Key Insights

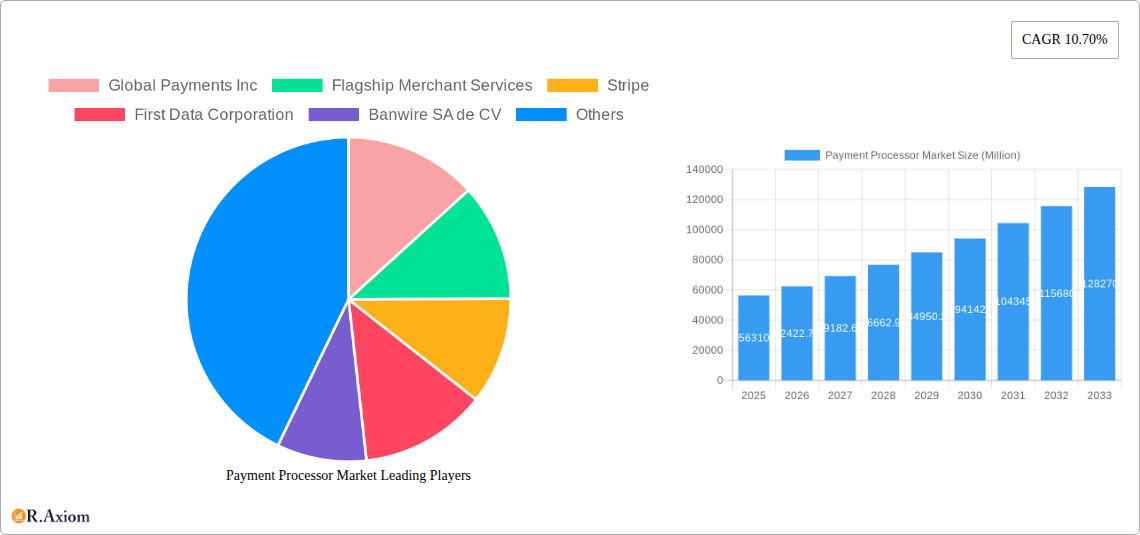

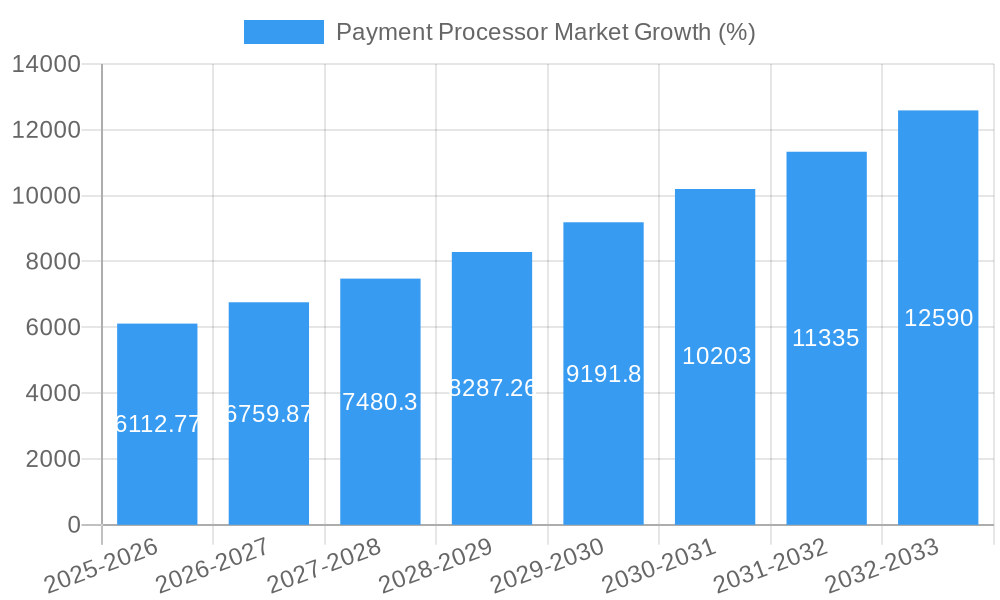

The global payment processing market, valued at $56.31 billion in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 10.70% from 2025 to 2033. This expansion is fueled by several key drivers. The increasing adoption of e-commerce and digital transactions, particularly amongst younger demographics, significantly boosts demand for secure and efficient payment processing solutions. Furthermore, the rise of mobile payments, fueled by the proliferation of smartphones and improved mobile internet penetration globally, continues to propel market growth. The shift towards contactless payments, driven by concerns regarding hygiene and convenience, further accelerates the adoption of payment processing technologies. Innovation in areas such as Artificial Intelligence (AI) for fraud detection and blockchain technology for enhanced security are also contributing factors. The market is segmented by payment type, with credit cards, debit cards, and e-wallet transactions representing significant shares, each contributing to the overall growth. Geographic expansion, particularly in developing economies witnessing rapid digitalization, presents lucrative opportunities for market players. Competition among established players like PayPal, Stripe, and Square, alongside emerging fintech companies, is intense, driving innovation and enhancing the overall service offerings available to consumers and businesses.

However, certain restraints could potentially moderate market growth. These include stringent regulatory frameworks and compliance requirements across different jurisdictions, posing challenges for global expansion and operational efficiency. Concerns over data security and privacy, alongside the potential for fraud, represent ongoing obstacles that require continuous investment in robust security measures. The cost of implementing and maintaining payment processing infrastructure, particularly for smaller businesses, can also act as a barrier to entry and limit wider adoption in certain segments. Nevertheless, the overall positive trajectory of digital transformation and e-commerce suggests a largely optimistic outlook for the payment processing market in the coming years, with opportunities for both established players and innovative startups to capitalize on market expansion.

This in-depth report provides a comprehensive analysis of the global Payment Processor Market, offering invaluable insights for industry stakeholders, investors, and businesses seeking to navigate this dynamic landscape. The report covers the period 2019-2033, with a focus on the forecast period 2025-2033, utilizing 2025 as the base and estimated year. The analysis incorporates key market segments, leading players, and significant industry developments, providing actionable intelligence for strategic decision-making. The total market size in 2025 is estimated at xx Million.

Payment Processor Market Market Concentration & Innovation

The Payment Processor Market demonstrates a moderately concentrated landscape, with a few dominant players controlling a significant market share. Global Payments Inc, PayPal Holdings Inc, and Stripe, for example, hold substantial positions, while numerous smaller players compete for niche markets. Market share dynamics are influenced by factors such as technological innovation, regulatory changes, and mergers and acquisitions (M&A) activity.

- Market Concentration: The Herfindahl-Hirschman Index (HHI) is estimated at xx, suggesting a moderately concentrated market. Top 5 players hold an estimated xx% market share.

- Innovation Drivers: The market is driven by continuous innovation in areas such as mobile payments, contactless transactions, and blockchain technology. Companies are investing heavily in R&D to enhance security, improve user experience, and expand functionalities.

- Regulatory Frameworks: Stringent regulatory compliance requirements, varying across jurisdictions, pose a significant challenge for market players. This necessitates substantial investments in compliance infrastructure and expertise.

- Product Substitutes: The emergence of alternative payment methods, such as Buy Now, Pay Later (BNPL) services and cryptocurrency transactions, presents competitive pressure to traditional payment processors.

- End-User Trends: Increasing digital adoption among consumers, particularly in emerging markets, fuels market growth. Demand for seamless, secure, and convenient payment solutions continues to rise.

- M&A Activities: The Payment Processor Market has witnessed substantial M&A activity in recent years, with deals valued at xx Million in 2024. These activities aim to expand market reach, acquire new technologies, and enhance competitive positioning.

Payment Processor Market Industry Trends & Insights

The global Payment Processor Market is experiencing robust growth, driven by several key factors. The increasing adoption of e-commerce and digital transactions fuels significant demand for secure and efficient payment processing solutions. Technological advancements, such as the proliferation of mobile wallets and contactless payments, significantly contribute to the market's expansion. Moreover, shifting consumer preferences towards digital payment methods, particularly among younger demographics, further accelerates growth. The competitive landscape is characterized by intense competition among established players and emerging fintech companies.

- Market Growth Drivers: The CAGR during the forecast period (2025-2033) is projected to be xx%. Market penetration of digital payment methods in emerging economies remains relatively low, presenting significant untapped potential.

- Technological Disruptions: The integration of artificial intelligence (AI), machine learning (ML), and blockchain technology is transforming the industry. AI-powered fraud detection systems enhance security, while blockchain technology improves transparency and efficiency.

- Consumer Preferences: Consumer demand for personalized and convenient payment experiences is driving innovation in areas such as mobile payments, peer-to-peer (P2P) transfers, and customized payment options.

- Competitive Dynamics: The market is intensely competitive, with established players facing challenges from agile fintech startups that offer innovative and cost-effective solutions.

Dominant Markets & Segments in Payment Processor Market

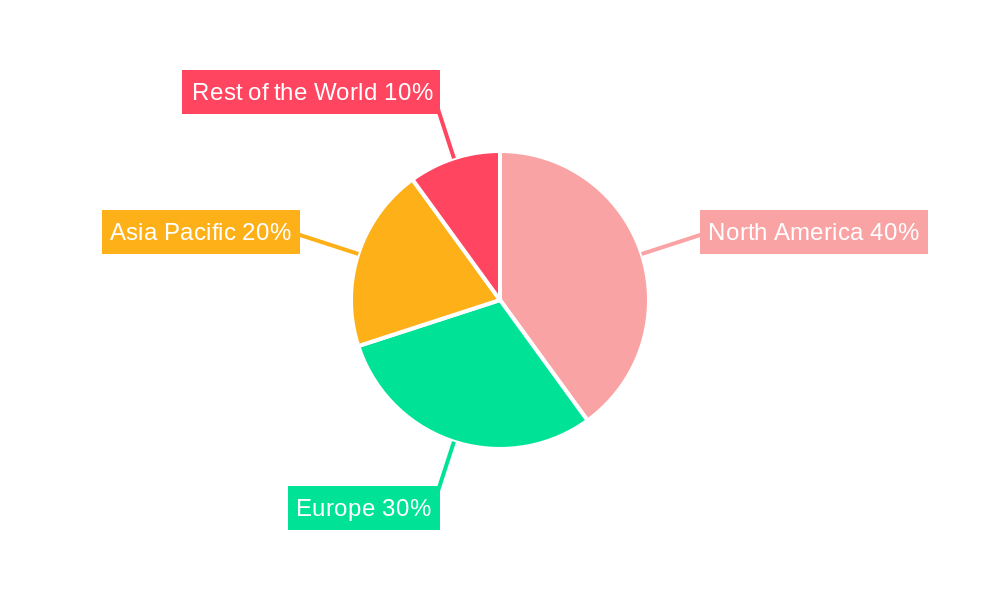

The Payment Processor Market exhibits regional variations in growth and adoption rates. North America and Europe currently hold significant market shares due to higher digital penetration and robust financial infrastructure. However, Asia-Pacific is experiencing rapid growth, propelled by expanding internet and smartphone usage, particularly in countries like India and China. Among payment types, credit cards and e-wallet transactions are currently the most dominant segments, although debit cards are showing significant growth, especially in emerging markets.

- Leading Region: North America currently holds the largest market share, driven by high e-commerce penetration and a developed financial infrastructure.

- By Type:

- Credit Cards: Dominant segment driven by widespread acceptance and established infrastructure.

- Debit Cards: Experiencing rapid growth, particularly in emerging markets, fueled by increased financial inclusion.

- e-Wallet Transactions: Strong growth driven by the convenience and security offered by digital wallets.

- Key Drivers (Bullet Points):

- North America: High digital adoption, robust financial infrastructure, and strong consumer spending.

- Europe: Growing adoption of digital payment methods, increasing regulatory focus on financial technology.

- Asia-Pacific: Rapid growth fueled by increasing internet and smartphone penetration, coupled with rising disposable incomes.

Payment Processor Market Product Developments

Recent product innovations focus on enhancing security, improving user experience, and expanding functionality. This includes the integration of biometric authentication, advanced fraud detection systems, and the development of specialized payment solutions for specific industry verticals. The market emphasizes seamless cross-border payments, support for multiple currencies, and the integration of payment gateways with e-commerce platforms. These advancements cater to evolving consumer preferences and enhance the overall payment experience.

Report Scope & Segmentation Analysis

This report segments the Payment Processor Market by payment type: Credit Cards, Debit Cards, and e-Wallet Transactions. Each segment is analyzed based on historical data (2019-2024), current estimates (2025), and future projections (2025-2033). Growth projections, market size, and competitive dynamics are discussed for each segment, providing a holistic understanding of market opportunities and challenges.

- Credit Cards: This segment is projected to maintain a significant market share throughout the forecast period. Growth is expected to be driven by continued acceptance and the integration of new technologies like contactless payments.

- Debit Cards: This segment is expected to experience robust growth, driven by increasing financial inclusion and the rising popularity of online banking.

- e-Wallet Transactions: This segment exhibits high growth potential, driven by the increasing adoption of mobile payments and the convenience offered by digital wallets.

Key Drivers of Payment Processor Market Growth

Several key factors contribute to the growth of the Payment Processor Market. These include the increasing adoption of e-commerce and digital transactions, technological advancements enabling seamless and secure payments, and favorable regulatory environments promoting financial innovation. Furthermore, increasing smartphone and internet penetration, particularly in developing economies, opens up significant growth opportunities.

Challenges in the Payment Processor Market Sector

Despite the market's positive outlook, several challenges persist. These include stringent regulatory compliance requirements that necessitate substantial investments, security concerns relating to data breaches and fraud, and intense competition from established players and emerging fintech companies. The need for constant technological upgrades and the integration of new technologies also pose challenges. The estimated cost of regulatory compliance for the industry in 2025 is xx Million.

Emerging Opportunities in Payment Processor Market

Emerging opportunities lie in areas such as the expansion of mobile payment solutions in underserved markets, the integration of AI and ML to enhance fraud detection and customer experience, and the development of innovative payment solutions for specific industry verticals (e.g., healthcare, education). The increasing adoption of blockchain technology also presents significant opportunities for secure and transparent payment processing.

Leading Players in the Payment Processor Market Market

- Global Payments Inc

- Flagship Merchant Services

- Stripe

- First Data Corporation

- Banwire SA de CV

- Square Inc

- PayPal Holdings Inc

- Galileo Financial Technologies LLC

- BitPay

- Adyen

- Payline Data Services LLC

- Tutuka Software (Pty) Ltd

- Due Inc

- Braspag

- Marqeta Inc

- CCBill LLC

- Paysafe Limited

Key Developments in Payment Processor Market Industry

- May 2022: Visa partners with Fundbox to launch the Fundbox Flex Visa Debit Card, enhancing small business cash flow management.

- March 2022: Mastercard establishes a 5-year partnership with Zeta, investing in next-generation credit card processing technology.

Strategic Outlook for Payment Processor Market Market

The Payment Processor Market is poised for continued growth, driven by technological advancements, increasing digital adoption, and expanding e-commerce. Strategic focus should be placed on innovation, regulatory compliance, and strategic partnerships to capitalize on emerging opportunities and maintain a competitive edge. The market is expected to reach xx Million by 2033, presenting significant growth potential for established players and new entrants alike.

Payment Processor Market Segmentation

-

1. Type

- 1.1. Credit Cards

- 1.2. Debit Cards

- 1.3. e-Wallet Transactions

Payment Processor Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

- 4. Rest of the World

Payment Processor Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 10.70% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 High Proliferation of Digital Initiatives Resulting in Higher Transaction Volume for Payment Processors; Growing Bargaining Leverage of Consumers With Buying Firms

- 3.2.2 Leading to Greater Focus on Enabling Seamless Transactions; Favorable Government Regulations Coupled with Key Innovations Playing a Key Role in Driving Credit/Debit Transactions

- 3.3. Market Restrains

- 3.3.1. Lack of a Standard Legislative Policy Across the Globe; Privacy and Security Concerns

- 3.4. Market Trends

- 3.4.1. Credit Card Segment is Expected to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Payment Processor Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Credit Cards

- 5.1.2. Debit Cards

- 5.1.3. e-Wallet Transactions

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Payment Processor Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Credit Cards

- 6.1.2. Debit Cards

- 6.1.3. e-Wallet Transactions

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Payment Processor Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Credit Cards

- 7.1.2. Debit Cards

- 7.1.3. e-Wallet Transactions

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Payment Processor Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Credit Cards

- 8.1.2. Debit Cards

- 8.1.3. e-Wallet Transactions

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of the World Payment Processor Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Credit Cards

- 9.1.2. Debit Cards

- 9.1.3. e-Wallet Transactions

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. North America Payment Processor Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1 United States

- 10.1.2 Canada

- 11. Europe Payment Processor Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United Kingdom

- 11.1.2 Germany

- 11.1.3 France

- 11.1.4 Rest of Europe

- 12. Asia Pacific Payment Processor Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 China

- 12.1.2 India

- 12.1.3 Japan

- 12.1.4 South Korea

- 12.1.5 Rest of Asia Pacific

- 13. Rest of the World Payment Processor Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Competitive Analysis

- 14.1. Global Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 Global Payments Inc

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 Flagship Merchant Services

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Stripe

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 First Data Corporation

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Banwire SA de CV

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Square Inc

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 PayPal Holdings Inc

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 Galileo Financial Technologies LLC

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 BitPay

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 Adyen

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.11 Payline Data Services LLC

- 14.2.11.1. Overview

- 14.2.11.2. Products

- 14.2.11.3. SWOT Analysis

- 14.2.11.4. Recent Developments

- 14.2.11.5. Financials (Based on Availability)

- 14.2.12 Tutuka Software (Pty) Ltd

- 14.2.12.1. Overview

- 14.2.12.2. Products

- 14.2.12.3. SWOT Analysis

- 14.2.12.4. Recent Developments

- 14.2.12.5. Financials (Based on Availability)

- 14.2.13 Due Inc

- 14.2.13.1. Overview

- 14.2.13.2. Products

- 14.2.13.3. SWOT Analysis

- 14.2.13.4. Recent Developments

- 14.2.13.5. Financials (Based on Availability)

- 14.2.14 Braspag

- 14.2.14.1. Overview

- 14.2.14.2. Products

- 14.2.14.3. SWOT Analysis

- 14.2.14.4. Recent Developments

- 14.2.14.5. Financials (Based on Availability)

- 14.2.15 Marqeta Inc*List Not Exhaustive

- 14.2.15.1. Overview

- 14.2.15.2. Products

- 14.2.15.3. SWOT Analysis

- 14.2.15.4. Recent Developments

- 14.2.15.5. Financials (Based on Availability)

- 14.2.16 CCBill LLC

- 14.2.16.1. Overview

- 14.2.16.2. Products

- 14.2.16.3. SWOT Analysis

- 14.2.16.4. Recent Developments

- 14.2.16.5. Financials (Based on Availability)

- 14.2.17 Paysafe Limited

- 14.2.17.1. Overview

- 14.2.17.2. Products

- 14.2.17.3. SWOT Analysis

- 14.2.17.4. Recent Developments

- 14.2.17.5. Financials (Based on Availability)

- 14.2.1 Global Payments Inc

List of Figures

- Figure 1: Global Payment Processor Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Payment Processor Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Payment Processor Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Payment Processor Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Payment Processor Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Payment Processor Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Payment Processor Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Rest of the World Payment Processor Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Rest of the World Payment Processor Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America Payment Processor Market Revenue (Million), by Type 2024 & 2032

- Figure 11: North America Payment Processor Market Revenue Share (%), by Type 2024 & 2032

- Figure 12: North America Payment Processor Market Revenue (Million), by Country 2024 & 2032

- Figure 13: North America Payment Processor Market Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Payment Processor Market Revenue (Million), by Type 2024 & 2032

- Figure 15: Europe Payment Processor Market Revenue Share (%), by Type 2024 & 2032

- Figure 16: Europe Payment Processor Market Revenue (Million), by Country 2024 & 2032

- Figure 17: Europe Payment Processor Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: Asia Pacific Payment Processor Market Revenue (Million), by Type 2024 & 2032

- Figure 19: Asia Pacific Payment Processor Market Revenue Share (%), by Type 2024 & 2032

- Figure 20: Asia Pacific Payment Processor Market Revenue (Million), by Country 2024 & 2032

- Figure 21: Asia Pacific Payment Processor Market Revenue Share (%), by Country 2024 & 2032

- Figure 22: Rest of the World Payment Processor Market Revenue (Million), by Type 2024 & 2032

- Figure 23: Rest of the World Payment Processor Market Revenue Share (%), by Type 2024 & 2032

- Figure 24: Rest of the World Payment Processor Market Revenue (Million), by Country 2024 & 2032

- Figure 25: Rest of the World Payment Processor Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Payment Processor Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Payment Processor Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Global Payment Processor Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Global Payment Processor Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: United States Payment Processor Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Canada Payment Processor Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Global Payment Processor Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: United Kingdom Payment Processor Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Germany Payment Processor Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: France Payment Processor Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Rest of Europe Payment Processor Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global Payment Processor Market Revenue Million Forecast, by Country 2019 & 2032

- Table 13: China Payment Processor Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: India Payment Processor Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Japan Payment Processor Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: South Korea Payment Processor Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Rest of Asia Pacific Payment Processor Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Global Payment Processor Market Revenue Million Forecast, by Country 2019 & 2032

- Table 19: Payment Processor Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Global Payment Processor Market Revenue Million Forecast, by Type 2019 & 2032

- Table 21: Global Payment Processor Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: United States Payment Processor Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Canada Payment Processor Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Global Payment Processor Market Revenue Million Forecast, by Type 2019 & 2032

- Table 25: Global Payment Processor Market Revenue Million Forecast, by Country 2019 & 2032

- Table 26: United Kingdom Payment Processor Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Germany Payment Processor Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: France Payment Processor Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Rest of Europe Payment Processor Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Global Payment Processor Market Revenue Million Forecast, by Type 2019 & 2032

- Table 31: Global Payment Processor Market Revenue Million Forecast, by Country 2019 & 2032

- Table 32: China Payment Processor Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: India Payment Processor Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Japan Payment Processor Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: South Korea Payment Processor Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Rest of Asia Pacific Payment Processor Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Global Payment Processor Market Revenue Million Forecast, by Type 2019 & 2032

- Table 38: Global Payment Processor Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Payment Processor Market?

The projected CAGR is approximately 10.70%.

2. Which companies are prominent players in the Payment Processor Market?

Key companies in the market include Global Payments Inc, Flagship Merchant Services, Stripe, First Data Corporation, Banwire SA de CV, Square Inc, PayPal Holdings Inc, Galileo Financial Technologies LLC, BitPay, Adyen, Payline Data Services LLC, Tutuka Software (Pty) Ltd, Due Inc, Braspag, Marqeta Inc*List Not Exhaustive, CCBill LLC, Paysafe Limited.

3. What are the main segments of the Payment Processor Market?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 56.31 Million as of 2022.

5. What are some drivers contributing to market growth?

High Proliferation of Digital Initiatives Resulting in Higher Transaction Volume for Payment Processors; Growing Bargaining Leverage of Consumers With Buying Firms. Leading to Greater Focus on Enabling Seamless Transactions; Favorable Government Regulations Coupled with Key Innovations Playing a Key Role in Driving Credit/Debit Transactions.

6. What are the notable trends driving market growth?

Credit Card Segment is Expected to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

Lack of a Standard Legislative Policy Across the Globe; Privacy and Security Concerns.

8. Can you provide examples of recent developments in the market?

May 2022 - Visa, one of the leading global digital payment companies, announced a partnership with Fundbox, an integrated working capital platform for small businesses, to enhance Fundbox's platform with the power of digital payments. The Fundbox Flex Visa Debit Card, issued by Pathward, N.A., is the first stage in this relationship, and it helps small company clients better control their cash outflows.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Payment Processor Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Payment Processor Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Payment Processor Market?

To stay informed about further developments, trends, and reports in the Payment Processor Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence