Key Insights

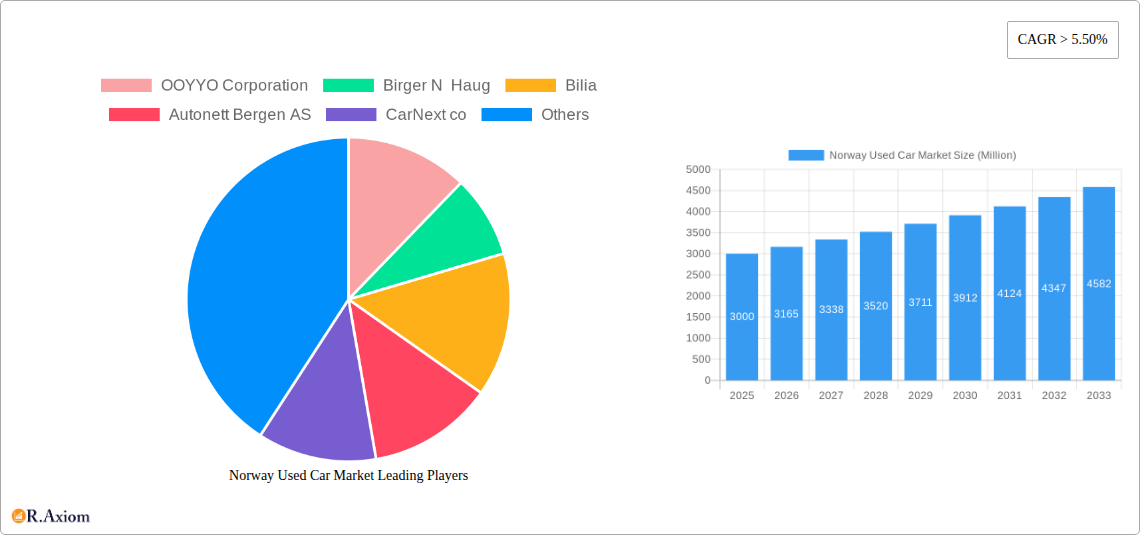

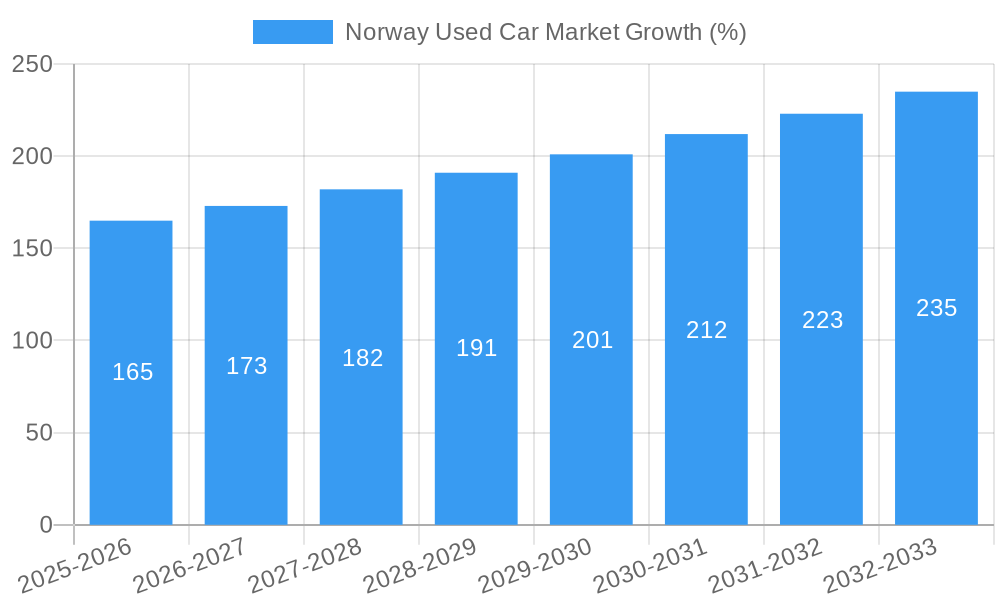

The Norway used car market, valued at approximately €3 billion in 2025, exhibits robust growth potential, driven by a Compound Annual Growth Rate (CAGR) exceeding 5.50% from 2025 to 2033. This expansion is fueled by several key factors. Rising vehicle ownership rates, particularly among younger demographics, contribute significantly to market demand. Furthermore, the increasing affordability of used cars compared to new vehicles, coupled with evolving consumer preferences towards cost-effective mobility solutions, boosts market attractiveness. The shift towards electric vehicles (EVs) is also a significant trend impacting the market, creating a niche for used EVs and influencing pricing dynamics across fuel types. However, the market faces certain constraints, including fluctuating used car prices influenced by global economic conditions and the availability of certified pre-owned vehicles. Segment-wise, SUVs and MUVs are experiencing high demand, reflecting changing lifestyle preferences in Norway. The organized sector dominates the market share, showcasing increased consumer trust and preference for formal sales channels. Key players like OOYYO Corporation, Bilia, and Autonett Bergen AS are leveraging online platforms and improved customer services to solidify their market positions. The forecast period (2025-2033) presents a promising outlook, with continued growth expected due to sustained economic stability and evolving consumer behavior within the Norwegian automotive landscape.

The competitive landscape is marked by a mix of both organized and unorganized vendors. While organized players like Bilia and RSA BIL benefit from established networks and trust, the unorganized segment still retains a presence. Growth opportunities exist for both sectors, but those focusing on enhanced transparency, quality assurance, and digital sales channels are expected to see greater success. The market is also witnessing a growing preference for certified pre-owned vehicles, a testament to the growing importance of quality assurance and warranties in the used car sector. This emphasis on quality, combined with evolving technological advancements in vehicle condition assessments, contributes to market sophistication and potential for future expansion. Geographically, the market is currently concentrated within Norway, though further regional diversification might be considered as international trade in used vehicles evolves.

Norway Used Car Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Norway used car market, offering invaluable insights for industry stakeholders, investors, and businesses seeking to navigate this dynamic sector. The study covers the period 2019-2033, with a focus on the base year 2025 and a forecast period spanning 2025-2033. The report leverages extensive data analysis and expert insights to deliver actionable strategies and projections for market growth, competition, and future trends. The total market size in 2025 is estimated at xx Million.

Norway Used Car Market Concentration & Innovation

The Norwegian used car market exhibits a moderately concentrated structure, with a few dominant players alongside numerous smaller, independent operators. Market share data from 2024 reveals that the top five players account for approximately 40% of the total market volume, while the remaining 60% is shared by hundreds of smaller businesses. Innovation is primarily driven by the adoption of online platforms and digitalization in sales and servicing, alongside growing demand for electric and hybrid vehicles. Regulatory frameworks, such as emissions standards and consumer protection laws, significantly impact market operations. The increasing prevalence of subscription services and online vehicle valuations are key examples of product innovation. M&A activity has been moderate in recent years; however, strategic acquisitions by larger companies to expand their market share or gain access to new technologies are anticipated to increase. For example, in June 2022, the TrueCar Inc. acquisition of Digital Motors valued at xx Million, showcased a strategy towards enhanced digital car sales.

- Market Share: Top 5 players: 40% (2024)

- M&A Activity: Moderate (2019-2024), with potential for increased activity driven by digitalization and electrification trends.

- Key Innovation Drivers: Online platforms, digitalization, electric vehicle adoption, subscription services.

- Regulatory Impact: Stringent emissions standards and consumer protection laws shape market practices.

Norway Used Car Market Industry Trends & Insights

The Norwegian used car market is experiencing steady growth, driven by factors such as increasing vehicle ownership rates, favorable economic conditions (prior to recent economic downturn), and the rising popularity of used cars as a more affordable alternative to new vehicles. The market's Compound Annual Growth Rate (CAGR) during the historical period (2019-2024) was approximately 3%, and the forecast indicates continued growth at a slightly lower CAGR of 2.5% from 2025 to 2033. Technological disruptions, such as the emergence of online marketplaces and digital vehicle inspection tools, are fundamentally reshaping the consumer experience. Consumer preferences increasingly favor fuel-efficient vehicles, including electric and hybrid models, reflecting growing environmental consciousness. The competitive landscape is characterized by both intense rivalry among established players and the entry of new online-focused businesses. Market penetration of online used car sales platforms has increased significantly in recent years, reaching an estimated xx% in 2024.

Dominant Markets & Segments in Norway Used Car Market

The Oslo region dominates the Norway used car market due to its higher population density and economic activity. However, other major cities, such as Bergen, Stavanger, and Trondheim also show substantial market share. In terms of vehicle type, SUVs enjoy significant market dominance, followed by hatchbacks and sedans. The organized vendor segment holds a larger share compared to the unorganized segment, reflecting the increasing professionalization of the used car trade. Gasoline-powered vehicles still constitute the largest fuel type segment; however, the share of electric and hybrid vehicles is growing rapidly.

- Key Drivers for SUV Dominance: Growing family sizes, increased demand for space and versatility.

- Organized Vendor Segment Advantages: Greater transparency, better warranties, higher consumer trust.

- Growth of Electric Vehicles: Driven by government incentives, environmental concerns, and technological advancements.

- Regional Disparities: Market size varies significantly across different regions due to variations in population, income levels, and economic activity.

Norway Used Car Market Product Developments

Technological advancements are driving significant product developments in the Norwegian used car market. The integration of telematics systems in used vehicles is becoming increasingly common, offering features like remote diagnostics and vehicle tracking. This enhances both the safety and security of used cars. Furthermore, online platforms facilitate improved access to detailed vehicle histories and condition reports, promoting greater transparency and buyer confidence. The market is seeing the rise of certified pre-owned (CPO) programs, which provide warranties and additional benefits, boosting consumer trust in used vehicle purchases.

Report Scope & Segmentation Analysis

This report segments the Norway used car market based on several key parameters:

- Vehicle Type: Hatchback, Sedan, SUVs, MUVs. Each segment shows varied growth trajectories based on consumer preferences and evolving trends. SUVs are expected to continue their dominance, while the electric vehicle segment across all vehicle types is showing the most significant growth.

- Vendor Type: Organized (dealerships, online platforms) and Unorganized (private sellers). The organized segment is projected to have a higher growth rate driven by consumer trust and professional services.

- Fuel Type: Gasoline, Diesel, Electric, and Other Fuel Types. The electric vehicle segment is rapidly expanding, driven by environmental concerns and governmental support.

Market size and growth projections are provided for each segment, offering a granular understanding of market dynamics.

Key Drivers of Norway Used Car Market Growth

Several factors fuel the growth of the Norwegian used car market. These include the affordability of used cars relative to new vehicles, increasing disposable incomes (before recent economic shifts), governmental incentives promoting fuel-efficient vehicles (including electric vehicles), and the expansion of online marketplaces facilitating easier access to used car options. The development of robust infrastructure for charging electric vehicles is another major driver, removing a significant barrier to electric vehicle adoption.

Challenges in the Norway Used Car Market Sector

The Norwegian used car market faces challenges such as fluctuating fuel prices which affect consumer demand, the supply chain disruptions impacting vehicle availability, stringent environmental regulations leading to higher compliance costs, and the intense competition amongst both traditional and online vendors. These factors contribute to price volatility and create uncertainty for market participants. Additionally, maintaining the quality and reliability of used vehicles remains a key operational challenge.

Emerging Opportunities in Norway Used Car Market

The rise of subscription-based services for used cars, the increasing adoption of used electric and hybrid vehicles, and the expansion of online marketplaces present significant growth opportunities. Furthermore, the implementation of innovative vehicle inspection and certification programs can further increase consumer trust and market transparency. The market's capacity to integrate advanced data analytics tools and AI to enhance pricing and risk assessment remains largely untapped, offering considerable potential for businesses.

Leading Players in the Norway Used Car Market Market

- OOYYO Corporation

- Birger N Haug

- Bilia

- Autonett Bergen AS

- CarNext co

- RSA BIL

- Toyota South

- TrueCar Inc

- Egeland Auto

- Lee Auto Malls

Key Developments in Norway Used Car Market Industry

- June 2022: TrueCar Inc. acquired Digital Motors, strengthening its digital car marketplace.

- January 2023: Bilia partnered with Great Wall Motor, expanding its new and used car offerings.

Strategic Outlook for Norway Used Car Market Market

The Norwegian used car market exhibits promising growth potential, driven by continued technological advancements, favorable government policies supporting sustainable mobility, and the rising preference for used cars as a cost-effective alternative. The market's adaptation to evolving consumer preferences and the innovative use of technology present significant opportunities for growth and expansion. The increasing emphasis on sustainability and environmental concerns will likely accelerate the adoption of electric and hybrid vehicles, driving further market transformation in the coming years.

Norway Used Car Market Segmentation

-

1. Vehicle Type

- 1.1. Hatchback

- 1.2. Sedan

- 1.3. Sport Utility Vehicles (SUVs)

- 1.4. Multi-Purpose Vehicles (MUVs)

-

2. Vendor Type

- 2.1. Organized

- 2.2. Unorganized

-

3. Fuel Type

- 3.1. Gasoline

- 3.2. Diesel

- 3.3. Electric

- 3.4. Other Fuel Types

Norway Used Car Market Segmentation By Geography

- 1. Norway

Norway Used Car Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 5.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in Price of New Cars

- 3.3. Market Restrains

- 3.3.1. Trust And Transparency In Used Car Remained A Key Challenge For Consumers

- 3.4. Market Trends

- 3.4.1. Growing Adoption of Online Services to Witness Major Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Norway Used Car Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Hatchback

- 5.1.2. Sedan

- 5.1.3. Sport Utility Vehicles (SUVs)

- 5.1.4. Multi-Purpose Vehicles (MUVs)

- 5.2. Market Analysis, Insights and Forecast - by Vendor Type

- 5.2.1. Organized

- 5.2.2. Unorganized

- 5.3. Market Analysis, Insights and Forecast - by Fuel Type

- 5.3.1. Gasoline

- 5.3.2. Diesel

- 5.3.3. Electric

- 5.3.4. Other Fuel Types

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Norway

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 OOYYO Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Birger N Haug

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Bilia

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Autonett Bergen AS

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 CarNext co

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 RSA BIL

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Toyota South

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 TrueCar Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Egeland Auto

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Lee Auto Malls

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 OOYYO Corporation

List of Figures

- Figure 1: Norway Used Car Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Norway Used Car Market Share (%) by Company 2024

List of Tables

- Table 1: Norway Used Car Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Norway Used Car Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 3: Norway Used Car Market Revenue Million Forecast, by Vendor Type 2019 & 2032

- Table 4: Norway Used Car Market Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 5: Norway Used Car Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Norway Used Car Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Norway Used Car Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 8: Norway Used Car Market Revenue Million Forecast, by Vendor Type 2019 & 2032

- Table 9: Norway Used Car Market Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 10: Norway Used Car Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Norway Used Car Market?

The projected CAGR is approximately > 5.50%.

2. Which companies are prominent players in the Norway Used Car Market?

Key companies in the market include OOYYO Corporation, Birger N Haug, Bilia, Autonett Bergen AS, CarNext co, RSA BIL, Toyota South, TrueCar Inc, Egeland Auto, Lee Auto Malls.

3. What are the main segments of the Norway Used Car Market?

The market segments include Vehicle Type, Vendor Type, Fuel Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 3 Million as of 2022.

5. What are some drivers contributing to market growth?

Rise in Price of New Cars.

6. What are the notable trends driving market growth?

Growing Adoption of Online Services to Witness Major Growth.

7. Are there any restraints impacting market growth?

Trust And Transparency In Used Car Remained A Key Challenge For Consumers.

8. Can you provide examples of recent developments in the market?

January 2023: Bilia entered into an agreement with Great Wall Motor to become the official importer and dealer of their car brands in Norway. The primary goal is to strengthen the presence of both new and used cars in the Norwegian market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Norway Used Car Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Norway Used Car Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Norway Used Car Market?

To stay informed about further developments, trends, and reports in the Norway Used Car Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence