Key Insights

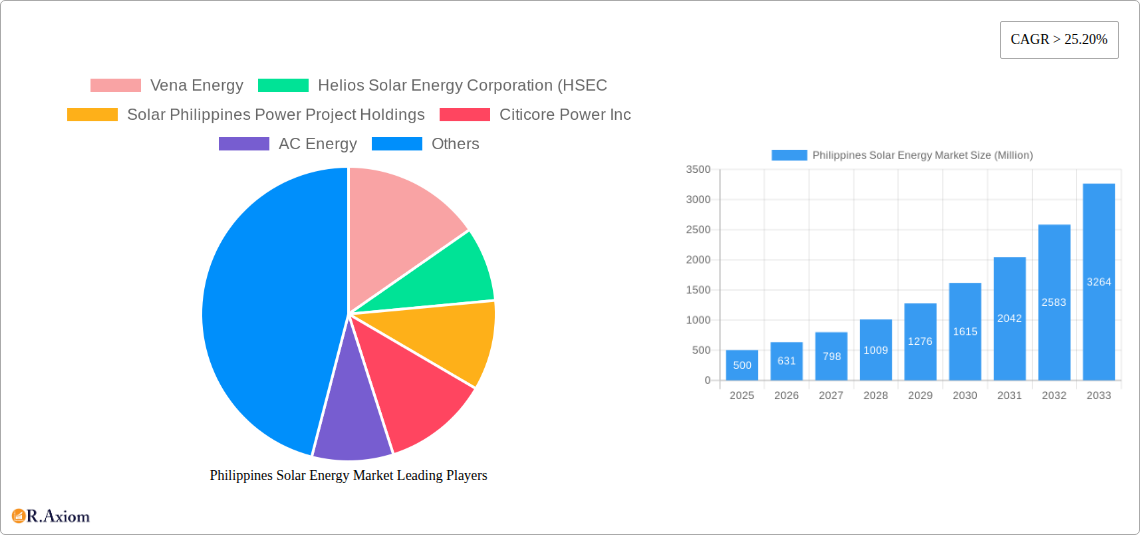

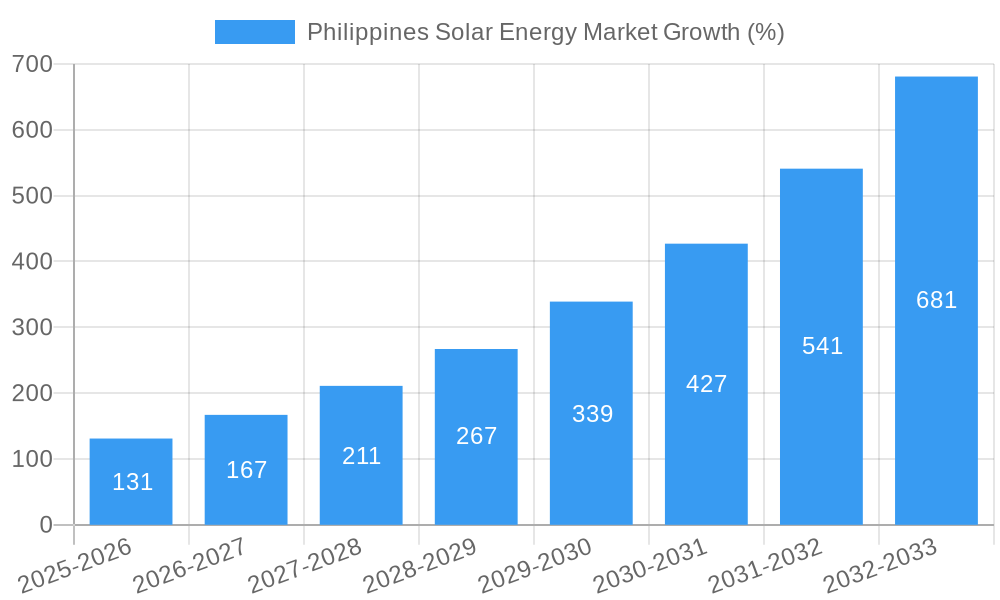

The Philippines solar energy market is experiencing robust growth, fueled by increasing energy demands, government support for renewable energy initiatives, and declining solar technology costs. With a Compound Annual Growth Rate (CAGR) exceeding 25.20% from 2019 to 2024, the market demonstrates significant potential. The market is segmented by technology type (monocrystalline, polycrystalline, thin-film) and application (utility-scale, commercial, and residential). Monocrystalline silicon panels currently dominate due to higher efficiency, though polycrystalline and thin-film technologies are gaining traction due to cost competitiveness in certain applications. The residential sector is showing strong growth driven by individual rooftop installations, while the utility-scale segment remains the largest, largely driven by large-scale solar power plants. Key players like Vena Energy, Helios Solar Energy Corporation, and Solar Philippines Power Project Holdings are actively shaping the market landscape through project development and investments. The government's commitment to renewable energy targets and supportive policies, including feed-in tariffs and net metering schemes, further stimulate market expansion. However, challenges such as land acquisition complexities, grid infrastructure limitations, and intermittent solar power generation remain.

Looking ahead to 2033, the market's trajectory remains positive. Continued technological advancements, decreasing installation costs, and increasing awareness of environmental sustainability will likely drive further growth. The expansion of the grid infrastructure and the government's focus on improving energy access in rural areas will be crucial in unlocking the full potential of the solar energy market. The competitive landscape will likely see increased consolidation and diversification, with both local and international players vying for market share. To ensure sustainable growth, the Philippines needs to address regulatory hurdles, enhance grid integration capabilities, and foster innovation in solar energy storage solutions. The focus on efficient project financing mechanisms will be key to attracting more private investment and accelerating the adoption of solar energy across all segments.

Philippines Solar Energy Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the Philippines solar energy market, offering invaluable insights for industry stakeholders, investors, and policymakers. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report meticulously examines market trends, growth drivers, challenges, and opportunities. It features an in-depth segmentation analysis across various types (monocrystalline, polycrystalline, thin-film) and applications (utility, commercial, residential), highlighting key players like Vena Energy, Helios Solar Energy Corporation (HSEC), Solar Philippines Power Project Holdings, Citicore Power Inc, AC Energy, Trina Solar Ltd, Aboitiz Power Corporation, Solenergy Systems Inc, Solaric Corp, and Cleantech Global.

Philippines Solar Energy Market Market Concentration & Innovation

This section analyzes the competitive landscape of the Philippines solar energy market, examining market concentration, innovation drivers, regulatory frameworks, and M&A activities. The report quantifies market share for key players and explores the value of significant M&A deals concluded within the study period. We delve into the role of government regulations in shaping market dynamics and analyze the impact of substitute technologies and evolving end-user trends.

- Market Concentration: The report details the market share held by leading companies like Vena Energy and AC Energy, providing a clear picture of the level of competition. We analyze the potential for consolidation and the impact of mergers and acquisitions on market structure. xx% market share for top 5 players (estimated).

- Innovation Drivers: We investigate the factors driving innovation within the sector, such as advancements in solar technology, decreasing costs, and the push for renewable energy. This includes an analysis of R&D investments and the emergence of new technologies.

- Regulatory Framework: The report analyzes the influence of government policies, incentives, and regulations on the market's growth trajectory. This involves an assessment of feed-in tariffs, renewable portfolio standards, and net metering policies.

- Product Substitutes: We consider the competitive pressures from alternative energy sources and evaluate their potential impact on market share.

- End-User Trends: The report examines the evolving energy needs of various sectors (residential, commercial, utility) and their impact on solar energy adoption.

- M&A Activities: Analysis of key mergers and acquisitions within the Philippines solar energy sector, including deal values and their implications for market dynamics. For example, we evaluate the impact of a xx Million deal (estimated) between two major players.

Philippines Solar Energy Market Industry Trends & Insights

This section delves into the key trends and insights shaping the Philippines solar energy market. We analyze market growth drivers, technological disruptions, consumer preferences, and competitive dynamics, providing a comprehensive overview of the sector's evolution. The report also includes specific metrics such as the Compound Annual Growth Rate (CAGR) and market penetration rates for solar energy across different segments.

The Philippines’ commitment to renewable energy is a major catalyst for growth, evidenced by increasing government support and private sector investment. Technological advancements resulting in lower solar panel costs and higher efficiency are fueling market expansion. Consumer preference for sustainable energy solutions is driving residential and commercial adoption. However, the sector faces challenges in terms of grid infrastructure and intermittency of solar power generation. The report provides insights into the competitive dynamics among key players and the strategies employed to maintain a competitive edge. The CAGR for the period 2025-2033 is estimated at xx%. Market penetration is projected to reach xx% by 2033.

Dominant Markets & Segments in Philippines Solar Energy Market

This section identifies the leading segments within the Philippines solar energy market, analyzing their dominance across different types (monocrystalline, polycrystalline, thin-film) and applications (utility, commercial, residential).

- Dominant Type: Monocrystalline solar panels currently hold the largest market share due to higher efficiency and power output. However, polycrystalline panels retain a significant share due to their lower cost. Thin-film technology is expected to witness growth in niche applications.

- Dominant Application: The utility-scale segment dominates the market due to large-scale solar power plant projects. The commercial and residential segments are also experiencing substantial growth driven by cost reduction and government incentives.

Key Drivers for Dominant Segments:

- Economic Policies: Government incentives, tax breaks, and supportive regulations significantly influence the growth of the solar energy sector.

- Infrastructure Development: Investments in grid infrastructure and transmission lines are crucial for facilitating the integration of solar power into the national grid.

- Technological Advancements: Continuous improvements in solar panel technology, including higher efficiency and lower production costs, drive market expansion.

Philippines Solar Energy Market Product Developments

This section summarizes recent product innovations in the Philippines solar energy market, highlighting technological advancements and their market relevance. New designs are focusing on improved energy conversion efficiency, durability, and reduced manufacturing costs. The integration of smart technologies and energy storage solutions is also gaining traction. These advancements enable greater system reliability, enhanced performance, and optimized energy utilization, improving the overall value proposition for end-users.

Report Scope & Segmentation Analysis

This report provides a detailed segmentation analysis of the Philippines solar energy market, covering:

- By Type: Monocrystalline, Polycrystalline, Thin-Film. Each segment is analyzed for its market size, growth projections, and competitive dynamics. Monocrystalline is projected to dominate due to its superior efficiency. Polycrystalline maintains a substantial market share due to lower cost. Thin-film's market share is expected to grow, driven by specific niche applications.

- By Application: Utility, Commercial, Residential. We analyze each application's market size, growth rate, and specific drivers. The utility segment is expected to remain the largest, followed by commercial and then residential.

Key Drivers of Philippines Solar Energy Market Growth

Several factors drive the growth of the Philippines solar energy market. The government's strong commitment to renewable energy targets, alongside decreasing solar energy costs and technological advancements, creates a favorable environment for market expansion. Furthermore, rising energy demand and increasing awareness of environmental concerns fuel the adoption of sustainable energy solutions. Specific policies like feed-in tariffs and net metering schemes provide significant incentives to consumers and investors.

Challenges in the Philippines Solar Energy Market Sector

Despite the significant growth potential, the Philippines solar energy sector faces challenges. These include limitations in grid infrastructure, land acquisition complexities, and the intermittent nature of solar power generation. Regulatory hurdles and potential supply chain disruptions also pose obstacles. The impact of these challenges on market growth is quantified where data is available; for example, grid limitations might delay project deployment by xx months (estimated).

Emerging Opportunities in Philippines Solar Energy Market

The Philippines solar energy market presents exciting opportunities. The expanding adoption of floating solar technology, coupled with the potential for integrating energy storage systems, represents substantial growth potential. The focus on decentralized energy solutions for rural areas is another key opportunity, while exploring new business models like Power Purchase Agreements (PPAs) can further unlock market potential.

Leading Players in the Philippines Solar Energy Market Market

- Vena Energy

- Helios Solar Energy Corporation (HSEC)

- Solar Philippines Power Project Holdings

- Citicore Power Inc

- AC Energy

- Trina Solar Ltd

- Aboitiz Power Corporation

- Solenergy Systems Inc

- Solaric Corp

- Cleantech Global

Key Developments in Philippines Solar Energy Market Industry

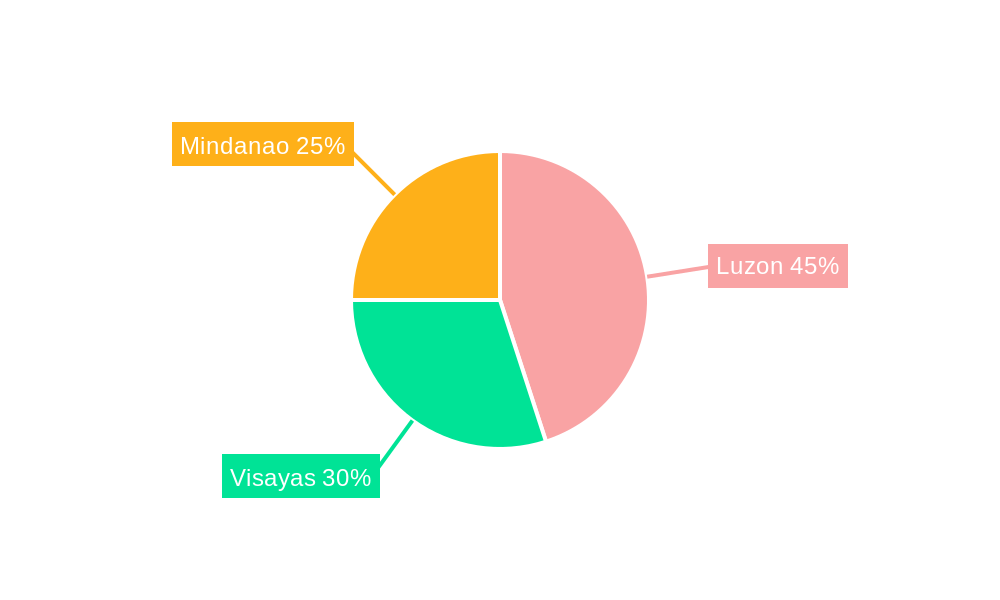

- June 2023: Solar Philippines Neva Ecija Corporation (SPNEC) plans a 3.5GW solar farm expansion in Luzon, adding to its existing 500MW project. This significantly boosts the utility-scale segment.

- May 2023: The Department of Energy awards contracts for 1.3GW of floating solar projects, primarily located in Laguna Lake. This demonstrates a commitment to innovative solar technologies and opens a new market segment.

Strategic Outlook for Philippines Solar Energy Market Market

The Philippines solar energy market is poised for robust growth. Continued government support, declining costs, and technological advancements will drive market expansion. The integration of energy storage systems and the increasing adoption of floating solar solutions present significant opportunities for growth. The market is expected to experience substantial growth through 2033, driven by both large-scale projects and decentralized solar installations.

Philippines Solar Energy Market Segmentation

-

1. Type

- 1.1. Monocrystalline

- 1.2. Polycrystalline

- 1.3. Thin-Film

-

2. Application

- 2.1. Utility

- 2.2. Commercial

- 2.3. Residential

Philippines Solar Energy Market Segmentation By Geography

- 1. Philippines

Philippines Solar Energy Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 25.20% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; The Growing Demand for Solar Energy-Based Power Generation4.; Declining Photovoltaic System Prices

- 3.3. Market Restrains

- 3.3.1. 4.; The Country's Inefficient Electricity Grid Infrastructure

- 3.4. Market Trends

- 3.4.1. Solar Photovoltaic (PV) to Register Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Philippines Solar Energy Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Monocrystalline

- 5.1.2. Polycrystalline

- 5.1.3. Thin-Film

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Utility

- 5.2.2. Commercial

- 5.2.3. Residential

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Philippines

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. China Philippines Solar Energy Market Analysis, Insights and Forecast, 2019-2031

- 7. Japan Philippines Solar Energy Market Analysis, Insights and Forecast, 2019-2031

- 8. India Philippines Solar Energy Market Analysis, Insights and Forecast, 2019-2031

- 9. South Korea Philippines Solar Energy Market Analysis, Insights and Forecast, 2019-2031

- 10. Taiwan Philippines Solar Energy Market Analysis, Insights and Forecast, 2019-2031

- 11. Australia Philippines Solar Energy Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Asia-Pacific Philippines Solar Energy Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Vena Energy

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Helios Solar Energy Corporation (HSEC

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Solar Philippines Power Project Holdings

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Citicore Power Inc

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 AC Energy

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Trina Solar Ltd

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Aboitiz Power Corporation

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Solenergy Systems Inc

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Solaric Corp

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Cleantech Global

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 Vena Energy

List of Figures

- Figure 1: Philippines Solar Energy Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Philippines Solar Energy Market Share (%) by Company 2024

List of Tables

- Table 1: Philippines Solar Energy Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Philippines Solar Energy Market Volume watt Forecast, by Region 2019 & 2032

- Table 3: Philippines Solar Energy Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Philippines Solar Energy Market Volume watt Forecast, by Type 2019 & 2032

- Table 5: Philippines Solar Energy Market Revenue Million Forecast, by Application 2019 & 2032

- Table 6: Philippines Solar Energy Market Volume watt Forecast, by Application 2019 & 2032

- Table 7: Philippines Solar Energy Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Philippines Solar Energy Market Volume watt Forecast, by Region 2019 & 2032

- Table 9: Philippines Solar Energy Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Philippines Solar Energy Market Volume watt Forecast, by Country 2019 & 2032

- Table 11: China Philippines Solar Energy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: China Philippines Solar Energy Market Volume (watt) Forecast, by Application 2019 & 2032

- Table 13: Japan Philippines Solar Energy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Japan Philippines Solar Energy Market Volume (watt) Forecast, by Application 2019 & 2032

- Table 15: India Philippines Solar Energy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: India Philippines Solar Energy Market Volume (watt) Forecast, by Application 2019 & 2032

- Table 17: South Korea Philippines Solar Energy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: South Korea Philippines Solar Energy Market Volume (watt) Forecast, by Application 2019 & 2032

- Table 19: Taiwan Philippines Solar Energy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Taiwan Philippines Solar Energy Market Volume (watt) Forecast, by Application 2019 & 2032

- Table 21: Australia Philippines Solar Energy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Australia Philippines Solar Energy Market Volume (watt) Forecast, by Application 2019 & 2032

- Table 23: Rest of Asia-Pacific Philippines Solar Energy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Rest of Asia-Pacific Philippines Solar Energy Market Volume (watt) Forecast, by Application 2019 & 2032

- Table 25: Philippines Solar Energy Market Revenue Million Forecast, by Type 2019 & 2032

- Table 26: Philippines Solar Energy Market Volume watt Forecast, by Type 2019 & 2032

- Table 27: Philippines Solar Energy Market Revenue Million Forecast, by Application 2019 & 2032

- Table 28: Philippines Solar Energy Market Volume watt Forecast, by Application 2019 & 2032

- Table 29: Philippines Solar Energy Market Revenue Million Forecast, by Country 2019 & 2032

- Table 30: Philippines Solar Energy Market Volume watt Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Philippines Solar Energy Market?

The projected CAGR is approximately > 25.20%.

2. Which companies are prominent players in the Philippines Solar Energy Market?

Key companies in the market include Vena Energy, Helios Solar Energy Corporation (HSEC, Solar Philippines Power Project Holdings, Citicore Power Inc, AC Energy, Trina Solar Ltd, Aboitiz Power Corporation, Solenergy Systems Inc, Solaric Corp, Cleantech Global.

3. What are the main segments of the Philippines Solar Energy Market?

The market segments include Type , Application .

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; The Growing Demand for Solar Energy-Based Power Generation4.; Declining Photovoltaic System Prices.

6. What are the notable trends driving market growth?

Solar Photovoltaic (PV) to Register Significant Growth.

7. Are there any restraints impacting market growth?

4.; The Country's Inefficient Electricity Grid Infrastructure.

8. Can you provide examples of recent developments in the market?

June 2023: Solar Philippines Neva Ecija Corporation (SPNEC) intends to build a 3.5GW solar farm in the Philippines. The project extension will take place in the same region as its existing 500MW solar facility in the northern province of Luzon. The total project, including the 500MW section already under development, encompasses roughly 3,500 hectares of land that have been bought or are being acquired.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in watt.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Philippines Solar Energy Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Philippines Solar Energy Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Philippines Solar Energy Market?

To stay informed about further developments, trends, and reports in the Philippines Solar Energy Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence