Key Insights

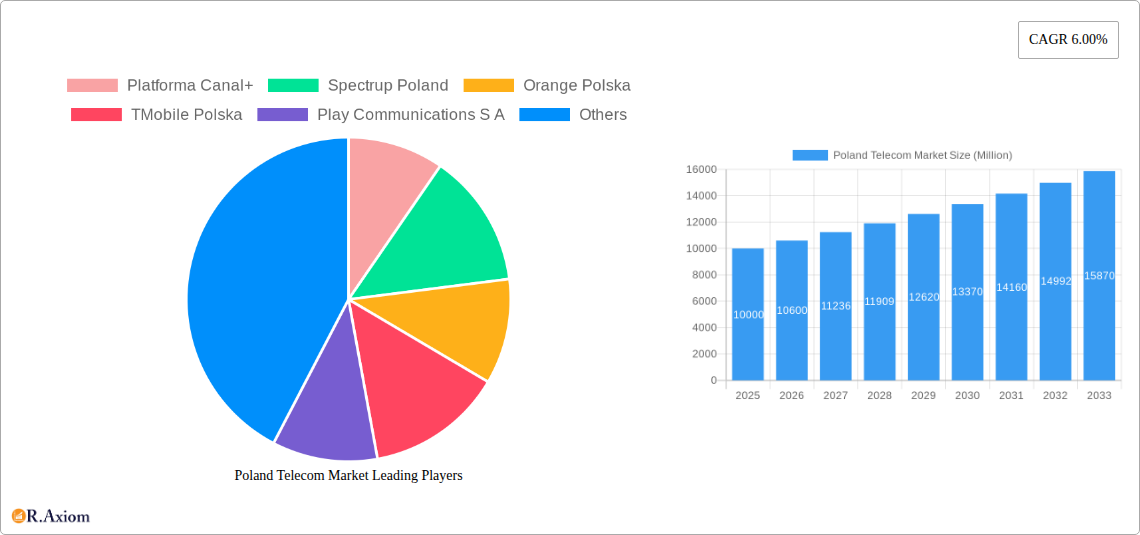

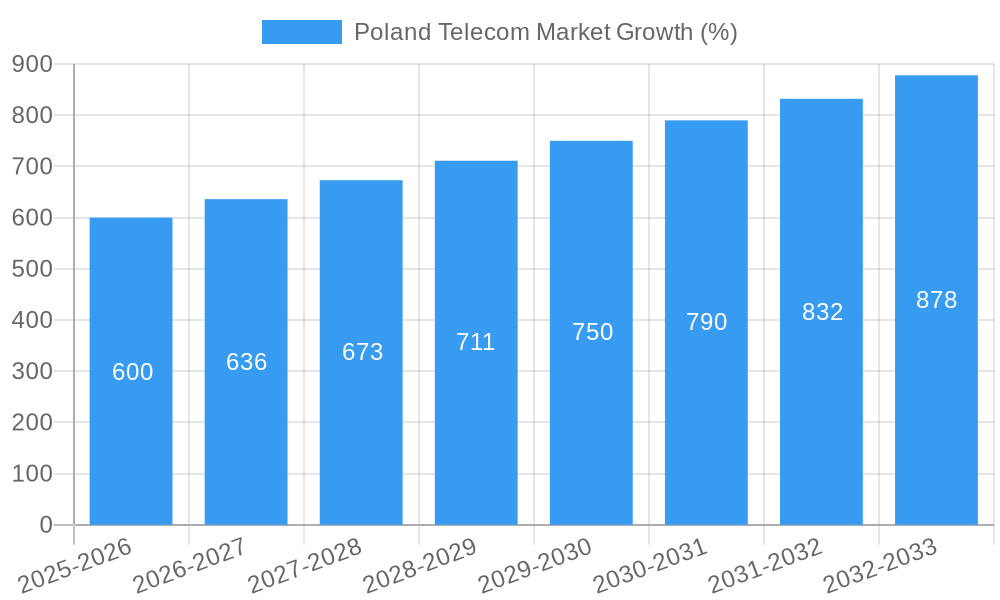

The Polish telecom market, valued at approximately €X million in 2025 (assuming a logical extrapolation from the provided CAGR and market size), exhibits robust growth potential, projected at a 6.00% CAGR from 2025-2033. This expansion is driven primarily by the increasing adoption of wireless data and messaging services, fueled by rising smartphone penetration and data consumption. The surge in demand for high-speed internet access and attractive data packages, including bundled offerings, is a significant contributor. Furthermore, the growing popularity of OTT (Over-the-Top) platforms and PayTV services contributes to overall market growth. Competition among major players such as Orange Polska, T-Mobile Polska, Play Communications, and Plus (Polkomtel) is fierce, driving innovation and price competitiveness within the market. While the market displays strong growth, potential restraints include infrastructural limitations in certain regions, particularly concerning broadband availability in rural areas, and the ongoing challenge of managing the increasing data traffic demand.

Segment analysis reveals that wireless services, encompassing data and messaging, dominate the market share, followed by OTT and PayTV services, and lastly voice services. The Average Revenue Per User (ARPU) for the overall services segment is expected to remain relatively stable, reflecting both the competitive landscape and the shift towards data-centric consumption patterns. Growth in the wireless data segment is expected to outpace growth in the voice services segment over the forecast period. This underscores a critical shift in consumer behavior towards digital content and communications. The continued investment in 5G infrastructure and the development of innovative mobile services are key factors that will continue to shape the Polish telecom landscape over the coming years.

Poland Telecom Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Poland Telecom Market, covering the period from 2019 to 2033. It offers invaluable insights into market trends, competitive dynamics, and future growth opportunities for industry stakeholders. The report leverages a robust data set to deliver actionable intelligence for strategic decision-making. It encompasses detailed segmentation analysis, market sizing, and forecasts across key segments, enabling businesses to navigate the complexities of the Polish telecom landscape. This report is essential for telecom operators, investors, and regulatory bodies seeking a clear understanding of this dynamic market.

Poland Telecom Market Concentration & Innovation

The Polish telecom market exhibits a moderately concentrated structure, with a few dominant players holding significant market share. Orange Polska, T-Mobile Polska, Play Communications S.A., and Polkomtel (Plus) represent the major forces, vying for dominance across various service segments. While market share fluctuates, these players consistently engage in strategic initiatives to maintain their positions. The level of market concentration is reflected in the M&A activity, although the precise deal values for recent years remain unavailable (xx Million). The industry is characterized by continuous innovation, driven by the need to meet evolving consumer demands and stay competitive. This includes investments in 5G network infrastructure, the expansion of fiber optic networks, and the development of innovative services such as OTT and PayTV offerings. The regulatory framework plays a vital role in shaping market dynamics and influencing the pace of innovation. Product substitutes, such as VoIP services and alternative communication platforms, are gaining traction. End-user trends, such as increasing data consumption and the growing demand for bundled packages, are shaping market demands.

- Key Market Players: Orange Polska, T-Mobile Polska, Play Communications S.A., Polkomtel (Plus), Netia, Vectra S.A. (List Not Exhaustive)

- Innovation Drivers: 5G deployment, fiber optic expansion, OTT/PayTV services development.

- Regulatory Influence: Significant impact on market entry, pricing, and infrastructure development.

- M&A Activity: Occasional consolidation observed, with precise deal values currently unavailable (xx Million).

Poland Telecom Market Industry Trends & Insights

The Poland Telecom Market is experiencing robust growth, propelled by several key factors. The increasing penetration of smartphones and the escalating demand for high-speed data services are primary drivers. Consumers are increasingly adopting data-intensive applications and services, such as streaming video and online gaming. The average revenue per user (ARPU) is experiencing growth driven by the adoption of higher-tier data plans and bundled service packages. Technological disruptions, such as the ongoing rollout of 5G networks, are significantly impacting the market. 5G promises to offer greater speeds, lower latency, and enhanced capacity, which will lead to the development of new services and applications. The market is experiencing intense competitive dynamics, with operators constantly seeking to differentiate their offerings through pricing strategies, network coverage expansion, and the introduction of innovative services. Market penetration for broadband and mobile services continues to increase, with significant growth potential remaining in less-connected areas. The Compound Annual Growth Rate (CAGR) for the overall market for the period 2020-2027 is estimated to be xx%.

Dominant Markets & Segments in Poland Telecom Market

The Polish telecom market demonstrates significant growth across all segments, although specific dominance varies.

- Wireless: Data and Messaging Services: This segment exhibits strong growth, driven by increasing smartphone penetration and data consumption. Internet and handset data packages, along with package discounts, are key drivers. Market size is expected to reach xx Million by 2027.

- OTT and PayTV Services: This sector is experiencing considerable expansion, fueled by the rising demand for streaming content and affordable entertainment options. Market size estimates for 2020-2027 range from xx Million to xx Million.

- Voice Services: While facing pressure from alternative communication platforms, this segment retains significance, particularly within bundled packages. ARPU for the overall services segment is estimated to be xx in 2025.

- Key Drivers: Increasing urbanisation, rising disposable incomes, government initiatives to improve digital infrastructure.

The dominant regions are the major urban centers, reflecting higher population density and greater demand for advanced telecom services. However, rural areas are experiencing gradual improvements in infrastructure and service availability.

Poland Telecom Market Product Developments

The Polish telecom market witnesses continuous product innovation, largely centered around enhancing data services and improving network capabilities. Operators are investing heavily in 5G infrastructure, aiming to provide faster speeds and lower latency. Furthermore, the focus is shifting towards offering bundled packages that integrate various services, such as mobile data, fixed broadband, and PayTV, to cater to consumers' integrated needs. The competitive advantage lies in providing superior network quality, wider coverage, and attractive pricing plans.

Report Scope & Segmentation Analysis

This report comprehensively analyzes the Poland Telecom Market across its major segments:

Wireless: Data and Messaging Services: This segment is categorized by data package types (e.g., prepaid, postpaid), internet speeds, and handset data allowances. Growth is projected at xx% CAGR for 2025-2033. Competition is fierce, with pricing and data offerings as key differentiators.

OTT and PayTV Services: This segment encompasses streaming platforms, video-on-demand services, and traditional PayTV offerings. Growth is driven by increasing internet penetration and consumer preference for digital entertainment. Market size estimates for 2025 are xx Million, projected to reach xx Million by 2033.

Voice Services: This segment includes traditional voice calls (mobile and fixed-line) and VoIP services. While experiencing slowing growth, it remains relevant, particularly within bundled packages. Market size is estimated at xx Million for 2025. The competitive landscape focuses on cost-effective solutions and integrated services.

Key Drivers of Poland Telecom Market Growth

Several factors fuel the Poland Telecom Market’s growth:

- Rising Smartphone Penetration: Increased adoption of smartphones drives demand for data services.

- Growing Data Consumption: The increasing use of data-intensive applications necessitates higher data allowances and speeds.

- 5G Deployment: The introduction of 5G networks enhances network capacity and speeds, creating new opportunities.

- Government Initiatives: Government support for digital infrastructure development facilitates market expansion.

Challenges in the Poland Telecom Market Sector

The Poland Telecom Market faces several challenges:

- Regulatory Hurdles: Strict regulations can hinder market entry and innovation.

- Infrastructure Gaps: Uneven distribution of infrastructure presents challenges in providing universal service.

- Competitive Pressures: Intense competition among operators leads to price wars and reduced profit margins.

Emerging Opportunities in Poland Telecom Market

The Poland Telecom Market presents several emerging opportunities:

- Expansion of 5G Services: Developing new applications and services leveraging 5G technology.

- Growth of IoT: Capitalizing on the increasing adoption of Internet of Things devices.

- Bundled Service Packages: Offering comprehensive packages integrating various services to attract customers.

Leading Players in the Poland Telecom Market Market

- Orange Polska

- T-Mobile Polska

- Play Communications S.A.

- Polkomtel (Plus)

- Effortel SA

- Multimedia Polska SA

- Netia

- Vectra S.A.

- Platforma Canal+

- Spectrup Poland

- (List Not Exhaustive)

Key Developments in Poland Telecom Market Industry

November 2022: Polkomtel launched Poland's first commercial 5G network, covering 900,000 people in seven major cities. This signifies a significant step towards nationwide 5G deployment and is expected to drive further investment and innovation.

October 2022: Orange Polska partnered with Dimetor to explore the possibilities of drone operation using its network infrastructure. This initiative showcases the potential of telecom networks in supporting emerging technologies and expanding service offerings beyond traditional applications.

Strategic Outlook for Poland Telecom Market Market

The Poland Telecom Market exhibits strong growth potential driven by increasing smartphone penetration, rising data consumption, and the ongoing rollout of 5G networks. Opportunities exist in expanding 5G services, developing innovative IoT applications, and offering bundled packages that cater to evolving consumer preferences. Continued investment in infrastructure and technological advancements will be crucial in sustaining this growth trajectory. The market is poised for further consolidation and innovation, creating both challenges and opportunities for industry participants.

Poland Telecom Market Segmentation

-

1. Segmenta

-

1.1. Voice Services

- 1.1.1. Wired

- 1.1.2. Wireless

- 1.2. Data and

- 1.3. OTT and PayTV Services

-

1.1. Voice Services

Poland Telecom Market Segmentation By Geography

- 1. Poland

Poland Telecom Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand For OTT & Pay TV Services; Active Digital Transformation

- 3.3. Market Restrains

- 3.3.1. Evolving Market Regulations

- 3.4. Market Trends

- 3.4.1. Rising OTT & Pay TV Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Poland Telecom Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Segmenta

- 5.1.1. Voice Services

- 5.1.1.1. Wired

- 5.1.1.2. Wireless

- 5.1.2. Data and

- 5.1.3. OTT and PayTV Services

- 5.1.1. Voice Services

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Poland

- 5.1. Market Analysis, Insights and Forecast - by Segmenta

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Platforma Canal+

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Spectrup Poland

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Orange Polska

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 TMobile Polska

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Play Communications S A

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Polkomtel (Plus)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Effortel SA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Multimedia Polska SA

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Netia

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Vectra S A *List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Platforma Canal+

List of Figures

- Figure 1: Poland Telecom Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Poland Telecom Market Share (%) by Company 2024

List of Tables

- Table 1: Poland Telecom Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Poland Telecom Market Revenue Million Forecast, by Segmenta 2019 & 2032

- Table 3: Poland Telecom Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Poland Telecom Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Poland Telecom Market Revenue Million Forecast, by Segmenta 2019 & 2032

- Table 6: Poland Telecom Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Poland Telecom Market?

The projected CAGR is approximately 6.00%.

2. Which companies are prominent players in the Poland Telecom Market?

Key companies in the market include Platforma Canal+, Spectrup Poland, Orange Polska, TMobile Polska, Play Communications S A, Polkomtel (Plus), Effortel SA, Multimedia Polska SA, Netia, Vectra S A *List Not Exhaustive.

3. What are the main segments of the Poland Telecom Market?

The market segments include Segmenta.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand For OTT & Pay TV Services; Active Digital Transformation.

6. What are the notable trends driving market growth?

Rising OTT & Pay TV Market.

7. Are there any restraints impacting market growth?

Evolving Market Regulations.

8. Can you provide examples of recent developments in the market?

November 2022: Poland's key telecom player Polkomtel declared the launch of the nation's first commercial 5G network. The deployment, which is still in its early stages, has so far necessitated the operation of a network of 100 transmitters in seven significant cities: Warsaw, Gdansk, Katowice, Lodz, Poznan, Szczecin, and Wroclaw. According to local news sources, a total of 900,000 people are covered.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Poland Telecom Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Poland Telecom Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Poland Telecom Market?

To stay informed about further developments, trends, and reports in the Poland Telecom Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence