Key Insights

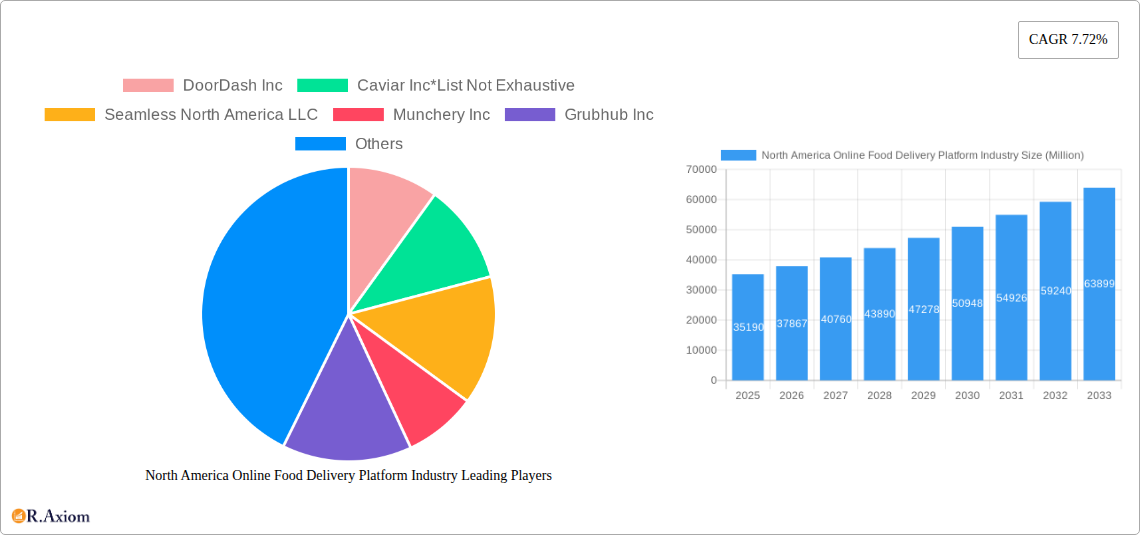

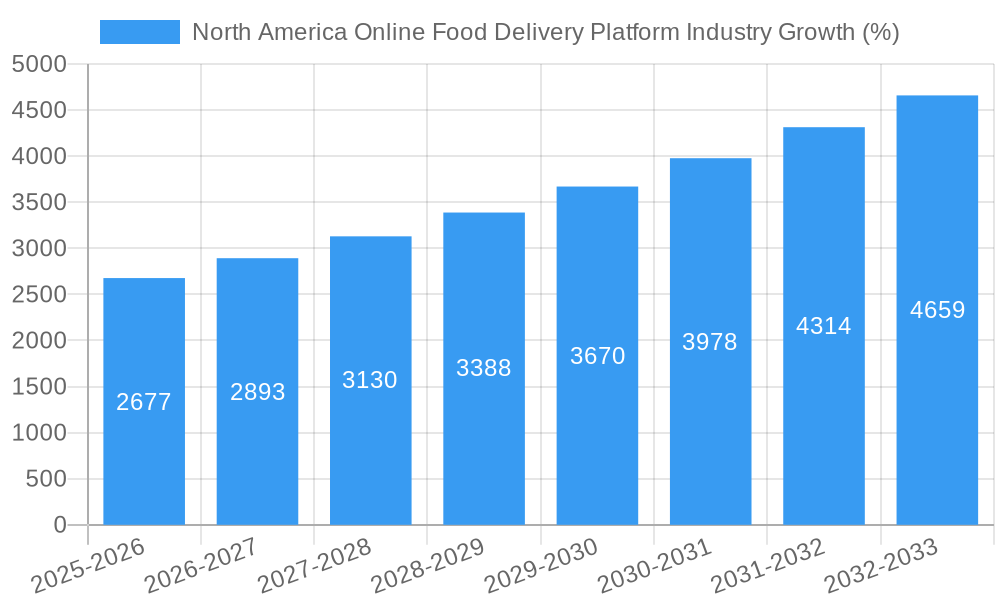

The North American online food delivery platform industry is experiencing robust growth, projected to reach a market size of $35.19 billion in 2025, with a Compound Annual Growth Rate (CAGR) of 7.72% from 2025 to 2033. This expansion is fueled by several key factors. The increasing adoption of smartphones and readily available high-speed internet access has significantly broadened the reach and convenience of online food ordering. Consumer preference for convenience, coupled with busy lifestyles and a growing demand for diverse culinary options, continues to drive market expansion. Furthermore, strategic partnerships between delivery platforms and restaurants, along with innovative features such as pre-ordering, real-time tracking, and personalized recommendations, are enhancing the overall user experience and driving customer loyalty. Competition remains intense amongst major players like DoorDash, Grubhub, Uber Eats, and others, leading to continuous improvements in service quality, delivery speed, and pricing strategies.

However, the market isn't without challenges. Rising operational costs, including driver wages and logistics, pose a significant hurdle to profitability. Maintaining consistent service quality and addressing concerns around food safety and hygiene are crucial aspects for sustained growth. Additionally, regulatory changes and evolving consumer expectations concerning sustainability and ethical sourcing practices require continuous adaptation from industry players. The market’s geographic concentration in major metropolitan areas presents both an opportunity and a limitation for future expansion. Future growth will likely be driven by increased penetration into smaller cities and rural areas, alongside strategic investments in technological innovations to optimize delivery efficiency and enhance customer engagement. Expanding into adjacent services, such as grocery delivery and quick-commerce, offers substantial avenues for further market development.

North America Online Food Delivery Platform Industry: 2019-2033 Market Report

This comprehensive report provides a detailed analysis of the North America online food delivery platform industry, covering the period 2019-2033. It offers in-depth insights into market dynamics, competitive landscape, growth drivers, and future opportunities, empowering stakeholders to make informed strategic decisions. The report utilizes data from the historical period (2019-2024), base year (2025), and estimated year (2025) to forecast market trends until 2033.

North America Online Food Delivery Platform Industry Market Concentration & Innovation

This section analyzes the market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user trends, and mergers and acquisitions (M&A) activities within the North American online food delivery platform industry. The market is characterized by a high degree of competition among several key players, leading to significant M&A activity as companies strive for market share dominance.

Market Concentration: The industry displays an oligopolistic structure, with a few dominant players controlling a significant portion of the market. Market share data for 2024 indicates DoorDash holds approximately xx%, Grubhub holds approximately xx%, Uber Eats holds approximately xx%, and other players hold the remaining xx%. These figures are subject to constant fluctuation due to aggressive competition and strategic acquisitions.

Innovation Drivers: Key innovation drivers include advancements in delivery technologies (e.g., autonomous vehicles, drone delivery), improved mobile applications with enhanced user interfaces and personalized recommendations, and expansion into adjacent markets (e.g., grocery delivery, prescription delivery).

Regulatory Frameworks: Varying regulations across different states and provinces impact operational costs and market access. These regulations often focus on issues such as food safety, labor practices, and data privacy.

Product Substitutes: The primary substitutes are traditional restaurant dining and grocery store shopping. However, the convenience and expanding options offered by online food delivery platforms are increasingly compelling consumers to choose this method.

End-User Trends: Rising consumer disposable incomes, increasing urbanization, and changing lifestyle preferences contribute to the growth of the online food delivery market. The demand for convenience, particularly among younger demographics, drives adoption rates.

M&A Activities: The industry has witnessed significant M&A activity. For instance, DoorDash’s acquisition of Wolt Enterprises Oy in November 2021 for approximately USD 8 Billion demonstrates the pursuit of consolidation and expansion. The total value of M&A deals within this sector during the study period (2019-2024) is estimated at xx Billion.

North America Online Food Delivery Platform Industry Industry Trends & Insights

This section explores the key trends and insights shaping the North American online food delivery platform industry. The market has experienced phenomenal growth, fueled by several factors that have intensified since the COVID-19 pandemic.

The industry's Compound Annual Growth Rate (CAGR) during the historical period (2019-2024) was approximately xx%, and market penetration reached approximately xx% in 2024. This growth is anticipated to continue, albeit at a slightly moderated pace, during the forecast period (2025-2033), with a projected CAGR of approximately xx%. Several factors contribute to this trend:

Market Growth Drivers: The increasing prevalence of smartphones, rising internet penetration, expanding urban populations, and the convenience offered by online platforms are fundamental drivers. The COVID-19 pandemic acted as a significant catalyst, accelerating market growth considerably.

Technological Disruptions: The continuous integration of advanced technologies, such as AI-powered recommendation systems, real-time order tracking, and improved logistics, enhances the overall customer experience and operational efficiency. The potential for autonomous delivery systems represents a significant technological disruption.

Consumer Preferences: The evolving consumer landscape reflects a growing preference for convenience, speed, and variety. Consumers are increasingly willing to pay a premium for the ease and flexibility of online food delivery services.

Competitive Dynamics: Intense competition among major players is driving innovation, price wars, and strategic partnerships. The market is witnessing consolidation through mergers and acquisitions, leading to a more concentrated market landscape.

Dominant Markets & Segments in North America Online Food Delivery Platform Industry

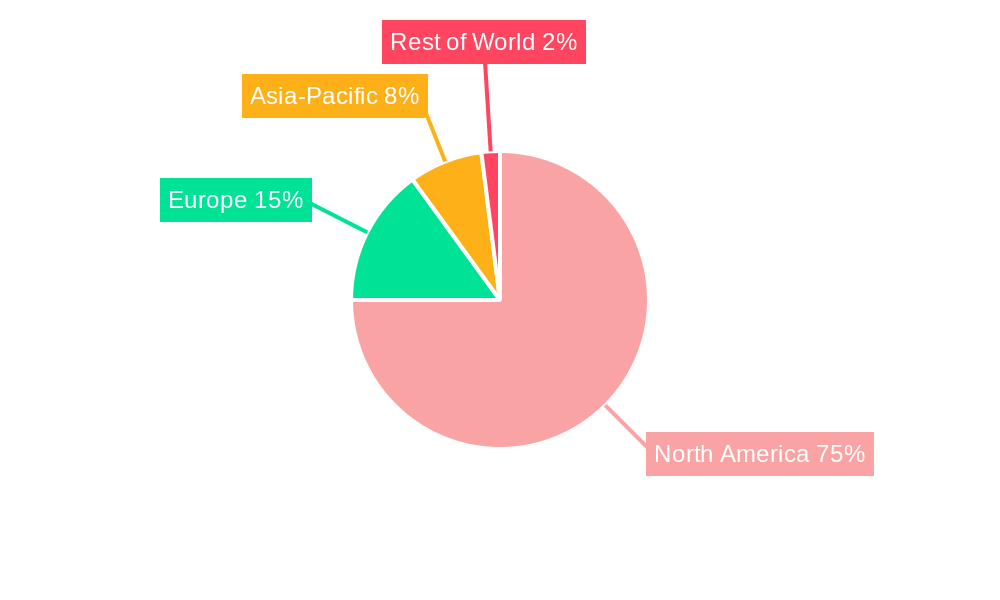

This section analyzes the dominant markets and segments within the North American online food delivery industry. Focusing on the United States and Canada, it identifies key drivers of dominance and highlights regional disparities.

The United States represents the dominant market, accounting for approximately xx% of the total market value in 2024. Canada comprises the remaining xx%. This disparity stems from several factors:

United States:

- Key Drivers: Higher population density in urban areas, higher disposable incomes, greater internet penetration, and a more established online ordering culture contribute significantly to the US market dominance.

- Dominance Analysis: The large and diverse restaurant landscape within the US, combined with a higher adoption rate of online food delivery services, fuels significant market growth. The presence of major players like DoorDash, Grubhub, and Uber Eats intensifies competition and accelerates innovation.

Canada:

- Key Drivers: Growing urban populations, increasing internet and smartphone penetration, and rising disposable incomes are fostering the expansion of the Canadian market.

- Dominance Analysis: While Canada's market is smaller than the US, it shows considerable growth potential, particularly in major metropolitan areas. The presence of international and domestic players fosters competition.

North America Online Food Delivery Platform Industry Product Developments

Recent product innovations focus on enhancing convenience and personalization. Platforms are integrating features such as advanced search filters, personalized recommendations, loyalty programs, and streamlined checkout processes. Technological advancements, such as AI-powered order optimization and real-time delivery tracking, improve efficiency and customer satisfaction. The market fit of these innovations is strong, directly addressing consumer demand for a more seamless and personalized experience.

Report Scope & Segmentation Analysis

This report segments the North America online food delivery platform market by country: the United States and Canada. Both markets are experiencing substantial growth. The United States market is characterized by high competition and a wide range of service offerings, while the Canadian market demonstrates strong growth potential. The competitive dynamics within each segment vary, with some experiencing more intense competition than others. Growth projections vary based on several factors, including economic conditions, consumer preferences, and regulatory changes.

Key Drivers of North America Online Food Delivery Platform Industry Growth

Several key factors are driving the growth of the North American online food delivery platform industry. The increasing penetration of smartphones and internet access provides widespread access to these platforms. The rising popularity of online ordering, fueled by convenience and a wider selection of restaurants, is a major growth driver. Furthermore, the changing lifestyles and increasing urbanization are influencing consumer demand. Finally, technological advancements, such as improved delivery logistics and sophisticated mobile applications, are improving customer experience.

Challenges in the North America Online Food Delivery Platform Industry Sector

The industry faces several challenges, including intense competition, fluctuating food costs, and stringent regulatory requirements impacting operational efficiency. Maintaining profitability amidst competitive pricing strategies and managing delivery driver costs present significant hurdles. Supply chain disruptions can also impact service reliability, while regulatory scrutiny relating to data privacy and labor practices necessitates compliance costs. These challenges collectively affect overall market profitability and growth.

Emerging Opportunities in North America Online Food Delivery Platform Industry

Expansion into new market segments, such as grocery delivery and prescription delivery, presents significant opportunities for growth. The integration of new technologies, including AI-powered recommendations, autonomous delivery, and drone delivery, promises to enhance operational efficiency and create new revenue streams. Focusing on customer loyalty programs and building personalized experiences through data analytics can further optimize revenue generation. Finally, exploring international expansion beyond North America represents a substantial long-term opportunity.

Leading Players in the North America Online Food Delivery Platform Industry Market

- DoorDash Inc

- Uber Technologies Inc (Uber Eats)

- Grubhub Inc

- Caviar Inc

- Seamless North America LLC

- Munchery Inc

- ChowNow

- goBrands Inc (goPuff Delivery)

Key Developments in North America Online Food Delivery Platform Industry Industry

- November 2021: DoorDash Inc. acquires Wolt Enterprises Oy for approximately USD 8 billion, significantly expanding its global footprint and competitive advantage.

- June 2021: Uber's Uber Eats business experiences substantial growth due to the increased demand during the COVID-19 pandemic, highlighting the resilience and adaptability of the platform.

Strategic Outlook for North America Online Food Delivery Platform Industry Market

The North American online food delivery platform market holds immense potential for future growth. Technological advancements, evolving consumer preferences, and expansion into new service segments will continue to drive market expansion. Companies that effectively leverage technology, build strong brand loyalty, and adapt to evolving regulations will be well-positioned to capitalize on future opportunities and achieve sustainable growth within this dynamic industry.

North America Online Food Delivery Platform Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

North America Online Food Delivery Platform Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Online Food Delivery Platform Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.72% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Smartphone Penetration and Surge in Internet Penetration; Launch of Appealing and User-friendly Apps

- 3.3. Market Restrains

- 3.3.1. Uncertain Regulatory Standards and Frameworks

- 3.4. Market Trends

- 3.4.1. Rise of Mobile Penetration in North America

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Online Food Delivery Platform Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. United States North America Online Food Delivery Platform Industry Analysis, Insights and Forecast, 2019-2031

- 7. Canada North America Online Food Delivery Platform Industry Analysis, Insights and Forecast, 2019-2031

- 8. Mexico North America Online Food Delivery Platform Industry Analysis, Insights and Forecast, 2019-2031

- 9. Rest of North America North America Online Food Delivery Platform Industry Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 DoorDash Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Caviar Inc*List Not Exhaustive

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Seamless North America LLC

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Munchery Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Grubhub Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 ChowNow

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 goBrands Inc (goPuff Delivery)

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Uber Technologies Inc (UberEats)

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.1 DoorDash Inc

List of Figures

- Figure 1: North America Online Food Delivery Platform Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Online Food Delivery Platform Industry Share (%) by Company 2024

List of Tables

- Table 1: North America Online Food Delivery Platform Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Online Food Delivery Platform Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 3: North America Online Food Delivery Platform Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 4: North America Online Food Delivery Platform Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 5: North America Online Food Delivery Platform Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 6: North America Online Food Delivery Platform Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 7: North America Online Food Delivery Platform Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 8: North America Online Food Delivery Platform Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 9: United States North America Online Food Delivery Platform Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Canada North America Online Food Delivery Platform Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Mexico North America Online Food Delivery Platform Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of North America North America Online Food Delivery Platform Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: North America Online Food Delivery Platform Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 14: North America Online Food Delivery Platform Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 15: North America Online Food Delivery Platform Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 16: North America Online Food Delivery Platform Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 17: North America Online Food Delivery Platform Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 18: North America Online Food Delivery Platform Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 19: United States North America Online Food Delivery Platform Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Canada North America Online Food Delivery Platform Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Mexico North America Online Food Delivery Platform Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Online Food Delivery Platform Industry?

The projected CAGR is approximately 7.72%.

2. Which companies are prominent players in the North America Online Food Delivery Platform Industry?

Key companies in the market include DoorDash Inc, Caviar Inc*List Not Exhaustive, Seamless North America LLC, Munchery Inc, Grubhub Inc, ChowNow, goBrands Inc (goPuff Delivery), Uber Technologies Inc (UberEats).

3. What are the main segments of the North America Online Food Delivery Platform Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 35.19 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Smartphone Penetration and Surge in Internet Penetration; Launch of Appealing and User-friendly Apps.

6. What are the notable trends driving market growth?

Rise of Mobile Penetration in North America.

7. Are there any restraints impacting market growth?

Uncertain Regulatory Standards and Frameworks.

8. Can you provide examples of recent developments in the market?

November 2021 - DoorDash Inc., DoorDash Inc said it's buying Finnish food-delivery startup Wolt Enterprises Oy for about USD 8 billion. The biggest meal-delivery service in the U.S. said it's buying Finnish food-delivery startup Wolt Enterprises Oy for about $8 billion as it seeks to stay ahead of rivals in the race to satisfy soaring demand for the fast delivery of everything from food to prescriptions and pet supplies.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Online Food Delivery Platform Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Online Food Delivery Platform Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Online Food Delivery Platform Industry?

To stay informed about further developments, trends, and reports in the North America Online Food Delivery Platform Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence