Key Insights

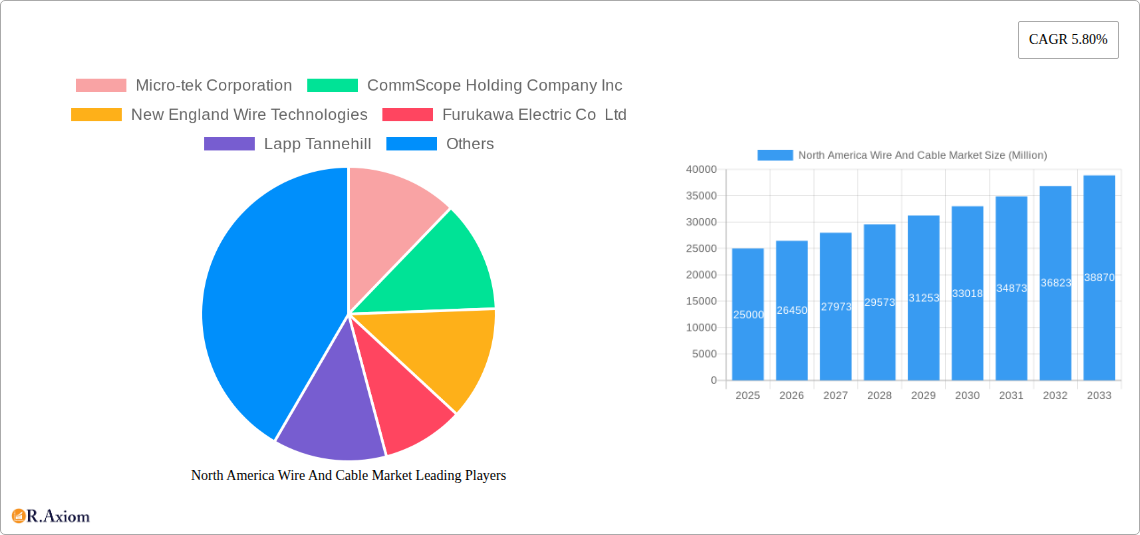

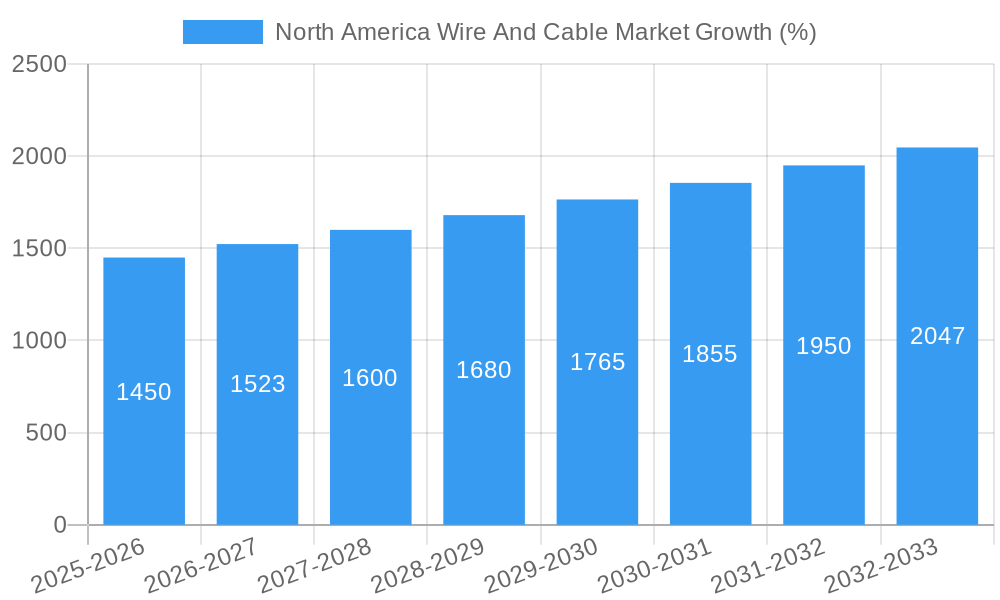

The North American wire and cable market, valued at approximately $XX million in 2025, is projected to experience robust growth, driven by a compound annual growth rate (CAGR) of 5.80% from 2025 to 2033. This expansion is fueled by several key factors. The burgeoning construction sector, encompassing both residential and commercial projects, significantly boosts demand for power cables and fiber optic cables for infrastructure development and building electrification. Simultaneously, the telecommunications industry's continuous expansion, propelled by increasing 5G deployment and the growth of data centers, further fuels market growth. The power infrastructure sector, including renewable energy projects and the electric vehicle revolution, also contributes significantly to the demand for specialized high-voltage and power cables. Technological advancements, such as the development of lighter, more efficient, and durable cables, are further shaping market dynamics, alongside a rising focus on sustainable and environmentally friendly cable manufacturing practices.

However, several restraints might impede market growth. Fluctuations in raw material prices, particularly copper and aluminum, can impact manufacturing costs and profitability. Supply chain disruptions and geopolitical instability can also present challenges. Moreover, increasing competition among established players and emerging market entrants could put pressure on pricing. Despite these restraints, the North American wire and cable market is poised for significant expansion, driven by the strong performance of key end-user industries and ongoing technological innovation. The market segmentation reveals strong growth in fiber optic cables due to increased bandwidth requirements, and the construction segment is expected to be a major driver of overall market size, especially in the residential sector, reflecting ongoing urbanization and infrastructure development initiatives in the region. Market leaders such as CommScope, Prysmian, and Southwire are well-positioned to benefit from these trends, although smaller, niche players are also emerging with specialized product offerings.

This in-depth report provides a comprehensive analysis of the North America wire and cable market, encompassing market size, growth projections, competitive landscape, and key industry trends from 2019 to 2033. The study period covers the historical period (2019-2024), the base year (2025), and the forecast period (2025-2033). This report is essential for industry stakeholders, investors, and strategic decision-makers seeking a detailed understanding of this dynamic market.

North America Wire And Cable Market Market Concentration & Innovation

The North American wire and cable market exhibits a moderately concentrated landscape, with a few major players holding significant market share. The market share distribution is dynamic, influenced by M&A activities, technological innovations, and evolving end-user demands. While precise market share figures for each player are proprietary to this report, companies like Southwire Company LLC, Prysmian Group, and CommScope Holding Company Inc. are prominent contenders. The total value of M&A deals within the period 2019-2024 is estimated at xx Million, with deal sizes varying considerably based on the target companies and their market position.

Innovation is a key driver, spurred by increasing demand for high-performance cables across various sectors. Fiber optic cable technology continues to advance, driven by the need for higher bandwidth and data transmission capabilities. The industry is also focusing on developing sustainable and environmentally friendly cable materials to address growing environmental concerns. Regulatory frameworks, particularly those related to safety standards and environmental regulations, play a significant role in shaping market dynamics. Product substitutes, such as wireless communication technologies, are posing challenges, but the market remains robust due to the persistent need for reliable wired connections in critical infrastructure and industrial applications. End-user trends are shifting towards the adoption of smart technologies and automation, driving demand for specialized cables with enhanced capabilities.

- Key Market Concentration Metrics: xx% market share for top 5 players (estimated).

- M&A Deal Value (2019-2024): xx Million (estimated).

- Key Innovation Drivers: Fiber optic advancements, sustainable materials, smart technologies.

- Regulatory Impacts: Safety standards, environmental regulations.

North America Wire And Cable Market Industry Trends & Insights

The North American wire and cable market is experiencing steady growth, driven by robust infrastructure development, expanding telecommunications networks, and increasing industrial automation. The Compound Annual Growth Rate (CAGR) for the forecast period (2025-2033) is projected to be xx%, indicating healthy expansion. Technological disruptions, such as the rise of 5G networks and the increasing adoption of smart grids, are profoundly impacting market dynamics, driving demand for high-speed data cables and specialized power cables. Consumer preferences are shifting towards energy-efficient and sustainable products, pushing manufacturers to develop eco-friendly cable solutions. The competitive landscape is characterized by intense rivalry among established players and emerging entrants, with pricing strategies and product differentiation playing crucial roles. Market penetration of fiber optic cables, a key growth segment, is expected to reach xx% by 2033, demonstrating significant market expansion.

Dominant Markets & Segments in North America Wire And Cable Market

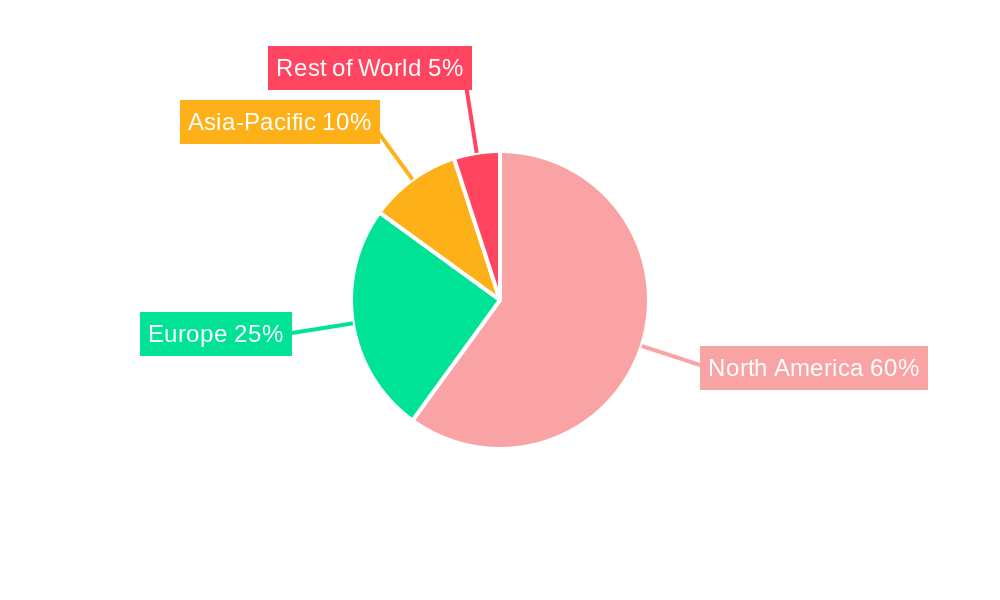

The United States dominates the North American wire and cable market, accounting for a larger share than Canada due to its larger economy and extensive infrastructure projects. Within the segmentation analysis, the Power Cable segment holds the largest market share by cable type, driven by the energy sector's expansion. The Telecommunications sector dominates among end-user industries, fueled by continuous network upgrades and 5G deployment.

- Dominant Region: United States

- Dominant Cable Type: Power Cable

- Dominant End-User Industry: Telecommunications

Key Drivers for Dominance:

- United States: Significant government investment in infrastructure projects, robust industrial activity, and technological advancements.

- Power Cable: Growing electricity demand, expansion of renewable energy sources, and grid modernization.

- Telecommunications: Expansion of 5G networks, increasing data consumption, and the growth of the cloud computing industry.

North America Wire And Cable Market Product Developments

Recent product innovations focus on higher bandwidth capabilities, improved durability, lighter weight materials, and enhanced flexibility. The integration of advanced technologies, such as sensors and smart features, is gaining traction. These innovations aim to improve performance, enhance efficiency, and reduce the environmental impact of cable products. Manufacturers are also concentrating on optimizing their supply chains to enhance efficiency and minimize costs. The market fit of these new products is strong, largely driven by increasing technological demands across key sectors.

Report Scope & Segmentation Analysis

This report segments the North American wire and cable market comprehensively by cable type, end-user industry, and country.

By Cable Type:

- Low Voltage Energy Cables: The market size is projected to reach xx Million by 2033, with steady growth driven by residential and commercial construction.

- Power Cables: This segment is the largest, with a projected market size of xx Million by 2033, owing to infrastructure development and renewable energy projects.

- Fiber Optic Cables: This high-growth segment is predicted to reach xx Million by 2033, driven by 5G expansion and increased data demands.

- Signal and Control Cables: The market is expected to grow at a moderate pace to xx Million by 2033, driven by industrial automation and smart technologies.

- Other Cable Types: This segment, including coaxial, telecom, and data cables, is projected to reach xx Million by 2033, influenced by diverse applications.

By End-user Industry:

- Construction: Residential and commercial construction projects are driving market growth.

- Telecommunications: The IT and telecom sector is a major driver due to network expansion.

- Power Infrastructure: The energy and power, and automotive sectors contribute significantly to power cable demand.

- Other End-user Industries: BFSI, railway, defense, industrial, medical, and other sectors showcase diverse applications.

By Country:

- United States: This market holds the largest share, driven by economic activity and infrastructure investments.

- Canada: Market growth is moderate, influenced by its economy and infrastructure projects.

Key Drivers of North America Wire And Cable Market Growth

Several factors drive market growth. Government investments in infrastructure, particularly in telecommunications and renewable energy, are crucial. The rising adoption of smart technologies and industrial automation boosts demand for specialized cables. Technological advancements in fiber optics and other cable types also contribute significantly. Furthermore, increasing urbanization and population growth create a constant need for new and upgraded infrastructure.

Challenges in the North America Wire And Cable Market Sector

The market faces challenges including fluctuations in raw material prices, supply chain disruptions, and intense competition among manufacturers. Strict regulatory compliance requirements also increase costs. These challenges necessitate strategic resource management and innovative solutions for manufacturers to thrive. For example, material price increases have led to an approximate xx% increase in production costs (estimated).

Emerging Opportunities in North America Wire And Cable Market

Opportunities lie in the expansion of 5G networks, the growth of renewable energy projects, and the increased adoption of electric vehicles. The development of sustainable and environmentally friendly cable materials also presents considerable opportunities. Furthermore, the integration of advanced technologies such as sensors and AI into cable systems offers significant potential for innovation.

Leading Players in the North America Wire And Cable Market Market

- Micro-tek Corporation

- CommScope Holding Company Inc

- New England Wire Technologies

- Furukawa Electric Co Ltd

- Lapp Tannehill

- Prysmian Group

- Aba Industry Inc (Wonderful Hi-tech company)

- Encore Wire

- EIS Wire and Cable

- Daburn Electronics & Cable and Polytron Devices

- Dacon Systems Inc

- Fujikura Ltd

- TE Connectivity

- Southwire Company LLC

- Amphenol Corporation

- Leoni AG

- Belden Incorporated

- American Wire Group

- Coherent Corporatio

- Corning Incorporated

- Amercable Incorporated (Nexans)

Key Developments in North America Wire And Cable Market Industry

- July 2023: CommScope announced a USD 60.3 Million investment to expand fiber cable manufacturing in North Carolina, aiming to meet increased US demand for broadband access.

- August 2023: Southwire Company LLC partnered with the University of West Georgia to enhance sustainability initiatives, focusing on environmental responsibility and operational efficiency.

Strategic Outlook for North America Wire And Cable Market Market

The North American wire and cable market is poised for continued growth, driven by technological advancements, infrastructure development, and increasing demand across various sectors. Opportunities for innovation in sustainable materials, advanced cable technologies, and smart solutions will shape the market's future. Companies focusing on efficient supply chains and strong customer relationships will be well-positioned for success.

North America Wire And Cable Market Segmentation

-

1. Cable Type

- 1.1. Low Voltage Energy

- 1.2. Power Cable

- 1.3. Fiber Optic Cable

- 1.4. Signal and Control Cable

- 1.5. Other

-

2. End-user Industry

- 2.1. Construction (Residential and Commercial)

- 2.2. Telecommunications (IT and Telecom)

- 2.3. Power In

- 2.4. Other

North America Wire And Cable Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Wire And Cable Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.80% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Investments in Infrastructure; Deployment of Smart Grid Infrastructure

- 3.3. Market Restrains

- 3.3.1. High Cost of Installation and Associated Complexities

- 3.4. Market Trends

- 3.4.1. Construction Industry to be the Largest End User

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Wire And Cable Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Cable Type

- 5.1.1. Low Voltage Energy

- 5.1.2. Power Cable

- 5.1.3. Fiber Optic Cable

- 5.1.4. Signal and Control Cable

- 5.1.5. Other

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Construction (Residential and Commercial)

- 5.2.2. Telecommunications (IT and Telecom)

- 5.2.3. Power In

- 5.2.4. Other

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Cable Type

- 6. United States North America Wire And Cable Market Analysis, Insights and Forecast, 2019-2031

- 7. Canada North America Wire And Cable Market Analysis, Insights and Forecast, 2019-2031

- 8. Mexico North America Wire And Cable Market Analysis, Insights and Forecast, 2019-2031

- 9. Rest of North America North America Wire And Cable Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Micro-tek Corporation

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 CommScope Holding Company Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 New England Wire Technologies

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Furukawa Electric Co Ltd

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Lapp Tannehill

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Prysmian Group

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Aba Industry Inc (Wonderful Hi-tech company)

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Encore Wire

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 EIS Wire and Cable

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Daburn Electronics & Cable and Polytron Devices

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Dacon Systems Inc

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Fujikura Ltd

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 TE Connectivity

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.14 Southwire Company LLC

- 10.2.14.1. Overview

- 10.2.14.2. Products

- 10.2.14.3. SWOT Analysis

- 10.2.14.4. Recent Developments

- 10.2.14.5. Financials (Based on Availability)

- 10.2.15 Amphenol Corporation

- 10.2.15.1. Overview

- 10.2.15.2. Products

- 10.2.15.3. SWOT Analysis

- 10.2.15.4. Recent Developments

- 10.2.15.5. Financials (Based on Availability)

- 10.2.16 Leoni AG

- 10.2.16.1. Overview

- 10.2.16.2. Products

- 10.2.16.3. SWOT Analysis

- 10.2.16.4. Recent Developments

- 10.2.16.5. Financials (Based on Availability)

- 10.2.17 Belden Incorporated

- 10.2.17.1. Overview

- 10.2.17.2. Products

- 10.2.17.3. SWOT Analysis

- 10.2.17.4. Recent Developments

- 10.2.17.5. Financials (Based on Availability)

- 10.2.18 American Wire Group

- 10.2.18.1. Overview

- 10.2.18.2. Products

- 10.2.18.3. SWOT Analysis

- 10.2.18.4. Recent Developments

- 10.2.18.5. Financials (Based on Availability)

- 10.2.19 Coherent Corporatio

- 10.2.19.1. Overview

- 10.2.19.2. Products

- 10.2.19.3. SWOT Analysis

- 10.2.19.4. Recent Developments

- 10.2.19.5. Financials (Based on Availability)

- 10.2.20 Corning Incorporated

- 10.2.20.1. Overview

- 10.2.20.2. Products

- 10.2.20.3. SWOT Analysis

- 10.2.20.4. Recent Developments

- 10.2.20.5. Financials (Based on Availability)

- 10.2.21 Amercable Incorporated (Nexans)

- 10.2.21.1. Overview

- 10.2.21.2. Products

- 10.2.21.3. SWOT Analysis

- 10.2.21.4. Recent Developments

- 10.2.21.5. Financials (Based on Availability)

- 10.2.1 Micro-tek Corporation

List of Figures

- Figure 1: North America Wire And Cable Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Wire And Cable Market Share (%) by Company 2024

List of Tables

- Table 1: North America Wire And Cable Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Wire And Cable Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: North America Wire And Cable Market Revenue Million Forecast, by Cable Type 2019 & 2032

- Table 4: North America Wire And Cable Market Volume K Unit Forecast, by Cable Type 2019 & 2032

- Table 5: North America Wire And Cable Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 6: North America Wire And Cable Market Volume K Unit Forecast, by End-user Industry 2019 & 2032

- Table 7: North America Wire And Cable Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: North America Wire And Cable Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 9: North America Wire And Cable Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: North America Wire And Cable Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 11: United States North America Wire And Cable Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: United States North America Wire And Cable Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 13: Canada North America Wire And Cable Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Canada North America Wire And Cable Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 15: Mexico North America Wire And Cable Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Mexico North America Wire And Cable Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 17: Rest of North America North America Wire And Cable Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Rest of North America North America Wire And Cable Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 19: North America Wire And Cable Market Revenue Million Forecast, by Cable Type 2019 & 2032

- Table 20: North America Wire And Cable Market Volume K Unit Forecast, by Cable Type 2019 & 2032

- Table 21: North America Wire And Cable Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 22: North America Wire And Cable Market Volume K Unit Forecast, by End-user Industry 2019 & 2032

- Table 23: North America Wire And Cable Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: North America Wire And Cable Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 25: United States North America Wire And Cable Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: United States North America Wire And Cable Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 27: Canada North America Wire And Cable Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Canada North America Wire And Cable Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 29: Mexico North America Wire And Cable Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Mexico North America Wire And Cable Market Volume (K Unit) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Wire And Cable Market?

The projected CAGR is approximately 5.80%.

2. Which companies are prominent players in the North America Wire And Cable Market?

Key companies in the market include Micro-tek Corporation, CommScope Holding Company Inc, New England Wire Technologies, Furukawa Electric Co Ltd, Lapp Tannehill, Prysmian Group, Aba Industry Inc (Wonderful Hi-tech company), Encore Wire, EIS Wire and Cable, Daburn Electronics & Cable and Polytron Devices, Dacon Systems Inc, Fujikura Ltd, TE Connectivity, Southwire Company LLC, Amphenol Corporation, Leoni AG, Belden Incorporated, American Wire Group, Coherent Corporatio, Corning Incorporated, Amercable Incorporated (Nexans).

3. What are the main segments of the North America Wire And Cable Market?

The market segments include Cable Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Investments in Infrastructure; Deployment of Smart Grid Infrastructure.

6. What are the notable trends driving market growth?

Construction Industry to be the Largest End User.

7. Are there any restraints impacting market growth?

High Cost of Installation and Associated Complexities.

8. Can you provide examples of recent developments in the market?

July 2023 - CommScope announced plans to invest USD 60.3 million to expand its fiber cable manufacturing in North Carolina. Through this facility, the aim was to meet US supply demands driven by federal initiatives to bring 'Internet for All' to underserved and rural broadband markets.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Wire And Cable Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Wire And Cable Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Wire And Cable Market?

To stay informed about further developments, trends, and reports in the North America Wire And Cable Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence