Key Insights

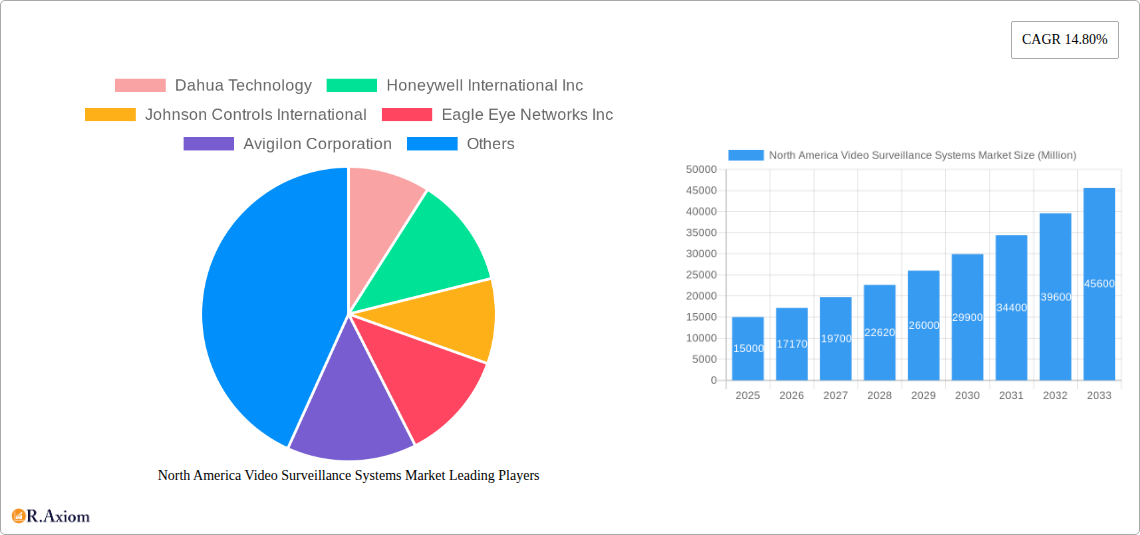

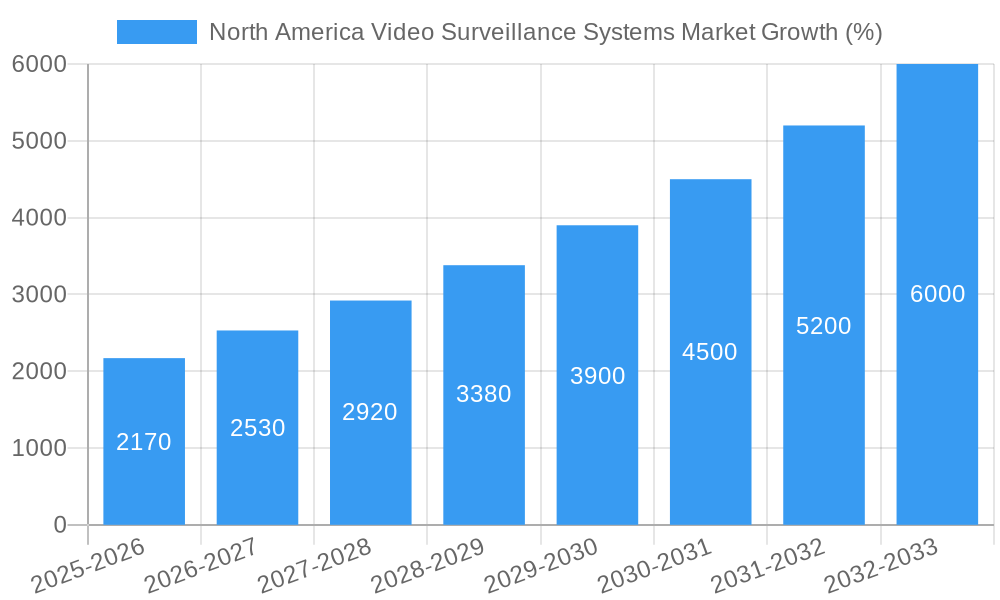

The North American video surveillance systems market is experiencing robust growth, driven by increasing security concerns across commercial, residential, and governmental sectors. The market, valued at approximately $XX million in 2025 (assuming a logical extrapolation from the provided CAGR and market size), is projected to expand at a Compound Annual Growth Rate (CAGR) of 14.80% from 2025 to 2033. This significant growth is fueled by several key factors. The rising adoption of cloud-based Video Surveillance as a Service (VSaaS) solutions offers scalability and cost-effectiveness, attracting a wider range of users. Furthermore, technological advancements in areas like high-definition IP cameras, advanced analytics (like facial recognition and license plate recognition), and improved storage solutions are driving market expansion. The increasing integration of video surveillance systems with other security technologies, such as access control and intrusion detection, further contributes to this growth trajectory. Government initiatives promoting enhanced security infrastructure and the growing adoption of smart city technologies are also significantly impacting the market.

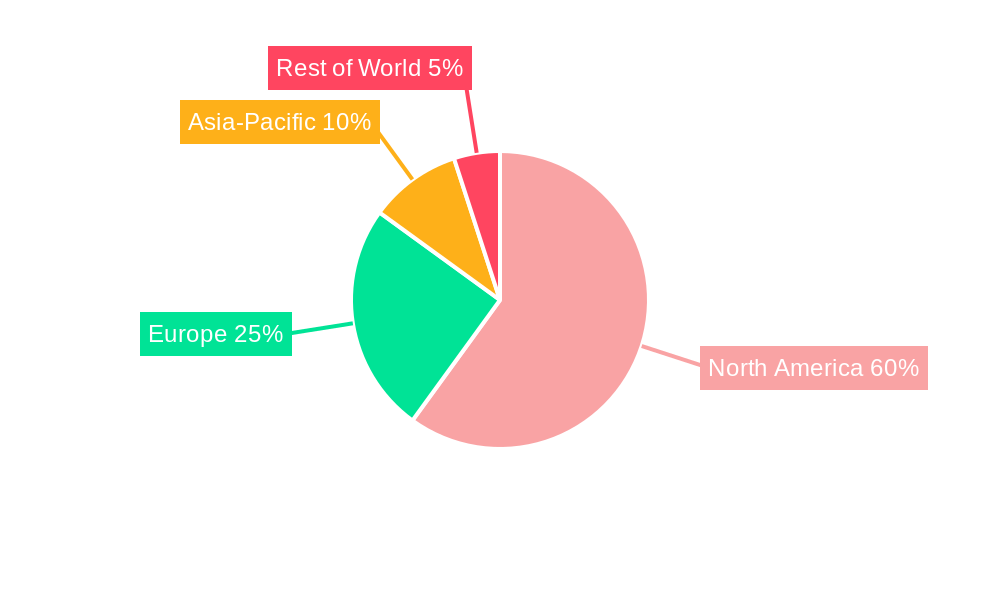

Within North America, the United States and Canada represent the largest market segments, propelled by high levels of technological adoption and robust security infrastructure investments. However, Mexico and the Rest of North America also present promising growth opportunities, particularly as security awareness increases and the adoption of modern video surveillance technologies expands. The market is segmented by component (hardware and software), camera type (analog, IP, hybrid), and end-user (commercial, infrastructure, industrial, institutional, residential, and government). The IP camera segment is expected to dominate due to its superior features and capabilities compared to analog and hybrid systems. Similarly, the commercial sector, driven by businesses' need for enhanced security and loss prevention, is expected to show strong growth throughout the forecast period. Competitive pressures are shaping the market, with prominent players like Dahua Technology, Honeywell, Johnson Controls, and others constantly innovating to offer advanced features and competitive pricing strategies. The market's future prospects remain bright, propelled by sustained technological advancements, increased security awareness, and the continued expansion of smart city initiatives across North America.

North America Video Surveillance Systems Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the North America video surveillance systems market, encompassing historical data (2019-2024), current estimations (2025), and future forecasts (2025-2033). It delves into market dynamics, key players, emerging trends, and growth opportunities, offering actionable insights for industry stakeholders. The base year for this analysis is 2025. The report covers key segments including Video Management Software (including Video as a Service - VSaaS), hardware components (cameras – analog, IP, hybrid – and storage – software), and end-user applications across commercial, infrastructure, industrial, institutional, residential, and government sectors in the United States and Canada.

North America Video Surveillance Systems Market Concentration & Innovation

The North America video surveillance systems market exhibits a moderately concentrated landscape, with a few dominant players capturing significant market share. However, the market is also characterized by a considerable number of smaller, specialized firms offering niche solutions. The top five players – Dahua Technology, Honeywell International Inc, Johnson Controls International, Avigilon Corporation, and Samsara Inc – collectively hold an estimated xx% market share in 2025. This concentration is partly driven by economies of scale and established distribution networks. However, continuous innovation, particularly in areas like AI-powered analytics, cloud-based solutions (VSaaS), and cybersecurity features, fosters competition and provides opportunities for smaller players to gain a foothold.

Market innovation is primarily fueled by the increasing demand for advanced functionalities, including improved video quality, intelligent analytics (object detection, facial recognition), and seamless integration with other security systems. Regulatory frameworks, such as data privacy regulations (e.g., GDPR, CCPA), are influencing product development and driving demand for compliant solutions. Product substitutes, such as advanced access control systems, are also impacting the market, though video surveillance remains a critical security component. End-user trends favor cloud-based solutions and remote accessibility, while strategic mergers and acquisitions (M&A) are shaping the competitive landscape. Notable M&A activities in recent years have involved deals with values ranging from xx Million to xx Million, mainly focused on consolidating market share and expanding technological capabilities.

North America Video Surveillance Systems Market Industry Trends & Insights

The North America video surveillance systems market is experiencing robust growth, projected to register a CAGR of xx% during the forecast period (2025-2033). This growth is primarily driven by factors such as increasing security concerns across various sectors, technological advancements (e.g., higher resolution cameras, AI-powered analytics), and rising adoption of cloud-based video surveillance solutions (VSaaS). Market penetration of IP cameras continues to increase, replacing traditional analog systems, driven by advantages in image quality, scalability, and network integration. Consumer preferences are shifting towards user-friendly interfaces, remote monitoring capabilities, and cost-effective solutions. The competitive landscape is highly dynamic, with established players constantly innovating and new entrants leveraging technological advancements. The market exhibits a high degree of fragmentation with both large multinational corporations and smaller specialized firms vying for market share. Increased focus on cybersecurity is a key trend due to the rising threat of cyberattacks targeting video surveillance systems.

Dominant Markets & Segments in North America Video Surveillance Systems Market

Leading Region: The United States dominates the North America video surveillance systems market, accounting for xx% of the total market value in 2025. This dominance is attributed to factors such as a strong economy, advanced technological infrastructure, and high security spending across various sectors.

Leading Country: The United States maintains a clear leadership position due to its large market size, higher security concerns across various sectors (commercial, government, residential), and continuous investment in technological upgrades.

Dominant Segments:

- By End-User: The commercial sector is the largest end-user segment, driven by increasing business needs for security and safety. The government sector follows closely with high spending on security infrastructure.

- By Component: Hardware constitutes the largest market segment, particularly IP cameras, due to their superior functionality and growing adoption.

- By Video Management Software: VSaaS is experiencing rapid growth, fueled by its cost-effectiveness, scalability, and ease of access.

Key Drivers:

- Strong economic growth in the US.

- Increasing security awareness.

- Technological advancements such as AI and Cloud.

- Government investments in critical infrastructure security.

North America Video Surveillance Systems Market Product Developments

Recent product developments in the North America video surveillance systems market focus heavily on integrating advanced analytics, such as AI-powered object detection and facial recognition, into camera systems and VMS platforms. There's also a strong trend towards cloud-based solutions (VSaaS) offering remote access, scalability, and cost-effectiveness. This trend is enhanced by the development of higher-resolution cameras, improved cybersecurity features, and seamless integration with other security technologies (access control, intrusion detection). These innovations cater to increasing end-user demands for enhanced security, efficiency, and ease of use.

Report Scope & Segmentation Analysis

This report segments the North America video surveillance systems market across several key parameters:

- By Video Management Software: The market is segmented into on-premise and cloud-based (VSaaS) solutions. VSaaS is expected to witness significant growth due to its flexibility and cost-effectiveness.

- By End-User: The report analyzes the market across commercial, infrastructure, industrial, institutional, residential, and government sectors.

- By Country: The report focuses on the United States and Canada. The US market holds a significantly larger share.

- By Component: The market is segmented into hardware (cameras - analog, IP, hybrid - and storage - software). IP cameras are the fastest-growing hardware segment.

Key Drivers of North America Video Surveillance Systems Market Growth

The market's growth is driven by several key factors: rising security concerns, particularly in commercial and government sectors, leading to increased investment in security systems; technological advancements resulting in higher-resolution cameras, advanced analytics (AI and machine learning), and cloud-based solutions (VSaaS); favorable government regulations and policies supporting the deployment of advanced security infrastructure; and the increasing adoption of smart city initiatives, enhancing the demand for integrated surveillance systems.

Challenges in the North America Video Surveillance Systems Market Sector

Key challenges include high initial investment costs for advanced systems, concerns about data privacy and security breaches, complexities associated with integrating various security technologies, and the need for skilled personnel to manage and maintain these systems. Supply chain disruptions can also impact the availability of components and increase costs. The competitive landscape with numerous established and emerging players also creates pressure on pricing and profitability.

Emerging Opportunities in North America Video Surveillance Systems Market

Emerging opportunities include the integration of video surveillance with other technologies like IoT and blockchain for enhanced security and data management. The growing demand for AI-powered analytics opens doors for developing more sophisticated solutions for threat detection and prevention. Expansion into new markets, such as smart homes and smart cities, presents considerable potential. Focus on improving cybersecurity features and complying with data privacy regulations will also create significant market opportunities.

Leading Players in the North America Video Surveillance Systems Market Market

- Dahua Technology

- Honeywell International Inc

- Johnson Controls International

- Eagle Eye Networks Inc

- Avigilon Corporation

- Samsara Inc

- Genetec Inc

- AV Costar

- Napco Security Technologies Inc

- March Networks

Key Developments in North America Video Surveillance Systems Market Industry

- November 2021: CBC AMERICA announced a strategic business alliance with NAPCO Security Technologies, Inc., integrating Ganz CORTROL Video Management Software with Napco Access Solutions. This collaboration expands the market reach of both companies and offers a more comprehensive security solution.

- January 2022: Dahua Technology launched a Three-in-One Camera (TiOC) featuring warm-light LEDs, an active alarm, and two-way talk, enhancing security and deterring unwanted behavior. This product innovation demonstrates the trend towards integrating multiple security features into a single device.

Strategic Outlook for North America Video Surveillance Systems Market Market

The North America video surveillance systems market is poised for sustained growth, driven by technological advancements, increasing security concerns, and the expanding adoption of cloud-based solutions. Future opportunities lie in the integration of AI, IoT, and blockchain technologies to enhance security and data management capabilities. The market will continue to witness a dynamic competitive landscape with both established players and emerging companies vying for market share through innovation and strategic partnerships. Focus on cybersecurity, data privacy, and user-friendly interfaces will be crucial for success.

North America Video Surveillance Systems Market Segmentation

-

1. Component

-

1.1. Hardware

-

1.1.1. Camera

- 1.1.1.1. Analog

- 1.1.1.2. IP Cameras

- 1.1.1.3. Hybrid

- 1.1.2. Storage

-

1.1.1. Camera

-

1.2. Software

- 1.2.1. Video Analytics

- 1.2.2. Video Management Software

- 1.3. Video as a Service (VSaaS)

-

1.1. Hardware

-

2. End-User

- 2.1. Commercial

- 2.2. Infrastructure

- 2.3. Industrial

- 2.4. Institutional

- 2.5. Residential

- 2.6. Government

North America Video Surveillance Systems Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Video Surveillance Systems Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 14.80% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Widespread Application of Video Surveillance Systems in Retail and Commercial Establishments; Increasing Adoption of Facial Surveillance

- 3.3. Market Restrains

- 3.3.1. Vulnerable To Security Attacks; Redundancy And Lack Of Interoperability

- 3.4. Market Trends

- 3.4.1. Hardware Segment to Hold a Major Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Video Surveillance Systems Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Hardware

- 5.1.1.1. Camera

- 5.1.1.1.1. Analog

- 5.1.1.1.2. IP Cameras

- 5.1.1.1.3. Hybrid

- 5.1.1.2. Storage

- 5.1.1.1. Camera

- 5.1.2. Software

- 5.1.2.1. Video Analytics

- 5.1.2.2. Video Management Software

- 5.1.3. Video as a Service (VSaaS)

- 5.1.1. Hardware

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Commercial

- 5.2.2. Infrastructure

- 5.2.3. Industrial

- 5.2.4. Institutional

- 5.2.5. Residential

- 5.2.6. Government

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. United States North America Video Surveillance Systems Market Analysis, Insights and Forecast, 2019-2031

- 7. Canada North America Video Surveillance Systems Market Analysis, Insights and Forecast, 2019-2031

- 8. Mexico North America Video Surveillance Systems Market Analysis, Insights and Forecast, 2019-2031

- 9. Rest of North America North America Video Surveillance Systems Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Dahua Technology

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Honeywell International Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Johnson Controls International

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Eagle Eye Networks Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Avigilon Corporation

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Samsara Inc *List Not Exhaustive

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Genetec Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 AV Costar

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Napco Security Technologies Inc

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 March Networks

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Dahua Technology

List of Figures

- Figure 1: North America Video Surveillance Systems Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Video Surveillance Systems Market Share (%) by Company 2024

List of Tables

- Table 1: North America Video Surveillance Systems Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Video Surveillance Systems Market Revenue Million Forecast, by Component 2019 & 2032

- Table 3: North America Video Surveillance Systems Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 4: North America Video Surveillance Systems Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: North America Video Surveillance Systems Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States North America Video Surveillance Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada North America Video Surveillance Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico North America Video Surveillance Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Rest of North America North America Video Surveillance Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: North America Video Surveillance Systems Market Revenue Million Forecast, by Component 2019 & 2032

- Table 11: North America Video Surveillance Systems Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 12: North America Video Surveillance Systems Market Revenue Million Forecast, by Country 2019 & 2032

- Table 13: United States North America Video Surveillance Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Canada North America Video Surveillance Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Mexico North America Video Surveillance Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Video Surveillance Systems Market?

The projected CAGR is approximately 14.80%.

2. Which companies are prominent players in the North America Video Surveillance Systems Market?

Key companies in the market include Dahua Technology, Honeywell International Inc, Johnson Controls International, Eagle Eye Networks Inc, Avigilon Corporation, Samsara Inc *List Not Exhaustive, Genetec Inc, AV Costar, Napco Security Technologies Inc, March Networks.

3. What are the main segments of the North America Video Surveillance Systems Market?

The market segments include Component, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Widespread Application of Video Surveillance Systems in Retail and Commercial Establishments; Increasing Adoption of Facial Surveillance.

6. What are the notable trends driving market growth?

Hardware Segment to Hold a Major Market Share.

7. Are there any restraints impacting market growth?

Vulnerable To Security Attacks; Redundancy And Lack Of Interoperability.

8. Can you provide examples of recent developments in the market?

November 2021 - CBC AMERICA announced a strategic business alliance with NAPCO Security Technologies, Inc. to deliver an intelligent video solution by integrating the Ganz CORTROL Video Management Software with Napco Access Solutions & the Continental Access Control Platform.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Video Surveillance Systems Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Video Surveillance Systems Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Video Surveillance Systems Market?

To stay informed about further developments, trends, and reports in the North America Video Surveillance Systems Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence