Key Insights

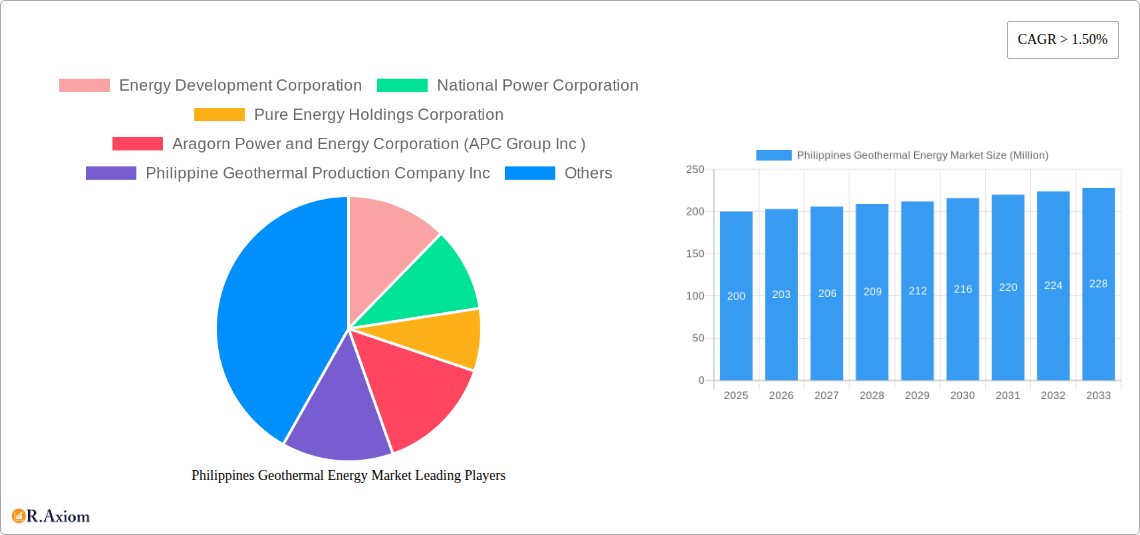

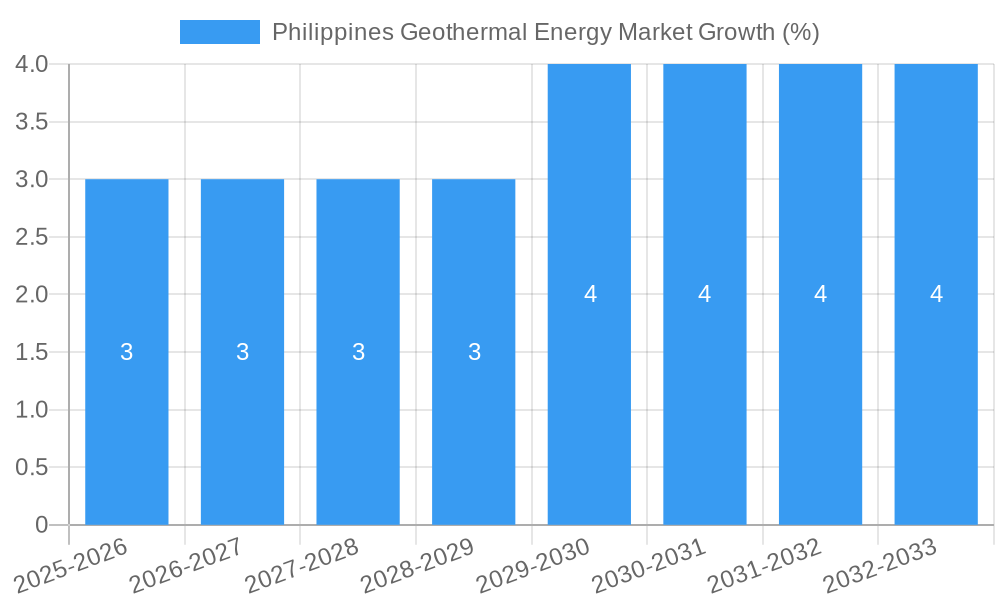

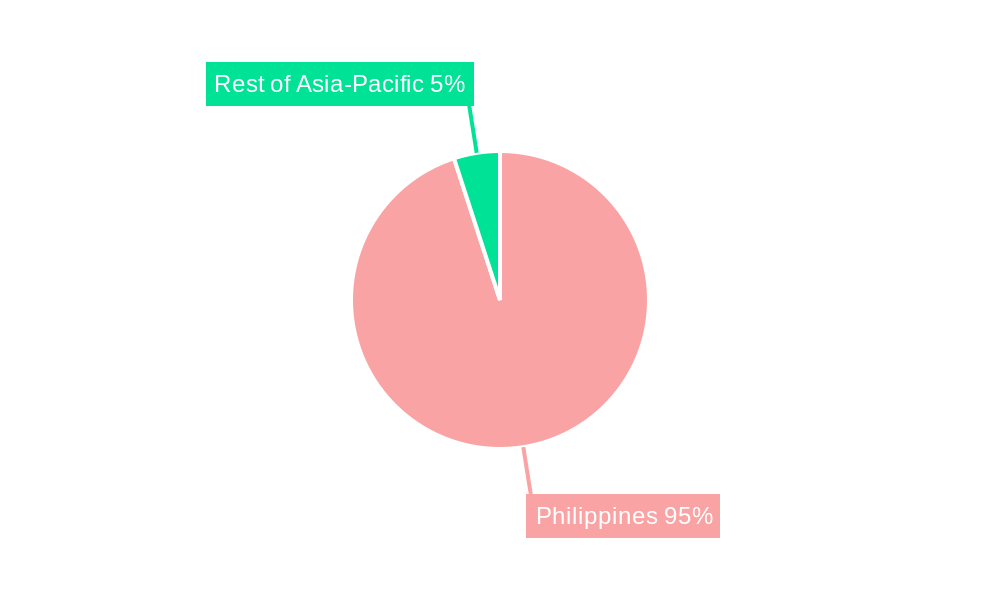

The Philippines geothermal energy market, exhibiting a Compound Annual Growth Rate (CAGR) exceeding 1.50%, presents a compelling investment opportunity. Driven by increasing electricity demand, government support for renewable energy initiatives, and the country's abundant geothermal resources, the market is poised for significant expansion. The power generation sector is the primary end-user, accounting for a substantial portion of the market share. Within the product type segment, dry steam and flash steam technologies currently dominate, with binary cycle technology expected to gain traction in the coming years due to its suitability for lower-temperature resources. Key players like Energy Development Corporation, National Power Corporation, and Aboitiz Power Corporation are driving market growth through investments in new projects and capacity expansions. However, the market faces challenges such as the high upfront capital costs associated with geothermal power plants and environmental concerns related to greenhouse gas emissions and potential land subsidence. Despite these restraints, the long-term prospects for the Philippines geothermal energy market remain positive, fueled by consistent government policy support and a growing need for sustainable energy solutions. The Asia-Pacific region, particularly the Philippines, is at the forefront of this growth, leveraging its geological advantages to diversify its energy portfolio and address climate change concerns. Future growth will be influenced by technological advancements, regulatory frameworks, and the successful implementation of sustainable energy policies. Expansion into untapped geothermal fields and increased investment in research and development will play crucial roles in the market's trajectory through 2033.

The market size in 2025 is estimated to be around $200 million (a reasonable estimate based on a rapidly growing market with a CAGR > 1.50% and significant player involvement). This figure is projected to increase significantly by 2033, driven by consistent government support for renewable energy and the increasing demand for clean energy sources within the Philippines. The regional focus remains largely within the Philippines itself, though there is potential for future expansion within the wider Asia-Pacific region, with China, Japan, and other countries potentially increasing their collaborations and imports of geothermal technology and expertise from the Philippines. This creates a compelling opportunity for both domestic and international stakeholders to participate in a sector showcasing considerable long-term growth potential.

Philippines Geothermal Energy Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the Philippines geothermal energy market, covering the period from 2019 to 2033. It offers in-depth insights into market trends, segment performance, key players, and future growth opportunities. The report is essential for industry stakeholders, investors, and policymakers seeking a thorough understanding of this dynamic sector. With a base year of 2025 and a forecast period spanning 2025-2033, this report leverages historical data (2019-2024) to provide accurate projections and actionable strategies.

Philippines Geothermal Energy Market Concentration & Innovation

The Philippines geothermal energy market exhibits a moderately concentrated landscape, dominated by a few major players. Energy Development Corporation (EDC), National Power Corporation (NPC), and Aboitiz Power Corporation hold significant market share, estimated at xx%, xx%, and xx%, respectively, in 2025. Smaller players like Pure Energy Holdings Corporation, Aragorn Power and Energy Corporation (APC Group Inc), and Philippine Geothermal Production Company Inc contribute to the remaining market share. Innovation is driven by the need to enhance efficiency, reduce costs, and explore new applications of geothermal energy. The regulatory framework, while supportive of renewable energy development, faces challenges in streamlining approvals and ensuring grid integration. The market also experiences competition from other renewable energy sources like solar and wind power. M&A activities in the sector have been relatively modest in recent years, with total deal values estimated at xx Million in the period 2019-2024. However, future consolidation is anticipated as companies seek to expand their portfolios and achieve economies of scale. Key factors influencing innovation include:

- Technological advancements: Improved drilling techniques, enhanced power generation technologies (e.g., binary cycle plants), and better resource exploration methods.

- Government incentives: Policies aimed at promoting renewable energy adoption and investment in geothermal projects.

- International collaboration: Partnerships with foreign companies bring in expertise and capital.

Philippines Geothermal Energy Market Industry Trends & Insights

The Philippines geothermal energy market is experiencing robust growth, driven by increasing electricity demand, government support for renewable energy, and the country's abundant geothermal resources. The market is expected to register a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), reaching a market size of xx Million by 2033. Market penetration of geothermal energy in the overall power generation mix is projected to increase from xx% in 2025 to xx% by 2033. This growth is fueled by factors such as:

- Government initiatives: The Philippine government's commitment to increasing renewable energy capacity, including ambitious targets for geothermal energy deployment.

- Technological advancements: The adoption of more efficient and cost-effective geothermal technologies, such as binary cycle systems.

- Rising energy demand: The growing population and economic activity are driving the need for increased power generation capacity.

- Environmental concerns: The growing awareness of climate change and the need to reduce reliance on fossil fuels.

Dominant Markets & Segments in Philippines Geothermal Energy Market

The Luzon region dominates the Philippines geothermal energy market due to its high geothermal resource concentration and established infrastructure. Power generation accounts for the largest share of end-user segments, driven by strong electricity demand and government support for renewable energy integration into the grid.

Key Drivers for Luzon's Dominance:

- High geothermal resource potential.

- Established infrastructure for power generation and transmission.

- Government policies supportive of renewable energy development in the region.

Segment Analysis:

- Product Type: Flash steam currently holds the largest market share, followed by dry steam and binary cycle systems. However, binary cycle is expected to experience significant growth due to its ability to utilize lower-temperature resources.

- End-User: Power generation constitutes the most significant portion, while direct use (e.g., for heating and industrial processes) remains a smaller but growing segment.

Philippines Geothermal Energy Market Product Developments

Recent technological advancements in geothermal energy production include improvements in drilling techniques, optimized power plant designs, and enhanced resource exploration methods. These innovations have resulted in increased efficiency, cost reductions, and expanded applicability of geothermal energy. The market is witnessing a shift toward binary cycle technology, which offers greater flexibility and potential for harnessing lower-temperature resources. This technological advancement enhances the viability of exploiting geothermal resources previously considered uneconomical.

Report Scope & Segmentation Analysis

This report segments the Philippines geothermal energy market by product type (dry steam, flash steam, and binary cycle) and end-user (power generation and direct use). Each segment is analyzed in detail, including growth projections, market sizes, and competitive dynamics. The market size for each segment is expected to grow significantly, with flash steam maintaining a dominant position, while binary cycle is anticipated to witness the most substantial growth rate due to technological advancements and resource accessibility. The power generation segment will remain the largest end-user segment, driven by the increasing electricity demand and government initiatives promoting renewable energy integration into the grid. Direct use segment growth is projected to be slower compared to the power generation segment.

Key Drivers of Philippines Geothermal Energy Market Growth

The growth of the Philippines geothermal energy market is driven by several factors:

- Abundant geothermal resources: The Philippines possesses significant geothermal potential, offering a sustainable and reliable energy source.

- Government support: The government's commitment to renewable energy development through supportive policies and incentives.

- Increasing electricity demand: The growing population and economy necessitate expanding power generation capacity.

- Environmental concerns: The need to reduce greenhouse gas emissions and reliance on fossil fuels.

Challenges in the Philippines Geothermal Energy Market Sector

Several factors hinder the full potential of the Philippines geothermal energy market:

- High upfront capital costs: Geothermal power plants require significant initial investment.

- Regulatory hurdles: Navigating permits and approvals can be time-consuming.

- Grid infrastructure limitations: Integrating geothermal power into the national grid can pose challenges in some areas.

- Geological risks: Geothermal projects involve geological uncertainties that may impact project feasibility.

Emerging Opportunities in Philippines Geothermal Energy Market

The Philippines geothermal energy market offers exciting opportunities:

- Exploration of untapped geothermal resources: Significant potential exists for discovering new geothermal fields.

- Expansion of direct use applications: Growing demand for geothermal energy for heating and industrial processes.

- Technological advancements: Continuous innovations in geothermal technologies can improve efficiency and reduce costs.

- Regional cooperation: Collaboration with neighboring countries to share expertise and resources.

Leading Players in the Philippines Geothermal Energy Market Market

- Energy Development Corporation

- National Power Corporation

- Pure Energy Holdings Corporation

- Aragorn Power and Energy Corporation (APC Group Inc)

- Philippine Geothermal Production Company Inc

- Aboitiz Power Corporation

Key Developments in Philippines Geothermal Energy Market Industry

- October 2022: Energy Development Corp (EDC) partnered with Toshiba Energy Systems & Solutions Corp. and Toshiba (Philippines) Inc. to develop a 20-MW flash geothermal power project in Luzon. This signifies a notable expansion in geothermal capacity and showcases technological collaboration to enhance project efficiency.

Strategic Outlook for Philippines Geothermal Energy Market Market

The Philippines geothermal energy market is poised for significant growth, driven by the country's substantial geothermal resources, supportive government policies, and increasing energy demand. Continued technological advancements, improved infrastructure, and strategic partnerships will play a crucial role in unlocking the market's full potential and securing a sustainable energy future for the Philippines. The market is expected to attract further investments, fostering innovation and diversification within the sector.

Philippines Geothermal Energy Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Philippines Geothermal Energy Market Segmentation By Geography

- 1. Philippines

Philippines Geothermal Energy Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 1.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Gas Production and Infrastructure4.; Increasing Exploration and Production Activities

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Adoption of Clean Power Sources

- 3.4. Market Trends

- 3.4.1. Deep Geothermal Systems Expected to See Significant Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Philippines Geothermal Energy Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Philippines

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. China Philippines Geothermal Energy Market Analysis, Insights and Forecast, 2019-2031

- 7. Japan Philippines Geothermal Energy Market Analysis, Insights and Forecast, 2019-2031

- 8. India Philippines Geothermal Energy Market Analysis, Insights and Forecast, 2019-2031

- 9. South Korea Philippines Geothermal Energy Market Analysis, Insights and Forecast, 2019-2031

- 10. Taiwan Philippines Geothermal Energy Market Analysis, Insights and Forecast, 2019-2031

- 11. Australia Philippines Geothermal Energy Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Asia-Pacific Philippines Geothermal Energy Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Energy Development Corporation

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 National Power Corporation

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Pure Energy Holdings Corporation

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Aragorn Power and Energy Corporation (APC Group Inc )

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Philippine Geothermal Production Company Inc

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Aboitiz Power Corporation

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.1 Energy Development Corporation

List of Figures

- Figure 1: Philippines Geothermal Energy Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Philippines Geothermal Energy Market Share (%) by Company 2024

List of Tables

- Table 1: Philippines Geothermal Energy Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Philippines Geothermal Energy Market Volume Gigawatt Forecast, by Region 2019 & 2032

- Table 3: Philippines Geothermal Energy Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 4: Philippines Geothermal Energy Market Volume Gigawatt Forecast, by Production Analysis 2019 & 2032

- Table 5: Philippines Geothermal Energy Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 6: Philippines Geothermal Energy Market Volume Gigawatt Forecast, by Consumption Analysis 2019 & 2032

- Table 7: Philippines Geothermal Energy Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 8: Philippines Geothermal Energy Market Volume Gigawatt Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 9: Philippines Geothermal Energy Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 10: Philippines Geothermal Energy Market Volume Gigawatt Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 11: Philippines Geothermal Energy Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 12: Philippines Geothermal Energy Market Volume Gigawatt Forecast, by Price Trend Analysis 2019 & 2032

- Table 13: Philippines Geothermal Energy Market Revenue Million Forecast, by Region 2019 & 2032

- Table 14: Philippines Geothermal Energy Market Volume Gigawatt Forecast, by Region 2019 & 2032

- Table 15: Philippines Geothermal Energy Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Philippines Geothermal Energy Market Volume Gigawatt Forecast, by Country 2019 & 2032

- Table 17: China Philippines Geothermal Energy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: China Philippines Geothermal Energy Market Volume (Gigawatt) Forecast, by Application 2019 & 2032

- Table 19: Japan Philippines Geothermal Energy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Japan Philippines Geothermal Energy Market Volume (Gigawatt) Forecast, by Application 2019 & 2032

- Table 21: India Philippines Geothermal Energy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: India Philippines Geothermal Energy Market Volume (Gigawatt) Forecast, by Application 2019 & 2032

- Table 23: South Korea Philippines Geothermal Energy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: South Korea Philippines Geothermal Energy Market Volume (Gigawatt) Forecast, by Application 2019 & 2032

- Table 25: Taiwan Philippines Geothermal Energy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Taiwan Philippines Geothermal Energy Market Volume (Gigawatt) Forecast, by Application 2019 & 2032

- Table 27: Australia Philippines Geothermal Energy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Australia Philippines Geothermal Energy Market Volume (Gigawatt) Forecast, by Application 2019 & 2032

- Table 29: Rest of Asia-Pacific Philippines Geothermal Energy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Rest of Asia-Pacific Philippines Geothermal Energy Market Volume (Gigawatt) Forecast, by Application 2019 & 2032

- Table 31: Philippines Geothermal Energy Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 32: Philippines Geothermal Energy Market Volume Gigawatt Forecast, by Production Analysis 2019 & 2032

- Table 33: Philippines Geothermal Energy Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 34: Philippines Geothermal Energy Market Volume Gigawatt Forecast, by Consumption Analysis 2019 & 2032

- Table 35: Philippines Geothermal Energy Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 36: Philippines Geothermal Energy Market Volume Gigawatt Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 37: Philippines Geothermal Energy Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 38: Philippines Geothermal Energy Market Volume Gigawatt Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 39: Philippines Geothermal Energy Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 40: Philippines Geothermal Energy Market Volume Gigawatt Forecast, by Price Trend Analysis 2019 & 2032

- Table 41: Philippines Geothermal Energy Market Revenue Million Forecast, by Country 2019 & 2032

- Table 42: Philippines Geothermal Energy Market Volume Gigawatt Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Philippines Geothermal Energy Market?

The projected CAGR is approximately > 1.50%.

2. Which companies are prominent players in the Philippines Geothermal Energy Market?

Key companies in the market include Energy Development Corporation, National Power Corporation, Pure Energy Holdings Corporation, Aragorn Power and Energy Corporation (APC Group Inc ), Philippine Geothermal Production Company Inc, Aboitiz Power Corporation.

3. What are the main segments of the Philippines Geothermal Energy Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Gas Production and Infrastructure4.; Increasing Exploration and Production Activities.

6. What are the notable trends driving market growth?

Deep Geothermal Systems Expected to See Significant Market Growth.

7. Are there any restraints impacting market growth?

4.; Increasing Adoption of Clean Power Sources.

8. Can you provide examples of recent developments in the market?

October 2022: The Philippine renewable energy business Energy Development Corp (EDC) unit partnered with Toshiba Energy Systems & Solutions Corp. and Toshiba (Philippines) Inc. to deliver a 20-MW flash geothermal power project in the southern region of the island of Luzon.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Gigawatt.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Philippines Geothermal Energy Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Philippines Geothermal Energy Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Philippines Geothermal Energy Market?

To stay informed about further developments, trends, and reports in the Philippines Geothermal Energy Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence