.

North America Generator Sets Industry Industry Trends & Insights

The North America generator sets market is experiencing robust growth, driven primarily by increasing electricity demand, rising frequency of power outages, and the expanding adoption of backup power solutions across various sectors. The market is projected to exhibit a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Market penetration of generator sets is highest in regions with unreliable power grids, such as certain areas in the southern US. Technological disruptions, such as the integration of smart grid technologies and advancements in fuel cell technology, are significantly reshaping the industry. Consumer preferences are shifting towards environmentally friendly and energy-efficient solutions. Competitive dynamics are intense, with major players focusing on product innovation, technological advancements, and strategic partnerships to gain a competitive edge. This includes partnerships to offer integrated renewable power solutions.

Dominant Markets & Segments in North America Generator Sets Industry

The industrial sector represents the largest segment within the North America generator sets market. This is fueled by high demand in diverse applications within manufacturing, construction, oil and gas, and data centers. The demand for diesel generator sets dominates the market by fuel type, due to their reliability and high power output. However, the market share of natural gas generators is gradually growing due to increased environmental consciousness and lower emission profiles.

Key Drivers for Industrial Segment Dominance:

- High power requirements: Industrial processes often demand significant power.

- Backup power necessity: Power outages can disrupt production, leading to financial losses.

- Remote locations: Many industrial operations are in remote areas with unreliable grids.

Geographic Dominance: The largest market for generator sets lies within the US, driven by its large industrial base and geographically varied power grid reliability. Canada follows as a significant market, with consistent growth potential.

Fuel Type Dominance: Diesel generators hold the largest market share due to their reliability and power output. Natural gas generators show increasing growth due to emissions concerns and relative cost-effectiveness.

North America Generator Sets Industry Product Developments

Recent product developments focus on enhancing efficiency, reducing emissions, and improving overall performance. Manufacturers are integrating advanced control systems, incorporating hybrid technologies (combining diesel with renewables), and exploring the use of hydrogen fuel cells. These advancements cater to the growing demand for sustainable and reliable power solutions. The market is seeing the introduction of more compact and lightweight generators, meeting demands for versatile and portable power options.

Report Scope & Segmentation Analysis

This report segments the North America generator sets market by end-user (residential, commercial, industrial) and fuel type (diesel, natural gas, others). The industrial segment displays the highest growth potential due to its substantial demand, followed by the commercial sector. The residential segment shows slower but steady growth due to increased power outage concerns and rising energy costs. Diesel remains the dominant fuel type, although natural gas and other alternative fuels are gaining traction due to environmental regulations and cost benefits. Growth projections for each segment are provided in the main report, incorporating market size data and competitive dynamics analysis.

Key Drivers of North America Generator Sets Industry Growth

The North America generator sets market is driven by several factors. The rising demand for reliable backup power due to increasing power outages and grid instability is a significant driver. Furthermore, the growth of industries with high power requirements (like data centers and manufacturing) fuels demand. Government initiatives promoting renewable energy and stricter emission regulations are also influencing the market toward cleaner and more sustainable solutions.

Challenges in the North America Generator Sets Industry Sector

Several challenges hinder the North America generator sets market. Stringent emission regulations increase compliance costs and limit the market share of older, less efficient generators. Supply chain disruptions, particularly concerning raw materials and components, can impact production and pricing. Intense competition among established players and the emergence of new entrants create pressures on profit margins. These issues collectively influence the overall market growth trajectory, potentially decreasing the CAGR by an estimated xx%.

Emerging Opportunities in North America Generator Sets Industry

Emerging opportunities exist in several areas. The integration of renewable energy sources with generator sets presents a significant opportunity to meet growing sustainability requirements. The expanding demand for portable and lightweight generators offers potential for increased market penetration in the construction and event sectors. The adoption of advanced technologies like hydrogen fuel cells and smart grid integration holds significant growth potential for innovative generator sets.

Leading Players in the North America Generator Sets Industry Market

- Doosan Corporation (Bobcat)

- Kohler Co

- Briggs & Stratton Corporation

- Atlas Copco AB

- Caterpillar Inc

- GeneratorJoe Inc

- Cummins Inc

- Grupel SA

- Himoinsa (Yanmar Co Ltd )

- Generac Holdings Inc

- Genesal Energy

- Rolls-Royce Holding PLC

Key Developments in North America Generator Sets Industry Industry

June 2022: Cummins Inc. launched the C1000D6RE, a 1MW twin-pack diesel generator, expanding its rental power solutions. This launch significantly impacted the rental segment of the market, boosting Cummins's competitiveness.

October 2022: Generac Power Systems partnered with EODev to distribute GEH2 hydrogen fuel cell generators in North America. This strategic move positions Generac as a leader in zero-emission power solutions, addressing growing environmental concerns.

Strategic Outlook for North America Generator Sets Industry Market

The North America generator sets market holds significant growth potential driven by increasing power demand, infrastructure development, and the growing adoption of renewable energy. The shift towards sustainable and efficient power generation presents considerable opportunities for companies that innovate in areas such as hydrogen fuel cell technology and hybrid power systems. Further market consolidation through M&A activity is expected, leading to a more concentrated but competitive landscape. The market's future will be shaped by technological advancements, regulatory changes, and the need for resilient and reliable power solutions across various sectors.

North America Generator Sets Industry Segmentation

-

1. Fuel Type

- 1.1. Diesel

- 1.2. Natural Gas

- 1.3. Others

-

2. End-User

- 2.1. Residential

- 2.2. Commercial

- 2.3. Industrial

-

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Mexico

North America Generator Sets Industry Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

North America Generator Sets Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 3.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Corporate Sustainability Goals4.; Stringent Regultions and Compliance

- 3.3. Market Restrains

- 3.3.1. 4.; High Complexity in Carbon Accounting

- 3.4. Market Trends

- 3.4.1. Diesel Segment Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Generator Sets Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Fuel Type

- 5.1.1. Diesel

- 5.1.2. Natural Gas

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.2.3. Industrial

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Mexico

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Fuel Type

- 6. United States North America Generator Sets Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Fuel Type

- 6.1.1. Diesel

- 6.1.2. Natural Gas

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by End-User

- 6.2.1. Residential

- 6.2.2. Commercial

- 6.2.3. Industrial

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Mexico

- 6.1. Market Analysis, Insights and Forecast - by Fuel Type

- 7. Canada North America Generator Sets Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Fuel Type

- 7.1.1. Diesel

- 7.1.2. Natural Gas

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by End-User

- 7.2.1. Residential

- 7.2.2. Commercial

- 7.2.3. Industrial

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Mexico

- 7.1. Market Analysis, Insights and Forecast - by Fuel Type

- 8. Mexico North America Generator Sets Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Fuel Type

- 8.1.1. Diesel

- 8.1.2. Natural Gas

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by End-User

- 8.2.1. Residential

- 8.2.2. Commercial

- 8.2.3. Industrial

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Mexico

- 8.1. Market Analysis, Insights and Forecast - by Fuel Type

- 9. United States North America Generator Sets Industry Analysis, Insights and Forecast, 2019-2031

- 10. Canada North America Generator Sets Industry Analysis, Insights and Forecast, 2019-2031

- 11. Mexico North America Generator Sets Industry Analysis, Insights and Forecast, 2019-2031

- 12. Rest of North America North America Generator Sets Industry Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Doosan Corporation (Bobcat)

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Kohler Co

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Briggs & Stratton Corporation

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Atlas Copco AB

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Caterpillar Inc

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 GeneratorJoe Inc

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Cummins Inc

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Grupel SA

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Himoinsa (Yanmar Co Ltd )

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Generac Holdings Inc

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Genesal Energy

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 Rolls-Royce Holding PLC

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.1 Doosan Corporation (Bobcat)

List of Figures

- Figure 1: North America Generator Sets Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Generator Sets Industry Share (%) by Company 2024

List of Tables

- Table 1: North America Generator Sets Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Generator Sets Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: North America Generator Sets Industry Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 4: North America Generator Sets Industry Volume K Unit Forecast, by Fuel Type 2019 & 2032

- Table 5: North America Generator Sets Industry Revenue Million Forecast, by End-User 2019 & 2032

- Table 6: North America Generator Sets Industry Volume K Unit Forecast, by End-User 2019 & 2032

- Table 7: North America Generator Sets Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 8: North America Generator Sets Industry Volume K Unit Forecast, by Geography 2019 & 2032

- Table 9: North America Generator Sets Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 10: North America Generator Sets Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 11: North America Generator Sets Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 12: North America Generator Sets Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 13: United States North America Generator Sets Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: United States North America Generator Sets Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 15: Canada North America Generator Sets Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Canada North America Generator Sets Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 17: Mexico North America Generator Sets Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Mexico North America Generator Sets Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 19: Rest of North America North America Generator Sets Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Rest of North America North America Generator Sets Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 21: North America Generator Sets Industry Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 22: North America Generator Sets Industry Volume K Unit Forecast, by Fuel Type 2019 & 2032

- Table 23: North America Generator Sets Industry Revenue Million Forecast, by End-User 2019 & 2032

- Table 24: North America Generator Sets Industry Volume K Unit Forecast, by End-User 2019 & 2032

- Table 25: North America Generator Sets Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 26: North America Generator Sets Industry Volume K Unit Forecast, by Geography 2019 & 2032

- Table 27: North America Generator Sets Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 28: North America Generator Sets Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 29: North America Generator Sets Industry Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 30: North America Generator Sets Industry Volume K Unit Forecast, by Fuel Type 2019 & 2032

- Table 31: North America Generator Sets Industry Revenue Million Forecast, by End-User 2019 & 2032

- Table 32: North America Generator Sets Industry Volume K Unit Forecast, by End-User 2019 & 2032

- Table 33: North America Generator Sets Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 34: North America Generator Sets Industry Volume K Unit Forecast, by Geography 2019 & 2032

- Table 35: North America Generator Sets Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 36: North America Generator Sets Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 37: North America Generator Sets Industry Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 38: North America Generator Sets Industry Volume K Unit Forecast, by Fuel Type 2019 & 2032

- Table 39: North America Generator Sets Industry Revenue Million Forecast, by End-User 2019 & 2032

- Table 40: North America Generator Sets Industry Volume K Unit Forecast, by End-User 2019 & 2032

- Table 41: North America Generator Sets Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 42: North America Generator Sets Industry Volume K Unit Forecast, by Geography 2019 & 2032

- Table 43: North America Generator Sets Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 44: North America Generator Sets Industry Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Generator Sets Industry?

The projected CAGR is approximately > 3.00%.

2. Which companies are prominent players in the North America Generator Sets Industry?

Key companies in the market include Doosan Corporation (Bobcat), Kohler Co, Briggs & Stratton Corporation, Atlas Copco AB, Caterpillar Inc, GeneratorJoe Inc, Cummins Inc, Grupel SA, Himoinsa (Yanmar Co Ltd ), Generac Holdings Inc, Genesal Energy, Rolls-Royce Holding PLC.

3. What are the main segments of the North America Generator Sets Industry?

The market segments include Fuel Type, End-User, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Corporate Sustainability Goals4.; Stringent Regultions and Compliance.

6. What are the notable trends driving market growth?

Diesel Segment Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; High Complexity in Carbon Accounting.

8. Can you provide examples of recent developments in the market?

October 2022: Generac Power Systems, a leading global designer and manufacturer of energy technology solutions and other power products, and EODev, a French developer and manufacturer of zero-emission hydrogen fuel cell power generators, announced a formal distribution agreement. Generac will offer EODev's GEH2 generators, a large-scale, zero-emissions hydrogen fuel cell power generator, to the North American market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Generator Sets Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Generator Sets Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Generator Sets Industry?

To stay informed about further developments, trends, and reports in the North America Generator Sets Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence