Key Insights

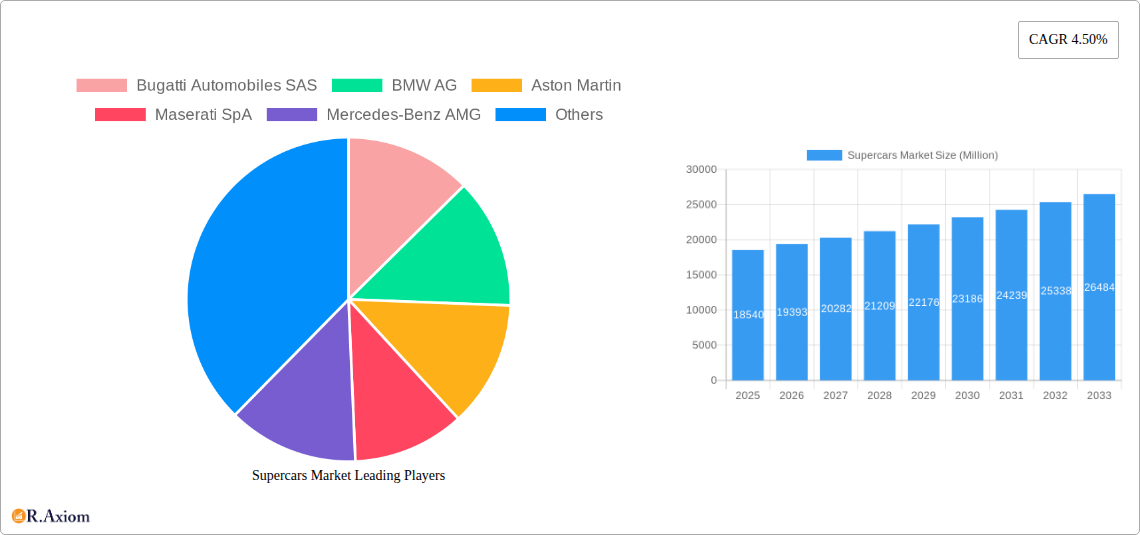

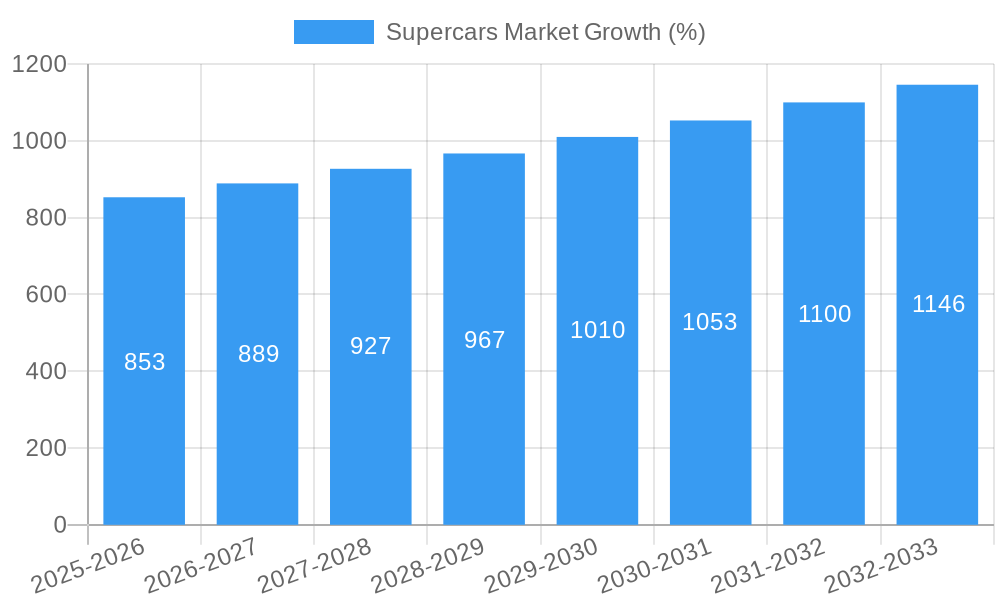

The global supercar market, valued at $18.54 billion in 2025, is projected to experience robust growth, exhibiting a compound annual growth rate (CAGR) of 4.50% from 2025 to 2033. This expansion is fueled by several key factors. Increasing disposable incomes, particularly in emerging economies, are driving demand for luxury goods, including high-performance vehicles. Technological advancements in engine technology, aerodynamics, and materials science are leading to enhanced performance and efficiency, further boosting consumer appeal. The growing popularity of motorsport and the aspirational value associated with owning a supercar also contribute to market growth. Furthermore, manufacturers are increasingly focusing on customization and personalization options, catering to the unique preferences of affluent buyers. This trend, coupled with the introduction of hybrid and electric supercars, is shaping the future of the market.

However, the market faces certain challenges. Stringent emission regulations globally are pushing manufacturers to invest heavily in cleaner technologies, potentially impacting production costs and profitability. Geopolitical instability and economic downturns can also dampen demand for luxury goods. Competition among established players and the emergence of new entrants further intensify the market dynamics. Despite these challenges, the long-term outlook for the supercar market remains positive, driven by continuous innovation, technological advancements, and the enduring appeal of these high-performance vehicles amongst discerning consumers. The market segmentation, while not explicitly detailed, likely includes variations based on engine type (gasoline, hybrid, electric), body style (coupe, roadster, convertible), and price point. The leading players, including Bugatti, BMW, Aston Martin, and Ferrari, are expected to maintain their dominance, while niche manufacturers are likely to continue to capture a segment of the market with specialized and highly customized offerings.

Supercars Market: A Comprehensive Report (2019-2033)

This detailed report provides an in-depth analysis of the global supercars market, encompassing market size, growth projections, key players, and emerging trends from 2019 to 2033. The study period covers the historical period (2019-2024), the base year (2025), and the forecast period (2025-2033). It offers actionable insights for industry stakeholders, investors, and businesses operating within this exclusive market segment. The report leverages extensive primary and secondary research to deliver a comprehensive understanding of market dynamics and future opportunities. The total market value is estimated to reach xx Million by 2033.

Supercars Market Concentration & Innovation

This section analyzes the competitive landscape of the supercar market, evaluating market concentration, innovation drivers, regulatory frameworks, and industry dynamics. The analysis includes an assessment of mergers and acquisitions (M&A) activities impacting the market.

Market Concentration: The supercar market is characterized by high concentration, with a few dominant players controlling a significant market share. Ferrari, Lamborghini, and Porsche, for example, collectively hold approximately xx% of the market, while other players like Bugatti, Aston Martin, and McLaren command a smaller, yet significant, portion. This high concentration reflects the high barriers to entry linked with extensive research and development, specialized manufacturing processes, and high capital investment requirements.

Innovation Drivers: Ongoing innovation in engine technology (hybrid and electric powertrains), advanced materials (lightweight composites), autonomous driving features, and infotainment systems are key drivers of market growth. The pursuit of superior performance, enhanced safety, and unique design features drives continuous improvement.

Regulatory Frameworks: Emission regulations, safety standards, and fuel efficiency requirements significantly influence supercar design and production. The increasing focus on sustainability is driving the development of hybrid and electric supercars, while stricter safety regulations necessitate continuous improvements in safety features.

Product Substitutes: While direct substitutes for supercars are limited, high-end luxury vehicles and performance cars from mainstream manufacturers can be considered indirect substitutes, posing a certain competitive pressure.

End-User Trends: The demand for supercars is driven by high-net-worth individuals and collectors who seek exclusivity, prestige, and high performance. Growing affluence in emerging economies contributes to expanding the market's potential customer base.

M&A Activities: M&A activity in the supercar market has been relatively moderate during the historical period. Deal values have generally been in the range of xx Million to xx Million per transaction, with consolidation primarily focused on strengthening existing portfolios or acquiring specialized technologies.

Supercars Market Industry Trends & Insights

This section delves into the key trends and insights shaping the supercar market, examining growth drivers, technological advancements, consumer preferences, and competitive dynamics.

The supercar market is expected to exhibit a CAGR of xx% during the forecast period (2025-2033), driven by several factors. Rising disposable incomes in emerging economies, coupled with a desire for exclusive luxury goods and powerful vehicles, significantly contribute to market growth. Technological advancements, such as lightweight materials, hybrid and electric powertrains, and autonomous driving systems, further enhance the appeal and performance of these vehicles. Market penetration has increased steadily over the historical period, with a notable surge in demand observed in regions such as Asia-Pacific, particularly in China, where the ultra-high-net-worth population continues to grow. The competitive landscape is marked by intense rivalry among established manufacturers, characterized by continuous product development, technological innovation, and brand positioning strategies. These competitive dynamics drive the development of increasingly powerful and technologically advanced supercars.

Dominant Markets & Segments in Supercars Market

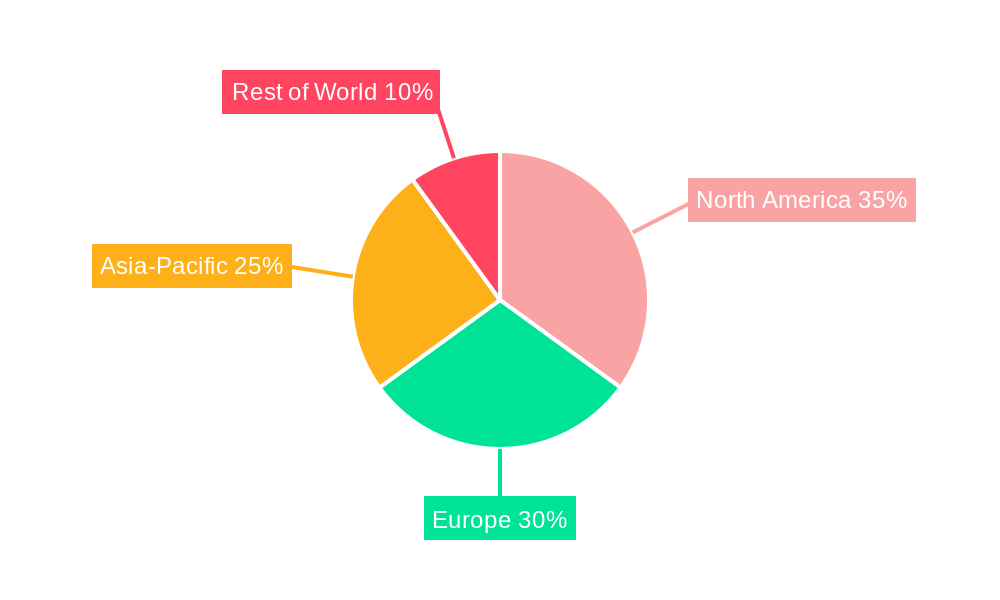

This section identifies the leading regions and segments within the supercar market and analyzes the factors contributing to their dominance.

The North American market currently holds the leading position, owing to factors such as high disposable income, a strong appreciation for performance vehicles, and the presence of major supercar manufacturers. Key drivers in this region include:

- High per capita income and strong purchasing power.

- Well-developed infrastructure and automotive culture.

- Favorable regulatory environment.

Europe, specifically Western Europe, also holds a significant market share, driven by a sophisticated automotive industry and strong consumer demand for luxury and performance vehicles. The Asian market, especially China, demonstrates robust growth potential, driven by a growing affluent population and increased adoption of luxury goods. While exact segment breakdowns (e.g., by body type, engine type) are not provided in the prompt, future research can expand upon the segmentation and specific market sizes within each segment.

Supercars Market Product Developments

Recent years have witnessed significant product innovations in the supercar sector. Manufacturers are increasingly focusing on hybrid and electric powertrains, integrating advanced driver-assistance systems, and incorporating lightweight materials to enhance performance and efficiency. The market is also observing a trend toward personalized customization, allowing customers to tailor the features and specifications of their supercars to their individual preferences. This trend has enhanced brand exclusivity and heightened customer satisfaction. These developments are aimed at maximizing performance and driving a differentiation within an intensely competitive market.

Report Scope & Segmentation Analysis

This report encompasses a comprehensive analysis of the global supercar market, segmenting it by region, vehicle type (e.g., coupe, roadster, convertible), engine type (e.g., petrol, hybrid, electric), and price range. Growth projections are provided for each segment, incorporating market size estimations and competitive landscape analysis. For example, the hybrid and electric segment is projected to experience the fastest growth, driven by increasing environmental concerns and technological advancements. The high-end price range segment is expected to maintain a dominant position due to the exclusive nature of these vehicles.

Key Drivers of Supercars Market Growth

The supercar market is experiencing growth propelled by several key drivers. Technological advancements, such as the development of more powerful and efficient engines, as well as lightweight materials that improve performance, are pivotal. Economic growth in emerging markets is significantly expanding the potential consumer base. Finally, the strong preference for personalization and exclusive design features continues to be a driving force behind the expanding demand.

Challenges in the Supercars Market Sector

Despite its growth potential, the supercar market faces several challenges. Stringent emission regulations and fuel efficiency standards necessitate manufacturers to invest heavily in research and development, increasing production costs. Supply chain disruptions, particularly in the sourcing of specialized components, can impact production and delivery timelines. Intense competition among established players necessitates ongoing innovation and brand differentiation, adding another layer of challenge. These factors could impact the overall growth, leading to potentially lower production numbers than predicted.

Emerging Opportunities in Supercars Market

The supercar market presents several promising opportunities. The development and adoption of hybrid and electric powertrains open new avenues for growth, catering to the increasing awareness of environmental sustainability. Emerging markets with rising affluence represent untapped potential for expansion. The ongoing trend toward personalized customization offers the possibility for manufacturers to expand their revenue streams through bespoke designs.

Leading Players in the Supercars Market Market

- Bugatti Automobiles SAS

- BMW AG

- Aston Martin

- Maserati SpA

- Mercedes-Benz AMG

- McLaren Group

- Porche AG

- Automobili Lamborghini SpA

- Ferrari SpA

- Bentley Motors Limited

- Koenigsegg Automotive AB

- Audi A

Key Developments in Supercars Market Industry

October 2023: Entop launched the Simurgh supercar at the Geneva International Motor Show, showcasing a unique design and four-cylinder engine. This demonstrates innovation outside traditional supercar manufacturers.

March 2024: Audi completed production of its R8 supercar, marking the end of an era for this iconic model. This indicates shifts in production focus and potential new models from Audi.

April 2024: Supercar Blondie launched SBX Cars, an online auction platform for high-value vehicles. This highlights new avenues for sales and showcases the growing interest in rare vehicles, increasing market liquidity and potentially altering distribution models.

Strategic Outlook for Supercars Market Market

The future of the supercar market appears promising, with continued growth anticipated. Technological advancements, particularly in electrification and autonomous driving, will play a key role in shaping the market landscape. The expanding affluence in emerging economies and an ongoing preference for luxury and exclusivity will drive future demand. Strategic partnerships and collaborations among manufacturers could also lead to innovative developments and expand market reach. Manufacturers must prioritize sustainability and innovation to meet evolving consumer preferences and regulatory requirements.

Supercars Market Segmentation

-

1. Type

- 1.1. Convertible

- 1.2. Non-convertible

-

2. Propulsion type

- 2.1. IC Engine

- 2.2. Electric

- 2.3. Hybrid

-

3. Payment Type

- 3.1. Cash Payment

- 3.2. Financing/Loan

- 3.3. Leasing

Supercars Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. South America

- 4.2. Middle East and Africa

Supercars Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rapid Shift Toward Electric and Hybrid Supercars to Drive Market Growth

- 3.3. Market Restrains

- 3.3.1. Rapid Shift Toward Electric and Hybrid Supercars to Drive Market Growth

- 3.4. Market Trends

- 3.4.1. The Electric Segment Expected to be the Fastest-growing During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Supercars Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Convertible

- 5.1.2. Non-convertible

- 5.2. Market Analysis, Insights and Forecast - by Propulsion type

- 5.2.1. IC Engine

- 5.2.2. Electric

- 5.2.3. Hybrid

- 5.3. Market Analysis, Insights and Forecast - by Payment Type

- 5.3.1. Cash Payment

- 5.3.2. Financing/Loan

- 5.3.3. Leasing

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Supercars Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Convertible

- 6.1.2. Non-convertible

- 6.2. Market Analysis, Insights and Forecast - by Propulsion type

- 6.2.1. IC Engine

- 6.2.2. Electric

- 6.2.3. Hybrid

- 6.3. Market Analysis, Insights and Forecast - by Payment Type

- 6.3.1. Cash Payment

- 6.3.2. Financing/Loan

- 6.3.3. Leasing

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Supercars Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Convertible

- 7.1.2. Non-convertible

- 7.2. Market Analysis, Insights and Forecast - by Propulsion type

- 7.2.1. IC Engine

- 7.2.2. Electric

- 7.2.3. Hybrid

- 7.3. Market Analysis, Insights and Forecast - by Payment Type

- 7.3.1. Cash Payment

- 7.3.2. Financing/Loan

- 7.3.3. Leasing

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Supercars Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Convertible

- 8.1.2. Non-convertible

- 8.2. Market Analysis, Insights and Forecast - by Propulsion type

- 8.2.1. IC Engine

- 8.2.2. Electric

- 8.2.3. Hybrid

- 8.3. Market Analysis, Insights and Forecast - by Payment Type

- 8.3.1. Cash Payment

- 8.3.2. Financing/Loan

- 8.3.3. Leasing

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of the World Supercars Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Convertible

- 9.1.2. Non-convertible

- 9.2. Market Analysis, Insights and Forecast - by Propulsion type

- 9.2.1. IC Engine

- 9.2.2. Electric

- 9.2.3. Hybrid

- 9.3. Market Analysis, Insights and Forecast - by Payment Type

- 9.3.1. Cash Payment

- 9.3.2. Financing/Loan

- 9.3.3. Leasing

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Bugatti Automobiles SAS

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 BMW AG

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Aston Martin

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Maserati SpA

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Mercedes-Benz AMG

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 McLaren Group

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Porche AG

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Automobili Lamborghini SpA

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Ferrari SpA

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Bentley Motors Limited

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Koenigsegg Automotive AB

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Audi A

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.1 Bugatti Automobiles SAS

List of Figures

- Figure 1: Global Supercars Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Global Supercars Market Volume Breakdown (Billion, %) by Region 2024 & 2032

- Figure 3: North America Supercars Market Revenue (Million), by Type 2024 & 2032

- Figure 4: North America Supercars Market Volume (Billion), by Type 2024 & 2032

- Figure 5: North America Supercars Market Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Supercars Market Volume Share (%), by Type 2024 & 2032

- Figure 7: North America Supercars Market Revenue (Million), by Propulsion type 2024 & 2032

- Figure 8: North America Supercars Market Volume (Billion), by Propulsion type 2024 & 2032

- Figure 9: North America Supercars Market Revenue Share (%), by Propulsion type 2024 & 2032

- Figure 10: North America Supercars Market Volume Share (%), by Propulsion type 2024 & 2032

- Figure 11: North America Supercars Market Revenue (Million), by Payment Type 2024 & 2032

- Figure 12: North America Supercars Market Volume (Billion), by Payment Type 2024 & 2032

- Figure 13: North America Supercars Market Revenue Share (%), by Payment Type 2024 & 2032

- Figure 14: North America Supercars Market Volume Share (%), by Payment Type 2024 & 2032

- Figure 15: North America Supercars Market Revenue (Million), by Country 2024 & 2032

- Figure 16: North America Supercars Market Volume (Billion), by Country 2024 & 2032

- Figure 17: North America Supercars Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: North America Supercars Market Volume Share (%), by Country 2024 & 2032

- Figure 19: Europe Supercars Market Revenue (Million), by Type 2024 & 2032

- Figure 20: Europe Supercars Market Volume (Billion), by Type 2024 & 2032

- Figure 21: Europe Supercars Market Revenue Share (%), by Type 2024 & 2032

- Figure 22: Europe Supercars Market Volume Share (%), by Type 2024 & 2032

- Figure 23: Europe Supercars Market Revenue (Million), by Propulsion type 2024 & 2032

- Figure 24: Europe Supercars Market Volume (Billion), by Propulsion type 2024 & 2032

- Figure 25: Europe Supercars Market Revenue Share (%), by Propulsion type 2024 & 2032

- Figure 26: Europe Supercars Market Volume Share (%), by Propulsion type 2024 & 2032

- Figure 27: Europe Supercars Market Revenue (Million), by Payment Type 2024 & 2032

- Figure 28: Europe Supercars Market Volume (Billion), by Payment Type 2024 & 2032

- Figure 29: Europe Supercars Market Revenue Share (%), by Payment Type 2024 & 2032

- Figure 30: Europe Supercars Market Volume Share (%), by Payment Type 2024 & 2032

- Figure 31: Europe Supercars Market Revenue (Million), by Country 2024 & 2032

- Figure 32: Europe Supercars Market Volume (Billion), by Country 2024 & 2032

- Figure 33: Europe Supercars Market Revenue Share (%), by Country 2024 & 2032

- Figure 34: Europe Supercars Market Volume Share (%), by Country 2024 & 2032

- Figure 35: Asia Pacific Supercars Market Revenue (Million), by Type 2024 & 2032

- Figure 36: Asia Pacific Supercars Market Volume (Billion), by Type 2024 & 2032

- Figure 37: Asia Pacific Supercars Market Revenue Share (%), by Type 2024 & 2032

- Figure 38: Asia Pacific Supercars Market Volume Share (%), by Type 2024 & 2032

- Figure 39: Asia Pacific Supercars Market Revenue (Million), by Propulsion type 2024 & 2032

- Figure 40: Asia Pacific Supercars Market Volume (Billion), by Propulsion type 2024 & 2032

- Figure 41: Asia Pacific Supercars Market Revenue Share (%), by Propulsion type 2024 & 2032

- Figure 42: Asia Pacific Supercars Market Volume Share (%), by Propulsion type 2024 & 2032

- Figure 43: Asia Pacific Supercars Market Revenue (Million), by Payment Type 2024 & 2032

- Figure 44: Asia Pacific Supercars Market Volume (Billion), by Payment Type 2024 & 2032

- Figure 45: Asia Pacific Supercars Market Revenue Share (%), by Payment Type 2024 & 2032

- Figure 46: Asia Pacific Supercars Market Volume Share (%), by Payment Type 2024 & 2032

- Figure 47: Asia Pacific Supercars Market Revenue (Million), by Country 2024 & 2032

- Figure 48: Asia Pacific Supercars Market Volume (Billion), by Country 2024 & 2032

- Figure 49: Asia Pacific Supercars Market Revenue Share (%), by Country 2024 & 2032

- Figure 50: Asia Pacific Supercars Market Volume Share (%), by Country 2024 & 2032

- Figure 51: Rest of the World Supercars Market Revenue (Million), by Type 2024 & 2032

- Figure 52: Rest of the World Supercars Market Volume (Billion), by Type 2024 & 2032

- Figure 53: Rest of the World Supercars Market Revenue Share (%), by Type 2024 & 2032

- Figure 54: Rest of the World Supercars Market Volume Share (%), by Type 2024 & 2032

- Figure 55: Rest of the World Supercars Market Revenue (Million), by Propulsion type 2024 & 2032

- Figure 56: Rest of the World Supercars Market Volume (Billion), by Propulsion type 2024 & 2032

- Figure 57: Rest of the World Supercars Market Revenue Share (%), by Propulsion type 2024 & 2032

- Figure 58: Rest of the World Supercars Market Volume Share (%), by Propulsion type 2024 & 2032

- Figure 59: Rest of the World Supercars Market Revenue (Million), by Payment Type 2024 & 2032

- Figure 60: Rest of the World Supercars Market Volume (Billion), by Payment Type 2024 & 2032

- Figure 61: Rest of the World Supercars Market Revenue Share (%), by Payment Type 2024 & 2032

- Figure 62: Rest of the World Supercars Market Volume Share (%), by Payment Type 2024 & 2032

- Figure 63: Rest of the World Supercars Market Revenue (Million), by Country 2024 & 2032

- Figure 64: Rest of the World Supercars Market Volume (Billion), by Country 2024 & 2032

- Figure 65: Rest of the World Supercars Market Revenue Share (%), by Country 2024 & 2032

- Figure 66: Rest of the World Supercars Market Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Supercars Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Supercars Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: Global Supercars Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Global Supercars Market Volume Billion Forecast, by Type 2019 & 2032

- Table 5: Global Supercars Market Revenue Million Forecast, by Propulsion type 2019 & 2032

- Table 6: Global Supercars Market Volume Billion Forecast, by Propulsion type 2019 & 2032

- Table 7: Global Supercars Market Revenue Million Forecast, by Payment Type 2019 & 2032

- Table 8: Global Supercars Market Volume Billion Forecast, by Payment Type 2019 & 2032

- Table 9: Global Supercars Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Global Supercars Market Volume Billion Forecast, by Region 2019 & 2032

- Table 11: Global Supercars Market Revenue Million Forecast, by Type 2019 & 2032

- Table 12: Global Supercars Market Volume Billion Forecast, by Type 2019 & 2032

- Table 13: Global Supercars Market Revenue Million Forecast, by Propulsion type 2019 & 2032

- Table 14: Global Supercars Market Volume Billion Forecast, by Propulsion type 2019 & 2032

- Table 15: Global Supercars Market Revenue Million Forecast, by Payment Type 2019 & 2032

- Table 16: Global Supercars Market Volume Billion Forecast, by Payment Type 2019 & 2032

- Table 17: Global Supercars Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Global Supercars Market Volume Billion Forecast, by Country 2019 & 2032

- Table 19: United States Supercars Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: United States Supercars Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 21: Canada Supercars Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Canada Supercars Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 23: Rest of North America Supercars Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Rest of North America Supercars Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 25: Global Supercars Market Revenue Million Forecast, by Type 2019 & 2032

- Table 26: Global Supercars Market Volume Billion Forecast, by Type 2019 & 2032

- Table 27: Global Supercars Market Revenue Million Forecast, by Propulsion type 2019 & 2032

- Table 28: Global Supercars Market Volume Billion Forecast, by Propulsion type 2019 & 2032

- Table 29: Global Supercars Market Revenue Million Forecast, by Payment Type 2019 & 2032

- Table 30: Global Supercars Market Volume Billion Forecast, by Payment Type 2019 & 2032

- Table 31: Global Supercars Market Revenue Million Forecast, by Country 2019 & 2032

- Table 32: Global Supercars Market Volume Billion Forecast, by Country 2019 & 2032

- Table 33: Germany Supercars Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Germany Supercars Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 35: United Kingdom Supercars Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: United Kingdom Supercars Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 37: France Supercars Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: France Supercars Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 39: Italy Supercars Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Italy Supercars Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 41: Spain Supercars Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Spain Supercars Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 43: Rest of Europe Supercars Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Rest of Europe Supercars Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 45: Global Supercars Market Revenue Million Forecast, by Type 2019 & 2032

- Table 46: Global Supercars Market Volume Billion Forecast, by Type 2019 & 2032

- Table 47: Global Supercars Market Revenue Million Forecast, by Propulsion type 2019 & 2032

- Table 48: Global Supercars Market Volume Billion Forecast, by Propulsion type 2019 & 2032

- Table 49: Global Supercars Market Revenue Million Forecast, by Payment Type 2019 & 2032

- Table 50: Global Supercars Market Volume Billion Forecast, by Payment Type 2019 & 2032

- Table 51: Global Supercars Market Revenue Million Forecast, by Country 2019 & 2032

- Table 52: Global Supercars Market Volume Billion Forecast, by Country 2019 & 2032

- Table 53: China Supercars Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: China Supercars Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 55: Japan Supercars Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Japan Supercars Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 57: India Supercars Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: India Supercars Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 59: South Korea Supercars Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 60: South Korea Supercars Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 61: Rest of Asia Pacific Supercars Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 62: Rest of Asia Pacific Supercars Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 63: Global Supercars Market Revenue Million Forecast, by Type 2019 & 2032

- Table 64: Global Supercars Market Volume Billion Forecast, by Type 2019 & 2032

- Table 65: Global Supercars Market Revenue Million Forecast, by Propulsion type 2019 & 2032

- Table 66: Global Supercars Market Volume Billion Forecast, by Propulsion type 2019 & 2032

- Table 67: Global Supercars Market Revenue Million Forecast, by Payment Type 2019 & 2032

- Table 68: Global Supercars Market Volume Billion Forecast, by Payment Type 2019 & 2032

- Table 69: Global Supercars Market Revenue Million Forecast, by Country 2019 & 2032

- Table 70: Global Supercars Market Volume Billion Forecast, by Country 2019 & 2032

- Table 71: South America Supercars Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 72: South America Supercars Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 73: Middle East and Africa Supercars Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 74: Middle East and Africa Supercars Market Volume (Billion) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Supercars Market?

The projected CAGR is approximately 4.50%.

2. Which companies are prominent players in the Supercars Market?

Key companies in the market include Bugatti Automobiles SAS, BMW AG, Aston Martin, Maserati SpA, Mercedes-Benz AMG, McLaren Group, Porche AG, Automobili Lamborghini SpA, Ferrari SpA, Bentley Motors Limited, Koenigsegg Automotive AB, Audi A.

3. What are the main segments of the Supercars Market?

The market segments include Type, Propulsion type, Payment Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 18.54 Million as of 2022.

5. What are some drivers contributing to market growth?

Rapid Shift Toward Electric and Hybrid Supercars to Drive Market Growth.

6. What are the notable trends driving market growth?

The Electric Segment Expected to be the Fastest-growing During the Forecast Period.

7. Are there any restraints impacting market growth?

Rapid Shift Toward Electric and Hybrid Supercars to Drive Market Growth.

8. Can you provide examples of recent developments in the market?

April 2024: Supercar Blondie launched SBX Cars, an online auction site to sell hypercars and other expensive items. The auction house primarily operates in Los Angeles and Dubai. The site features rare cars like the BMW Glass Yacht, the Lotus F1 Team's John Player Specials from the 1970s and 80s, the Hyperion XP-1 prototype, and the Mercedes-AMG One supercar.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Supercars Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Supercars Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Supercars Market?

To stay informed about further developments, trends, and reports in the Supercars Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence